Dubai GDP & inflation. FDI inflows 2023. GCC’s US Treasury holdings. Global tourism recovery & concerns.

Weekly Insights 26 Jan 2024: Foreign Direct Investment & tourism improve in 2023, but remains weak & uneven across regions

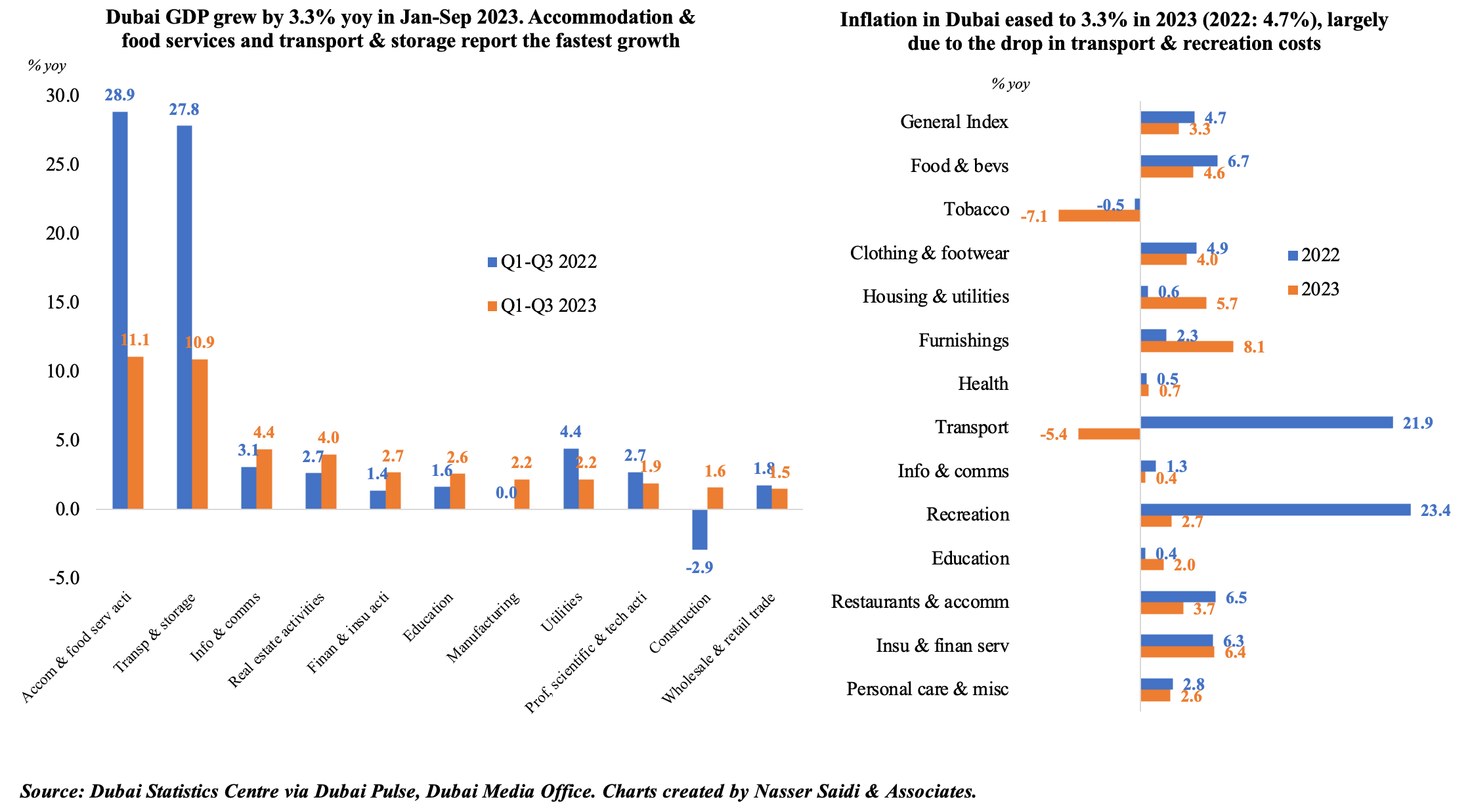

1. Dubai real GDP grew by 3.3% yoy in Jan-Sep 2023; inflation has eased, thanks to declines in transport and recreation costs

- Dubai real GDP growth of 3.3% yoy in the first nine months of 2023 continues to be supported by a recovery in Covid-affected sectors (accommodation & food services up by 11.1% and transportation & storage which was up 10.9%). Real estate activities have also picked up, rising by 4% yoy in Jan-Sep 2023 (vs. 2.7% growth in the same period a year before).

- Dubai PMI averaged 55.5 in Jan-Sep 2023, slightly higher than the Jan-Sep 2022 figure. GDP prospects for Q4 look promising, given that PMI was highest in Q4 of last year, and Dec PMI climbed to the highest level since Aug 2022. Wholesale & retail and travel & tourism sectors reporting upturn in sales will be reflected in the GDP numbers. However, businesses in the emirate choosing to remain more competitive by absorbing cost increases could affect business bottom lines.

- Inflation has eased in Dubai to 3.3% in 2023 from 4.7% in 2022. Though transport & recreation costs have seen a massive decline compared to 2022, non-tradeable goods like housing & utilities (5.7% vs 0.6%) and education (2% from 0.4%) have increased.

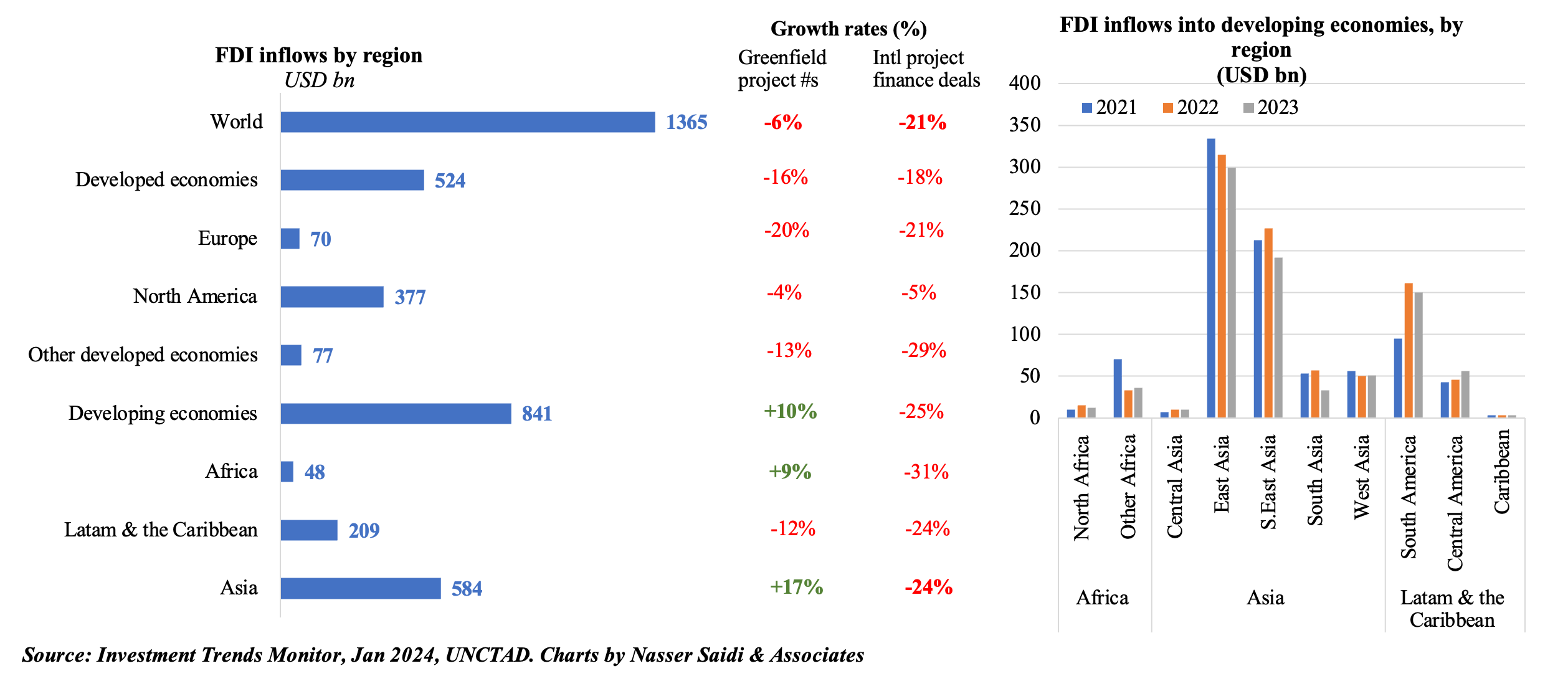

2. Global FDI inflows rose by 3% in 2023; West Asia sees an uptick in flows & UAE stands out as 2nd largest recipient of greenfield projects (following US)

- UNCTAD’s Investment Trends Monitor report showed global FDI grew by 3% yoy in 2023, to USD 1.37trn, with uptick driven by a few “conduit” economies in Europe (denoted by the fact that these countries act as intermediaries for FDI destined for other countries). Excluding conduit nations, FDI flows dropped by a massive 18% compared to 2022.

- There was an uneven growth across the globe: US was the world’s largest recipient of FDI, but inflows declined by 3% yoy. Flows to developing nations fell by 9% to USD 841bn, with Asia posting a 11.5% drop while flows to Africa & Latam remained almost stable.

- Though flows to developing Asia fell in 2023, a further breakdown showed that the decline was more pronounced in South Asia (-42%) and South-East Asia (-15.4%) while in West Asia it edged up by 2% to USD 51bn.

- Despite the FDI flows decline, developing Asia remained attractive destinations for greenfield projects. China and India saw FDI inflows drop by 6% and 47% respectively, but the former reported an 8% growth in project announcements while India was among the top 5 destinations for greenfield projects. West Asia’s UAE and Saudi Arabia saw greenfield project announcements surge by 28% and 63%.

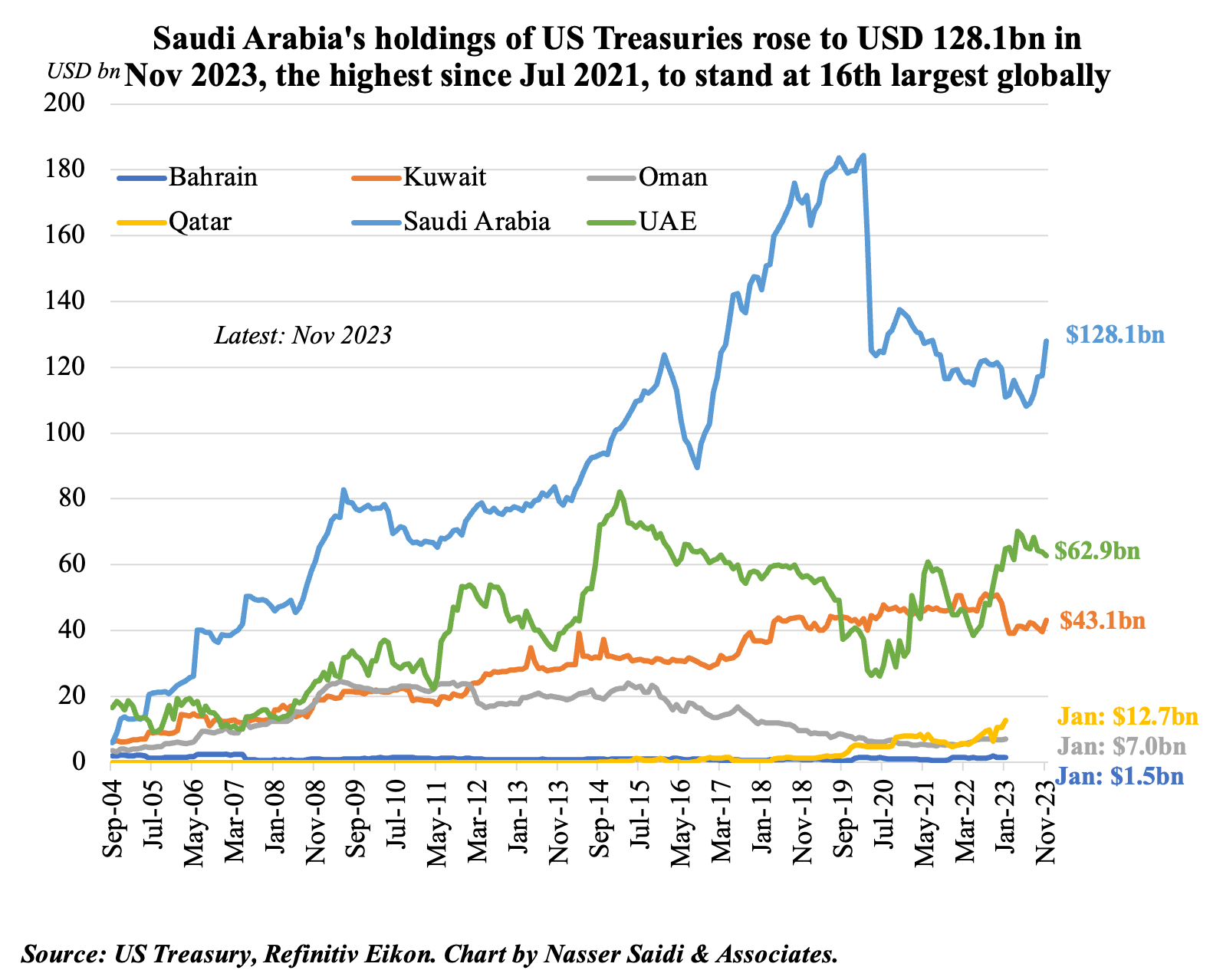

3. Saudi Arabia US Treasuries holdings rose to USD 128.1bn in Nov 2023 – it was the 16th largest investor globally; UAE drops to USD 62.9bn

- Saudi Arabia is currently the 16th largest investor in US Treasury bonds as of Nov 2023 (USD 128.1bn).

- This pales in comparison to the top of the list Japan (USD 1.113trn) and China (USD 782.0bn), but it is still highest among the GCC.

- While Kuwait decreased their holdings compared to end-2022 (by 11.2%), Saudi Arabia and UAE holdings have increased by 7%.

- KSA had lowered its holdings to a 6-year low of USD 108.1bn in Jun 2023, but Nov’s level is the highest since July 2021.

- UAE’s holdings clocked in at USD 62.9bn in Nov, up 7.2% from end-2022, but lower than this year’s high of USD 70.2bn (in Apr).

- Global central banks’ aggressively raising rates to combat inflation & it staying higher for longer have contributed to selling of Treasuries; the potential for weaponization of the dollar has also added to such moves (China reduced its holdings by USD 85.1bn since end-2022).

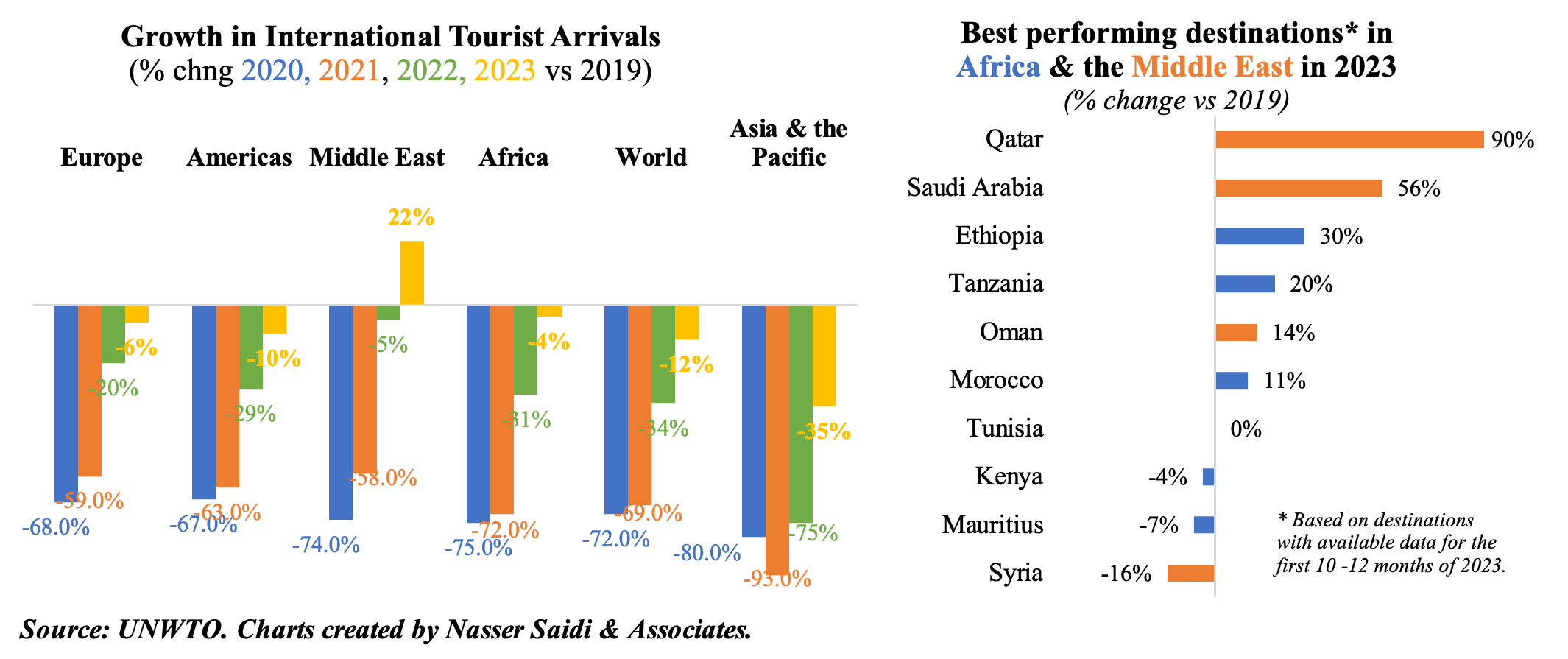

4. Middle East 2023 international tourist arrivals rise 22% above 2019: the only region to cross pre-pandemic levels

- The UNWTO reported in its latest World Tourism Barometer (issued Jan 2024) that an estimated 1.3bn tourists travelled internationally in 2023. The Middle East stands out, being the only region to recover pre-pandemic levels; Africa, Europe, and the Americas are close behind, having reached 96%, 94% & 90% of pre-pandemic levels last year. Europe was supported by intra-regional travel while Asia & the Pacific benefitted from reopening of several markets last year.

- Among the best performing destinations in 2023 in terms of international tourist arrivals were Qatar (top, +90% vs 2019), Saudi Arabia (2nd, +56%) and Oman (17th highest, +14%). Visa and travel facilitation measures are expected to benefit the GCC nations (e.g., the recently announced unified GCC tourist visa policy)

- International tourism receipts also recovered to USD 1.4trn in 2023, about 93% of pre-pandemic levels.

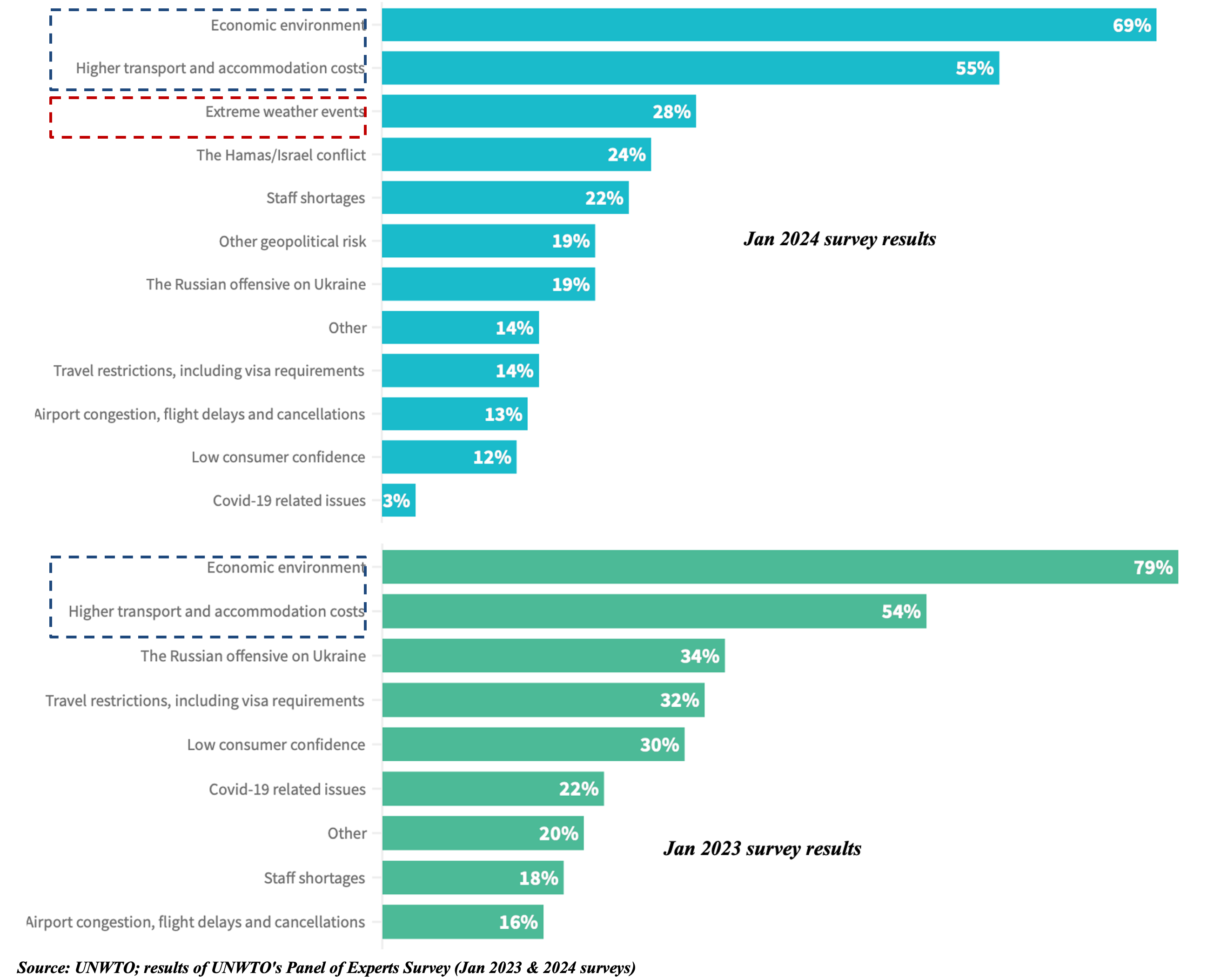

- According to UNWTO panel of experts survey (next point, #5), the main concerns weighing on tourism recovery are economic environment (69% of experts mentioned this) & higher transport & accommodation costs (55%) – similar to a year ago; extreme weather events becomes the 3rd biggest worry (28%) in 2024, appearing in the list for the very first time!

5. What are the main factors weighing on the recovery of international tourism?

Powered by: