GCC PMIs. Saudi Arabia GDP, monetary stats, trade surplus & 2024 budget.

Weekly Insights 8 Dec 2023: Saudi Arabia’s macro picture to be boosted by the Expo win and expanding project pipeline

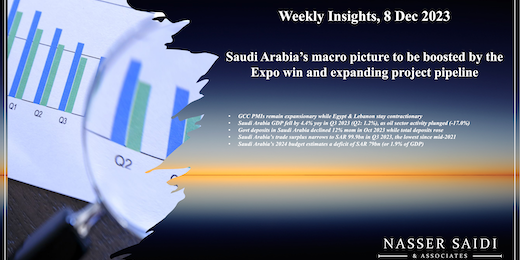

1.GCC PMIs remain expansionary while Egypt & Lebanon stay contractionary

- Both UAE and Saudi Arabia saw non-oil sector PMIs edge down in Nov while it rose by 0.7 points to 51.5 in Qatar.

- In Saudi Arabia, new orders rose to a 5-month high while export orders declined for the 3rd time in 4 months. The UAE also saw new orders increase, thanks to strong demand and new clients.

- Qatar reported expansions in output and employment, with manufacturing sector reporting the fastest growth in Nov. Construction firms also confirmed strong sales and increase in new businesses. Price increases were relatively weak.

- However, both UAE and Saudi Arabia saw cost inflation remaining high; input costs in Saudi rose at the fastest rate since Jun 2022 (especially the construction sector).

- The 12-month outlook remained strong in Saudi, as respondents were confident and expected business climate to improve. However, UAE companies were less confident, mostly due to concerns about a build-up of competition (large number of firms entering the market) & that competitive pressures could lead to changes in market shares.

- Egypt PMI remained below-50 for the 36th month in a row, as both output and new orders fell (albeit more slowly) alongside a drop in employment. Given the ongoing war in Gaza and concerns about the depreciating EGP and supply shortages, firms also recorded the lowest level of confidence.

- Lebanese firms edged up to a 4-month high in Nov, supported by new export orders – rising for the first time since Jun & at the fastest pace since May 2015. Interestingly, business confidence also ticked up thanks to indications of improvement in certain sectors.

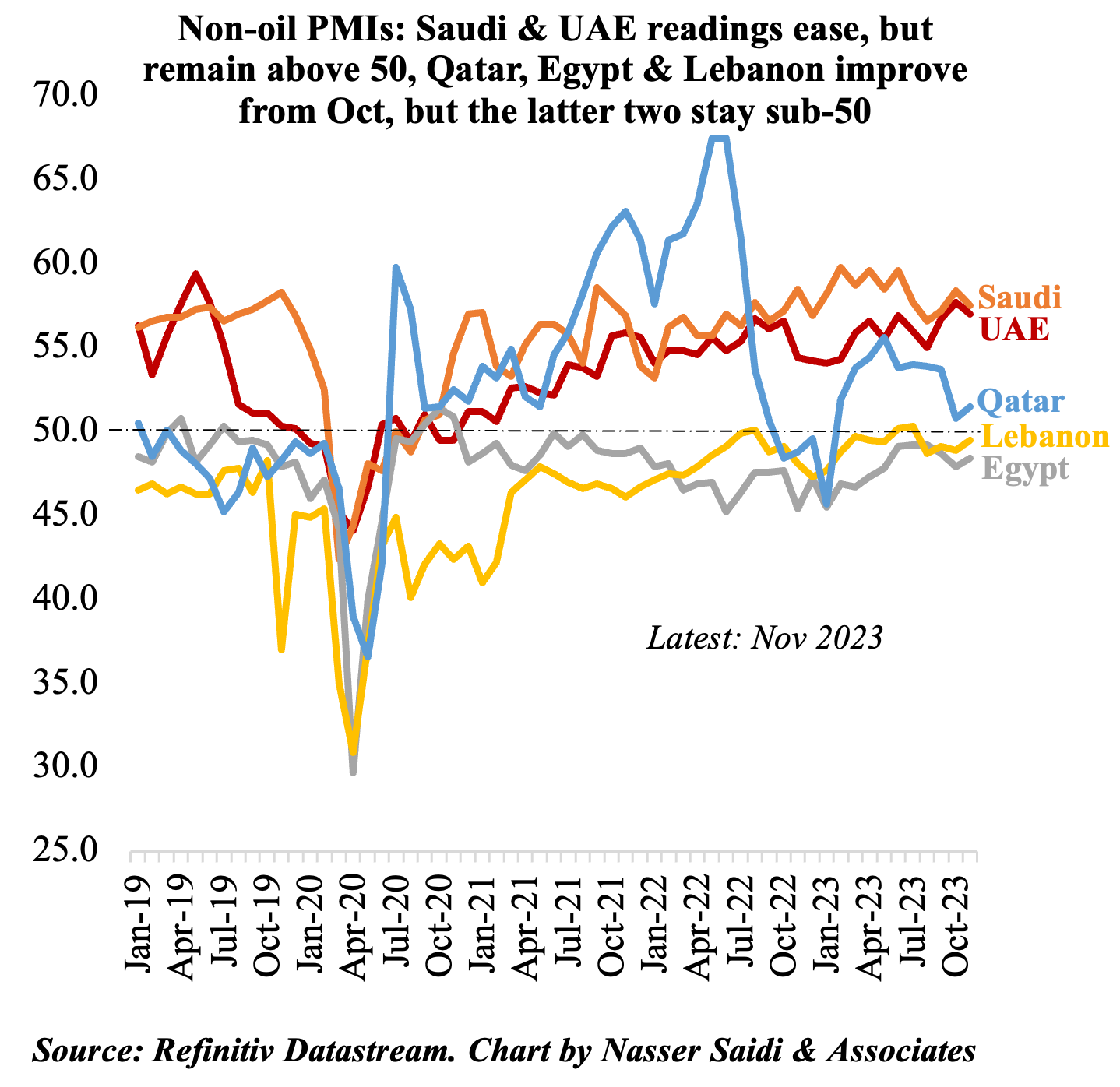

2. Saudi Arabia GDP fell by 4.4% yoy in Q3 2023 (Q2: 1.2%), as oil sector activity plunged (-17.0%)

- Saudi Arabia’s real GDP fell by 4.4% in Q3 2023, dragged down by the oil sector (-17.0% yoy following Q2’s 3.8% drop). The extension of a voluntary cut of 1mn barrels per day till Q1 2024 implies further dips in oil sector growth.

- Non-oil sector grew by 3.5% in Q3 (Q2: 5.3%), though the pace has been slowing in recent quarters (averaging 4.7% this year vs an average of 5.3% in Jan-Sep 2022). Non-oil sector growth has been supported by strong domestic demand. Meanwhile, government spending continues to grow, up by 1.9% in Q3.

- Various factors such as the pipeline of megaprojects, the move of around 200 firms’ regional HQs to Riyadh and the recent win of the Expo 2030 imply a strong expansionary trajectory for the non-oil sector in the coming quarters.

- According to MEED, contracts awarded in Saudi Arabia this year touched USD 82.52bn as of 21st Nov, breaking previous all-time highs. The number of mega and giga projects in the pipeline notwithstanding, large contracts were also given by Aramco alongside power and transport projects. The Expo win and the hosting of World Cup in 2034 will see additional infrastructure spending including on roads, rails, infrastructure, buildings and more.

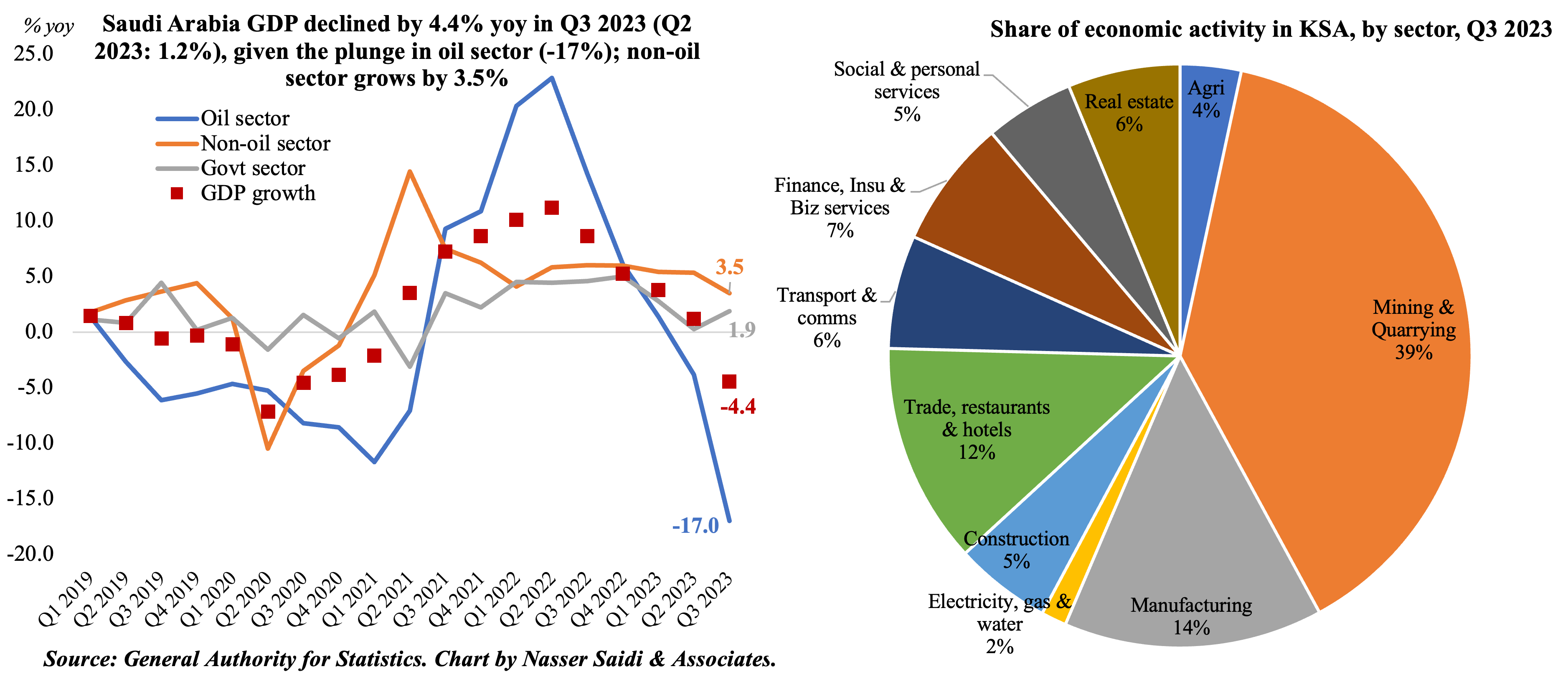

3. Govt deposits in Saudi Arabia declined 12% mom in Oct 2023 while total deposits rose; net foreign assets fell 7.7% year-to-date; credit & deposit growth are inching closer; claims on public sector outpacing private

4. Saudi Arabia’s trade surplus narrows to SAR 99.9bn in Q3 2023, the lowest since mid-2021

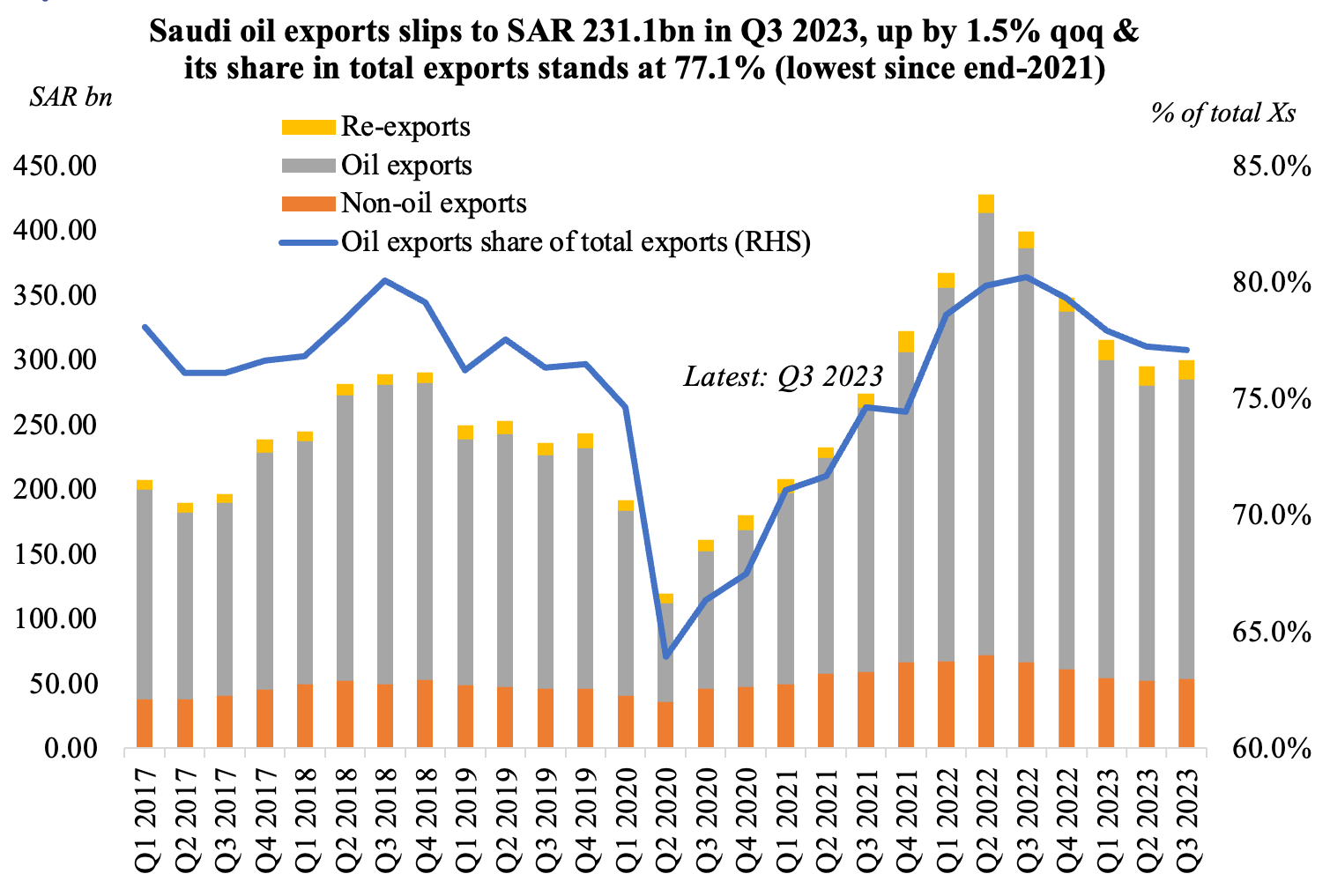

- Saudi Arabia’s overall exports fell by 25% yoy to SAR 299.8bn in Q3 – due to the drop in oil exports (-27.8% yoy) and non-oil exports (-19.2% yoy) while re-exports grew by 18.9%. In qoq terms, all components posted a slight increase (below 5%).

- Share of oil exports to overall exports stood at 77.1% in Q3, the lowest since end-2021.

- Imports increased in Q3, by 3.8% qoq and 9.4% yoy to SAR 199.95bn. This resulted in trade surplus narrowing to SAR 99.86bn (Q2: SAR 102.2bn & SAR 216.3bn from a year ago).

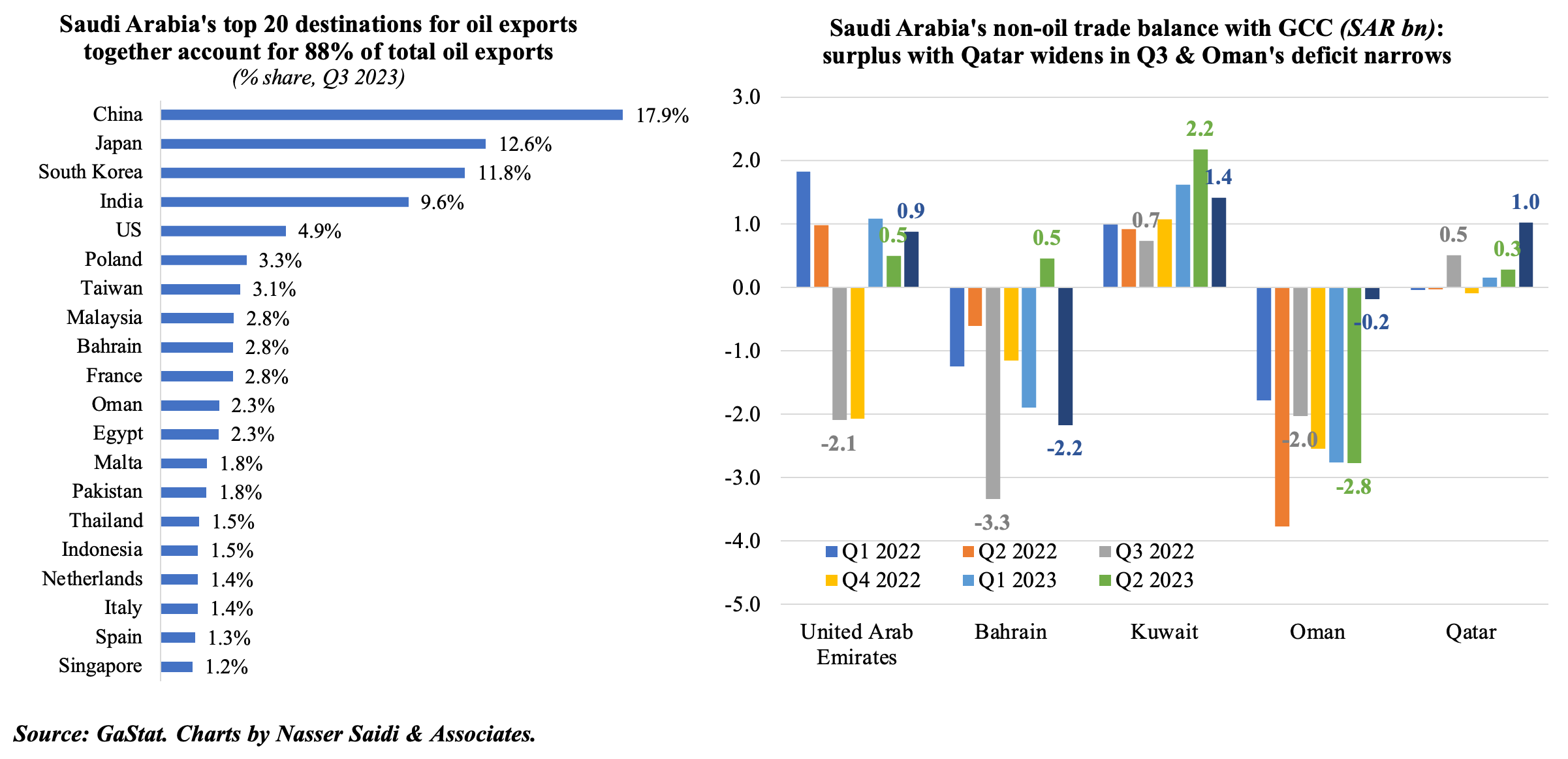

- Unsurprisingly, China continues to be the top destination for oil exports; top 5 nations account for ∼60% of total oil exports & top 20 for 88% of the total.

- Saudi Arabia’s non-oil trade with the GCC has been diverse: surpluses with UAE and Qatar increased in Q3; Oman’s deficit narrowed while Bahrain’s widened; Kuwait’s surplus remains the highest the GCC, though it has declined from the previous quarter.

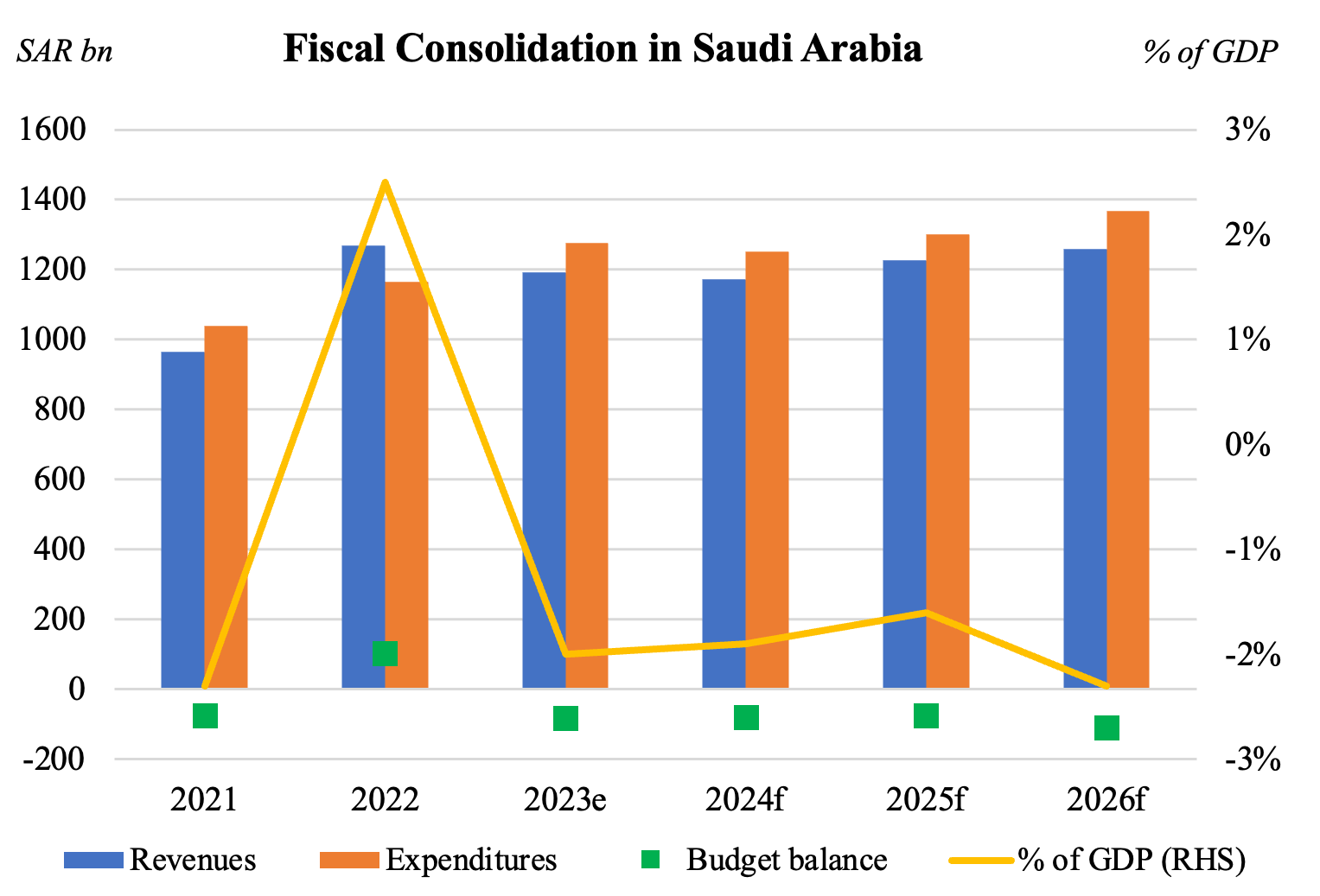

5. Saudi Arabia’s 2024 budget estimates a deficit of SAR 79bn (or 1.9% of GDP)

- Saudi Arabia’s fiscal balance is estimated to narrow to a deficit of SAR 79bn in 2024 (or 1.9% of GDP), in line with the pre-budget statement. This follows 2023’s estimate of a SAR 82bn deficit (or 2% of GDP this year). The narrower deficit stems from revenues budgeted to fall by 1.8% alongside a slightly faster 1.9% drop in spending (compared to the 2023 estimates).

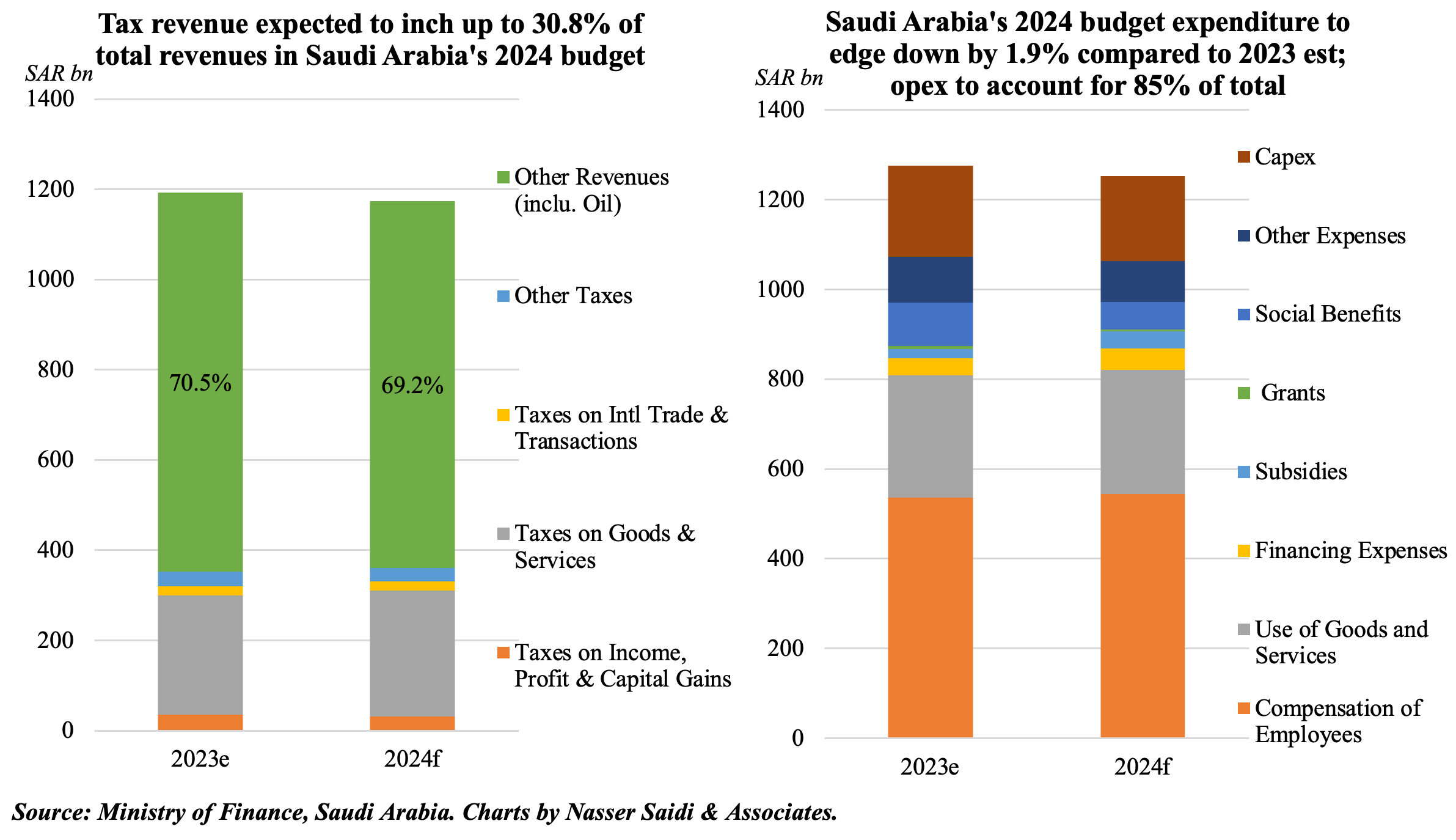

- While tax revenues will support overall revenue, its share is estimated to remain steady at 30% of the total revenues.

- Opex forms bulk of the spending (84.9% in 2024 budget), and within opex, compensation of employees’ accounts for the largest share (51%). Subsidies will almost double to SAR 38bn while capex is budgeted to drop by 1.9% to SAR 189bn.

- Public debt remains relatively modest, at SAR 1.103trn in 2024 (or 25.9% of GDP).

- While fiscal consolidation remains the key message, winning the Expo 2030 and hosting large sporting events (such as World Cup 2034) will necessitate the building of related infrastructure & buildings; it will need accelerated spending in the coming years. A USD 92bn investment plan for the Expo was unveiled this week: it would be good practice to tap the markets for partial funding of such mega projects.

- Policy steps can further support fiscal consolidation, including: (a) phase out fuel/ electricity subsidies (IMF estimates Saudi fossil-fuel subsidies at USD 253bn or 27% of GDP in 2022, split roughly equally between explicit & implicit subsidies); (b) rein in public sector wage bills, by offering incentives for job creation in the private sector; and (c) diversifying non-oil revenue sources (e.g. introduction of property taxation) among others.

Powered by: