IMF global & MENA growth for 2024-25. Saudi GDP & FDI. Kuwait 2024-25 budget.

Weekly Insights 2 Feb 2024: Macroeconomic Outlook & Risks for the MENA region

1. IMF projects global growth to hold steady in 2024 (3.1%)

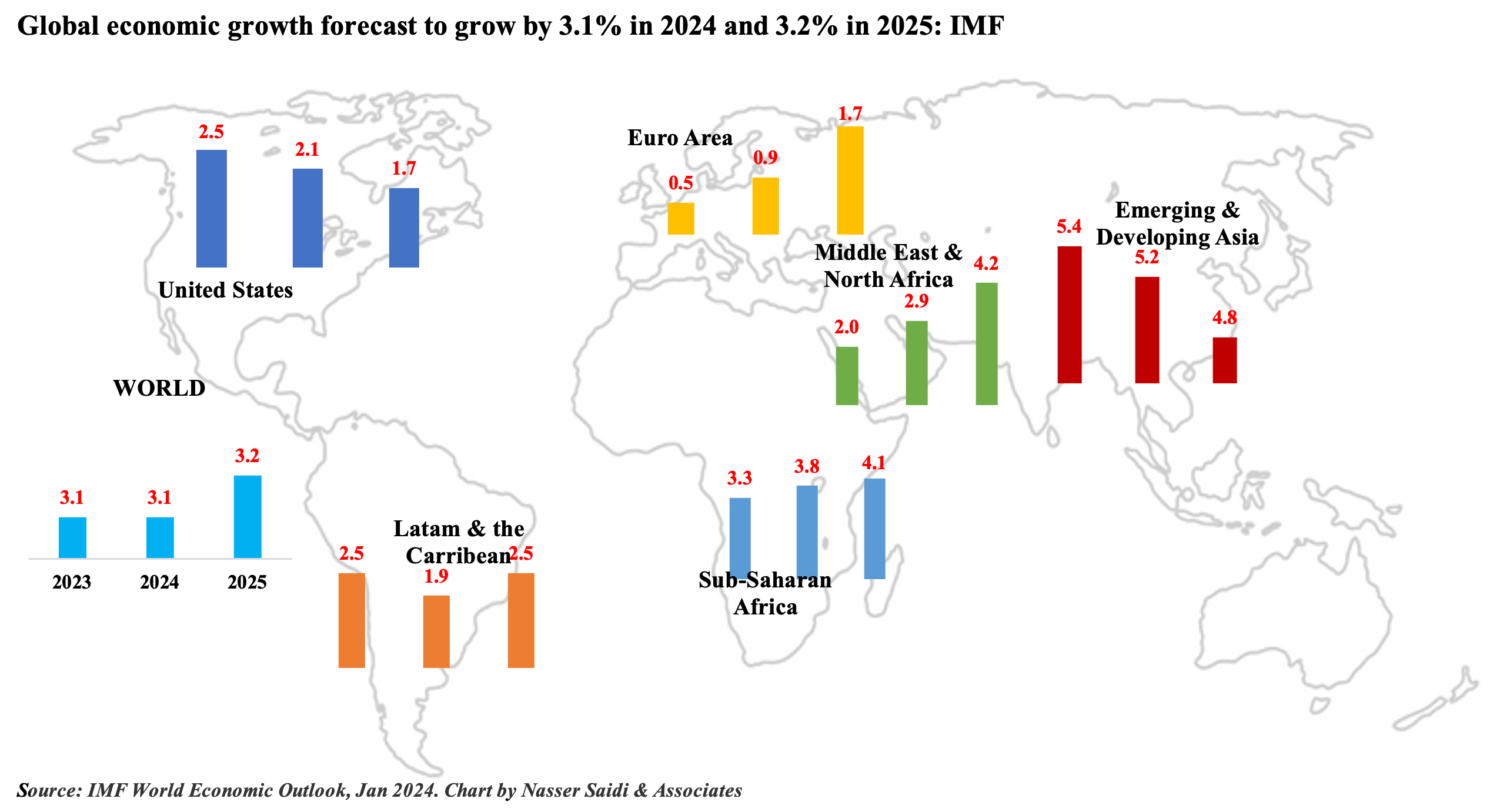

- The IMF’s World Economic Outlook update forecasts global growth to remain steady at 3.1% in 2024 (2023: 3.1%), and then inch up to 3.2% in 2025. This remains lower than the historical average of 3.8% in 2000-19. Many emerging market economies are showing resilience (e.g., India, Brazil, Mexico) though China’s weak consumption & investment patterns could slow growth.

- Inflation is projected to fall from earlier peaks, given the decline in energy and commodity prices, improvements in supply side issues, and central banks’ tightening policy that has constrained economic activity. However, the ongoing disruptions in the Red Sea could lead to new commodity price hikes if it escalates and/ or continues for longer and supply chains dislocated.

- Oil prices are projected to decline by about 2.3% in 2024, following the 16% drop last year, reflecting the slowdown in global economic activity. Robust non-oil sector alongside temporarily lower oil production in Saudi Arabia sees growth forecasts improve to 2.7% and 5.5% in 2024 and 2025 (2023: -1.1%). As the largest economy in the region, growth in the wider MENA region is also estimated to grow in 2024 and 2025, by 2.9% and 4.2% respectively (2023: 2%).

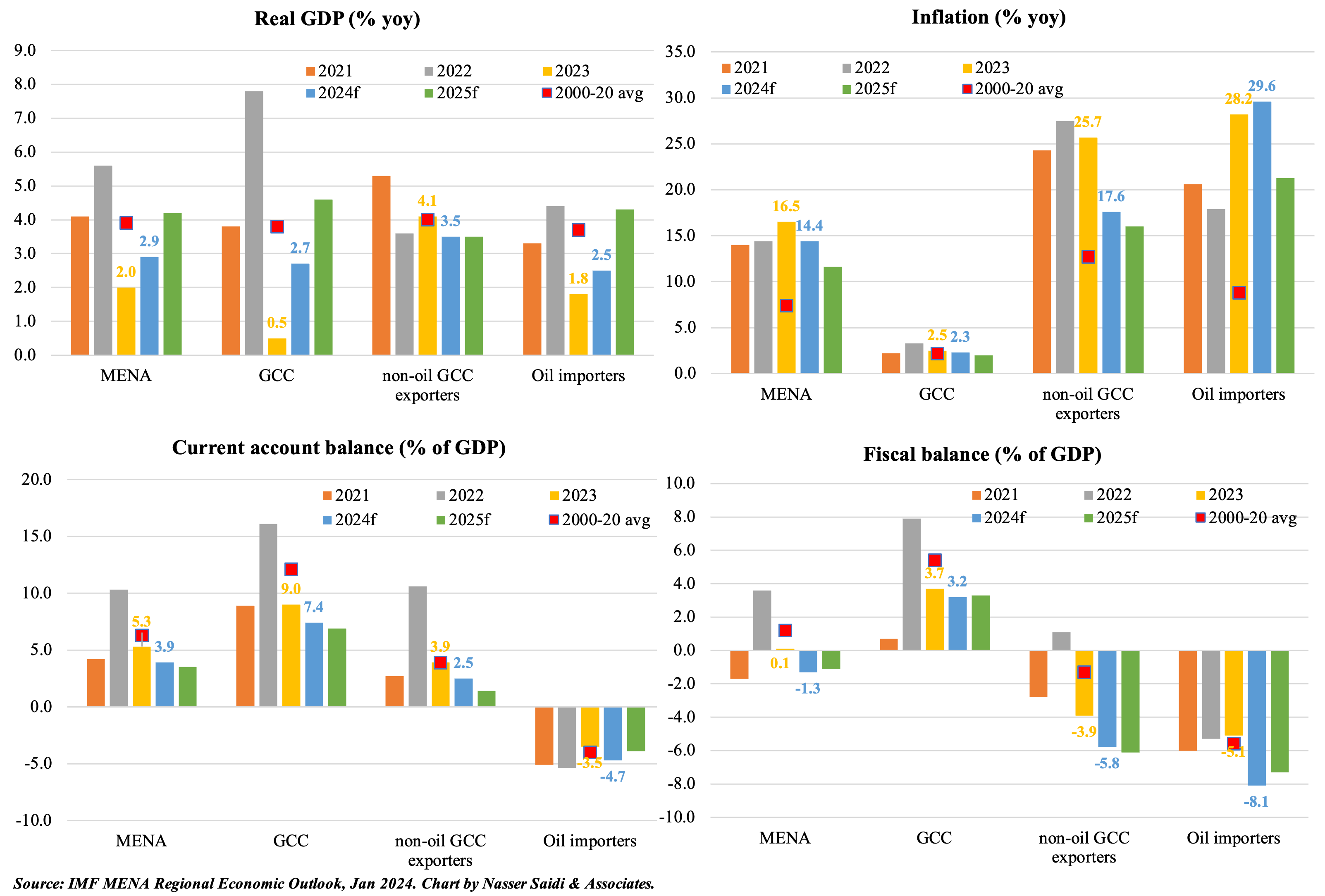

2. IMF lowers Middle East and North Africa growth forecast to 2.9% in 2024, from Oct 2023’s projection of 3.4%

- Factors affecting MENA growth: impacts of the conflict (tourism, trade) & oil production cuts. Non-oil growth remains strong in GCC. Broad-based easing in inflation, though country-specific factors are resulting in persistently high readings e.g., Egypt’s dollar shortages, Lebanon’s eco-political-socio woes.

- Current account surpluses for oil exporting nations, though down from 2022’ s record highs; GCC to see fiscal surpluses (given relatively high oil prices & reforms) though oil importers’ fiscal deficits are set to widen this year. High public sector gross financing needs (USD 186bn in 2024 vs USD 156bn in 2023)

- Risks: an escalation in conflict & potential spillovers to more countries, impact on oil prices if chokepoints are throttled, increase in commodity prices if shipping disruptions are prolonged & trade routes affected, political uncertainty & social unrest.

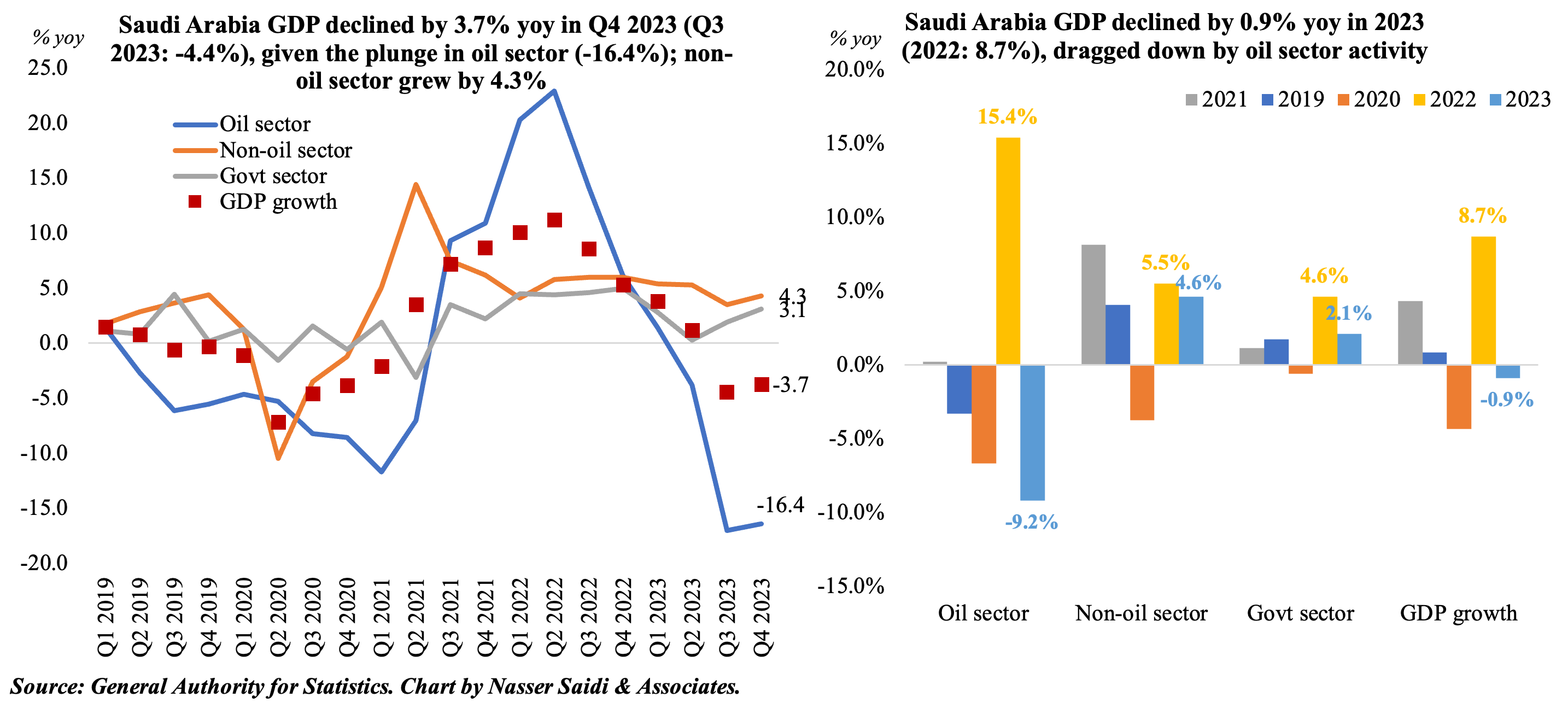

3. Saudi Arabia GDP fell by 3.7% yoy in Q4 2023, but at a slower pace than Q3 (-4.4%), with the oil sector dragging down activity

- Preliminary data showed that Saudi Arabia’s real GDP contracted by 3.7% in Q4 2023, the second consecutive quarter of declines, largely owing to the sharp plunge in oil sector activity (-16.4% in Q4 from Q3’s 17.0% drop). As the voluntary cut of 1mn barrels per day continues, KSA is pumping around 9mn barrels per day (vs a capacity of around 12mn bpd).

- Non-oil sector growth ticked up by 4.3% in Q4 (Q3: 3.5%); growth also supported by government spending which was up 3.1% (Q3: 1.9%). Overall GDP for 2023 declined by 0.9% yoy (2022: 8.7%) while non-oil sector grew by 4.6% (slower than 2022’s 5.5% gain).

- Non-oil sector growth has been supported by the strong domestic demand (especially from newly “open” tourism & entertainment sectors), ongoing labour, legal & regulatory reforms, efforts to encourage FDI inflows (e.g., financial markets, attracting regional HQs) as well as spending on giga projects & projects related to Expo 2030.

- Saudi estimates financing needs to the tune of SAR 86bn this year and has already tapped debt markets for USD 12bn so far.

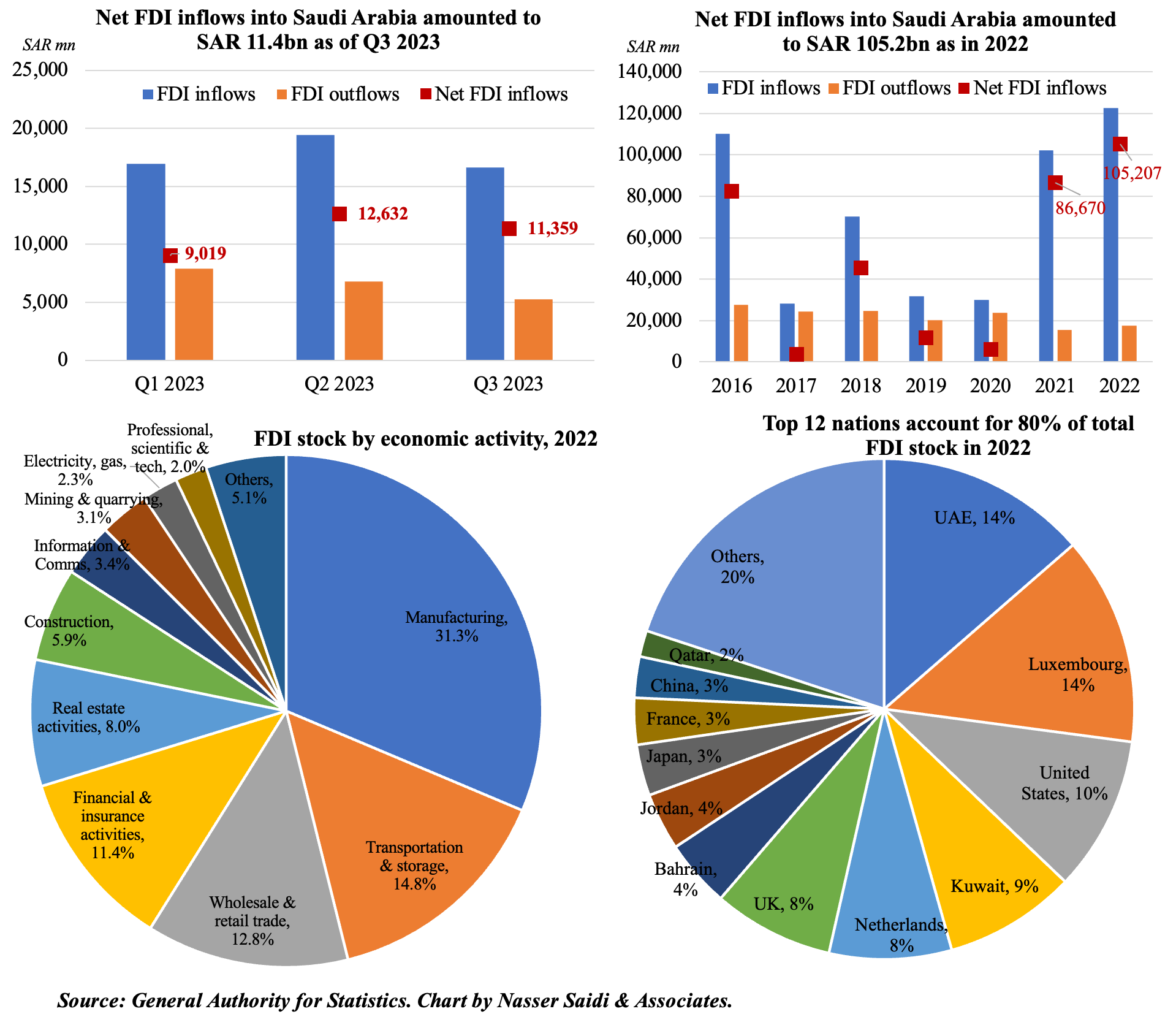

4. Saudi Arabia’s net FDI inflows stand at SAR 11.4bn in Q3; rose to SAR 105.2bn in full year 2022, the highest since 2004

- FDI into Saudi Arabia touched SAR 16.6bn in Q3 (Q2: SAR 19.4bn). This is the first time quarterly data are being issued, using the new methodology. Outflows were SAR 5.3bn in Q3, leading to net FDI inflows at SAR 11.4bn (-10% qoq).

- Net FDI inflow jumped to SAR 105.2bn in 2022 (21% yoy), the highest since 2004. FDI inflow volumes doubled to SAR 123bn in 2022 (vs SAR 59bn in 2015), partly due to an Aramco deal.

- FDI stock for manufacturing, transportation & storage and wholesale & retail trade sectors accounted for >2/3-rd (70.3%) of total FDI stock in 2022.

- By region, FDI net inflows went mostly into the Eastern region (SAR 86bn), followed by Riyadh (SAR 18.4bn) and Madinah (SAR 1.4bn).

- By country, UAE topped in terms of FDI stock in KSA in 2022 (14% of total) while the top 12 nations accounted for 80%. Luxembourg accounted for 49% of FDI net inflow in 2022.

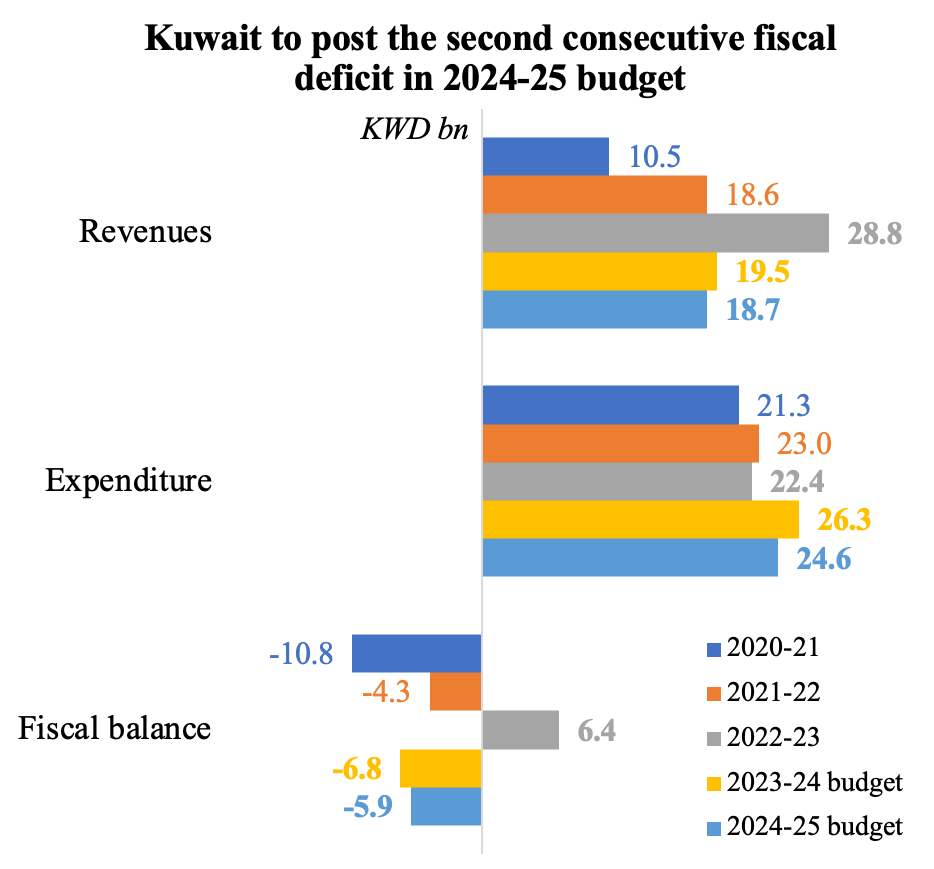

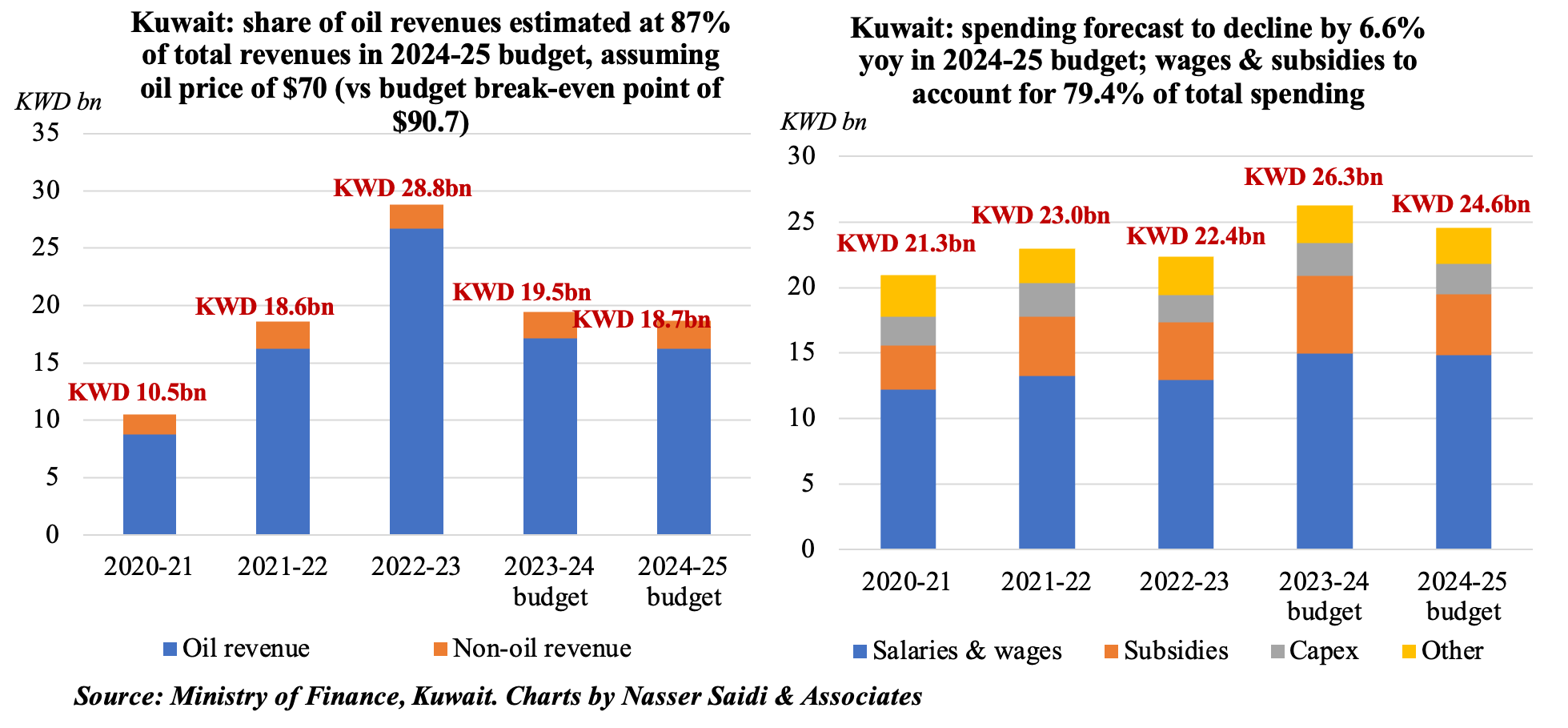

5. Kuwait approved its 2024-25 budget, estimates a KWD 5.89bn deficit

- Kuwait expects to post a second consecutive year of deficit as per the 2024-25 budget, prepared with oil price at an estimated USD 70. Deficit is estimated to narrow to KWD 5.9bn from a shortfall of KWD 5.8bn in the previous budget

- Oil revenues are estimated to decline by 5.4% compared to the 2023-24 budget, while non-oil revenues see a slight uptick (5.7%). Total revenues are down by 4.1% to KWD 18.662bn but share of oil revenues stand at 87%.

- Expenditures are projected to fall by 6.6% to KWD 24.56bn (compared to the 2023-24 budget), dragged down by capex spending (-7.7% to KWD 2.3bn) while subsidies fell sharply (-21.5% to KWD 4.67bn).

- Kuwait’s years of gridlock between the government and parliament has delayed reforms including implementation of a 5% VAT and the passage of a public debt law. Remains to be seen if the new government is successful in introducing fiscal reforms.

Powered by: