Download a PDF copy of the weekly economic commentary here.

Markets

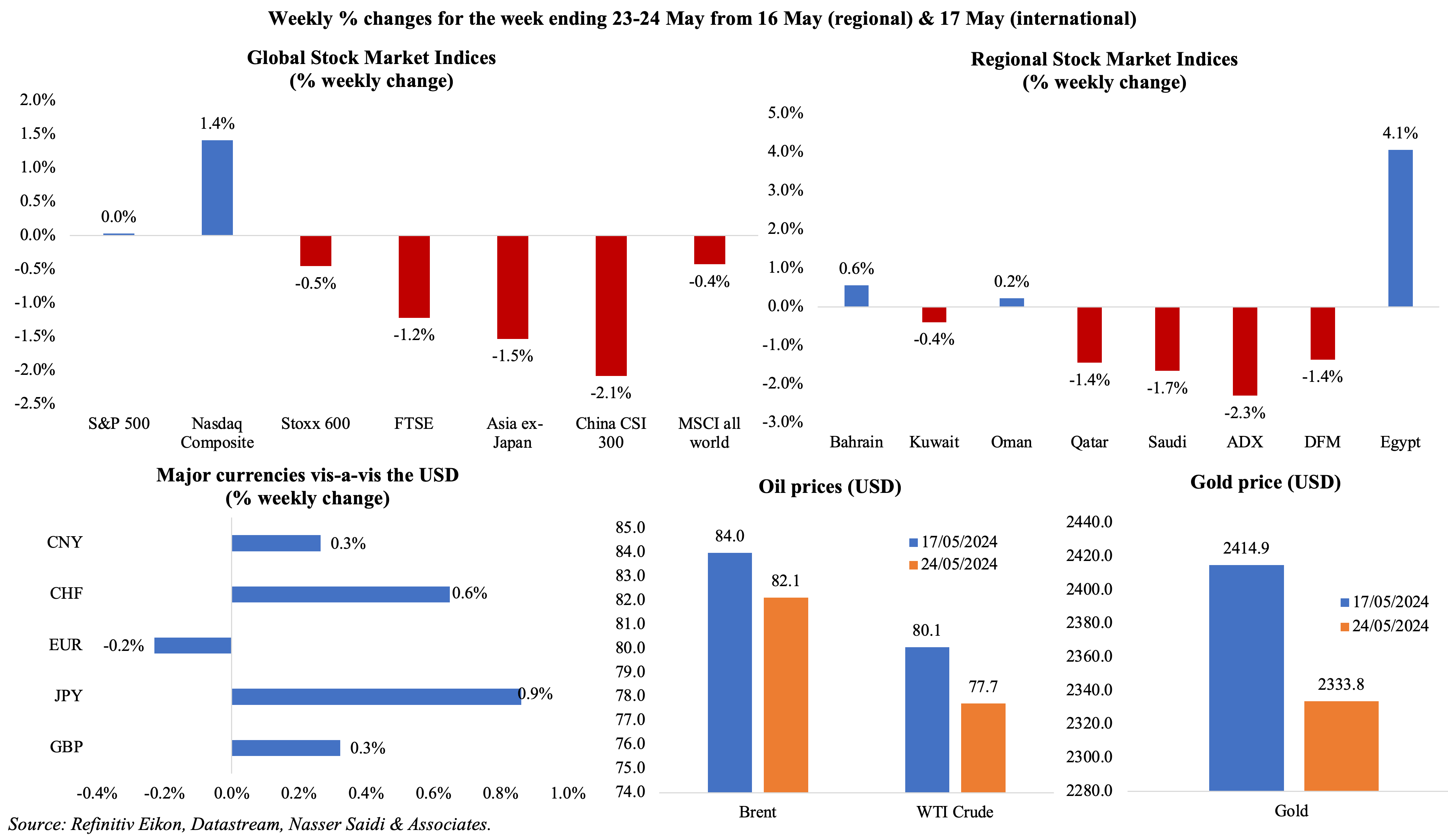

Equities markets posted a mixed picture as interest rate woes (i.e. “higher for longer”) appear on the radar again given indicators of continued strength of the US economy and labour markets. While the US markets rallied ahead of the long weekend, elsewhere weekly declines were the norm. Regional markets edged lower on hawkish views from the Fed and a potential dampened demand outlook: Abu Dhabi’s index touched the lowest level in more than 2 years on Friday and posted a steep 2.3% weekly drop, though Egypt posted a jump based on improving economic prospects. Among currencies, the dollar weakened against a basket of currencies on Fri but ended positive for the week. Oil prices were near 3-month lows, with both Brent and WTI down by more than 2%. Though gold hit a record USD 2449.89 last Monday, it fell during the week dropping by more than 3% (the worst since Dec).

US/Americas:

- FOMC minutes lamented the “lack of further progress toward the Committee’s 2% objective” and noted the upside risks to inflation from geopolitics and effect of inflation on lower-income consumers.

- Durable goods orders in the US grew by 0.7% mom in Apr (Mar: 0.8%), thanks to increases in orders of transportation equipment (1.2%), motor vehicles & parts (1.5%) and computers & electronic parts (0.6%) among others. Non-defence capital goods orders excluding aircraft rebounded by 0.3% in Apr (Mar: -0.1%).

- US existing home sales declined by 1.9% mom to a seasonally adjusted 4.14mn in Apr. The supply of houses grew 9% mom and 16.3% yoy to 1.21mn units, the highest since Oct 2021.

- New home sales in the US fell by 4.7% mom to 634k in Apr; it fell by 7.7% in year-on-year basis, the first decline since Mar 2023. There were 480k new homes on the market and median new house price was up by 3.9% yoy to USD 433,500 in Apr.

- Chicago Fed national activity index dropped further to a 3-month low of -0.23 in Apr (Mar: -0.04) as production and employment related indicators fell. Kansas Fed manufacturing production index improved to -1 in May (Apr: -13), with the composite index staying negative for the 9th month in a row, though moving up to -2 (from -8).

- Michigan consumer sentiment index was revised up to 69.1 in May (prelim: 67.4), though this was the lowest reading in 6 months. The 1- and 5-year inflation expectation edged lower to 3.3% and 3% (from 3.5% and 3.1% respectively in the preliminary estimates).

- S&P Global manufacturing PMI in the US rose to 50.9 in May (Apr: 50), the 3rd-highest reading in over 20 months, with support from both output and employment while the decline in new orders moderated. Services PMI jumped to 54.8 in May (Apr: 51.3), the most in a year, thanks to increased output and inflows of new work while services exports fell.

- Initial jobless claims fell by 8k to 215k in the week ended May 17th and the 4-week average moved up by 1.75k to 219.75k. Continuing jobless claims rose by 8k to 794mn in the week ended May 10th, at historically low levels.

Europe:

- Flash manufacturing PMI in the eurozone jumped to a 15-month high of 47.4 in May (Apr: 45.7). New business continued to fall, but to a lesser extent than the past two years; new export orders declined for the 27th month in a row but the pace of decline softened.

- Preliminary estimates of consumer confidence in the euro area improved to -14.3 in May (Apr: -14.7), inching closer to the highest since Feb 2022. In the EU, confidence rose to a below-historical average of -13.2 (up by 0.5 points).

- Germany’s flash manufacturing PMI increased to a 4-month high of 45.4 in May (Apr: 42.5): while most components including output, new orders and export sales remained in contraction, the deterioration eased sharply.

- Producer price index in Germany slipped further into deflation in Apr (-3.3% vs Mar’s -2.9%). In the 10th consecutive month of negative readings, prices were down in energy costs (-8.2%) as well as in intermediate goods (-3.1%) while capital goods prices rose by 2.4%.

- Inflation in the UK eased to 2.3% yoy in Apr (Mar: 3.2%), the lowest reading since Jul 2021, thanks to falling electricity and gas prices (-37.5% and -21% respectively). Food prices slowed (2.9%, the lowest since Nov 2021) while core CPI slipped to 3.9% (Mar: 4.2%).

- The preliminary manufacturing PMI in the UK rose to 51.3 in May (Apr: 49.1), as production increased the most since Apr 2022, supported by strong demand and signs of recovery in export sales. Business optimism also increased to the highest since Feb 2022.

- Retail sales in the UK fell by 2.3% mom and 2.7% yoy in Apr as bad weather caused sales volumes to fall sharply across most sectors; non-food sales fell by 4.1%, the biggest decline since Jan 2021, while sales at clothing and household goods stores plunged by 5%. Though sales volumes were down 3.7% from the Feb 2020 levels, consumers spent 15% more.

- Producer price index in the UK, on the output side, rose to 1.1% in Apr (Mar: 0.7%), with highest increases for refined petroleum products (13.3%) and computer, electronic & electrical products (4.2%). Producer input prices fell by 1.6% in Apr (Mar: -2.5%). The annual inflation rates for both input and output PPI are at their highest levels since May 2023.

- Retail price index in the UK grew by 0.5% mom and 3.3% yoy in Apr: this was the lowest yoy number since May 2021.

- GfK consumer confidence in the UK improved to -17 in May (Apr: -19), the highest since Dec 2021, though high costs of living and borrowing costs are still major worries for consumers.

Asia Pacific:

- The PBoC left loan prime rates steady, in line with market expectations: the one-year and five-year LPRs were left unchanged at 3.45% and 3.95%, respectively.

- FDI into China plunged by 27.9% to CNY 360.2bn (USD 49.74bn) in Jan-Apr (Q1: -26.1%). About 12.7% of the total investment went into the high-tech manufacturing industries.

- The Bank of Korea left interest rates unchanged at 3.5% for the 11th consecutive time, while signalling a hawkish stance. The apex bank raised the 2024 GDP growth forecast up to 2.5% yoy (from 2.1% previously) while lowering the 2025 forecast to 2.1% (from 2.5%).

- The preliminary manufacturing PMI for Japan rose to 50.5 in May (Apr: 49.6), the first expansionary one since May 2023; new orders shrank, albeit at a softer pace. Services PMI eased to 53.6 (Apr: 54.3) as output and new orders slowed alongside an uptick in export orders.

- Exports from Japan grew by 8.3% yoy in Apr (Mar: 7.3%), rising for a fifth straight month, supported by the weaker yen. Imports accelerated by 8.3% (Mar: -5.1%), given upticks in crude oil, airplanes and computers, moving the trade balance to a deficit JPY 462.5bn.

- Inflation in Japan slowed to 2.5% in Apr (Mar: 2.7%). Excluding food and energy, prices slipped to 2.4% (Mar: 2.9%), the slowest uptick since Sep 2022. Excluding fresh food prices were lower in Apr, for the second month in a row: 2.2% from Mar’s 2.6%.

- Japan’s machinery orders grew by 2.7% yoy in Mar, following a 1.8% drop in the month before. Core machinery orders gained by 2.9% mom, though slower than Feb’s 7.7% gain.

- India’s preliminary manufacturing PMI edged down to 58.4 in May (Apr: 58.8): new export and total orders were robust and though output rose, it was at the slowest pace since Feb. Services PMI rose to 61.4 (Apr: 60.8), at 50+ for the 34th month in a row, supported by new export orders and employment, enabling an uptick in composite PMI to 61.7 (from 61.5).

- GDP in Singapore grew by 2.7% yoy in Q1, the quickest growth since Q3 2022; growth expanded by 0.1% qoq, in line with the initial estimates. Separately, inflation and core inflation in Singapore stood pat at 2.7% and 3.1% respectively in Apr. Prices for food and housing & utilities were at 2.8% and 4.0% in Apr while clothing prices fell (-0.7%).

- Manufacturing production in Singapore fell by 1.6% yoy in Apr (Mar: -9.2%), dragged down by the volatile biomedical manufacturing segment (-29.1% yoy, with pharmaceuticals alone diving 55% yoy).

Bottom line: The limelight is back on central banks, as multiple inflation releases are on the cards this week, ranging from PCE price index in the US to inflation in the eurozone (out on Thursday, that could affect the ECB rate call in June especially if inflation remains sticky) to Tokyo inflation (2 weeks before the BoJ meeting). Flash PMIs released last week indicate an improvement in May across most major economies, alongside easing inflationary pressure. Services sector continues to outperform the manufacturing side, though the latest reading offers some signs of a recovery in production. Meanwhile, OPEC+ meets this week, and is likely to hold steady on the production cuts, possibly to be extended till end-Sep. As attacks in the Red Sea continue, the average cost of shipping is ticking up – the average cost of shipping a 40ft container between the Far East and northern Europe at short notice crossed USD 4,300 a few days ago (Spring is reportedly a quiet shipping period), roughly three times higher than the same period last year. However, the markets “fear gauge” Vix seems to be at multi-year lows (despite the geopolitical developments and worries).

Regional Developments

- Bahrain’s finance minister revealed that the increased oil revenues will be used to pay off public debts. The average oil price touched USD 84 in 2023, while it stood at around USD 82 till Mar 2024. In contrast, the budget for 2023-24 was set with oil price at USD 60 per barrel and a total fiscal deficit of BHD 681mn.

- Egypt central bank left interest rates unchanged at the latest meeting: the overnight deposit and lending rates were held at 27.25% and 28.25% respectively.

- Economic growth in Egypt has been revised downwards to between 2.8%-2.9% in the current fiscal year from 3% projected previously, revealed the planning and economic development minister. She also disclosed that revenues from the Suez Canal fell between 60-65% in Jan-Apr 2024. According to IMF’s Port Watch, the number of cargo ships through the Canal dropped to an average 24 a day from 47 ships in the same period a year ago.

- Egypt’s Suez Canal Economic Zone secured 144 projects worth USD 3.2bn between Jul 2023 and Apr 2024. Of these, 67 and 77 projects have received final and initial approvals respectively. These projects are also estimated to create more than 25k job opportunities.

- Exports from Egypt grew by 10% yoy to USD 12.9bn in Jan-Apr: Saudi Arabia, Turkey, Italy, UAE and the US were the top destinations while the largest sectors were building materials (USD 2.8bn) and food industries (USD 2.1bn). Separately, agricultural exports hit a record level of 7.5mn tonnes last year, with a value of USD 8.8bn.

- Tourism revenues in Egypt touched USD 4.3bn in Jan-Apr 2024, after receiving 4.6mn tourists (slightly lower than a record 4.7mn visitors received in Jan-Apr 2019), reported Asharq Business citing the minister of tourism. It was also reported that the government plans to offer incentives to tourism investors that plan to complete construction of hotels before Jun 2026.

- Egypt secured USD 38.8bn in development financing between 2020 and 2023 – with USD 28.5bn going to various state sectors and rest to the private sector – according to the Ministry of International Cooperation. The long-term agreements have an average interest rate of 1.6% and an average repayment period of 18.6 years.

- Loans disbursed by Kuwait’s banks grew by 2.4% year-to-date to KWD 1.316bn till end-Apr 2024. Private sector deposits were up by 2.9% ytd to KWD 38.463bn while government deposits fell by 7.8% to KWD 10.5bn.

- The IMF, following its staff visit,issued a statement highlighting the lack of progress on economic reforms in Lebanon. Alongside Lebanon’s unresolved political-economic crisis, high unemployment and poverty levels, the conflict in Gaza has added further uncertainty and risk to economic growth (via agriculture production, trade, tourism). Refugees per capita in Lebanon was already the highest globally, and this adds on to existing woes. More: https://www.imf.org/en/News/Articles/2024/05/22/pr24173-lebanon-imf-staff-concludes-visit

- A World Bank-supported household survey found that poverty inLebanon has more than tripled over the past decade to 44% of the total population (one out of three Lebanese were poverty stricken in 2022!) with income inequality worsening. Given greater dollarization, those without access to dollars were more exposed to higher inflation levels (the bottom 20% received just 6% of their income in dollars). More: https://documents1.worldbank.org/curated/en/099052224104516741/pdf/P1766511325da10a71ab6b1ae97816dd20c.pdf

- Oman is planning to open 6 new airports by 2029, in a bid to encourage tourism. The openings would take total airports to 13 and are projected to receive 50mn passengers by 2040 (from 17mn currently).

- Inflation in Qatar inched lower to 0.71% yoy in Apr (Mar: 0.98%), the lowest reading since Mar 2021, though increases were seen across food & beverages (3.2% from 2.73%), transport (1.2% from -0.93%), education (3.4%) and recreation & culture (10.03%).

- Qatar posted a budget surplus of QAR 2bn in Q1 2024, and this was directed to reduce public debt. Overall revenues stood at QAR 53.4bn in Q1, with non-oil revenues declining by 22.1% to QAR 6.1bn. Spending touched QAR 51.4bn in Q1, with salaries and wages accounting for 32% of the total while current expenses share was 36.6%. Major capital expenditures grew by 5% yoy to QAR 14.6bn in Q1.

- Qatar issued green bonds worth USD 2.5bn, its first external debt issuance in 4 years. Qatar sold five-year offerings worth USD 1bn with a yield of 30bps above US treasury bonds, and ten-year debt securities worth USD 1.5bn with a yield of 40bps.

- Industrial production in Qatar grew by 4.7% mom in Mar, thanks to an increase in the mining & quarrying sector (4.8%). In yoy terms, IP declined by 3.2%.

- GCC debt capital market issuances stood at USD 940bn outstanding at end-Mar 2024, up 7% yoy, according to Fitch. Saudi Arabia and UAE accounted for 43% and 30% of the total while the share of sukuk stood at close to 40% (with the remainder in bonds).

- The Middle East’s trade surplus with Japan widened by 13.5% yoy to JPY 845.6bn in Apr, as exports surged (+15.3%; oil & gas exports grew by 16.1%). The region’s imports from Japan jumped by 20% given the demand for automobiles, machinery and manufactured goods.

- The World Economic Forum’s Travel and Tourism Development Index 2024revealed an underperforming MENA region vis-à-vis the global average. However, divergence within the region was evident with UAE ranked 18th globally, followed by Saudi Arabia (41) among the top 50. At the other end, Kuwait and Algeria ranked 96th and 98th respectively. Saudi, UAE and Egypt featured in the top 10 most improved when comparing 2024 rankings vs 2019.

Saudi Arabia Focus

- Exports from Saudi Arabia grew by 4.9%mom to SAR 100.7bn in Mar, supported by both oil (5.5% mom) and non-oil exports (6.0% mom). Imports grew by 1.0% mom and 1.0% yoyto SAR 67.4bn, thereby widening trade surplus to SAR 33.3bn (Feb: SAR 29.4bn). Non-oil trade with the GCC moved to a surplus SAR 443mn in Q1, from a deficit SAR 1.95bn a year before. Notably, the UAE posted a surplus from a deficit in Q4 2023.

- Reuters reported that Saudi Arabia is planning an Aramco share sale as soon as June: to be listed in Riyadh, the offering is expected to raise around USD 10bn.

- Saudi Arabia issued 54 industrial licenses in Mar, with the volume of investments amounting to SAR 1.047trn (USD 279mn). This takes the total permits issued this year to 324. The number of factories existing and under construction rose by 0.6% mom to 11,832 factories, with an investment volume of SAR 1.528trn.

- Point-of-sales spending in Saudi Arabiatouched SAR 11.65bn (USD 3.11bn) in the third week of May, with spending on food & beverages accounting for the largest share at 15%, followed by restaurants & cafes (14.8%). About 50% of PoS transactions happened in Riyadh (35%) and Jeddah (14%).

- Crude exports from Saudi Arabia grew by 1.52% mom to a 9-month high of 6.41mn barrels per day (bpd) in Mar, according to the Joint Organizations Data Initiative. According to the Ministry of Energy, production will be approximately 9mn bpd until end-Jun.

- Moody’s raised Saudi Arabia’s local and foreign currency rating to “Aa1” from “Aa2” citing “increased predictability of policies and decision-making processes affecting non-government issuers given institutional improvements”.

- Saudi Arabia-based fintech firm Rasan Information Technology priced its IPO at SAR 37 per share for its offering of 22.74mn shares (or 30% stake).

- Property technology (PropTech) VC investments in Saudi Arabia surged by 35% yoy to USD 9mn via 6 PropTech deals, according to MAGNiTT. In comparison, the UAE raised USD 35mn from 5 deals.

- Over 100 agreements were signed during the Future Aviation Forum held in Saudi Arabia, with values exceeding SAR 75bn (USD 20bn). The largest deal was signed between Saudia Group and Airbus, worth USD 19bn, to buy an additional 105 A320neo family planes.

- Saudi Arabian Mining Co. Ma’aden’s CEO disclosed that though the firm had successfully extracted lithium from seawater, it was not yet at commercially viable levels.

- Saudi Arabia’s Minister of Tourism revealed that the nation is investing USD 800bn to establish tourism projects, with the aim to increase the sector’s contribution to 10% of GDP by 2030 (this share was 4.5% at end-2023).

UAE Focus![]()

- Real GDP in the UAE expanded by 3.6% yoy in 2023(2023: 7.5%), as non-oil sector activity remains robust (6.2% in 2023 following 2022’s 7.1% gain). The contribution of the non-oil sector stood at 74.3% of the total last year. UAE’s financial sector grew the most in 2023 (14.3% yoy) followed by transportation & storage (11.5%), construction (8.9%) and real estate (5.9%). The oil sector accounted for just over one-fourth of GDP (25.7%, the largest share), followed by wholesale & retail trade (12.6%) and manufacturing (11.2%).

- Sharjah’s economy grew by 6.5% yoy in 2023: non-oil sector growth accelerated by 7.1% to AED 142.5bn; the wholesale & retail trade sector was the largest contributor (24%), followed by manufacturing (16.7%). Separately, S&P expects private sector activity to drive economic growth in the emirate (an average of 2.8% in 2024-2027).

- The IMF, following its staff visit, expects the UAE to maintain strong fiscal and external surpluses given high oil prices. Growth and inflation are projected at 4% and 2% respectively this year while active debt management strategies will result in public debt declining further towards 30% of GDP.

- Fitch Ratings upgraded Ras Al Khaimah’s credit rating to “A+” from “A” previously, based on large investment projects expected to drive medium-term growth and increase diversification.

- Abu Dhabi’s financial centre ADGM reported a 211% surge in assets under management in Q1 2024, supported by an expansion in global asset managers getting established in the centre (107 fund and asset managers managing 137 funds).

- ADNOC raised USD 935mn from the sale of an additional 5.5% stake in its drilling unit to institutional investors. While ADNOC retains a majority 78.5% shareholding in its drilling unit, it has also agreed to a restriction from selling further shares for a 6-month period.

- ADNOC acquisitions: ADNOC acquired a 11.7% stake in NextDecade’s Rio Grande LNG export facility in Texas – the firm’s first large investment in the US. The firm’s stake is in phase 1 of the project which is expected to reach completion by early 2029 and it also signed a 20-year LNG offtake deal for 1.9 mpta of LNG from the second phase of the development. Additionally, ADNOC also acquired a 10% stake from Portugal’s Galp Energia in an LNG project in Mozambique.

- UAE committed USD 10bn in investments to Pakistan’s promising economic sectors. Though the specific sectors were not disclosed, strategic partnerships are being planned in IT, renewable energy and tourism.

- Abu Dhabi’s sovereign wealth fund ADQ plans to invest USD 5bn in Jordan, in infrastructure and other projects including a waste-to-energy plant and an internal rail network among others. UAE’s direct investments into Jordan stood at USD 4bn in 2023 and accounted for 14% of FDI inflow into the country.

- Assets of Islamic banks in the US increased by 13.61% yoy to AED 717.7bn at end-Feb, according to central bank data, while deposits grew by 15.8% to AED 509.4bn.

- Etihad Credit Insurance, the UAE’s federal export credit company, reported a 21-fold increase in gross exposure to AED 9.6bn (USD 2.6bn) in 2023 compared to 2019. In 2023, ECI’s credit covers amounted to 3.1% of the UAE’s AED 441bn in non-oil exports (from just 1.9% in 2022), with over two-thirds of the beneficiaries being SMEs.

- Passenger traffic at the Dubai International Airport grew by 8.4% yoy to around 23mn in Q1. This boost in passengers is a result of the increase destinations offered by the main airlines and has resulted in Dubai Airports revising upwards its projection for this year to 91mn guests (higher than the previous annual record of 89.1mn in 2018).

- According to the General Civil Aviation Authority, passenger traffic at UAE airports expanded by 15% yoy to 36.5mn in Q1 2024: arrivals stood at 10.7mn and transit passengers at 14.9mn.

- The DWTC played host to 76 large-scale business events last year, attracting 1.54mn attendees (46% international). These events added AED 10.53bn to Dubai’s GDP, created 69,281 jobs and generated AED 3.36bn in disposable income.

Media Review

No more excuses — central bankers need to get back ahead of the curve

https://www.ft.com/content/f3cf044e-7b2e-4429-aa7d-066da47c129d

Yellen Says Higher Path for Rates Boosts Need to Lift Revenue

https://www.bloomberg.com/news/articles/2024-05-25/yellen-says-higher-path-for-rates-boosts-need-to-lift-revenue

Reuters exclusive: Saudi sovereign wealth fund to reorganize management amid budget crunch, sources say

https://www.reuters.com/world/middle-east/saudi-sovereign-wealth-fund-reorganize-management-amid-budget-crunch-sources-say-2024-05-24/

AI firms mustn’t govern themselves, say ex-members of OpenAI’s board

https://www.economist.com/by-invitation/2024/05/26/ai-firms-mustnt-govern-themselves-say-ex-members-of-openais-board

Powered by: