Weekly Insights 5 Apr 2024: Non-oil sector growth slows in GCC, but will remain a major contributor to growth

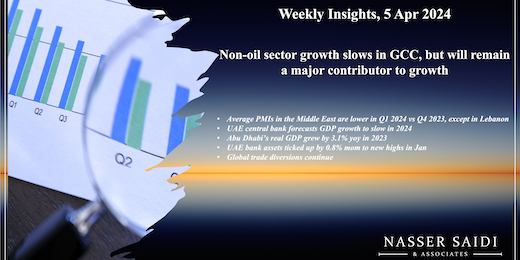

1. Average PMIs in the Middle East are lower in Q1 2024 compared to Q4 2023, except in Lebanon

- Saudi Arabia and UAE PMIs edged lower by 0.2 points to 57 and 56.9 respectively in Mar. Both report increases in new orders and output alongside robust demand. UAE firms’ higher inflows were noted to be associated with rising client spending and marketing campaigns. While export sales increased in the UAE, Saudi saw foreign demand growth (in month-on-month terms) sustaining for the first time since mid-2023. Employment in both nations remained higher than the series average. Qatar’s PMI was 50.6 in Mar, supported by rising output and new orders.

- Costs-wise, Saudi firms reported input cost inflation at an 8-month low, which could be traced back to weakening wage pressures while Qatar reported stable wages and purchasing costs. However, increased competition & plans to retain customers saw selling prices fall in the UAE (at the sharpest rate in 3.5 years) and Saudi (to a 6-month low). The 12-month ahead outlook remains optimistic in all 3 GCC nations.

- Egypt posted its 40th straight month of readings below-50, pulled down by the second-sharpest drop in output for 14 months and a sharp decline in new orders given lower consumer spending (which can be traced to inflation and volatile EGP market). In positive signs, new exports increased for the first time since Dec 2022 and employment increased for the first time in 2024, but business expectations worsened.

- Lebanon’s PMI recovered in Mar, but new order intakes shrank for an 8th month in a row, new business from non-domestic consumers dropped the quickest since Dec 2022. War and continued political uncertainty led firms to have a pessimistic 12-month ahead outlook.

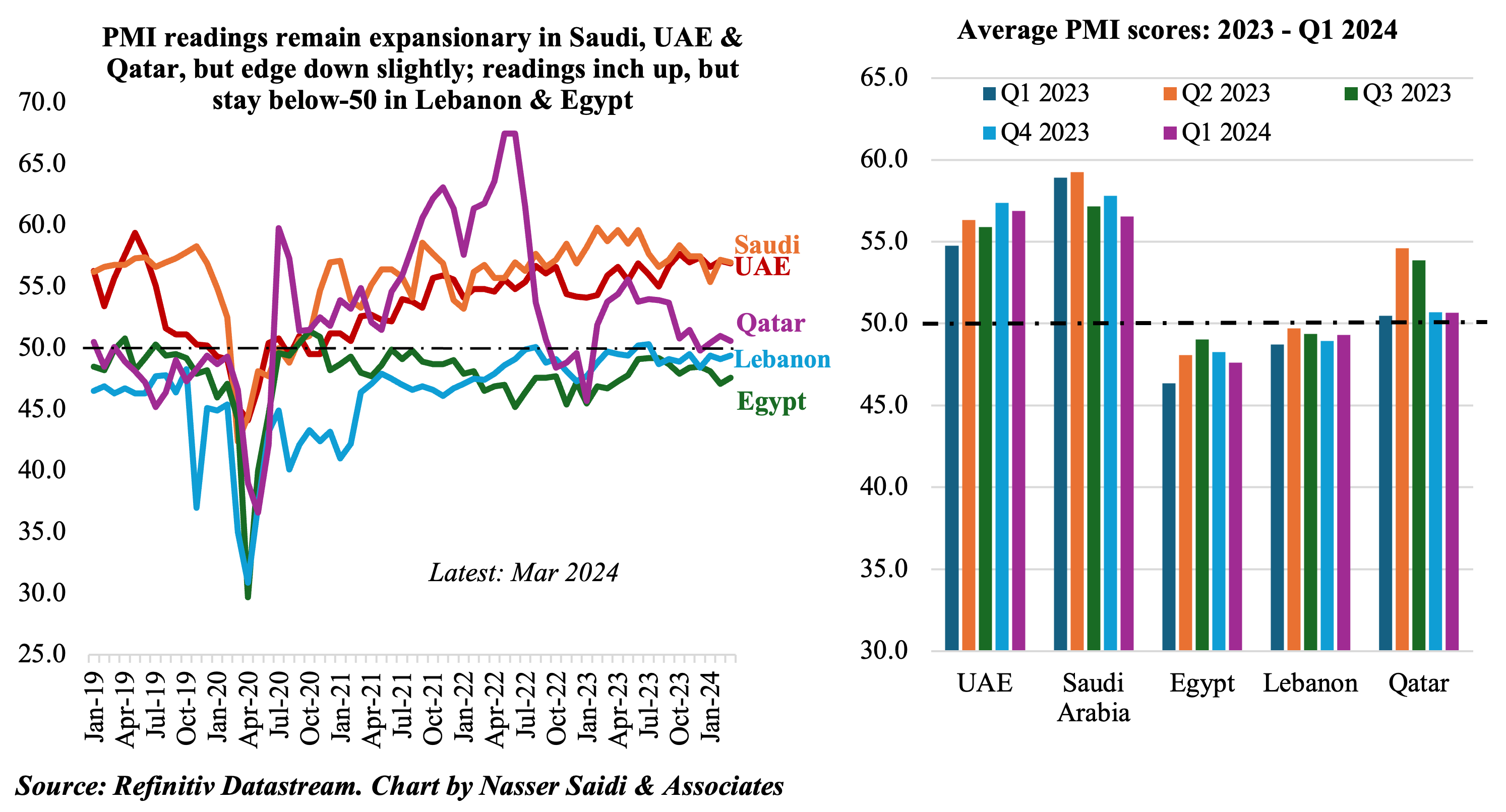

2. UAE central bank forecasts GDP growth to slow in 2024 (4.2% from an estimated 3.1% in 2023); UAE inflation eased sharply to 1.6% in 2023 (2022: 4.8%)

- The UAE central bank lowered its GDP forecast for 2024 to 4.2% (compared to its earlier forecast of 5.7% for 2024, issued in Dec 2023). Growth in 2024 will be dragged down by a slower growth in the non-oil sector (4.7%, from 5.9% in 2023).

- PMI data indicates that non-oil private sector firms are optimistic about the next 12-months; in addition, the UAE’s ongoing reforms like the long-term business licenses plan (to attract businesses and potentially lower admin costs) and CEPAs (to encourage bilateral trade and investments) will generate increased activity.

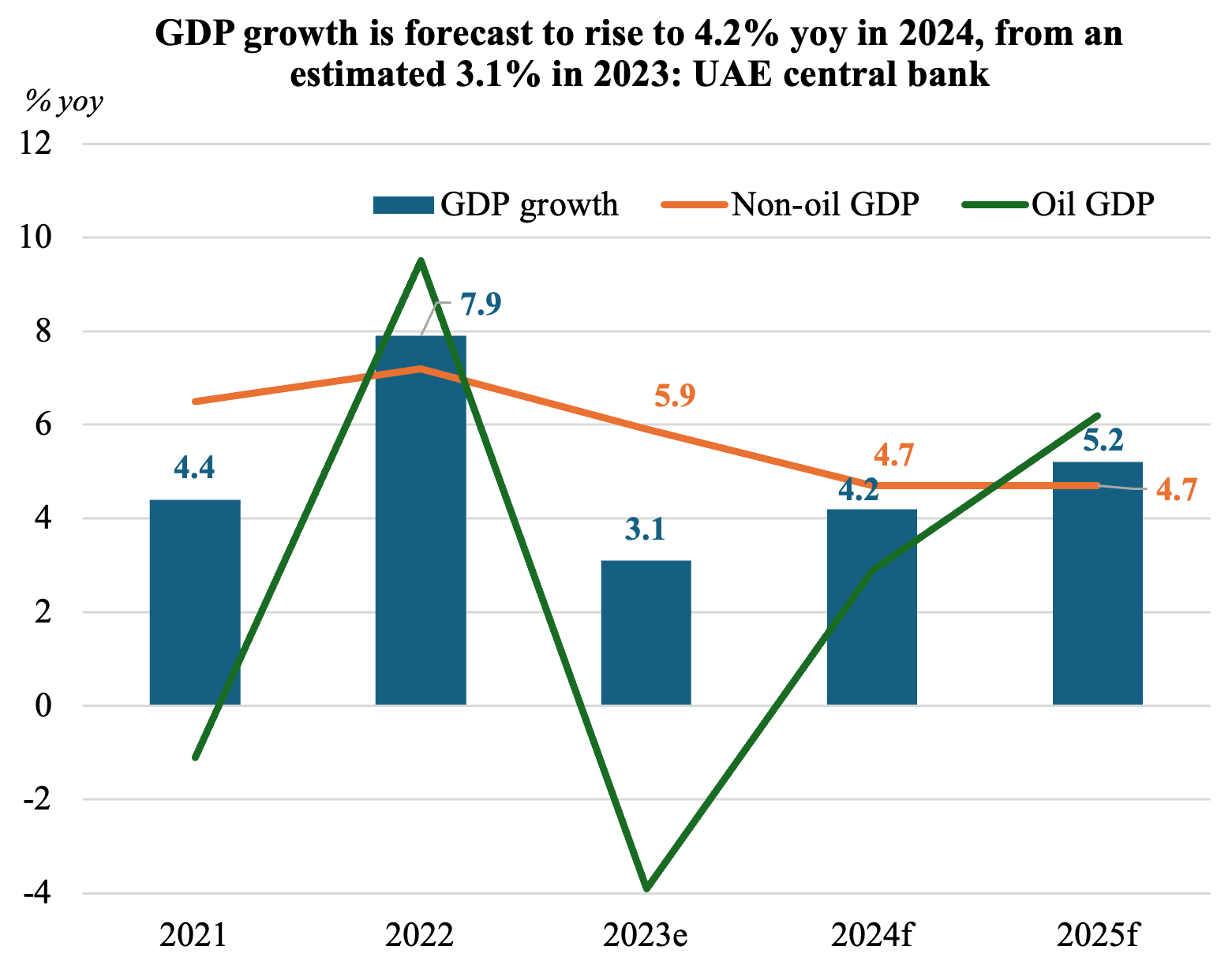

- Inflation in the UAE, according to FCSA data, eased to 1.6% yoy in 2023, from 4.8% in 2022. This was largely due to the declines in transportation costs (-5.6% in 2023 from 22.95%), recreation & culture (0.4% from 12.96%), and food & beverages (3.8% from 7.2%). Other categories like housing (35.1% weight in the basket), education and insurance & financial sector costs have increased. A breakdown by quarter, however, shows a slight easing in Q4 in housing & utilities (3.3% from 3.7% in Q3).

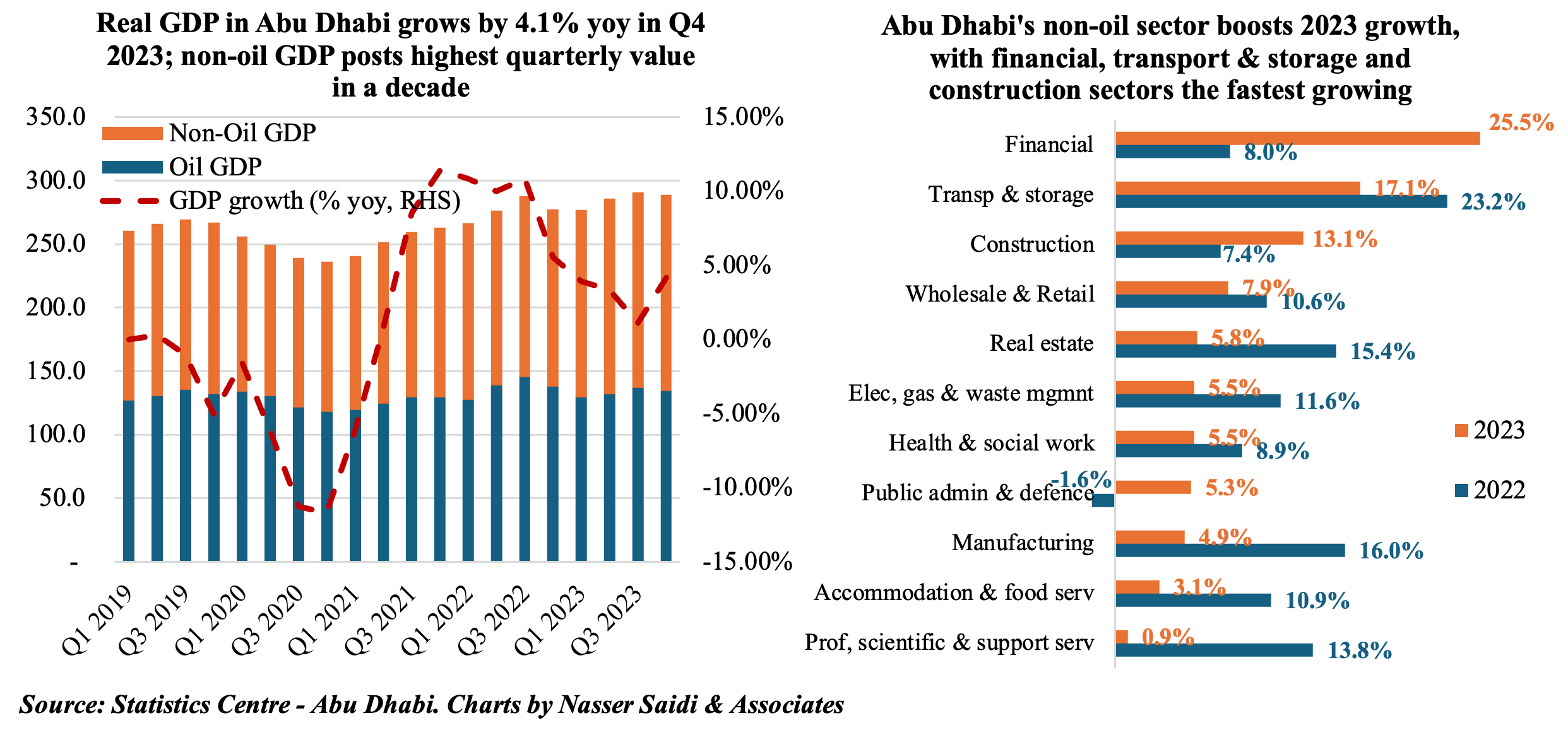

3. Abu Dhabi’s real GDP grew by 3.1% yoy in 2023; non-oil GDP in Q4 was the highest quarterly value in a decade

- Real GDP in Abu Dhabi grew by 3.1% yoy in 2023 (2023: 9.1%), supported by robust non-oil sector activity. The contribution of the non-oil sector stood at 53.4% of the total last year.

- Non-oil growth surged, touching AED 154.32bn in Q4 (4.1% yoy & 0.4% qoq): this was the highest quarterly non-oil GDP reading since 2014, crossing the previous high in Q2 2023 (AED 154.04bn). This stands in contrast to oil GDP which fell by 2.3% yoy to AED 134.5bn in Q4 (from lower prices and production cuts).

- The financial sector grew the most in 2023 (25.5% yoy), underscores the attractiveness of ADGM as a global financial centre: ADGM reported a 32% yoy growth in 2023, with many investment firms and hedge funds setting up base in the centre; total asset managers touched 102, managing 141 funds and assets under management grew by 35%. Other fastest growing sectors in Abu Dhabi were transportation & storage (17.1%) and construction (13.1%).

- Manufacturing sector, which contributed 8.8% to total GDP in 2023 (the largest share), grew by 4.9% (2022: 16%); wholesale & retail trade and public administration expanded by 7.9% and 5.3% respectively (with a share of 5.5% to GDP each).

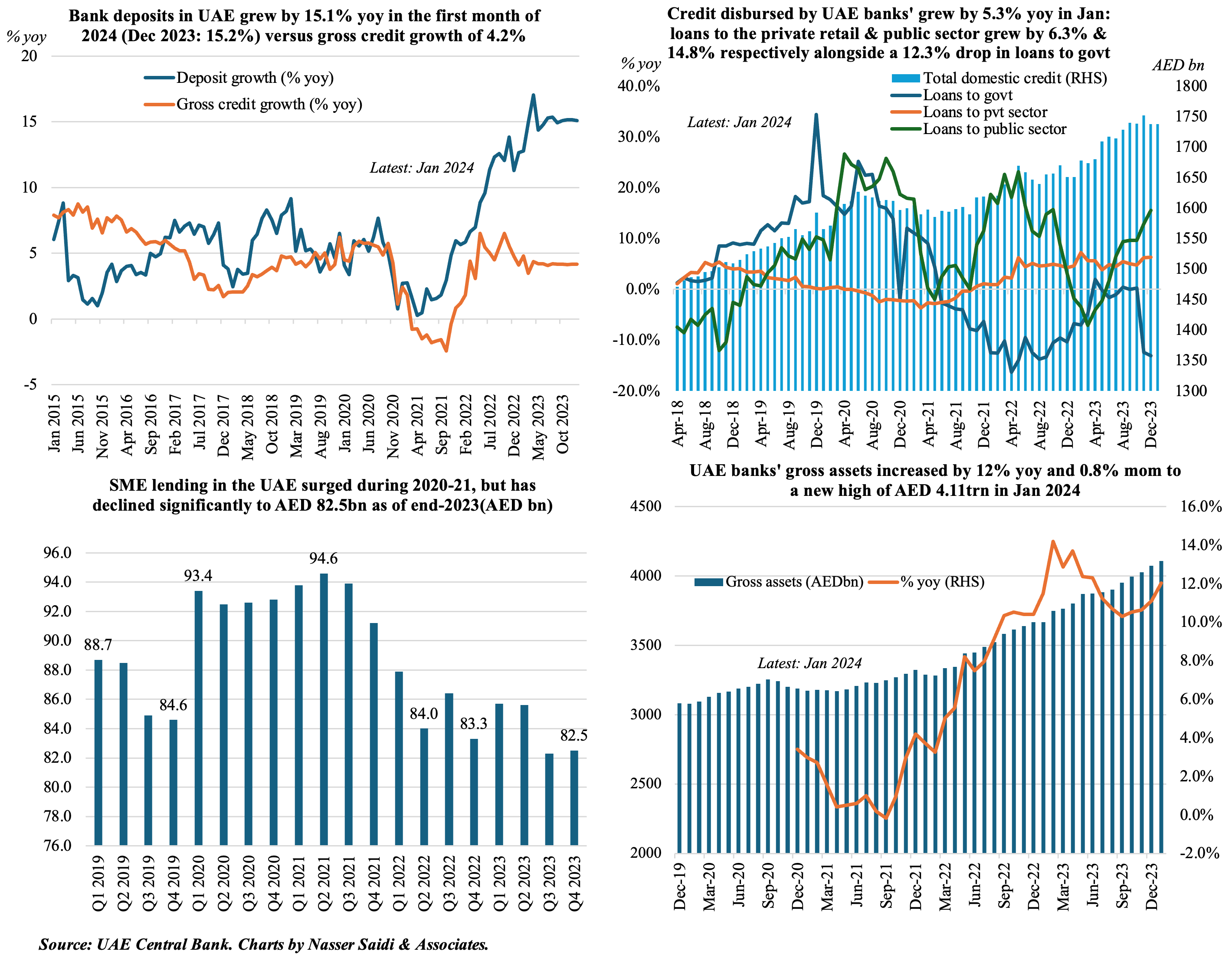

4. UAE bank assets ticked up by 0.8% mom to new highs in Jan. Deposits grew by 0.7% mom & 13.7% yoy in Jan, thanks to a healthy 0.9% mom & 15.7% uptick in resident private sector deposits. Overall domestic credit grew by 5.3% despite a drop in credit to the government (-12.3%). SME lending slipped to AED 82.5bn as of Dec (high of AED 94.6bn in Q2 2021)

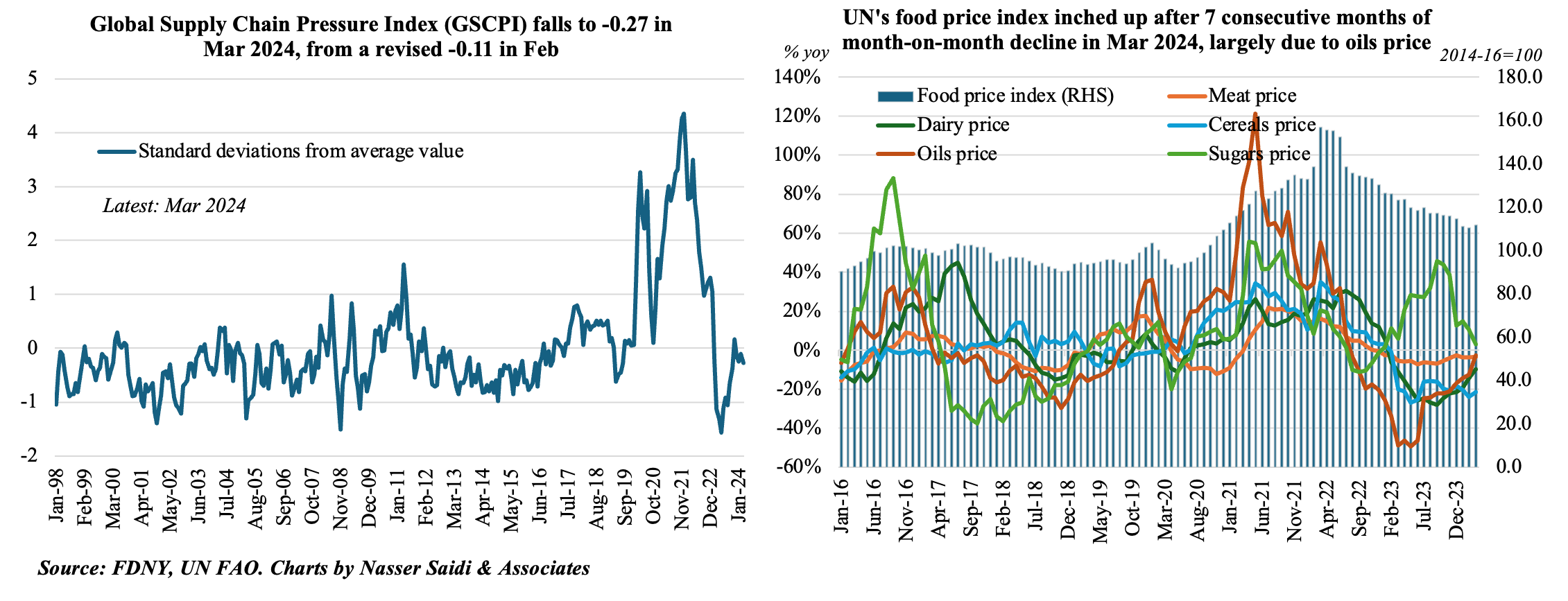

5. Global trade diversions continue: but, global supply chain pressures are falling alongside no sudden surges in shipping costs & food prices

- According to the IMF’s PortWatch platform, shipping volumes in the Red Sea dropped by 55% yoy in Q1 2024 and by 64% in Mar. Since mid-Dec, about 2,900 ships (roughly 2% of global maritime trade in 2023) have been diverted from the Suez Canal.

- Average global rates for shipping containers continue to fall after the surge in Dec (when the attacks in Red Sea began): additional container ship deliveries (record levels in Jan-Feb), increased sail speeds and softer demand have also eased supply chain pressures. The Fed’s Global Supply Chain Pressures Index (GSCPI) fell to -0.27 in Mar (Feb: revised to -0.11), indicating lower than normal supply chain pressures. In Mar 2024, UN’s food price index rose by 1.1% mom after 7 straight months of decline (however, it fell 7.7% in yoy terms), mostly due to the rise in vegetable oil price (+8% mom to a 1-year high 130.6 points).

- Meanwhile, demand for air cargo has been rising, with Feb posting the third consecutive month of double-digit yoy growth (+11.9% to 19.7bn cargo-tonne-kilometers or CTKs), according to IATA. The Middle East airlines posted one of the largest annual growth rates in Feb (20.9%): the Middle East – Europe trade lane experienced 39.3% yoy growth in international CTKs, and the Middle East-Asia segment was up 21%.

Powered by: