Download a PDF copy of the weekly economic commentary here.

Markets

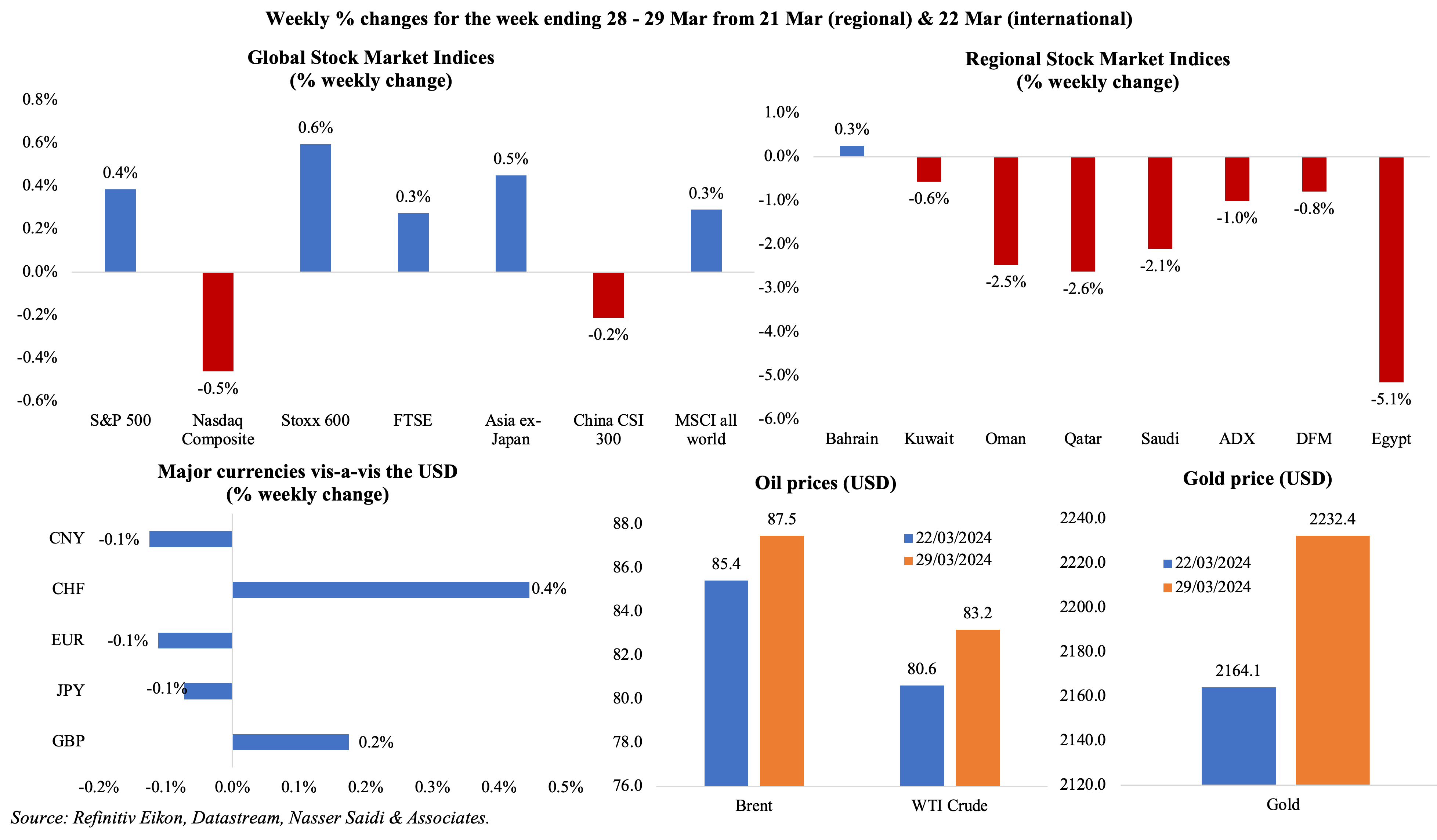

Major equity markets were relatively unchanged last week, ahead of the Easter weekend: the MSCI index of global markets was little changed on a weekly basis, but was up over 7% in Q1; Chinese equity market and the tech-heavy Nasdaq ended in the red compared to a week ago. Regional markets dropped ahead of the US PCE data release; Dubai’s index improved on Friday, given gains in banking stocks, but ended 0.8% lower. Expectations of slow increase in rates by the BoJ and a strong dollar pushed the yen to a 34-year low against the dollar last week. Oil prices ended slightly higher, with OPEC+ expected to potentially continue with production cuts. Gold price rose by 3%+ while cocoa futures has been pushed to record highs given a supply shortage.

Global Developments

US/Americas:

- US GDP growth was revised higher to 3.4% qoq in Q4 (prev: 3.2%), thanks to upward revisions to consumer spending (+3.3% from 3% previously, led by services) and business investment (+3.7% from 2.4%).

- PCE price index inched up to 2.5% in Feb (Jan: 2.4%), as services prices rose (3.8% yoy) alongside a 0.2% drop in goods prices. In mom terms, PCE price index ticked up by 0.3% (Jan: 0.4%), pushed up by rising energy costs (2.3%) and food prices (0.1%). Core PCE price index eased to 0.3% mom and 2.8% yoy (Jan: 0.5% mom and 2.9% yoy); the yoy reading was the smallest since Mar 2021.

- Personal income in the US grew by 0.3% mom in Feb (Jan: 1%) while personal spending grew by 0.8% (Jan: 0.2%), the biggest gain since Jan 2023. The saving rate dropped to 3.6% (Jan: 4.1%), the lowest level since Dec 2022.

- Goods trade deficit in the US widened to a 10-month high of USD 91.84bn in Feb (Jan: USD 90.51bn), with exports rising by 2.8% and imports up by a relatively slower 2.3%.

- S&P Case Shiller home price index increased by 6.6% yoy in Jan (Dec: 6.7%), with all cities reporting an uptick in annual prices.

- New home sales in the US fell by 0.3% mom to 662k in Feb, as sales of single-family homes fell unexpectedly. Pending home sales were up by 1.6% in month-on-month terms in Feb, as inventories rose, while it fell by 7% yoy (Jan: -8.7%).

- Durable goods orders increased by 1.4% mom in Feb (Jan: 1.1%), as transportation orders rebounded (3.3% vs Jan’s 18.3% drop) and machinery orders inched up by 1.9%. Non-defence goods orders excluding aircraft increased by 0.7% (Jan: -0.4%).

- Multiple manufacturing indices reported declines in Mar. Dallas Fed manufacturing index worsened to -14.4 in Mar (Feb: -11.3), with production index falling by 5.1 points to -4.1 while outlook uncertainty index rose to a 6-month high of 23. Richmond Fed manufacturing index moved to -11 in Mar (Feb: -5), as the volume of new orders plunged (-17 from -5) amid easing of shipments and new orders. Chicago PMI fell to 41.4 in Mar (Feb: 46) and the Kansas Fed manufacturing index fell to -9 in Mar (Feb: 3).

- Michigan consumer sentiment index was revised higher to 79.4 in Mar (prelim: 76.5, Feb: 76.9), the highest reading since Jul 2021. Inflation expectations for the 1- and 5-year ahead lowered to 2.9% and 2.8% (from 3% and 2.9% respectively).

- Initial jobless claims fell by 2k to 210k in the week ended Mar 22nd while the 4-week average rose by 0.75k to 211k.Continuing jobless claims inched up by 24k to 1.819mn in the week ended March 8th.

Europe

- Economic sentiment index in the euro area gained 0.8 points to 96.3 in Mar while in the EU it rose 0.7 points to 96.2. Manufacturers’ confidence in the euro area rose to -8.8, the highest since Sep 2023, while services sentiment improved to 6.3 (from 6.0). Consumer sentiment jumped to -14.9, the highest since Feb 2022.

- Retail sales in Germany fell by 1.9% mom and 2.7% yoy in Feb: this was the sharpest mom decline since Oct 2022, with food and non-food sales down by 1.7% and 1% respectively.

- GfK consumer confidence in Germany edged up to -27.4 in Apr (Mar: -27.9), supported by a high “propensity to save” reading (even though it fell 5 points to 12.4) and a rise in both economic and income expectations indices by 3.3 points each to -3.1 and -1.5 respectively.

- German unemployment rate remained unchanged at 5.9% in Mar, the highest level since May 2021. The number of jobless persons rose by 4k to 2.719mn in Mar.

- GDP in the UK fell by 0.3% qoq and 0.2% yoy in Q4 (Q3: -0.1% qoq), confirming a technical recession in H2 2023. Real household disposable income grew by 0.7% in Q4 while the household saving ratio rising to 10.2% (Q3: 10.1%).

Asia Pacific:

- NBS manufacturing PMI in China returned to expansion in Mar, rising to a 12-month high of 50.8 (Feb: 49.1), thanks to increase in output and new orders to 52.2 and 53 respectively (Feb: 49.8 and 49) amid foreign sales moving to 51.3 (after 11 months of below-50 readings).

- China’s non-manufacturing PMI jumped to 53.0 (Feb: 51.4), remaining expansionary for the 15th month in a row. Foreign sales remained contractionary for the third month (47.3), employment was weak (46.6) while selling prices fell for the 6th month (48.6).

- China’s industrial profits grew by 1.2% in Jan-Feb, following a 2.3% decline for the full year 2023, partly due to a lower base. There was a substantial divergence across firms: state-owned forms posted a 0.5% uptick while foreign and private sector firms saw gains surge by 31.2% and 12.7% respectively.

- Inflation in Tokyo surprisingly rose to 2.6% in Mar (Feb: 2.5%) while core CPI (excluding fresh food) inched slightly lower to 2.4% (Feb: 2.5%); excluding food and energy, prices slowed faster in Mar (to 2.9% from 3.1%).

- Industrial production in Japan fell by 0.1% mom and 3.4% yoy in Feb, as car manufacturing declined for a second month in a row (-8% from Jan’s 16.4% drop). Retail sales in Japan grew by 1.5% mom and 4.6% yoy, expanding for the 24th month in a row.

- Japan’s leading economic index was revised down to 109.5 in Jan (prelim: 109.9; Dec: 109.9). The coincident index was revised upwards to 112.1 (prelim: 110.2, but lower than the revised Dec reading of 115.9) – this was however the lowest reading since May 2022.

- Unemployment rate in Japan inched up to 2.6% yoy in Feb (Jan: 2.4%) and the job to applicants’ ratio eased to 1.26 from 1.27 the month before.

- Industrial production in Korea expanded by 3.1% mom and 4.8% yoy in Feb (Jan: -1.5% mom and +12.9% yoy), largely due to recovery in semiconductor production (65.3% yoy) while chip production and output of mechanical equipment grew by 4.8% and 10.3%. Retail sales declined by 3.1% mom (Jan: 1%), posting the biggest decline since Jul 2023.

- Infrastructure output in India grew by 6.7% yoy in Feb (Jan: 4.1%), taking the cumulative output for the period Apr 2023-Feb 2024 to 7.7% (Apr 2022-Feb 2023: 8.2%). Coal and cement production increased by 11.6% yoy and 10.2% respectively in Feb 2024 while production of refined products was up by 2.6%.

- Inflation in Singapore increased to 3.4% in Feb, from Jan’s 2-year low reading of 2.9%, owing to an uptick in costs of housing (3.9%) and food (3.8%). Core inflation jumped to a 7-month high of 3.6% from 3.1% in Jan. In mom terms, prices were up by 1%, a 15-month high.

- Industrial production in Singapore unexpectedly grew by 14.2% mom and 3.8% yoy in Feb (Jan: -6.7% mom and 0.6% yoy). Production in biomedical, chemical and aerospace transport contributed to the yoy increase – up by 27.4%, 11.2% and 37.3% respectively.

Bottom line: Global equity market performance has been on a roll in Q1 (with record highs in gold, Bitcoin etc) and while there are divergences in growth patterns (a “soft landing” in the US versus a probable Q1 slump in Germany alongside moderate growth in Asia), the main event on the horizon in Q2 would be the expected rate cuts (from the ECB and the Fed – though Powell’s recent statements indicate that they are not “in a hurry to cut”). The 12-month high manufacturing PMI reading in China offered a slight respite, but will this positive story persist? China will be watched closely to see if further stimulus measures are rolled out to expand domestic demand and restore confidence about economic recovery.

Regional Developments

- Private sector credit in Bahrain declined by 0.2% yoy in Jan (Dec: +2.6%) – the first yoy drop since Sep 2017 – while money supply growth edged up by 0.9%.

- Bahrain plans to spend over BHD 200mn (USD 500mn) to raise the minimum wage of citizens. The plan is to set aside BHD 129mn for 13k Bahrainis while it will also support employees earning below BHD 1,500 per month in private institutions over a two-year period.

- Egypt plans to achieve a 4.2% yoy growth in fiscal year 2024-25 and aims for a primary surplus of 3.5% as well as a 50% increase in private sector investment. The plan allocates 42.4% of government investments towards education and healthcare initiatives, and pledges the allocation of 50% of public investments to green projects. State budget has allocated EGP 575bn for wages and EGP 636bn for subsidies, grants and social benefits.

- Egypt’s expanded USD 8bn IMF loan programme received approval from the IMF executive board last week, enabling the immediate release of USD 820mn, according to the IMF. The PM announced that the first tranche from the IMF will be received this week and that the second tranche of UAE payments will be received in the coming weeks.

- About USD 1.5bn has been set aside by Egypt for payments owed to foreign oil and gas companies in the countries, and payments have been initiated. This accounts for about 20% of arrears owed while the remainder will be paid off as per a scheduled plan.

- Foreign exchange receipts in Egypt fell by 24% yoy to USD 121.9bn in 2022-23, according to CAPMAS, largely due to the decline in government receipts (which stood at USD 2.4bn). Foreign exchange payments fell by 27% to USD 135bn, as portfolio investments plunged (to USD 7.6bn from USD 32.2bn the previous fiscal year).

- Fuel subsidies in Egypt increased by 9% yoy to EGP 72bn in H1 of the fiscal year 2023-24, reported Asharq Business, citing government officials.

- Population growth in Egypt slowed to 1.4% in 2023, its lowest rate in decades, according to the planning ministry; rate has fallen by 46% from 2017 to 2023. Total population stood at 106mn (as of Jan 1), and about 60% are estimated to live below or close to the poverty line.

- Iraq signed a 5-year gas supply deal with Iran, according to state media. The contract involves daily gas delivery rates of up to 50mn cubic meters, to ensure that the power generation stations are able to meet the demand for electricity (and peak loads).

- Kuwait has provided UNRWA with its annual contribution of USD 2mn, disclosed Kuwait’s state news agency on Thursday.

- S&P revised up its outlook on Oman to positive from stable before, citing strengthening balance sheet and positive economic reform program (including fiscal resilience), while also affirming the country’s rating at “BB+/B”.

- Oman launched the Future Fund Oman with USD 5.2bn of capital: aiming to deploy about USD 1bn per year, 90% of the Fund will be invested in major projects located in Oman.

- The Oman Daily Observer cited the minister of agriculture, fisheries and water resources that the country is investing a total of OMR 1.6bn (USD 4.2bn) on 137 food projects – expected to yield 852,000 tonnes of produce. Food production in the country touched 4.7mn tonnes in early 2024 from 3.9mn in 2019.

- Oman’s electric vehicle maker Mays plans to roll out its first car this year: at a cost of OMR 15,000, the five-seater car can cover 510km on a single charge and its battery can be turbo charged in 30 minutes.

- Qatar launched a 5-year renewable residency programme for people with expertise in the arts and scientific research. The program, which open in the next few months, needs applicants to either have a job offer in Qatar, or show self-sufficiency or a USD 68k minimum investment for entrepreneurs (with a business plan approved by a Qatari incubator).

- Trade surplus in Qatar widened to QAR 18.1bn in Feb (+3.4% mom) as exports declined by 8.8% mom (to USD 28.2bn) and imports fell by a sharper 24.8% (to QAR 10.1bn). China was the top destination of Qatar’s exports (25.5% of total exports, or QAR 7.2bn) and also the top source market for imports (14.5% of total imports, or QAR 1.5bn).

- QatarEnergy signed contracts to charter 19 LNG vessels (with Asian ship owners) to strengthen its shipping fleet. The firm had already contracted for 77 ships to be built at Korean and Chinese shipyards in the first phases of its LNG ship acquisition program.

- Turkey’s main opposition party – the Republican People’s Party (CHP) – won the local elections, posting the best results in any election, local or general, since the late 1970s. Rising inflation (67.7% in Feb) and value of the lira (hit a record low of 32.4 per USD post-election results) have seen an impact on overall cost of living and affected election outcomes. Interest rates have surged to 50% at the latest central bank meeting and another is to be held this month.

- Renewable energy capacity in the Middle East grew by 16.6% yoy in 2023, adding 5.1GW to overall capacity, according to IRENA. The fastest pace of growth was seen in Saudi Arabia, where capacity surged by 219% yoy to 2689 MW, followed by the UAE, which recorded a 68.3% yoy jump to 6052 MW in 2023.

- Market capitalization of Arab stock markets grew by 12% yoy to USD 4.5trn at end-2023, according to the Union of Arab Securities Authorities. The increase was largely owing to the uptick in Saudi markets, which saw market cap rise to above USD 3trn in 2023 (2022: USD 2.6trn). The Egyptian exchange accounted for 17% of the region’s total trading value.

Saudi Arabia Focus

- Saudi Arabia’s exports declined by 10.3% yoy to SAR 94.9bn in the first month of 2024. Oil exports fell by 13.5% yoy and 1.4% mom to SAR 71.0bn while non-oil exports plunged by 11.5% yoy and 15.1% mom to SAR 16.3bn. Imports grew by 10.5% mom to SAR 66.7bn, thereby narrowing trade surplus to SAR 28.2bn. China continues to be the top trade partner in Jan: accounting for 15% of overall exports and 20.4% of total imports.

- FDI inflows into Saudi Arabia grew by 16.6% qoq and 32.2% yoy to SAR 19.4bn in Q4 2023 (Q3: SAR 16.6bn).Outflows were SAR 6.2bn in Q4 (Q3: SAR 5.3bn), leading to net FDI inflows of SAR 13.2bn in Q4 (16.1% qoq & 23.3% yoy). Summing up the quarterly data indicates that FDI inflows touched SAR 72.4bn in 2023. This compares to FDI inflow volume of SAR 123bn in 2022, which was in part due to a SAR 58.1bn Aramco deal in Q1.

- Saudi central bank’s net foreign assets fell by 1.7% mom and 4.9% yoy to SAR 1.545trn in Feb. Money supply (M3) grew by 10.1% yoy in Feb. Total bank deposits grew by 10.3% yoy in Feb, despite government deposits declining by 8.4% mom and 30% yoy to SAR 434.6bn. Claims on private sector increased at a faster pace of 11.1% yoy in Feb, versus public sector’s 7.8% uptick. Additionally, e-commerce transactions continue to surge, up by 24.6% yoy to SAR 14.11bn in Feb.

- Unemployment rate in Saudi Arabia (inclusive of expats) slipped to 4.4% in Q4 (Q3: 5.1%). Saudi citizens unemployment rate also edged lower to 7.7% (Q3: 8.6%). Saudi female unemployment rate fell to a record-low of 13.7% in Q4 (Q3: 16.3%), with all groups recording a decline in unemployment rate, while female labour force participation eased slightly to 35.5% (Q3: 35.9%).

- Saudi Arabia’s National Labour Observatory disclosed that 1.06mn persons joined the Saudi private sector in 2023 (+11.5% yoy), of which women accounted for 37%. As of Feb, there were 11.1mn employees in the private sector, including 2.3mn citizens.

- Citing fDi Markets data (as of 26 Mar), a report by Emirates NBD revealed that Saudi Arabia’s greenfield FDI inflows more than doubled to USD 28.78bn in 2023, with China accounting for 58% of the inflows. UAE was the third largest source market, with USD 2.67bn of investment, mostly in the renewable energy sector.

- SAMA’s balance of payments data disclosed that spending by inbound visitors into Saudi Arabia grew by 42.8% yoy to SAR 135bn in 2023. Saudi posted a 156% increase in tourist arrivals in 2023 compared to 2019.

- Business registrations in Saudi Arabia grew by 12% to a total 1.12mn to 2023 (from 2019). Enrollments for limited-liability companies surged by 40% to 229,000 while joint-stock firms grew by 15% to 2756.

- Saudi Arabia’s private equity activity surged in the 5 years till 2023, reaching USD 4bn in 2023, according to MAGNiTT. The sector achieved a surge of 370% in 2021(vs 2020) and a leap of 590% in 2022 (vs 2021). Buyouts, which accounted for 80% of all PE activity, increased their share of activity by 20% between 2020 and 2023.

- The Saudi Ministry of Finance launched the Green Finance Framework, in a bid to achieve its net-zero emissions by 2060 and other sustainability goals. Net proceeds of any Green Bond/Sukuk issued by Saudi under this Green Financing Framework will be allocated to finance new or re-finance existing projects/expenditures. More details: https://ndmc.gov.sa/investorsrelations/Documents/Green-Financing-Framework-KSA-28March2024.pdf

- Abu Dhabi National Energy Co. (TAQA) and Japan’s largest power generation company (JERA Co. Inc.) signed a Power and Steam Purchase Agreement with Saudi Aramco Total Refining and Petrochemical Co. (SATORP) to develop a greenfield industrial steam and electricity cogeneration plant.

- EV-maker Lucid disclosed that it was raising USD 1bn in capital from Ayar Third Investment Company, a PIF affiliate, via private placement. The firm is estimated to make 9000 vehicles this year (vs 8428 in 2023).

UAE Focus![]()

- UAE is considering issuing long-term business licenses at “competitive prices”, including 10-year golden and 5-year silver licenses for trade. This was discussed at the government’s Economic Integration Committee, with an aim to raise government revenue and growth. The Minister of Economy disclosed that the number of companies in the country rose to more than 788,000 by end-2023.

- A Dubai Chambers report disclosed that 104 SMEs entered the Dubai market in 2023 (550% yoy), with 32% moving from the Middle East and Eurasia while Asian and Australian firms accounted for 29%. Top sectors were trade and logistics (17%), ICT (13%) and food and agriculture (10%).

- UAE’s investments abroad, both government and private, are estimated at USD 2.5trn as of early 2024, according to the secretary-general of the UAE International Investors Council. US attracted the largest investment (USD 65bn in bonds and USD 50bn in direct investments), followed by Egypt (USD 65bn), India and the UK (USD 40bn each).

- Petrol prices in the UAE are set to increase in Apr: depending on the grade of petrol, prices are up by around 4% (to AED 2.96 to 3.15), but diesel prices slipped by 2.2% to AED 3.09.

- Abu Dhabi aims to attract 40mn visitors, create 178k new tourism jobs, and raise tourism’s contribution to the non-oil sector to AED 90bn a year by 2030, as part of the emirate’s Tourism Sector Strategy 2030. In 2023, visitors to the emirate grew by 30% yoy to 24mn while tourism contributed AED 49bn (+22%).

- Reuters reported UAE indicating an interest in becoming a minority investor in European nuclear power infrastructure, via state-owned Emirates Nuclear Energy Company (ENEC). UAE and Britain had signed an MoU on civil nuclear cooperation at the UN climate summit in Dubai last Dec.

- Real estate transactions in the UAE grew by 22.6% yoy to a total AED 765.1bn (USD 208.34bn) in 2023, with Dubai driving the surge (20% to AED 634bn). Property agreements in Abu Dhabi reached AED 87.1bn in 2023, from 38,404 sales and mortgage transactions.

- Abu Dhabi announced plans to build a residential project for citizens, valued at AED 3.5bn (USD 953.1mn), via a public-private partnership – expected to be completed by Q4 2027.

Media Review

The Fiscal and Financial Risks of a High-Debt, Slow-Growth World

https://www.imf.org/en/Blogs/Articles/2024/03/28/the-fiscal-and-financial-risks-of-a-high-debt-slow-growth-world

Why cocoa prices spiked and what it means for chocolate lovers

https://www.bloomberg.com/news/articles/2024-03-31/why-cocoa-prices-spiked-and-what-it-means-for-chocolate-lovers

Russia struggles to collect oil payments as China, UAE, Turkey raise bank scrutiny

https://www.reuters.com/markets/commodities/russia-struggles-collect-oil-payments-china-uae-turkey-raise-bank-scrutiny-2024-03-27/

Antarctica, Earth’s largest refrigerator, is defrosting

https://www.economist.com/interactive/science-and-technology/2024/03/27/antarctica-earths-largest-refrigerator-is-defrosting

How Big Tech is winning the AI talent war

https://www.ft.com/content/2892bac2-d848-49ea-b983-bc649a8c0529

AI boom drives global stock markets to best first quarter in 5 years

https://www.ft.com/content/1f471c88-d49f-4a52-8619-cc5c0c506008

Powered by: