Download a PDF copy of the weekly economic commentary here.

Markets

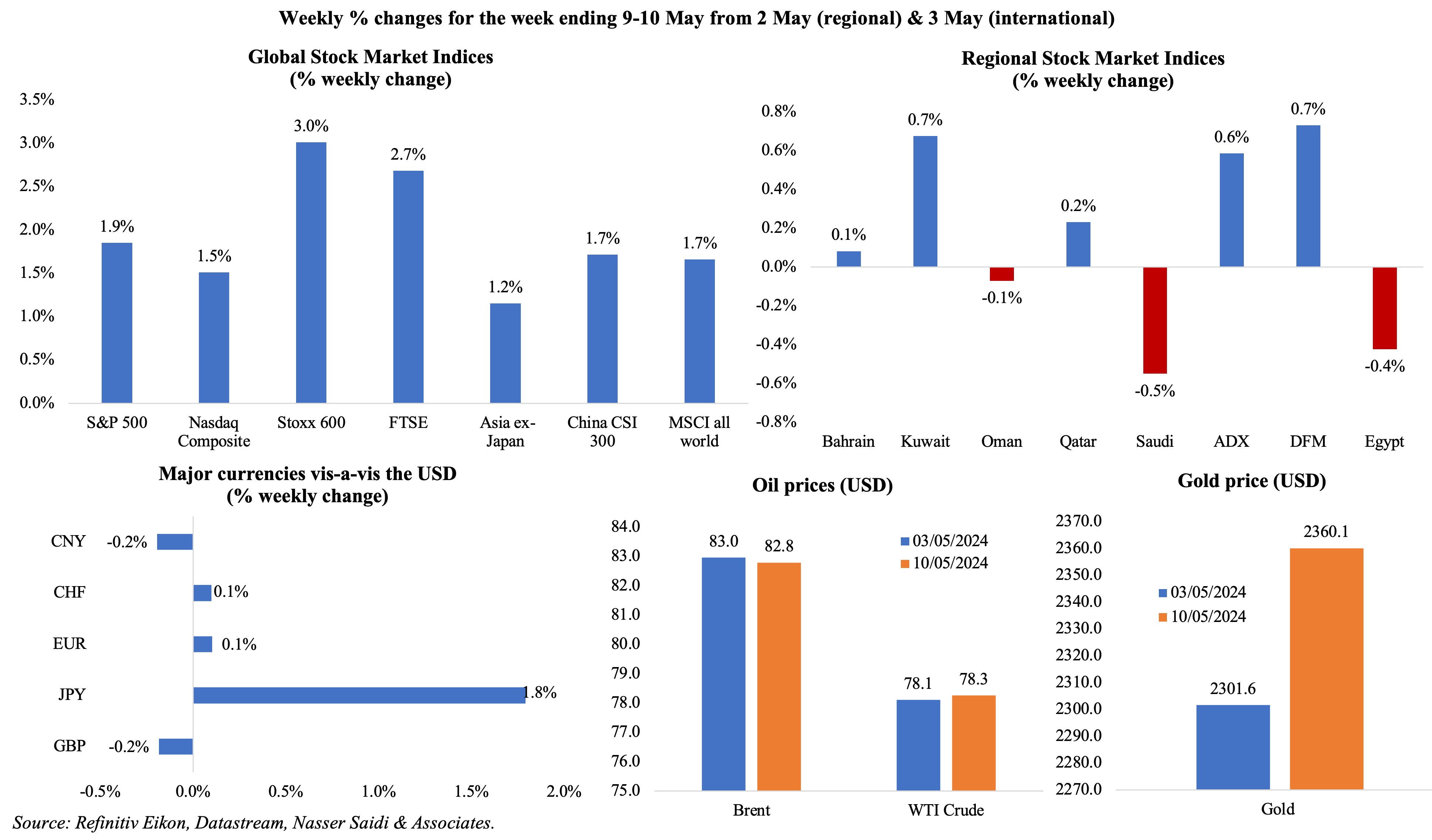

Major equities markets had a strong rally last week, with many indices at record highs as hopes for interest rate cuts gained traction. Regional markets were mixed, partly affected by the escalation of conflict in the region: Dubai and Abu Dhabi posted gains after five and three consecutive weeks of losses. The dollar strengthened vis-à-vis the yen, with Japanese officials commenting that the government would intervene if needed. The GBP posted a modest weekly loss after the BoE held rates steady but signalled a potential rate cut in summer should inflation continue to tread down. Oil prices fell by almost USD 1 a barrel on Friday: WTI closed higher by 0.2% compared to a week ago and Brent was down by 0.2%. Gold price moved up, closing at a 5-week high.

Global Developments

US/Americas:

- Monthly budget statement in the US posted a surplus of USD 210bn in Apr (Mar: deficit of USD 236bn), thanks to revenues rising by 22% yoy (to USD 776bn) supported by an uptick in income tax receipts. Spending rose by 23% yoy (to USD 567bn), with the largest increase coming from higher interest payments on federal debt. For the fiscal year so far, overall deficit stands at USD 855bn.

- US Michigan consumer sentiment index fell to 67.4 in May (Apr: 77.2), the lowest level since Nov 2023. Inflation expectations for the 1- and 5-years rose to 3.5% and 3.1% respectively (Apr: 3.2% and 3%).

- Signs of a cooling labour market: initial jobless claims increased by 22k to 231k in the week ended May 3rd, the highest level since end-Aug, and the 4-week average moved up by 4.75k to 215k. Continuing jobless claims also rose to 1.785mn in the week ended Apr 26th (from 1.768mn the week before).

Europe

- Eurozone’s composite PMI moved up to an 11-month high of 51.7 in Apr (Mar: 50.3), thanks to the gains in services PMI (53.3 from Mar’s 51.5). Services PMI grew to an 11-month high as a result of increased demand: output and new businesses were higher and employment accelerated while prices increased marginally.

- Investor confidence in Europe improved for the seventh month in a row, to -3.6 in May (Apr: -5.9): the current situation indicator moved up to -14.3 (the highest since May 2023) while the expectations indicator rose to a 27-month high of 7.8.

- Producer price index in the eurozone fell by 0.4% mom and 7.8% yoy in Mar. Energy prices were down by 20% (Feb: 21.3%) while inflation slowed for capital goods (1.9% from Mar’s 2%). Excluding energy prices, prices declined by 1.3% yoy (Feb: -1.3%).

- Retail sales in the eurozone rebounded in Mar, rising by 0.8% mom (Feb: -0.3%) – the highest increase since Sep 2022 – driven by an increase in food & beverages sales (1.2% from Feb’s 0.5% drop) and automotive fuel (2% from -0.9%). In yoy terms, sales grew by 0.7% (Feb: -0.5%) – the first positive yoy reading since Sep 2022 and the highest since May 2022.

- German composite PMI moved to 50.6 in Apr (Mar: 47.7), the first expansionary reading after 9 months of sub-50 readings, supported by a strong services PMI reading (53.2, the highest since Jun 2023). Services sector saw an increase in domestic orders and employment while both input and output costs were higher than historical averages.

- Industrial production in Germany fell by 0.4% mom and 3.3% yoy in Mar (Feb: 1.7% mom and -5.3% yoy). This was the first month-on-month decline this year, as manufacturing and energy output fell by 0.4% and 4.2% respectively while construction grew (+1%).

- Exports from Germany ticked up by 0.9% mom in Mar (Feb: -1.6%) supported by increased exports to US (3.6%) and China (+3.7%) while imports inched up by 0.3% (Feb: 3%). Trade surplus stood at EUR 22.3bn in Mar (Feb: EUR 21.4bn).

- German factory orders declined by 0.4% mom and 1.9% yoy in Mar: the decline can be traced to large scale orders including orders for aircraft, ships, trains orders (-2.3% mom) while new orders for automotive industry grew by 1.1%. Domestic orders fell 3.6% and orders from outside the euro area fell 2.9% while orders from the rest of the euro area grew by 10.6%.

- The Bank of England left policy rates unchanged at a 16-year high of 5.25%. However, the apex bank signalled an interest rate cut in summer if inflation continues to ease. Markets have priced in a first 25bps BoE rate cut by Aug and another before end-2024.

- GDP in the UK grew by 0.6% qoq and 0.2% yoy in Q1 (Q4: -0.3% qoq and -0.2% yoy): this was the fastest qoq growth since Q4 2021, thanks to services (0.7%) and manufacturing (1.4%, largely due to car production). The economy is estimated to be 1.7% larger than its pre-pandemic levels in Q4 2019. GDP per capita rose for the first time in 2 years, up 0.4% qoq (but was 0.7% lower in yoy terms).

- UK like-for-like retail sales dropped by 4.4% yoy in Apr (Mar: +3.2%), posting the worst reading since Nov 2019 – partly due to wet weather conditions and early timing of Easter.

Asia Pacific:

- Inflation in China increased to 0.3% in Apr (Mar: 0.1%), the third straight month of inflationary readings, while core inflation grew 0.7% (Mar: 0.6%). Non-food inflation rose 0.9% (Mar: 0.7%) and transport costs were up 0.1% (Mar: -1.3%) while food prices fell for the 10th month in a row (-2.7%).

- Producer price index in China fell by 2.5%, extending contractionary readings for the 19th month, but at a slower pace than Mar’s 2.8% drop. In Jan-Apr, producer prices shrank 2.7%.

- Money supply in China grew by 7.2% in Apr, slower than Mar’s 8.3% gain. New yuan loans stood at CNY 730bn, falling sharply from Mar’s CNY 3.09trn: this is a fairly common occurrence as banks tend to front-load loans at the beginning of the year. Outstanding yuan loans grew by 6.6% yoy to CNY 291.59trn. Annual growth of outstanding total social financing (TSF) slowed to 8.3% in Apr, a record low (Mar: 8.7%).

- Exports from China increased by 1.5% yoy in Apr (rebounding from Mar’s 7.5% drop) while imports grew at a faster 8.4% pace (Mar: -1.9%). This brought the trade surplus to a wider USD 72.35bn (Mar: USD 58.55bn).

- China’s Caixin services PMI eased by 0.2 points to 52.5 in Apr, staying expansionary for the 16th consecutive month. New orders rose to the highest since May and foreign orders rose to a 10-month high while employment fell for the third month in a row and inflationary pressures were evident (on both the input and output side).

- Forex reserves in China declined to USD 3.2trn in Apr (Mar: USD 3.246trn) while gold reserves rose for the 18th month, to 72.8mn fine troy ounces (Mar: 72.74mn ounces) valued at USD 167.96bn.

- Japan’s preliminary leading economic index dropped to 111.4 in Mar (Feb: 112.1). In contrast the coincident index moved up to 113.9, highest since Dec 2023, from 111.5 in Feb.

- Japan’s Jibun Bank services PMI rose to 54.3 in Apr (Mar: 54.1) though it was lower than the preliminary estimate of 54.6. It was the 20th month of expansionary readings, with new orders at a 10-month high and employment rising for the seventh month in a row. Output cost inflation was the fastest since Apr 2014 (when sales tax was hiked).

- Overall household spending fell by 1.2% yoy to JPY 318,713 in Mar, down for the 13th month in a row. Spending fell by 3.2% yoy in the fiscal year 2023 – the first fall in 3 years.

- Labour cash earnings in Japan increased by 0.6% yoy in Mar (Feb: 1.4%) to JPY 301,193 (USD 1,940.3). Real wages fell by 2.5% yoy in Mar (Feb: -1.8%), declining for two consecutive years.

- Japan’s current account surplus widened to JPY 3.399trn in Mar (Feb: JPY 2.64trn), taking the surplus for the fiscal year to a record-high JPY 25.3trn (2.8 times higher than the year before). This was partly due to the smaller deficit in goods trade: JPY 3.572ten from last year’s JPY 17.787bn.

- India’s composite PMI eased to 61.5 in Apr (Mar: 61.8), with new orders rising at the fastest pace since mid-2010. Services PMI slowed to 60.8 (Mar: 61.2), but new export orders grew on strong demand and output growth was the fastest in 14 years.

- Industrial output in India grew by 4.9% yoy in Mar, slower than Feb’s 5.6% gain, thanks to increases in manufacturing (5.2%) and mining (1.2%). Capital goods grew by 6.1% in Mar while consumer durables production rebounded (+9.5% from Mar’s 8% fall). Cumulative output for the financial year that ended in Mar stood at 5.8%.

Bottom line: A data-heavy week with – (a) lower US inflation data could potentially set the stage for earlier rate cuts by the Fed; (b) strong readings on industrial production and retail sales in China could boost sentiment (alongside the sale of CNY 1trn in longer-dated bonds this week to support spending); and (c) following comments from the BoE, eyes will be on UK wage growth (whether wage growth will slow down further). In another sign of diverging policy vis-à-vis the Fed, Sweden’s Riksbank cut rates for the first time since 2016, taking the main policy rate to 3.75%. Earlier the Swiss National Bank had lowered rates, and it is widely expected that the ECB will join next month.

Regional Developments

- Non-oil domestic-origin exports from Bahrain grew by 5% to BHD 1.02bn in Q1, with Saudi (27% of total), UAE (13%) and US (8%) accounting the top 3 destinations. Non-oil re-exports increased by 11% to BHD 206mn and non-oil imports were up 5% to BHD 1.5bn.

- Egypt PMI stayed in contractionary territory for the 41st straight month in Apr (47.4 from 47.6), but business expectations jumped to a 6-month high. Weak demand, high prices and volatility in exchange rates affected output (to 44.8 in Apr from 44.5), new orders (to 45.5 from 45) and employment declined (to 49.7 after the uptick in Mar). Inflationary pressures eased: input cost inflation was its lowest since Mar 2021 and output costs were at a 2-year low.

- Annual urban inflation in Egypt slowed to 32.5% in Apr (Mar: 33%), continuing with an easing trend that started in Sep 2023. Food and beverage costs grew by 40.5%, but core inflation also eased (to 31.8% from 33.7%).

- Egypt’s foreign debt rose to USD 168bn in Oct-Dec from USD 164.5bn at end-Sep and USD 162.9bn at end-Dec 2022. About 82.5% of the foreign debt was long term, and was equivalent to 43% of GDP, disclosed the central bank. Net international reserves climbed to USD 41.057bn at end-Apr from USD 40.361bn at end-Mar, partly due to the appreciation in gold reserves (up by USD 381mn to USD 9.384bn).

- Government debt to GDP in Egypt rose to 81.4% in Q1 from 80.5% in Q1 2023. Debt of the non-financial companies declined to 19.1% of GDP from 21.6% (in Q1 2023) while household debt accounted for 7.6% of GDP (from 8.5%).

- Visitors to Egypt grew by 27% yoy in Jan-Apr, according to the Vice Minister for Tourism, with tourists from Arab nations surging by 54%.

- Daily consumption of natural gas in Egypt stepped up by 300mn cubic feet daily to 6.1bn cubic feet in May. The government plans to boost production by 8% to an average 5.7bn cubic feet per day in the fiscal year 2024-25.

- Bilateral trade between Egypt and Kuwait totalled USD 3bn in 2023 while Kuwaiti investments in Egypt slipped to USD 632.6mn during the fiscal year 2022-23 (prev: USD 669.3mn). Number of Egyptians in Kuwait was estimated at 612,700 in 2022.

- Iraq’s oil minister disclosed that the nation will not agree to any further OPEC+ cuts. The country has pumped over its output quota by a cumulative 602k barrels per day in Q1 2024.

- Iraq awarded several oil concessions to 22 international firms including one Iraqi company and three Chinese companies bidding for 29 oil and gas sites. These discoveries could boost recoverable crude deposits to 160bn barrels (from nearly 145bn barrels currently).

- Kuwait’s Emir dissolved the Parliament and suspended specific parts of the Constitution for up to 4 years: the emir and cabinet will assume powers of the National Assembly.

- Lebanon’s PMI slipped in Apr (to 48.9 from 49.4), painting an overall dismal picture: decline in demand led to lower output (& activity) and fall in new orders while employment was unchanged. Companies in Lebanon remained pessimistic on the ongoing war, conflicts and continued political uncertainty.

- Israel’s conflict with Southern Lebanon has resulted in USD 1.5bn of damage to buildings and infrastructure, according to the President of the Council of the South. Not included in the estimates are indirect effects such as lost tourism or economic effects of displacement and agriculture output.

- Qatar PMI increased to 52 in Apr (Mar: 50.6), supported by new customers as well as high quality, competitive products alongside an uptick in employment (for the 14th month in a row). The seasonally adjusted Financial Services Business Activity and New Business Indexes rose to 6-month highs of 55.2 and 55.0 respectively.

- International reserves and foreign currency liquidity at the Qatar Central Bank surged by 4.68% yoy to QAR 248.2bn at end-Apr. Official reserves at the central bank rose by QAR 10.38bn to QAR 189.3bn.

- An agreement has been signed by Etihad Rail, Oman Rail and Mubadala Investment Company to begin work on the Oman-UAE rail project (valued at USD 3bn). Enabling travel between Oman and UAE, the trains can carry up to 400 passengers and the duration of the journey would vary by destination (as low as 47 mins from Sohar and Al Ain or 100 minutes between Sohar and Abu Dhabi).

- EY’s IPO Eye report shows that 10 IPOs were launched in the MENA region in Q1 2024 with proceeds reaching USD 1.2bn (-66% yoy). While nine of the IPOs were in Saudi Arabia, UAE’s Parkin IPO was the largest (USD 400mn).

- Market cap of Arab stock exchanges crossed USD 4.36trn at end-Apr 2024, according to the Arab Monetary Fund. While the Saudi market value was USD 2.87trn, Abu Dhabi and Dubai markets were valued at USD 754.7bn and USD 193.4bn respectively.

- Dubai is the richest city in MENA and 21st globally, according to the World’s Wealthiest Cities Report 2024. Persons with liquid investable wealth of USD 1mn+ in Dubai surged by 78% to 72500 between 2013 and 2023 while the number of centi-millionaires were 212.

Saudi Arabia Focus

- Saudi Arabia’s year-on-year industrial production fell by 8.7% in Mar, dragged down by oil activities (-0.3% mom and -12.2% yoy). Manufacturing inched up by 0.4% mom and 0.6% yoy while non-oil manufacturing sector (i.e. excluding manufacture of coke and refined petroleum products) slipped by 0.4% yoy in Mar 2024, with the manufacture of electrical devices the fastest growing (15.2% yoy) alongside manufacture of paper & paper products (8.2%) and manufacture of beverages (6.5%).

- Saudi Arabia aims to boost private sector investments in the manufacturing sector, according to the Deputy Minister of Industry and Mineral Resources. Not only had investments more than doubled to SAR 7bn in Q1 2024, but the minister also highlighted partnership with non-government bodies as of significant importance in achieving industrial development.

- Credit card loans in Saudi Arabia jumped by 16% yoy to SAR 27.25bn in Q1 2024, according to the Saudi central bank. Consumer loans were up by 1% to SAR 451bn while education loans surged to SAR 8bn (24%).

- Private sector employees in Saudi Arabia grew to 11.27mn in Apr (Feb: 11.1mn): of this total, Saudi citizens stood at more than 2.35mn.

- Hong Kong is developing an ETF in collaboration with Saudi Arabia, disclosed the deputy financial secretary of Hong Kong. This follows an earlier ETF launched in Nov 2023 tracking the Saudi Index. He also revealed that Cathay Pacific Airways would commence flights from Hong Kong to Riyadh by end-2024, reducing flight time to six hours.

- Smasco, the Saudi Manpower Solutions Company, is expected to raise between SAR 840-900mn (USD 224-240mn) from its IPO. The firm plans to offer a 30% stake or 120mn shares.

- Saudia has allocated 1.2mn seats for Hajj pilgrims for the 2024 Hajj season (that started from May 9th). Religious tourists account for almost half of all international arrivals.

UAE Focus![]()

- UAE’s non-oil sector is expected to grow by 4.9% this year, according to the minister of economy. He highlighted the need for diversifying away from oil, including traditional sectors such as real estate and tourism as well as newer formats such as sustainable tourism, healthtech or AI.

- Tourism is forecast to contribute 11.7% to UAE’s GDP in 2024 or AED 220bn, disclosed the minister of economy during the Arabian Travel Market conference. The discussions touched upon the unified GCC tourism visa as a key facilitator of promoting regional tourism.

- UAE and New Zealand signed an agreement to launch negotiations for a CEPA. Non-oil trade between the two nations rose to USD 764.5mn in 2023, 15%+ higher than in 2019.

- The central bank of UAE and Bank Indonesia signed an MoU promoting the use of local currencies for bilateral transactions (supporting trade growth). Bilateral non-oil trade between the two nations stood at AED 16bn+ in 2023.

- Investments in Vietnam from Dubai increased to AED 280mn between 2019 and 2023, according to the CEO of Dubai Chambers. Companies from Vietnam that are members in Dubai Chamber have increased to 147 now from 118 at end-2023 and only 12 in 2014.

- Indonesia’s investments in Dubai rose to AED 188mn (USD 51mn) in 2023, accounting for 87% of total investments into the emirate from 2019-23 (about USD 58.7mn), revealed the CEO of Dubai Chambers. The number of Indonesian companies in Dubai has increased to 114 active firms, from 29 in 2014.

- Dubai welcomed 5.18mn international overnight visitors in Q1 2024, up 11% yoy. Western Europe region was Dubai’s biggest source market with 1.138mn arrivals, followed by South Asia (869k visitors). Hotel revenue per available room grew by 4% yoy to AED 527.

- Fintech firms in DIFC have raised USD 3.3bn in venture funding, disclosed the DIFC governor. Fintech and innovation was the fastest growing sector in the DIFC, with 902 registered companies, up 31% yoy in 2023; this number has already crossed 1000 in 2024.

Media Review

Dangers of dollar nationalism hang over the world economy

https://www.ft.com/content/ad0e0403-5b77-4205-ba20-6b214427a0c9

More Diversified Trade Can Make Middle East and Central Asia More Resilient

https://www.imf.org/en/Blogs/Articles/2024/05/13/more-diversified-trade-can-make-middle-east-and-central-asia-more-resilient

Fears mount EU’s USD 1.1bn migration aid to Lebanon will feed political corruption (with Dr. Nasser Saidi’s comments)

https://www.al-monitor.com/originals/2024/05/fears-mount-eus-11b-migration-aid-lebanon-will-feed-political-corruption

The Rise of the Finternet

https://www.project-syndicate.org/commentary/finternet-redesign-global-financial-architecture-blockchain-innovation-by-agustin-carstens-and-nandan-nilekani-2024-05

Powered by: