Weekly Insights 15 Mar 2024: Saudi GDP contracts in 2023, but non-oil activity to remain robust

1. Saudi Arabia GDP fell by 0.8% yoy in 2023 (2022: 7.5%), as oil sector activity plunged (-9.0%)

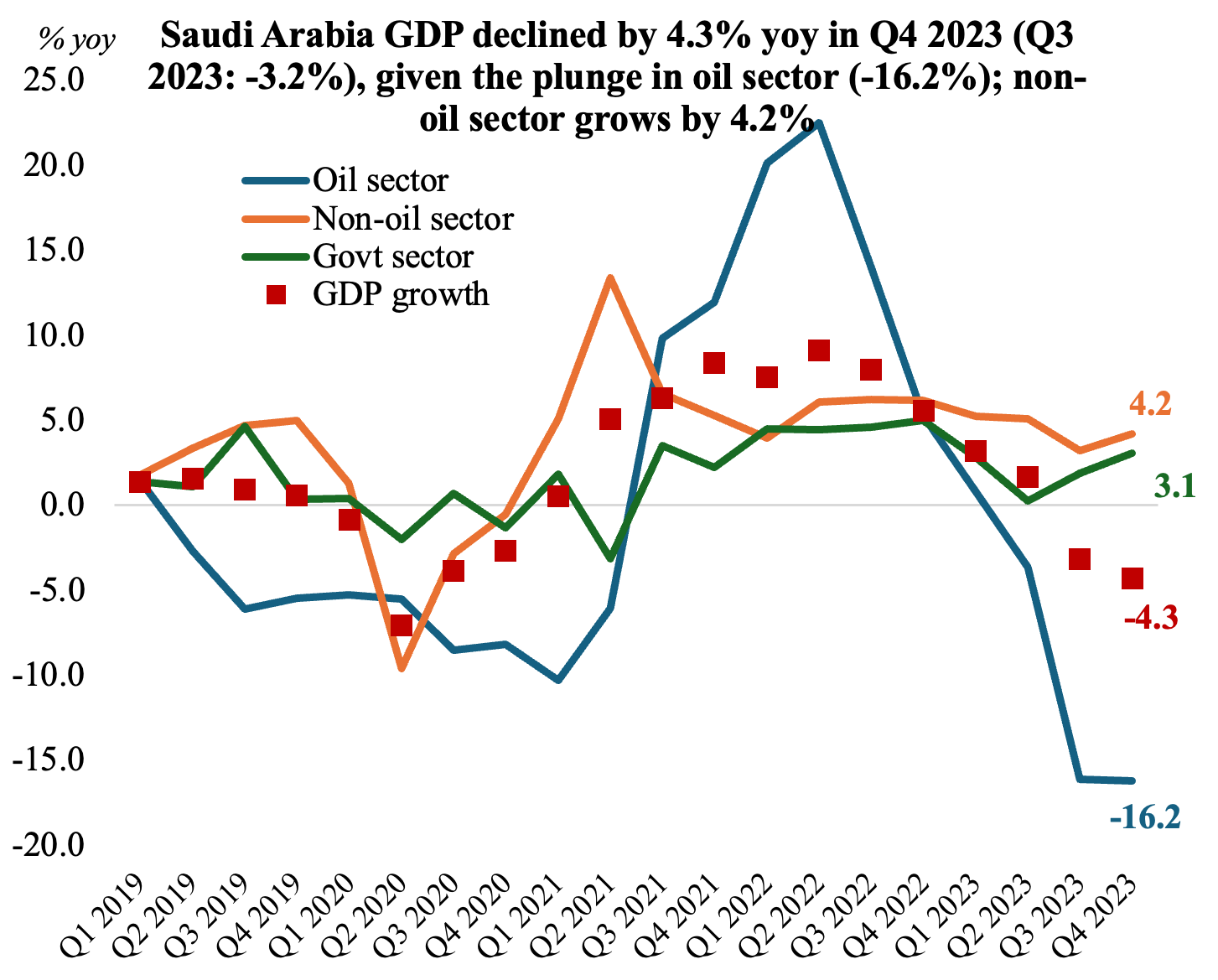

- Saudi Arabia’s real GDP declined by 4.3% yoy and 0.6% qoq in Q4 2023; this led GDP to contract by 0.8% yoy for the full year 2023. The calculation has changed to a moving chain methodology, using 2018 as the base year.

- Non-oil sector grew by 4.2% in Q4 (Q3: 3.2%), though the pace has been slowing in recent quarters: it averaged 5.2% H1 2023 and 3.7% in H2, taking the full year rate to 4.4% (2022: 5.6%). Government spending slowed in 2023 as well, growing by 2.1% vs 4.6% in 2022.

- By economic activity, the share of non-oil activities touched 50% of overall GDP in 2023, the highest on record so far. Further breakdown shows that mining and quarrying sector still accounted for one-third of total output in 2023 while manufacturing had a significant 15% share alongside real estate & construction (14%). By expenditure components, both consumption and investment supported overall GDP growth in 2023 (variations by quarter).

- Various factors such as the pipeline of mega and giga projects, the relocation of about 350 firms’ regional HQs to Riyadh (such regional HQ licenses are being issued at around 10 per week) and winning the bid to host Expo 2030 imply a strong expansionary trajectory for the non-oil sector in the coming quarters.

2. Consumer price inflation in Saudi Arabia inches up in Feb, while wholesale prices ease slightly after Jan’s surge

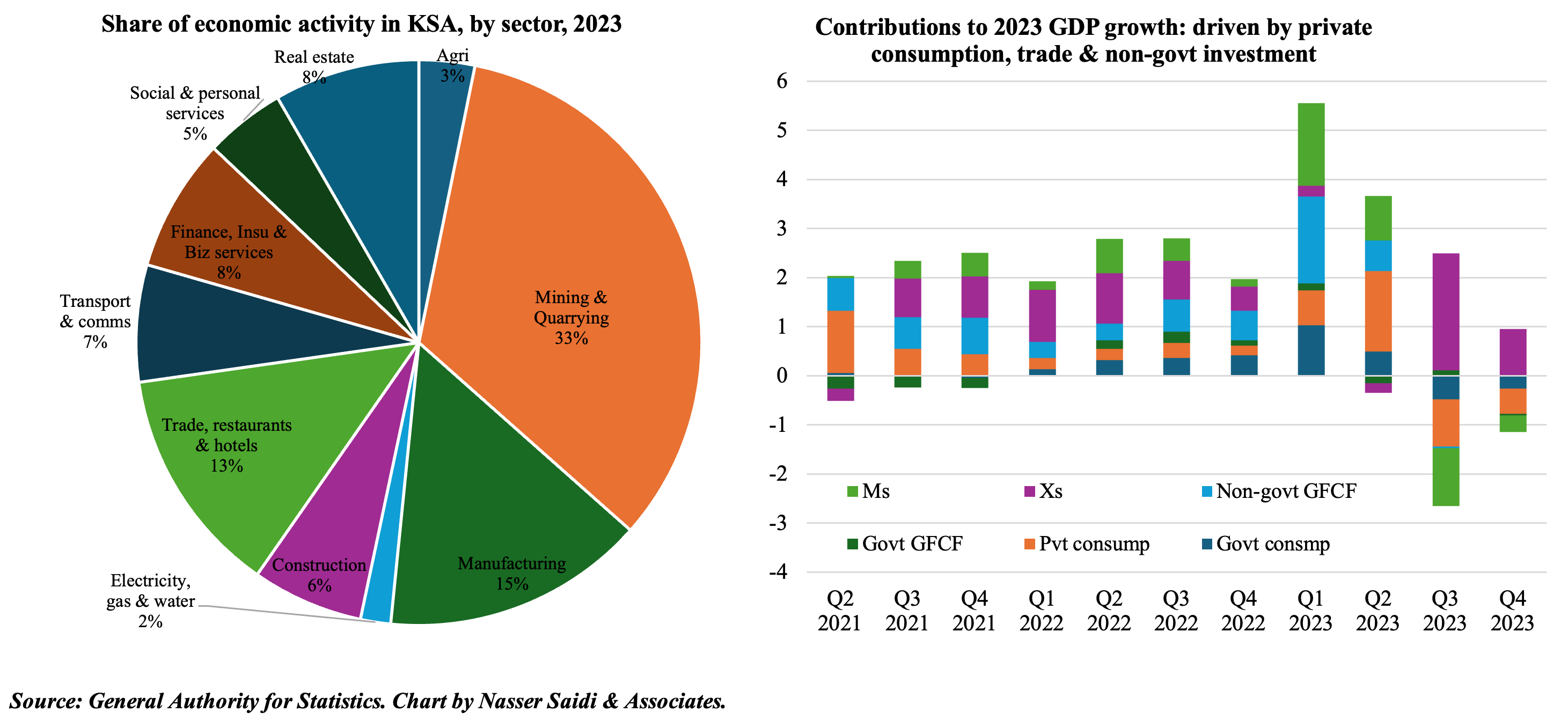

- Consumer price inflation in Saudi Arabia edged up to 1.8% yoy in Feb (Jan: 1.6%), the highest reading since Aug 2023, driven up by housing and food costs. The “housing, water, electricity, gas and other fuels” category (which account for one-fourth of total weighting of the basket) jumped by 8.5% in Feb (Jan: 7.8%), with housing rents alone surging 10% (from 9.3%). Ahead of the month of Ramadan, prices on foods and beverages rose (1.3% from Jan’s 1%), with vegetable prices accelerating most, by 7.6% (more than double Jan’s 3.7% gain).

- Wholesale prices in Saudi Arabia eased to 3.1% in Feb (from Jan’s 15-month high 4.3% reading). Deflation increased in ores & minerals category (-2% vs -1.7% in Jan) as well as in metal products, machinery & equipment (-0.6% from Jan’s -0.3%); meanwhile, prices of refined petroleum products and basic chemicals rose by 12.1% and 10.8% respectively.

- For now, there seems to be very limited impact from the ongoing disruptions in the Red Sea: PMI for Saudi Arabia in Feb showed input price inflation falling to its lowest level since Jul 2023 while firms were choosing to lower selling prices to remain competitive.

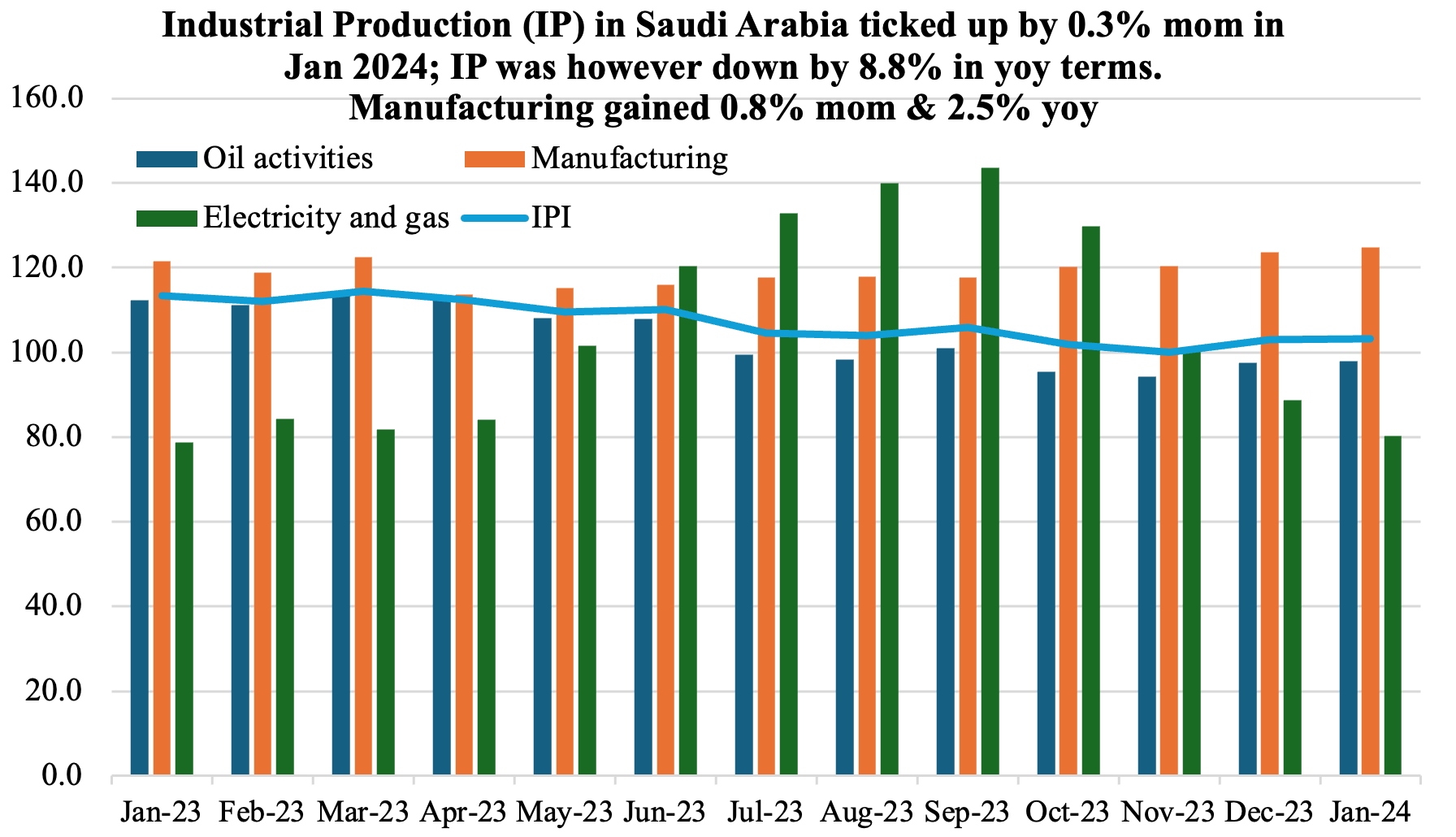

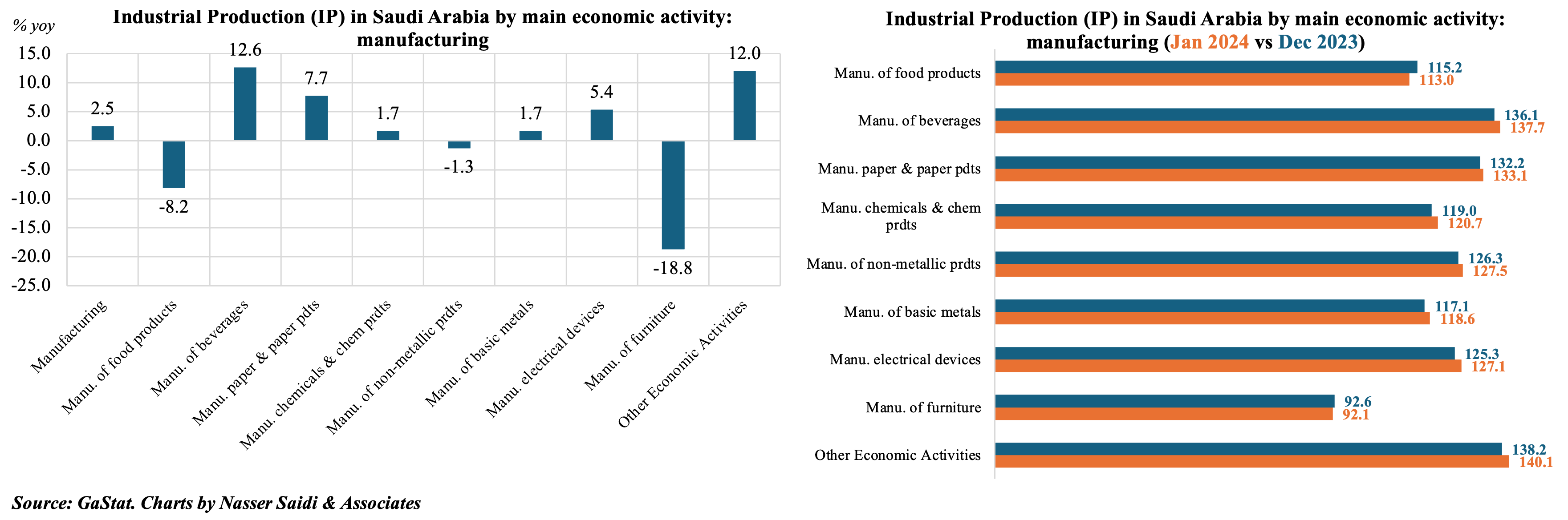

3. Saudi Arabia’s industrial production dragged down by oil activities in Jan 2024; manufacturing records growth

- Industrial production in Saudi Arabia inched up by 0.3% mom in Jan, thanks to a 1.1% rise in manufacturing while mining & quarrying activity inched up by 0.1%. In yoy terms, however, IP fell by 8.8% in Jan, dragged down by the mining & quarrying sector (-14.3%). The new IP readings have used 2021 as the base year (i.e. 2021=100).

- Overall, non-oil manufacturing sector grew by 2.5% yoy and 0.8% mom in Jan 2024, with the manufacture of beverages one of the fastest growing (12.6% yoy) alongside other economic activities (12%) and manufacture of paper & paper products (7.7%).

- Positive signs for increase in non-oil sector activity in coming months. Ministry of Industry & Mineral Resources, in a bid to reduce financial burden on businesses, decided to waive customs duties on certain manufacturing products from Apr 1st; Saudi PMI in Feb showed an increase in both output and new orders; issuance of new industrial licenses and setup of factories increased

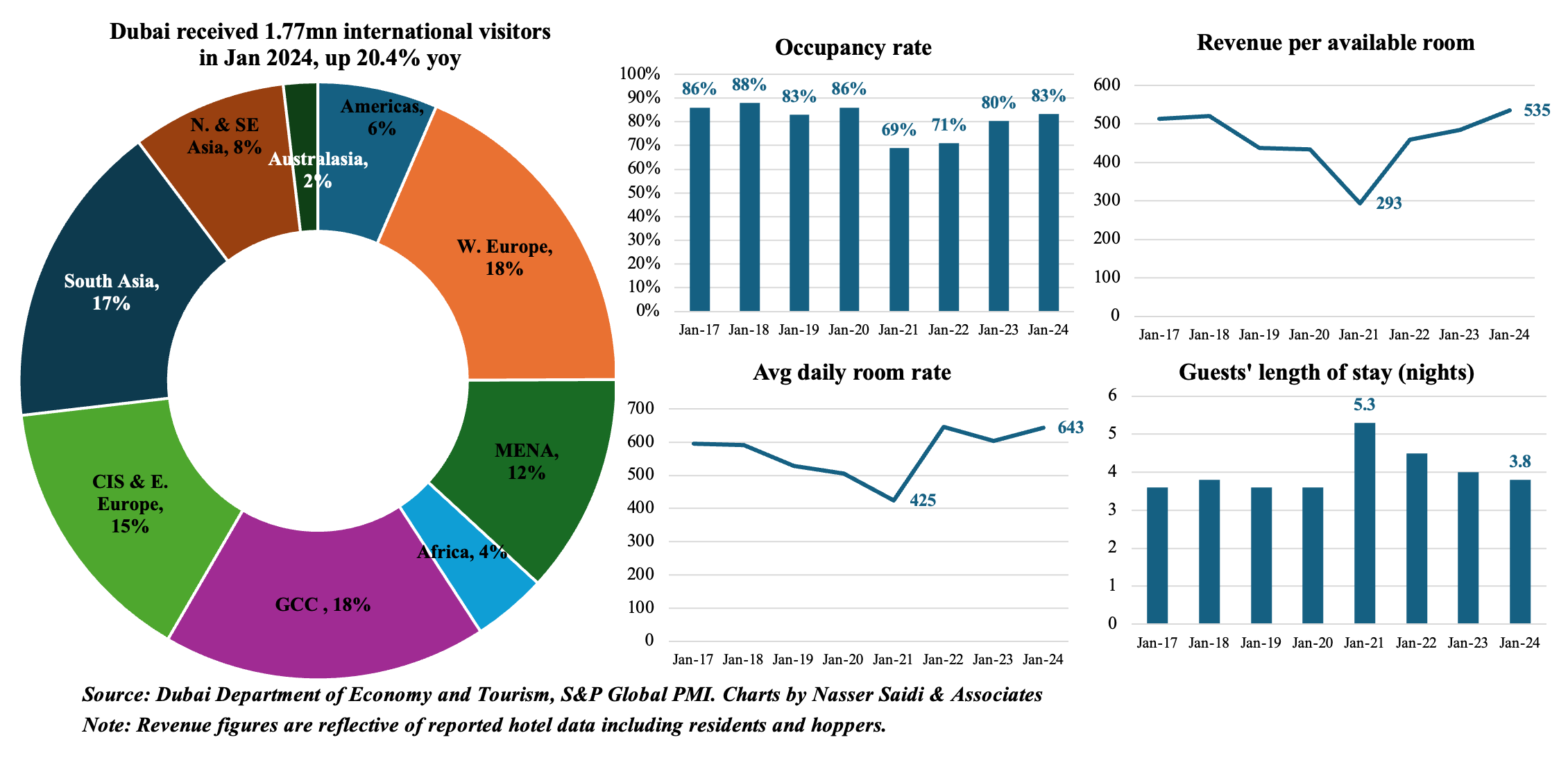

4. International visitors to Dubai surge by 20.4% yoy to 1.77mn in Jan 2024

- International visitors to Dubai surge by 20.4% yoy to 1.77mn in Jan 2024, following last year’s record-high 17.15mn (up 19.4% yoy & 2.5% higher compared to 2019).

- Regional composition of tourists broadly unchanged: GCC & MENA regions together accounted for 30% of visitors in Jan while Western Europe and South Asia accounted for the largest shares at 18% and 17% respectively.

- At end-Jan 2024, there were 150,408 hotel rooms (+2% yoy) across 823 establishments (+2% yoy) in Dubai. Hotel occupancy rate at 83% was on par with 2019; revenue per available room in 2024 remains the highest for Jan (AED 535 vs previous Jan high of AED 520 in 2018) while room rates have remained at AED 600+ while length of stay has inched slightly lower (-4% yoy to 3.8, though higher than 3.6 in Jan 2019). Furthermore, occupied room nights jumped by 6% yoy to 3.84mn in Jan 2024.

- In addition to international visitors, Dubai and the UAE is becoming a major events & conferences hub in the region – with international events being held such as the COP28 in Nov-Dec and the most recent WTO Ministerial Conference).

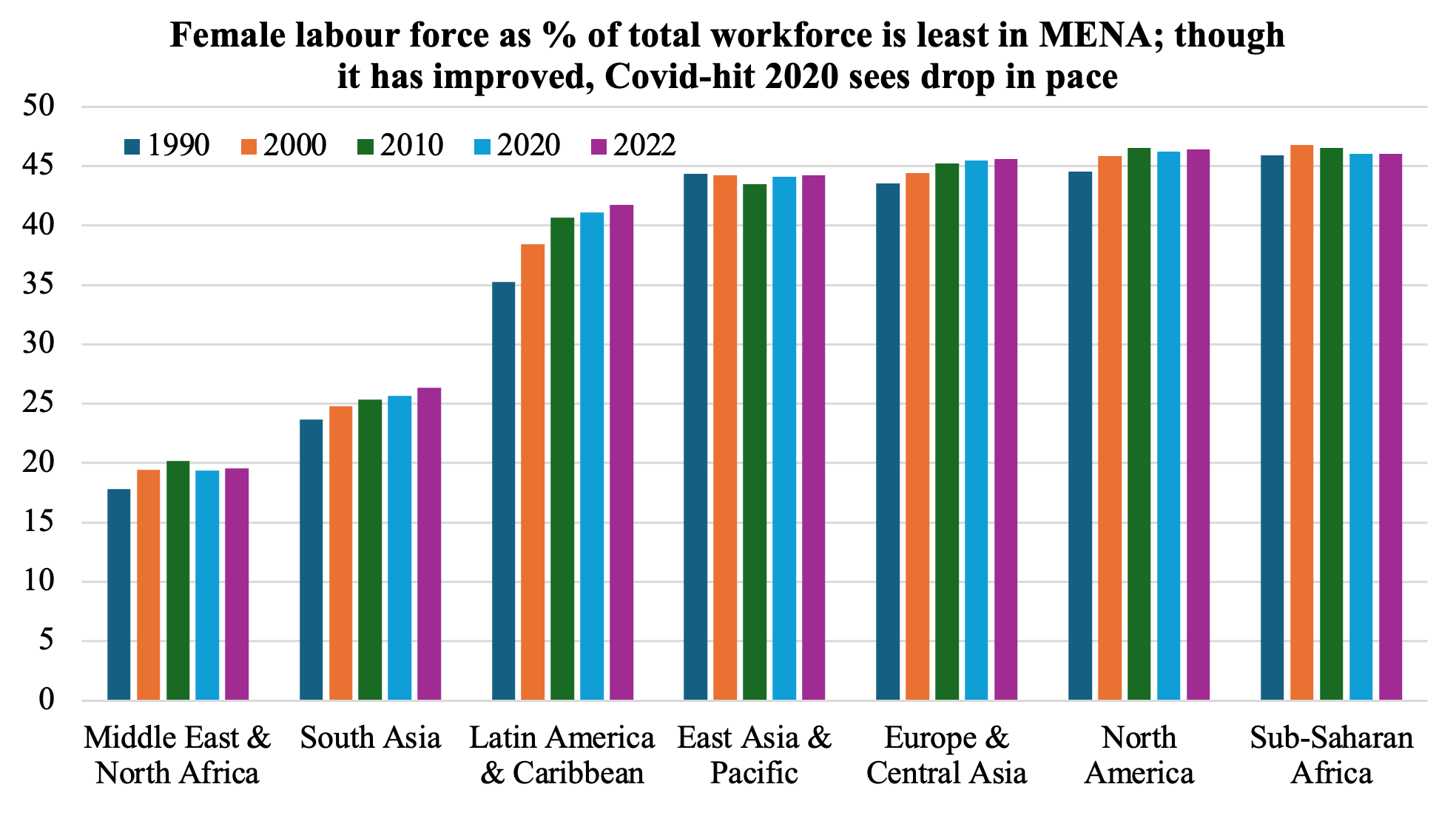

5. MENA region lags other regions in the share of women in the labour force

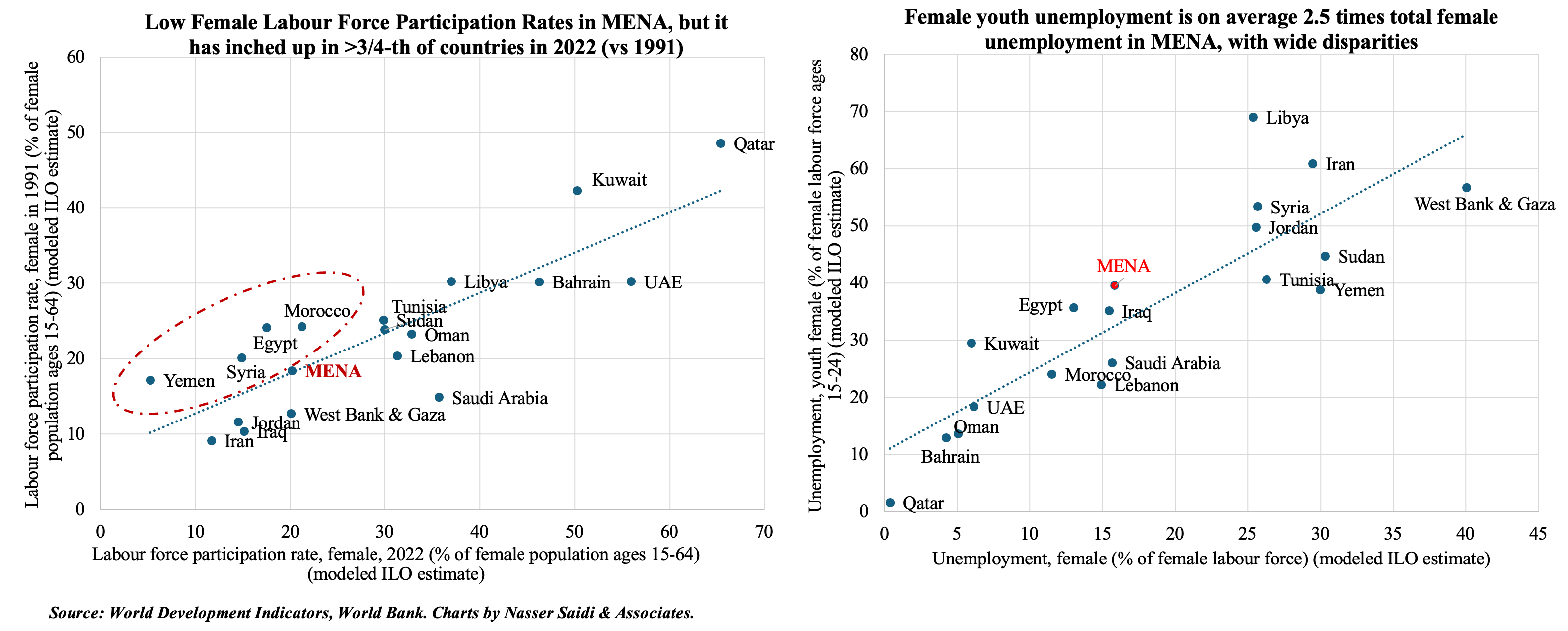

- Only about one-fifth (on average) of all women (aged 15-64) participate in the labour market in MENA: it had been inching up, peaking in 2016 (21.1%) before dropping to 19.4% in the Covid19-hit 2020.

- Regional disparity exists in MENA’s female labour force participation rates (FLFPR). It is relatively higher in the GCC.

- A comparison with rates in 1991 (vertical axis, LHS chart) show that most nations have improved FLFPRs (x-axis). Saudi gained the most, rising to 35.7% in 2022 vs 14.9% in 1991. Nations within the red-dotted ellipse show a decline in 2022 versus rates in 1991 (Egypt, Morocco, Syria & Yemen).

- Low FLFPR also coincides with average female unemployment rates of 9% and 40% for young women in 2022!

6. Gender-related reforms & implementation in MENA have a long way to go!

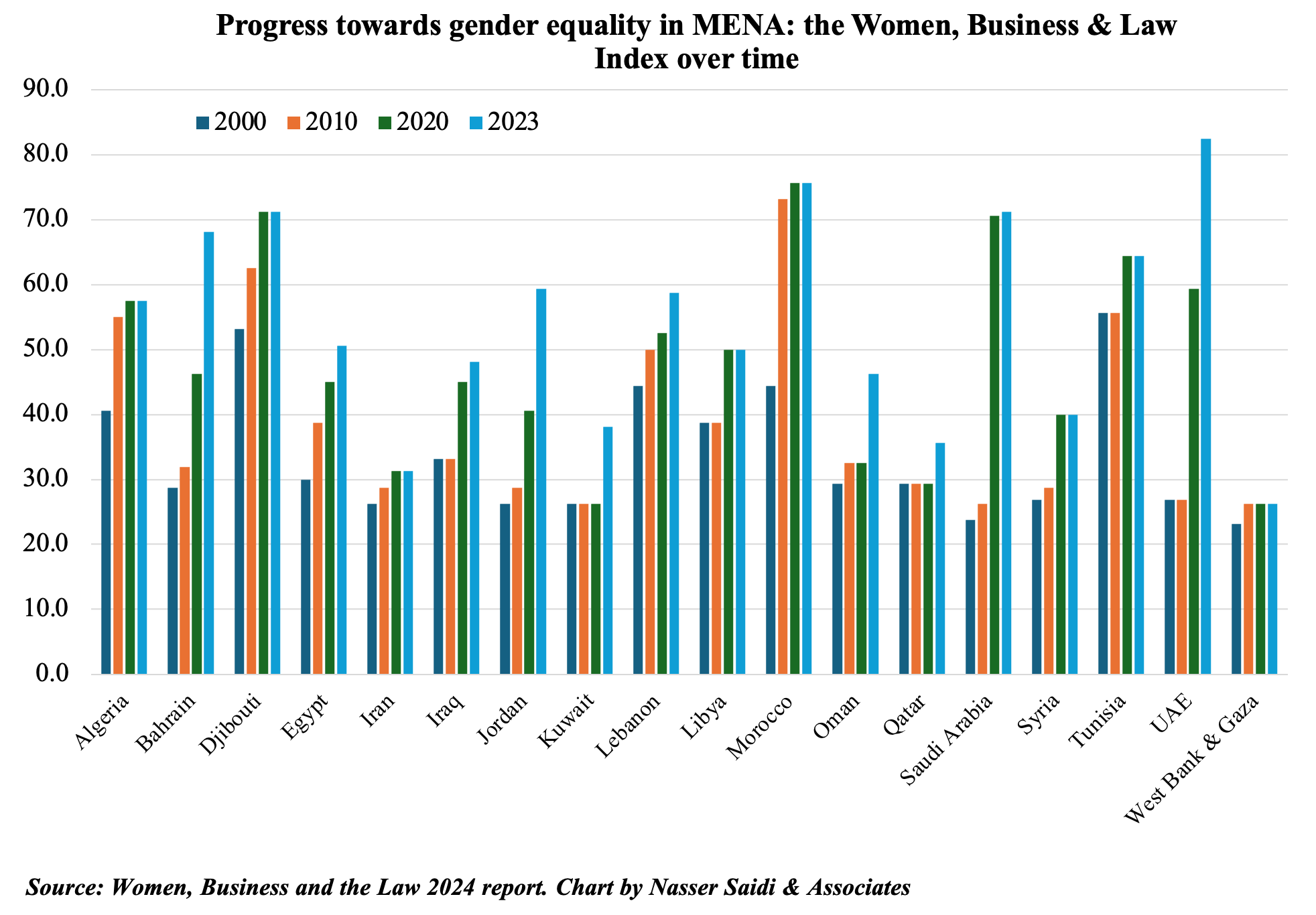

- The 2024 Women, Business and the Law index finds that women on average have just 64% of the legal protections that men do.

- Unsurprisingly, with respect to implementation, the gap is high: a whopping 98 nations have legislation mandating equal pay, but only 35 have adopted transparency measures! Globally, women earn 77c for every $1 paid to men.

- MENA region scored the least among regions (38.6) & also has the largest variations in scores within the group. In 2024, UAE scored the most in the region (82.5), and the lowest, West Bank & Gaza, was a long way down at 26.3.

- Economies with historically larger legal gender gaps have been catching up faster, especially since 2000, including many of the GCC nations (Bahrain, Saudi Arabia, UAE).

- Between 2022 and 2023, only Jordan, Oman and Qatar introduced reforms in the MENA region (a total of 10). Jordan’s was related to the workplace, Oman’s regarding parenthood and Qatar’s pension related; both Jordan and Oman also introduced pay-related reforms.

Powered by: