Download a PDF copy of the weekly economic commentary here.

Markets

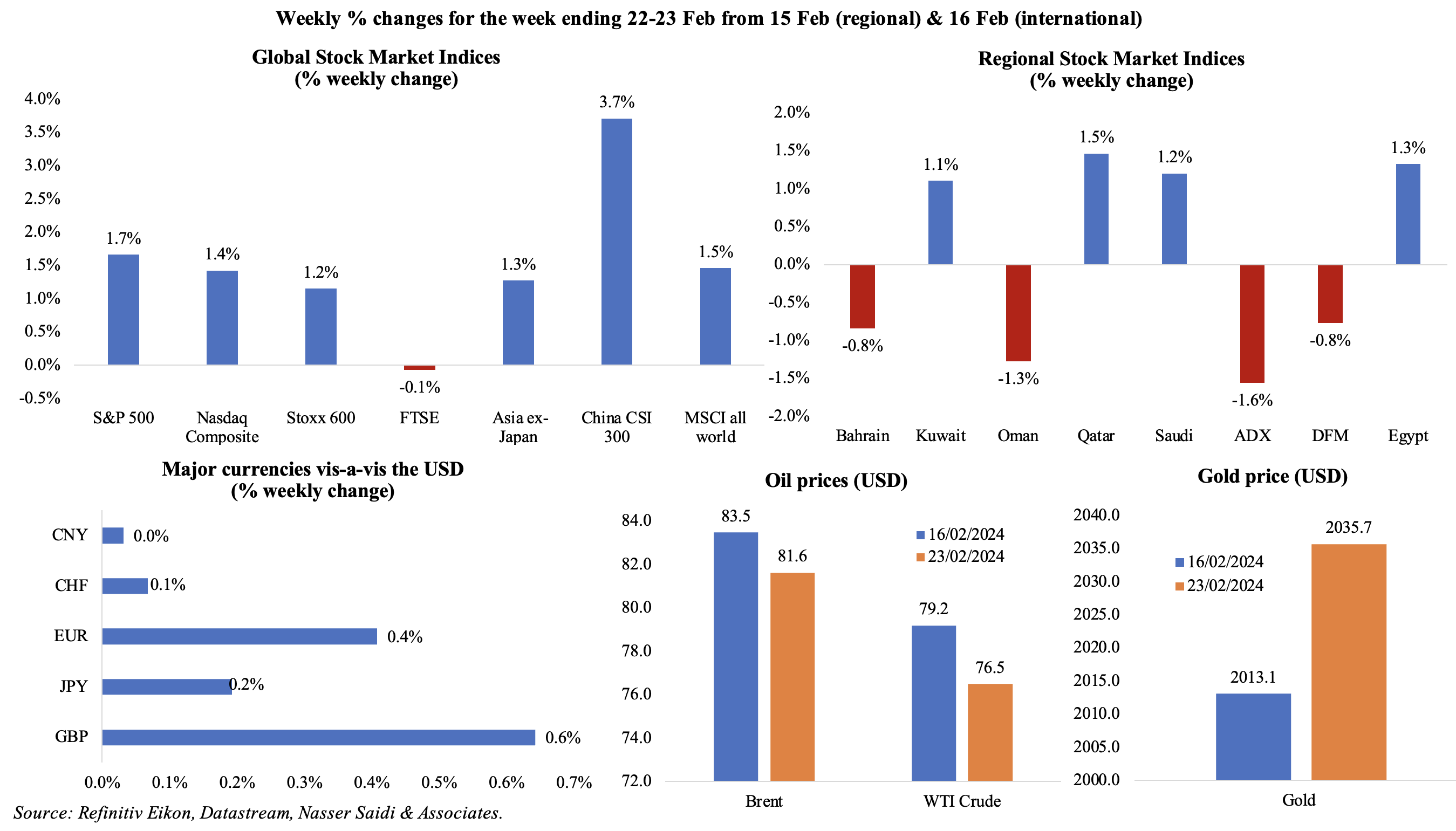

Most equities markets were frothy and closed in the green last week, with the MSCI all-world index posting a new intra-day high, while Stoxx600 posted a new record-high and a fifth straight week of gains. Regional markets showed a mixed picture, with the Abu Dhabi market falling the most (-1.6%, the largest weekly decline since Oct 20, 2023) given rising geopolitical tensions in the region. Among currencies, the dollar posted its first weekly fall this year given Fed’s caution about cutting interest rate too quickly, but the USD meanwhile gained 6.7% vs the JPY this year. Oil prices fell from the week prior – Brent by 2.2% and WTI by 3.4% – while gold price gained thanks to a softer dollar.

Global Developments

US/Americas:

- FOMC minutes revealed thinking that interest rates could be at their peak; also stated that Fed rate cuts were unlikely until there was evidence of inflation heading lower (“moving sustainably toward 2%”).

- Chicago Fed national activity index fell to -0.3 in Jan (Dec: 0.02), with three of the four broad indicators declining.

- S&P Global manufacturing PMI in the US rose to 51.5 in Feb (Jan: 50.7), the strongest reading since Sep 2022, supported by upticks in output and new orders. Composite PMI slipped to 51.4 as services PMI posted a decline to 51.3 (from 52.5) and overall input prices fell to the lowest since Oct 2020 heralding lower costs.

- Existing home sales in the US grew by 3.1% mom to 4mn in Jan, the highest level since Aug; first time buyers accounted for just 28% of sales (versus about 40% historically). The median existing home prices grew by 5.1% yoy to USD 379,100 in Jan.

- Initial jobless claims declined by 12k to 201k in the week ended Feb 16th, falling for the third time in 5 weeks, and the 4-week average slipping by 3.5k to 215.25k. Continuing jobless claims fell by 27k to 1.862mn in the week ended Feb 9th.

Europe

- Consumers were less pessimistic with the confidence barometer in the eurozone improving to -15.5 in Feb (Jan: -16.1).

- GDP in Germany declined by 0.3% qoq and 0.2% yoy in Q4, recording two back-to-back quarters of negative growth. Gross fixed capital formation declined by 1.9% in Q4 while private consumption and public spending increased by 0.2% and 0.3% respectively. For the full year 2023, Germany fell into recession shrinking 0.3%.

- German Ifo business climate inched up to 85.5 in Feb (Jan: 85.2), due to slightly less pessimistic expectations. Current assessment was steady at 86.9 while expectations improved (to 84.1 from 83.5). The Ifo report stated the German economy is stabilizing at a low level.

- Germany’s flash manufacturing PMI fell to a 4-month low of 42.3 in Feb (Jan: 45.5), as output and new orders slowed on weaker demand. Services PMI rose to 48.2 (Jan: 47.7), the fifth month in a row of contraction, though employment rose the most in 8 months.

- Flash manufacturing PMI in the eurozone slipped to 46.1 in Feb (Jan: 46.6), with output dropping for the 11th straight month and input process fell at the slowest rate in almost a year. Services PMI moved to the neutral reading of 50 (Jan: 48.4), a 7-month high and after 6 months of readings below-50.

- UK’s flash manufacturing PMI edged up to 47.1 in Feb (Jan: 47), falling for the 12th straight month while workforce levels decreased the most since Jun 2020.

- GfK consumer confidence in the UK deteriorated unexpectedly to -21 in Feb (Jan: -19), but remains below the average of -17 over the past few decades. Outlook for the next 12 months also declined, to -24 in Feb, while expectations for their personal finances held steady at zero.

Asia Pacific:

- The People’s Bank of China left the 1-year loan prime rate unchanged at 3.45% but cut the 5-year LPR by 25bps to 3.95%. This was the largest cut to the 5-year LPR on record, and is potentially expected to support a property market recovery.

- FDI into China fell by 11.7% yoy to USD 15.86bn in Jan (Dec: -8%); 4,588 new foreign-invested firms were set up in Jan, up 74.4% yoy.

- Exports from Japan grew by 11.9% yoy in Jan (Dec: 9.7%), as exports to China jumped by 29.2% (partly influenced by the Chinese New Year holidays) and US shipments rose by 15.6%, while imports fell by 9.6% (at a faster pace than Dec’s 6.9% drop). This moved Japan’s trade balance to a deficit of JPY 1758.3bn (Dec: surplus JPY 68.9bn).

- Japan’s flash manufacturing PMI unpredictably dropped to 47.2 in Feb (Jan: 48), the ninth month in a row of sub-50 readings. New orders and foreign sales declined while output contracted fell the most in a year.

- Manufacturing PMI in India inched up to 56.7 in Feb (Jan: 56.5), thanks to an uptick in output and new orders while business sentiment rose to the highest since Dec 2022.

- Inflation in Singapore eased to 2.9% yoy in Jan (Dec: 3.7%), the lowest reading since Sep 2021, despite the hike in GST to 9% in Jan. Food inflation slowed to a 22-month low (3.3% from 3.7%) while core inflation stood at 3.1%, a 4-month low (Dec: 3.3%).

Bottom line: Flash PMI readings were not consistent across continents – prices in Europe were rising, with respondents citing supply chain delays while the reading was more subdued in the US. Services sector PMIs have mostly been showing improvements and supporting overall numbers. A few important data releases this week, with US GDP and core PCE numbers, in addition to inflation in the eurozone and Japan. Meanwhile, the ministerial level WTO meeting started in Abu Dhabi this week, in the backdrop of increased protectionism – there was a more than twofold increase in the number of trade interventions in 2022 relative to 2021 according to the IMF – and rising geopolitical tensions.

Regional Developments

- Bahrain received investments of more than USD 1.7bn in 2023, up 55% yoy. These investments covered around 85 projects, with financial services, ICT, manufacturing, and logistics accounting for the bulk of the investments; this is estimated to generate 5700 jobs. Bahrain’s FDI stock relative to GDP is well above the global average rate, at around 82%.

- UAE announced a massive USD 35bn investment in Egypt’s Ras El Hekma peninsula: work on building the “next generation city” of over 170 square kilometres is expected to begin in early 2025. Egypt’s government will have a 35% stake in the project. The first investment will be a USD 15bn payment and the remaining funds will be invested within 2 months.

- Egypt’s President revealed that Suez Canal revenues have declined by 40-50% so far this year given the shipping disruptions. Revenues from the canal had crossed USD 10bn last year.

- Egypt’s minister of planning revealed that growth is estimated to rise to 4.2% in 2024-25 from a targeted growth of 3% this fiscal year; communication and tourism are projected to grow by 16% and 45% respectively.

- Exports from Egypt grew by 8.7% yoy to USD 3.12bn in Jan while imports fell by 40% yoy to USD 4.476bn. Top export destinations were Turkey (USD 292mn), Saudi Arabia (USD 263mn) and Italy (USD 173mn).

- Egypt expects foreign investments in the oil and gas sector to increase by 25% yoy USD 7.5bn in 2024-25, disclosed the minister of petroleum & mineral resources. He also stated that natural gas production currently stood at 5.5bn cubic feet, down 5% from its levels in 2023. Separately, BP disclosed plans to invest up to USD 1.5bn in oil exploration in the country over the next few years.

- The value of mergers and acquisitions in Egypt fell by 62% yoy to USD 3.48bn from only 139 deals executed in 2023, according to report from Baker McKenzie. Dec 2023 was the strongest month, registering 20 deals worth USD 1.6bn.

- Tourist arrivals into Egypt grew by 5% yoy in the first 40 days of 2024, despite regional tensions, according to the minister of tourism and antiquities. Egypt is set to open new 25k hotel rooms in this year, and is forecast to rise to a total of 432,000 by 2028.

- Population in Kuwait touched 4.859mn at end-2023, up 2.6% yoy, with citizens accounting for 32% of the population. Share of Indians and Egyptians stood at 21% and 13% of the population respectively.

- Inflation in Kuwait slowed to an 11-month low of 3.28% yoy in Jan (Dec: 3.37%) as transportation and communication costs eased to 2.1% and 2.6% respectively while food prices inched up to 4.8% (from Dec’s 4.7%).

- The Board of the Électricité du Liban (EDL) passed a decision to allow customers to choose to pay their bills in USD instead of Lebanese lira. However, the EDL general manager stated that this would be “contingent on the Lebanese Central Bank (BDL) permitting the unrestricted use of the soon to be collected amounts in USD”.

- Credit growth in Oman stood at a modest 4.3% yoy in 2023 alongside a 12% jump in total deposits, according to central bank data. Credit to the private sector rose by 4.7% to OMR 25.5bn, with household sector receiving the highest share of total private credit (45.2%)

- The volume of FDI into Oman jumped by 8.2% yoy to OMR 27.13bn at the end of 2022, according to NCSI data. FDI constituted 75.9% of the total foreign investment by end-2022.

- Oman’s minister of economy disclosed that a development budget of OMR 15mn had been approved for AI projects for 2025.

- Inflation in Qatar increased to 2.99% in Jan (Dec: 1.7%), the highest since Jul 2023: recreation costs surged (23.2% from 11.9%) while food prices rose the most in 17 months (5.2% from 4.6% in Dec). On a monthly basis, however, prices declined by 1.3% – the first fall in five months.

- QatarEnergy plans to further increase LNG export capacity, by a further 16mn tonnes per annum (mpta) before end-2030 taking capacity to a total of 142 mpta – up a massive 85% surge from current levels.

- Qatar’s industrial production fell by 4.2% yoy in Dec. However, in month-on-month terms, IP rose by 3.9%, supported by the 5% uptick in the mining sector.

- Saudi Arabia jumped 9 places to rank third in Kearney’s Global Retail Development Index 2023, supported by an increase in non-cash transactions and the doubling of female workforce participation. More: https://www.kearney.com/industry/consumer-retail/global-retail-development-index/2023-full-report

Saudi Arabia Focus

- Non-oil exports from Saudi Arabia grew by 12% yoy to SAR 26.5bn (USD 7.07bn) in Dec. Overall merchandise exports fell by 9.47% to SAR 98.5bn, driven by a fall in oil exports (-15.8%). China was Saudi Arabia’s top trading partner, with its exports share standing at 14.8% of the total, and was followed closely by Japan and India (SAR 10.9bn and SAR 8.7bn of exports respectively).

- Growth in Saudi Arabia is forecast to be just above 5% in the medium term, disclosed the finance minister, with non-oil GDP growth estimated at 4% and higher. The minister highlighted its economic, social, and fiscal policy reforms as the reason how the nation became “more resilient and deals with these [external] shocks”.

- Saudi minister of investment, when discussing the progress of investment targets under Vision 2030, revealed that gross capital formation has jumped to near 28% of GDP by Q3 2023 (from less than 22% when Vision 2030 was started). He also stated that yoy flows of FDI had increased to over 3% from below 1% of GDP, in line with a target of 4% by 2030.

- Tadawul’s CEO revealed that the exchange had listed 120 companies in the past three years across all markets, raising more than USD 100bn and had witnessed an increase in qualified foreign investors to more than 3700 by end-2023 from 50 in 2017. Currently, foreign investment in the Saudi financial market reached SAR 400bn or 12% of tradable shares.

- Saudi Arabia’s Capital Market Authority has received 56 IPO applications, up 30% compared to a year ago.

- Three new derivatives bourse members – Al-Rahji Capital, Alkhabeer Capital, and Aljazira Capital – are expected to start brokerage services in Saudi Arabia later this year.

- Aramco plans to issue a bond this year to optimise the firm’s capital structure, and will focus on longer maturities, according to the CFO. The company had tapped debt markets before in 2021, raising USD 6bn.

- Retail sector in Saudi Arabia contributes around 23% to the non-oil economy, and aims to surpass SAR 460bn by end-2024, according to the minister of municipal and rural affairs and housing. He also mentioned that occupancy rates in Riyadh and Jeddah’s retail sector had reached 88% in 2023, and around 70k retail sector licenses had been issued annually.

- The entertainment sector in Saudi Arabia now boasts 4,000 companies from fewer than 10 since the launch of Vision 2030, according to General Entertainment Authority CEO. The media sector contributed SAR 14.5bn to GDP last year, with an aim of SAR 16bn this year.

- PIF-owned entity Alat announced a USD 200mn partnership with Dahua Technology (a Chinese surveillance technology & equipment maker firm) to manufacture surveillance hardware in Saudi Arabia. Alat also revealed a USD 150mn partnership with Japan’s SoftBank Group to manufacture advanced robotics in Saudi.

- Saudi Arabia’s funding for regional projects. The Saudi Fund for Development signed a USD 55mn funding agreement with Tunisia for the renovation and development of the phosphate transport railway.

- Small businesses with less than 9 workers in Saudi Arabia have been given an extended three years to pay their financial fees as per a Cabinet decision, in a bid to boost the SME sector.

UAE Focus![]()

- UAE and Kenya concluded a comprehensive economic partnership agreement (CEPA), disclosed the minister of foreign trade. Bilateral trade between the two nations touched USD 3.1bn in 2023, up 26.4% yoy.

- UAE was removed from the Financial Action Task Force (FATF) “grey list” – countries that are at risk of illicit money flows – after being placed under scrutiny in 2022. This will increase investor trust and confidence, leading to an increase in more sustainable capital, FDI and portfolio flows. Another major beneficiary will be the asset and wealth management activities of UAE-based family offices.

- Dubai’s non-oil foreign trade has reached AED 2trn in 2023, a year earlier than planned. Under the Economic Agenda D33, the new target for total volume of foreign trade is AED 25.6trn over the next decade.

- UAE’s food & beverages sector attracted new FDI worth USD 577mn between 2019-2023, according to fDi Intelligence. This came from 48 international firms in 23 nations. A Euromonitor report found that consumer spending on food via e-commerce platforms stood at USD 1.1bn in 2023 and is expected to rise at a CAGR of 9.5% between 2023 and 2027.

- About 67,222 new companies joined Dubai Chamber as members in 2023, up 20% yoy. The number of active members of the Chamber grew to 217,788 (+26.8%) while value of members exports and re-exports rose by 4.3% to over AED 284bn. The chairman of Dubai Chambers predicted that Dubai would grow by around 5% this year.

- Dubai property market recorded a strong 2023, with the volume of deals rising by 30% to a record-high 118,993 transactions, according to a CBRE report; however, off-plan sales tumbled by 69.7% in Dec. Transactions related to luxury homes (AED 5mn+ worth) or super-prime properties (AED 10mn+) fell by 15.5% and 3.1% yoy to 1968 and 1003 respectively.

- FT reported that the proposed USD 30bn merger between ADNOC and the Austrian oil and gas firm OMV have stalled given disagreements including the name of the merger unit.

- There was a 216% yoy increase in the use of digital signatures in the UAE last year, supported by the government’s efforts to accelerate the adoption of digital solutions. Blockchain use has also gained prominence: nine banks, six exchange houses and three insurance companies have adopted the technology.

- Dubai Electricity and Water Authority (Dewa) and Abu Dhabi’s Masdar have achieved the financial closing of the 1,800MW sixth phase of the Mohammed bin Rashid Al Maktoum Solar Park. This phase is expected to provide clean energy for 540k residences and reduce emissions by around 2.4mn tonnes of carbon a year.

- Dubai International Airport expects to welcome 88.8mn passengers this year, up 2.1% yoy – this would still be below the record-high 89.1mn clocked in during 2018. Separately, the CEO of the Dubai Corporation for Tourism and Commerce Marketing expects the number of tourists to surpass the 17.15mn visitors received in 2023.

Media Review

UAE’s removal from Financial Action Task Force’s grey list (with Dr. Saidi’s comments)

https://www.thenationalnews.com/business/economy/2024/02/24/uaes-removal-from-financial-action-task-forces-grey-list-to-spur-investor-confidence/

Stock markets are booming. But the good times are unlikely to last

https://www.economist.com/finance-and-economics/2024/02/25/stockmarkets-are-booming-but-the-good-times-are-unlikely-to-last

Saving America’s future from the Blob

https://asiatimes.com/2024/02/saving-amercas-future-from-the-blob/

Which AI risks matter?

https://www.project-syndicate.org/onpoint/ai-risk-management-navigating-myths-and-realities-by-edoardo-campanella-2024-02

Megaprojects in the Desert Sap Saudi Arabia’s Cash

https://www.wsj.com/world/middle-east/megaprojects-in-the-desert-sap-saudi-arabias-cash-45478ce5

Powered by: