Weekly Insights 31 May 2024: Investment deals, credit activity, trade & tourism to sustain non-oil sector growth

1. Saudi Arabia closed 64 investment deals in Q1 2024 & investment licenses issued rose to 3157: Boosting Non-Oil sector activity

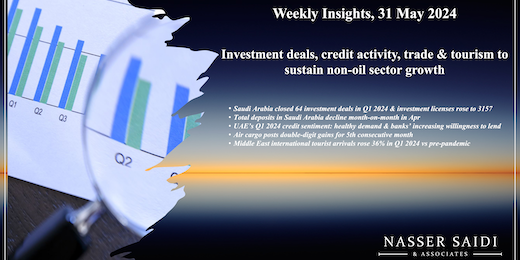

- The Ministry of Investment Saudi Arabia (MISA) closed 64 investment deals in Q1 2024 (Q1 2023: 104), with 55 new investors.

- By economic activity, deals were mostly in innovation and entrepreneurship (34 or 53% of total) followed by sports (12 or 18.8%) and environmental services (5 or 7.8%).

- Investment licenses issued by MISA grew by 93% yoy to 3157 in Q1 2024. The top five sectors – construction (+104.7% yoy), manufacturing (+81.3% yoy), professional, scientific & technical activities (141.5% yoy), ICT (93.4% yoy), accommodation & food services (87.3% yoy), and wholesale & retail trade, & repair of motor activities (60.3% yoy) – represent 81.8% of licenses issued in Q1. The highest growth in investment licenses in Q1 2024 was recorded in real estate (253.3% yoy to 53) followed by professional, scientific & technical activities (141.5% yoy to 396).

- Distribution of licenses show that Egypt received the highest number of licenses in Q1 2024 (60% to 950), followed by Yemen & India. Regional strategic ties are evident from the distribution, in addition to usual suspects UK, US and China (almost three times to 104).

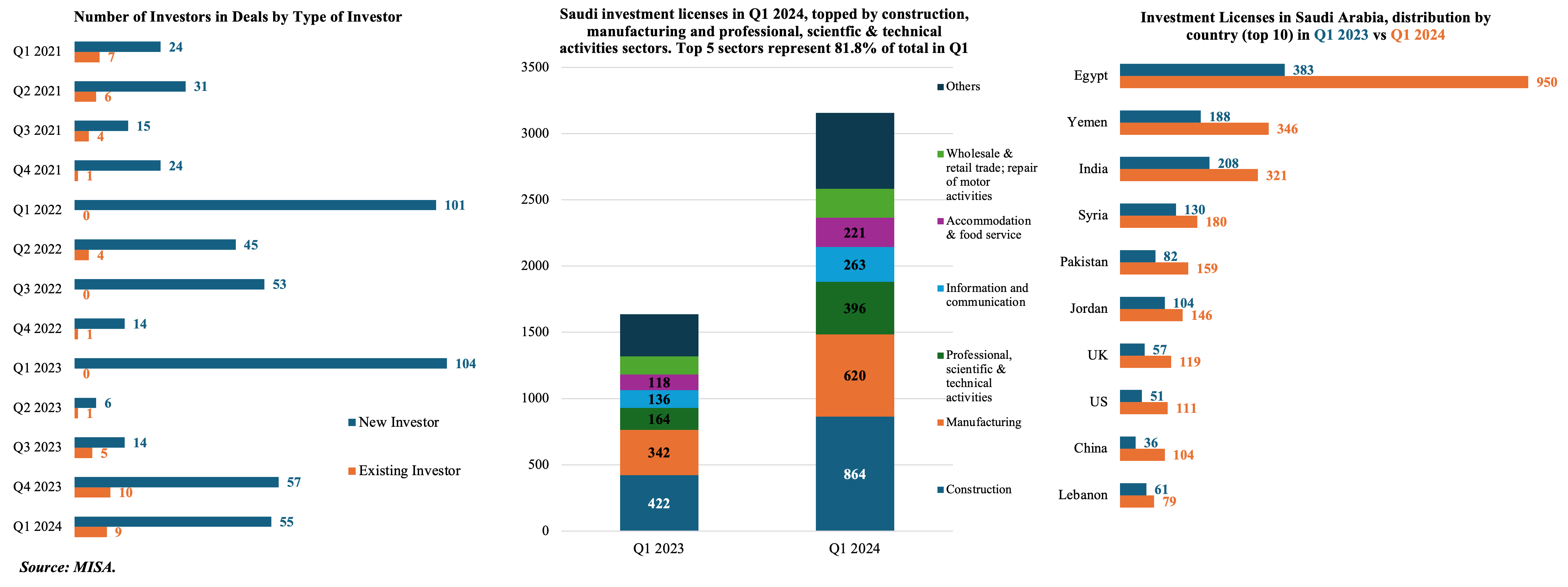

2. Total deposits in Saudi Arabia decline month-on-month in Apr, despite an uptick in government deposits; credit growth rise by 10.3% in Jan-Apr; residential new mortgages finance slips from Mar’s 14-month high

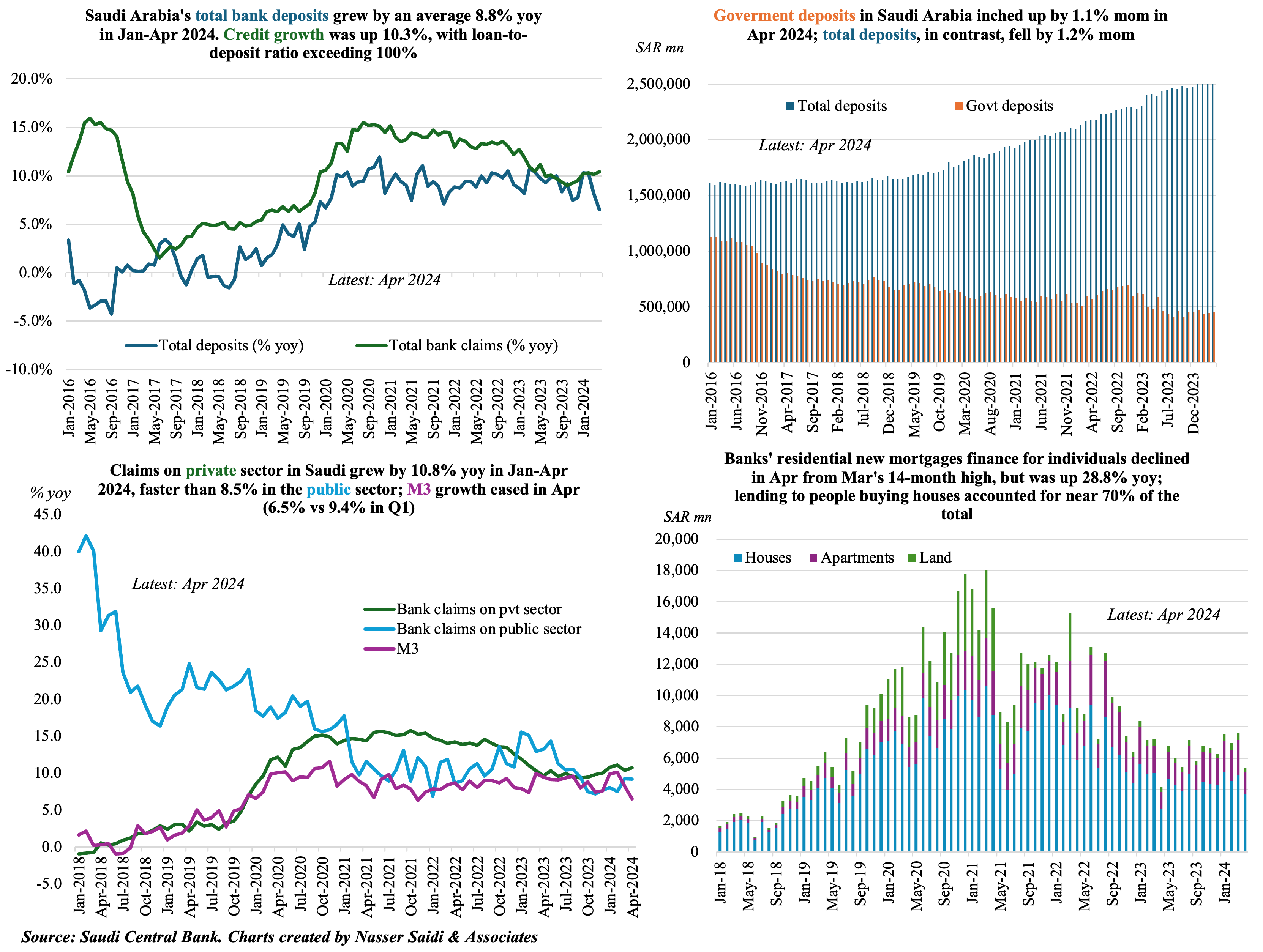

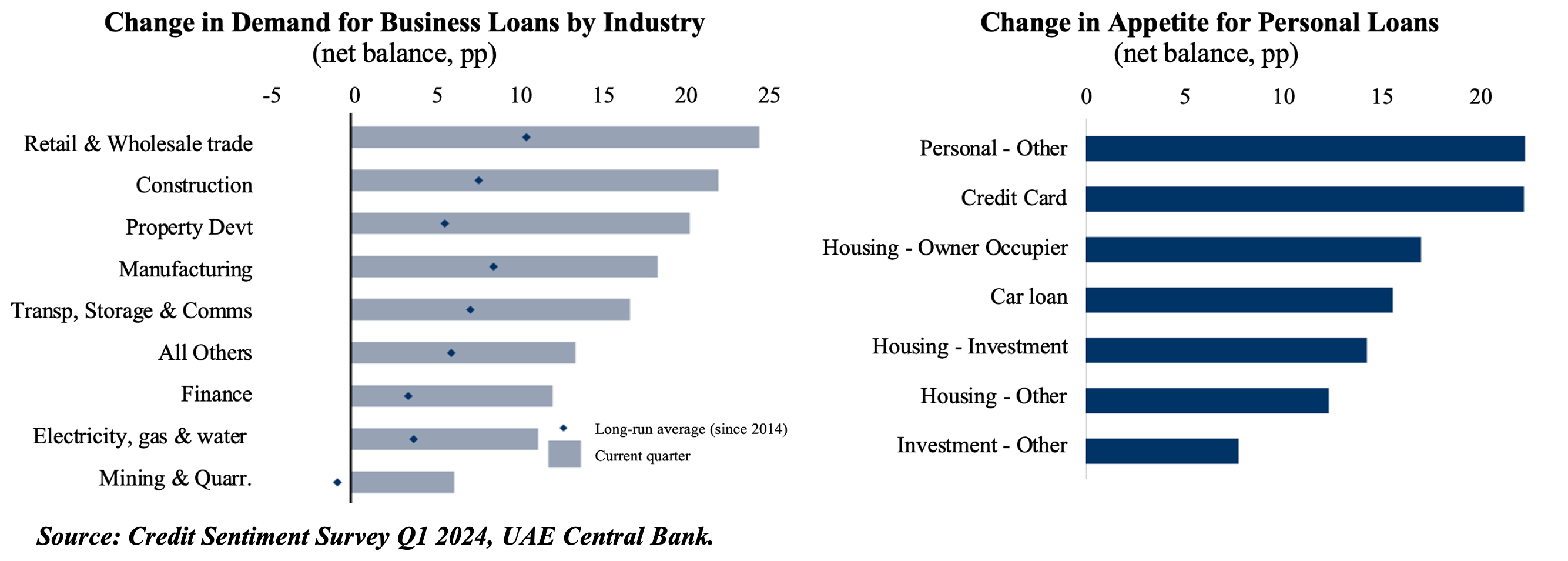

3. UAE’s Q1 2024 credit sentiment survey indicates healthy demand & banks’ increasing willingness to lend

- Loans disbursed to UAE’s business & industrial sector accounted for ~50% of total domestic credit in Jan 2024.

- UAE central bank’s Q1 2024 credit sentiment survey shows a strong credit demand and supply (domestic credit grew by 5.3% yoy in Jan 2024 vs 2% in Jan 2023)

- Demand for business loans rose in Q1 2024: quarterly growth was at its highest in over a year. Positive future economic outlooks seems to have partially offset the impact of higher interest rates.

- By industry, strong sentiment was seen in retail & wholesale trade, construction, property development and manufacturing.

- Banks showed a higher willingness to offer personal loans. Demand was strong across all segments (the highest level on record). Personal and credit card loans as well as housing loans (owner-occupier) showed an uptick.

- Credit appetite is largely expected to remain strong in Q2.

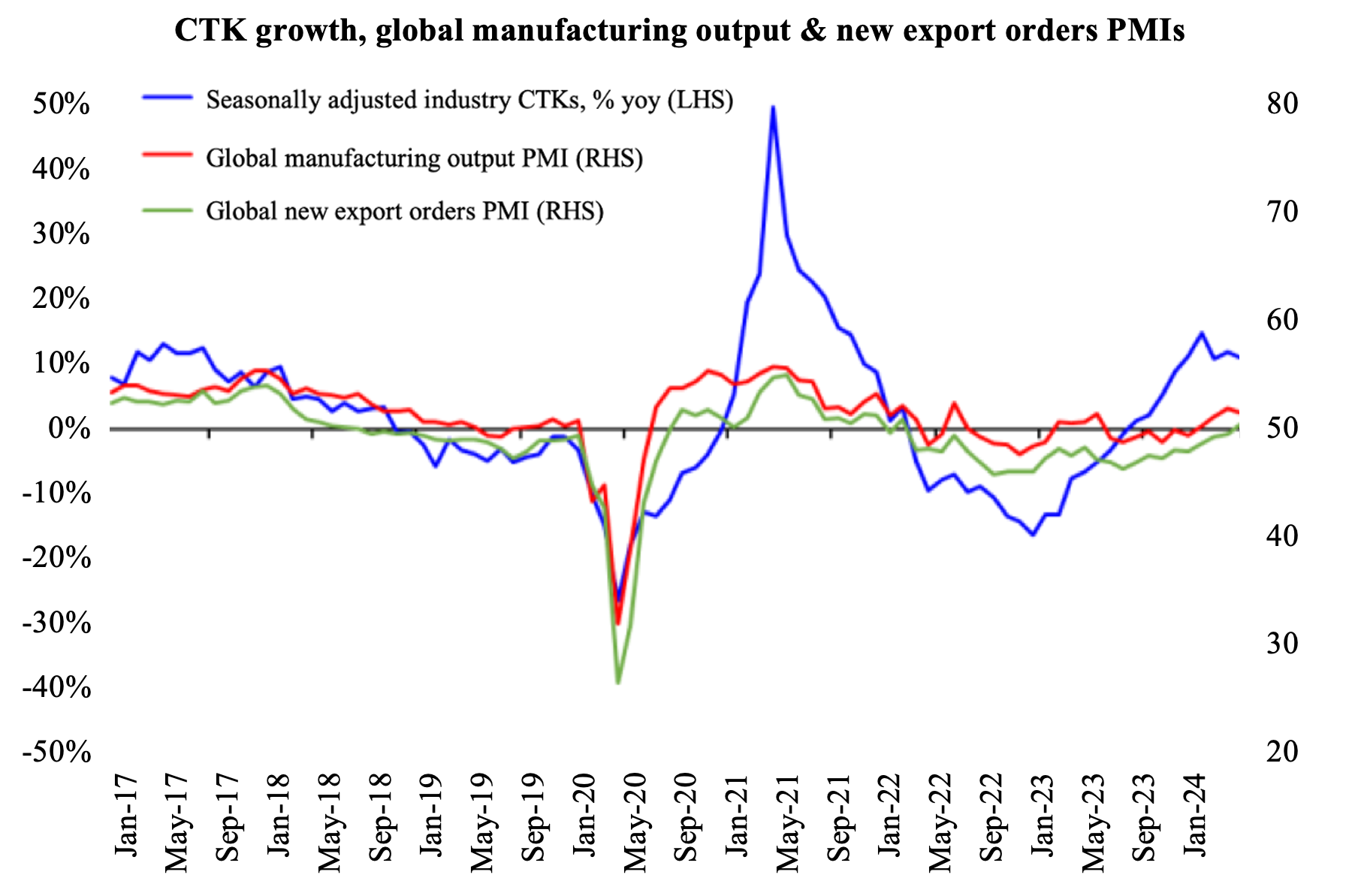

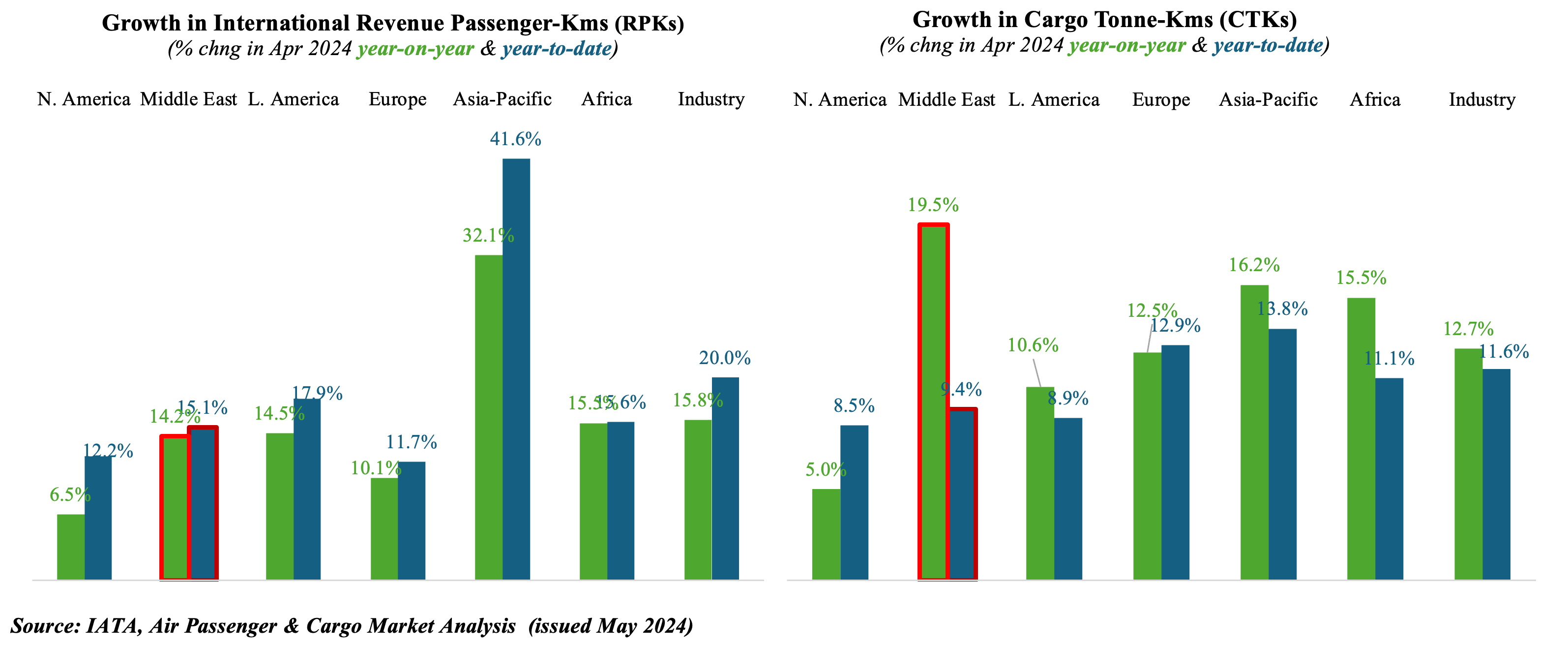

4. Air cargo posts double-digit gains for 5th consecutive month; commercial services trade to benefit from travel & tourism recovery

- Cargo demand has been resilient: Cargo tonne-kms (CTKs) grew by 11.1% yoy in Apr (the 5th month of double-digit growth). An uptick in new orders and manufacturing output bode well for cargo movements.

- In contrast to the previous seven months when Middle East carriers grew the most, April saw airlines from Asia Pacific and Europe recording the highest growth rates.

- On the other hand, passenger traffic remains positive (11% yoy in Apr), largely due to resilient international traffic. Middle Eastern airlines grew their international revenue passenger-kilometers (RPKs) by 14.2% yoy in Apr. Traffic in the Middle East-Asia route has fully recovered and risen above its 2019 historical peak (18.9% in Apr vs 12.7% in Mar 2024).

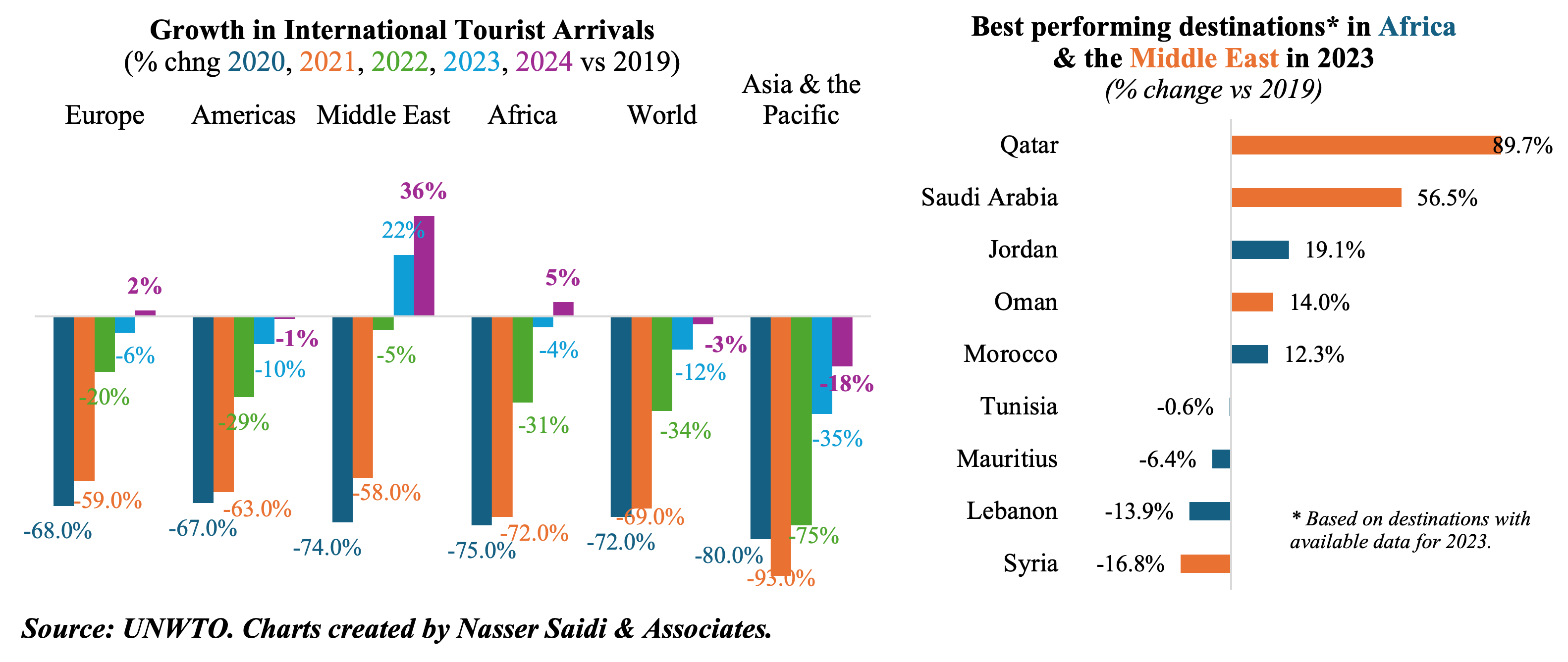

5. Middle East International Tourist arrivals rose 36% in Q1 2024 vs pre-pandemic, continuing its robust performance

- The UNWTO reported in its latest World Tourism Barometer (issued May 2024) that an estimated 285mn tourists travelled internationally in Q1 2024.

- The Middle East was the only region to recover pre-pandemic levels in 2023: this strong growth continued into Q1 2024. International arrivals in the Middle East exceeded pre-pandemic levels by 36% in Q1 2024; Europeexceeded pre-pandemic levels for the first time in a quarter (+2% from Q1 2019) while Africa welcomed 5% more arrivals vs Q1 2019.

- Among the best performing destinations in 2023 in terms of international tourist arrivals were Qatar (top, +89.7% vs 2019), Saudi Arabia (2nd, +56.5%) and Oman (+14%). The Middle East is also emerging as a major investment hub for tourism, with 254 greenfield projects announced between 2018 and 2023, representing a total capital investment of USD 15.2bn.

- Total export revenues from international tourism, including both receipts and passenger transport, surged to USD 1.7trn in 2023, about 96% of pre-pandemic levels in real terms (i.e. excluding inflation). Receipts in the Middle East climbed 33% above 2019 levels.

Powered by: