FDI Middle East & Africa. Oman budget surplus. Saudi inflation, airports. Dubai tourism.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 17 May 2024: Tourism & Capital Investments support non-oil growth, as oil revenues tumble

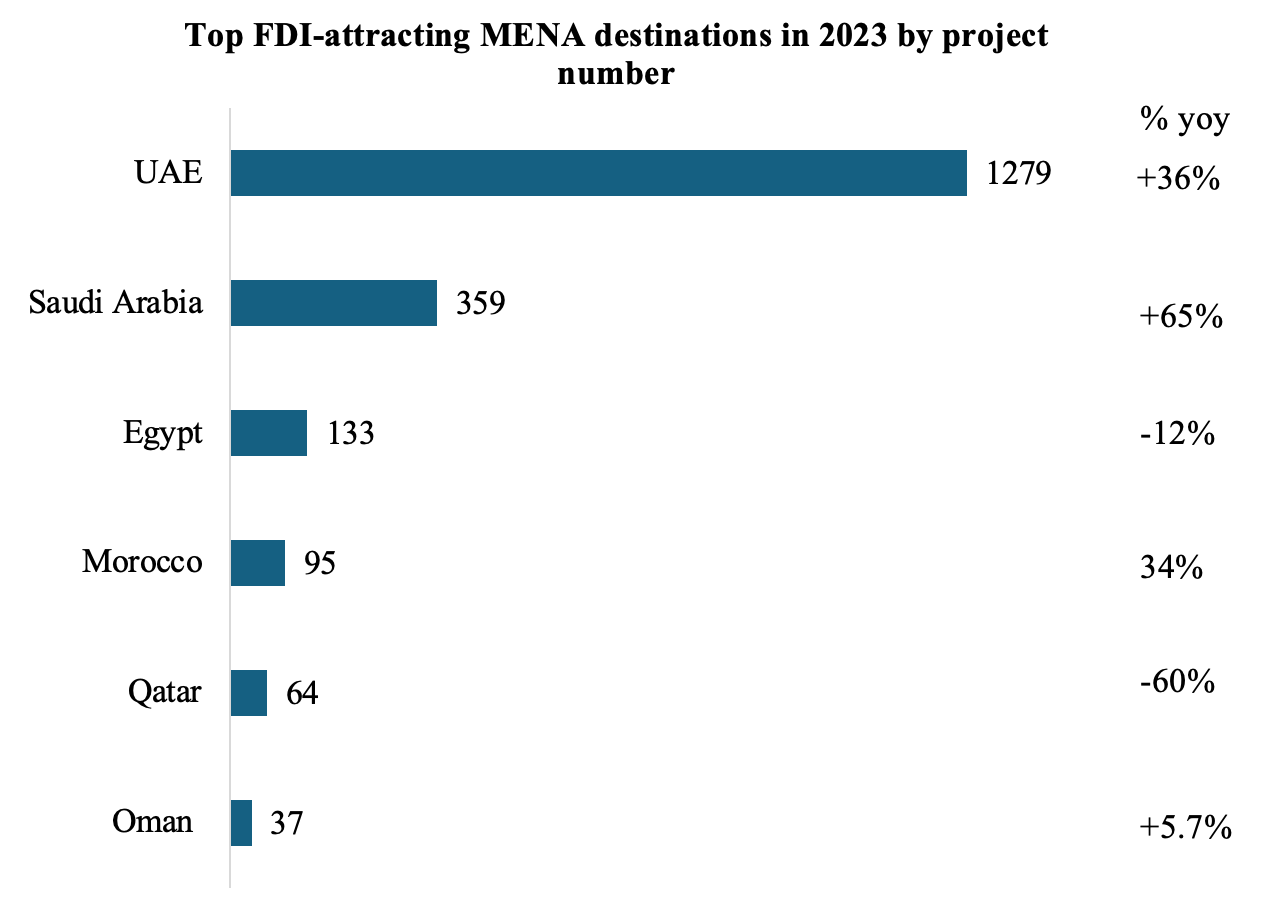

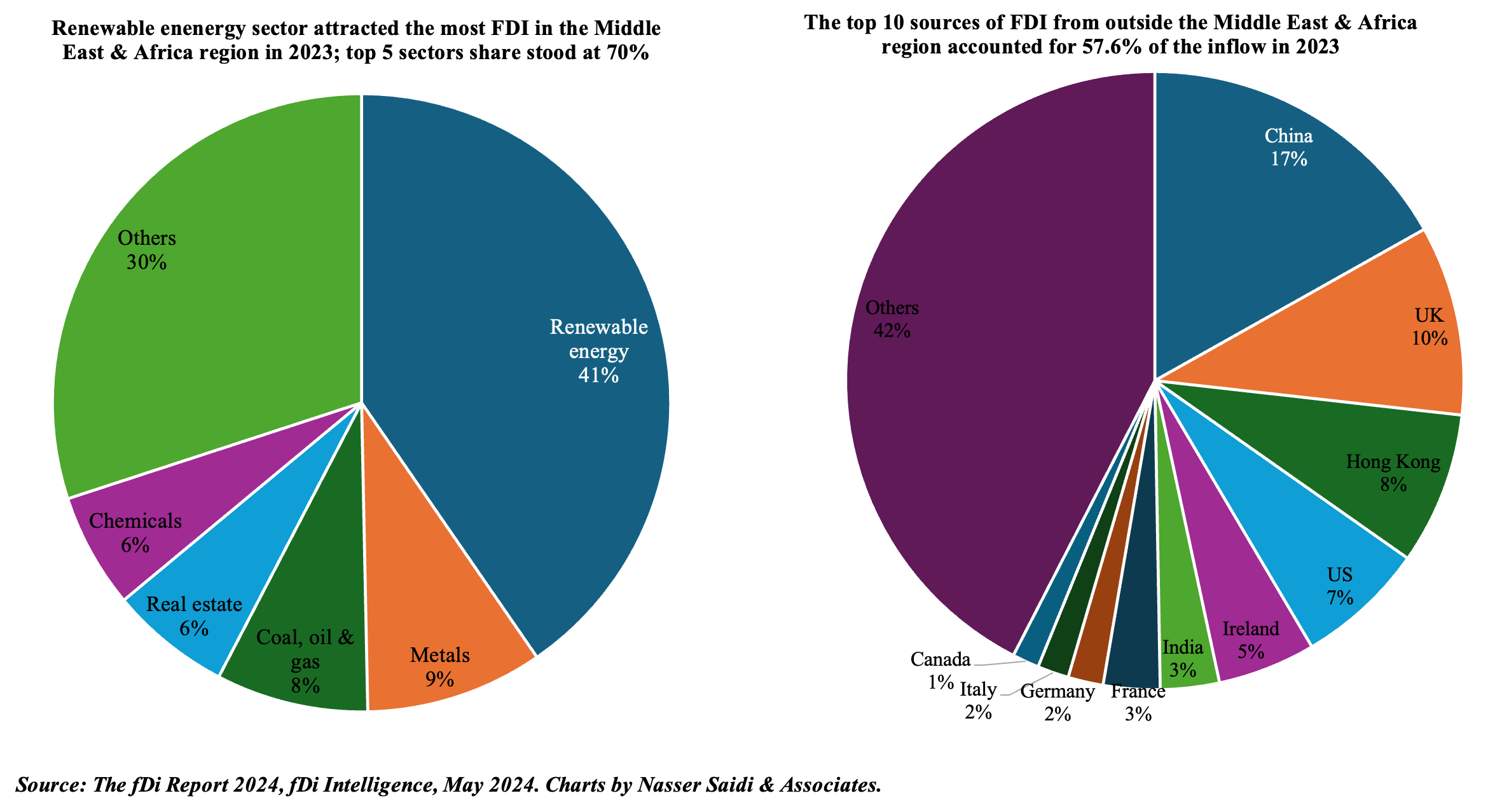

1. FDI in Middle East & Africa region

- FDI, measured by number of projects, grew by 19% yoy to 2658 in 2023, according to fDi Intelligence, roughly 16% of global FDI projects. Capital investment however fell by 6% to USD 249.8bn. Versus pre-pandemic 2019, number of projects and investment were up by 46% and 111% respectively.

- FDI into Saudi Arabia surged by 111% yoy to USD 28.8bn; one-fifth went to automotive sector. Saudi was also the top destination of Chinese FDI.

- Renewables was the region’s top sector in 2023 by value: however, investment was down by 21% yoy to USD 100.9bn – largely due to the number of hydrogen projects announced in 2022. Egypt saw three major green hydrogen projects last year, totaling an investment of USD 17.4bn.

- Interestingly, firms from the region appeared in global lists: (a) UAE’s Dubai World was among the top 10 foreign investors in 2023 by project – a total of 27, and a capex of USD 4.7bn, jobs created 15,073; (b) Mubadala Investment Group was the top-ranked foreign investor in 2023 by capex, deploying USD 41.8bn in capex across 22 projects; Saudi Aramco was 4th in the list, with capex at 13.9bn into 8 projects.

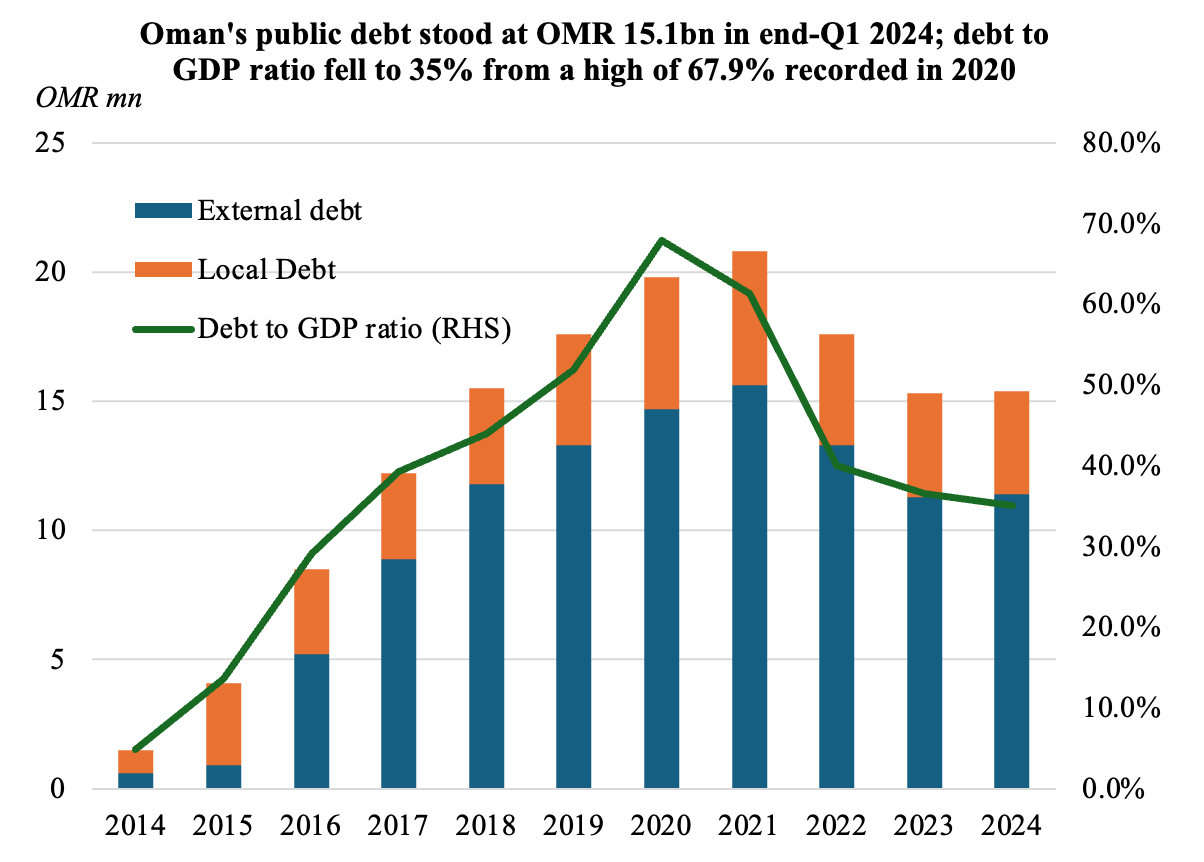

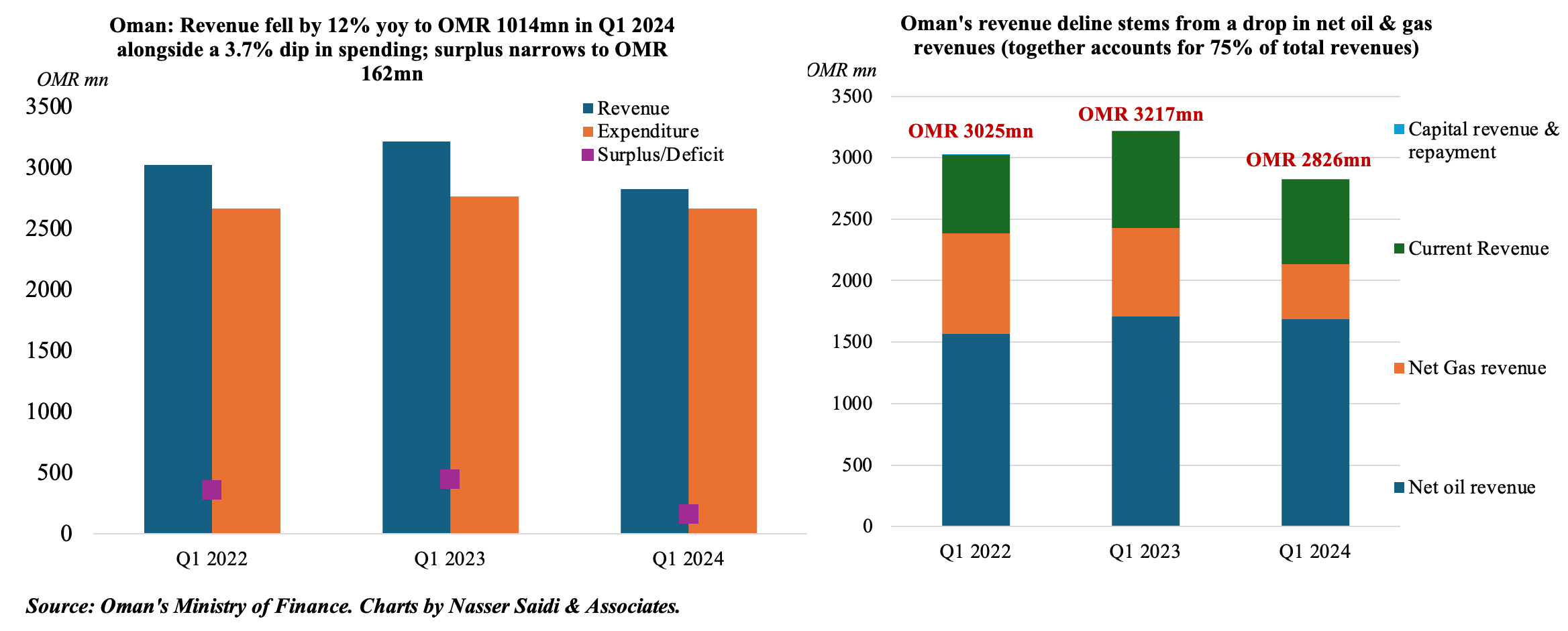

2. Oman budget surplus narrowed sharply to OMR 162mn in Q1 2024

- Oman posted a budget surplus of OMR 162mn in Feb (showing sharply from a surplus of OMR 450mn in Q1 2023), as both revenues and spending slowed – the former at a much faster pace. Average oil price in Q1 was USD 83 (-2.4% yoy) and average daily oil production down by 4.6% to 1014k bpd.

- Public revenues fell by 12.2% yoy to OMR 2.83bn in Q1, driven down by declines in both net oil & gas revenues. Net oil revenues dropped by 1.1% to OMR 1.7bn while net gas revenues plunged by 38.3% to OMR 444bn. Together, net O&G accounted for 75% of revenues at end-Q1.

- Expenditure declined by 3.7% yoy to OMR 2.66bn at end-Q1: within this, development expenditure grew by 71% yoy to OMR 200mn while contributions & other expenses surged by 78% yoy to OMR 486mn.

- Public debt stood at OMR 15.1bn in end-Q1 2024, edging up slightly from OMR 15.3bn in end-2023. Oman has successfully lowered its public debt to GDP ratio to 35% in Q1, from a high 67.9% in 2020.

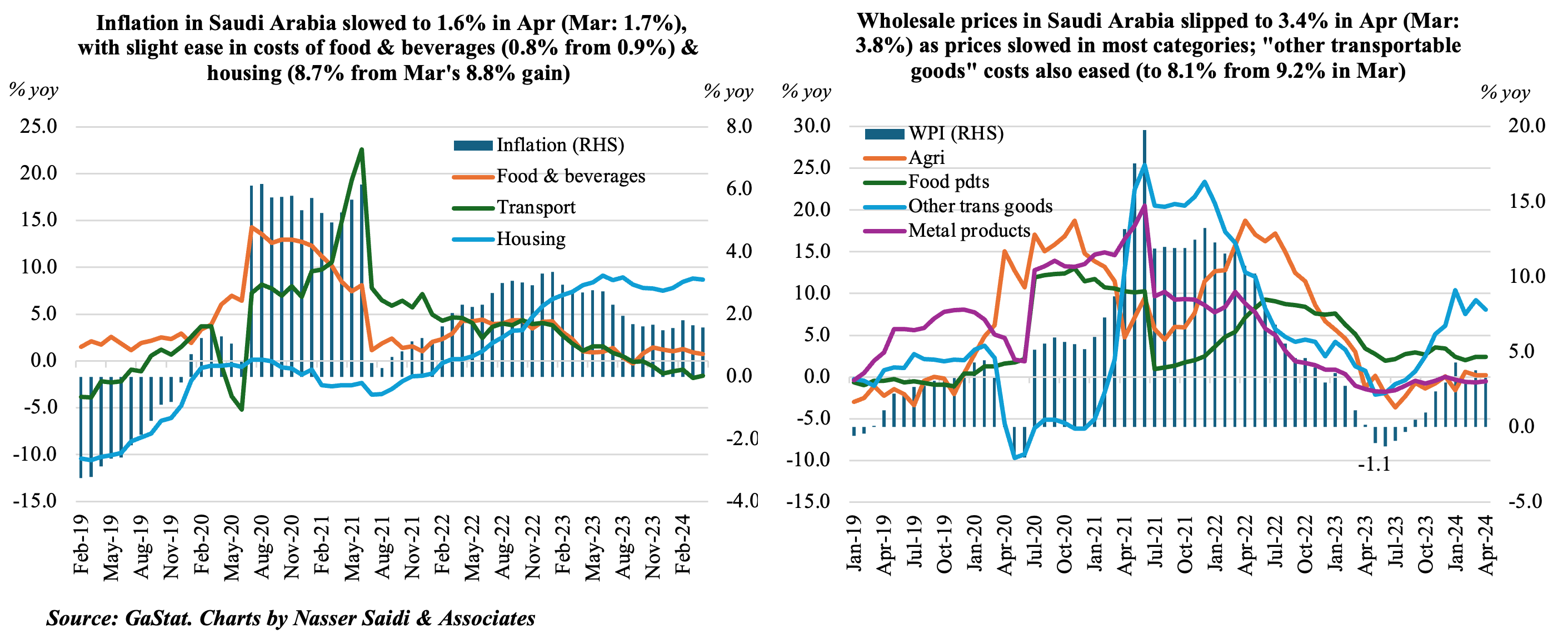

3. Saudi Arabia’s consumer & wholesale price inflation slowed in Apr

- Consumer price inflation in Saudi Arabia eased to 1.58% yoy in Apr (Mar: 1.6%), with multiple categories posting slight declines: food & beverages (0.8% from 0.9%), education (1.1% from 1.2%), hotels & restaurants (2% from 2.4%). In month-on-month terms, prices rebounded in Apr, up by 0.33% from a 0.1% dip in Mar.

- Housing costs eased though staying at a relatively high 8.7% yoy (Mar: 8.8%) as housing rents slipped to 10.4% (Mar: 10.55%). Recreation costs on the other hand moved into deflation territory: -1.4% from Mar’s 0.7% and transport costs remained deflationary (-1.59% from -1.79%).

- Wholesale prices in Saudi Arabia slipped to 3.4% in Apr (Mar: 3.8%), with most categories posting declines. “Other transportable goods” category posted the highest readings (8.06% from 9.23% in Mar); within this category, prices accelerated most in basic chemicals (54%) and refined petroleum products (12.01%). Deflation was visible in ores & minerals (-2.25% vs -2.2% in Mar) as well as in metal products, machinery & equipment (-0.55% from Mar’s -0.65%).

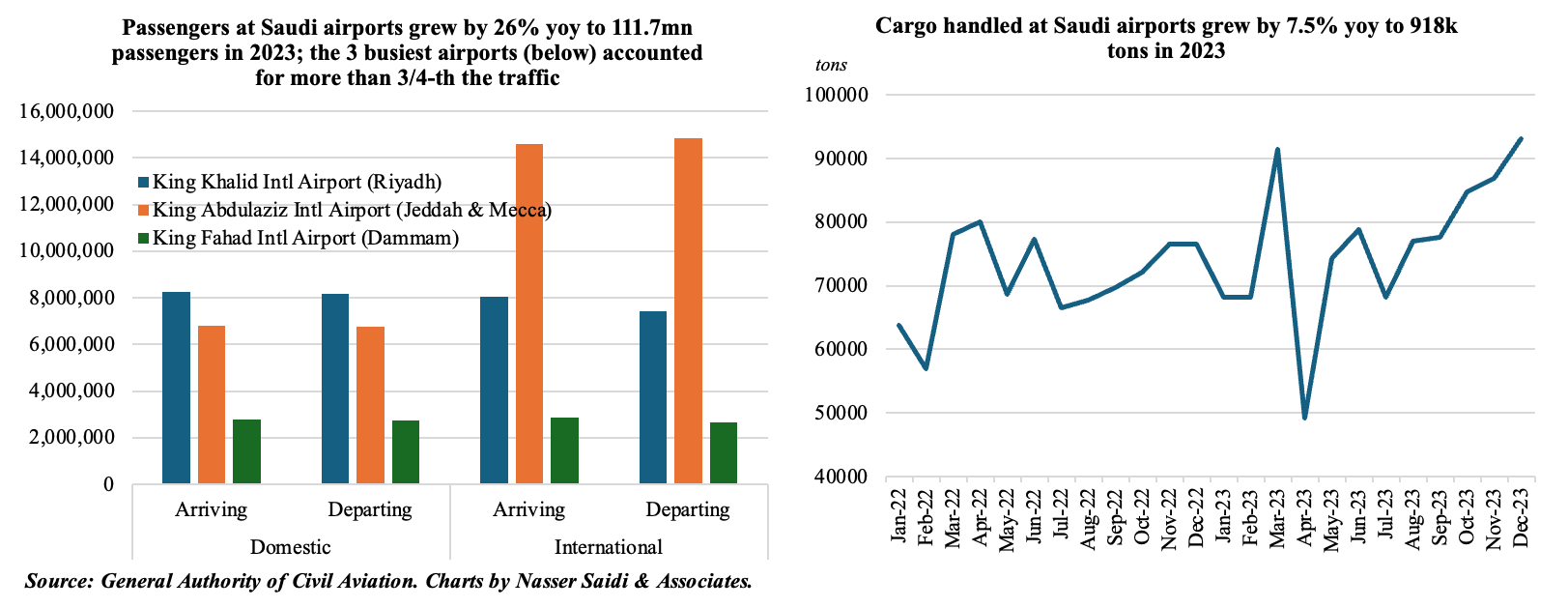

4. Saudi airports welcomed 111.7mn passengers in 2023, up 26% yoy

- Saudi Arabia published Air Transport Statistics for last year: the country welcomed 111.7mn passengers (26% yoy), with the split between domestic and international travelers at 51mn (+9% yoy) and 61mn (+46% yoy) respectively. Domestic and international flights rose by 2% and 36% to 421k and 394k respectively.

- The three busiest airports in 2023 were King Khalid International Airport (based in Riyadh, the top destination for international flights), King Abdulaziz International Airport (based in Jeddah, and connecting Mecca, the top destination for domestic flights) and King Fahad International Airport (in Dammam). These three airports together accounted for more than ¾-th of the passenger traffic (77.0%).

- Cargo into Saudi Arabia grew by 7.5% yoy to 918,017 tons in 2023; it has been trending upwards in 2023.

- The report also highlighted that (a) air connectivity indicator advanced (by 26.75% yoy); (b) total number of destinations traveled to through international airports rose by 47% to 148; (c) the number of countries traveled to through international airports grew by 12% to 86 (though lower than 89 in 2019).

- Religious tourism is one of the key drivers of passengers: around 1.2 million+ pilgrims are expected to pass through during the 2024 Hajj season (spanning 74 days starting May 9th).

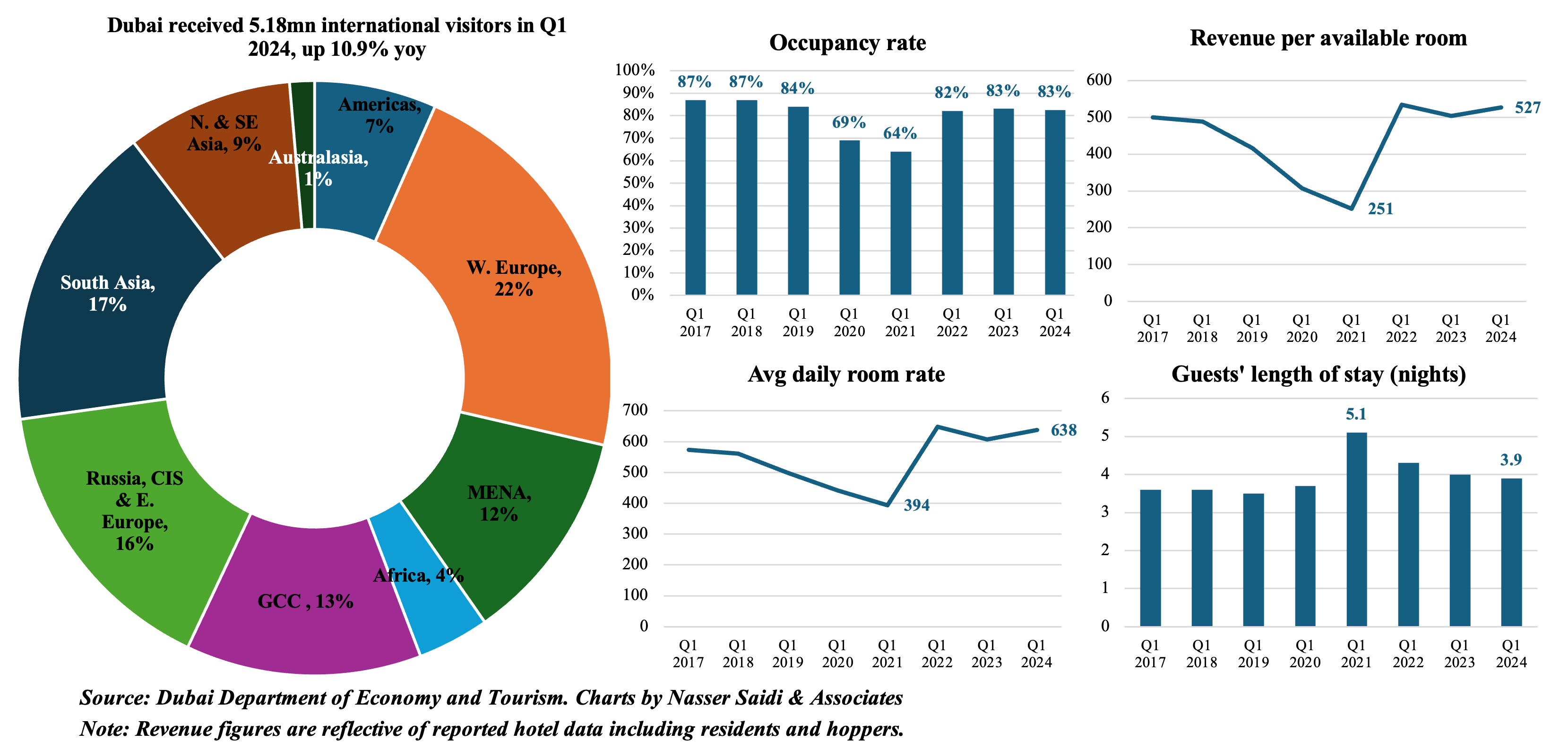

5. International visitors to Dubai rose 10.9% yoy to 5.18mn in Q1 2024

- Visitors into Dubai grew by 10.9% yoy to 5.18mn in Q1 2024: this was 9.1% higher compared to Q1 2019.

- Regional composition of tourists broadly unchanged: GCC & MENA regions together accounted for 1269k visitors (or about 25% of the total) this year while Western Europe and South Asia accounted for the largest shares at 22% and 15% (1.14mn and 869k respectively).

- At end-Q1 2024, there were 152,162 hotel rooms (+2% yoy) across 832 establishments (+2% yoy) in Dubai. Hotel occupancy rate at 83% was a tad below that in 2019; revenue per available room in Q1 2024, at AED 527 was lower than the previous Q1 high of AED 534 in 2022) while room rates stood at AED 638 (Q1 2022: AED 649) and length of stay has inched slightly lower (3.9, lower than Q1 2022’s 4.3 but higher than 3.5 in Q1 2019). Furthermore, occupied room nights jumped by 2% yoy to 11.2mn in Q1 2024.

- The unified Schengen-style GCC visa has been officially named “GCC Grand Tours”: expected to be rolled out in late 2024 or early-2025, the visa would benefit regional tourism. In addition to hospitality investments (such as hotels), UAE’s forward-looking investments in infrastructure – the Al Maktoum airport, Etihad Rail connecting the emirates and its joint venture with Oman Rail will further ease travel.

Powered by: