Download a PDF copy of the weekly economic commentary here.

Markets

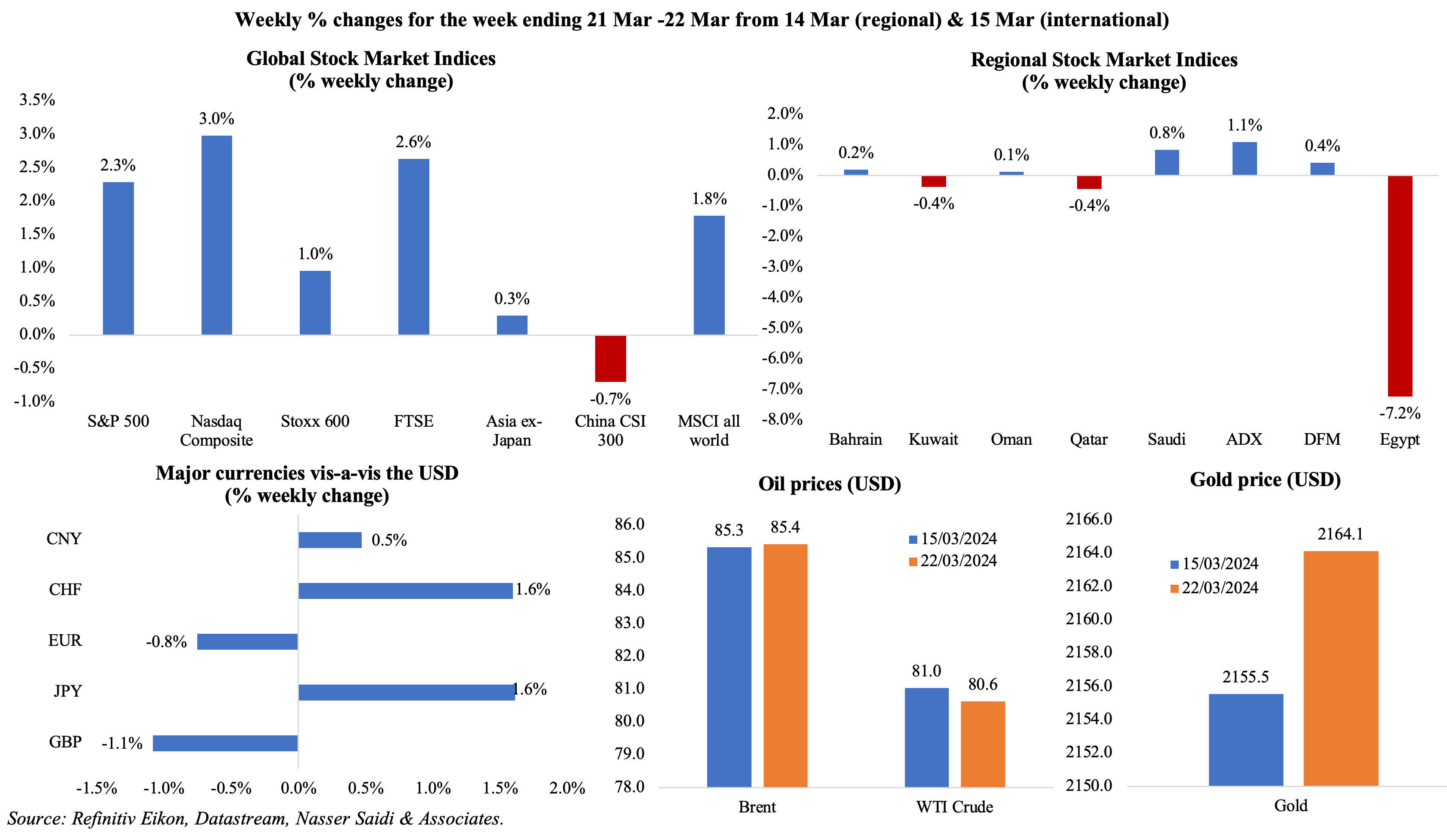

Equity markets across the globe hit record-highs last week on Fed driven expectations of rate cuts by year-end: S&P 500 registered its biggest weekly percentage gain of 2024, as did the MSCI World index; Stoxx 600 and Japan’s Nikkei climbed to new all-time highs. Regional markets saw Abu Dhabi post a weekly gain after 4 consecutive weeks of losses while Egypt posted the biggest drop of 7.2%. Among currencies, the dollar strengthened while the CNY and JPY touched a four-month low (the former given expectations of monetary easing and the latter recovering afterwards); the Swiss Franc slid after the central bank’s surprise rate cut. Oil prices were influenced by ceasefire negotiations, alongside dollar strength and lower demand. Gold touched a record high on Thursday but closed the week slightly lower at USD 2,164 per ounce.

Global Developments

US/Americas:

- The Fed left interest rates unchanged at a 23-year high of 5.25%-5.5% and indicated that there will be three rate cuts by end of this year. The FOMC statement cited strong job gains, and low unemployment rate; growth forecasts for the year was revised upwards to 2.1% (from the previous estimate of 1.4%).

- Building permits in the US increased by 1.9% mom to 1.518mn in Feb; single-family permits rose by 1% to 1.031mn units, the highest since May 2022. Housing starts jumped by 10.7% to 1.521mn, with single family housing starts surging by 11.6% to 1.129mn (the highest since Apr 2022). Home completions surged, up 19.7% to 1.729mn in Feb – the highest reading since Jan 2007 – thereby adding to the overall housing supply.

- Existing home sales grew by 9.5% mom to a seasonally adjusted 4.38mn units in Feb, the highest since Feb 2023.

- Preliminary reading of the S&P Global manufacturing PMI improved to a 21-month high of 52.5 in Mar (Feb: 52.2), thanks to expansions in output and employment readings. Services PMI edged down to 51.7 (Feb: 52.3), as new business from abroad declined.

- Philadelphia Fed manufacturing index posted the second positive reading a row in Mar, though declining slightly to 3.2 (Feb: 5.2). Shipments index rose to 11.4 (+1 point) and new orders rose to 5.4 (from -5.2) while employment rose 1 point to -9.6.

- Initial jobless claims slipped by 2k to 210k in the week ended Mar 15th, and the 4-week average rose by 2.5k to 211.25k. Continuing jobless claims inched up by 4k to 1.807mn in the week ended March 8th.

Europe

- Eurozone’s preliminary manufacturing PMI declined to 45.7 in Mar (Feb: 46.5), with output and new orders declining (albeit at a softer pace) while employment fell at the joint-fastest pace since Aug 2020. Services PMI gained 0.9 points to 51.1, staying in expansionary territory for the second month in a row, with input costs rising at the softest pace in 8 months.

- Hourly labour costs in the euro area grew by 3.4% in Q4, slower than Q3’s 5.2% uptick. Wages and salaries per hour worked were up 3.1% (Q3: 5.2%) while the non-wage component increased by 4.2% (Q3: 5%). Labour costs slowed in both Germany (2.5% vs 5.6%) and France (2.8% vs 3.2%) among others.

- Eurozone consumer confidence index moved up to -14.9 in Mar (Feb: -15.5). In the European Union as a whole, consumer sentiment rose by 0.6 points to -15.2.

- The German ZEW economic sentiment index improved to 31.7 in Mar (Feb: 19.9). The current situation index edged up by just 1.2 points to -80.5. The survey also showed that more than 80% of respondents expect the ECB to cut interest rates in the next six months. The eurozone’s economic sentiment indicator rose by 8.5 points to 33.5 in Mar though the current situation indicator fell by 1.4 points to -54.8 points.

- German Ifo business climate index rose to 87.8 in Mar (Feb: 85.7), the highest since Jun 2023. Both current assessment and expectations improved to 88.1 and 87.5 (from 86.9 and 84.4 respectively).

- Germany’s flash manufacturing PMI fell to a 5-month low of 41.6 in Mar (Feb: 42.5), with businesses reporting faster declines in factory employment and stock of purchases. While services PMI inched up, it stayed below-50 for the sixth month in a row, at 49.8 (Feb: 48.3).

- Producer price index in Germany shrank by 4.1% yoy in Feb (Jan: -4.4%), the eighth month in a row of deflationary readings, as energy costs plunged by 10.1%. Meanwhile, prices of non-durable and durable consumer goods were up by 0.2% and 1.5% respectively while capital goods prices grew by 2.8%.

- The Bank of England left rates unchanged at a 16-year high of 5.25%, while sounding less hawkish – stating that the nation is “moving in the right direction” towards potential rate cuts.

- UK’s preliminary manufacturing PMI inched closer to 50: 49.9 in Mar from Feb’s 47.5, with new orders expanding the most since May 2022 and the 1-year outlook was optimistic (highest reading in 11 months). Services PMI edged slightly lower to 53.4 (Feb: 53.8).

- Inflation in the UK slipped to 3.4% yoy in Feb (Jan: 4%), its lowest level since Sep 2021, as food costs eased (to 5% from Jan’s 6.9%) alongside lower prices at restaurants and hotels (6% from 7% in Jan). Core CPI slipped to 4.5% (Jan: 5.1%), the lowest since Jan 2022.

- UK retail sales volume remained flat in Feb from a month ago but fell by 0.4% yoy (Jan: 0.5%). Sales remained 1.3% below levels before the pandemic in 2020. Clothing and department stores posted mom increases of 1.7% and 1.6% respectively while online sales grew by 2.1% (the most since Jul 2023).

- Producer price index for output in the UK inched up to 0.4% yoy in Feb (Jan: -0.3%), the highest since Jun; the PPI for inputs was deflationary for the ninth consecutive month (-2.7% from Jan’s -2.8%). Retail price index edged lower to 4.5% (Jan: 4.9%).

- UK’s GfK consumer confidence index unexpectedly remained steady at -21 in Mar. The index measuring consumers’ confidence in their personal finance in the next 12 months rose to 2, the first positive and highest reading since Dec 2021.

Asia Pacific:

- The PBoC left the 1- and 5-year loan prime rates unchanged at 3.45% and 3.95% respectively.

- Industrial production in China grew by 7% yoy in Jan-Feb (Dec: 6.8%). Retail sales were up by 5.5% in Feb, slower than Dec’s 7.4% gain. Fixed asset investment in China increased by 4.2% in Jan-Feb (2023: 3%) while property investment fell 9% yoy in Jan-Feb, after a sharp 24% fall in Dec.

- The Bank of Japan announced its first interest-rate increase in 17 years raising the overnight interest rate to a range of 0.0-0.1% from -0.1% before, and also abandoned its yield curve control policy. The BoJ will maintain “accommodative” financial conditions and keep buying “broadly the same amount” of government bonds, according to its statement.

- Inflation in Japan accelerated to 2.8% in Feb (Jan: 2.2%) while excluding food and energy prices rose by 3.2% (vs Jan’s 3.5%). Excluding fresh food, prices rose to 2.8% (Jan: 2%), given the increase in petrol costs, processed food prices and hotel fees.

- Japan’s exports grew by 7.8% yoy in Feb (Jan: 11.9%), with exports of cars and electrical machinery rising. While exports to China and Asia rose by just 2.5% and 2.3% yoy, exports to the US and EU surged by 18% and 16% respectively. Imports rebounded by 0.5% (Jan: -9.8%). Trade balance narrowed to a JPY 379.4bn deficit (Jan: JPY 1760.3bn deficit).

- Industrial production in Japan plunged by 6.7% mom and 1.5% yoy in Jan. The mom decline in IP was the steepest since May 2020, with motor vehicles production plunging by 15.9% (Dec: 0.3%). Separately, machinery orders fell by 1.7% mom and 10.9% yoy in Jan.

- The preliminary manufacturing PMI for Japan inched up by 1 point to 48.2 in Mar, as the decline in both output and new orders eased, employment increased, and input-cost inflation stood at an 8-month low. Services PMI was up 2 points to 54.9, the 19th month of growth and the strongest since May.

- India’s preliminary manufacturing PMI rose to 59.2 in Mar (Feb: 56.9), the highest reading since Feb 2008, thanks to a surge in both output and new orders. Services PMI meanwhile edged down to 60.3 (Feb: 60.6), with output cost inflation accelerating to an 80-month high.

Bottom line: The only unexpected move from last week’s spate of central bank meetings was the surprise rate cut by Switzerland; the Fed and ECB are expected to cut rates later this year and the BoE governor suggested that rate cuts are “in play” (possibly more than one rate cut this year) given “encouraging signs” of falling inflation: could we be looking at multiple rate cuts in June? While the BoJ’s first rate hike in 17 years was anticipated, there are unlikely to be any further hikes in the immediate near-term. The flash PMIs continued to indicate expansion in the US and UK while in the wider eurozone composite PMI inched closer to the 50-mark (49.9 in Mar, the highest in 9 months). One consistent messaging across the board is of rising prices pressures – both input costs and selling prices. But amid messaging of rate cuts from major central banks, business optimism rose to the highest since Mar 2022.

Regional Developments

- Domestic-origin exports from Bahrain grew by 17% yoy to BHD 336mn (USD 892mn) in Feb, with the top 10 destinations accounting for 74% of the total; Saudi Arabia (28%), UAE (13%) and US (9%) were the top 3 destinations. Imports grew by 9% to BHD 475mn, with China (14% of total), Brazil (10%) and UAE (8%) the top origin nations.

- The World Bank will provide a USD 6bn financing package to Egypt for the next three years; the first USD 1bn of this package is expected to arrive by the end of June. The funds are allocated equally (i.e. USD 3bn each) to support the government’s economic reform programme and to empower the private sector. Separately, the EBRD is planning to extend the IMF’s USD 8bn loan program by USD 1bn, to be used in green transformation projects.

- The Egyptian government has requested USD 5bn from the IMF in Apr, as the first tranche of the financing programme. This is pending review of the IMF’s Executive Board.

- Standard & Poor’s upgraded of Egypt’s outlook from stable to positive and affirmed Egypt’s debt rating at “B-/B”.

- Egypt plans to allocate more than EGP 125bn (USD 2.66bn) for bread subsidies in its 2024-25 state budget; further, more than EGP 147bn will be set aside for petroleum subsidies. Budget spending stands at an estimated EGP 3.9trn in the next fiscal year, revenues are expected at EGP 2.6trn and the government aims to record a primary budget surplus of 3.5%.

- Bilateral trade between Egypt and the EU fell by 19.2% yoy to USD 31.2bn in 2023, as Egypt’s exports to the EU plunged by 31.8% (to USD 11.8bn). During the 2022-23 fiscal year, remittances into Egypt from the EU declined by 21.3% to USD 652mn.

- Iraq disclosed that it would reduce its crude exports to 3.3mn barrels a day (bpd) in the coming months to compensate for exceeding its OPEC+ quota since Jan. The nation exported an average 3.43mn bpd in Feb.

- Iraq signed an agreement with Siemens Energy to convert flare gas into fuel for electricity: this covers about 120mn standard cubic feet of gas within a period of 6 months and an additional 120mn standard cubic feet within one year.

- Inflation in Kuwait rose to 3.36% yoy in Feb (Jan: 3.28%), with food prices inching slightly higher to 5% (Jan: 4.8%) while prices slowed for transport (1.8% from 2.1%) and home furnishings (3.8% from 3.9%).

- Kuwait’s trade surplus with Japan widened by 53.4% yoy to JPY 83.5bn (USD 652mn) in Feb, as exports from Kuwait surged by 34.2% yoy to JPY 101.9bn while imports shrank for the third month in a row (-14.4% to JPY 18.4bn).

- Total visitors into Lebanon posted a 13.7% yoy increase to 1.67mn last year, according to the Ministry of Tourism. European tourists accounted for 40.77% of the total while the share of Arab and US nationals stood at 25.87% and 20.39% respectively.

- Total credit disbursed by Oman’s banking sector to the private sector grew by 4.5% yoy to OMR 25.7bn at end-Jan 2024. Non-financial corporations received 45.6% of the total private sector credit, followed by household sector at 45.3%.

- Oil exports from Oman inched up by 0.6% yoy to more than 26.2mn barrels in Jan while oil production dropped by 7.9% to more than 23.9mn barrels.

- Qatar inflation inched lower to 2.7% in Feb (Jan: 2.99%) as prices of recreation and culture eased sharply (16.6% from Jan’s 23.2%) while some other categories posted increases such as food (6.6% from 5.2%) and communication (3.8% from 3.6%).

- Industrial production in Qatar grew by 4% mom and 5.5% yoy in Jan, supported by gains in the mining sector (4.9% mom and 7.6% yoy). Manufacturing however posted declines of 0.6% mom and 5.7% yoy.

- Venture capital investments in Qatar declined by 57% yoy to QAR 43mn (USD 11.8mn) in 2023, in line with the wider MENA region’s drop (of 23%), according to a report by the Qatar Development Bank. However, between the 5-year period 2019-23, the VC ecosystem reported a 17% CAGR in capital deployment and 10% growth in transaction volumes.

- Fitch upgraded Qatar’s long-term foreign-currency issuer default rating (IDR) to “AA”, an improvement from the previous “AA-”, citing the nation’s strong external balance sheet, and budget surpluses.

- Turkey and the GCC signed a deal to initiate negotiations for a Free Trade Agreement. Turkey already has a CEPA with the UAE.

- GCC holdings of US Treasuries declined in Jan 2024 (month-on-month terms). Saudi Arabia is still the 16th largest investor in US Treasury bonds: USD 127.5bn as of Jan 2024; however, the mom decline is the first after continuously increasing holdings since Jul 2023. UAE and Kuwait holdings also fell by 6% & 0.8% mom respectively in Jan 2024.

Saudi Arabia Focus

- Saudi Arabia’s crude oil exports fell for the second month in a row, by 0.2% mom to 6.297mn barrels per day (bpd) in Jan, according to the Joint Organisations Data Initiative. Crude oil production rose by 12k bpd to 8.956mn bpd (or 0.22% mom).

- Saudi Arabia reported a 138% increase in the issuance of exploitation licenses in the mining sector since the implementation of the new Mining Investment Law in 2021. There was a surge in building materials quarry licenses (to 538 in 2023, from 158 in 2021) and in exploration licenses (to 259 from 58). Separately, the Ministry of Industry and Mineral Resources launched a new incentive package totalling nearly SAR 685mn (USD 182mn) in financial facilitation, aimed at supporting mining exploration in the Kingdom.

- Point-of-sale operations in Saudi Arabia increased in the first week of Ramadan: people spent SAR 11.7bn (USD 3.11bn) from 168.6mn transactions. The value was highest in food and beverages (SAR 2.2bn), restaurants and cafes (SAR 1.22bn) while spending in clothing and shoes touched SAR 914mn.

- Credit facilities provided to micro, small, and medium enterprises (MSMEs) in Saudi Arabia grew by 20% yoy to SAR 275.66bn (USD 75.31bn) in 2023. Medium enterprises received 57% of the credit, amounting to SAR 158.41bn, while micro firms posted the highest growth rate (+36% yoy to SAR 24.93bn).

- Saudi Aramco plans to increase its gas output by 60% by 2030, disclosed a senior official at an energy conference.

- The New York Times reported that Saudi Arabia plans to create a fund of about USD 40bn to invest in artificial intelligence. Discussions are reportedly ongoing between the PIF and US venture capital firm Andreessen Horowitz and other financiers.

- Sukuk issuance in Saudi Arabia closed at SAR 4.44bn (USD 1.18bn) in Mar, staying above USD 1bn for the fourth month in a row.

- Foreign investors can now officially be classified as Saudis (when calculating Saudisation percentages) under the Nitaqat Saudization program, following an approval from the Ministry of Human Resources and Social Development. Other categories that will be treated as nationals include individuals from displaced tribes, citizens of Gulf countries, players or athletes from the region, children of local women married to non-Saudis and widows of non-Saudi residents among others.

- The Saudi cabinet approved an agreement to establish a regional office for the International Monetary Fund in Riyadh.

- Flynas airline is increasing seat capacity by 25%, given the acquisition of two Airbus planes, offering more than 1.2 mn seats for flights during Ramadan.

- Only the first phase of The Line project, three miles around a lagoon in the Gulf of Aqaba, will be completed by 2030. Full completion of the 100-mile Line is targeted to be 2045.

UAE Focus![]()

- UAE’s industrial exports have grown by USD 19bn in 3 years and industrial productivity increased by 18% since 2020, disclosed the Minister of Industry and Advanced Technology. The National In-Country Value Programme has seen the redirection of more than AED 237bn (being spent outside the UAE) into the national economy – a 13-fold increase compared to AED 18bn when the programme was launched in 2018.Separately, Abu Dhabi’s industrial sector reported a 51% surge in new licenses issued to 363 by end-2023 (Excluding free zones). About 46 foreign firms secured industrial licences in the emirate, with mining support services attracting 13 from overseas – the most of any sector.

- Inflation eased in Dubai to 3.4% in Feb 2024compared to Jan’s 3.6%. Food and beverages costs, with a weight of 11.6% in the overall index, slowed in Feb (3.08% from 3.69% in Jan). Prices increased for a few non-tradeable goods including housing & utilities (6.2% vs 4.7%), education (3.6% from 0.8%) and insurance (10.8% from 3%).

- Reuters reported that UAE is considering a bilateral trade pact with the EU given the pace of ongoing negotiations with the GCC. Sources stated that come summer, if negotiations with the GCC are still stalled, a standalone process with the UAE may be initiated.

- Borse Dubai sold (nearly 27mn) shares worth USD 1.6bn, reducing its stake in Nasdaq to 10.8% from 15.5%, making it the company’s second-largest shareholder.

- UAE Islamic banks assets have increased by 11% yoy to AED 703bn (USD 191.4bn) as of end-2023, according to central bank data. As of end-Dec, credit disbursed by the banks grew by 7.82% yoy to AED 428.9bn while deposits were up by 12.6% to AED 495.3bn.

- ADNOC signed a 15-year deal with Germany’s state-owned Securing Energy for Europe (SEFE) to supply 1mn metric tons of LNG annually, with deliveries expected to begin in 2028 (from the Ruwais LNG project).

- The Dubai government approved public-private partnership projects worth AED 40bn (USD 10.89bn) to boost economic growth and infrastructure development. This will cover 10 fundamental economic sectors from 2024 to 2026, though no further details were provided.

- Dubai International Chamber revealed that 50% of the MNCs it successfully attracted to Dubai last year are based in Asia and Australia while Latam & Europe and Middle East & Eurasia accounted for equal shares of 23.5% each. A breakdown by sector shows that financial services (18% of total), trade & logistics (15%) and IT (12%) were the main sectors of the MNC’s operation.

- UAE reported a 14.41% yoy surge in tourist tax refunds in 2023, totalling 4.18mn transactions and a daily average of 11,460. No details were given on the total amount refunded.

- Abu Dhabi announced an extension of its 10% tourism tax waiver programme for event organisers on tickets sold until Dec 31, 2024. In a bid to support tourism, the emirate had earlier reduced tourism and municipality fees for hotels in the emirate.

- Abu Dhabi’s International Resources Holdings, part of International Holding Company, completed its acquisition of Mopani Copper Mines in Zambia – securing critical metal supply, to support and accelerate its energy transition plans. Separately, Reuters reported that IRH was interested in acquiring Lubambe Copper Mine in Zambia (which had already agreed a deal with China).

Media Review

Shipping disruptions in the Red Sea: Local shock, global impact

https://cepr.org/voxeu/columns/shipping-disruptions-red-sea-local-shock-global-impact

Strengthen Central Bank Independence to Protect the World Economy

https://www.imf.org/en/Blogs/Articles/2024/03/21/strengthen-central-bank-independence-to-protect-the-world-economy

Gatun Lake’s lower water levels imperil the Panama Canal in 2024

https://www.piie.com/research/piie-charts/2024/gatun-lakes-lower-water-levels-imperil-panama-canal-2024

Declining fertility rates will transform global economy

https://www.ft.com/content/318ff981-d189-4bd6-b608-a9709097eedc

Powered by: