Download a PDF copy of the weekly economic commentary here.

Markets

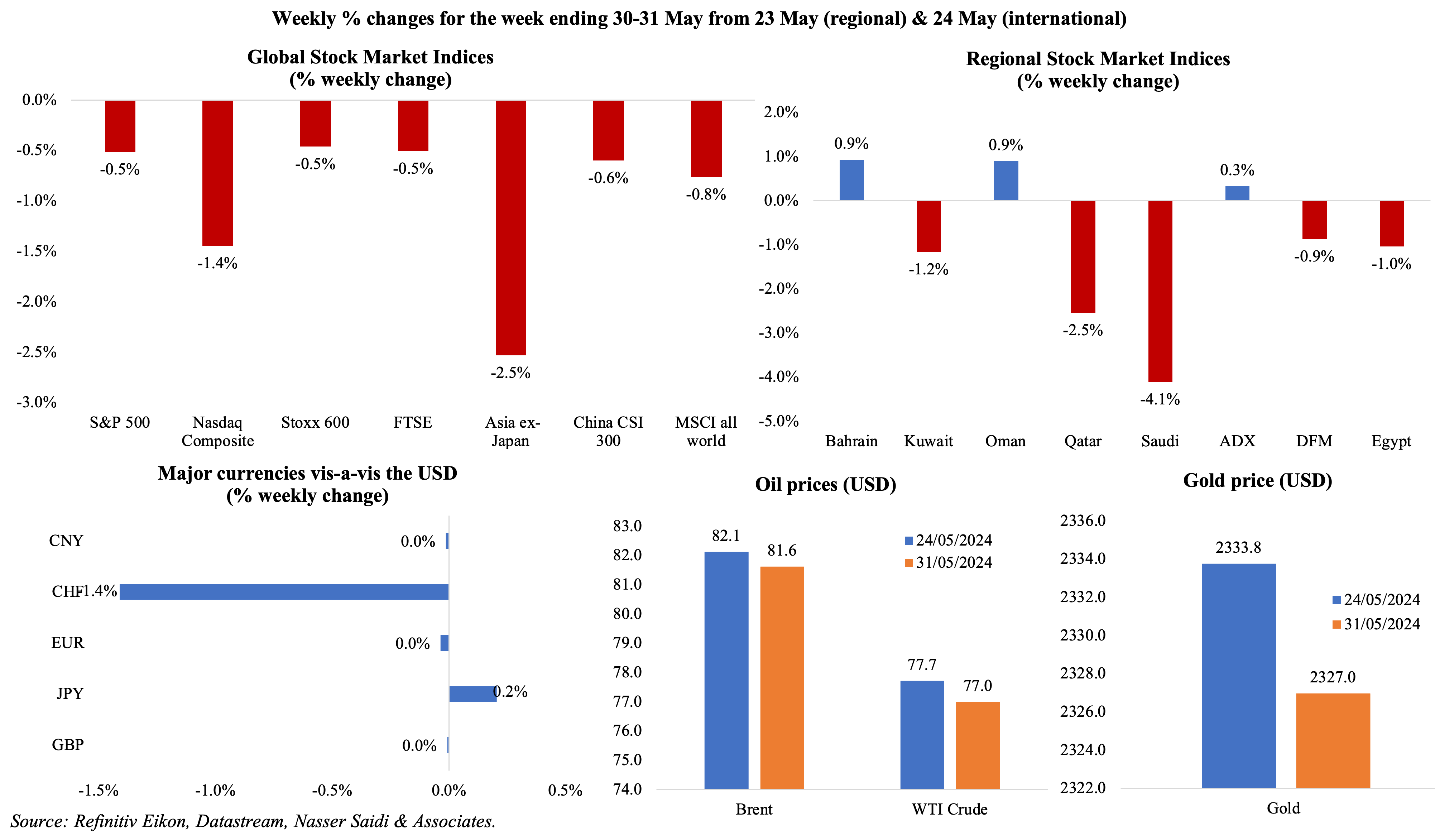

Equities markets ended in the red last week though many indices rebounded on Friday (the month-end). Regional markets were also mostly down: Saudi Tadawul hit more than a 5-month low last week, Qatar’s exchange dropped to its lowest in almost 4 years while Dubai’s DFM touched a 6-month low and posted the highest monthly decline since Oct 2023. Abu Dhabi’s ADX, despite gaining 0.3% on the week, touched a 28-month low on Wednesday (May 29). The dollar index posted its first monthly decline in 2024 while the GBP reached a 21-month high against the euro. Oil prices fell ahead of the OPEC+ meeting (Brent and WTO down by 0.6% and 1% from a week ago) and while gold price fell from the previous week, it posted a fourth consecutive monthly gain.

Global Developments

US/Americas:

- GDP in the US grew at an annualised 1.3% rate in Q1, lower than the preliminary estimate of 1.6% and Q4’s 3.4% pace – this was the lowest rate since Q2 2022. Consumer spending was revised down to a 2% annualised rate from the previous reading of 2.5%.

- Personal income in the US grew by 0.3% mom in Apr (Mar: 0.5%). Personal spending grew by 0.2% (Mar: 0.7%), the least since Jan. The savings-to-income ratio remained at 3.6% for the second consecutive month. Headline PCE inflation was up by 2.7% yoy in Apr and core PCE prices grew by 2.8% (the lowest since Mar 2021), both unchanged from Mar.

- Goods trade deficit in the US widened to USD 99.4bn in Apr (Mar: USD 92.3bn), the largest since May 2022: exports grew by 0.5% mom to USD 169.9bn while imports rose by 3.1% mom to USD 269.3bn.

- S&P Case Shiller home prices gained 7.4% yoy in Mar (Feb: 7.3%), the most since Oct 2022. Separately, pending home sales fell by 7.7% mom in Apr, the slowest pace since Apr 2020. The average rate on the 30-year fixed mortgage moved up to 7.5% by end-Apr (end-Mar: around 6.9%).

- Dallas Fed manufacturing business index plunged to -19.4 in May (Apr: -14.5), with the production index down by 7.6 points to -2.8 and the outlook uncertainty index near its historical average at 16.4; new orders however rose 3.1 points to -2.2.

- Richmond Fed manufacturing index rose to a 7-month high reading of 0 in May (Apr: -7), thanks to improvements in shipments (13 from -10) and new orders (-6 from -9) while employment dipped (-6 from -2).

- Chicago PMI declined to 35.4 in May (Apr: 37.9), the lowest since May 2020 and the 6th month in a row of contractionary readings, dragged down by new orders (fell by 9.2 points).

- Initial jobless claims increased by 3k to 219k in the week ended May 24th and the 4-week average moved up by 2.5k to 222.5k – the highest since Sep. Continuing jobless claims rose by 4k to 791mn in the week ended May 17th.

Europe:

- Inflation in the eurozone moved up to 2.6% in May (Apr: 2.4%), with energy prices rising for the first time in over a year (+0.3%) and services inflation rising to a 7-month high of 4.1% (Apr: 3.7%). Core inflation inched up to 2.9% from 2.7%.

- Economic sentiment indicator in the euro area inched up to 96 in May (Apr: 95.6). Consumer confidence remained unchanged at -14.3, while industrial confidence improved to -9.9 (Apr: -10.4). Unemployment rate in the euro area slipped to 6.4% in Apr (Mar: 6.5%), with youth unemployment at 14.1%.

- Harmonised index of consumer prices in Germany rose to 2.8% in May (Apr: 2.4%), the highest reading in 4 months, while core inflation stood unchanged at 3%.

- Germany Ifo business climate index remained unchanged at 89.3 in May: results showed that the manufacturing, trade, and construction sectors were recovering, while the service sector index declined (1.8 from 3.2). Current assessment slipped to 88.3 (Apr: 88.9) while business expectations inched up to 90.4 (89.7).

- Wholesale price index in Germany fell by 1.8% yoy in Apr (Mar: -2.6%), the smallest decline since Aug 2023. This was largely due to a 17.9% yoy drop in prices of chemical prices.

- Retail sales in Germany fell by 1.2% mom and 0.6% yoy in Apr; food sales declined by 3.7% mom while non-food sales edged up by 0.2%. Economic prospects rose for the fourth time in a row (to 9.8 from 0.7).

- GfK consumer confidence index in Germany rose to -20.9 in Jun (May: -24), the highest value since Apr 2022 and improving for the fourth consecutive month.

Asia Pacific:

- China’s NBS manufacturing PMI fell to 49.5 in May (Apr: 50.4), the first contraction since Feb, dragged down by new orders (49.6 from 51.1) and foreign sales (48.3 from 50.6) amid weak employment (48.1). Non-manufacturing PMI moved to 51.1 in May (Apr: 51.2), staying in expansionary territory for the 17th month in a row.

- Inflation in Tokyo inched up to 2.2% in May (Apr: 1.8%), with private-sector service inflation also slowed to 1.4% in May (Apr: 1.6%). Excluding food and energy, prices slowed (1.7% from Apr: 1.8%). Excluding fresh food, prices rose to 1.9% (Apr: 1.6%) as electricity bills rose for the first time in 16 months (+13.1% yoy).

- Unemployment rate in Japan stood pat at 2.6% in Apr, the highest since last Sep. Jobs to applicants’ rate slipped to 1.26 in Apr (Mar: 1.28) while the non-seasonally adjusted labour force participation rate increased to a five-month top of 63.1% in Apr.

- Industrial production in Japan fell by 0.1% mom and 1% yoy in Apr; this was the sixth month of yoy contraction.

- Retail trade in Japan grew by 1.2% mom and 2.4% yoy in Apr. Sales in department stores jumped by 8.3% yoy alongside a 1.1% rise in supermarkets sales.

- Japan’s leading economic index moved to 112.2 in Mar, up from a flash reading of 111.4 and higher than Feb’s 112.1: this was the highest since Aug 2022. Coincident index stood at 113.6 in Mar, slightly lower than the preliminary reading of 113.9, but higher than the previous month’s 111.5.

- GDP in India grew by 7.8% yoy in Jan-Mar (Oct-Dec: 8.6%), supported by robust growth in manufacturing (8.9% yoy from 11.5%) while consumer spending grew by 4%. Gross value added was up by 6.3% in the first three months of this year, easing from 6.8% in the previous quarter. Separately, S&P Global raised its sovereign rating outlook for India to “positive” from “stable” while retaining the rating of BBB-.

- Fiscal deficit in India clocked in at INR 16.54trn (USD 198.34bn), equivalent to 5.63% of GDP for the fiscal year ending Mar 2024. Net tax receipts exceeded the full-year target at INR 23.27trn (100.1% of full-year target) while total spending touched INR 444.43trn (99% of targeted spend).

Bottom line: Considering the uptick in eurozone inflation, the main question this week is whether the ECB will proceed with the expected cut rates. We expect a cut but watch out for the message afterwards: sticky services inflation and a robust labour market raise questions of how many further cuts can be anticipated this year. Separately, the OPEC+ agreed to extend its output cuts – it will keep more than 3mn barrels per day off the market into 2025; eight members, including Saudi Arabia, Russia, Iraq and the UAE agreed to begin unwinding some “voluntary” cuts from Oct. This morning, Mexico elected Sheinbaum as its first woman president while when final election results are revealed in India this week, it is likely another victory for PM Modi (as exit polls suggest).

Regional Developments

- The World Bank has revised downwards its GCC growth forecast this year to 2.8% (from its previous estimate of 3.6% in Apr). Growth is however expected to rise to 4.7% in 2025, much higher than its Apr forecast of 3.8%, supported by recover in oil output alongside a robust non-oil sector growth. Fiscal surplus is forecast to narrow to 0.1% of GDP this year while current account surplus rises to 3.9%.

- Bahrain’s ‘B+/B’ credit rating was reaffirmed by S&P with a stable outlook, with the country’s “proactive approach to fiscal management” being cited alongside implementation of “effective measures to reduce the budget deficit”.

- Egypt increased the price of subsidised bread by 300% to EGP 0.20 (USD 0.0042) starting June – this is the first hike in over 30 years. The raised price represents roughly 16% of the cost of making the bread, according to the supply minister.

- Egypt’s trade deficit narrowed by 23.2% yoy to USD 2.37bn in Mar: this could be traced back to a drop in exports (-10.9% yoy to USD 3.57bn) alongside a sharper decline in imports (-16.2% to USD 5.94bn).

- China-Egypt bilateral trade reached USD 13.9bn in 2023, down from USD 16.6bn in 2022. Egypt’s exports to China declined to USD 909mn in 2023 (2022: USD 1.9bn) while imports from China totalled USD 12.9bn (2022: USD 14.8bn).

- Bilateral trade between Egypt and Malaysia touched USD 777mn in 2023. Discussions between the two governments include cooperation in industry and trade including the potential establishment of a Malaysian palm oil storage and refining hub in the Suez Canal Economic Zone.

- Around 17,357 foreign nationals were granted work licenses in Egypt in 2023, up 30.2% yoy; of these permits, 7,973 were issued for the first time in 2023. Non-Arab Asian countries expats accounted for the largest share (6275 persons or 36.2%), followed by Europeans (34.4%), Arab (20.1%) and Americans (4.5%).

- Sheikh Sabah al-Khalid al-Sabah was nominated as Kuwait’s crown prince, in a decree issued by the Emir. Sheikh Sabah al-Khalid had served as PM from 2019 until 2022.

- Non-oil trade between Kuwait and Pakistan reached USD 590bn in 2023, disclosed the Undersecretary of Ministry of Commerce and Industry during the fifth Kuwait-Pakistan ministerial committee meeting.

- Oman announced plans to launch a new low-cost airline: no specific details were disclosed by Oman’s civil aviation authority in the post on X. This follows reports that work is underway to design 6 new airports in the country.

- The value of e-commerce sector in Oman hit USD 2.2bn last year, with electronics and media leading with a share of 32.9% of the total, followed by food and personal care (25%) and fashion (22.2%) among others. It was also revealed that 46% of initiatives from Oman’s National E-Commerce Plan were completed by end-2023.

- Fitch affirmed a “BB+” credit rating for Oman with a stable outlook, thanks to the decline in public debt and improvements in public finance.

- The Qatar Chamber and the Australian Chamber of Commerce and Industry signed an MoU to strengthen cooperation to boost trade and investment. Bilateral trade volume currently stands at QAR 2.58bn (as of end-2023).

- Qatar entered into a long-term 15-year urea supply agreement with US-based Koch Fertilizer. This will see the supply of upto 0.74mn tonnes per annum of urea starting this Jul.

- Qatar signed double taxation avoidance agreements with Saudi Arabia and the UAE, with an aim to also prevent tax evasion.

- A Rystad Energy report disclosed that Saudi Arabia achieved a world-record low levelized cost of electricity for solar photovoltaics – of USD10.4 per megawatt-hour. The report also identified the “exceptional solar energy potential” in the region: total solar capacity is projected to touch 23 GW by end-2024 and 100 GW by 2030 (2023: 16 GW). Green hydrogen projects are estimated to contribute to an annual growth rate of 30%.

- Startups in Saudi Arabia accounted for more than 53% of total venture debt financing in the region, according to MAGNiTT. Saudi startups raised USD 400mn in 2023, up 602% yoy while the wider MENA region saw a total financing of USD 757mn in 2023, up 262%.

- Kuwait and Saudi Arabia approved a feasibility study to investigate building a rail link between Kuwait City and Riyadh. No further details were provided about the project.

Saudi Arabia Focus

- Saudi Aramco share sale: offering about 1.545bn shares, or 0.64%, the sale expected to raise USD 12bn and was sold out in hours, indicating appetite for assets amid geopolitical tensions; about 10% of the offering was reserved for retail investors. The banks are permitted to use shares to stabilise the price, raising an additional USD 1bn allowing the sale of nearly 1.7bn shares (or 0.7% stake).

- The Council of Economic and Development Affairs (CEDA) in Saudi Arabia, following a meeting last week, revealed that 87% of its Vision 2030 plans are “complete” or “on the right track”. While mergers (Seven and Qiddiya giga project) and reduced targets (The Line to open less than 5km in 2030 versus the planned 170km) have been reported, additional funding is being secured by accessing the bond markets (the PIF) and with the Aramco sale.

- The Ministry of Investment in Saudi Arabia disclosed that the ministry had issued 3,157 business licenses in Q1 2024, up 9% qoq, with construction and manufacturing accounting for the largest number of licenses (at 864 and 620 respectively).

- Saudi Arabia’s credit to the private sector grew by 10.8% yoy to SAR 2.614trn in Apr, with personal loans accounting for 47% of banks’ lending. Saudi central bank data also revealed that SAMA’s net foreign assets fell by USD 10.66bn to USD 423.4bn (SAR 1.589trn) in Apr.

- Point of sale transactions in Saudi Arabia touched SAR 11.2bn (USD 2.98bn) in the last week of May. Spending on beverage & food and restaurants & cafes accounted for the largest shares of 14.9% and 14.6% of total spending. Just over one-third of the PoS spending occurred in Riyadh (35.4%) while Jeddah followed (14.3% of total).

- Saudi Arabia issued USD 5bn in triple-tranche dollar-denominated sukuk on May 28th: this follows a bond issuance that raised USD 12bn in Jan this year, as the country diversifies its funding sources given its projected fiscal deficit. Strong investor demand was evident, with the order books reaching USD 20bn. Furthermore, the National Debt Management Centre disclosed the issuance of new sukuk worth SAR 64bn (USD 17bn), to support the domestic market, following the early purchase of over SAR 63bn of outstanding debt.

- Tadawul approved the listing of SAR 45.28bn (USD 12.08bn) worth of government debt instruments, with the listing and trading having started on May 27th.

- Financing to SMEs in Saudi Arabia grew by 20.4% yoy to USD 73.5bn in Q4 2023, according to report from Monsha’at, with credit to micro and small enterprises amounting to USD 6.7bn and USD 24.6bn respectively. The report also stated that banks in Saudi Arabia provided credit facilities worth USD 68.9bn to SMEs in Q4 2023, up 21.1% yoy. The report also highlighted that the fashion industry in Saudi Arabia is expected to grow by 48% from 2021-2025. The value of the fashion sector stood at USD 24.6bn in 2022, with the domestic industry worth USD 12.5bn.

- Saudi PIF launched Neo Space Group last week to invest in the country’s space sector ventures (including satellite navigation and communications, Earth observation and remote sensing). The fully PIF-owned company aims to develop and enhance commercial space operations in Saudi alongside developing the growing satellite and space sector.

- In its efforts to promote energy efficiency, the number of companies in energy efficiency services in Saudi Arabia touched 55 licensed firms at end-2023, including 41 local and 14 international companies. The CEO of Saudi Energy Efficiency Center disclosed that efforts in this space led to an estimated savings of approximately 7 terawatt-hours by end-Q1 2024.

- Aramco fund Prosperity7 invested in Chinese GenAI startup Zhipu AI, making it the first instance of foreign investment in the largest Chinese generative AI startup.

- Aramco disclosed the completion of its acquisition of a 40% equity stake in Gas & Oil Pakistan. The press release noted that this was Aramco’s first downstream retail investment in Pakistan, also signalling the firm’s growing presence in high-value markets.

- Lucid and Electric Vehicle Infrastructure Co (EVIQ) signed an MoU to develop a high-speed public charging offering for Lucid customers, utilizing EVIQ’s stations to provide fast-charging capabilities to support the adoption of EVs. There were less than 1000 electric cars in Saudi Arabia last year.

- Saudi Arabia issued its first maritime tourism licence to Jeddah-based Cruise Saudi. The ship can cater to 3,362 passengers and includes 20 entertainment venues across 18 decks. The cruises will begin in Dec with Red Sea trips, with stops on a private land, in Egypt and Jordan.

UAE Focus![]()

- UAE and South Korea signed a trade agreement, that sees a sharp reduction in import duties (on mor than 90% of all imports) alongside strengthened economic ties. The agreement will remove all tariffs on South Korean arms exports when it is ratified and the UAE will drop import duty on automobiles over the next 10 years. Additionally, about 19 business deals and agreements were signed in investment, energy, nuclear power, defence, technology, climate change and cultural exchange: this includes plans for South Korea to build six LNG carriers worth USD 1.5bn in a deal between ADNOC L&S, Samsung Heavy Industries and Hanwha Ocean.

- According to a joint declaration, UAE and China have signed multiple cooperation agreements “aimed at strengthening bilateral relations in the fields of Belt and Road Initiative, investment and trade, science and technology, tourism, health, culture, statistics, higher education as well as Chinese language teaching, intellectual property, peaceful uses of nuclear energy, tolerance and coexistence”. This includes the establishment of the China-UAE high-level investment cooperation committee in addition to an MoU for intellectual property cooperation as well as a MoU on statistical cooperation.

- UAE’s Emirates Nuclear Energy Corporation and China National Nuclear Corporation signed a MoU to explore opportunities for developing, operating and maintaining civil nuclear plants. This follows an MoU singed during the COP28 in Dubai in Dec 2023.

- The UAE industrial sector will receive an additional AED 23bn (USD 6.3bn) in funding, raising the total funding for the sector to more than AED 143bn, as the country progresses with its “Make it in the Emirates” initiative. ADNOC will contribute AED 20bn and Pure Health another AED 3bn, disclosed the Minister of Industry and Advanced Technology. Related plans announced to support domestic manufacturing included a new lending program worth AED 1bn for SMEs (in coordination with Emirates Development Bank) and competitive electricity prices for industrial firms in Ajman, Umm Al Quwain, Ras Al Khaimah and Fujairah.

- Dubai’s sovereign wealth fund, the Investment Corporation of Dubai, posted 68% jump in net profits to a record high AED 60.8bn in 2023. This was largely due to its ownership of Emirates Airlines alongside holdings in Emirates NBD bank and Emaar Properties; about AED 10.4bn came from non-controlling interests. Profit from ICD’s transportation division surged 119% in 2023, while those from banking and other financial services rose 69%. ICD’s assets touched a record AED 1.322trn (+12% yoy) while revenues grew by 16% to AED 310.2bn.

- ADNOC announced at the “Make it in the Emirates” forum that it is raising its local manufacturing goal for critical industrial products in its procurement pipeline to AED 90bn by 2030, after achieving its previous AED 70bn target ahead of schedule. The company’s in-country value programme generated 11500 local jobs last year and it expects AED 178bn to be invested back into the economy by 2028.

- Bloomberg reported that ADNOC expects to touch its 5mn barrels per day production capacity target by end-2025 or early-2026 (versus by 2027, as announced in Nov 2022).

- Digital trade in the UAEis projected to grow at a compound annual growth rate of 12.3% from 2023 to 2028, largely driven by the rise of “buy now, pay later” models (about 40% of consumers in the UAE rely on BNPL systems), according to a research paper. Findings also included that about 47% of the residents rely on credit cards (vs a global average of 18%).

- ADNOC Distribution announced plans to expand its number of fast-charging stations for electric cars from 90 currently to 150-200 by end of this year and 500 over the next 5 years. The firm also plans to increase the number of its fuel stations in UAE, Egypt and Saudi Arabia to 1000 in 5 years from 840 currently.

- Tourism sector in the UAE is expected to contribute AED 236bn (USD 64bn) to GDP in 2024, roughly 12% of GDP, and generate 833k direct jobs.

Media Review

How Saudi Aramco plans to win the oil endgame

https://www.economist.com/business/2024/06/02/how-saudi-aramco-plans-to-win-the-oil-endgame

Red Sea diversions, tariff risks send ocean shipping soaring

https://www.reuters.com/markets/commodities/red-sea-diversions-tariff-risks-send-ocean-shipping-soaring-2024-05-31/

Is the ‘cult of Modi’ starting to lose its lustre?

https://www.ft.com/content/30d7ca2a-92f0-412c-8234-2e9ec64043bb

Xi says China wants to work with Arab states to resolve hot spot issues

https://www.reuters.com/world/china-wants-ties-with-arab-states-that-will-be-model-world-peace-2024-05-30/

Egypt and UAE still in talks over $35bn Ras El Hekma deal

https://www.agbi.com/construction/2024/05/egypt-and-uae-still-in-talks-over-35bn-ras-el-hekma-deal/

Powered by: