Download a PDF copy of the weekly economic commentary here.

Markets

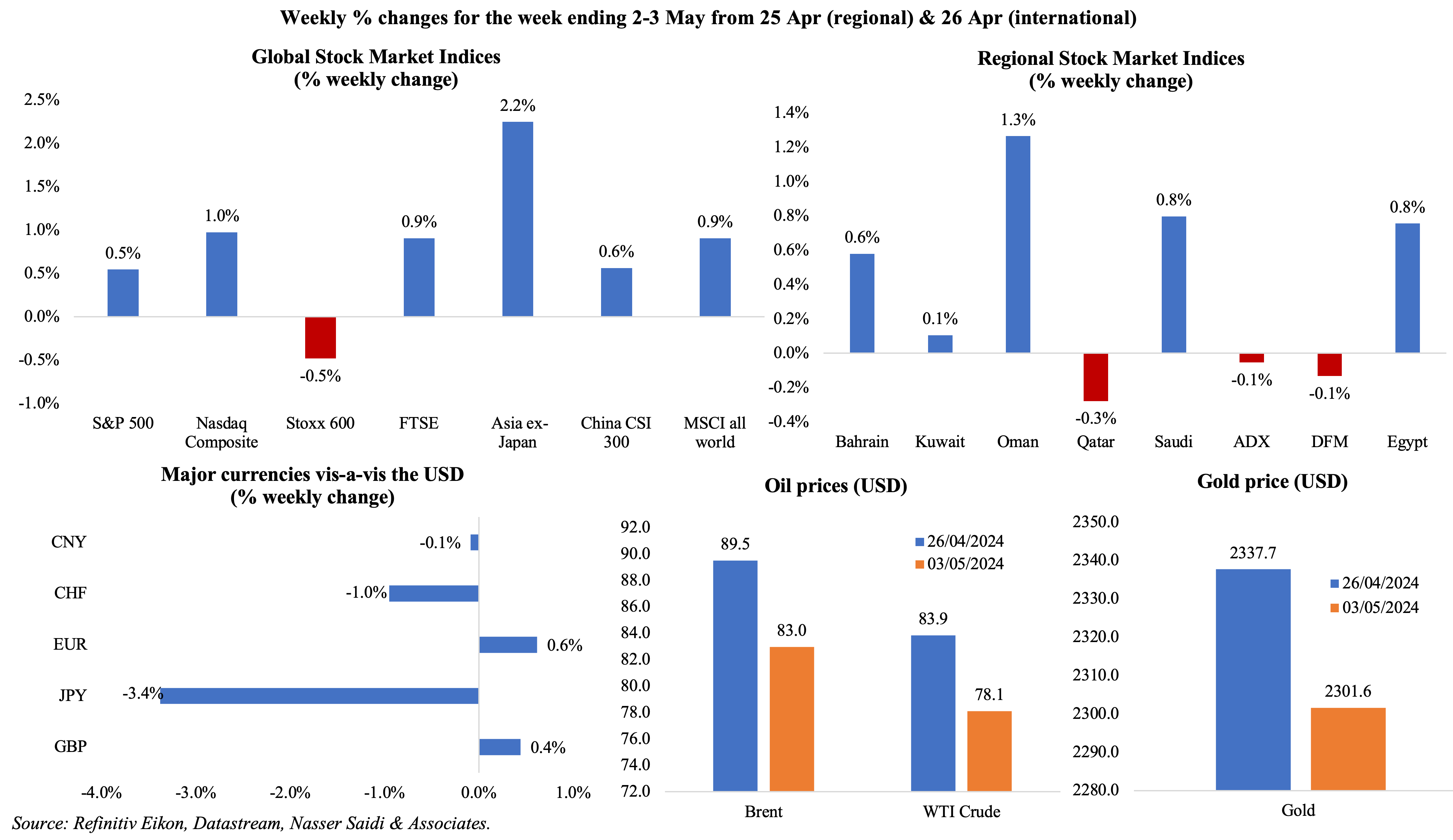

Equities markets were mostly up last week, as weak US jobs data eased concerns that the Fed would keep rates higher for longer: robust earnings report and tech stocks drove the US markets while MSCI global stocks posted a second straight weekly gain. Regional markets were mixed, with Qatar hitting a 6-month low and UAE also closing in the red. Among currencies, JPY reached a 34-year low of 160.245 on Monday while for the full week the dollar fell more than 3% vis-à-vis the JPY (posting the steepest weekly loss since late-Nov). Oil prices fell by around 7% last week, while gold price was down by more than 1.5%.

Global Developments

US/Americas:

- The federal funds rate was left unchanged in a range of 5.25%-5.5%, citing lack of progress on inflation returning to the 2% target: rates have been at this level since Jul 2023. At the press conference, Powell stated that “it is unlikely the next policy move will be a hike”.

- Non-farm payrolls in the US rose by 175k in Apr (Mar: 315k), the least in 6 months. Average hourly earnings grew by 3.9% yoy in Apr (falling below 4% for the first time since Jun 2021 and down from Mar’s 4.1%) while labour force participation rate was unchanged at 62.7%. Unemployment rate inched up to 3.9% (Mar: 3.8%).

- Non-farm productivity increased by 0.3% in Q1 (Q4: 3.5%) – the weakest pace of uptick since Q1 2023 – as output rose by 1.3% and hours worked were up 1.0%. Unit labour costs were up by 4.7% following Q4’s 0.4% gain.

- US private sector added 192k jobs in Apr (Mar: 208k), with job gains strongest in leisure and hospitality (56k), followed by construction (35k). Separately, JOLTS job openings declined to 488mn in Mar, the lowest since Feb 2021. There were 1.32 job openings for every unemployed person, down from 1.36 in Feb and 1.19 in 2019.

- Initial jobless claims remained unchanged at 208k in the week ended Apr 26th, the lowest in 2 months, while the 4-week average moved lower by 3.5k to 210k. Continuing jobless claims also stayed put at 774mn in the week ended Apr 19th (the least since Jan).

- Factory orders in the US grew by 1.6% mom in Mar (Feb: 1.2%) as overall transportation orders climbed 7.8%. Orders for non-defence capital goods excluding aircraft were up 0.1%.

- US S&P Global manufacturing PMI moved to a neutral 50 in Apr (Mar: 51.9), with new orders declining marginally for the first time in 4 months, while new exports orders grew, and jobs increased for a 4th successive month. Consumer goods producers reported a further strengthening of demand.

- ISM manufacturing PMI slipped to 49.2 in Apr (Mar: 50.3), as new orders fell to 49.1 (from 51.4) while output slowed (51.3 from 54.6) and employment rose (to 48.6 from 47.4). Prices paid jumped to 60.9 from Mars 55.8.

- ISM services PMI fell 2 points to 49.4 in Apr, the first contractionary reading since Dec 2022, as new orders and output declined to 52.2 and 50.9 (Mar: 54.4 and 57.4 respectively). Employment meanwhile plummeted to 45.9 (Mar: 48.5) and prices paid rose (59.2 from 53.4).

- Goods and services trade deficit in the US narrowed to USD 69.4bn in Mar (Feb: USD 69.5bn), remaining at close to 10-month highs, as goods trade deficit widened to USD 92.5bn in Mar (Feb: USD 91.8bn). Exports of goods and services dropped 2% mom to USD 257.6bn while imports fell by 1.6% to USD 327bn.

- Dallas Fed manufacturing business index fell to -14.5 in Apr (Mar: -14.4) as new orders remained negative (-5.3) while production index rose (4.8 from Mar’s -4.1). Chicago PMI fell to 37.9 in Apr (Mar: 41.4), contracting for the 5th month in a row, posting the sharpest decline since Nov 2022.

- S&P Case Shiller national home price index increased by 6.4% yoy in Feb (Jan: 6.0%): this was the fastest increase since Nov 2022 and all cities reported yoy increases for the third consecutive month.

Europe

- Eurozone GDP grew by 0.3% qoq and 0.4% yoy in Q1 (Q4: flat qoq and 0.1% yoy), supported by Germany’s gain (0.2% qoq from a 0.5% contraction in Q4, supported by higher investment and exports amid lower household spending). French and Italian GDP expanded by 0.2% and 0.3% qoq respectively while Spain was one of the strongest performers (0.7% uptick, thanks to rising domestic and external demand).

- Inflation in the eurozone remained steady at 2.4% yoy in Apr, after 17 continuous months of decline, while core inflation edged down to 2.7% (Mar: 2.9%). Cost of services eased (3.7% from 4% in Mar), as did non-energy industrial goods prices (0.9% from 1.1% in Mar) while food, alcohol & tobacco costs nudged up (2.8% from 2.6%).

- Manufacturing PMI in the eurozone slipped to a 4-month low of 45.7 in Apr (Mar: 46.1): output fell for a 13th straight month amid new orders falling at an increased rate (4-month low of 44.1 from 46) and employment levels continuing to fall.

- Euro area Economic Sentiment Indicator slipped to 95.6 in Apr (Mar: 96.2) as industrial confidence and services sentiment worsened to -10.5 (the lowest level since Jul 2020, from Mar’s -8.9) and 6 (from Mar’s 6.4 reading) respectively. Business climate index in the euro area worsened in Apr, falling to -0.53 (Mar: -0.32) while consumer confidence rose to -14.7 (the highest since Feb 2022).

- Harmonised inflation in Germany inched up to 2.4% yoy in Apr (Mar: 2.3%) as food costs rose (0.5% yoy) while energy costs declined at a slower pace (-1.2%, from Mar’s fall of 2.7%). Services inflation eased to 3.4% (Mar: 3.7%), as did core inflation (3.0% from 3.3%).

- Germany’s manufacturing PMI rose to 42.5 in Apr (Mar: 41.9): though new orders fell the most in 5 months, output fell at a slower pace and employment improved while factory prices posted the steepest drop since Sep 2009. Manufacturer’s confidence reached the highest since Apr 2023, thanks to brighter expectations for export sales and business investment.

- German retail sales rebounded in Mar, rising by 1.8% mom and 0.3% yoy compared to declines of -1.9% mom and -2.7% yoy respectively. It was the first mom increased after 4 months of declines, thanks to an increase in food sales; in yoy terms, it was the first increase after 5 months.

- Unemployment rate in the eurozone remained unchanged at 6.5% in Mar; in Germany, it held steady at 5.9% in Apr, the highest since May 2021, while the number of unemployed persons rose by 13k to 2.732mn.

- UK flash manufacturing PMI fell to 49.1 in Apr, down from Mar’s expansionary 50.3 reading, as new orders declined (new export business has fallen for 27 successive months) while selling prices rose to an 11-month high (stemming from input costs pressures and transport costs).

Asia Pacific:

- China’s manufacturing PMI edged down to 50.4 in Apr (Mar: 50.8), as new orders eased (51.1 from 53) as did foreign sales (50.6 from 51.3) and output gained (up 0.7 points to 52.9). NBS non-manufacturing PMI slowed to 51.2 (Mar: 53) as new orders declined sharply (46.3 from 47.4) while foreign sales and employment expanded though remaining below-50 (48.4 and 47.2 respectively).

- Caixin manufacturing PMI in China moved up by 0.3 points to 51.4 in Mar, the fastest pace recorded since Feb 2023, supported by output (fastest growth since May 2023), new orders (most in a year) and foreign sales (highest in 3.5 years).

- Japan manufacturing PMI inched closer to the 50-mark in Apr, clocking in at 49.6 (Mar: 48.2), with output and new orders falling at slower rates while employment growth picked up to a 19-month high.

- Industrial production in Japan fell by 6.7% yoy in Mar (Feb: -3.9%). In mom terms, IP rebounded, rising by 3.8% (vs Mar’s -0.6% drop): this was the fastest growth since Jun 2022, supported by production machinery (11.6% from Feb’s 3.2% drop), motor vehicles (9.6% from Feb’s -8.1%) and electronic parts (9.2% from 0.2%).

- Unemployment rate in Japan remained at a constant 2.6% in Mar, with the number of unemployed stable at 1.82mn. Jobs to applicants’ ratio inched up to 1.28 (Feb: 1.26), the highest since Oct 2023.

- Retail sales in Japan increased by 1.2% yoy in Mar (Feb: 4.7%), rising for the 25th month in a row, despite declines in automobile sales (-15.9%) and textile & clothing (-3.8%). Driving the uptick were machinery & equipment sales (8.1%) as well as fuel (8.1%) and food & beverages (4.6%).

- Industrial production in Korea inched up by 0.7% yoy in Mar (Feb: 4.6%), the lowest growth since Aug 2023. Industrial output fell by 2.1% mom in Mar, the first fall since Oct and the sharpest since Feb 2020. Mining and manufacturing output fell by 3.2% as semiconductor production plunged.

- India’s manufacturing PMI fell to 58.8 in Apr (Mar: 59.1): supported by an increase in demand, this was the second-fastest reading in over 3 years. Job creation was the fastest since Sep 2023 2hule output charge inflation was at a 3-month high.

- Unemployment rate in Singapore inched up to 2.1% in Q1 (Q4: 2%), the highest since Q3 2022. Employment of foreign workers declined for the first time since Q3 2021 while retrenchments fell for the second straight quarter (with 3k persons people laid off in Q1).

- Singapore retail sales fell by 1% mom in Mar (reversing Feb’s 3.1% gain), posting the steepest drop in 6 months. In yoy terms, sales were up by 2.7%, slower than Feb’s 8.6% pace (which was influenced by the Lunar New Year spending).

Bottom line: US growth remains strong and above trend, while inflation is sticky and the labour market remains buoyant. The prospects of Fed rate cuts by June are off the cards. The JP Morgan Global Manufacturing PMI slowed from Mar, but the rate of output growth remained close to the pre-pandemic 10-year average as new orders rose for a 3rd straight month; emerging markets were the major drivers. The Bank of England meets this week – we expect the apex bank to hold, as no clear picture has emerged about price pressures and ahead of the election results later this week.

Regional Developments

- Visitor numbers to Bahrain grew by 25% yoy in 2023 and saw revenues rise by almost one-third, according to the tourism minister (no overall data was provided). In a bid to increase the number of tourists to 14mn by 2026, the nation has been expanding its offerings: 11 new hotels (by international operators) are in the pipeline by end-2026, while number of beach clubs and private beaches will be increased to 17 and 24 respectively (from 7 and 20).

- Bloomberg reported that Bahrain is seeking investors for a key pipeline that transports crude from Saudi Arabia. The pipeline, operated by Aramco and Bahrain Petroleum Company (Bapco), transports up to 350k barrels of crude oil per day. Separately, Bapco Energies also announced the development and investment in wind energy projects, with a capacity of up to 2 GW, in coordination with UAE’s Masdar.

- Bahrain’s InvestCorp disclosed plans to buy India’s National Stock Exchange’s digital technology services business for USD 120mn.

- Egypt’s net foreign assets deficit shrank for the second month in a row, to EGP 200bn in Mar (Feb: EGP 679bn). This does not include the first instalment received from the IMF.

- Japan will provide USD 230mn in financing to Egypt, revealed the latter’s finance minister, in a bid to provide budget support.

- A cabinet spokesperson stated that taxes levied on capital gains arising from the sale of securities listed on the Egyptian Exchange will be collected as of the tax season of Mar-Apr 2025 through Misr for Central Clearing, Depository and Registry.

- Egypt’s PM disclosed that the direct cost of hosting refugees in Egypt is estimated at over USD 10bn annually, on the side-lines of the WEF meeting in Riyadh last week. Currently the country is home to more than 9mn refugees.

- Egypt’s foreign trade touched USD 24.6bn in Q1 of the fiscal year 2023-24. The UAE (USD 2.2bn), Saudi Arabia (USD 1.73bn) and US (USD 1.67bn) occupied the top 3 trade partners spot, while the top 14 nations accounted for 63.9% of the trade volume.

- Egypt will open its first digital bank by end-2024. MTI (a Banque Misr subsidiary), which applied for a digital bank license in Aug 2023, has received approval by the central bank.

- Fitch revised Egypt’s outlook to “positive” from “stable” as near-term external financing risks have reduced amidst exchange rate flexibility and fiscal reforms, while affirming the issuer default rating (IDR) at “B-”.

- Bilateral trade between Egypt and Kuwait fell by 11.8% yoy to USD 3bn in 2023, according to CAPMAS data. Exports to Kuwait slipped by 26.4% yoy to USD 315mn while imports from Kuwait fell by 10% to USD 2.7bn.

- Kuwait PMI declined to 51.5 in Apr (Mar: 53.2) as job creation dropped for the first time in 8 months and input costs surged alongside increases in output and new orders (for the 15th month in a row).

- Kuwait’s trade surplus narrowed by 10% yoy to KWD 1.1bn in Jan, largely due to the decline in oil prices. In Jan, exports from Kuwait declined by 8% yoy to around KWD 2bn (of which oil exports share was 91.5%) while imports fell by 7.5% to KWD 939.4mn.

- The EU announced a financial aid package for Lebanon valued at more than USD 1bn and the grants will be made available over the next three years. The aid includes EUR 736mn of grants to help Lebanon with the Syrian refugee crisis and EUR 264mn in regular bilateral aid.

- Total loans and financing provided by banks in Oman grew by 2.7% yoy to OMR 30.6bn by end-Feb, with credit to the private sector inching up by 3.9% to OMR 25.8bn. Total foreign assets of the Central Bank of Oman also increased by 4.3% to OMR 6.86bn.

- Qatar GDP grew by 4% qoq and 1.2% yoy in Q3 (Q2: 0.5% qoq and 1% yoy). Mining and quarrying activities grew by 0.8% qoq in Q3 while non-mining and quarrying posted a robust growth of 6% qoq.

- Qatar’s foreign trade surplus narrowed to QAR 17.6bn in Mar (-17.1% yoy and -2.8% mom) as exports fell by 7.6% yoy to QAR 28.5bn (largely due to fuel exports). Imports meanwhile grew by a strong 13.2% yoy and 7.8% mom to QAR 10.9bn. China was the top export destination (QAR 5.8bn), followed by India (QAR 4.4bn) and South Korea (QAR 4bn).

- QatarEnergy awarded a USD 6bn contract to China State Shipbuilding Corporation to build 18 of the largest LNG vessels as part of its fleet expansion programme. This is the industry’s largest single shipbuilding contract ever, and 8 of the vessels will be delivered in 2028 and 2029 and the rest 10 in 2030 and 2031.

- Saudi Arabia and the UAE provided 85% of Japan’s total crude oil exports in Mar, with another 10% coming from other Arab sources. The rest of its oil imports came from the US (4.1%), Central and South America (0.9%) and Oceania (0.3%).

- It will take a minimum of 16 years to rebuild destroyed homes in Gaza and it would take “approximately 80 years to restore all the fully destroyed housing units” if the pace of reconstruction follows previous post-conflict trends, according to the UN. Data show than about 80k homes have been destroyed in the conflict, and that over 70% of schools will need either major or full reconstruction.

Saudi Arabia Focus

- Preliminary data showed thatSaudi Arabia’s real GDP shrank by 1.8% yoy in Q1 2024, declining for the 3rd consecutive quarter (but at a slower pace than Q4’s 3.7% decline), as oil sector activity fell (-10.6%). Non-oil sector grew by 2.8% in Q1 this year, slower than the 4.2% gain recorded in Q4 2023; growth was also propped by a 2% rise in government sector activity (Q4: 3.1%). In qoq terms, however, GDP rebounded in Q1: an uptick in oil sector activity (2.4% qoq) supported the overall 1.3% qoq growth (Q4: -0.6%) while non-oil sector expanded by 0.5% (Q4: 1.4%).

- Saudi Arabia’s PMI stabilised at 57.0 in Apr, as output inched lower (61.9 from 62.2) as did new orders (61 from 64). Export orders remained above-50, driven by the manufacturing sector, while employment declined for the first time in just over two years.

- Budget deficit in Saudi Arabia touched SAR 12.39bn in Q1 2024: non-oil revenues grew by 9% yoy to SAR 111.51bn while oil revenues touched SAR 181.92bn (+1.9% yoy). Spending grew by 8% yoy to SAR 305.8bn, driven by a 33% increase in capex spending (to SAR 34.5bn) while compensation of employees still accounting for 45% of total spending. Public debt increased to nearly SAR 1.11trn in Q1 2024, from SAR 1.05trn at end-2023.

- Claims on the private sector in Saudi Arabia rose by 8.1% yoy to SAR 2.6trn in Mar alongside a 9.2% uptick in claims on the public sector (to SAR 1.19trn). Government deposits declined in yoy terms for the 13th month in a row in Mar (-10.8% yoy to SAR 444.1bn). Net Foreign Assets surged to SAR 1.628trn in Mar, the highest since Jan 2023.

- It was revealed that net FDI inflows into Saudi Arabia grew by 16% qoq in Q4 2023, during a meeting of the Council of Economic and Development Affairs.

- Saudi Capital Market Authority plans to list 24 companies this year, raise its assets under management to 29.4% of GDP and target 17% ownership of free float shares by end-2024. Another major aim is to deepen the sukuk and debt instruments market and increase the debt-to-GDP ratio to 22.1% by end-2024. Saudi also saw a surge in fintech companies, surpassing 2023 targets with 216 in operation and launching two digital banks.

- In a bid to attract foreign investment and support the private sector, Saudi Arabia is open to provide up to 75% of financing for certain industrial projects, disclosed the minister of industry and mineral resources.

- Saudi-based fintech firm Rasan Information Technology Co. is set to offer 30% of its issued share capital (22.74mn shares) for an IPO on Tadawul.

- Aramco is looking to invest in new energies outside of Saudi Arabia, disclosed the firm’s CEO on the side-lines of the WEF meeting in Riyadh last week.

- BlackRock and Saudi PIF signed an MoU to launch a multi-asset investment platform, backed by up to USD 5bn from the PIF. The platform is said to focus on Saudi though it will cover investments across the MENA region.

- Saudi Arabian Mining Co (or Ma’aden) announced the completion of a 10% acquisition of Brazil’s Vale Base Metals. Separately, Aramco acquired a 40% stake in Gas & Oil Pakistan – a firm involved in the procurement, storage, sale, and marketing of petroleum products and lubricants, and one of the largest retail and storage companies in Pakistan.

- Passenger traffic on Saudi railways increased by 23% yoy to 2.7mn persons in Q1 2024, alongside a 9% uptick in the volume of minerals and goods transported (to 6.34mn tonnes).

- Car imports into Saudi Arabia surged by 40% yoy to 93,199 in 2023. Saudi accounts for more than half the car sales in GCC and ranks among the top 20 markets globally.

- Saudi start-ups raised SAR 12bn in venture capital funding during the decade 2014-2023, according to a MAGNiTT report. The report finds that 44% of these firms were founded by multiple partners, and received 53% of the total venture capital funding.

UAE Focus![]()

- UAE PMI eased to 55.3 in Apr (Feb: 56.9), the lowest since Aug 2023, partly attributed to the heavy rains and subsequent flooding that slowed down sales (slowest since Feb 2023), new orders (56 from 61.5) and operating capacity while output inched up (63.2 from 62.7).

- The UAE and Ukraine have concluded negotiations related to a bilateral trade deal. The CEPA will remove or reduce tariffs on several goods and services while also easing market access. Bilateral trade between the two countries touched USD 385.8mn in 2023 while investments clocked in at USD 360mn as of end-2022.

- Trade between UAE and India increased by 15% since the CEPA was implemented in May 2022, according to the CEPA council director. Bilateral trade rose to USD 84bn at end-2023 from USD 73bn in 2021. UAE’s FDI into India rose to USD 3.3bn in 2023.

- Gross bank assets in the UAE surged to a new high in Feb (AED 4.2trn, up 2.2% mom).Deposits grew by 2.7% mom & 16.3% yoy in Feb, thanks to a healthy 2.0% mom & 20.4% uptick in resident private sector deposits. Overall domestic credit grew by 4.7% yoy as credit to individuals grew 8% yoy. Monetary base expanded by 2.7% mom to AED 688.7bn, driven by the rise in currency issued. Aggregate capital and reserves of banks operating in the UAE surpassed AED 0.5trn at end-Feb.

- UAE’s Spinneys IPO was priced at AED 1.53 per share and was oversubscribed by around 64 times. Interest in the company was 35% international and 65% regional. With proceeds of close to AED 1.38bn, capitalisation is implied at around AED 5.51bn at the time of listing.

- The Dubai Financial Market (DFM) counts “diversifying the investor base” as one of its top priorities and is currently focusing on supporting start-ups in the pre-IPO stage (i.e. to raise capital and connect them with investors). DFM’s CEO revealed that the exchange attracted around 44,000 new investors in Q1 2024, 10 times the average for the five years before 2019.

- Bloomberg reported that Etihad Airways had picked more banks ahead of an IPO that could raise USD 1bn. Etihad posted a record USD 296mn core operating profit in H1 2022, from a loss of USD 392mn a year before. ADQ, which took full ownership of the airlines in 2022, is reportedly planning a listing for end of this year.

- Reuters reported that UAE was planning to issue a tender for a second nuclear plant within months, with construction scheduled for later this year and being operational in 20232. This would double the number of reactors to 8.

- Gross written premiums in the DIFC grew by 23% yoy to a record-high USD 2.6bn in 2023. The freezone also posted a 20% rise in registration of insurance and re-insurance firms.

- ADQ, Abu Dhabi sovereign wealth fund, listed a dual tranche USD 2.5bn bond on the London Stock Exchange. The proceeds will be used to “diversify ADQ’s funding mix, enhance financial resilience and contribute growth capital”.

- ADNOC disclosed an increase in its production capacity to 4.85mn barrels per day (bpd) from 4.65mn bpd at end-2023. UAE plans to raise its capacity to 5mn bpd by 2027.

- UAE’s Mubadala Capital committed to invest USD 13.5bn in Brazil’s bio-fuel sector, revealed the head of Brazil strategy in an FT interview, with funds to be sourced through a blend of equity and debt over a span of five to 10 years.

- Abu Dhabi’s AI firm Presight acquired a majority stake in AIQ, a tech JV between ADNOC and G42. ADNOC will retain a 49% shareholding.

- A UAE-Iran joint economic commission took place last week in Abu Dhabi, for the first time in a decade. Iran imported USD 20.8bn worth goods from the UAE in the fiscal year till Mar 2024 while the UAE was Iran’s third largest export destination (USD 6.6bn).

- Ajman disclosed a 7% increase in total tourism revenue in Q1 2024, thanks to a 3% uptick in occupancy rates and a 9% growth in visitors while average hotel stay moved up by 5%.

Media Review

The Gulf superstorm is a climate change omen: Dr. Nasser Saidi’s oped in AGBI

https://www.agbi.com/opinion/sustainability/2024/05/nasser-saidi-gulf-superstorm-is-a-climate-change-omen/

US-Saudi Arabia defense pact

https://www.reuters.com/world/us-saudi-arabia-nearing-agreement-security-pact-sources-say-2024-05-02/

https://www.ft.com/content/8f5b6401-6c7c-4f73-8bea-ca9e9a10e9ed

Big tech’s great AI power grab

https://www.economist.com/business/2024/05/05/big-techs-great-ai-power-grab

Powered by: