Markets

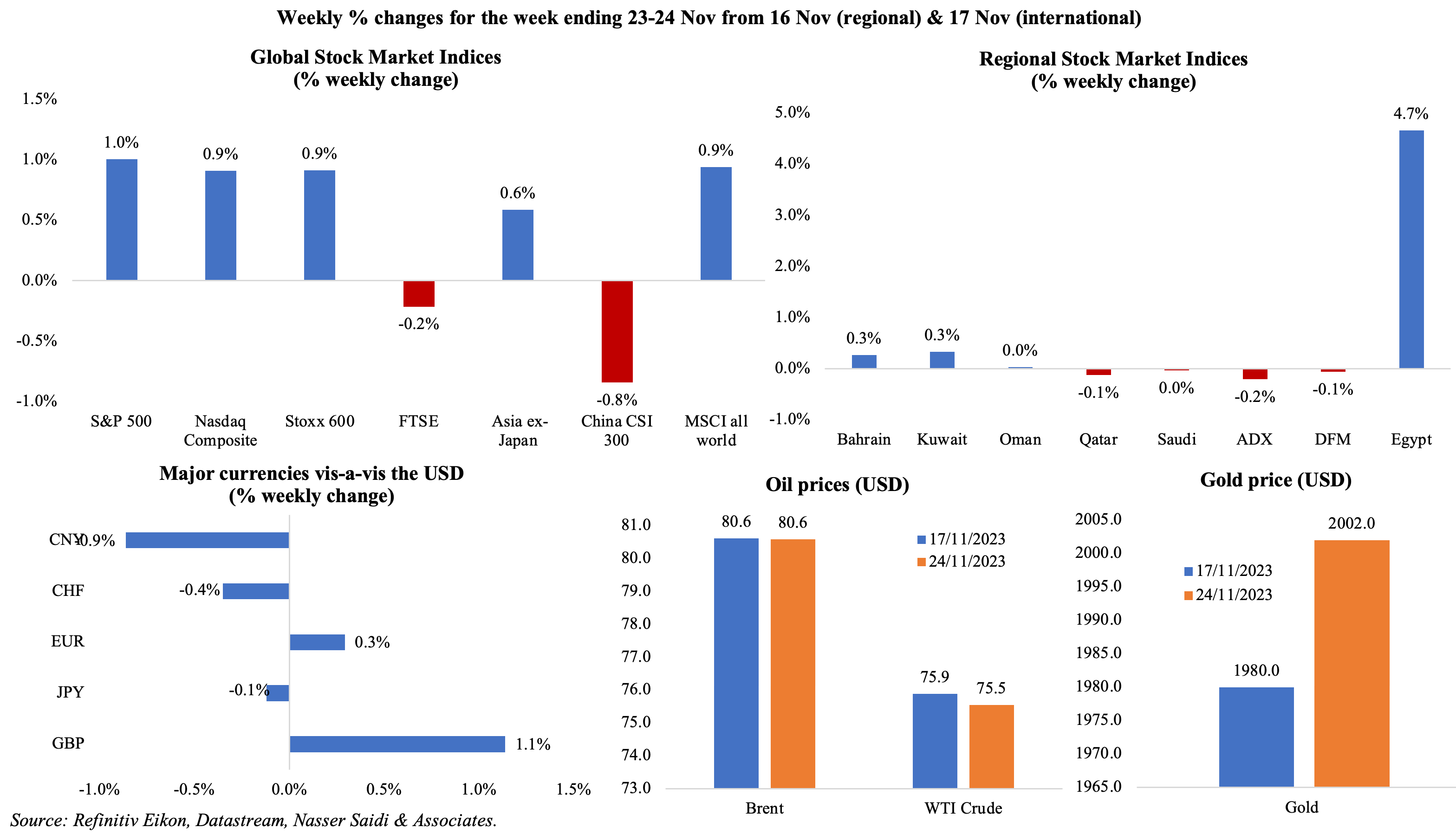

Most global equity markets posted weekly gains last week on expectations that interest rates have peaked, while China’s market fell for the second week in a row, pulled down over concerns over a slowing economy, property woes and despite potential injection of liquidity by authorities. Regional markets performance was muted, except for Egypt where most sectors closed in the green. The euro edged higher against the dollar, and the GBP rose to the highest since early Sep on expectations that interest rates will be left unchanged till mid-2024, while the JPY held almost steady after news of an uptick in core inflation (hoping for BoJ to roll back monetary stimulus). Oil prices fell on Wednesday over the announcement of a delayed OPEC+ meeting (to be held on Nov 30th) but were relatively unchanged on a weekly basis. Gold price moved up, closing above USD 2000, as the dollar weakened.

Global Developments

US/Americas:

- Durable goods orders in the US declined by 5.4% mom in Oct (Sep: +4.6%), second-largest decline in orders since Apr 2020. Transportation equipment orders plunged by 14.8% (Sep: 11.6%) while non-defence capital goods orders inched lower by 0.1% mom (Sep: 0.5%).

- Chicago Fed national activity index fell further to a 7-month low of -0.49 in Oct (Sep: -0.02), with all 4 categories posting declines.

- Existing home sales fell by 4.1% mom to 3.79mn in Oct, the lowest level since Aug 2010. Partly due to the high mortgage rate at 7.44%, though it is below the peak of 7.79% in late-Oct.

- Michigan consumer sentiment rose to 61.3 in Nov, lower than Oct’s 63.8 (though higher than the preliminary reading of 60.4). The 1-year inflation expectation rose to 4.5%, the highest reading since Apr; the 5-year inflation expectation stood at 3.2%, highest since Mar 2011, and up from 3% in Oct.

- The flash manufacturing PMI in the US slipped to 49.4 in Nov (Oct: 50) while services PMI rose by 0.2 point to 50.8. The composite new orders index increased to 50.4 in Nov alongside employment index dropping for the first time since Jun 2020. Input prices fell to 55.7, the lowest since Oct 2020, on lower energy and raw material prices.

- Initial jobless claims dropped by 24k to 209k in the week ended Nov 17th, the most since Jun and reversing the previous week’s increase; the 4-week average moved up by 750 to 220k. Continuing jobless claims fell by 22k to 1.84mn in the week ended Nov 10th.

Europe:

- Eurozone’s manufacturing PMI moved up to a 6-month high of 43.8 in Nov (Oct: 43.1), with new orders declining and staffing levels were lowered for the first time since 2021. Services PMI rose to 48.2 (Oct: 47.8), but remained in contractionary territory. The highlight was rising input and output prices alongside rise in employment and slower fall in new orders.

- Consumer confidence in the euro area improved in Nov but remained at a negative 16.9 (Oct: -17.8). Across the EU, consumer sentiment is pessimistic, up by 1.1 points to -17.5.

- German GDP contracted by 0.1% qoq and 0.4% yoy in Q3, confirming the initial estimates released in Oct. Private consumer spending was down by 0.3% qoq (Q2: 0.2%) while government spending rose by 0.2% (after 4 quarters of declines). Fixed investment grew by 0.6% qoq (Q2: -0.3%).

- Germany’s preliminary manufacturing PMI rose to a 6-month high of 42.3 in Nov (Oct: 40.8), as the decline in new orders showed signs of “tapering off”. Services PMI inched up to 48.7 in Nov (Oct: 48.2) though there is an upward pressure on wages and service sector output prices rising at a significantly high pace.

- German Ifo business climate improved for the third consecutive month in Nov, rising to 87.3 (Oct: 86.9). The current assessment and expectations readings rose to 89.4 and 85.2 in Nov (Oct: 89.2 from 84.8).

- Germany’s producer price index fell by 0.1% mom and 11% yoy in Oct (Sep: -0.2% mom and -14.7% yoy), largely due to the decline of prices of energy (-27.9%) and metal (-11.7%).

- UK’s preliminary manufacturing PMI increased to 46.7 in Nov (Oct: 44.8), with output clocking in the slowest decline in 5 months. The preliminary services PMI moved into expansion territory, rising to 50.5 from 49.5. It was noted that the pause in interest rate hikes and slowdown in inflation were likely supporting business activity.

Asia Pacific:

- China left the one-year and 5-year loan prime rate rates unchanged at 3.45% and 4.2% respectively. This follows last week’s PBoC injection of CNY 1.45 trn worth of one-year Medium-term Lending Facility loans into the banking system, in part to alleviate pressure on the property sector.

- Japan’s inflation rose to 3.3% in Oct (Sep: 3%). Excluding food and energy, prices eased (4% from 4.2%), staying above 4% for the 7th month in a row. Core inflation (i.e., excluding fresh food alone) inched up to 2.9% (from 2.8%), above the central bank’s 2% target for 19 consecutive months.

- Manufacturing PMI in Japan slipped to 48.1 in Nov (Oct: 48.7), the sixth consecutive month of below-50 readings, as both output and new orders shrank alongside new export orders. Services PMI moved up marginally to 51.7 in Nov(Oct: 51.6): this was the second lowest reading this year.

- Singapore’s GDP grew by 5.6% qoq and 1.1% yoy in Q3 (initial estimates of 1% qoq and 0.7% yoy). The trade ministry forecast full year GDP to be around 1% this year (from a previous range of 0.5%-1.5%) and next year’s to be stronger (a range between 1%-3%).

- Inflation in Singapore rose to 4.7% in Oct (Sep: 4.1%), given higher private transport costs (11.7%) and food inflation (4.1%). Core inflation inched up to 3.3%, accelerating for the first time since Jan, due to higher inflation for services (3.4%), retail and other goods (1.6%), as well as a rise in electricity and gas costs (1.8%).

- Manufacturing production in Singapore rebounded in Oct, rising by 7.4% yoy (Sep: -1.1%), thanks to upticks in biomedical manufacturing (5.1% from Sep’s 19% plunge) and general manufacturing (4.3% following Sep’s 10.1% drop).

Bottom line: Last week’s preliminary PMI readings showed that (a) new orders continue to decline (led by the eurozone), dragging down business activity & leading to a weaker jobs picture; (b) services sector growth is subdued, but performs better vis-à-vis manufacturing; (c) input costs seem to be softening though wage pressure is still mentioned by respondents. There was however some positive news on US retail spending: sales on Black Friday rose 2.5% yoy (excluding auto sales), with e-commerce sales up by 8.5%, according to Mastercard Spendingpulse.

This week will see whether the 4-day pause in the Israel war in Gaza will be extended further, reducing geopolitical pressures. The ‘fear gauge’ VIX had closed at 12.46 on Friday, the lowest since Jan 2020, having fallen by more than 46% from its late-Oct jump. Also this week, is the start of COP28 in Dubai: it remains to be seen if there will be a consensus on the warming target and whether deals will be agreed on funding, renewable energy capacity and so on.

Regional Developments

- S&P revised Bahrain’s outlook to “stable” from “positive” on spending hikes and widening fiscal deficit concerns while the ratings was maintained at “B+/ B”.

- Financial inclusion among Egypt’s citizens rose by 5.4% to 67.3% in H1 2023, according to the central bank of Egypt. Around 44.6mn Egyptians over 16 years held an account (from 42.3mn at end-2022).

- Saudi Arabia’s Public Investment Fund (PIF) raised its stake by 2% in Egypt’s E-Finance company (a developer of digital payments infrastructure), though the value of the deal was not revealed.

- UAE’s total investments in Egypt has reached nearly USD 29bn, according to the Secretary General of UAE International Investors Council, with more investments planned in the coming 5 years. Separately, investments by Saudi Arabia’s private sector in Egypt amounted to USD 35bn, according to the Chairman of the Saudi-Egyptian Business Council.

- Egypt’s exports of cement grew by 22% yoy to USD 625mn in Jan-Sep 2023 while iron and steel exports grew by 65% to USD 1.74bn during the same period, according to a report issued by the Export Council for Building Materials, Refractory, and Metallurgy Industries.

- Shell Egypt discovered a new natural gas reservoir in Egypt’s Mediterranean Sea. The size and recoverability potential of the new reservoir will require further analysis.

- Inflation in Kuwait inched up to 3.8% in Oct (Sep: 3.7%): this stemmed from an increase in communication costs (3.1% in Oct from Sep’s 1.7% gain) and transportation (3.0% from 2.7% in Sep). Core inflation, that excludes both food and housing, also edged up to 3.5% (Sep: 3.4%).

- Oman’s inflation eased to a 21-month low of 0.3% yoy in Oct, from Sep’s 1.3% rise. This reflects declines across multiple categories, including education (-2.3%), transport (-1.4%) and communication (-0.2%). Food costs moved lower to 1.7% (Sep: 3.4%) while clothing and housing posted no change in year-on-year terms.

- Producer price index in Oman fell by 13% yoy in Q3, as oil & gas products prices declined by 13.7% alongside a 2% dip in manufacturing industry costs.

- Oman LNG signed a deal to sell 1mn tons of natural gas to UK’s BP for 9 years, starting 2026. Oman is a leading player in the LNG market, with an operational capacity totalling 10.4mn tons per annum as of Apr 2023.

- IMF’s consultation report on Qatar revealed a favourable economic outlook in the medium term (output to expand by 1.75% in 2023-25), normalised following the World Cup-driven boom, fuelled by the non-hydrocarbon sector (2.75% growth). Inflation is estimated to moderate to 2% in 2023 and surpluses are forecast in both fiscal and current accounts.

- Trade surplus in Qatar narrowed to QAR 60.9bn in Q3 2023 (-40.4% yoy) as exports fell by 32.8% yoy to QAR 89.8bn and imports were down by 8.1% to QAR 28.9bn. In qoq terms, both exports and imports were up by 5.2% and 4.4% respectively. Asia was the largest trade partner (exports at 74.9% of total and imports at 36.3% of total in Q3) followed by EU and the GCC.

- MEED disclosed that the value of GCC contracts awarded touched an all-time high: a total of 1,268 contracts worth USD 178.6bn was awarded as of Nov 21st (versus the previous annual record of USD 173.5bn in 2014). Saudi Arabia’s contracts totalled USD 82.5bn so far this year (2022: USD 58.3bn) while UAE’s stood at USD 68.4bn (higher than 2014’s USD 48bn and 2022’s USD 27.1bn).

- Middle East climate tech-related transactions globally stood at USD 5bn in the 12 months to end-Sep 2023, almost triple estimated spending of USD 1.8bn in 2022, according to PWC’s “Climate Tech in the Middle East” report. Bulk of the funding was from Saudi Arabia (USD 3.7bn), followed by UAE (USD 900mn) and Qatar (USD 225mn). Furthermore, about 73.1% of Middle East investment in climate technology globally went into Mobility & Transport.

- Kearney’s Global Cities Index ranked Dubai 23rd globally and leading in the region. Doha (50), Riyadh (61), Abu Dhabi (66) and Muscat (118) were other regional cities. Cities Outlook, which identifies urban potential (based on personal well-being, economics, innovation and governance), ranks Abu Dhabi 27th while Dubai, Muscat, Doha and Riyadh are placed 38, 44, 68 and 99 respectively.

Saudi Arabia Focus

- Saudi Arabia’s overall exports fell by 17.1% yoy and 0.1% mom to SAR 103.8bn in Sep, due to the drop in both oil exports (-17.1% yoy) and non-oil exports (-25.8% yoy and -13.5% mom). Though re-exports plunged 40% from Aug, it grew by 48.1% yoy. As overall imports declined (-13.7% yoy and 2.2% mom), trade surplus widened to SAR 43.73bn. China was the top trade partner.

- Saudi Arabia and China signed a local currency swap agreement worth CNY 50bn (USD 6.93bn), valid for 3 years, and can potentially be extended by mutual agreement. This will strengthen financial ties and also promote trade and investment linkages.

- The MBC Group, Saudi-based media company, plans to float 10% of its share capital on the Saudi Exchange “in the coming months”, revealed the CEO. The IPO was approved by the Capital Market Authority last week, with a validity of 6 months.

- Foreign investments in Saudi Arabia’s Tadawul surged 300% (from 2018) to SAR 347.01bn (USD 92.53bn) in 2022, accounting for 14.2% of total free float value.

- Bilateral trade between Saudi Arabia and Egypt increased by up to 40% yoy to SAR 76.5bn (USD 20.4bn) in 2022, according to the Saudi Minister of Commerce. Saudi direct investment in Egypt amounted to an estimated USD 32bn.

- A CBRE report revealed that Grade A office space in Riyadh reached full capacity in Q3, thanks to the rise of companies moving international headquarters to the capital. Prime rents in Riyadh rose by almost 24% yoy to Q3, with rents currently at SAR 2,617 (USD 712) per square metre. Earlier this month, the Minister of Investment disclosed that 180 companies had moved their regional HQs (versus an initial goal of 160 by end-2023).

- Saudi Entertainment Ventures (or SEVEN, wholly-owned by the PIF) plans to construct a new entertainment destination in Asir with an investment of SAR 1.3bn. This will contribute more than SAR 4bn to GDP and is expected to welcome over 5 million visitors by 2030.

UAE Focus![]()

- Dubai’s inflation rose to a 6-month high of 4.3% in Oct, driven by higher transport prices (4.7%) alongside housing and utilities (6.07%) and insurance and financial services costs (8.97%). Food inflation rose by 3.52% while restaurant & hotel costs were up 2.94%.

- Dubai Taxi IPO subscription period is underway: the firm expects to raise up to USD 316mn from the plan to offer a 25% stake. A price range of between AED 1.8 and 1.85 has been set per share, implying a market cap at listing of AED 4.5-4.6bn. Shares will begin trading on Dec 7th after the final price is announced on Nov 30th.

- UAE’s largest healthcare group, Pure Health, plans to launch an IPO in Dec and list on the Abu Dhabi Securities Exchange.

- The Dubai Financial Market (DFM) is launching a carbon credits trading platform during COP28: it will cater to qualified institutional investors and is scheduled to commence trading from Dec 4 to 8, with the settlement of carbon credit transactions concluding on Jan 10, 2024. Credits traded on the DFM will originate from the Dubai Electricity and Water Authority (DEWA) and My Carbon, involving internationally accredited projects worldwide.

- The Dubai Financial Market, Nasdaq Dubai and the Shanghai Stock Exchange signed a MoU to advance joint products, including initiatives in indices and electronic funds transfer.

- Dubai Chamber of Commerce disclosed that 92 businesses have relocated to the emirate in Jan-Sep 2023: 15 were MNCs and the rest SMEs. Furthermore, it also supported 33 Dubai-based firms to access global markets (either by increasing exports or helping establish a presence abroad). The Chamber’s member companies exports, and re-exports stood at AED 210bn (USD 57.18bn) during the nine months. New membership was up by 42.9% yoy to 48,616 during this period.

- S&P Global reaffirmed Abu Dhabi’s credit rating in both local and foreign currencies at a robust “AA/A-1+” with a stable outlook. It also affirmed Sharjah’s “BBB-/A-3” long- and short-term foreign and local currency sovereign credit ratings, with a stable outlook.

- Ports operator DP World reduced its carbon emissions from its UAE operations by 47% this year by accessing renewable power from Dubai Electricity and Water Authority (DEWA). DP World pledged to become carbon neutral by 2040 and net-zero by 2050.

- The Gulf region’s first hydroelectric plant in Hatta is 80% complete and forecast to be completed by early 2025 (versus a prior plan for Q4 2024 completion). The AED 1.42bn plant will have a capacity of 250 MW, a storage capacity of 1,500 MWh, and a lifespan of 80 years.

- UAE’s regulator granted an operating licence for the fourth and final reactor at Abu Dhabi’s Barakah nuclear power plant. When the final reactor comes online, it will raise the plant’s total electricity generation capacity to 5.6GW.

- Abu Dhabi Exports Office (ADEX) funding has totalled AED 2.5bn and aims to raise it to over AED 3bn by end-2023.ADEX signed 14 agreements and MoUs with local, regional, and international institutions, in a bid to finance manufacturers access to foreign markets.

- The value of real estate transactions in Abu Dhabi grew by 56% yoy to AED 67.76bn (USD 18.5bn) between Jan-Sep 2023 from a total of 16170 transactions (+36% yoy).

- Ras Al Khaimah’s Department of Economic Development reported an increase of 82.7% yoy in total capital volume of new licenses to AED 378.3mn in Jan-Sep 2023. The number of renewed licenses grew by 3.4% yoy to 10,789.

Media Review

The Middle East needs an independent bank for climate adaptation: Dr. Nasser Saidi

https://www.agbi.com/opinion/nasser-saidi-the-middle-east-needs-a-bank-for-climate-adaptation/

Progress on climate change has been too slow. But it’s been real

https://www.economist.com/leaders/2023/11/23/progress-on-climate-change-has-not-been-fast-enough-but-it-has-been-real

Mideast Wealth Funds Draw US Scrutiny Over China Ties

https://www.bloomberg.com/news/articles/2023-11-24/mideast-wealth-funds-draw-greater-us-scrutiny-over-china-ties

Washington’s Looming Middle Eastern Quagmire

https://www.foreignaffairs.com/united-states/washingtons-looming-middle-eastern-quagmire

Cop28 brings big boost in occupancy for UAE hotels

https://www.agbi.com/articles/cop28-brings-big-boost-in-occupancy-for-uae-hotels/

Powered by: