Download a PDF copy of the weekly economic commentary here.

Markets

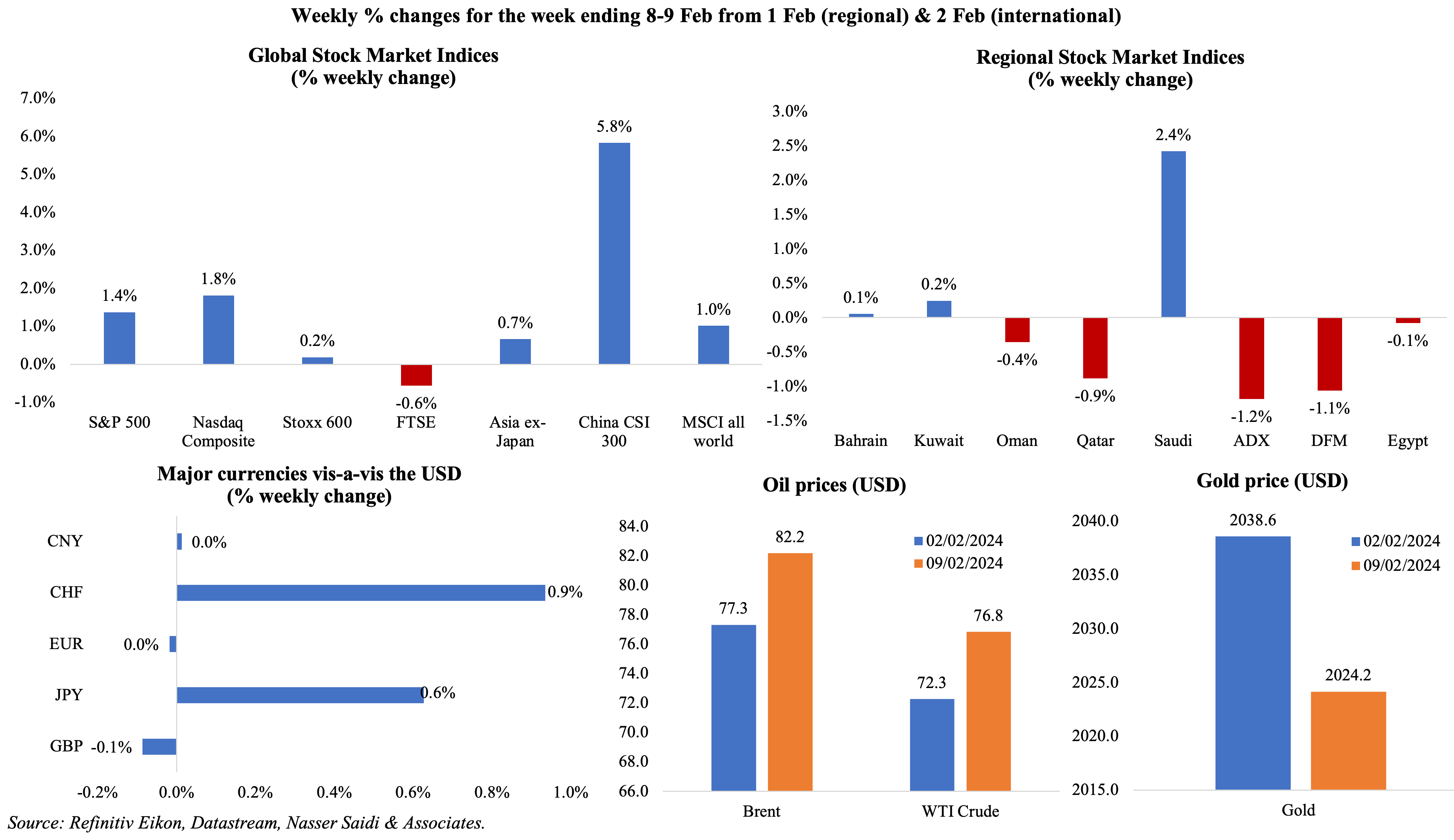

Most equity markets gained last week: S&P 500 touched the 5000-mark for the first time, Nikkei jumped to a 34-year high (previous record in Dec 1989) on weaker yen and China CSI ticked up (strongest week in 15 months) after intervention from the government. In the region, Saudi posted the maximum gain during a mixed week: markets were optimistic given the ceasefire proposal, but this was short-lived after Israel rejected the offer. On a related note, oil prices posted a weekly gain (following last week’s 7% drop) also as worries increased about tighter oil supply. Among currencies, yen fell to a 10-week low before recovering later in the week while safe-haven currency Swiss franc weakened (to 0.874; dollar was up 0.9% on the CHF). Gold price reported a weekly fall.

Global Developments

US/Americas:

- US trade deficit narrowed by 18.7% yoy to USD 773.4bn in 2023 – the sharpest decline since 2009. Goods and services trade deficit widened to USD 62.2bn in Dec (Nov: USD 61.9bn) while goods trade deficit alone widened to USD 89.1bn in Dec (Nov: USD 88.5bn).

- S&P Global’s composite PMI increased to 52 in Jan (Dec: 50.9), thanks to an uptick in services PMI to 52.5, the fastest in 7 months (but lower than the preliminary reading of 52.9). New orders and strong demand conditions supported the higher readings.

- ISM services PMI in the US increased in Jan, to 53.4 (Dec: 50.5), thanks to a rise in new orders (55 from 52.8), employment (50.5 from 43.8) while prices paid jumped to 64 (the highest since Feb, and from Dec’s 56.7).

- Initial jobless claims fell by 9k to 218k in the week ended Feb 2nd, falling for the first time in 3 weeks, and the 4-week average rose by 3.75k to 212.25k. Continuing jobless claims declined by 23k to 1.871mn in the week ended Jan 26th.

Europe

- Composite PMI in the Eurozone reached a 6-month high of 47.9 in Jan (Dec: 47.6), though the rate of decline was the slowest since Jul. Services PMI ticked lower to 48.8 (Dec: 48.8), the sixth consecutive month in a row of contraction, as output dropped alongside increases in both input and output inflation.

- Eurozone posted a decline in producer price indices in Dec, falling by 10.6% yoy and 0.8% mom. Energy prices fell by 27.5% yoy while prices slowed for capital goods (2.8% from 3.1%), durables (3% from 3.5%) and non-durables (3.2% from 3.6%).

- Retail sales in the Eurozone fell by 0.8% yoy (15th consecutive month of yoy decline) and 1.1% mom in Dec (Nov: -0.4% yoy and +0.3% mom). Sales of food, drinks and tobacco fell for the third month in a row (by 1.6% mom) and online trade plunged by 3.7% (the largest fall since Jul 2021).

- Sentix consumer confidence in the Eurozone improved in Feb, rising to -12.9 from Jan’s -15.8 reading. Both current situation and expectations indices rose to -20 and -5.5 in Feb (Jan: -22.5 and -8.8 respectively).

- Germany’s composite PMI slipped to 47 in Jan (Dec: 47.4), with services PMI inching up to 47.7 (Dec: 49.3). Services PMI posted the fastest decline in 5 months while costs rose at the fastest rate for eight months amid concerns about recession and geopolitical tensions.

- Industrial production in Germany declined further by 1.6% mom and 3% yoy in Dec (Nov: -0.2% mom and -4.3% yoy). The auto industry output ticked up by 4% mom, as did capital goods and energy (1.3% and 4.1% respectively).

- German factory orders unexpectedly rebounded in Dec, rising by 2.7% yoy (Nov: -4.7%); orders also rose by 8.9% mom in Dec, the largest uptick since Jun 2020, largely from a surge in plane orders. Domestic and foreign orders grew by 9.4% an 8.5% respectively. For the full year 2023, orders fell by 5.9% yoy.

- Exports from Germany declined by 4.6% mom in Dec, with exports to EU countries falling by 5.5%. Imports fell by 6.7%, thereby widening surplus to EUR 22.2bn (Nov: EUR 20.7bn). Exports declined by 1.4% yoy in 2023 while imports plunged at a much faster pace of 9.7%.

- UK’s composite PMI moved up to an 8-month high of 52.9 in Jan (Dec: 52.1), thanks to the gains in services PMI (to 54.3 from 53.4). Services PMI’s uptick can be traced back to strong readings in new orders and employment (a 6-month high)

Asia Pacific:

- China is facing deflationary pressure with prices falling for the fourth month in a row in Jan (-0.8% from Dec’s -0.3%), also posting the steepest decline since Sep 2009. In mom terms, prices gained by 0.3% (Dec: 0.1%), but partly due to the upcoming Lunar New Year holidays. Producer price index fell 2.5% (Dec: -2.7%), given lower energy prices and subdued domestic demand.

- China’s Caixin services PMI edged down to 52.7 in Jan (Dec: 52.9), though remaining expansionary for the 13th straight month. New export orders rose for the fifth month in a row and the employment increased.

- Money supply (M2) in China grew by 8.7% yoy in Jan (Dec: 9.7%). New loans surged to a record monthly high of CNY 4.92trn in Jan (Dec: CNY 1.17trn; Jan 2023: CNY 4.9trn). Loans jumped 6.8% yoy to a record high CNY 22.75trn in 2023.

- Overall household spending in Japan fell by 2.5% yoy to JPY 329,518 in Dec (Nov: -2.9%). Labour cash earnings (nominal pay) grew by 1% yoy in Dec, following the 0.7% gain in Nov while real wages fell for the 21st consecutive month.

- Preliminary leading economic index in Japan increased to 110 in Dec (Nov: 108.1), the highest since Oct 2022 and consumer confidence rose to the highest since Dec 2021. Coincident index increased to 116.2, the highest since Sep 2019, and from Nov’s 114.6.

- Current account surplus in Japan nearly doubled to JPY 20.6trn in 2023, thanks to a narrowing in trade deficit (more than halved to JPY 6.63trn) and primary income rose to JPY 34.56trn – the highest since data became available in 1985.

- The Reserve Bank of India kept the repo rate unchanged for the sixth time, at 6.5%, and left the reverse repo at 3.35%. GDP growth has been projected at 7% for the next financial year 2024-25 while inflation is forecast at 4.5% (from an estimated 5.4% in the current year).

- Retail sales in Singapore fell by 1.5% mom and 0.4% yoy in Dec: 10 of the 14 categories posted declining yoy sales.

Bottom line: The latest PMI data had businesses confirming that conflicts in the Red Sea are leading to longer delivery times and higher shipping costs. But, even then, many emerging markets posted faster expansion while European markets seem to be more affected by the disruptions. The JP Morgan Global PMI Composite Output Index rose to 51.8 in Jan (Dec: 51.0), consistent with an annualized quarterly global GDP growth of approximately 1.8%, according to S&P Global. For now, 2024 being an election year, with multiple wars and high interest rates seem to have had little impact on growth prospects. This week’s inflation data (from the US) and GDP updates (UK, Japan) will provide additional perspective on where the global economy is headed.

Regional Developments

- Inflation in Egypt slowed sharply to a 1-year low of 29.8% yoy in Jan (Dec: 33.7%), with food prices up by 47.5% (Dec: 60.5%). In month-on-month terms, prices rose by 1.6% (Dec: 1.4%), as the various price hikes – metro, electricity, internet services – took effect. Core inflation slipped to 29% (Dec: 34.2%).

- PMI in Egypt inched lower to 48.1 in Jan (Dec: 48.5), remaining contractionary for the 38th month in a row amid weak demand. New orders fell the most since May 2023 while input and output costs were at 1-year highs, given import restrictions and currency weakness. Forward looking sentiment plunged to the lowest in the series history. Potential devaluation and IMF-suggested structural reforms would likely bring further distress (before seeing the positive effects).

- Egypt raised the monthly minimum wage by 50% to EGP 6,000 (USD 194): this will come into effect in Mar, as part of an “urgent social protection package” valued at EGP 180bn.

- Trade deficit in Egypt narrowed to USD 36.908bn in 2023 (2022: USD 48.66bn), as exports touched USD 35.63bn while imports fell by 14% yoy to USD 72.539bn.

- Net foreign reserves in Egypt ticked up slightly to USD 35.25bn in Jan 2024 from USD 35.21bn in Dec, according to the central bank. However, Egypt’s net foreign assets touched a negative EGP 841.39bn in Dec (Nov: -EGP 831.92bn).

- Suez Canal revenues fell to USD 428mn in Jan, down by 46.7% yoy, as the number of vessels passing through declined sharply to 1362 (Jan 2023: 2155). Separately, the finance minister disclosed that the Red Sea conflict’s impact on Suez Canal revenues can be partly absorbed given growth prior to the recent attacks.

- Egypt plans to establish 11 freezones of roughly 150 acres each across various newly-built cities (like in Upper Egypt), in a bid to attract FDI and raise industrialisation.

- PMI in Lebanon inched up to 49.4 in Jan (Dec: 48.4), with businesses pointing to the domestic political and economic landscape as impeding output and sales while employment was steady. With limited impact of the conflict in Gaza, and stable exchange rates, business confidence was higher than the average in the past four years.

- Oman’s trade surplus narrowed to OMR 6.997bn (USD 17.9bn) as of end-Nov from OMR 9.59bn a year ago. Exports fell by 11.4% to USD 20.64bn in Nov, while imports inched down by 0.5% to OMR 13. 64bn. Its top non-oil export partner was Saudi Arabia (OMR 981mn) while UAE was the largest re-exports and imports partner (OMR 465mn and OMR 3.6bn respectively).

- Production and imports of natural gas in Oman rose by 3.6% yoy to about 53.92 cubic metres at end-Dec 2023. About 58.7% of natural gas use can be traced to industrial projects.

- Oman welcomed close to 4mn tourists in 2023 and was ranked among the top 20 global destinations last year by the World Travel and Tourism Council (WTTC). The WTTC expects Oman’s tourism sector to post an annual growth of 7.4% from 2023 to 2027.

- Qatar PMI moved up to 50.4 in Jan (Dec: 49.8), thanks to expansions in output, new orders and employment, while alsosupported by tourism related to the AFC Asian Cup. The 12-month business outlook strengthened, largely due to the uptick in demand.

- Foreign reserves in Qatar grew by 5.26% yoy to QAR 246.04bn (USD 67.58bn) in Jan, largely due to an increase in balances held in foreign banks, accounting for around 11% of the official reserves.

- Qatar received over 519k visitors in Dec, up 31.9% mom, with visitors from the GCC accounting for one-third of the total (or171,035).

- QatarEnergy and India’s Petronet signed a 20-year LNG supply agreement for the annual purchase of 7.5mn tonnes. The contracted volumes will be delivered starting May 2028.

- Phasing out explicit energy subsidies in the MENA region could save USD 336bn – equivalent to Iraq’s and Libya’s economies combined – revealed the IMF’s head at the World Governments Summit event, also highlighting Egypt, Jordan and Morocco as successful cases.

- MENA region saw 48 IPOs in 2023, generating USD 10.7bn in proceeds, according to the EY MENA IPO Eye Q4 2023 report. Five listings, within the energy and logistics sectors, accounted for 58% of the total IPO proceeds raised. Q4 saw 19 IPOs raising USD 4.9bn.

- MENA start-ups raised USD 86.5mn in Jan (Dec: USD 1.15bn), with UAE topping the list – with 10 deals amounting to USD 47mn.

- Public expenditure in Arab countries grew by 9.8% yoy to USD 957.5bn in 2022, according to a report from the Arab Monetary Fund. While capital expenditures grew by 3.6% to USD 132.5bn in 2022, Arab countries reported a fiscal surplus of USD 119.6bn in 2022, in contrast with a USD 62.5bn deficit in 2021.

Saudi Arabia Focus

- Saudi Arabia’s PMI declined to 55.4 in Jan (Dec: 57.5), the lowest since Jan 2022, as demand weakened amid cost pressures while export orders fell for the fourth time in 6 months (to 60.5 from Dec’s 68.3). Purchasing costs rose at the fastest pace since May 2012 and input costs rose to the highest since Aug 2020, given higher shipping costs and material prices alongside a rise in staff costs.

- Saudi Arabia’s overall exports tumbled by 15.6% yoy and 9% mom to SAR 94.98bn in Nov, partly due to the drop in oil exports (-19.4% yoy). Non-oil exports (excluding re-exports) also fell by 5.5% yoy to SAR 17.8bn (close to 20% of total exports) while re-exports, which accounts for 5.1% of total exports, grew by 21.8%. Overall trade surplus narrowed for a second month in Nov, to SAR 27.8bn, from Oct’s SAR 30.4bn. It plunged by 58% in yoy terms. China was the top trade partner in Nov: accounting for 17% of overall exports and 25% of total imports.

- Industrial production in Saudi Arabia fell by 10.5% yoy in Dec, falling for the 8th consecutive month, though slowing from Nov’ 11.2% drop. Mining & quarrying production declined (by 14.3% vs Nov’s 15.8% fall), and so did manufacturing (-3.3%).

- The Saudi minister of investment stated that investment opportunities in the country will exceed USD 3.3trn by end-2030. The economy is expected to grow to SAR 6.4trn (USD 1.7trn) by 2030, in line with the Vision 2030 target. Of this, close to 2/3-rds of GDP is expected to come from the private sector (3-4 times the contribution prior to the Vision).

- Fitch affirmed Saudi Arabia’s A+ rating with a stable outlook, based on its strong fiscal and external balance sheets.

- Saudi PIF and its portfolio firms attracted SAR 96bn (USD 25.6bn) worth investments in 3 years, according to the PIF’s governor.

- Saudi minister of tourism disclosed that the country welcomed over 100mn tourists in 2023 – of which 77mn were domestic tourists and 27mn from abroad – thereby crossing the 2030 target set in Vision 2030; together, the tourists spent an overall SAR 100bn (USD 26.67bn). Saudi also plans to add 250k hotel rooms by 2030 (vs 280k rooms at end-2023), with the private sector building about 75k of them; approximately 12 resorts on the Red Sea are scheduled to open in a year and a half.

- Private sector employees in Saudi Arabia reached a record-high of 11.054mn in Jan, with Saudi citizens standing at 2.327mn (with women accounting for 40% of the total).

- Saudi Arabia Railways (SAR) transported more than 11 million passengers in 2023, up more than 50% yoy while cargo transported jumped by 10%+ to 25mn tonnes. Separately, SAR signed a USD 690.16mn contract with Swiss manufacturer Stadler for 10 “next generation” passenger trains.

- Aramco plans to announce investments in Indian companies “soon” given ongoing discussions, disclosed a senior Aramco official during an energy conference in India.

- Saudi Arabia signed agreements with US weapons firm Lockheed Martin to manufacture parts of its missile defence system.

UAE Focus![]()

- UAE’s PMI slipped to a 5-month low of 56.6 in Jan (Dec: 57.4) as both output and new orders softened, though remaining above long-run trends. Firms also mentioned higher shipping costs, material prices and salary adjustments raising expenses amid greater competition (to attract new consumers and increase sales).

- Dubai PMI edged lower to 56.6 in Jan (Dec: 57.7): while output and new orders expanded thanks to strong demand, growth in the latter slipped to a 5-month low. Firms highlighted shipment delays (due to the Red Sea disruptions) and greater competition has resulted in a fall in business expectations (the lowest since Dec 2022, with only 10% of respondents expecting a rise in output).

- Non-oil trade in Dubai crossed AED 2trn (USD 544bn) last week, according to a tweet from the Ruler of Dubai. This was a target to be achieved by 2025, announced back in Jan 2020.

- UAE’s Ministry of Finance disclosed that UAE’s free zone corporate tax regime has been recognised as ‘non-harmful’ by the OECD. A decision on the UAE’s grey list status is expected to be made on Feb 23.

- UAE’s central bank disclosed that the UAE froze assets valued at AED 452.5mn (USD 123mn) in 2022. The bank also conducted “freeze orders” targeting 38 individuals and 41 corporate entities across nine separate cases. No data was released for 2023.

- Dubai touched a record-high 17.15mn international visitors 2023: this was up 19.4% yoy & 2.5% higher compared to the previous record of 16.73mn in 2019. Regional composition of tourists broadly unchanged: the GCC & MENA together accounted for 27% of visitors in 2023 (similar to 2019) while Western Europe and South Asia accounted for the largest shares at 19% and 18% respectively. Average occupancy for Dubai’s hotels stood at 77.4% in 2023, up from 72.9% in 2022 and exceeding 2019’s 75.3% reading.

- UAE’s ADIA plans to set up a USD 4-5bn fund to invest in India via the Gujarat International Finance Tec-City, or GIFT City, reported Reuters. The fund has already been granted in-principle approval by the authorities in India.

- Real estate transactions in Dubai rose to 166,400 in 2023 with a total value of AED 634bn (USD 172.61bn). Real estate investments grew by 55% yoy to AED 412bn in 2023 by 113,655 investors (71k were new entrants); non-resident investors rose to 42% of total new investors.

- Dubai Multi-Commodities Centre (DMCC) reported a 10% increase in US companies setting in the free zone to 679 in 2023: this accounts for 45% of the 1500 US firms in the UAE.

- AD Ports investments in regional projects: an agreement was signed for bulk and general cargo operations with the Karachi Port Trust, with USD 150mn allocated for port expansion; another deal was to transform Jordan’s Aqaba port by supporting the digitalisation of operations within a year.

- Dubai recorded a 59% yoy increase in electric vehicle (EV) charging sessions to 1,145,427 in 2023. The number of EV owners stood at around 13,959 by end-Dec while number of EVs rose to 25,929.

- Abu Dhabi will develop an industrial complex for green hydrogen in partnership with UK’s Hycap (an asset manager that funds net zero projects). The facility will include an electrolysis plant, hydrogen storage and tankers for transport.

Media Review

Saudi Arabia poised for new Aramco share sale

https://www.reuters.com/business/energy/saudi-arabia-poised-new-aramco-share-sale-sources-2024-02-08/

Seeding Fiscal Transformation in the Arab World: IMF speech at the 8th Annual Arab Fiscal Forum

https://www.imf.org/en/News/Articles/2024/02/11/sp-md-eighth-annual-arab-fiscal-forum

The 2024 Democracy Test

https://www.economist.com/international/2024/02/11/the-2024-democracy-test

Powered by: