Markets

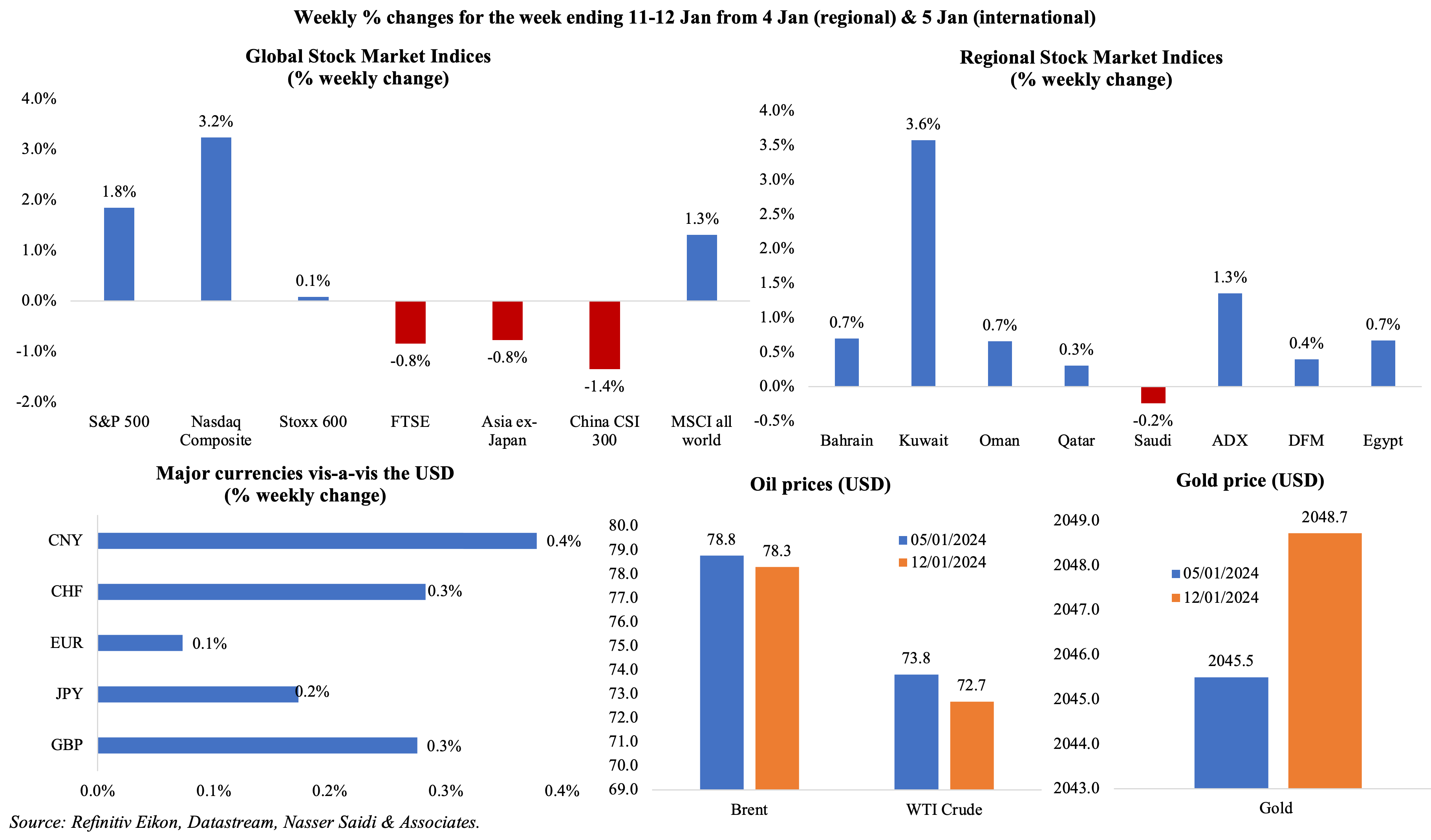

A mixed picture across global equity markets: S&P posted a weekly gain of 1.8%, the highest since mid-Dec, while STOXX posted slight gains (in a week which witnessed a 3-day losing streak). Kuwait posted the largest gains among regional markets, supported by optimism in the new government, while others gained ahead of the publication of US inflation data; even though UAE markets posted weekly gains, Friday saw shares dip given the US and UK air and sea strikes on Houthi targets and higher geopolitical risks affecting regional economies and markets. This, and diversion of oil tankers away from the Red Sea, also led to an increase in oil prices (on Friday) though prices ended lower on a weekly basis. Gold price rose on expectations of a Fed rate cut and due to the uptick in Middle East tensions.

Global Developments

US/Americas:

- Inflation in the US rose to 3.4% yoy in Dec, with shelter (6.2%), food away from home (5.2%) and motor vehicle insurance (20.3%) driving up prices. Core inflation eased slightly to 3.9% (Nov: 4%). Producer price index unexpectedly fell for the third month in a row, down by 0.1% mom in Dec (Nov: -0.1%), while PPI excluding food, energy and trade services rose 0.2% (Nov: +0.1%).

- Goods and services trade deficit in the US unexpectedly narrowed to USD 63.2bn in Nov (Oct: USD 64.5bn) as both exports and imports dropped by 1.9% to USD 253.7bn and USD 316.9bn respectively. Services exports rose to a record high of US 85.7bn, with the services surplus of USD 26.2bn the highest since Mar 2018. Goods trade deficit shrank to USD 89.4bn in Nov (Oct: USD 90.3bn) as goods imports fell 2.3% to USD 257.4bn. US imports from China fell by more than 20% in Jan-Nov and China accounted for 13.9% of US imports, the smallest share since 2004.

- Budget deficit in the US widened to USD 129bn in Dec, taking the total deficit in the current fiscal year to USD 510bn (Oct-Dec 2022: USD 421bn). Interest on the federal debt rose by USD 78bn to USD 288bn.

- Initial jobless claims declined by 1k to 202k in the week ended Jan 6th, the lowest level since mid-Oct, and the 4-week average inched down by 250 to 207.75k. Continuing jobless claims declined by 34k to 1.83mn in the week ended Dec 30th.

Europe

- Economic sentiment indicator in the eurozone rose to 96.4 in Dec (Nov: 94), the highest level since May; sentiment improved more among service providers (to 8.4 from 5.5) than manufacturers (-9.2 from -9.5). Consumer confidence moved up to -15 (from -15.1) while business climate indicator worsened (-0.45 from -0.39 in Nov).

- Sentix investor confidence in the eurozone improved by one point to -15.8 in Jan, with the report stating that “even though the situation and expectations values have each risen by 1 point, this does not yet ensure a turnaround”. Germany continues to drag, with its overall score down by 0.6 points in Jan.

- Retail sales in the eurozone fell by 1.1% yoy in Nov (Oct: -0.8%), the 14th consecutive month of decline in sales. In mom terms, sales fell by 0.3%, with sales of food, beverages & tobacco down by 0.1% (the second monthly drop in a row) while online retail fell by 1.2%.

- Unemployment rate in the euro area eased to a new low of 6.4% in Nov (Oct: 6.5%) while youth unemployment rate was 14.5% (Oct: 14.8%). Compared to Oct 2023, the number of unemployed fell by 99k.

- Exports from Germany grew by 3.7% mom in Nov – exports to EU nations grew at a faster pace of 5.4% compared to the 1.8% uptick to non-EU nations – while imports were up at a slower pace (1.9%). Trade surplus widened to EUR 20.4bn from Oct’s EUR 17.7bn reading.

- German factory orders rebounded by 0.3% mom in Nov (Oct: -3.8%), with orders for capital and consumer goods rising by 0.8% and 1.1% respectively though intermediate goods orders fell by 0.4%. In yoy terms, orders fell by 4.4%, slower than Oct’s 7.3% drop.

- Industrial production in Germany fell by 4.8% yoy and 0.7% mom in Nov (Oct: -3.4% yoy and -0.3% mom). This was the sharpest yoy decline in nearly three years, while it was the sixth consecutive month of declining IP in mom terms.

- Current account surplus in Germany widened to EUR 30.8bn in Nov, the largest surplus since Mar 2021 (Nov 2022: EUR 20.2bn). In Jan-Nov, surplus expanded to EUR 249.1bn from EUR 144.1bn in the same period a year ago.

- UK GDP expanded by 0.3% mom in Nov (Oct: -0.3%), led by a 0.4% uptick in services (retail, car leasing and computer games) as production output grew by 0.3% and construction fell by 0.2%. Output however shrank 0.2% in Sep-Nov.

Asia Pacific:

- Deflationary worries continue in China. Inflation declined for the third month in a row in Dec, falling 0.3% yoy (Nov: -0.5%) though services inflation was rising – tourism and hotel accommodation costs were up by 6.8% and 5.5% respectively. CPI rose only 0.2% for the full year, the weakest since 2009 and missing the official target of 3%. Producer price index fell for the 15th consecutive month by 2.7% (Nov: -3%) and for the full year it fell 0.3%.

- Exports from China grew by 2.3% yoy in Dec, the second month of growth (it had fallen for 6 months in a row before Nov). Exports for the full year 2023 fell by 4.6% yoy to USD 3.38trn – the first yearly drop since 2016. Imports fell by 5.5% to USD 2.56trn in 2023, resulting in a surplus of USD 823bn. US remained the top trade partner in 2023, accounting for 11.2% of total trade (though a drop in yoy terms, the first since 2019) while trade with Russia touched a new record high of USD 240bn (+26% yoy and 4% of total trade).

- China’s money supply grew by 9.7% yoy in Dec, the lowest since Mar 2022, while new yuan loans touched CNY 1.17trn. Outstanding yuan loans grew 10.6%, the lowest in over two decades and versus Nov’s 10.8%. New bank lending touched a record high of CNY 22.75trn (+6.8% yoy) in the full year 2023.

- Inflation in Tokyo eased to 2.4% yoy in Dec (Nov: 2.6%), as energy prices fell 18.8% (Nov: -16.7%) and food prices slowed (6.0% from Nov’s 6.4%). Excluding fresh food, prices moved lower to 2.1% (Nov: 2.3%), also matching a low touched in Jun 2022. Excluding both food and energy, prices slowed to 3.5% (vs 3.6%).

- Household spending in Japan fell by 2.9% yoy in Nov (Oct: -2.5%), the 10th month of decline, thanks to a fall in spending on food (-1.2%), housing (-20.9%), transport & communication (-5.2%) and education (-11%) among others. Real wages in Japan shrank for the 20th straight month in Nov (-3% from Oct’s 2.3% dip) while nominal pay inched up by 0.2% yoy in Nov (Oct: 1.5%), the slowest in nearly 2 years.

- Japan’s leading economic index slipped to 107.7 in Nov (Oct: 108.9), the lowest reading since Oct 2020. Coincident index fell to an 8-month low of 114.5 (Oct: 115.9).

- Current account surplus in Japan widened by 8.7% yoy to JPY 1925.6bn in Nov. Goods trade deficit more than halved from a year ago to JPY 724.1bn as exports and imports fell by 4.5% and 11.4% respectively.

- The Bank of Korea kept interest rates unchanged at 3.5%, and the governor stated that there were “little chances” of rate cuts for the next 6 months. The BoK expects inflation to return to the 2% target by end-2024 or early 2025.

- India’s retail inflation touched a 4-month high of 5.69% in Dec (Nov: 5.55%), towards the higher end of the central bank’s range of 2-6%, with food inflation at 10.4%.

- Industrial output in India inched up 2.4% yoy in Nov, the weakest pace in 8 months, and manufacturing was up by 1.2% (Nov: 10.2%). Industrial output grew by 6.4% yoy in Jan-Aug.

Bottom line: Geopolitical tensions in the Middle East continue to rise, with the latest being US and UK air strikes on the Houthis as the Israel-Gaza war crossed 100 days. These air strikes and diversion of shipping away from the Red Sea begs the question of whether the global economy should be prepared for further shipping delays/ disruptions, rising shipping costs, supply chain disruptions, higher energy prices and potentially higher inflationary pressure in the near term. The IfW Kiel Institute revealed that global trade had declined by 1.3% from Nov-Dec 2023, with the number of containers being transported via the Red Sea falling to 200k per day (from 500k in Nov). Till now, oil prices have been declining (in Oct-Dec), but will a potential escalation of tensions lead to rising oil prices (as seen following the air strikes a few days ago)? Any change in the scenario could cause a rethink by major central banks (that are expected to cut interest rates in 2024).

Regional Developments

- The World Bank forecasts growth in the GCC to rise to 3.6% in 2024 and 3.8% next year, in its latest Global Economic Prospects report, thanks to an uptick in oil sector activity. UAE and Saudi Arabia are projected to grow by 3.7% and 4.1% this year while growth in the wider MENA region is estimated at 3.5% in 2024 and 2025.

- Egypt inflation eased to 33.7% yoy in Dec (Nov: 34.6%). Core inflation also eased, falling to 34.2% from Nov’s 35.9%.

- Egypt’s finance minister disclosed that the tax authority is completing a new draft law for income taxes, which will be up for societal dialogue in Feb. Legal measures are also underway for exempting strategic industrial projects from various taxes for a period of five years.

- The Central Bank of Egypt plans to launch a digital currency (e-pound) by 2030, according to a report from the Information and Decision Support Centre highlighting targets for the 2024-30 period. Also included among the targets is one to achieve 100% financial inclusion by 2030. The government also plans to attract investment by offering a 5-year residency to foreigners who buy into its residential property market: details and regulations are still being finalised.

- Ship traffic in Egypt’s Suez Canal declined by 30% (to 544 ships) and dollar revenues down 40% in the period Jan 1-11 compared to a year ago, disclosed the canal authority head.

- The IMF revealed that discussions are underway with Egypt on the need for tighter fiscal and monetary policy as well as a move to a flexible exchange. A spokesperson also stated that “additional financing will be critical to ensure successful program implementation”.

- Egypt signed an agreement with a consortium led by Saudi utility company ACWA Power for wind energy production in the Gulf of Suez and Gulf of Zeit. The project, with investments worth USD 1.5bn, aims to generate 1.1 gigawatts of power, cut carbon emissions by 2.4mn tons, save about 840k tons of fuel, and supply power to a million homes in Egypt.

- The IMF approved a new USD 1.2bn, 4-year loan program to support Jordan’s economic reforms: this replaces the previous program (which was due to expire in Mar 2024) and allows the country to access an initial disbursement of USD 190mn.

- Kuwait reported a decline in economic activity in Q2 (-1.3% yoy), dragged down by oil sector output (-3.9%) given the OPEC+ production cuts mandate, according to a report by the National Bank of Kuwait. However, the non-oil sector grew by 1.5% in Q2, reversing the 0.9% decline recorded in Q1, thanks to transportation (+35%) and construction (+21% yoy) sectors.

- Oman and India free trade talks have seen duty concessions on petrochemicals emerging as a sticking point: polypropylene and polyethylene, key raw materials for plastics, are currently charged an import tax of 7.5% in addition to an 18% integrated goods and services tax in India. Bilateral trade touched USD 12.4bn in 2022-23 (from USD 5.4bn in 2020-21) and Oman is the 3rd largest export market for India in the GCC. The third round of negotiations are underway this week.

- Oman released a sustainable finance framework, with an aim to reduce reliance on oil and gas and attract ESG investors. Oman plans to issue financial instruments – such as green, social and sustainability bonds, loans and sukuk – to fund and refinance renewable energy projects.

- Qatar PMI dipped to 49.8 in Dec (Nov: 51.5) though financial services expanded and manufacturing witnessed rising demand. Employment in Qatari firms continued to rise in Dec.

- Qatar approved the third National Development Strategy for 2024-2030: it targets 4% growth in the non-hydrocarbon sector and an overall fiscal balance of 5.5% of GDP by 2030. Other focal points were to increase workforce productivity by 2% annually to support growth and reduce greenhouse gas emissions by 25%.

- Foreign reserves of the Qatar Central Bank grew by 6.9% to QAR 245.928bn at end-2023. Gold reserves rose by QAR 4.781bn to QAR 24.372bn as of end of last year.

- The MENA region saw a 33% yoy increase in VC funding to regional startups to USD 2.6bn in 2023, according to MAGNiTT data, while investment deals fell to 477 (2022: 718). Valued at USD 1.38bn, Saudi Arabia secured 52% of the total last year, an increase from the 31% share in 2022 while UAE and Egypt raised USD 691mn and USD 378mn respectively.

- GCC USD sukuk issuance surged by 178% yoy in 2023, as per a Fitch Ratings report. It also revealed that in core markets like the GCC, Malaysia, Indonesia, Pakistan, and Turkey, sukuk accounted for a 29% share of debt capital market issuances across all currencies in 2023.

Saudi Arabia Focus

- Saudi Arabia launched five new “Premium Residency” programs to attract investment and skilled personnel. The categories include special talent, gifted, investor, entrepreneur, and real estate owner; after obtaining residency, the persons can conduct business, own real estate and obtain work permits for holders and family.

- Total investment in Saudi Arabia’s industrial sector grew to a total of SAR 1.5trn as of Q3 2023: this is a 1.5% growth in Q3, and a 9.3% jump in the year to Q3 2023, according to the Saudi Press Agency.

- SAMA data showed that the total value of loans to micro-, small and medium-sized enterprises (MSMEs) in Saudi Arabia grew by 17.8% yoy to SAR 268.6bn in Q3. Total credit allocated to MSMEs was 8.3% of the total in Q3 vs 7.7% in 2022 and 5.8% in 2018.

- Saudi Arabia’s National Debt Management Centre completed the first offering of international bonds, at a value of SAR 45bn, in 2024. The issuance, oversubscribed 2.5 times, was divided into 3 tranches – first, a 6-year bond valued at SAR12.19bn, a second at SAR 15bn due in 2034 and a third totalling SAR 17.81bn maturing in 2054.

- Saudi Arabia signed a deal to boost investment and trade ties with Belarus including sharing of information related to trade, business environment, investment, production and export opportunities as well as joint research to boost trade prospects among others.

- Saudi Arabia established a USD 182mn mineral exploration incentive programme as the country expands its mining sector, to “de-risk investments in exploration, securing to enable new commodities, green field projects and junior miners”, according to the Minister of Industry and Mineral Resources.

- Saudi Arabia’s Royal Commission for Jubail and Yanbu signed a MoU with Brazilian mining company Vale for the development of an iron ore briquettes project in Saudi.

- Saudi investment fund Manara Minerals plans to set up a metals trading arm, disclosed the Acting CEO. The fund also has a strict mandate to source iron ore, lithium, copper and nickel as part of a wider plan for the country to become a metals processing hub.

- Saudi Arabia’s Quality of Life Program signed 20 agreements and strategic partnerships with government and private sector entities last year, leading to marketing and implementation of investment opportunities worth SAR 800mn (USD 213mn) in various sectors.

- Total employees in Saudi private sector rose to 10.9mn in Dec 2023, with 2.32mn of them Saudi citizens, according to the National Labour Observatory. Close to 45k citizen joined the labour market for the first time in the private sector.

UAE Focus![]()

- UAE and Costa Rica concluded negotiations for a CEPA between the two nations. Bilateral trade between the two countries had jumped by 23% to USD 60.4mn in 2022. Sectors like tourism, renewable energy, food security, ICT and manufacturing are expected to benefit from the collaboration.

- Dubai PMI rose to a 16-month high of 57.7 in Dec (Nov: 56.8), supported by the wholesale & retail sector’s strong “upturn in sales” alongside the travel & tourism sector’s “rapid” growth. New order growth was the second-fastest recorded since Jun 2019 and job creation rose to a 4-month high. Selling prices declined at the fastest pace since Jun, as firms opted to stay competitive.

- Dubai’s ruler approved AED 5.5bn (USD 1.49bn) worth of projects that fall under Dubai Social Agenda 33: this includes the allocation of 3,500 plots of land to be distributed among citizens in Dubai and 2,300 ready-to-move-in houses among others.

- Abu Dhabi wealth fund ADQ acquired a 40.5% stake in Egypt’s ICON, with the deal including the acquisition of a stake in seven iconic heritage hotels currently owned by the Egyptian government (through ICON). Financial details were not provided.

- UAE’s Ministry of Investment signed an MoU to cooperate in data centre and AI projects in Kazakhstan. The agreement was signed with Kazakhstan’s Ministry of Digital Development, Innovations & Aerospace Industry and sovereign wealth fund Samruk-Kazyna.

- UAE tops the list of countries that recorded the highest increase in property prices last year, according to the IMF citing BIS data. The UAE posted a 10.4% increase last year and 14.15% rise since pre-pandemic. More details: https://www.imf.org/en/Blogs/Articles/2024/01/11/housing-affordability-remains-stretched-amid-higher-interest-rate-environment

- Dubai launched the annual “world’s coolest winter” tourism campaign: during the campaign last year, tourist numbers rose 8% to 1.4mn. These projects will help Dubai achieve its aim of tourism contributing AED 450bn towards GDP by 2031.

- Etihad Airways has a target of 18mn passengers by 2025, disclosed the Group CEO. In 2023, the airline reported a 30% yoy growth in passengers.

- DP World signed USD 3bn worth of MoUs with India’s Gujarat government, covering the development of ports, terminals, and economic zones.

Media Review

GCC can emerge as ‘Middle Powers’ in second Cold War: Dr. Nasser Saidi

https://www.agbi.com/opinion/nasser-saidi-gcc-middle-powers-second-cold-war/

Saudi Arabia: new civil laws aim to boost investment, but caution lingers

Investors go lukewarm on startups but Riyadh is red hot: Wamda

https://www.agbi.com/opinion/triska-hamid-startup-investors-2024/

AI Will Transform the Global Economy. Let’s Make Sure It Benefits Humanity

Global Risks Report 2024: World Economic Forum

https://www.weforum.org/publications/global-risks-report-2024/

Eight charts illustrate 2023’s extreme weather: the Economist

https://www.economist.com/graphic-detail/2024/01/12/eight-charts-illustrate-2023s-extreme-weather

Powered by: