Markets

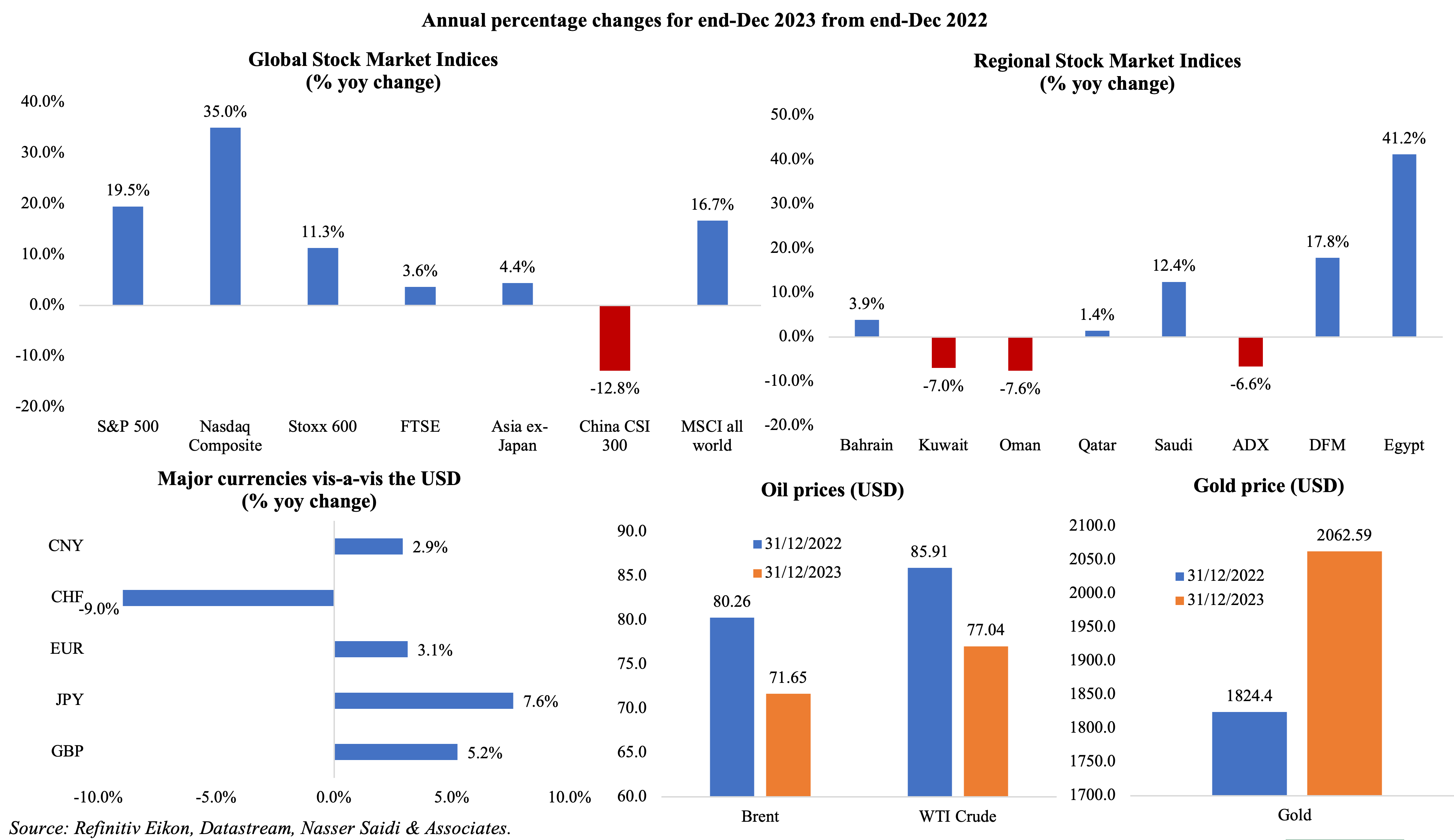

Most equity markets ended 2023 on a positive note, with some like the MSCI World posting close to a 20% gain for the year (the most since 2019) while Chinese markets underperformed (CSI300 lost more than 10%). Markets in the Middle East were mostly up, supported by expectations of a Fed rate cut in early 2024; Egypt posted its strongest year since 2016 while Oman posted a more than 7% drop for the year. Among currencies, dollar ended 2% lower in 2023 after gains in the 2 years before. Oil prices posted the biggest annual drop since 2020, more than 10%, with Brent and WTI settling at USD 77.04 and USD 71.65 a barrel respectively. Gold price closed the year at USD 2,062 an ounce – the best gain since 2020.

Global Developments

US/Americas:

- Dallas Fed manufacturing business index improved to -9.3 in Dec (Nov: -19.9), thanks to a rebound in production (1.4 from -7.2) while new orders fell at a slower pace (-10.9 from -20.5). The Future General Business Activity Index also improved to -8.7 (from -13.4 in Nov).

- Richmond Fed manufacturing index slipped to a 10-month low of -11 in Dec (Nov: -5). This could be traced back to a drop in shipments (-17 from -8), new orders (-14 from -5) and employment (-1 from 0) while vendor lead time rose (to 1 from -4).

- Chicago Fed national activity index moved up to a positive 0.03 reading in Nov (Oct: -0.66). Employment-related indicators contributed +0.03 to the index in Nov (Oct: -0.15) alongside an uptick in the contribution of the personal consumption and housing category (+0.04 from Oct’s -0.03) while production-related indicators made a neutral contribution.

- S&P Case Shiller 20-city composite home price index rose by 4.9% yoy in Oct (Sep: 3.9%), the largest gain since Nov 2022, partly due to the rise in mortgage interest rates.

- Pending home sales in the US fell by 5.2% yoy in Nov (Oct: -8.5%) while it was unchanged compared to a month before. Mortgage rates were over 8% in mid-Oct before it fell to 7.5% in early Nov before closing the month at around 7.25%. Despite the fall in mortgage rates, high home prices and tight supply has affected sales.

- Chicago PMI declined to 46.9 in Dec, returning to contractionary territory, after Nov’s 55.8 reading – which was the first 50+ reading in 15 months.

- Initial jobless claims rose by 12k to 218k in the week ended Dec 22nd, implying a cooling labour market, and the 4-week average inched down by 250 to 212k. Continuing jobless claims rose by 14k to 1.875mn in the week ended Dec 15th.

Asia Pacific:

- Japan’s unemployment rate stood unchanged at 2.5% in Nov, the lowest rate since Jan. Jobs-to-applicants ratio slipped to 1.28 (Oct: 1.3).

- Leading economic index in Japan inched up to 108.9 in Oct from the preliminary reading of 108.7 but was lower than Sep’s 109.3. The coincident index was unchanged from the flash reading at 115.9, the highest since Jun.

- Industrial production in Japan fell by 0.9% mom in Nov (Oct: +1.3%), this was the first fall since Aug, with motor vehicle production declining by 2.5% mom and output of electrical machinery & electronics equipment also down by 3.5%. IP grew by 5.3% yoy (Oct: 1.1%).

- Japan’s retail trade grew by 5.3% yoy and 1% mom in Nov (Oct: 4.1% and -1.6% mom): this was the 22nd consecutive month of yoy expansion since Mar 2022. Large retailer sales were up by 5% yoy in Nov (Oct: 3.7%).

- India posted a current account deficit of USD 8.3bn in Jul-Sep 2023, or 1% of GDP, lower than the previous quarter’s USD 9.2bn deficit. Trade deficit widened to USD 61bn (Q2: USD 56.6bn) while balance of payment surplus narrowed to USD 2.5bn (Q2: USD 24.2bn).

- Industrial production in Singapore grew by 1% yoy in Nov (Oct: 7.6%), with electronics production growing by 7.3% (slower than Oct’s 15.1% gain). In month-on-month terms, IP fell by 7.8% following the 9.9% gain in Oct.

- Inflation in Singapore slipped to 3.6% in Nov (Oct: 4.7%) while core inflation slowed to 3.2% (Oct: 3.3%). According to official estimates, headline and core inflation are projected to average 3.0–4.0% and 2.5–3.5% respectively in 2024.

Bottom line: Traders are pricing in 6 rate cuts this year by both the Fed and the European Central Bank even as the world remains witness to two ongoing wars – one, between Israel and Hamas (with, as yet, limited spillovers to a broader regional conflict) and two, between Russia and Ukraine. The year 2024 is also the biggest election year, with around 64 countries (home to more than half the world population) holding regional, legislative, and Presidential elections including in the US, European Parliament, Taiwan (already leading to early tensions with China), in South Asia (India, Pakistan, Bangladesh & Sri Lanka) and in Africa (South Africa, Senegal and others) to name a few. Though many outcomes are all-but-guaranteed, even a few curve balls can catch the global economy by surprise – some geopolitically riskier than others. 2024 will be overshadowed by geopolitical risks as a New Cold War, decoupling and increased global fragmentation disrupt global value chains, and can result in military confrontations.

Regional Developments

- GCC and South Korea signed a free trade deal: the deal will see South Korea remove tariffs on almost 90% of the items (including LNG and petroleum products) while the GCC will remove tariffs on 76.4% of traded products and 4% of traded goods. The discussions had begun in 2007 before being were put on hold, and then revived again last year.

- Saudi Arabia and the UAE formally join the BRICS bloc from Jan 1st. Of the countries issued an invite, only Argentina declined the invite to join the bloc.

- Bahrain’s real GDP grew by 2.45% yoy in Q3, supported by non-oil sector growth (4.48%). The financial and manufacturing sectors contributed 18.08% and 13.85% respectively to overall growth.

- Real estate transactions in Bahrain grew by 5% yoy in Jan-Sep while value of transactions was up by 2% to BHD 814mn (USD 2.16bn). The real estate regulatory authority launched an online platform that provides data on the sector (including transaction volumes, property valuations and land classifications among others).

- Bahrain’s Mumtalakat Holdings is currently in talks to take full ownership of the supercar maker McLaren Group. Mumtalakat already holds a 62.55% stake in the firm and is in talks to buy 20% held by minority shareholders.

- Egypt generated USD 5.6bn from (complete or partial) stake sales in 14 state-owned entities, according to the PM. The IFC, which is advising the government on the asset monetisation program, has advised prioritising 4 sectors: management and operation of airports, telecommunications, banks, and insurance.

- Egypt’s manufacturing industry index fell by 3.98% yoy in Oct: while the indices for electrical appliances and pharma, chemical & medicinal products fell by 1.73% and 2.65% respectively, the index for the chemical materials and products industries rose by 4.23% (due to higher demand).

- The petroleum sector in Egypt signed 29 agreements for oil and gas exploration in 2023, with a value of USD 1.2bn. The ministry also granted USD 61mn for drilling 87 new wells.

- A boost to port capacity in Egypt: Abu Dhabi’s AD Ports Group signed an agreement with the Red Sea Ports Authority to develop and operate a multi-purpose terminal at Safaga port, with an investment of USD 200mn over 3 years. Separately, Egypt was granted USD 455mn in funding to build a new container terminal in Damietta Port (which will triple the port’s capacity).

- Iran and Russia agreed to finance trade in their local currencies, using infrastructures including non-SWIFT interbank systems, instead of the US dollar given that both nations are subject to US sanctions.

- Inflation in Kuwait was unchanged at 3.8% yoy in Nov: food inflation ticked up marginally to 5.8% (Oct: 5.7%) while prices were steady for other groups including restaurants & hotels (3.5%), housing (3.1%), communication (3.1%) and transportation (3%) among others.

- Oman’s budget surplus touched OMR 931mn (USD 2.4bn) in 2023, as public revenue rose to OMR 12.21bn while spending touched OMR 11.282bn. Net oil revenues were up by 29% to OMR 6.88bn while net gas revenue surged by 43% to nearly OMR 2bn. Public debt was reduced by OMR 2.4bn to OMR 15.2bn.

- FDI into Oman reached OMR 23bn (USD 59bn) by end-Q3, up by 3.78% yoy: sector-wise, almost 77% of total FDI went into the oil and gas sector while by country, UK accounted for almost half of the FDI inflow (OMR 11.52bn) followed by US (OMR 3.88bn) and the UAE (OMR 1.28bn).

- QatarEnergy signed its first ever 5-year crude sales deal, to supply Shell in Singapore with up to 18mn barrels of oil a year for 5 years.

- Given the recent attacks on ships in the Red Sea route, some tankers transporting diesel and jet fuel from Middle East and India are taking the longer East-West route via the southern tip of Africa leading to a spike in shipping and container transport costs.

Saudi Arabia Focus

- Money supply in Saudi Arabia grew by 7.4% in Nov (Oct: 8.8%). Private sector loans increased by 9.8% yoy (Oct: 9.4%). Assets of the Saudi Central Bank rose by 3.25% mom to SAR 1.821trn in Nov while net foreign assets were up by 2.89% to SAR 1.568trn.

- Unemployment among Saudi Arabia’s citizens rose to 8.6% in Q3 (Q2: 8.3%) while the overall unemployment rate crept up to 5.1% (Q2: 4.9%). Saudi women’s unemployment inched up to 16.3% from 15.7% in the previous quarter.

- Merchandise exports from Saudi Arabia fell by 17.4% yoy to SAR 104.3bn in Oct, largely due to the fall in oil exports (by 18.3% yoy) while non-oil exports also declined (by 13.9% to SAR 22bn). China, Japan and India were the top export destinations.

- Participation of Saudi citizens in the private sector increased to 2.3mn in 2023, from 1.7mn in 2019, according to the Human Resources and Social Development System. Of this more than 360k persons entered the workforce for the first time. Women’s participation jumped to 35.3% in 2023, from just 17% in 2019.

- Saudi Cabinet approved contracting regulations for foreign firms without regional HQs, according to the Saudi Press Agency. The statement did not however disclose the regulations and it also remains unclear if contracts will be awarded to those without regional HQs in the country.

- The Saudi industrial cities authority, as part of the National Industry Strategy, signed contracts worth SAR 538mn (USD 133mn); among the agreements are plans to accelerate diversification and privatisation, increase non-oil exports, attract FDI and raise operational efficiency among others.

- Saudi Arabia’s mining company Maaden announced the discovery of multiple gold deposits south of its existing Mansourah Massarah gold mine. Samples from the site showed high grade gold deposits of 10.4 grams per tonne (g/t) gold and 20.6 g/t gold in two random drilling sites, according to the statement.

UAE Focus![]()

- UAE and the Republic of Congo have finalised terms of a CEPA to increase non-oil trade and investment ties. Non-oil bilateral trade touched USD 2.1bn in H1 2023, up 134% yoy. Earlier in 2023, the two nations signed three separate agreements on double taxation avoidance, investment promotion and protection, and air transport. Earlier in Dec, the UAE completed talks for a CEPA deal with Mauritius.

- Abu Dhabi’s non-oil GDP grew by 7.7% yoy in Q3 2023, as per data from the Statistics Centre Abu Dhabi. The emirate’s real GDP grew by 1% yoy to touch the highest quarterly value of AED 290.5bn. During Jan-Sep, real GDP grew by 2.8% while non-oil sector was up by 8.6%. Manufacturing contributed over 17% to non-oil GDP in Q3 and 9% to overall GDP.

- UAE petrol and diesel prices drop in Jan, with petrol prices down by between 4.6% to 4.9% (depending on the grade) while diesel was down by 5.9% to AED 3.

- UAE launched a unified registry for family businesses, to serve as a “comprehensive and unified database”. It is also an important step in “strengthening its governance and regulating registration procedures”, according to the Minister of Economy.

- Foreign and regional institutional investors’ net stock purchases amounted to AED 7bn (USD 1.91bn) in the Abu Dhabi and Dubai markets till towards end-Dec 2023. Institutional investors dominated the UAE equity markets, accounting for nearly 78% of total trading activity.

Media Review

The five biggest market surprises of 2023

https://www.economist.com/finance-and-economics/2023/12/27/the-five-biggest-market-surprises-of-2023

FT writers’ predictions for the world in 2024

https://www.ft.com/content/7eef99e6-6bd5-4e84-85c1-ec77cc0671af

Five big uncertainties facing the Chinese economy in 2024: PIIE

https://www.piie.com/blogs/realtime-economics/five-big-uncertainties-facing-chinese-economy-2024

Saudi sovereign wealth fund splashes cash in 2023: Global SWF

https://www.reuters.com/business/finance/saudi-sovereign-wealth-fund-splashes-cash-2023-report-shows-2024-01-01/

Companies flock to Riyadh as Saudi economy diversifies: Arab News report

https://www.arabnews.com/node/2434361/business-economy

Fireside Chat with Dr. Nasser Saidi on MENA’s Energy Transition, Bloomberg Green at COP28, 5 Dec 2023

https://nassersaidi.com/2023/12/09/fireside-chat-with-dr-nasser-saidi-on-menas-energy-transition-bloomberg-green-at-cop28-5-dec-2023/

Powered by: