Markets

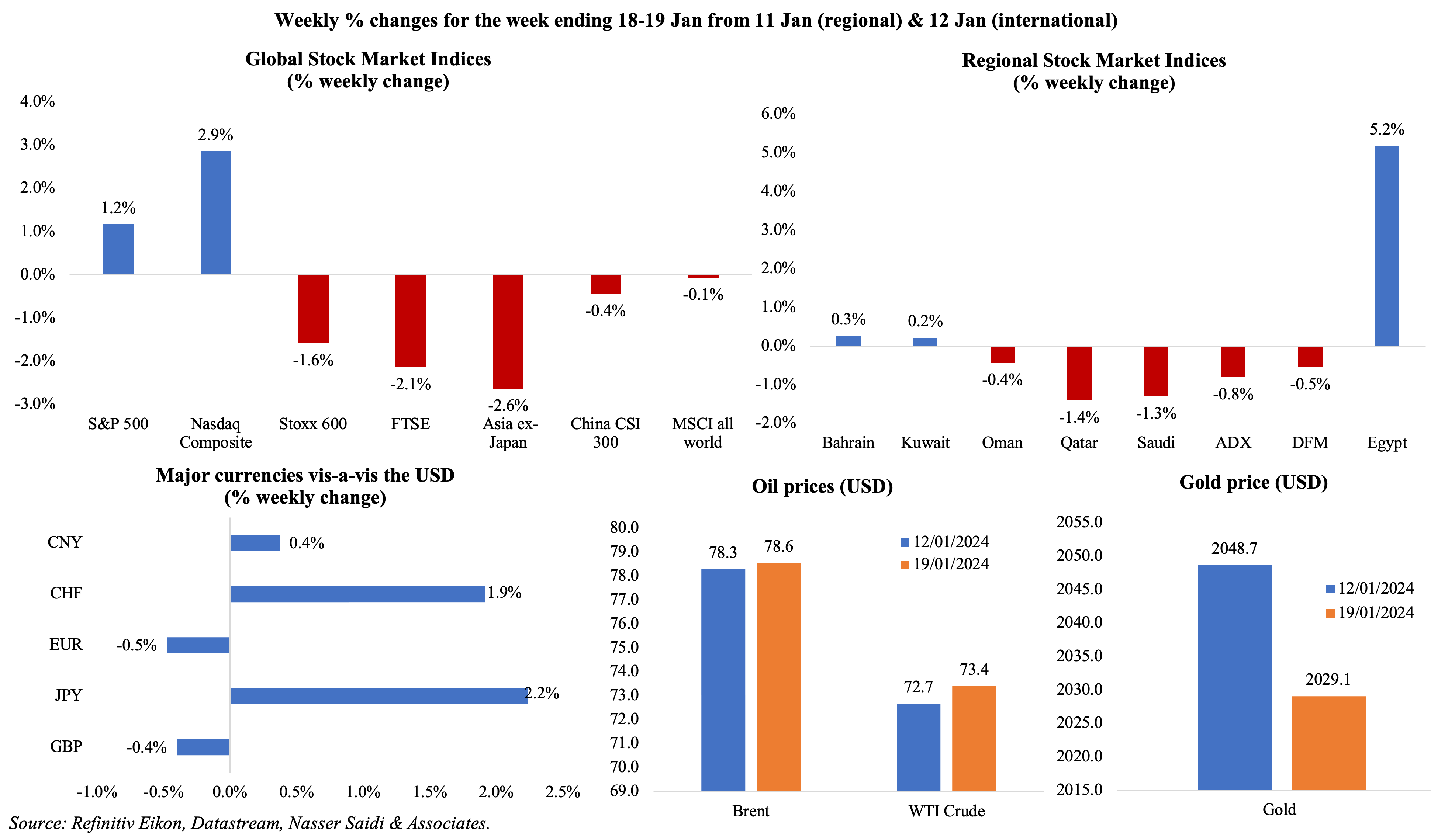

Equity markets mostly ended in the red last week, except for the US market – where S&P 500 moved to a record-high close for the first time in two years, supported by tech stocks rally. China’s CSI300 fell to an almost 5-year low after Q4 GDP missed estimates while Europe’s markets fell after Lagarde indicated that lower borrowing costs were more likely in thesummer rather than in the spring. Regional markets were mostly down; Egypt markets are up more than 10% since the beginning of 2024 while the country faces inflationary pressures and dollar shortages (USD neared EGP 60 in the black market last week) and with the IMF discussing additional financing. Oil was slightly up, given geopolitical risks on one side along with concerns of weaker demand from Chinese and global growth. Gold price fell by almost 1% week-on-week (the largest decline in 6 weeks) as optimism about early rate cuts faded.

Global Developments

US/Americas:

- Beige book showed “little or no change in economic activity” amid signs of a cooling labour market and half of the districts reporting slight or modest price increases.

- Housing starts fell by 4.3% mom to an annualised 1.46mn in Dec 2023, the first decline in 4 months. Single-family starts declined by 8.6% to 1.027mn, posting the biggest fall since Jul 2022. Building permits inched up by 1.9% mom and 6.1% yoy to 1.495mn. For the full year 2023, building permits fell by 11.7% yoy to 1,469,800 units. Existing home sales fell by 1% mom to 3.78mn in Dec, the lowest level since Aug 2010. The 30-year mortgage rate fell to an 8-month low of 6.6% earlier in Jan, which could raise home resales in the near-term.

- Industrial production in the US edged up by 0.1% mom in Dec, with manufacturing and mining output up by 0.1% and 0.9% respectively. IP and manufacturing output fell by 3.1% yoy and 2.2% respectively in Q4. Capacity utilisation was unchanged at 78.6% in Dec.

- US retail sales increased by 0.6% mom in Dec (Nov: 0.3%), thanks to an increase in motor vehicle (1.1%) and online purchases (1.5%). Sales at food services and drinking places were unchanged in Dec, though following a 1.7% uptick in Nov.

- NY Empire State manufacturing index plunged to -43.7 in Jan (Dec: -14.5), the lowest reading since May 2020. New orders and shipments fell to -49.4 and -31.3 (from -11.3 and -6.4) while employment fell modestly (to -6.9 from -8.4).

- Philadelphia Fed manufacturing survey moved up to -10.6 in Jan (Dec: -12.8), the 18th negative reading in 20 months. New orders and shipments increased to -17.9 (from -22.1) and -6.2 (+5 points) while employment was mostly steady at -1.8.

- Michigan consumer sentiment index rose to 78.8 in Jan (Dec: 69.7), the highest reading since Jul 2021. The one and 5-year inflation expectation eased in Jan to 2.9% (the lowest since Dec 2020) and 2.8% (from Dec’s 2.9%) respectively.

- Initial jobless claims declined by 16k to 187k in the week ended Jan 12th, a 16-month low, and the 4-week average inched down by 4.5k to 203.25k. Continuing jobless claims declined by 26k to 1.81mn in the week ended Jan 5th.

Europe

- The ZEW economic sentiment index in Germany improved to 15.2 in Jan (Dec: 12.8), though the current condition worsened to -77.3 (from -77.1). The eurozone economic sentiment index eased to 22.7 from 23 while the current situation climbed 3.4 points to -59.3.

- Industrial production in the eurozone fell by 0.3% mom in Nov (Oct: -0.7%), with output down for consumer durables (-2%), capital goods (-0.8%) and intermediate goods (-0.6%).

- Seasonally adjusted trade balance in the eurozone widened to EUR 14.8bn in Nov (Oct: EUR 11.1bn), as exports edged up by 0.9% while imports fell by 0.6%.

- German real GDP growth shrank by 0.3% yoy in 2023 (2022: 1.8%), with Q4 economic activity also declining by 0.3% qoq. Overall IP fell by 2% yoy while exports declined by 1.8%.

- Producer price index in Germany fell by 8.6% yoy in Dec (Nov: 7.9%), the sixth consecutive month of declines, largely due to the plunge in energy prices (-23.5%). Producer prices fell by 2.4% yoy in 2023; while excluding energy, prices rose by 3.6%.

- Inflation in the UK unexpectedly rose to 4% in Dec (Nov: 3.9%), largely due to an uptick in tobacco (+16%) and alcohol (9.6%) costs. Core consumer prices remained steady at 5.1% while services inflation increased to 6.2% (from 6.1%).

- Unemployment rate in the UK remained steady at 4.2% in the 3 months to Nov. Average earnings including (excluding) bonus slipped to 6.5% (6.6%) in Sep-Nov from 7.2% (7.2%).

- Retail sales in the UK fell by 3.2% yoy in Dec, the biggest decline since Jan 2021; sales volumes are at its lowest since May 2020.

Asia Pacific:

- China’s GDP grew by 5.2% in Q4 (Q3: 4.9%), taking the full year growth to 5.2% – in line with the official target. Earlier in the week, the People’s Bank of China left the medium-term policy rate unchanged.

- China’s industrial production grew by 6.8% in Dec (Nov: 6.6%), the largest uptick since. Feb 2022, thanks to increases in manufacturing (7.1% from 6.7%) and mining (4.7% from 3.9%). Retail sales grew by 7.4% in Dec, slower than Nov’s 10.1% gain, as car sales declined (to 4% from Nov’ 14.7%) while food and clothing sales improved. Additionally, jobless rate inched up to 5.1% in Dec (Nov: 5%), with the rate for 16-24 year olds at 14.9% (from Jun’s record-high 21.3%).

- FDI into China fell by 8% yoy to CNY 1.13trn in 2023 (Jan-Nov: -10%), shrinking for the first time since 2012. Separately, fixed asset investment in China grew by 3% yoy to CNY 50.3trn in 2023 (Jan-Nov: 2.9%).

- Inflation in Japan eased to 2.6% in Dec (Nov: 2.8%). Excluding fresh food, prices were down to 2.3% (Nov: 2.5%) – the slowest pace of rise since Jun 2022 as energy prices fell by 11.6%. For the full year, core inflation rose 3.1%, the biggest gain since 1982. Excluding food and energy prices slipped to 3.7% (Nov: 3.8%); services prices were up by 2.3%.

- Industrial production in Japan fell by 1.4% yoy and 0.9% mom in Nov (Oct: 5.3% yoy and 1.3% mom). In month-on-month terms, IP was dragged down by lower vehicle production (-2.5% from Oct’s 2% gain) and electrical & electronics equipment (-3.5% from 2.9%) among others.

- Machine tool orders in Japan declined by 9.9% yoy in Dec, declining at a slower pace than Nov’s 13.6% drop. Separately, machinery orders fell by 5% yoy in Nov (Oct: -2.2%): orders from manufacturers slipped 7.8% while services orders also declined by 0.4%.

- Wholesale price inflation in India inched up to a 9-month high of 0.73% yoy in Dec (Nov: 0.26%), largely due to an uptick in food products.

Bottom line: The first meetings of central banks get underway this week – neither the BoJ nor the ECB are expected to deliver rate cuts, though every comment and data will be scrutinised for signs about timings of rate cuts. This week also sees the flash PMIs from major economies across the globe, with eyes on the forward-looking indicators like new orders and hirings – especially important given the re-routing of hundreds of cargo ships from the Red Sea and impact on transport costs; air freight prices have remained stable so far (these are costlier compared to sea freight, but become attractive when bearing in mind time delays). With the Israel-Hamas war still ongoing and increasing risk for a widespread conflict (with more countries being drawn in), there is increasing chatter about political solutions to mitigate the risks of conflict spill-overs and spreading (see the Media Review section). Lastly, this week also sees presidential elections get underway in Finland, with 2 clear favourites; if no candidate wins more than 50% of the vote, a second run-off will be held on Feb 11th.

Regional Developments

- Bahrain’s minister of finance disclosed that the nation had attracted USD 2.5bn in FDI in both 2022 and 2023, in line with targets. He also revealed that Bahrain’s non-oil economy grew by 4.5% yoy in Q3.

- Economic growth in Egypt slowed to 2.65% in Q1 of the fiscal year 2023-24 (Jul-Sep 2022: 4.4%). Full year growth for this fiscal year is estimated at 3.5% (revised down in Dec 2023). Separately, the IMF team is in Egypt to discuss the USD 3bn loan program, including the first and second reviews of the program in addition to a potential expansion of the loan.

- Egypt recorded a primary surplus of EGP 150bn (USD 4.9bn) in Jul-Dec 2023, according to the minister of finance, while deficit for the period stood at 4.95% of GDP. Revenues grew by 41.6% yoy (with tax revenues up by 43.4%) while spending rose by 56%.

- External debt in Egypt slipped to USD 164.52bn in Jul-Sep 2023 (Apr-Jun: USD 164.73bn), thanks to a decline in long-term debt (to USD 134.25bn from USD 136.58bn) while short-term debt inched up by USD 2.12bn to USD 30.27bn. Banks’ external debt was relatively steady at USD 20.91bn.

- Egypt’s government IPO program’s volume of subscriptions reached USD 3.5bn, revealed the minister of finance.

- Transit volumes across the Suez Canal are down an estimated 37% yoy in the first two weeks of Jan, according to the IMF’s PortWatch platform. Top three industries traded through this corridor include petroleum, chemical & non-metallic mineral products, mining & quarrying and agriculture.

- Remittances into Egypt touched USD 24.2bn in 2023, according to the World Bank. Egypt ranked sixth globally (with the list topped by India, Mexico and China) and fifth among low and middle-income countries in receiving financial remittances in 2023.

- Moody’s downgraded Egypt’s outlook to negative from stable, citing weakening of the country’s credit standing in light of the increase in interest payments and external pressures.

- Kuwait formed a new government, with new ministers appointed for the major portfolios of oil, finance and foreign affairs.

- Oman Investment Authority launched a OMR 2bn (USD 5.2bn) fund (called the Future Fund Oman) to promote investments in local SMEs, and attract foreign investment. The fund will focus on tourism, manufacturing, green energy, maritime resources, and technology.

- Hotel revenues (of 3- to 5-star hotels) in Oman increased by 26.6% yoy to OMR 204.18mn (USD 531.77mn) by end-Nov 2023. The total number of hotel guests increased by 30.3% to 1.88mn in Jan-Nov 2023 and occupancy rose by 9% yoy.

- Qatar inflation inched up to 1.65% yoy in Dec (Nov: 1.29%). In monthly terms, prices rose by 1.59%, largely attributed to the uptick in recreation & culture (+9.74%), food & beverages (1.14 %) and transport by 0.75% among others.

- Qatar Energy is expected to sign a long-term LNG deal with India within weeks to provide LNG on a cheaper and more flexible terms than current existing contracts, reported Reuters. The agreement is likely to extend the contracts (set to expire in 2028) to supply 8.5 million metric tonnes per year LNG to Indian buyers.

- The minister of finance in Qatar revealed in a Bloomberg interview that the country plans to sell its first green bond soon and the first external debt issuance in four years.

- Qatar Investment Authority and fund manager Ashmore Group launched a USD 200mn fund (Ashmore Qatar Equity Fund) aimed at encouraging foreign investors to buy into the country’s stock market.

- Gulf bond issuance surged by 74% yoy to USD 64.7bn in 2023, according to Refinitiv data, while issuance in the MENA region stood at USD 69.9bn (+83% yoy).

- New foreign investment projects in the UAE grew by 28% yoy in 2023, to the second highest in the world after the US, according to UNCTAD’s Investment Trends Monitor report. Greenfield numbers also jumped in Saudi Arabia, by 63%.

- Morocco became the fifth country to join the MENA industrial partnership: the latest meeting announced deals worth USD 2.2bn including an USD 80mn agreement to establish an electric car manufacturing plant in Jordan in partnership with the UAE and a supply agreement between Bahrain Steel and Emirates Steel among others.

Saudi Arabia Focus

- Consumer price inflation in Saudi Arabia fell to 1.5% yoy in Dec, the lowest since Jan 2022, as both housing and food costs slowed to 7.5% and 1.2% respectively (Nov: 7.8% and 1.4%) while gains were recorded in services-related restaurants & hotels (2.5% from 2.3%) and recreation & culture (1% from 0.5%). For the full year 2023, consumer inflation averaged 2.3%, lower than the government’s estimate of 2.6%, slower than the 2.5% recorded in 2022.

- Wholesale prices in Saudi Arabia rose to 2.96% in Dec(Nov: 2.37%), the highest reading since Jan, largely driven by the jump in prices of “other transportable goods” which rose to 6.13% (Nov: 5.16%). WPI eased to 0.9% in 2023, from the 7.8% jump a year ago, with declines across all categories. However, if 2023 is split into 2 halves, “other transportable goods” costs rose to 2.19% in H2 (H1 2023: 0.92%), in contrast to all other groups.

- Saudi Arabia’s finance minister disclosed that the country has no plans to impose income tax on individuals. The country imposes VAT, income tax on companies and foreign investors and a zakat on the local population.

- The new “investor friendly” civil code has come into effect in Saudi Arabia: the code’s 721 articles lay down statutory requirements for judges to follow – regarding issues including real estate and tort – as opposed to the traditional Islamic principles. Importantly, this allows foreign firms to take commercial cases to an arbitration court (that operates in English) rather than the Saudi grievances court.

- Saudi Arabia has yet to officially join the BRICS+ bloc of countries, disclosed the minister of commerce at a WEF panel last week.

- Government-issued debt instruments worth SAR 5.17bn (USD 1.37bn) are to be listed on the Saudi Exchange, once approval is received. Trading is expected to begin this week.

- Saudi Arabia’s National Debt Management Center concluded its riyal-denominated sukuk issuance for Jan, at SAR 8.825bn (USD 2.35bn).

- International arrivals into Saudi Arabia surged by 156% in 2023, compared to 2019, according to the UN WTO. This compares to a 22% uptick in the wider Middle East region.

- Dammam’s King Fahd International Airport welcomed a record 10.9mn + passengers in 2023, up 16.2% yoy. Separately, Saudi Arabia’s state-owned airport operator issued a tender for a new terminal at Abha International Airport in the Aseer region, to be open by 2028. Capacity of the expanded airport is expected at 8mn passengers annually by 2030, from about 1.5mn passengers now.

- Saudi Ports handled 11,380,302 units in 2023, up by 9% compared to 2022, reported the Saudi News Agency. Additionally, facilities managed by the Saudi Ports Authority, reported a 12.07% jump in container handling to 8,443,746 in 2023.

UAE Focus![]()

- Dubai GDP grew by 3.3% in Jan-Sep 2023, supported by upticks in accommodation & food services (11.1%), transportation & storage (10.9%) and the information & communications sector (4.4%) among others. Real estate, financial & insurance and manufacturing activities grew by 4%, 2.7% and 2.2% respectively.

- UAE bank assets crossed AED 4trn (USD 1.09trn) for the first time ever in Nov 2023 while the central bank’s balance sheet surged by 30.4% yoy to AED 669.72bn. Monetary base inched up by 2.9% mom to AED 613.9bn, ticking up after 3 months of easing. Credit to the government plunged by 12.3% year-to-date to AED 185.7bn while business & industrial credit inched up by 4.8% to AED 836.5bn.

- Industrial sector in the UAE grew by 9% yoy to AED 197bn (USD 54bn) in 2023. The ministry of industry disclosed that since the launch of Operation 300bn in 2021, industrial exports grew by 17%, productivity in the sector grew by 7% and import substitution projects worth AED 9.3bn was activated.

- UAE has started paying for gems and jewellery imports from India using Indian rupees, according to a senior government official.

- Marine fuel sales fell by 7.1% yoy to 7,476,283 cubic metres (about 7.4mn metric tons) at UAE’s Fujairah hub last year. However, the bunker hub retained its rank as the third largest in the world, following Singapore and Rotterdam.

- Dubai welcomed 15.4mn international visitors in Jan-Nov 2023: this was up 20% yoy & 2.5% higher compared to Jan-Nov 2019. Regional composition of tourists remained broadly unchanged: GCC & MENA region accounted for 28% of visitors in Jan-Nov 2023.

- Passenger traffic at Sharjah airport grew by 17.4% yoy to 15.3mn in 2023, with air traffic rising by 12.5% to over 98k flights.

- Dubai’s Roads and Transport Authority announced the addition of two new toll gates from Nov this year, bringing the total number to 10.

- Cryptocurrency exchange OKX secured a regulatory license from Dubai’s Virtual Assets Regulatory Authority to offer crypto services to retail clients.

- UAE agreed to rollover a USD 2bn loan to Pakistan (which was maturing in Jan 2024) by another year. Separately, UAE’s DP World and Pakistan government entities have agreed to build a freight corridor and economic zone near Karachi.

Media Review

IMF report launch 2024: Economic prospects & policy challenges for GCC countries

https://agsiw.org/programs/imf-report-launch-economic-prospects-and-policy-challenges-for-the-gcc-countries/

Arab nations develop plan to end Israel-Hamas war & create Palestinian state

https://www.ft.com/content/11890426-0250-4a3c-ba48-d8523924eb9c

World nears dangerous climate tipping point with snow in short supply

https://www.bloomberg.com/graphics/2024-snow-drought-climate-change/

Cobalt refinery to support Saudi EV ambitions

https://www.agbi.com/articles/cobalt-refinery-to-support-saudi-ev-ambitions/

Aramco CEO predicts tighter oil markets, sees Red Sea risks

https://www.reuters.com/business/energy/aramco-ceo-predicts-tighter-oil-markets-sees-red-sea-risks-2024-01-17/

Powered by: