Download a PDF copy of the weekly economic commentary here.

Markets

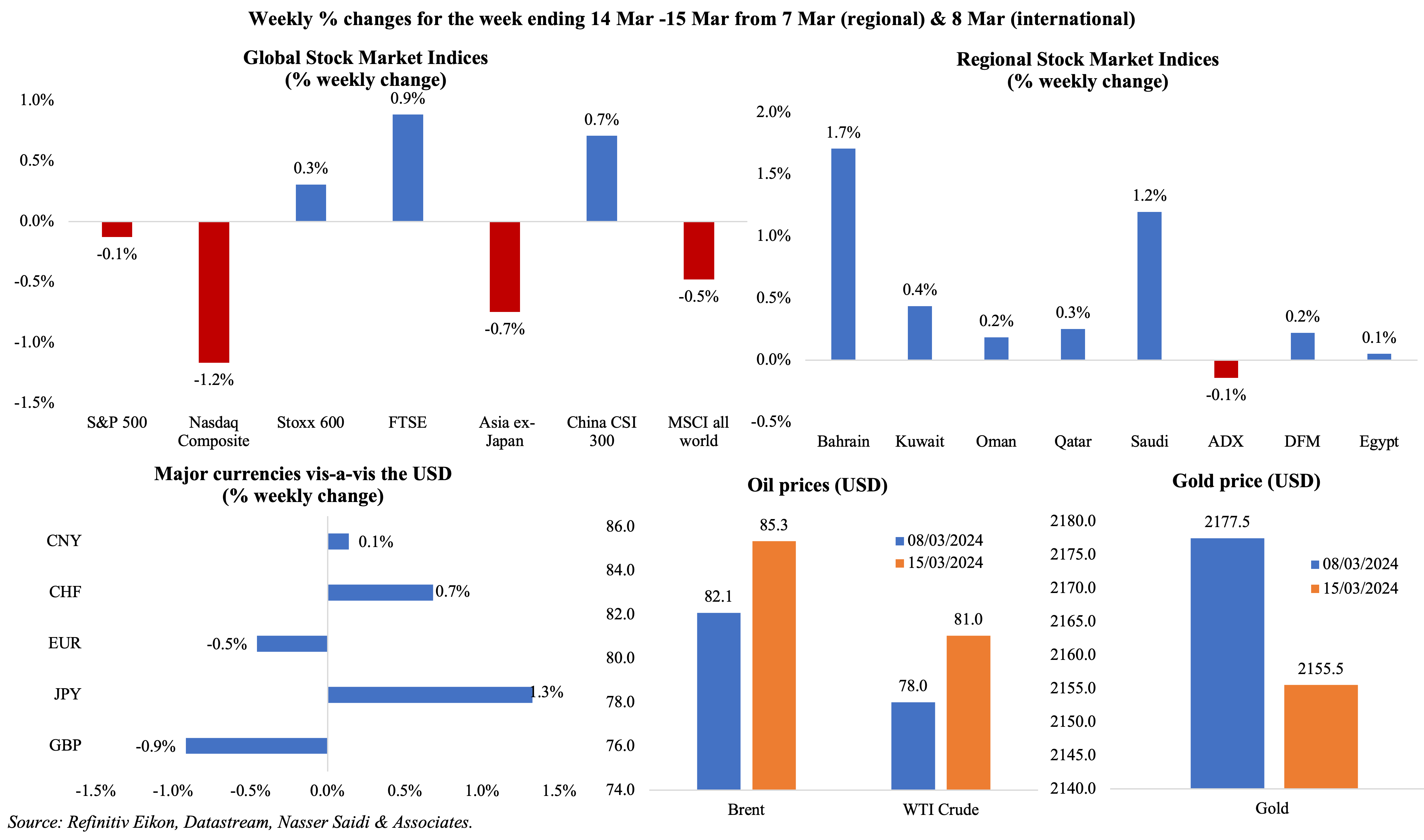

Equity markets ended in the red last week, led by US and Asian equities, as sticky inflation readings dampened hopes for “early” interest rate cuts (in Jun); the MSCI’s gauge for global stocks was down 0.5% for the week. Regional markets were mostly up, supported by rising oil prices on the back of higher geopolitical risks. The USD strengthened last week, rising to a more than one-week high on Friday, and continued to rise vis-a-vis the JPY (ahead of the BoJ meeting this week). Oil prices topped USD 85 a barrel (for the first time since Nov) and recorded a weekly gain of 3%+ despite slipping on Friday. Gold price was down by less than one percent last week.

Global Developments

US/Americas:

- Inflation in the US inched up to 3.2% yoy in Feb (Jan: 3.1%), with motor vehicle insurance and transportation prices accelerating by 20.6% and 9.9% while shelter and foods consumed away from home rose by 5.7% and 4.5%. Excluding food and energy, inflation eased slightly to 3.8% (Jan: 3.9%).

- Producer price index rose by 1.6% yoy in Feb (Jan: 1%) while excluding food, energy and trade services producer prices rose 2.8% yoy (Jan: 2.7%). In month-on-month terms, PPI rose 0.6% (Jan: 0.3%), as wholesale gasoline and food prices accelerated by 6.8% and 1% respectively.

- US industrial production increased in Feb, edging up by 0.1% mom (Jan: -0.5%), thanks to an increase in manufacturing (0.8%) and mining (2.2%). IP fell by 0.2% yoy in Feb, slower than Jan’s 0.3% fall. Capacity utilisation stood steady at 78.3%.

- Retail sales in the US rebounded by 0.6% mom in Feb (Jan: -1.1%), given increased sales at motor vehicles & parts (1.6%) as well as building material & garden equipment (2.2%).

- US budget deficit widened to USD 296bn in Feb (Jan: USD 22bn), with revenues up 3% yoy to USD 271bn and spending by 8% to USD 567bn. Deficit for the first five months of the fiscal year totalled USD 828bn, with interest on public debt up 41% yoy to USD 433bn.

- NY Empire State manufacturing index plunged to -20.9 in Mar (Feb: -2.4), as result of massive declines in new orders (-17.2 from Feb’s -6.3), shipments (-6.9 from 2.8) and employment (-7.1 from -0.2) among other indicators.

- Michigan consumer sentiment index slipped to 76.5 in Mar (Feb: 76.9), with the expectations index falling to 74.6 (from 75.2) alongside steady current conditions subindex (79.4). The one- and 5-year inflation expectations were steady at 3% and 2.9% respectively.

- US labour market remains tight: initial jobless claims unexpectedly fell by 1k to 209k in the week ended Mar 8th, and the 4-week average slipped by 500 to 208k. Continuing jobless claims inched up by 17k to 1.811mn in the week ended March 1st.

Europe

- Industrial production in the euro area declined by 3.2% mom and 6.7% yoy in Jan (Dec: 1.6% mom and 0.2% yoy). Capital goods production was down 12.1% while durable and non-durable consumer goods down by 8.4% and 3.1% respectively.

- UK GDP grew by 0.2% mom in Jan (Dec: -0.1%), largely due to an expansion in the services sector (0.2%); output in the hospitality sector shrank 0.6%. Output was down by 0.3% yoy in Jan, dragged down by the impact of high interest rates and high inflation.

- Industrial production in the UK fell by 0.2% mom in Jan (Dec: 0.6%): mining and quarrying output declined by 1.3% (Dec: -1.8%) and manufacturing production was flat (Dec: 0.8%).

- UK unemployment rate inched up to 3.9% in the 3 months to Jan (3m to Dec: 3.8%). Wage growth in the UK continued to slow: but, average earnings including (excluding) bonus still grew by 5.6% (6.1%) in the 3 months to Jan, slowing from the previous month’s readings.

Asia Pacific:

- Money supply (M2) in China grew by 8.7% yoy to CNY 299.56trn in Feb (Jan: 8.7%). New loans disbursed fell sharply to CNY 1450bn (Jan: CNY 4920bn) while outstanding yuan loans jumped 10.1% to CNY 243.96trn.

- Consumer price index in India remained relatively steady at 5.09% in Feb (Jan: 5.1%), remaining below the RBI’s 6% upper band, though food prices were higher at 8.66% (Jan: 8.3%). Wholesale price index rose by 0.2% in Feb (Jan: 0.27%) as food prices rose 4.09% (Jan: 3.79%) while manufactured products prices fell 1.27% (Jan: -1.13%).

- India’s industrial output grew by 3.8% yoy in Jan (Dec: 4.2%), supported by growth in manufacturing (3.2%, easing from Dec’s 4.5% gain). Overall cumulative output grew by 5.9% in Apr-Jan, versus 5.5% in the same period a year ago.

- Singapore’s unemployment rate stood at 2% in Q4, same as in the previous quarter, taking the full year jobless rate to 1.9% (the lowest since 2015).

Bottom line: It’s a central bank heavy calendar this week. The Bank of Japan seems to be inching closer to moving away from its policy of negative interest rates, while the Bank of England will likely hold interest rates steady (amid a drop in wage growth, and in line with the policies of the Fed & ECB). The Fed will in all likelihood stay put this week (the question mark remains on when it will initiate rate cuts – will it be Jun or later?).

Regional Developments

- Loans disbursed by banks in Bahrain grew by 4.3% yoy to BHD 11.8bn (USD 31.36bn) at end-2023, according to the central bank. The personal sector accounted for almost 50% of total loans while the business sector’s share stood at 42.6%. The balance sheet of the banking system grew by 6.4% to USD 238.5bn in 2023.

- The US export credit agency approved a USD 500mn loan guarantee to Bahrain’s Bapco Energies for an oil and gas drilling project. The agency has stated that the project includes measures to reduce GHG emissions and is expected to support “thousands of US jobs”.

- Egypt’s trade deficit widened by 17.8% yoy to USD 3.03bn in Dec 2023, as exports declined by 23% (to USD 3.48bn) while imports fell at a slower pace (8.2% to USD 6.51bn), according to data from CAPMAS. Exports were dragged down by plunges in fertilizers (-48.8%), petroleum products (-46.8%) and LNG (-88.1%). Separately, the Minister of Trade & Industry disclosed that exports rose by 6% yoy to USD 6.121bn in Jan-Feb 2023, topped by building exports (USD 1.177bn) and with Turkey, Saudi Arabia and Italy the top export destinations.

- Close on the heels of the currency devaluation and agreement with the IMF, the central bank governor in Egypt disclosed that demand for dollars had begun to decline given the sufficient supply. Furthermore, foreign investors resumed purchases of Egyptian Treasury bills, to take advantage of the high yields and stable outlook. Without providing any figures, the PM revealed that inward remittances were increasing post the sharp EGP devaluation.

- Egypt sees a flurry of additional funding: EU and Egypt signed a EUR 7.4bn (USD 8bn) package focusing on macro-financial assistance and on stepping up energy sales (as Europe plans to move away from Russian gas). Egypt and China are in discussions to set up an industrial zone, focusing on traditional and high-tech sectors, along the Mediterranean Sea: no financial details were released. Germany pledged EUR 258mn (USD 282mn) to Egypt via debt swaps, grants and concessional financing, stated Egypt’s Minister of International Cooperation.

- Egypt’s finance minister revealed that essential goods worth USD 1.7bn had been released from the ports in the 10 days till 14th March. Earlier this month, the Head of the Egyptian Customs Authority had stated that goods worth USD 780mn had been released on Mar 7-8th.

- Trade volume through the Suez Canal has plunged by 50% yoy in Jan-Feb, according to the IMF. In turn, the Cape of Good Hope saw a jump in trade transiting through (+74% yoy). Click to view chart.

- Fitch affirmed Kuwait’s foreign and local currency sovereign credit ratings at AA- with a stable outlook, given its strong “fiscal and external balance sheets” though also stating that its rating “is constrained by Kuwait’s heavy dependence on oil”.

- Kuwait’s official reserve assets fell by 3.59% yoy and 2.33% mom to KWD 532mn (USD 1.736bn) by end-Jan. These exclude external assets held by the General Investment Authority, which surged to USD 923.45bn (Jul 2023: USD 803bn).

- Lebanon plans to rebuild the Beirut Port that was partially destroyed in Aug 2020, disclosed the Minister of Public Works and Transport. A French-sponsored proposal to rebuild the port was unveiled at an event, with the government planning implementation “as soon as possible” either through “external contributions” or from revenues generated by the port.

- Inflation in Oman was flat in Feb (Jan: -0.1%), with the food and non-alcoholic beverages group positing a 1.1% increase in prices alongside a 2.6% drop in transportation costs.

- Oman posted a budget surplus of OMR 85mn in Jan, as public revenues rose 3% yoy to OMR 1.014bn (supported by a 132% surge in current revenues) while expenditure jumped by 11% to OMR 929mn.

- Projects financed by Oman’s SME Development Authority reached 224 at end-Feb, with development lending crossing OMR 24.6mn (USD 63.9mn). Top funded projects spanned industrial, commercial and service sectors (a total of 161 projects financed).

- Qatar central bank’s international reserves and foreign currency liquidity grew by 4.9% yoy to QAR 246.497bn (USD 67.69bn) in Feb 2024. Gold reserves increased to QAR 24.4bn, rising by QAR 4.9bn from a year ago.

- A PwC report, based on survey of over 1200 women in 9 MENA nations, finds that women returning to the workforce after a career gap could add USD 385bn to 9 MENA nations’ GDP. The report also found that permitting women to work additional hours by granting flexibility could result in GDP gains of up to USD 4.3bn. More: https://www.pwc.com/m1/en/publications/navigating-the-path-back-women-returners-in-mena.html

Saudi Arabia Focus

- Inflation in Saudi Arabia edged up to 1.8% yoy in Feb (Jan: 1.6%), the highest reading since Aug 2023, driven up by housing and food costs. The “housing, water, electricity, gas and other fuels” category (which account for one-fourth of total weighting of the basket) jumped by 8.5% in Feb (Jan: 7.8%), with housing rents alone surging 10% (from 9.3%).

- Wholesale prices in Saudi Arabia eased to 3.1% in Feb(from Jan’s 15-month high 4.3% reading). Deflation increased in ores & minerals category (-2% vs -1.7% in Jan) as well as in metal products, machinery & equipment (-0.6% from Jan’s -0.3%); meanwhile, prices of refined petroleum products and basic chemicals rose by 12.1% and 10.8% respectively.

- By economic activity, theshare of Saudi Arabia’s non-oil activities touched 50% of overall GDP in 2023, the highest on record so far. Further breakdown shows that mining and quarrying sector still accounted for one-third of total output in 2023 while manufacturing had a significant 15% share alongside real estate & construction (14%). Arts and entertainment led the growth in non-oil activity, more than doubling in value in 2021-2022.

- Saudi PIF updated its asset size on the website to USD 925.2bn after receiving the additional 8% stake in Aramco. The Aramco holding now accounts for around 37% of the PIF’s portfolio value. PIF’s overall assets under management now exceeds USD 860bn (up from USD 700bn at end-2022.

- Bloomberg reported that the PIF intends to regularly tap debt markets or secure bank loans to ease funding strain on domestic banks. PIF has issued two separate bonds in 2024 to raise USD 7bn.

- PIF is in early talks to buy Saudia and add to its aviation portfolio, with an aim to increase the airlines profitability and efficiency. The valuation is uncertain and it remains to be seen how this will work in line with Riyadh Air (which the PIF is now setting up).

- Saudi PIF’s subsidiary Jada Fund of Funds invested in Partners for Growth, which has SAR 3.75bn (USD 1bn) in assets under management, thereby supporting the venture debt ecosystem in the country.

- Residential mortgage loans jumped to a 11-month high of SAR 7.54bn (USD 2bn, up 21% mom) in Jan 2024. About 68% of residential loans were allocate for house purchases, with another 26% for apartments.

- Saudi Arabia’s Vice Minister for Tourism disclosed having secured USD 13bn in private sector investments for the tourism industry. This is expected to raise the number of hotel rooms to up to 200k within 2 years. Tourism revenues is estimated to jump to USD 85bn this year (2023: USD 66bn).

- Saudi Arabia’s two-hour clearance service at all ports received commendation from the World Customs Organisation. Saudi Arabia slashed customs clearance time by 84% to just two hours at end-2022, down from 13 hours the previous year.

- S&P affirmed Saudi Arabia’s A/A-1 rating with a stable outlook, supported by recent years’ economic and social reform, acceleration in non-oil sector investment, strong growth in construction and robust consumption among others.

- Moody’s retained a positive outlook for Saudi Arabia’s banking sector, stating that government backed giga projects-led demand for credit will improve loan growth and hence profitability. Non-performing loans are expected to stand at around 1.5% of gross loans, supported by high borrower quality and fast credit growth.

UAE Focus![]()

- S&P Global Dubai PMI rose to 56.3 in Feb (Jan: 54.6), the highest reading since May 2019. The uptick in output was supported by “increased demand, strong market conditions and greater project work”, according to the respondents. Average output charges declined at the fastest pace in 8 months while rate of input cost inflation ticked up.

- Dubai’s Parkin raised AED 1.57bn (USD 427.5mn) after pricing its IPO at AED 2.1 per share, and the offer oversubscribed by around 165 times. Parkin is likely to start trading on Mar 21st.

- UAE government finance statistics report indicated the value of revenues rose to AED 155.9bn in Q4 (8% yoy) while spending stood at AED 131.3bn (9.14% yoy).

- UAE banks and financial institutions added 2.52mn new loans and credit cards in 2023 (up 3% yoy), bringing the total number of active contracts to 9.8mn at end-Dec 2023 (end-2022: 8.9mn), according to the head of Al Etihad Credit Bureau. The number of individual borrowers stands at 4 million and the number of borrowing companies is around 189,000.

- Bilateral non-oil trade between the UAE and US stood at USD 31.4bn in 2023. US exports to the UAE rose by 19% yoy to USD 24.8bn (supporting 125k jobs in the US) while UAE exports to the US touched USD 6.6bn.

- International visitors to Dubai surged by 20.4% yoy to 1.77mn in Jan 2024,following last year’s record-high 17.15mn (up 19.4% yoy & 2.5% higher compared to 2019). GCC & MENA regions together accounted for 30% of visitors in Jan while Western Europe and South Asia accounted for the largest shares (18% and 17% respectively). Hotel occupancy rate at 83% was on par with 2019; revenue per available room in 2024 remained the highest for Jan (AED 535 vs previous Jan high of AED 520 in 2018) while room rates have remained at AED 600+.

- Dubai World Trade Centre (DWTC) reported a 25% increase in participants in 2023, to 2.47mn from a total of 301 meetings, incentives, conferences and exhibitions (23% yoy). The Healthcare, Medical, and Scientific sector was the top-performing industry at DWTC, holding 24 events with a total of 275,000 attendees, representing one-fifth of all exhibitions and conventions held at the venue.

- Diamond trade in Dubai increased by 2% yoy to USD 38.3bn in 2023, reflecting a 5-year compound annual growth rate of 11%. The value of polished diamonds surged 32% to USD 16.9bn last year.

- The Dubai Chamber of Commerce disclosed that 15k new Indian companies had become members in 2023, up 38% yoy. Pakistani and Egyptian businesses followed, with 8035 (+71.2%) and 4837 (63.2%) new members respectively. Wholesale and retail trade and repair of motor vehicles sector accounted for 44.2% of new memberships, followed by real estate, renting and business activities (32%).

- Abu Dhabi announced the creation of a technology investment company (MGX), with Mubadala and G42 as foundational partners: the company’s investment strategy will focus on 3 main areas: AI infrastructure, semiconductors and AI core technologies and applications.

- Nakheel and Meydan, two of Dubai’s largest state-backed developers, will merge into Dubai Holding to form a new entity. The two boards of the firms have been abolished, and the goal is “to create a more financially efficient entity”.

Media Review

The Future of “Communist Capitalism” in China

https://www.ft.com/content/58bb9713-2d71-4a50-b825-f7213907491b

“Addressing Challenges of a New Era: Against Rule-Of-Thumb Economics”, IMF F&D article, Mar 2024

https://www.imf.org/en/Publications/fandd/issues/2024/03/Point-of-view-addressing-challenges-of-a-new-era-Dani-Rodrick

Just how rich are businesses getting in the AI gold rush?

https://www.economist.com/business/2024/03/17/just-how-rich-are-businesses-getting-in-the-ai-gold-rush

Powered by: