Weekly Insights 10 May 2024: Muted inflation & robust demand in the GCC, amid global shipping woes & upticks in food prices

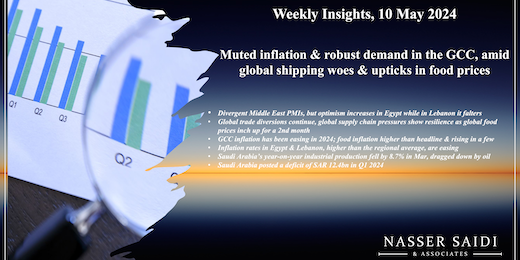

1. Divergent Middle East PMIs, but optimism increases in Egypt while in Lebanon it falters

- GCC’s PMIs for Apr ticked up in Qatar (52 from 50.6), remained steady in Saudi Arabia (57) and slipped in the UAE (55.3 from 56.9). Though all were united in being expansionary!

- Irrespective of the movement of the PMI, a main common factor was strong demand, supported by domestic markets in Saudi and in the services sector in Qatar although the one-off heavy rainfall in the UAE dampened demand slightly.

- Employment continued to grow in Qatar for the 14th month in a row (and above the long-run average) while it was modest in the UAE; Saudi employment declined for the first time in over 2 years.

- Input prices fell marginally in Qatar, and eased to a 9-month low in Saudi while in UAE it ticked up (largely due to rising purchasing prices and staff costs).

- However, to remain competitive and drive sales, output cost fell again in UAE and marginally in Qatar while Saudi’s output cost rose for a sixth successive month.

- Egypt posted its 41st straight month of below-50 readings (47.4 from 47.6), but business expectations jumped to a 6-month high. Weak demand, high prices and volatility in exchange rates affected new orders and employment declined (after the uptick in Mar). Inflationary pressures eased: input cost inflation was its lowest since Mar 2021 and output costs were at a 2-year low.

- Lebanon’s PMI slipped in Apr (to 48.9 from 49.4), painting an overall dismal picture: decline in demand led to lower output (& activity) and fall in new orders while employment was unchanged. In contrast to Egypt, companies in Lebanon remained pessimistic on the ongoing war, conflicts and continued political uncertainty.

2. Global trade diversions continue, global supply chain pressures show resilience as global food prices inch up for a second month

- According to the IMF’s PortWatch platform, Suez Canal shipping volume was down by two-thirds in Apr 2024 compared to a year ago; this follows a 55% yoy drop in Q1 this year, intensifying global trade disruptions.

- A recent advisory from Maersk highlighted the implications of such diversions: industry wide capacity loss is estimated to be around 15-20% on the Far East to North Europe and Mediterranean market during Q2; the firm also stated that “we are currently using 40% more fuel per journey and charter rates are currently three times higher, often fixed for five years”. These costs, when passed on to the customers, could lead to further inflationary pressure.

- The Fed’s Global Supply Chain Pressures Index (GSCPI) is still below its historical mean – it fell to -0.85 in Apr (Mar: -0.3), showing some resilience and indicating some spare shipping capacity. In Apr 2024, UN’s food price index rose for the second month in a row, by 0.3% mom (though it fell by 9.0% in yoy terms), as prices ticked up by 0.3% mom for meat, cereals and vegetable oil categories.

3. GCC inflation has been easing in 2024. While food inflation has been higher than headline in most of the region, it is slowly inching up – partly in line with the slight global uptick (some GCC nations have some forms of price controls/ subsidies). In Dubai & Saudi Arabia, housing costs remain the main driver of the uptick.

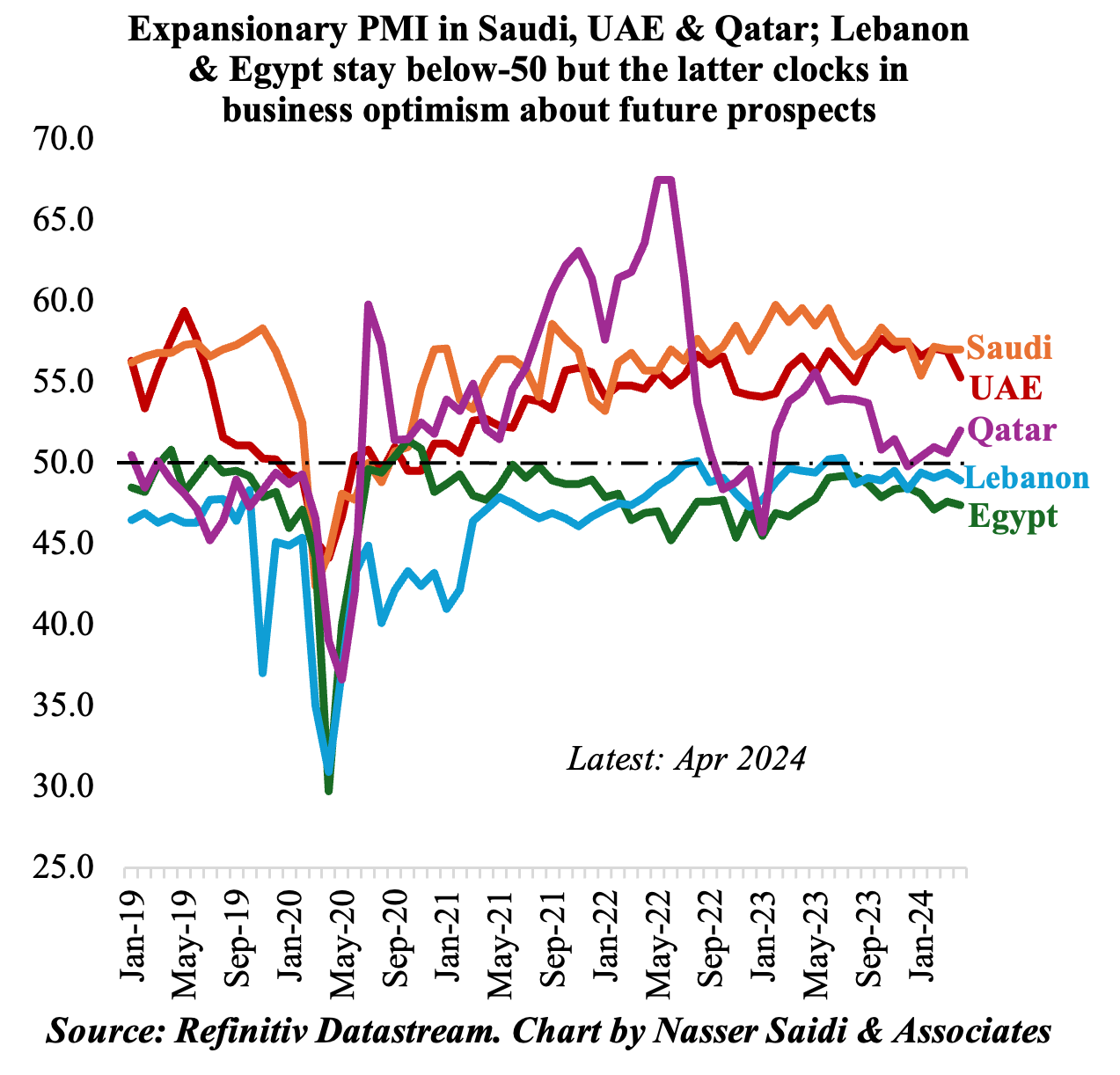

4. Inflation rates in Egypt & Lebanon, higher than the regional average, are easing

- Egypt’s annual urban inflation slowed to 32.5% in Apr (Mar: 33%), continuing with an easing trend that started in Sep 2023. Food and beverage costs grew by 40.5%), but core inflation also eased (to 31.8% from 33.7%).

- The economic backdrop of the country has changed given the recent increase in foreign exchange from the financial support provided the UAE, Europe and others alongside the IMF’s expanded USD 8bn support, and the move to a flexible exchange rate (along with a 600bps increase in interest rates). Inflation is still much higher than the upper limit of the central bank target of 5-9% though the central bank expects it to decline further.

- Inflation in Lebanon fell to 70.4% yoy in Mar 2024 (Feb: 123.2%), dropping below triple-digits for the first time since June 2020. Clocking in the lowest reading since May 2020, inflation has fallen from from a peak rate of 269% touched in Apr 2023. Food and beverages costs slumped to 51.3% (from Feb’s 103.4%) while transport costs declined to 13.2% (from 65%). The decline in prices have been partly due to a more stable LBP and growing dollarization. Unfortunately, the prospects seem dim (as seen in the PMI numbers) given the geopolitical uncertainty and a political power vacuum.

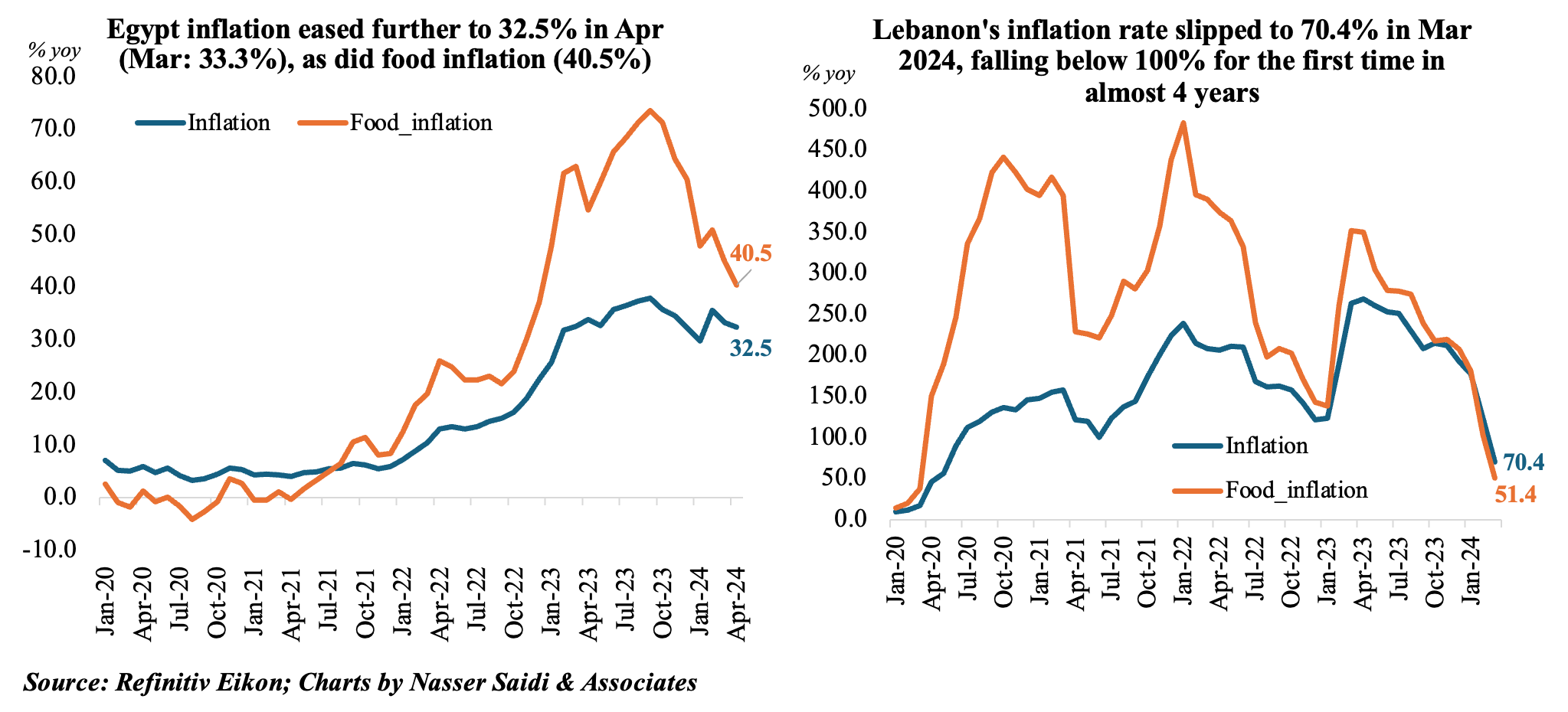

5. Saudi Arabia’s year-on-year industrial production fell by 8.7% in Mar, dragged down by oil activities; manufacturing gained by 0.6%

- Industrial production in Saudi Arabia slipped by 0.2% mom and 8.7% yoy in Mar, dragged down by oil activities (-0.3% mom and -12.2% yoy). Overall manufacturing inched up by 0.4% mom and 0.6% yoy.

- Non-oil manufacturing sector (i.e. excluding manufacture of coke and refined petroleum products) slipped by 0.4% yoy in Mar 2024, with the manufacture of electrical devices the fastest growing (15.2% yoy) alongside manufacture of paper & paper products (8.2%) and manufacture of beverages (6.5%).

- In Q1 2024, overall manufacturing was supported by gains in manufacturing of beverages (10% yoy), manufacture of paper & paper products (9.4%) and manufacture of electrical devices (8.6%).

- There are positive signs for increased non-oil sector activity in the near-term. The Saudi Ministry of Industry & Mineral Resources disclosed that 20 new mining licenses had been issued in Feb, in addition to 118 new industrial licenses.

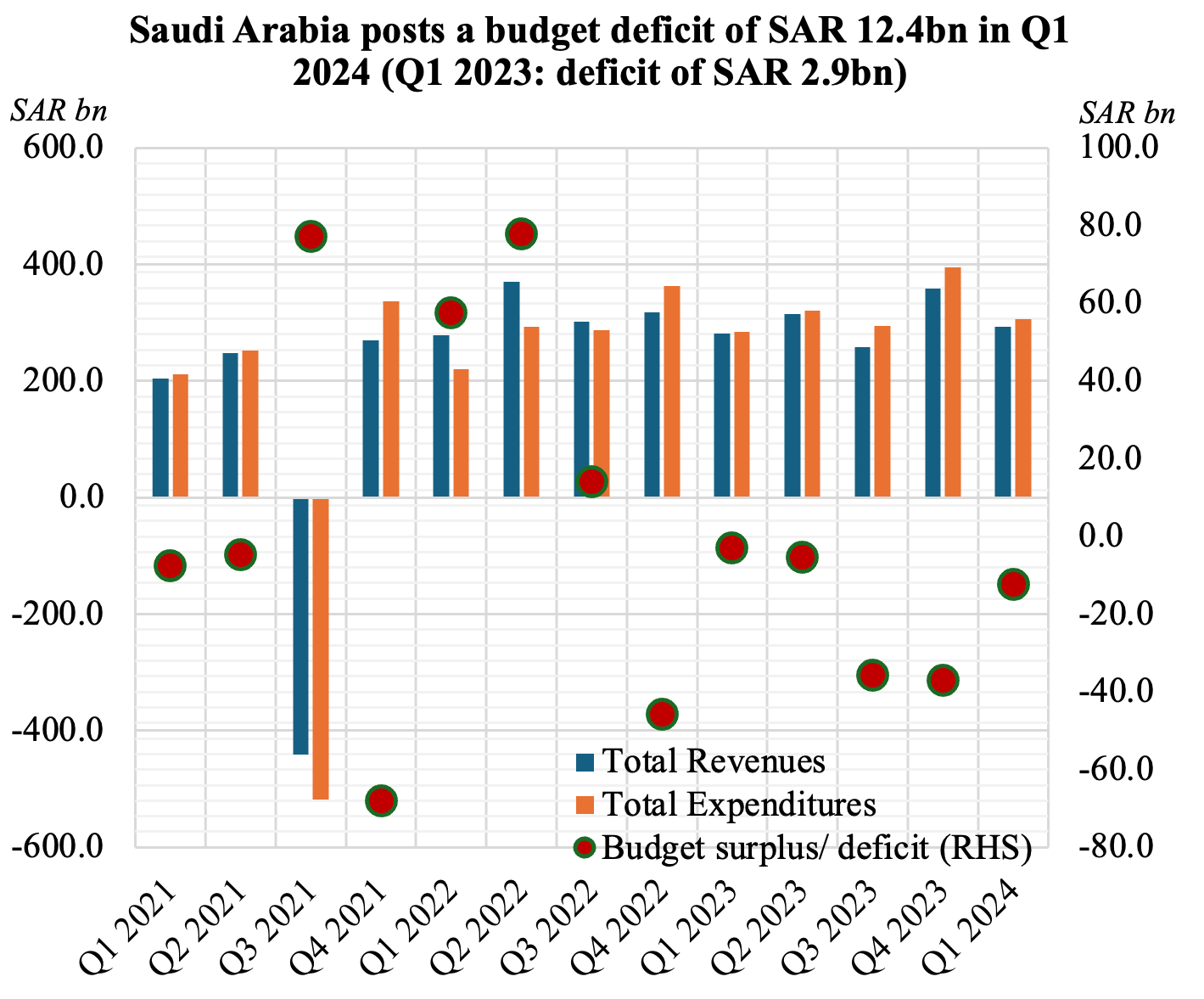

6. Saudi Arabia posted a deficit of SAR 12.4bn in Q1 2024

- Overall revenues in Saudi grew by 4% yoy to SAR 193.4bn in Q1 2024, thanks to oil revenues inching up by 2% yoy while non-oil revenues grew at a faster 9%.

- Bulk of non-oil revenues came from tax on goods & services (up 11% yoy to SAR 69.9bn in till Sep). However, taxes from income, profit and capital gains fell by 9% yoy to SAR 6.6bn).

- Spending rose at a faster pace of 8% yoy in Q1 2024, rising to SAR 305.8bn, with capex surging by 33% (to SAR 34.5bn) and subsidies jumping 37% (to SAR 8.3bn). Meanwhile, compensation of employees inched up by just 3% to SAR 137.5bn in Q1 and accounted for 45% of total spending.

- Overall deficit stood at SAR 12.49bn in Q1 2024, marking the sixth consecutive quarter of deficits. The finance minister revealed that the country was “intentionally running a sustainable deficit for economic development”. A budget deficit of SAR 79bn has been forecast for this year.

Powered by: