Weekly Insights 22 Mar 2024: Easing inflation, narrow fiscal surpluses & SWF asset surge in the GCC

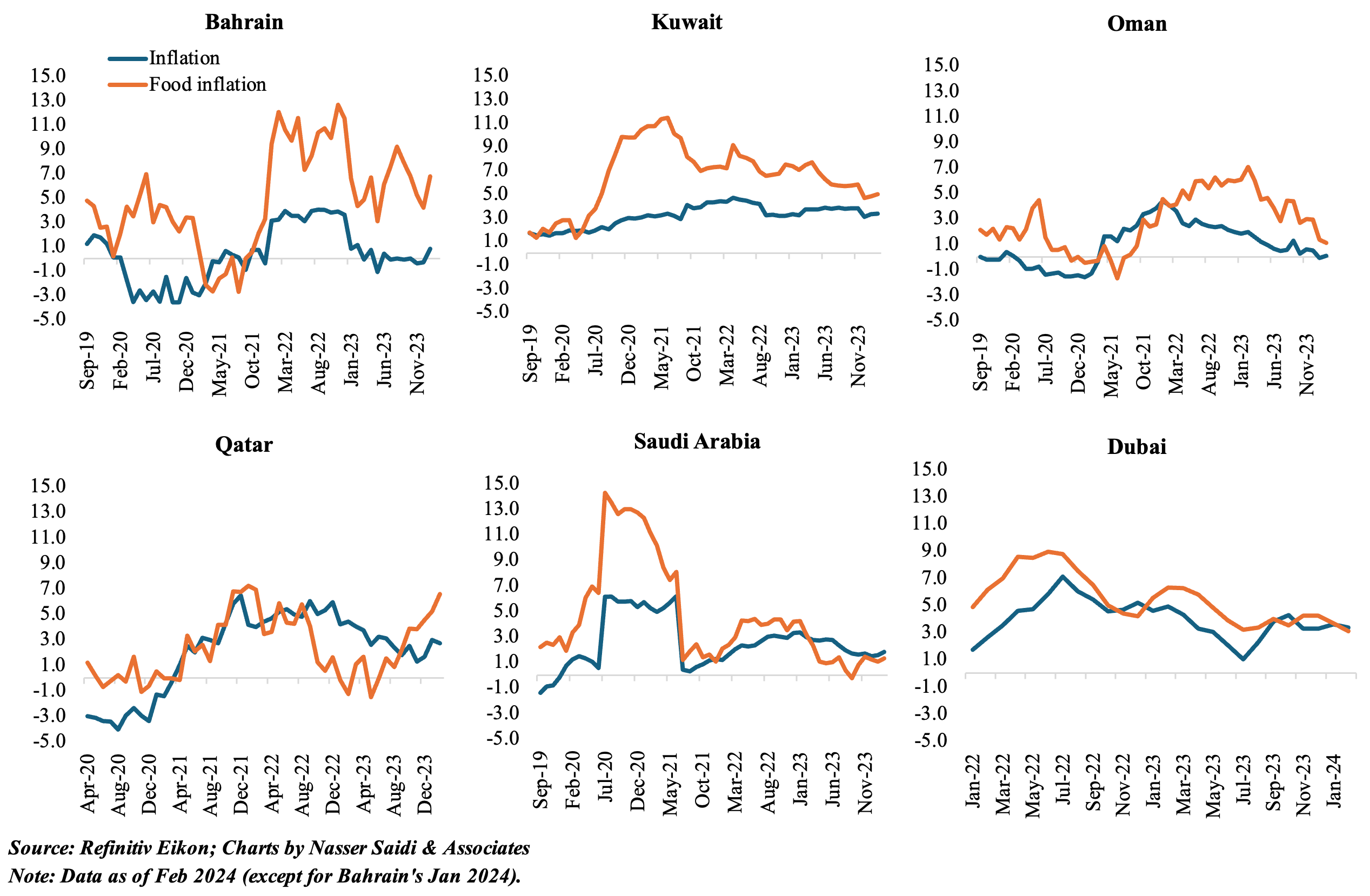

1. GCC inflation easing in Jan-Feb 2024. Food inflation is higher than headline in most of the region; in Dubai & Saudi Arabia, housing costs the main driver of the uptick. PMI indicates UAE & Saudi firms opting to absorb rising costs (amid rising competition).

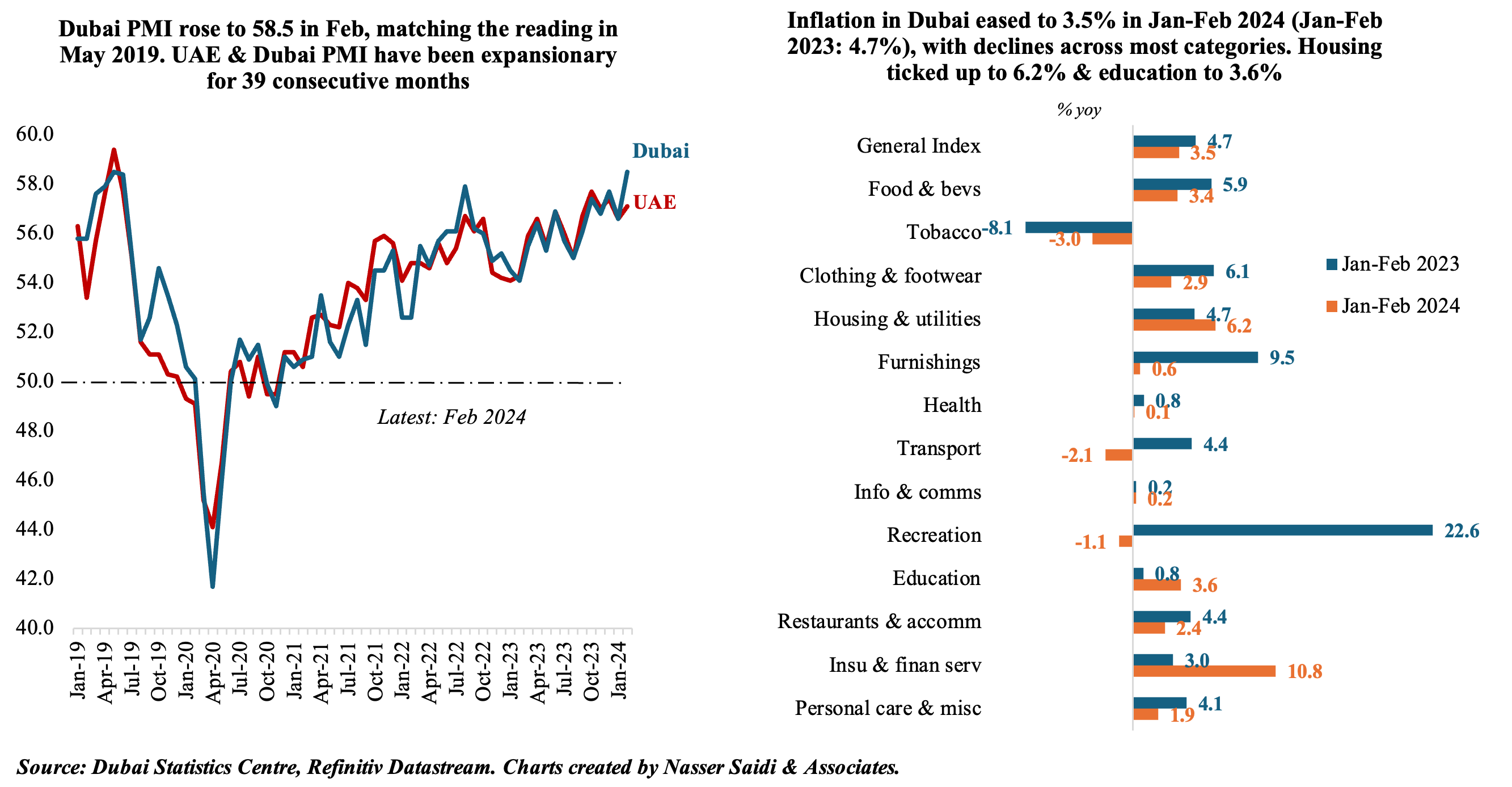

2. Non-oil PMI activity jumps in Dubai this Feb; while inflation has eased, housing & education costs have accelerated compared to a year ago

- Dubai PMI jumped to 58.5 in Feb, the best since a matching reading in May 2019, thanks to new orders and employment, with businesses citing robust demand and greater project work as reasons for higher output. All sectors reported improvements in Feb and have a positive 12-month output; however, the wholesale & retail sector recorded a substantial decline in average output charges. Sales promotions and price cuts, in a bid to remain more competitive, are likely to affect business bottom lines in the medium term.

- Inflation has also eased in Dubai, slipping to 3.4% in Feb 2024 (Jan: 3.6%). Food and beverages prices, with a weight of 11.6% in the overall index, slowed in Feb (3.08% from 3.69% in Jan).

- In the Jan-Feb period, transport & recreation costs have declined the most compared to a year ago. However, a few non-tradeable goods costs have increased: such as housing & utilities (6.2% vs 4.7%), education (3.6% from 0.8%) and insurance (10.8% from 3%); weights for these expenditure categories stand at 40.68%, 8.15% and 1.26% respectively.

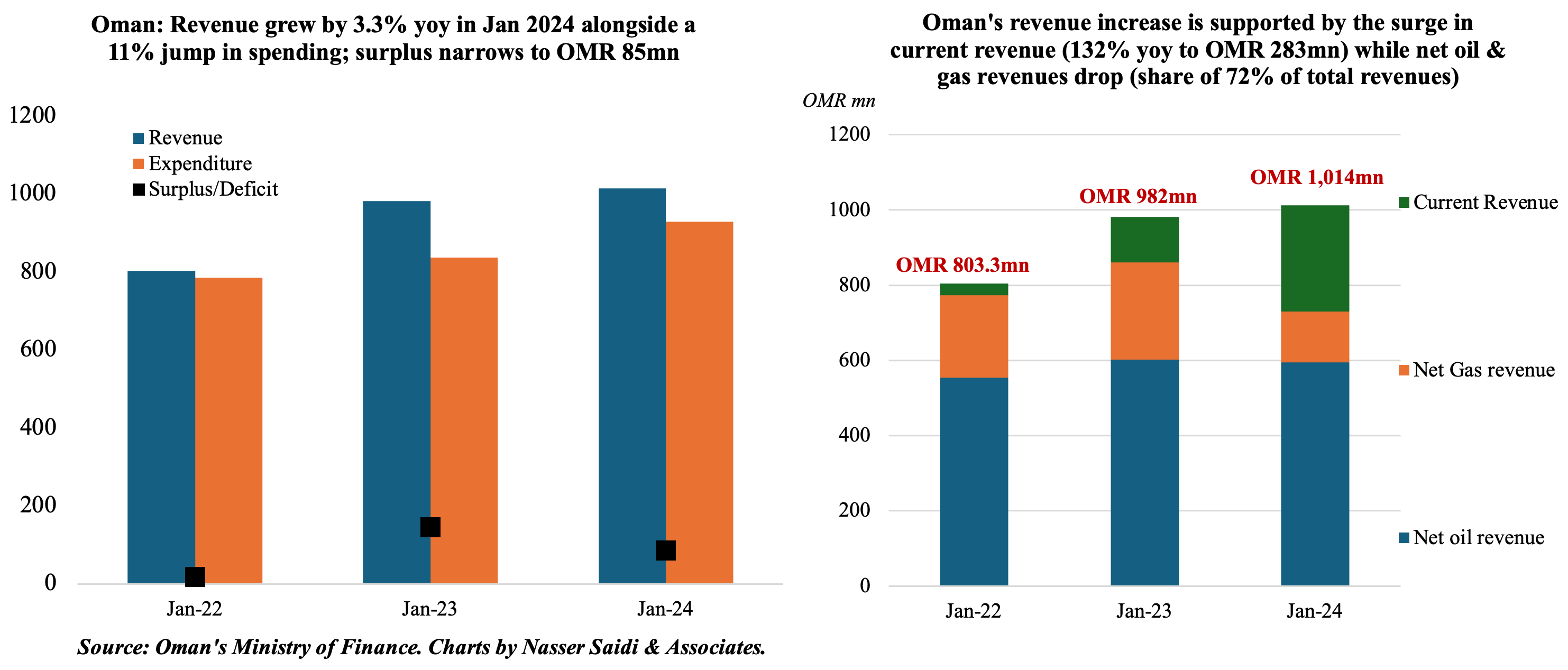

3. Oman posts a narrower budget surplus of OMR 85mn in Jan 2024

- Oman posted a budget surplus of OMR 85mn in Jan (vs. surplus of OMR 145mn in Jan 2023), “attributed mainly to an increase in government investments”. The average oil price in Jan 2024 was USD 90 (-1.1% yoy) and average daily oil production was 2.2% lower at 1040k bpd. The 2024 budget estimates an average oil price of only USD 60 a barrel.

- Public revenues rose 3% yoy to OMR 1.014bn in Jan, with the increase driven by the 132% surge in current revenues. Both net oil & gas revenues fell in Jan, down by 1.2% and 47.7% respectively to OMR 595mn and OMR 135mn respectively. Together, net O&G accounted for 72% of revenues in Jan.

- Overall expenditure increased by 11% yoy to OMR 929mn in Jan: of this, public expenditure of civil ministries stood at OMR 680mn (-3% yoy) while contributions & other expenses increased by a massive 227% yoy to OMR 121mn. Development expenditure, at OMR 19mn, was only 2% of the total allocated for 2024 (OMR 900mn).

- Oman’s budget 2024 estimates an increase in both revenues & expenditure (by 10% and 3% compared to 2023 budget), leading to a deficit of OMR 640mn – narrower compared to the 2023 budget deficit of OMR 1.3bn.

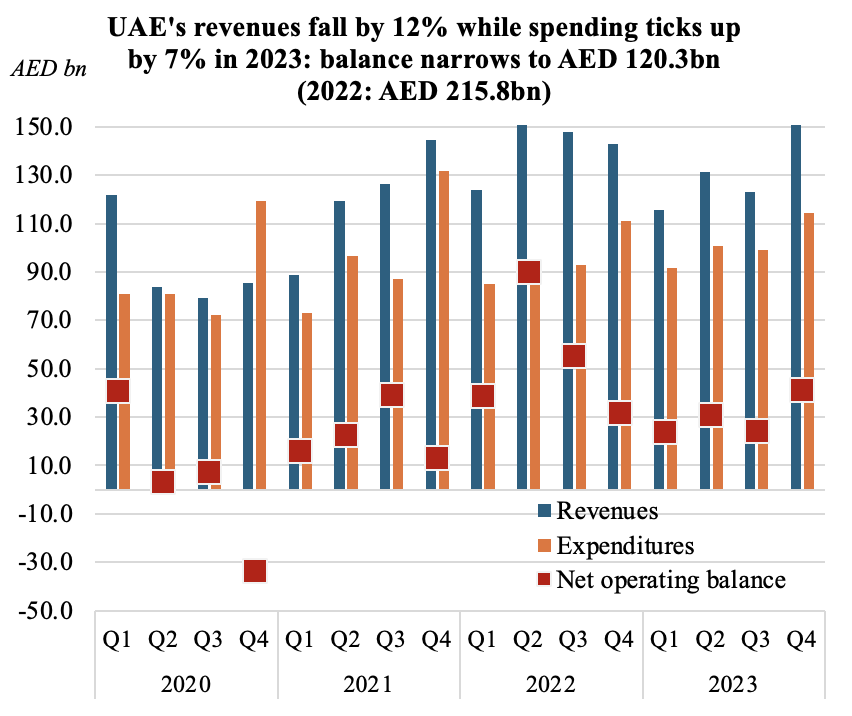

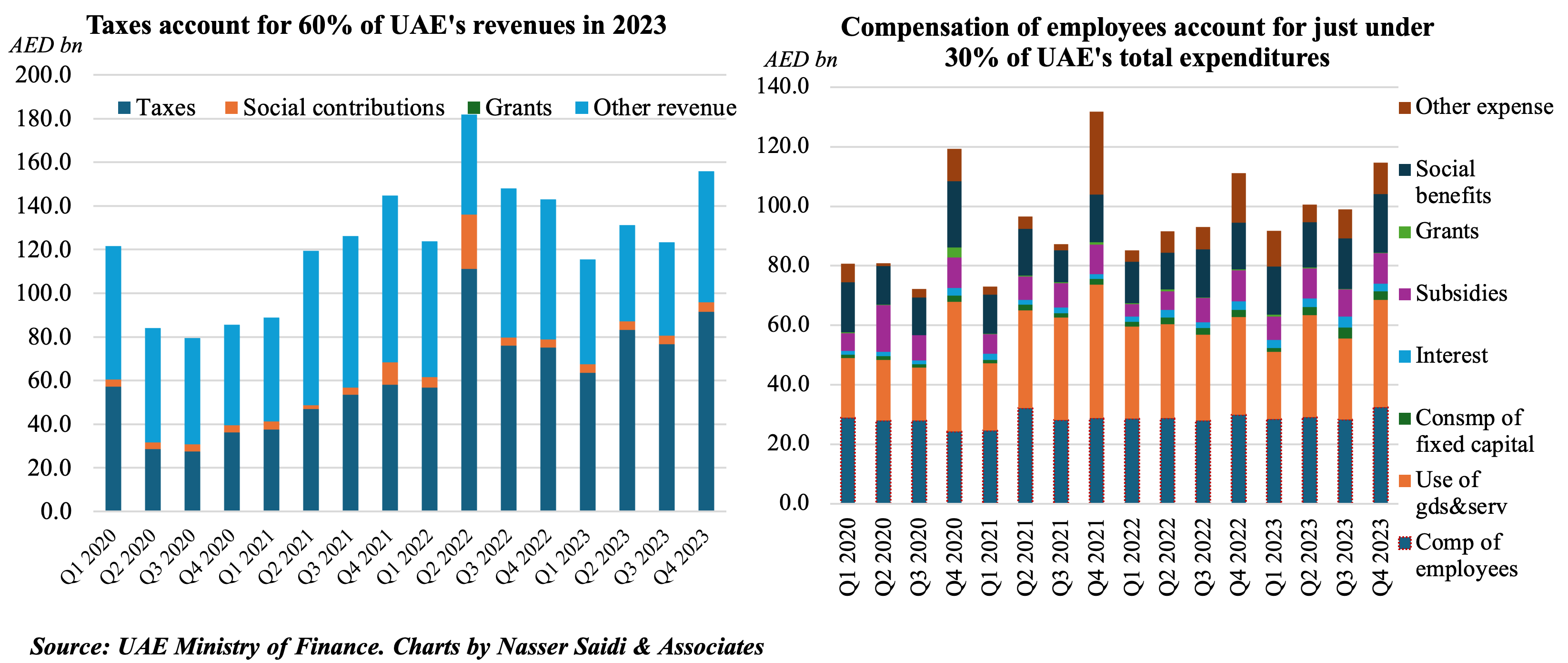

4. UAE federal revenues fell sharply to AED 526.1bn in 2023 & net lending/ borrowing value narrowed

- UAE’s federal revenues fell by 12% yoy to AED 526.1bn in 2023, as per the Ministry of Finance estimates. Tax revenues slipped by 3% yoy to AED 314.8bn in 2023, but accounted for 59.8% of total revenues.

- Spending increased by 5% yoy to AED 405.8bn in 2023, with compensation of employees holding steady at AED 118.4bn (or 29.2% of total expenditure). Subsidies and social benefits grew to AED 37.2bn (+28% yoy) and AED 38.3bn (+17%) respectively.

- The net lending/ net borrowing value stood at a surplus of AED 120.3bn for the full year: this compares to a surplus of AED 215.8bn in 2022.

- In Q4 2023 alone, revenues jumped by 26.5% qoq to AED 156mn, as taxes and other revenues grew by 19.5% and 40.8% respectively; expenditures were up by 15.8% qoq.

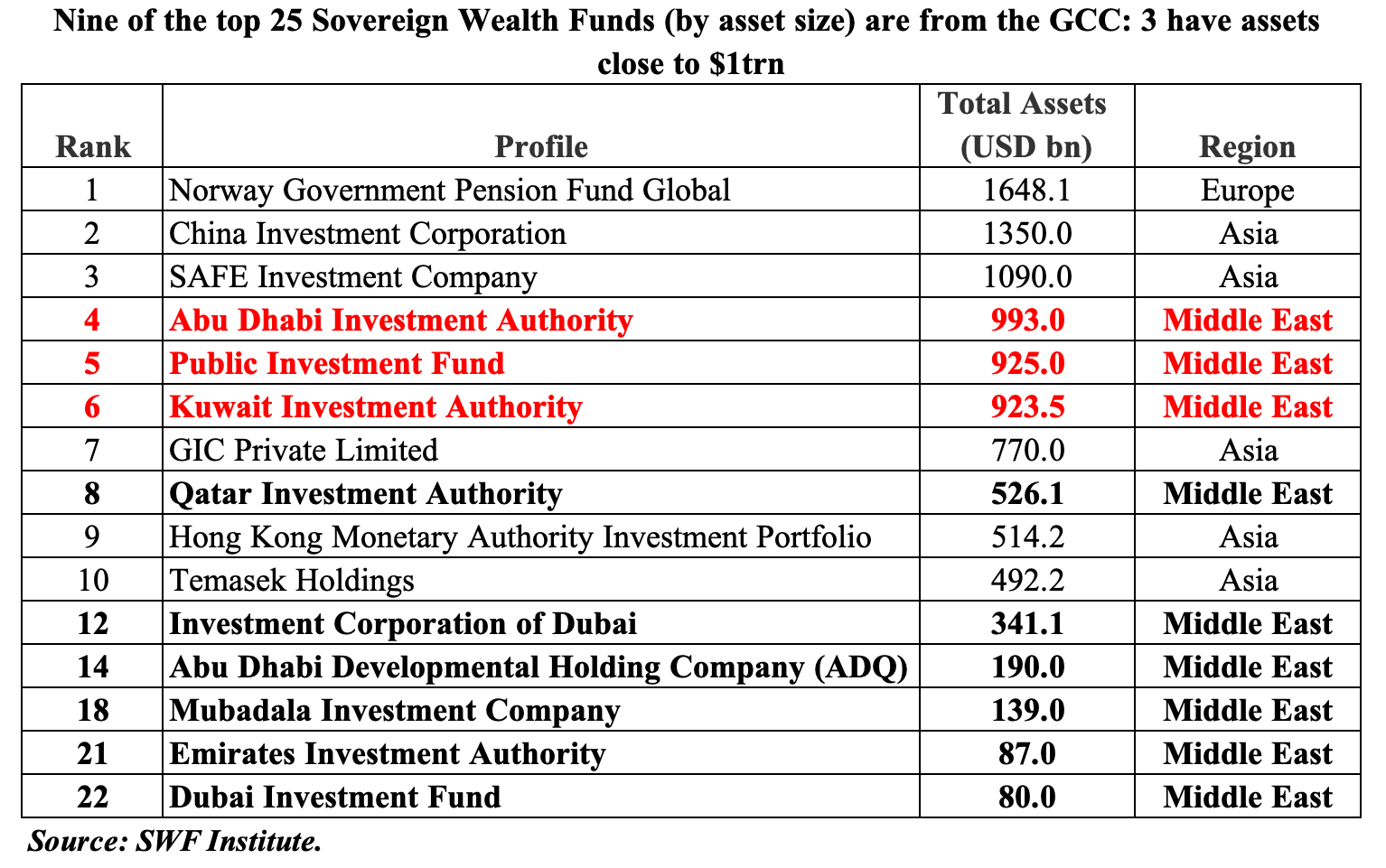

5. Asset Size Rising at GCC SWFs

- There are four representatives from the GCC among the top 10 sovereign wealth funds globally, according to data from the SWF Institute.

- Though exact portfolio amounts or asset allocation splits are hard to come by for SWFs in the region, it is known that ADIA tops the list of SWFs from the GCC, with assets size at USD 993bn (2022: USD 790bn).

- More recently, the transfer of an additional 8% Aramco stake raised PIF’s asset size, allowing it to overtake the Kuwait Investment Authority. Global SWF reported that PIF was the world’s largest sovereign investor in 2023, deploying USD 31.6bn across 49 deals. PIF aims to manage USD 2trn in assets by 2030, with 83% in domestic holdings.

- Kuwait Investment Authority benefitted from more than 50% of its investments being in the US (reported Bloomberg).

- Interestingly, Abu Dhabi hosts three SWFs in the global top 20 list: ADIA, ADQ and Mubadala.

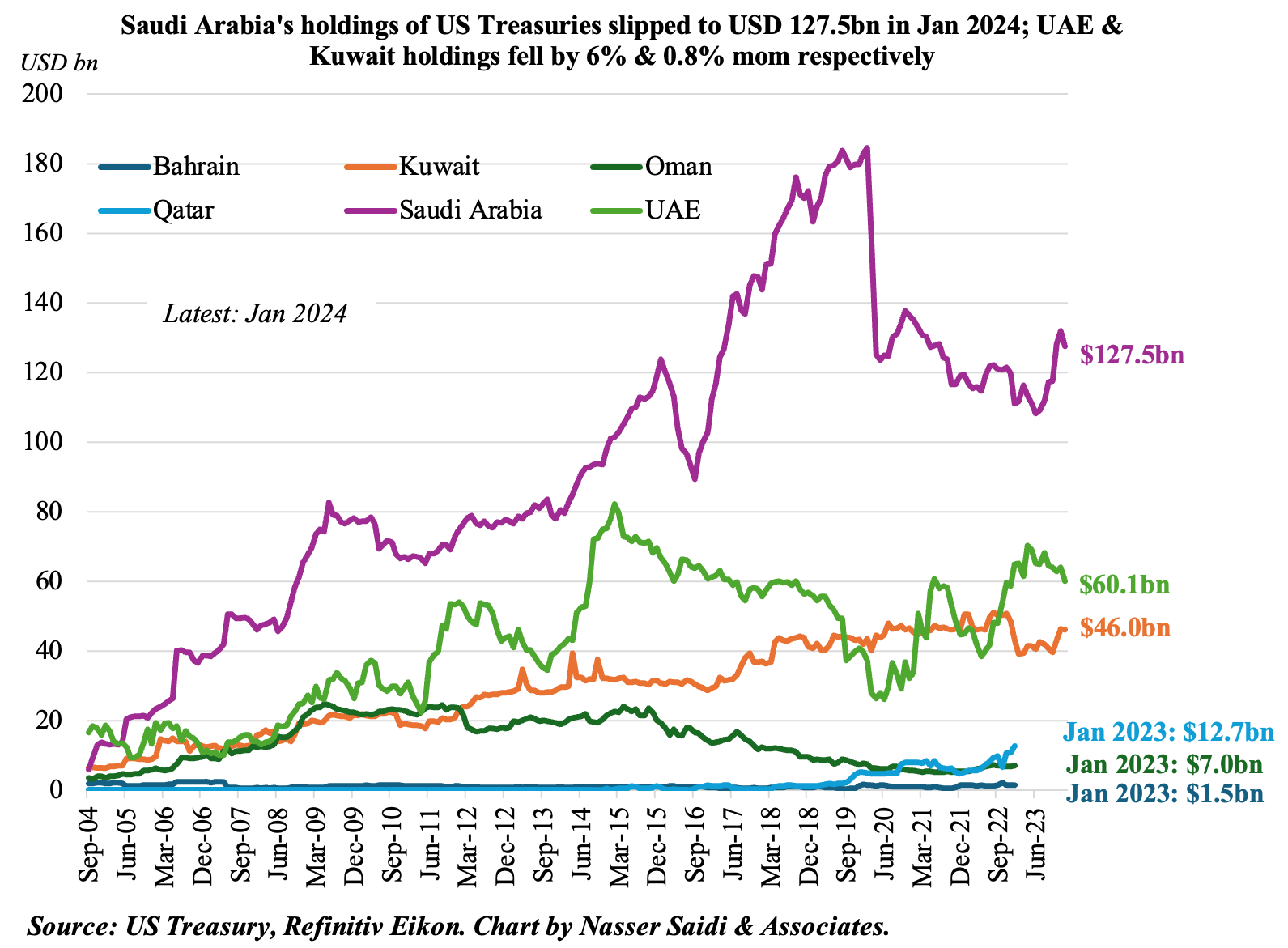

6. US Treasuries holdings of major GCC nations’ decline in month-on-month terms in Jan 2024

- GCC holdings of US Treasuries declined in Jan 2024 (month-on-month terms).

- Saudi Arabia is still the 16th largest investor in US Treasury bonds: USD 127.5bn as of Jan 2024; however, the mom decline is the first after continuously increasing holdings since Jul 2023.

- UAE and Kuwait holdings also fell by 6% & 0.8% mom respectively in Jan 2024.

- However, Kuwait and Saudi holdings gained 6.2% and 14.9% compared to Jan 2023 readings; UAE’s holdings were down also in yoy terms, by 7.4%.

- Yields on long-dated Treasury notes and bonds climbed in Jan.

- Wait and watch to see if there is a change in approach once the global central banks begin its rate cuts phase.

Powered by: