Markets

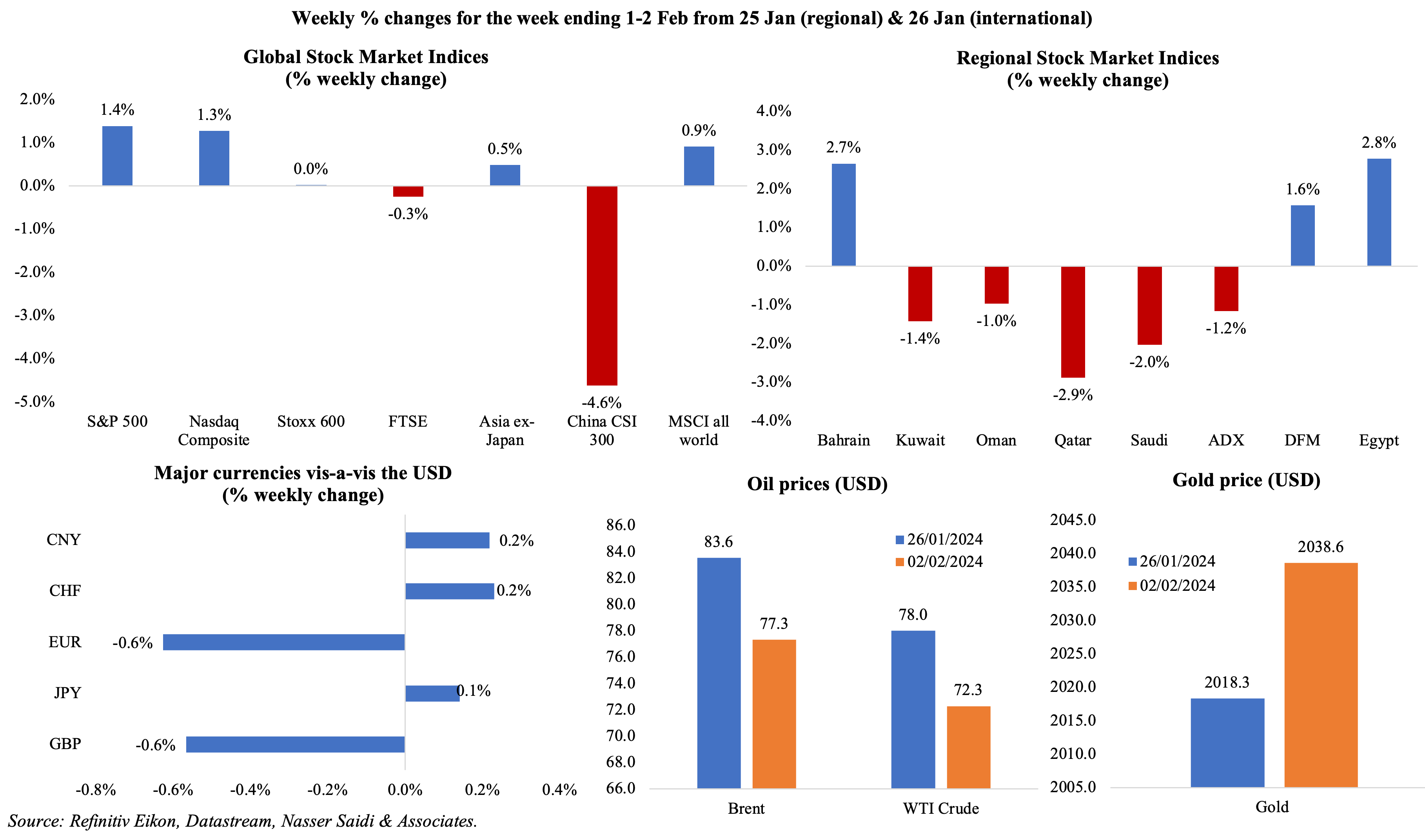

Most major equity markets posted a weekly gain last week except for China’s CSI300 (which saw a rampant sell-off after Evergrande Group’s insolvency proceedings and as investors’ remained unconvinced of stimulus measures) and UK’s FTSE. US markets were supported by robust earnings reports (80% of S&P 500 listed firms have come above expectations) and labour market indicating continued strong growth, while Stoxx touched 2-year highs before declining later in the week. Regional markets were mostly down with geopolitics tensions hurting investor sentiment; Egypt’s discussions with the IMF are ongoing and announcements of additional funding are expected. The dollar gained after Friday’s strong jobs report, while oil prices fell by more than 7% for the week (given uncertain growth in China and expectations of high interest rates for longer) and gold price gained 1%.

Global Developments

US/Americas:

- US Fed held the benchmark federal funds rate unchanged at between 5.25%-5.5% for the fourth meeting in a row, with Powell issuing a caution on inflation (“we are not declaring victory”). Earlier in the week, the Treasury announced that it would increase the size of auctions to fill the widening federal budget deficit. The five-year auction in Apr, for USD 70bn, would be the biggest ever for debt with a maturity of two years or more.

- Non-farm payrolls expanded by 353k in Jan (Dec: 333k), led by professional and business services (74k), healthcare (70k) and retail trade (45k) among others. Average hourly earnings inched up by 0.6% mom (Dec: 0.4%) and labour force participation rate remained unchanged at 62.5%. Unemployment rate stood pat at 3.7%.

- Private sector in the US added 107k jobs in Jan (Dec: 158k), with the services sector accounting for around 77k jobs.

- JOLTS job openings unexpectedly increased to a 3-month high of 9.026mn in Dec (Nov: 8.925mn) while resignations fell 132k to 3.392mn (the lowest since Jan 2021). There were 1.44 positions for every unemployed person, down from 2 jobs in Mar 2022.

- Initial jobless claims rose by 9k to 224k in the week ended Jan 26th, the highest since Nov, and the 4-week average rose by 5.25k to 207.75k. Continuing jobless claims rose by 70k to 1.898mn in the week ended Jan 19th, also the highest since Nov.

- Non-farm productivity grew at a 3.2% annualised rate in Q4 (Q3: 4.9%). Productivity growth averaged 1.2% in 2023 after contracting 1.9% in 2022. Unit labour costs rebounded by 0.5% in Q4 (Q3: -1.1%). Growth in unit labour costs averaged 2.9% in 2023, slowing from 5.6% in 2022.

- US employment cost index edged up by 0.9% in Q4 (Q3: 1.1%), the smallest quarterly gain since Q2 2021.

- Factory orders in the US inched up moderately, by 0.2% mom in Dec (Jan: 2.6%). Orders rose for electrical equipment, appliances & components (1.4%) and orders for motor vehicles, parts and trailers (0.9%) while orders for transportation equipment declined by 0.9%.

- ISM manufacturing PMI rose to 49.1 in Jan (Dec: 47.1), the highest since Oct 2022, supported by an increase in new orders (52.5 from 47) and production (50.4 from 49.9) while employment slipped (to 47.1 from 47.5) and prices paid rose (51.9 from 45.2).

- S&P Global manufacturing PMI in the US stood at 50.7 in Jan (Dec:47.9), the highest since Sep 2022, as new orders expanded amid a slower contraction in output while employment increased for the first time since Sep 2023.

- Michigan consumer sentiment index moved up to a final reading of 79 in Jan (Dec: 69.7), the highest level since Jul 2021. The year-ahead inflation expectations eased (to 2.9% from 3.1% in Dec) while the 5-year inflation expectation rose to 2.9% (Dec: 2.8%).

- Dallas Fed manufacturing business index plunged to an 8-month low of -27.4 in Jan (Dec: -10.4).

- S&P Case Shiller home prices fell by 0.2% mom in Nov, the first monthly drop since Jan 2023. In yoy terms, the 20-city composite showed prices were up by 5.4% yoy (Oct: 4.9%).

Europe

- Flash estimates show that GDP in the eurozone avoided a recession in Q4, as it stayed flat compared to a quarter ago (Q3: -0.1%). Spain and Italy grew by 0.6% and 0.2% respectively while France stalled. Q4 growth inched up by 0.1% yoy, bringing growth to 0.5% in 2023.

- GDP in Germany fell by 0.3% qoq in Q4, with gross fixed capital formation declining significantly. Germany contracted by 0.2% yoy in Q4, entering a technical recession for the first time since 2020-21.

- Inflation in eurozone inched lower to 2.8% yoy in Jan (Dec: 2.9%), with energy prices falling (-6.3% from -6.7% in Dec) while services inflation was steady at 4%. Core inflation eased to 3.3% from 3.4% in Dec.

- Eurozone’s manufacturing PMI rose to a 10-month high of 46.6 in Jan (Dec: 44.4), with both output and new orders experiencing smaller declines while employment fell for the eighth month in a row.

- Economic sentiment indicator in the eurozone eased to 96.2 in Jan (Dec: 96.3). Consumer confidence fell to -16.1 (Dec: -15.1) while business climate improved by 0.1 point to -0.4.

- Harmonised index of consumer prices in Germany eased to 3.1% yoy in Jan (Dec: 3.8%), the lowest rate since Jun 2021. Energy costs fell by 2.8% while food inflation eased (to 3.8% from 4.5%). Core inflation slowed to 3.4% in Jan, the lowest reading since Jun 2022.

- Manufacturing PMI in Germany improved to an 11-month high of 45.5 in Jan (Dec: 43.3), as the output index stood at an 8-month high of 45.7 and new orders contracted for the 22nd consecutive month.

- Retail sales in Germany declined by 1.6% mom and 1.7% yoy in Dec. In month-on-month terms, food and non-food retail sectors fell by 2.8% and 1.6% respectively. For the full year 2023, retail sales fell by 3.3% yoy from a 0.7% drop the year before.

- Unemployment rate (seasonally adjusted) in Germany held steady at 5.8% in Jan; the number of unemployed individuals fell by 2k to 2.694mn. Unemployment rate in the euro area was unchanged at 6.4% in Dec, with youth unemployment rate slipped to 14.4% (Nov: 14.5%).

- The Bank of England held interest rates unchanged at 5.25%. While two persons in the Committee voted for a hike and 1 for a rate cut, the governor indicated that the Bank would wait for evidence of inflation being under control before discussing cutting rates.

- Manufacturing PMI in the UK inched up to a 9-month high of 47 in Jan (Dec: 46.2): export sales declined amid weaker demand, and higher ocean freight rates led to higher costs.

Asia Pacific:

- China’s manufacturing PMI inched up to 49.2 in Jan (Dec: 49), remaining in contractionary territory for the 4th month in a row, with below-50 readings across new orders (49 from 48.7), foreign sales (47.2 from 45.8) and employment (47.6 from 47.9) fell further in Jan. Non-manufacturing PMI rose to 50.7 (Dec: 50.4), posting the 13th straight month of expansion, in spite of a fall in new orders and foreign sales to 47.6 and 45.2 respectively.

- Caixin manufacturing PMI in China was steady at 50.8 in Jan, with output stable alongside foreign sales growing for the first time in 7 months. Sentiment rose to a 9-month high.

- Industrial production in Japan rebounded in Dec, rising by 1.8% mom (Nov: -0.9%), the strongest uptick since Jun. In yoy terms, IP fell by 0.7% (Nov: -1.4%).

- Retail trade in Japan grew by 2.1% yoy in Dec (Nov: 5.4%) with automobile sales growing the most (6.6%) while machinery & equipment sales were up by 5.3%. Large retailer sales grew by 3% yoy, slower than Nov’s 4% gain.

- Unemployment rate in Japan slipped to 2.4% in Dec (Nov: 2.5%). Jobs to applicants ratio eased to 1.27 (Nov: 1.28) meaning there were 127 job openings for every 100 job seekers.

- Manufacturing PMI in Japan rose slightly to 48 in Jan (Dec: 47.9), posting the 8th month in a row of sub-50 readings, as new work shrank and lower demand from China and wider Asia-Pacific led to export sales drop. Output charges meanwhile rose the least since Jun 2021.

- India’s interim budget, ahead of the general elections in Apr-May, focused on infrastructure building with over USD 130bn allocated to roads and ports (+11% yoy, but much lower compared to the nearly three-fold annual increases seen since 2019). The government aims to reduce fiscal deficit to 5.1% of GDP in 2024-25 (from 2023-24’s 5.8% gap).

Bottom line: The IMF’s World Economic Outlook update has forecast global growth to remain steady at 3.1% in 2024 (2023: 3.1%), and then inch up to 3.2% in 2025. This remains lower than the historical average of 3.8% in 2000-19. Many emerging market economies are showing resilience (e.g., India, Brazil, Mexico) though China’s weak consumption and investment patterns could slow growth. Most central banks have pushed back against imminent rate cuts, preferring to closely monitor data points such as inflation to get back to target levels. Strong US jobs data last week has also lowered expectations of rate cuts soon. Meanwhile, global PMI data reflected the impact of disruptions in the Red Sea, with manufacturing supply chains lengthening for the first time in a year in Jan 2024; however, delays and any impact on prices have been lower than during the pandemic peak (for now).

Regional Developments

- The IMF (in its latest World Economic Outlook report) lowered Middle East and North Africa growth forecast to 2.9% in 2024, from Oct 2023’s projection of 3.4%, given the oil production cuts and impacts of the conflict in Gaza on tourism and trade. The drag from oil production cuts is expected to fade in 2024 and non-oil growth in the GCC will support the uptick in growth to 2.7% (2023: 0.5%).

- Egypt unexpectedly raised interest rates by 200bps: the deposit and overnight lending rates were hiked to 21.25% and 22.25% respectively, suggesting another devaluation in the offing, as IMF negotiations make progress on the policy and financing package. The IMF lowered its growth forecast for this fiscal year to 3% (from the 3.6% projection in the previous WEO) Separately, various Egyptian new outlets reported that the staff level agreement reached with the IMF is for a loan 2-3 times bigger than the existing USD 3bn deal.

- Egypt’s cabinet approved the removal of many tax and fee exemptions for state-owned enterprises, one of the conditions the IMF had put forward in the agreement signed in Dec 2022. It was clarified that the new regulations “apply to all investment or economic activities undertaken by state agencies” though not applicable to “military work”. The cabinet also approved a 15% reduction in the budget’s investment plan for the current fiscal year, prioritising projects that are 70% or more complete and not starting new projects.

- According to the PM, Egypt is looking to raise the private sector’s contribution to the state’s total investments to 65%.

- Egypt plans to issue bonds in various currencies – including the UAE dirham, Indian rupees and Hong Kong dollars – in a bid to diversify its debt portfolio and funding sources as well as “attract international investors at low financing costs”, revealed the finance minister.

- Kuwait expects to post a second consecutive year of deficit as per the 2024-25 budget: deficit is estimated to narrow to KWD 5.9bn from a shortfall of KWD 5.8bn in the previous budget. Oil revenues are estimated to decline by 5.4%compared to the 2023-24 budget, while non-oil revenues see a slight uptick (5.7%). Expenditures are projected to fall by 6.6% to KWD 24.56bn (compared to the 2023-24 budget), dragged down by capex spending (-7.7% to KWD 2.3bn) while subsidies fell sharply (-21.5% to KWD 4.67bn).

- Non-oil exports from Kuwait declined by 29.6% yoy to KWD 254.4mn in Jan-Nov 2023. Overall exports fell by 18.7% to KWD 19.35bn in Jan-Sep 2023 while imports ticked up by 7.5% (to KWD 8.64bn) causing the surplus to narrow to KWD 10.716bn from Jan-Sep 2022.

- Passenger traffic at Kuwait’s international airport rose by 26% yoy to 15.6mn in 2023 while aircraft were up by 23% to 128,584 flights. A new terminal being built at the airport is estimated to triple the capacity to 25mn passengers a year.

- Moody’s upgraded Qatar’s credit rating to AA2 and revised its outlook to stable, citing the improvement in its financial metrics and expectation of financial prudence going forward.

- Qatar PPI fell by 0.21% mom and 12.94% yoy in Dec: among the components, manufacturing PPI declined by 2.19% mom and 11.61% yoy in Dec.

- Exports from Qatar fell by 23.7% yoy to QAR 29.2bn in Dec, largely due to lower exports of hydrocarbon products: China, India and South Korea were the top export destinations. Trade surplus stood at QAR 18.7bn in Dec, though narrowing by 33.7% yoy.

- QatarEnergy awarded contracts worth USD 6bn for the third development phase at Al Shaheen, its largest oilfield. The third phase should see the production of 550mn barrels of oil over 5 years, with the first oil expected in 2027.

- South Africa’s foreign minister revealed at a news conference that Egypt, Ethiopia, Iran, Saudi Arabia and UAE confirmed plans to join the BRICS bloc after being invited last year. However, a Saudi official later commented that the invite is still “under consideration”.

- An UNCTAD report stated that if reconstruction efforts were to start immediately after military operations ended and an annual average growth rate of 0.4% was projected (trend seen in 2007-22), Gaza could restore pre-conflict GDP levels in 2092. More: https://unctad.org/publication/preliminary-assessment-economic-impact-destruction-gaza-and-prospects-economic-recovery

- Saudi Arabia will witness a 105% surge in average wealth per person in the next decade, from the current USD 54,000, according to Henley & Partners BRICS Wealth Report. Average wealth per capita in the UAE is expected to rise by 95% by 2033 while Egypt is projected to grow by 55%. Saudi and UAE are currently home to 58,300 and 116,500 millionaires respectively (+32% and 77% growth since 2013).

- Japan imported 36.28mn barrels (or 44% of total imports) of oil from Saudi in Dec 2023, with UAE, Kuwait and Qatar shares at 33.9%, 7.2% and 4.2% of total imports respectively.

Saudi Arabia Focus

- Saudi Arabia’s real GDP contracted by 3.7% in Q4 2023, the second consecutive quarter of declines, largely owing to the sharp plunge in oil sector activity (-16.4% in Q4 from Q3’s 17.0% drop).Non-oil sector growth ticked up by 4.3% in Q4 (Q3: 3.5%); growth also supported by government spending which was up 3.1% (Q3: 1.9%). Overall GDP for 2023 declined by 0.9% yoy (2022: 8.7%) while non-oil sector grew by 4.6% (slower than 2022’s 5.5% gain).

- FDI into Saudi Arabia touched SAR 16.6bn in Q3 (Q2: SAR 19.4bn). This is the first time quarterly data are being issued, using the new methodology. Outflows were SAR 5.3bn in Q3, leading to net FDI inflows at SAR 11.4bn (-10% qoq). Net FDI inflow jumped to SAR 105.2bn in 2022 (21% yoy), the highest since 2004. FDI inflow volumes doubled to SAR 123bn in 2022 (vs SAR 59bn in 2015). The Minister of Investment revealed that a detailed questionnaire had been prepared to record direct investments of private sector firms abroad.

- Bloomberg reported that Saudi Aramco was planning a follow-on share offering to raise around SAR 40bn by Feb. This followed the energy ministry asking Aramco to keep its oil capacity target (or maximum sustainable production capacity) at 12mn barrels a day (from the 13mn bpd target announced in 2020).

- Saudi Exchange disclosed that sukuk and bond issuance in the country rose by 2.8% yoy to SAR 758.8bn by end-Q4 2023. Listed sukuk and bonds issued by the government accounted for 70% of the total; Saudi investors held approximately 99% of the listed holdings while 0.2% and 0.8% were distributed between investors in GCC and foreigners respectively.

- Saudi money supply grew by 8% yoy to SAE 2.69trn in 2023 while loans to corporate activities grew by 10% yoy to SAR 2.58trn; new mortgages extended to individuals in 2023 fell by 35% to SAR 77.74bn. Net foreign assets declined by 5.3% yoy to SAR 1.564trn (USD 417.1bn) in Dec.

- Saudi Arabia launched Alat (fully owned by the PIF), to focus on the technology sector and manufacturing products, and is expected to generate 39k jobs in the country and directly contribute USD 9.3bn to non-oil GDP by 2030.

- The King Abdulaziz City for Science and Technology and ACWA Power have signed a deal to establish a research centre for clean energy and desalination technologies.

- Amended regulations of Saudi Arabia’s Privatization Law included that the minimum limit for a public-private partnership project shall be SAR 200mn and the minimum value for the transfer of asset ownership projects at SAR 50mn.

- Saudi Arabia’s Kafalah program facilitating SMEs allocated SAR 12.1bn (USD 3.22bn) to support 5476 initiatives as of Dec 2023.

UAE Focus![]()

- UAE’s economy is forecast to grow by 5.7% yoy in 2024, according to the Undersecretary of the Ministry of Finance. Non-oil GDP growth is estimated to touch 5.9% in 2023 and projected to grow by 4.7% in 2024. UAE is also planning to issue bonds and sukuk valued at AED 5bn in Q1 following a total issuance of AED 7.7bn last year.

- Abu Dhabi Department of Economic Development issued 25k+ new economic licenses in 2023 while around 75k+ licenses were renewed. The total capital of new economic licenses from last year rose to more than AED 210.7bn (USD 57.3bn).

- ADNOC Gas signed a 10-year LNG deal with India’s state-owned energy firm GAIL to provide the latter with 0.5mn metric tonnes of LNG per annum.

- India approved a Bilateral Investment Treaty with the UAE to promote more investments, create direct investment opportunities, and improve investor confidence.

- Dubai-based Aster DM Healthcare is planning to dual-list in the UAE and Saudi Arabia within the next three to five years, disclosed the firm’s founder and chairman. He also revealed that an agreement to sell a majority share of 65% of the group’s business in the Gulf to a consortium led by Fajr Capital will be closed in the coming weeks.

- Abu Dhabi Investment Authority (ADIA) saw rolling returns of 17.3% during 2023 compared to returns of 16.4% in 2022, according to Global SWF.

Media Review

Markets face bumpy ride rather than soft landing: op-ed by Nasser Saidi in AGBI

https://www.agbi.com/opinion/nasser-saidi-markets-inflation-interest-rates/

OPEC and Saudi spare oil production capacity

https://www.reuters.com/business/energy/factbox-opec-saudi-spare-oil-production-capacity-2024-01-30/

IMF’s Regional Economic Outlook update for MENA, Jan 2024

America’s economy is booming. So why are bosses worried?

https://www.economist.com/business/2024/02/04/americas-economy-is-booming-so-why-are-bosses-worried

Powered by: