Weekly Insights 25 May 2024: Robust GDP, Trade & Tourism growth in the GCC

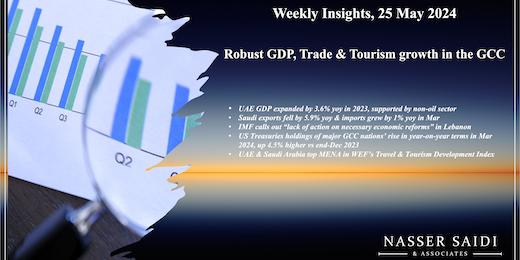

1. UAE GDP expanded by 3.6% yoy in 2023, supported by 6.2% non-oil sector growth; within non-oil, financial sector growth dominates

- Real GDP in the UAE expanded by 3.6% yoy in 2023 (2023: 7.5%), as non-oil sector activity remains robust (6.2% in 2023 following 2022’s 7.1% gain). The contribution of the non-oil sector stood at 74.3% of the total last year.

- UAE’s financial sector grew the most in 2023 (14.3% yoy): not surprising considering the strong growth in both the DIFC and ADGM in attracting many investment firms, hedge funds and family offices setting up base in the country. Other fast growing sectors were transportation & storage (11.5%), construction (8.9%) and real estate (5.9%). The latter two boosted by the various infrastructure projects (e.g. road expansions, Etihad Rail project) in addition to housing & hospitality projects (USD 78bn worth of contracts were awarded in UAE last year, or 30% of total MENA projects).

- Distribution of GDP showed that the oil sector accounted for just over one-fourth of GDP(25.7%, the largest share), followed by wholesale & retail trade (12.6%) and manufacturing (11.2%). The oil sector contracted by 3.1%, given compliance with the OPEC+ oil production cuts. Wholesale & retail trade grew by 3.9% in 2023, higher than the 2.9% uptick in 2022 as recent CEPAs started being implemented as well as supported by services trade (UAE was the 9th largest exporter of commercial services excluding intra-EU trade in 2023, according to WTO). Manufacturing increased by 3.8%, though at a slower pace compared to 2022’s 10.1% surge. In this regard, the UAE’s industrial sector initiatives such as Operation 300bn are progressing well: 30% of the strategy’s target was achieved in 2023.

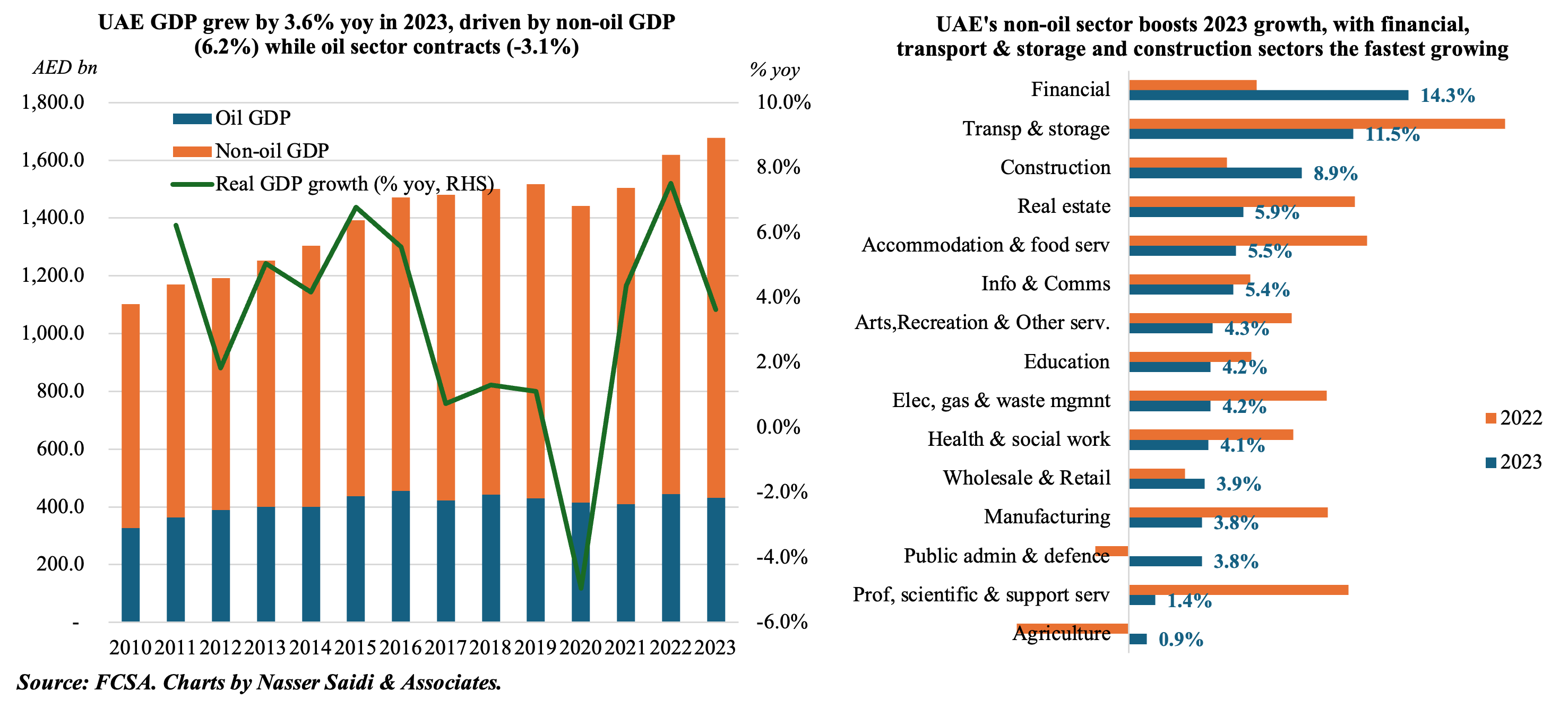

2. Saudi exports fell by 5.9% yoy & imports grew by 1% yoy in Mar; surplus widened to SAR 33.3bn

- Exports from Saudi Arabia grew by 4.9% month-on-month to SAR 100.7bn in Mar, supported by both oil (5.5% mom) and non-oil exports (6.0% mom).

- However, oil exports fell in yoy terms: by 7.3% to SAR 77.5bn in Mar; its share in overall exports stood at 76.9%.

- In year-on-year terms, non-oil exports fell by 6.3% yoy to SAR 16.9bn in Mar while re-exports surged by 17.6% yoy to SAR 6.4bn.

- Imports grew by 1.0% mom and 1.0% yoy to SAR 67.4bn, thereby widening trade surplus to SAR 33.3bn (Feb: SAR 29.4bn).

- In Q1 2024, non-oil exports were up 3.3% yoy to SAR 49.2bn, with re-exports rising by 18% to SAR 6.4bn. Oil exports fell by 8.3% yoy to SAR 221.9bn.

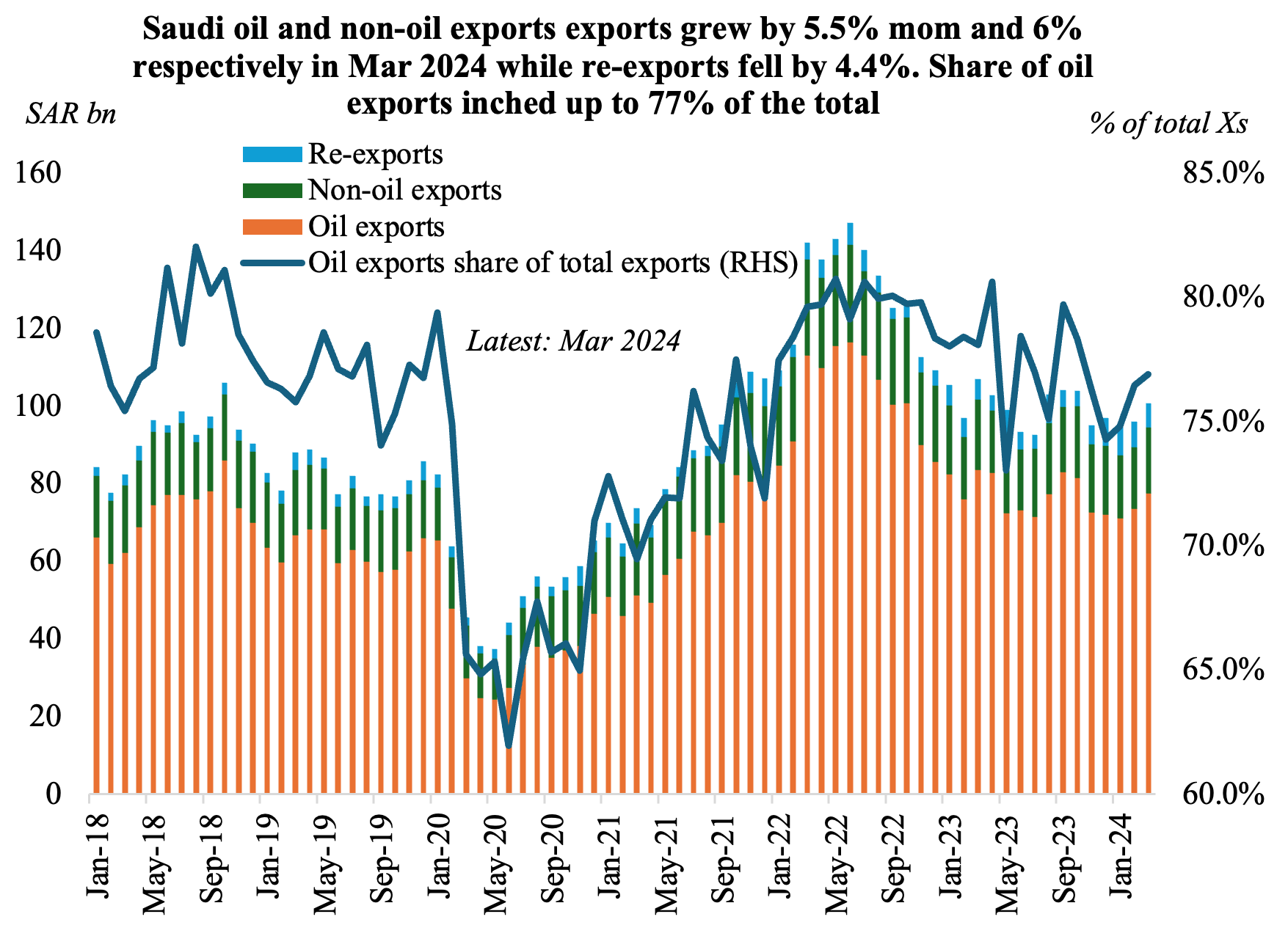

- Oil exports to top 5 destinations (China, South Korea, Japan, India & US) stood at 58.2% of total oil exports in Mar. Share of top 25 nations was 94.1%.

- China was the top trade partner in Q1: accounting for 14.9% of overall exports and 20.9% of total imports.

- Non-oil trade with the GCC moved to a surplus SAR 443mn in Q1, from a deficit SAR 1.95bn a year before. Notably, the UAE posted a surplus from a deficit in Q4 2023.

3. IMF calls out Lebanon on “lack of action on necessary economic reforms”

- The IMF, following its IMF staff visit to Lebanon, issued a statement highlighting the lack of progress on economic reforms. Alongside Lebanon’s unresolved political-economic crisis, high unemployment and poverty levels, the conflict in Gaza has added further uncertainty and risk to economic growth (via agriculture production, trade, tourism). Refugees per capita in Lebanon was already the highest globally, and this adds on to existing woes.

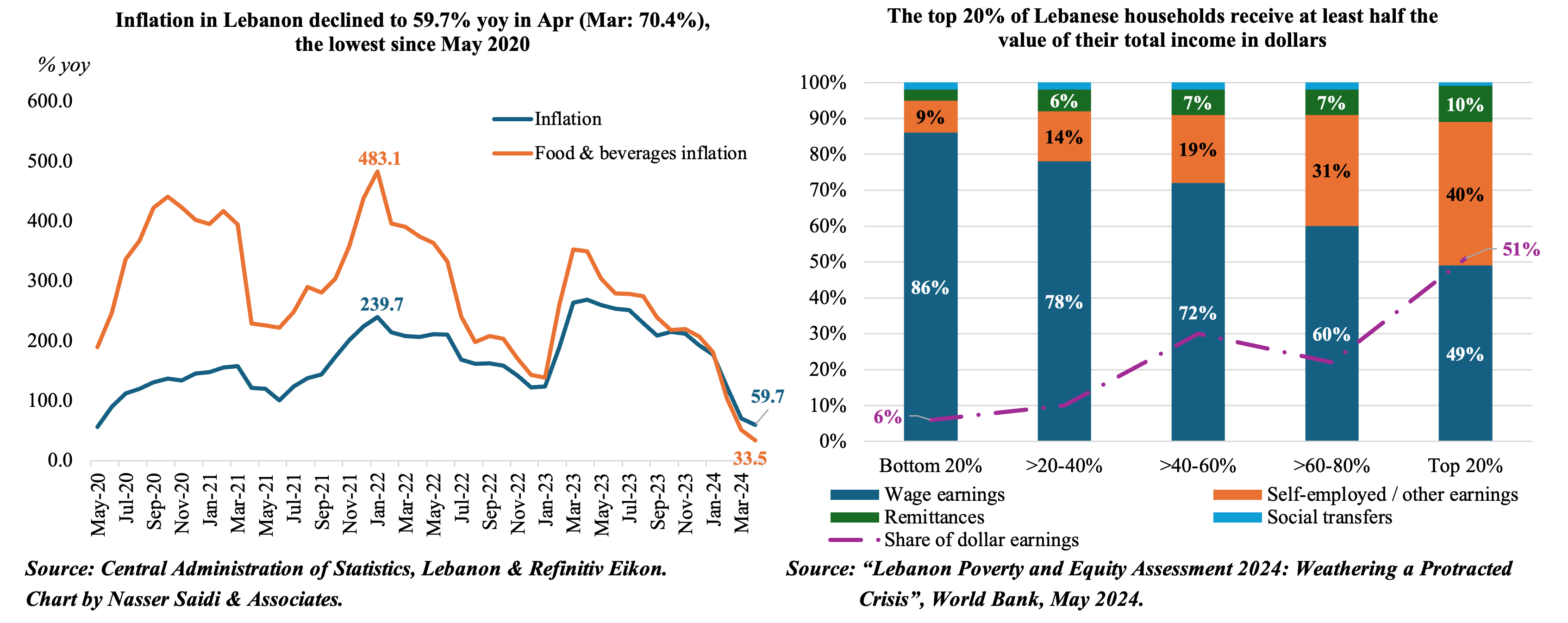

- Some remedial measures from the Ministry of Finance and the Banque du Liban (including termination of the Sayrafa platform) have helped with the exchange rate depreciation and reduced inflationary pressure. Inflation in Lebanon fell to 59.7% yoy in Apr (Mar: 70.4%), the lowest reading since May 2020, with declines across multiple categories including food & non-alcoholic beverages (33.5% from 51.3%), housing & utilities (87.4% from 108.3%) and clothing & footwear (27.2% from 39.5%) among others.

- While inflation has declined after a grueling 44 months of three-digit readings, the forward-looking PMI indicator shows companies remaining pessimistic amidst decline in demand, weak sales and employment levels.

- Separately, a World Bank-supported household survey found that poverty in Lebanon has more than tripled over the past decade to 44% of the total population (one out of three Lebanese were poverty stricken in 2022!) with income inequality worsening. Given greater dollarization, those without access to dollars were more exposed to higher inflation levels (the bottom 20% received just 6% of their income in dollars, denoted by the purple dotted line in the chart highlighting share of total income). This has led to greater food insecurity levels. Meanwhile, remittances have been a growing contributor to overall income.

4. US Treasuries holdings of major GCC nations’ rise in year-on-year terms in Mar 2024, up 4.5% higher vs end-Dec 2023

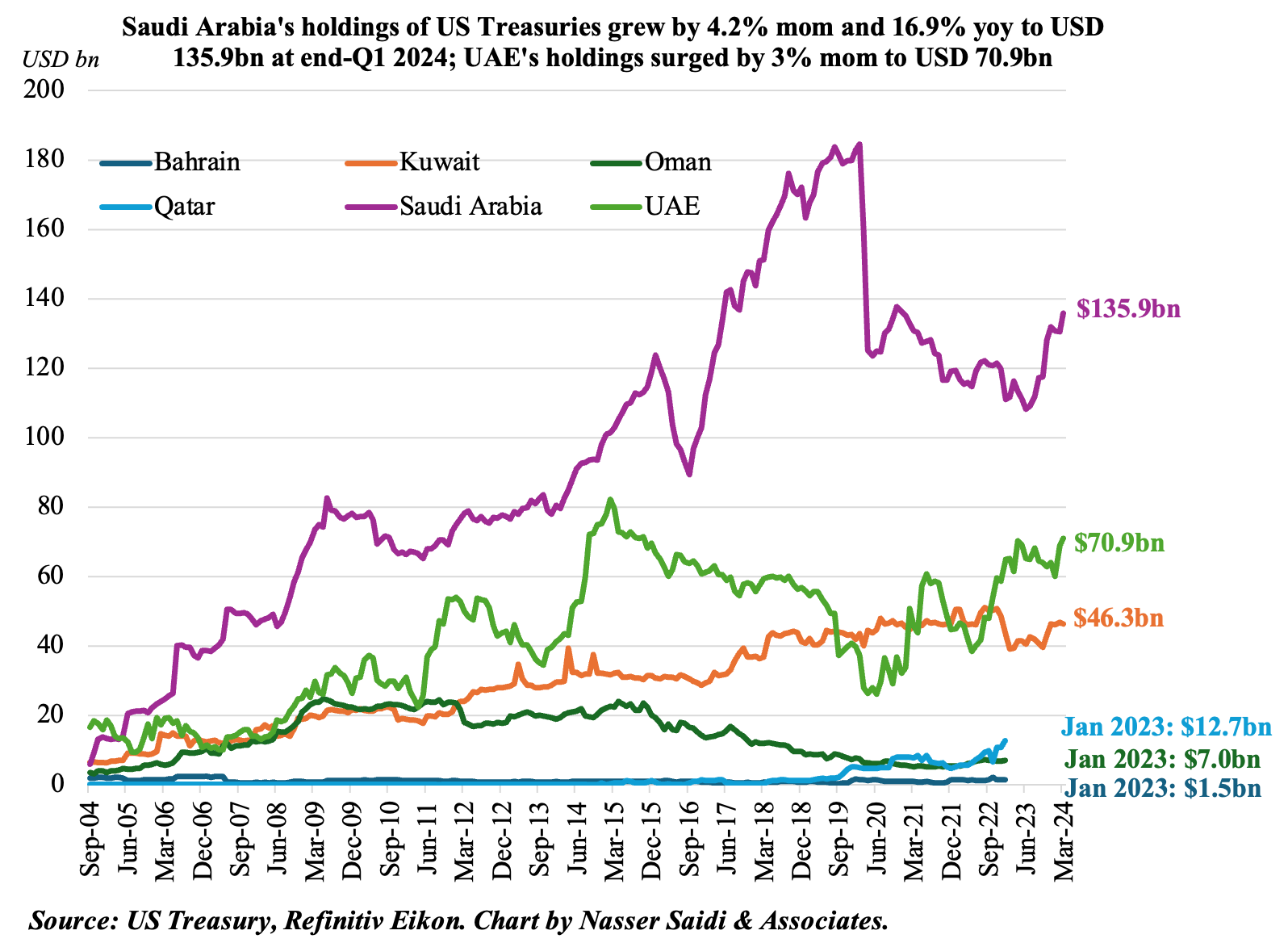

- Foreign holdings of US Treasuries surged to a record USD 8.091trn in Mar 2024: topped by Japan, China and UK. Amid rising tensions with the US (trade & tech wars) China’s holdings of US bonds fell by USD 48.9bn (or 6% ytd) to USD 767.4bn.

- GCC holdings of US Treasuries grew by 2.9% mom and 16.6% yoy in Mar 2024, thanks to a sharp jump in UAE’s holdings to USD 70.9bn (+3% mom and 15.3% yoy).

- Saudi Arabia was the 17th largest investor in US Treasury bonds in Mar: USD 135.9bn, up 4.2% mom and 16.9% yoy. Long-term bonds accounted for more than ¾-th of total holdings (USD 107.3bn) while 21% were short-term bonds (USD 28.6bn).

- Kuwait’s holdings edged down by 0.9% mom to USD 46.3bn in Mar; in yoy terms, holdings were up by 17.8%. UAE’s holdings grew by 3% mom and 15.3% yoy to USD 70.9bn.

5. UAE & Saudi Arabia top MENA performance in WEF’s Travel & Tourism Development Index

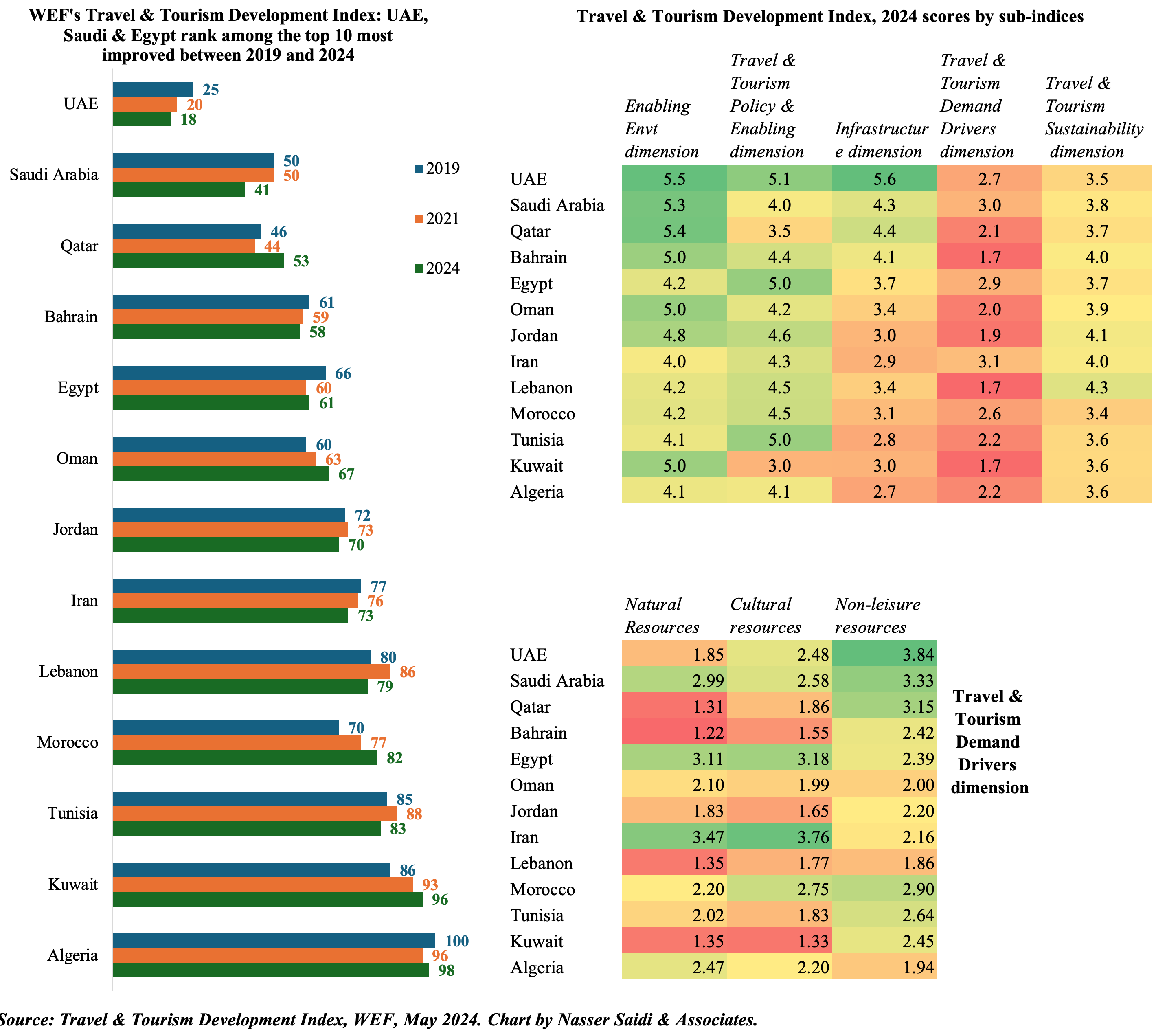

- WEF’s Travel and Tourism Development Index 2024 revealed an underperforming MENA region vis-à-vis the global average.

- However, divergence within the region was evident with UAE ranked 18th globally, followed by Saudi Arabia (41) among the top 50. On the other end, Kuwait and Algeria ranked 96th and 98th respectively.

- Saudi, UAE and Egypt featured in the top 10 most improved when comparing 2024 rankings vs 2019.

- Enabling environment sub-index was the most supportive dimension in the overall index while it was dragged down by the demand drivers dimension.

- UAE scores highly on enabling environment (safety, ICT, business environment etc.) and infrastructure (air, ground, port, tourist services). However, demand drivers offers much scope for improvement

- Many of MENA’s developing nations perform much better on natural & cultural resources within the “demand drivers” (e.g. Iran, Egypt) but are dragged down by infrastructure & safety aspects. Among GCC nations, Saudi outperforms in this dimension.

Powered by: