Weekly Insights 29 Mar 2024: Saudi Exports, FDI, Unemployment & Monetary Indicators – an update

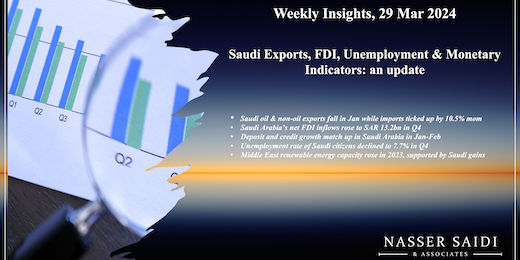

1. Saudi oil & non-oil exports fell in Jan; imports ticked up by 10.5% mom, narrowing surplus

- Saudi Arabia’s exports declined by 10.3% yoy to SAR 94.9bn in the first month of 2024. Oil exports fell by 13.5% yoy and 1.4% mom to SAR 71.0bn.

- Non-oil exports plunged by 11.5% yoy and 15.1% mom to SAR 16.3bn. Re-exports, which accounts for 8.1% of total exports, grew by 42.6% yoy and 4.6% mom to SAR 7.7bn.

- Share of oil exports in total exports nudged up to 74.8% in Jan.

- Imports grew by 10.5% mom to SAR 66.7bn, thereby narrowing trade surplus to SAR 28.2bn.

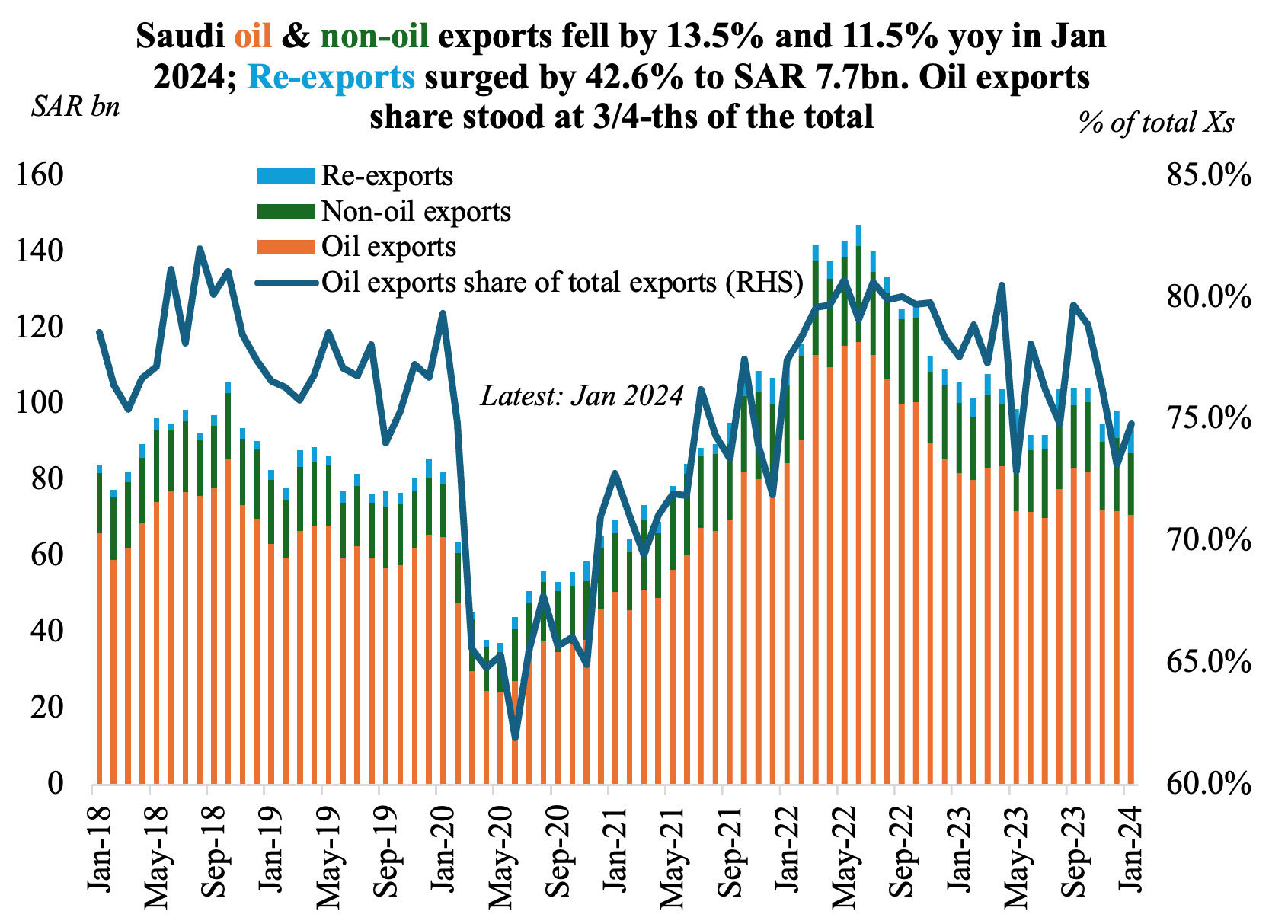

- China continues to be the top trade partner in Jan: accounting for 15% of overall exports and 20.4% of total imports.

- Oil exports to the top 5 destinations (China, South Korea, Japan, India & US) accounted for 58.7% of total oil exports in Jan; 94.8% for top 25.

- While Asian Non-Arab Non-Islamic nations received more than 50% of Saudi exports in Jan 2024, GCC received 14% of the total & Islamic nations’ share stood at 26%.

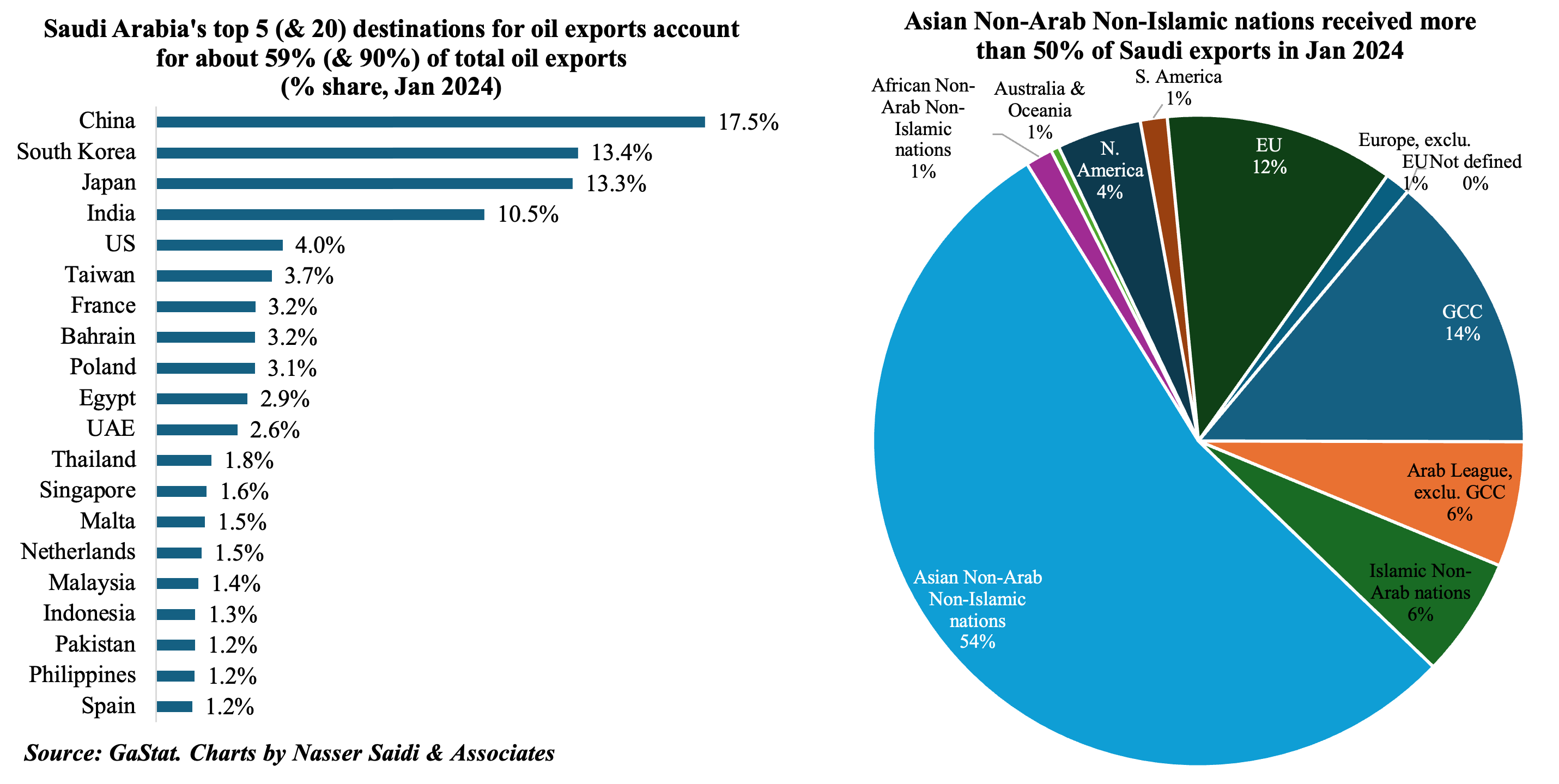

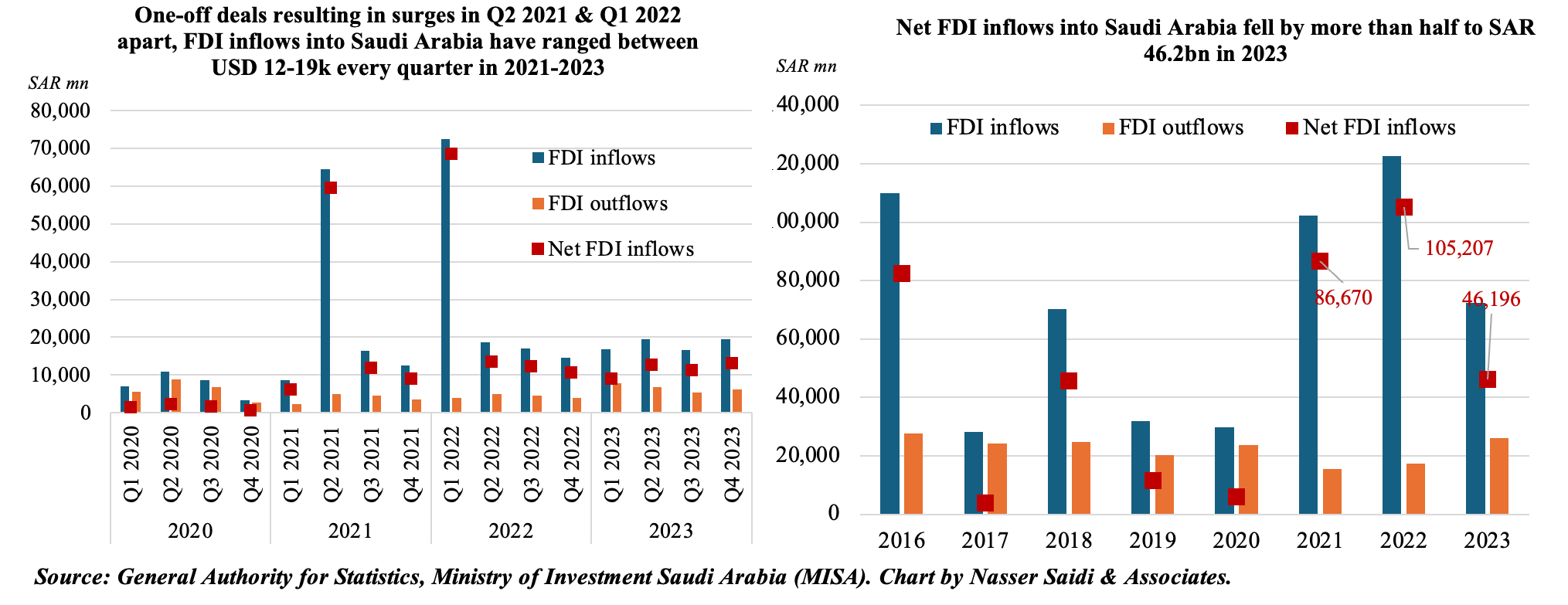

2. Saudi Arabia’s net FDI inflows rose to SAR 13.2bn in Q4. Summing quarterly values, 2023 FDI inflows totaled SAR 72.4bn

- FDI inflows into Saudi Arabia grew by 16.6% qoq and 32.2% yoy to SAR 19.4bn in Q4 2023 (Q3: SAR 16.6bn).

- Outflows were SAR 6.2bn in Q4 (Q3: SAR 5.3bn), leading to net FDI inflows of SAR 13.2bn in Q4 (16.1% qoq & 23.3% yoy).

- Summing up the quarterly data indicates that FDI inflows touched SAR 72.4bn in 2023. This compares to FDI inflow volume of SAR 123bn in 2022, which was in part due to a major SAR 58.1bn Aramco deal in Q1. Comparing the 2023 FDI inflow to 2022 value excluding the Aramco deal, it grew by 12.1%. But comparing the full amounts show a 41% drop.

- As per the National Investment Strategy (NIS) goals, Saudi Arabia FDI inflow needs to rise to SAR 388bn by 2030 from a total of SAR 109bn this year (2023: SAR 83bn).

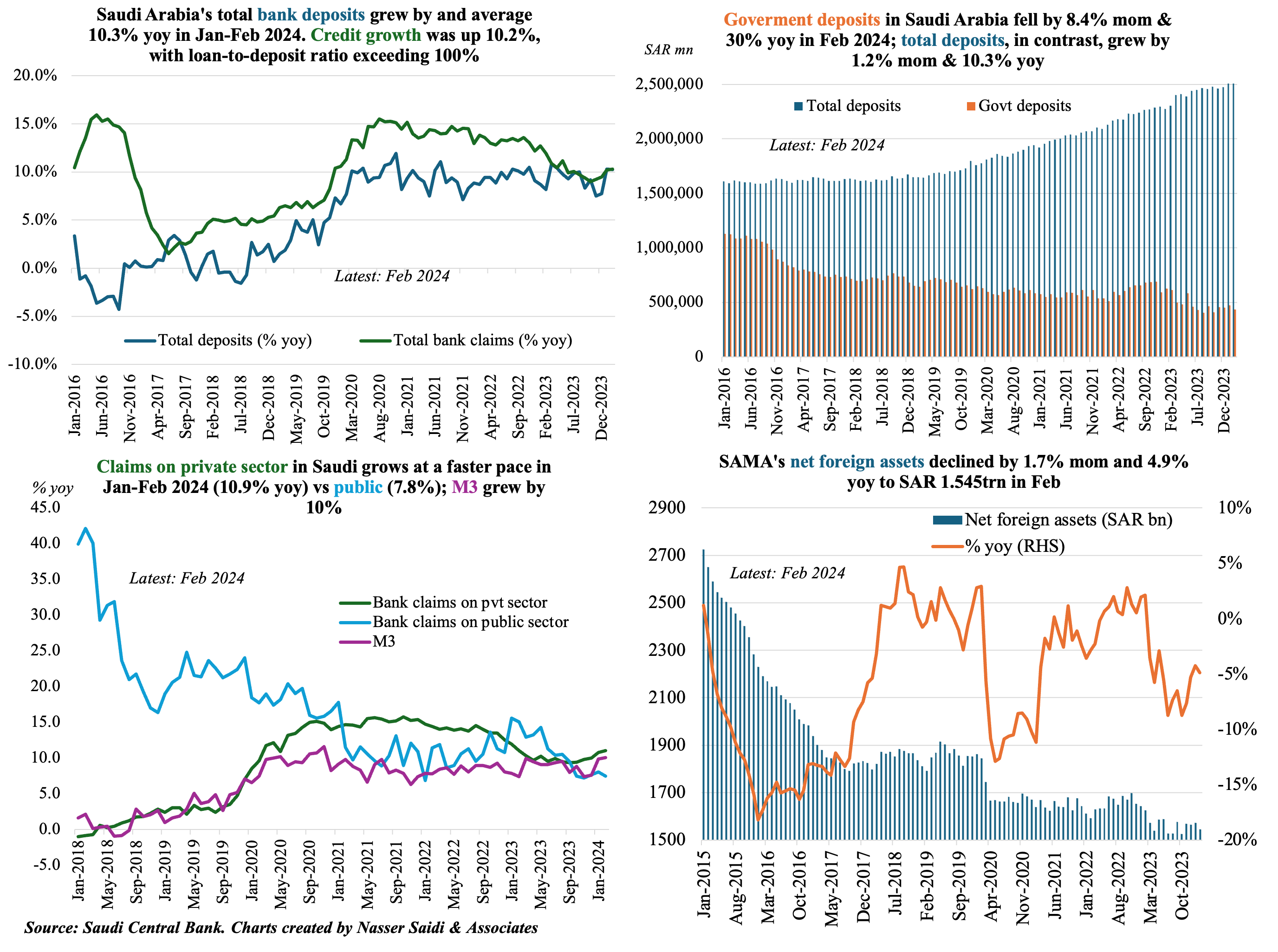

3. Deposit and credit growth match up in Saudi Arabia in Jan-Feb; overall deposits grow despite government deposits declining for the 12th month in a row; net foreign assets fall in Feb, after Jan’s slight uptick

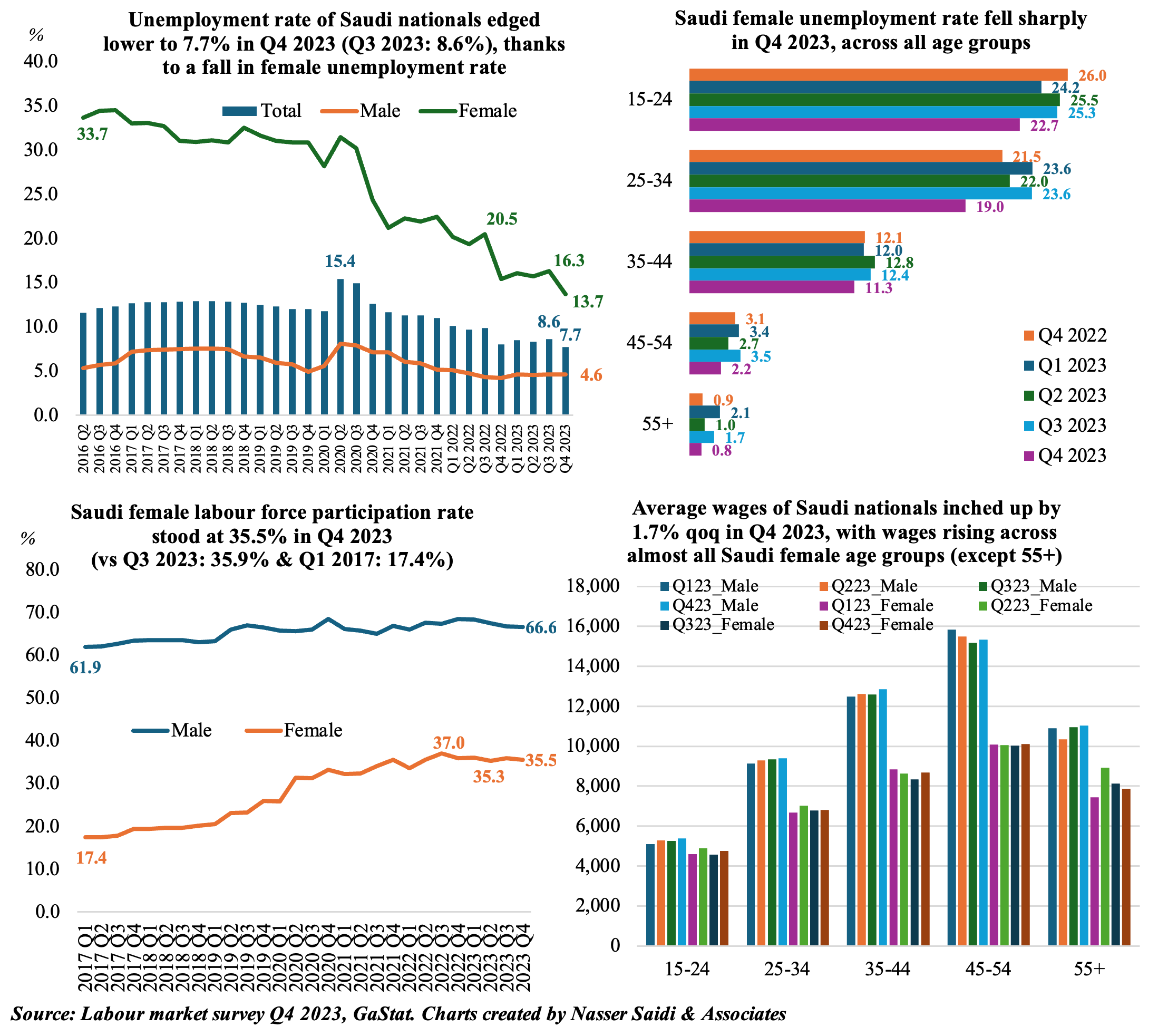

4. Unemployment rate of Saudi citizens declined to 7.7% in Q4

- Unemployment rate in Saudi Arabia (inclusive of expats) slipped to 4.4% in Q4 (Q3: 5.1%). Saudi citizens unemployment rate also edged lower to 7.7% (Q3: 8.6%).

- Saudi female unemployment rate fell to a record-low of 13.7% in Q4 (Q3: 16.3%), with all groups recording a decline in unemployment rate.

- Saudi female labour force participation eased slightly to 35.5% (Q3: 35.9%).

- Females’ wages (for citizens) grew by 1.7% qoq to SAR 7,745 in Q4); only the wages of 55+ dropped (-3.2% qoq to SAR 7870). However, the male-female wage gap remains highest in 35-54 age groups: when men earn 1.5X vs women.

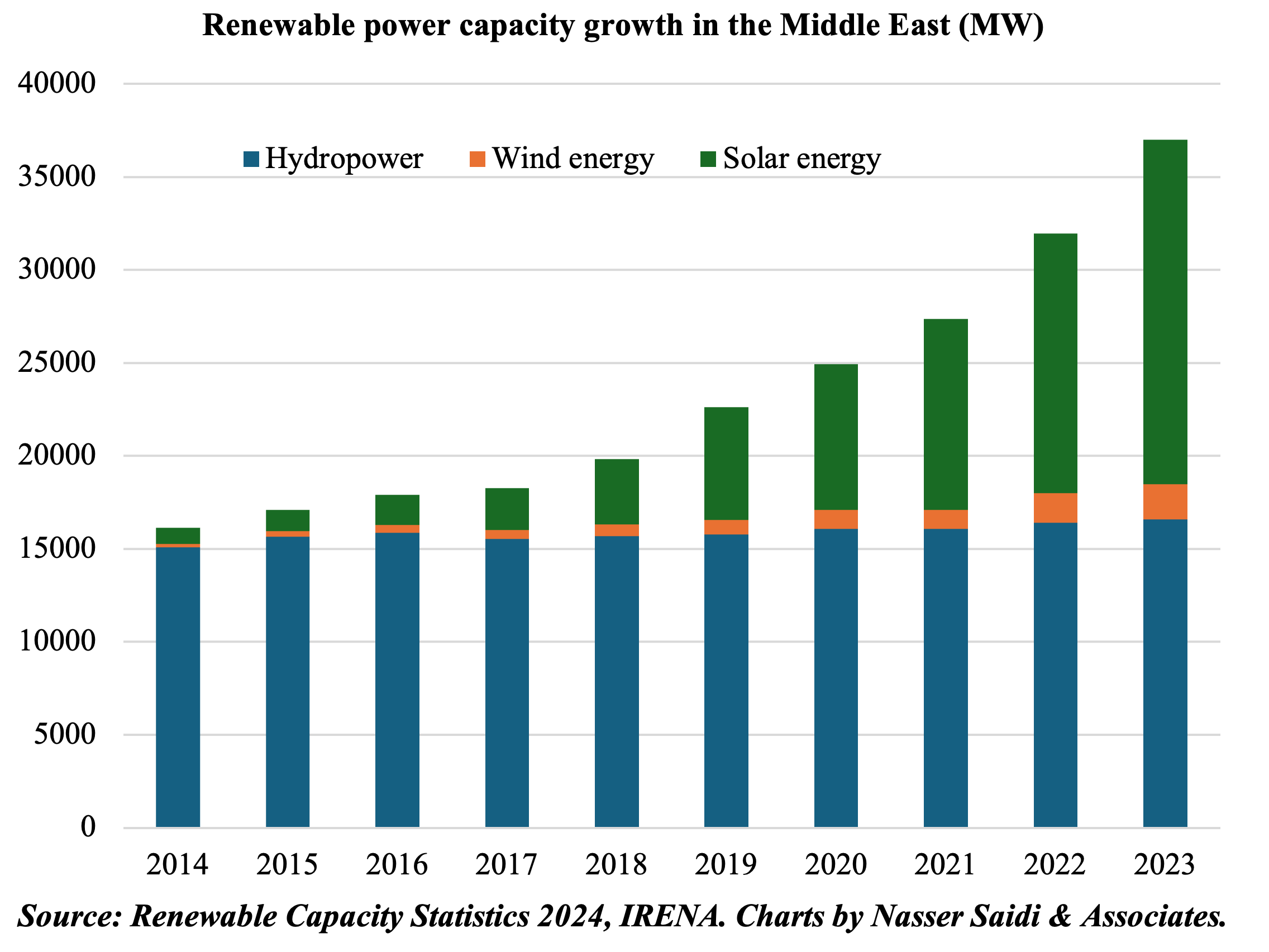

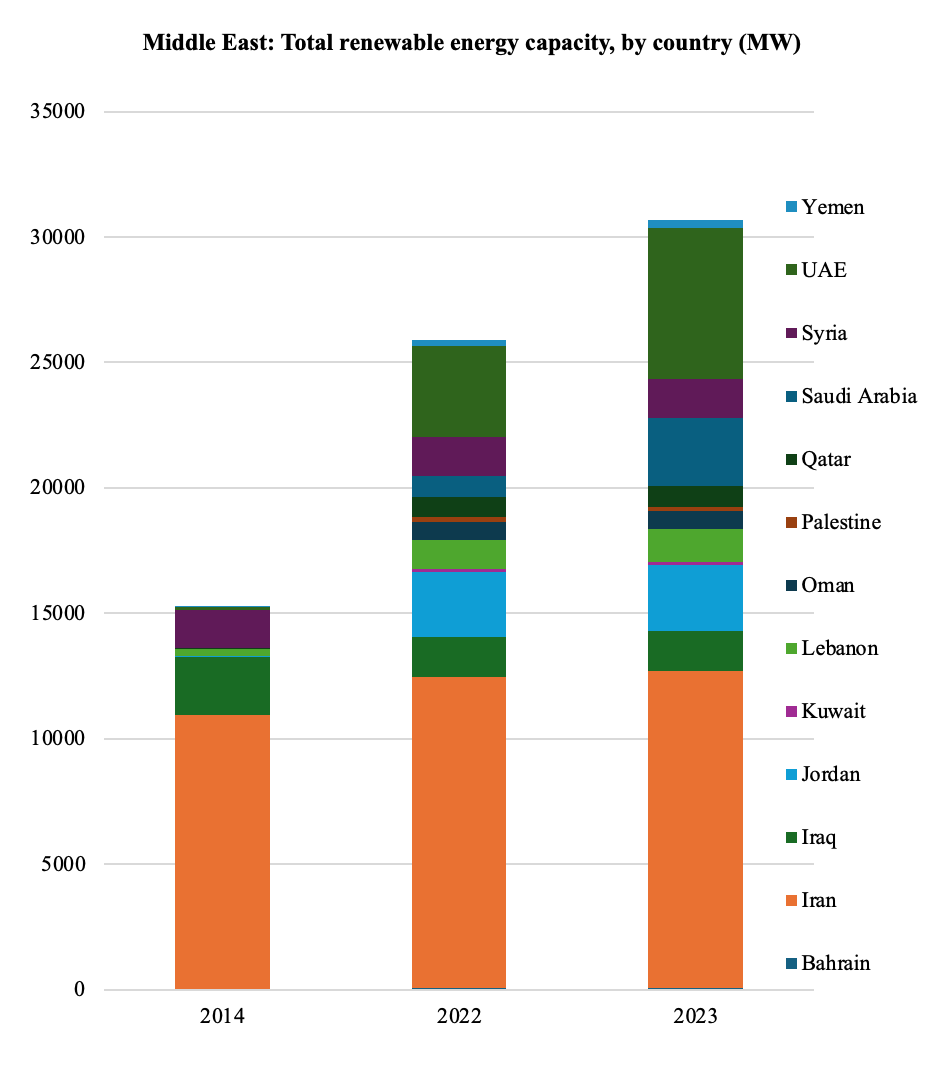

5. Middle East Renewable Energy Capacity rose in 2023, supported by Saudi gains and driven by solar power

- Globally, renewable energy sources comprised 43% of the global installed power capacity in 2023, according to IRENA.

- Renewables deployment grew by 473 gigawatts (GW) last year, taking global capacity to 3.87 terrawatts in 2023.

- There however continues to be a disparity in the distribution of sustainable energy: Asia saw the maximum growth (327GW capacity increase, led by China); in contrast, Africa’s total capacity increased just 4.6% to 62GW.

- Renewable energy capacity in the Middle East grew by 16.6% yoy in 2023, adding 5.1GW to overall capacity. The region accounts for under 1% of total capacity globally.

- In the Middle East, added capacity was mostly from solar energy, followed by wind.

- The fastest pace of growth was seen in Saudi Arabia, where capacity surged by 219% yoy to 2689 MW, followed by the UAE, which recorded a 68.3% yoy jump to 6052 MW in 2023. Both nations increase in capacity can be traced back to solar energy. Wind energy also contributed to UAE’s capacity increase (to 104 MW in 2023 from 0).

Powered by: