Markets

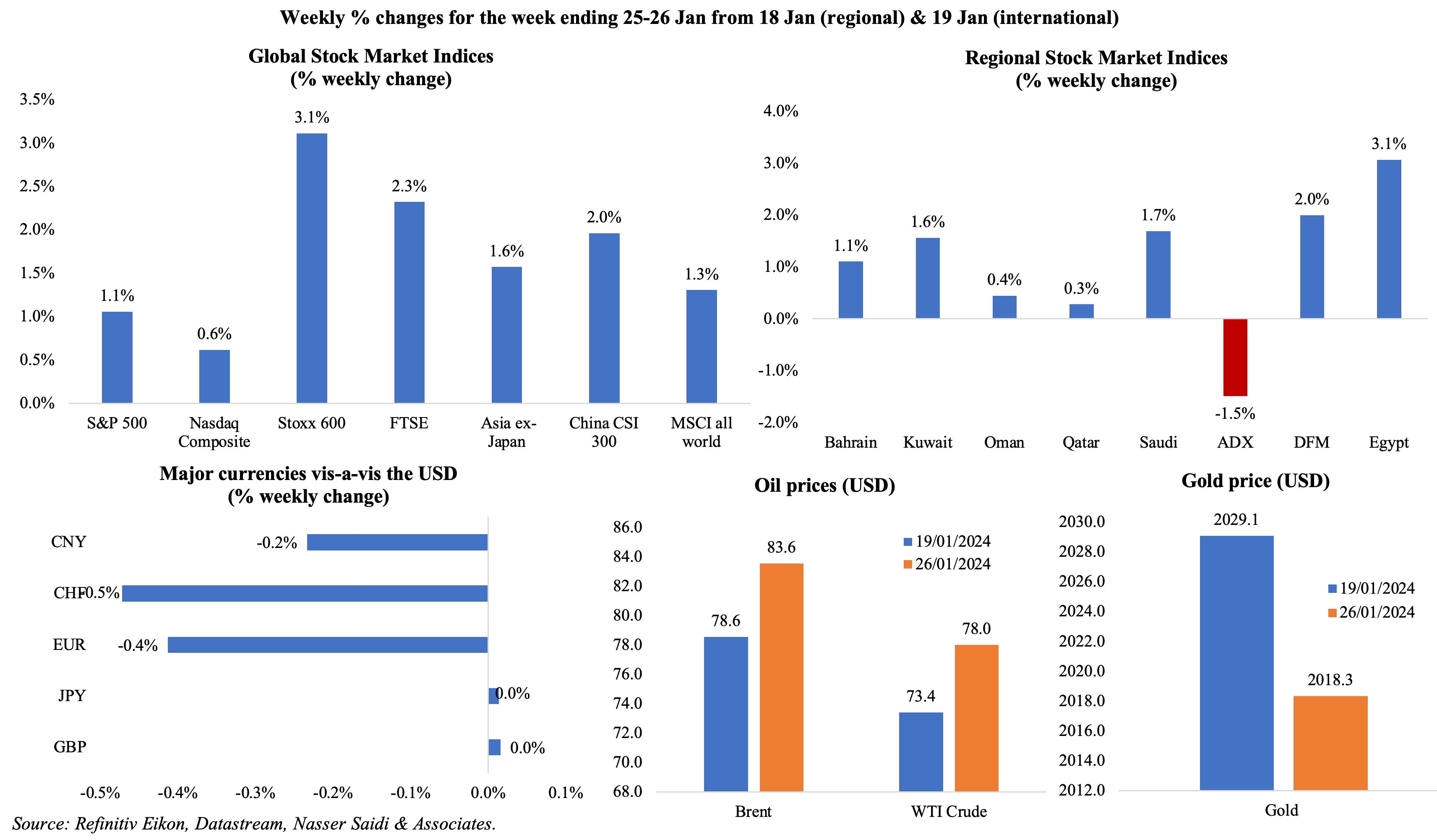

Equity markets mostly gained last week, with US data supporting a soft-landing scenario (US GDP, PCE price index); European markets gained after money markets priced in potential rate cuts in Apr given a slightly more dovish ECB stance (Lagarde called it “premature” to discuss cuts), and Stoxx 600 hit its highest level in 2 years. Even Chinese markets had a good week given signs of stimulus and following three straight weeks of losses. Upbeat earnings aside, regional markets were affected by escalation in the region’s geopolitical conflicts & shipping disruptions. Oil prices rose by more than 6% from a week ago and closed at the highest in almost 8 weeks, while gold price fell slightly.

Global Developments

US/Americas:

- US GDP grew at an annualised rate of 3.3% in Q4 (Q3: 4.9%), supported by consumer spending (2.8%) and government outlays (3.3%) while residential fixed investments increased 1.1% (a steep decline from Q3’s 6.7%). In full year 2023, GDP grew by 2.5% (2022: 1.9%).

- Personal income in the US inched up by 0.3% mom in Dec (Nov: 0.4%) while spending was up by 0.7% (Nov: 0.4%). The saving rate slipped to a 1-year low of 3.7% from 4.1% in Nov.

- Personal-consumption expenditures price index increased 1.7% in Q4 (Q3: 2.6%). Core PCE was unchanged, clocking in at a 2% rise.

- Durable goods orders were unexpectedly flat in Dec following Nov’s 5.5% mom gain; transportation orders fell by 0.9% while motor vehicles and parts orders were up by 0.4%. Non-defence capital goods excluding aircraft rose by 0.3% (Nov: 1%).

- Richmond Fed manufacturing index declined to -15 in Jan (Dec: -11), the lowest reading since Feb 2023, as both new orders and employment fell (to -16 and -15 respectively). Kansas Fed manufacturing activity in Jan plunged to -17 (Dec: -5), given a decline in new orders (-19) and an uptick in prices paid for raw materials (+24). Chicago Fed national activity index fell to -0.15 in Dec (Nov: 0.01), with all four categories posting declines.

- S&P Global manufacturing PMI in the US rose to 50.3 in Jan (Dec: 47.9), the highest since Oct 2022, though production dropped further. Services PMI rose to a 7-month high of 52.9 (Dec: 51.4) despite a slight drop in new export orders. Composite PMI hence increased to 52.3 (Dec: 50.9).

- New home sales rebounded by 8% mom to 664k in Dec as mortgage rates fell to the lowest level since May (to an average 6.6%), thanks to sales of new single-family homes. Pending home sales surged by 8.3% mom in Dec (Nov: -0.3%), the strongest increase since Jun 2020.

- Initial jobless claims increased by 25k to 214k in the week ended Jan 19th, following the 16-month low the previous week, and the 4-week average inched down by 1.5k to 202.25k. Continuing jobless claims rose by 27k to 1.833mn in the week ended Jan 12th.

Europe

- ECB held policy rates steady at 4%, with the consensus of the council being it was “premature to discuss rate cuts”, also stating that “the declining trend in underlying inflation has continued”.

- The flash estimate of the consumer confidence in the eurozone fell further to -16.1 in Jan (Dec: -15). For the EU, consumer confidence was down 0.2 from Dec to -16.2.

- Eurozone’s manufacturing PMI rose to a 10-month high of 46.6 in Jan (Dec: 44.4), with both output and new orders experiencing smaller declines while employment fell for the eighth month in a row. Services PMI declined slightly to 48.4 (Dec: 48.8), remaining in contractionary territory for the sixth consecutive month. Composite PMI moved up to 47.9 from 47.6 the month before.

- Manufacturing PMI in Germany improved to an 11-month high of 45.4 in Jan (Dec: 43.3), as falls in output and new orders eased. Services PMI fell to 47.6 in Jan (Dec: 49.3), partly due to new orders declining at a faster pace while operating costs increased.

- Ifo business climate index in Germany dropped to 85.2 in Jan (Dec: 86.3), the weakest level since May 2020, with companies assessing their current situation as worse. Expectations fell (to 83.5 from Dec’s 84.2) as did the current assessment (87 from 88.5).

- German GfK consumer confidence index fell further to -29.7 in Feb (Jan: -25.1), the lowest in 11 months. Propensity to save jumped to its highest since Aug 2008 while declines were recorded in income expectations (-20 from -6.9), propensity to buy (-14.8 from -8.8) and economic prospects (-6.6 from -0.4).

- Manufacturing PMI in the UK inched up to a 9-month high of 47.3 in Jan (Dec: 46.2): export sales declined, and higher ocean freight rates led to higher costs (inflation at the highest since Mar 2023). Services PMI was up slightly to 53.8 (Dec: 53.4), supported by uptick in output, while composite PMI increased to 52.5 (Dec: 52.1).

- GfK consumer confidence index in the UK rose to -19 in Jan (Dec: -22), the third month-on-month increase and the highest since Jan 2022.

Asia Pacific:

- China’s central bank will cut the reserve ratio requirements (RRR) for banks by 50bps from Feb 5. Earlier in the week, the PBOC left the one-year loan prime rate at 3.45% and the 5-year rate at 4.2%.

- The Bank of Japan maintained its ultra-loose policy, keeping its short-term rate target steady at -0.1% and the 10-year bond yield around 0% under yield curve control.

- Manufacturing PMI in Japan stayed in contractionary territory for the 8th straight month in Jan, though rising to 48 (Dec: 47.9). Services PMI increased to 52.7 in Jan, expanding for the 17th consecutive month (Dec: 51.5), with foreign demand rising for the first time in 5 months.

- Trade balance in Japan moved to a surplus JPY 62.1bn in Dec (Nov: JPY 780.4bn deficit), thanks to a 9.8% increase in exports while imports fell by 6.8%. Exports to China jumped by 9.6% to JPY 1.77trn, the second-largest amount on record, while exports to the US surged by 20.4%. For 2023, Japan clocked in a deficit of JPY 9.29trn, the third deficit year in a row.

- Inflation in Tokyo eased to 1.6% in Jan (Dec: 2.4%). Excluding fresh food, prices eased to 1.6% (Dec: 2.1%), falling to the lowest since Mar 2022 and below the 2% BoJ target. Excluding both food and energy, prices slowed to 3.1% (Dec: 3.5%).

- GDP in Korea grew by 0.6% qoq in Q4, the same pace as in Q2 and Q3: private and government consumption inched up by 0.2% and 0.4% respectively while construction investment fell by 4.2%. In yoy terms, GDP grew by 2.2% (Q4: 1.4%).

- Inflation in Singapore rose slightly to 3.7% in Dec (from Nov’s 25-month low of 3.6%), as transport costs increased (3.9% from 2.8%) while housing & utilities and healthcare costs were unchanged at 3.8% and 5.1% respectively; core inflation at 3.3%.

- Industrial production in Singapore fell by 1.7% mom and 2.5% yoy in Dec, as biomedical manufacturing output declined (-23.9% from Nov’s 2.8% drop). For the full year 2023, manufacturing output was lower by 4.3% yoy.

Bottom line: In line with last week’s central bank meetings in EU and Japan, the Fed and BoE are likely to leave rates unchanged when it meets this week. Markets are already expecting the BoE to lower rates sooner than its peers. While flash PMI estimates are already indicating an uptick in costs given supply disruptions, uncertainty only seems to be rising further with new nations being drawn into the conflicts. According to the UNCTAD, ships transiting through the Suez Canal had declined by 39% since the start of Dec thereby leading to a 45% drop in freight tonnage. Container shipments through the Suez were down 82% in the week to Jan 19 from early-Dec, while the decline was much higher for LNG.

Regional Developments

- Bahrain’s trade deficit widened by 212% yoy to BHD 276mn in Q4: during the period exports fell by 10% yoy to BHD 1.01bn and re-exports fell by 6% to BHD 188mn while imports grew by 5% to BHD 1.5bn. Imports originated mostly from China (BHD 207mn), followed by Brazil (BHD 136mn) and UAE (BHD 119mn).

- Egypt’s Minister of Tourism revealed that tourist arrivals were up by 9% yoy in the first 19 days of Jan. Furthermore, it was disclosed that a record 14.9mn tourists visited in 2023, up 33% yoy and hotel rooms had jumped by 10% to 220k rooms.

- Revenues from the Suez Canal has declined by 44% yoy in Jan 2024, revealed the canal authority head during a TV interview. Separately, the WTO’s Wheat Dashboard shows that shipments of wheat through the Suez Canal have fallen by 40% yoy. Data provider Kpler disclosed that only an estimated 2.4mn tons of grain would transit through the Suez Canal this month versus 6.6mn tons in Dec and 6.4mn tons in Jan 2023.

- To improve income and job stability, Egypt has committed EGP 2.2bn to support salaries of governorates’ private fund employees for the months Jul 2023-Mar 2024, according to the Minister of Finance: this represents a 315% yoy growth. He also separately stated that the government will bear the annual real estate tax for 21 industries until 2026, amounting to about EGP 1.4bn annually.

- There has been a visible surge in gold imports given the uptick in gold prices: the Head of the Egyptian Customs Authority disclosed that Egyptian travellers have brought in over 3.8 tons of duty-free gold into the country in 8 months.

- Moody’s affirmed ratings for 5 Egyptian banks but downgraded their long-term deposit scores to negative from stable, amid weakening credit profile concerns for the country.

- Inflation in Kuwait inched lower to 3.37% yoy in Dec (Nov: 3.79%), the lowest since Feb 2023. Food prices rose the least in nearly 3 years in Dec (4.7% fro Nov’s 5.8%) while prices also eased for housing, transportation, and restaurants & hotels (to 2.4% from 3%+ in Nov).

- Kuwait’s total foreign debt declined by 10% in 6 months to KWD 18.4bn by end-Q3 2023 (end-Q1 2023: KWD 20.4bn). FDI in Kuwait posted a 13.6% yoy increase to KWD 4.9bn at end-Q3 2023.

- Lebanon passed an amended 2024 budget last week, without announcing any major reforms (including no unification of exchange rates). Reuters reported that a draft version seen by them had used an exchange rate of LBP 89,000 to the USD for most calculations and a different rate of LBP 50,000 in others.

- IMF’s Article IV consultation report for Oman forecasts a slight increase in GDP growth in 2024 (to 1.4% from 2023’s 1.3%) supported by non-oil sector growth (2.5%) as hydrocarbon GDP dips (-0.5%). The IMF also commended Oman’s “commitment to prudent fiscal management” which has resulted in a substantial fall in central government debt (to 38% of GDP in 2023 from 68% in 2020). More: https://www.imf.org/en/News/Articles/2024/01/23/pr2421-omn-imf-executive-board-concludes-2023-article-iv-consultation-with-oman

- Oman energy investment company OQ’s investment in three major energy projects in the Musandam governorate has touched OMR 800mn: this includes the Musandam power plant which has a production capacity of 120 megawatts per hour.

- Bloomberg reported mid-last week that Qatar had diverted at least 6 LNG shipments to Europe given the conflict in the Red Sea. Though exports were not reduced, they were getting delayed given the additional time to reach destinations via the Cape of Good Hope route.

- Saudi holdings of US Treasuries rose to a 2-year high of USD 128.1bn in Nov, following months of reduced holdings in H1 2023.

Saudi Arabia Focus

- Saudi crude oil exports touched a 5-month high of 6.34mn barrels per day in Nov, according to the Joint Organisations Data Initiative. Production slipped by 1.36% mom to 8.82mn bpd in Nov and the share of oil exports to total exports rose to 71.85% (an 8-month high).

- The French Ambassador to Saudi Arabia revealed that most French firms had moved their regional HQs to Riyadh, while also stating that there were 175 French firms operating in the country employing more than 13,300 Saudi citizens.

- Saudi-based Avalon Pharma priced its IPO at the top of its range, selling the shares at SAR 82 (or USD 21.87) each. The firm is offering 6mn shares or 30% of its issued share capital.

- Saudi PIF raised USD 5bn from a triple- tranche high-grade bond sale last week: the offering was more than five times oversubscribed, with order books reaching USD 27bn, reflecting the strong demand from international institutional investors.

- Sabic, in a regulatory filing, disclosed that it will start building a USD 6.4bn petrochemical complex in southeastern China’s Fujian province in Q1 2024. It will be completed by Q1 2027, when it would be able to produce 1.8mn metric tons of ethylene per year.

- The Saudi Capital Market Authority’s chairman revealed that real estate funds, at SAR 170bn (USD 45.3bn), represented a third of all assets under management in the country. Real estate funds jumped to 337 as of Jun 2023 (Jun 2022: 204).

- SAMA granted licenses to two additional payment service providers, Network International Arabia to offer PoS solutions and Barraq to offer e-wallet services, thereby taking the total number to 27. Separately, debt crowdfunding platform Thara obtained a license from SAMA. Overall, the number of fintech firms licensed in Saudi stands at 59.

- The Saudi Ministry of Industry and Mineral Resource disclosed that 183 licenses had been issued for the building materials sector in 2023, up from 132 in 2022 and that the number of factories in the sector grew by 5.6% to 2,065.

- Saudi Arabia and Morocco are setting up a joint investment fund to boost economic cooperation, and an agreement on shipping projects was signed at the recently held Saudi-Moroccan Economic Forum.

- As part of its ongoing judicial reforms, Saudi Arabia opened an administrative enforcement court as part of the complaints court where commercial disputes can be heard. This will support “the investment environment and social development”.

- Saudi Arabia plans to open its first alcohol store to serve non-Muslim diplomats within weeks, reported Reuters. This move is to be seen in the wider context of opening up the country for tourism and business purposes.

- Saudia reported a 21% yoy growth in passenger numbers in 2023 to more than 30 million. Over 16.7mn passengers were transported through its international network (36% yoy) and over 13.5mn passengers domestically (7% yoy).

UAE Focus![]()

- UAE’s Abu Dhabi National Oil Company (ADNOC) announced an allocation of USD 23bn for decarbonisation and lower-carbon projects compared to a USD 15bn target previously. The company plans to reduce its carbon intensity by 25% by 2030 and reach net zero carbon emissions by 2045.

- Bilateral non-oil trade between Hong Kong and the UAE touched USD 16.2bn in Jan-Nov 2023, up from USD 9.4bn in 2020, according to the Deputy Executive Director of the Hong Kong Trade Development Council.

- UAE removed the AED 1mn (USD 272,294) minimum down payment requirement to qualify for a golden visa through real estate investment. With this change any property worth AED 2mn or above can be used to obtain the long-term visa irrespective of whether it is off-plan or finished or mortgaged or not. Separately, service and community charges for property owners in Abu Dhabi were reduced by 6% in 2023 resulting in a savings of AED 39.7mn (USD 10.81mn) in yoy terms.

- UAE’s Ministry of Economy is setting up the “Intangible Assets Finance Committee” to help businesses and start-ups gain access to financing and support the growth of their company, especially during the initial years of establishment. Another initiative called “Patent Incubator” was also launched to support with documentation of the patent registration process while also clarifying the roles and responsibilities related to obtaining IPRs.

- The Artificial Intelligence and Advanced Technology Council was set up by Abu Dhabi as part of its efforts to regulate AI and create research opportunities.

- Abu Dhabi National Energy Company (Taqa) has entered into an agreement to sell its entire stake in the Atrush oilfield in Iraqi Kurdistan to Canada’s ShaMaran Petroleum. The value was not disclosed and the deal is still subject to third-party approvals.

- The “Dubai Retiree Projects Support” aims to support “projects launched” by retired UAE citizens through the Mohammed bin Rashid Fund for SME. This will enable them being given priority for financing, government projects and service fees exemptions among others.

- The Ras al Khaimah Economic Zone announced that over 7800 new firms had joined in 2023: this is an 86% yoy surge in new registrations.

- The UAE Ministry of Human Resources and Emiratisation revealed that women’s participation in the private sector grew by 23.1% yoy in 2023.

- UAE plans to invest AED 9bn to develop 127 infrastructure projects over the next 5 years, after investing more than AED 13bn in the last decade to implement 258 projects, according to a post from the government media office.

Media Review

Saudi Arabia tops GCC ranking in the World Bank’s Statistical Performance Index

https://www.zawya.com/en/economy/gcc/saudi-arabia-tops-gcc-ranking-in-statistical-performance-index-kdh0m8qu

Dubai’s property boom shows signs of fizzling out

https://www.reuters.com/world/middle-east/dubais-property-boom-shows-signs-fizzling-out-2024-01-26/

Climate Science Meets Geopolitics

https://www.project-syndicate.org/onpoint/geopolitics-makes-climate-science-a-national-security-issue-by-giulio-boccaletti-2022-06

10 key takeaways from Davos 2024

https://www.mckinsey.com/featured-insights/themes/10-key-takeaways-from-davos-2024

Powered by: