Rising Dubai tourism & a Q4 boost from COP28. Saudi trade surplus amid lower oil exports. Inflation in Kuwait & Oman. Middle East ClimateTech investments.

Weekly Insights 24 Nov 2023: Dubai tourism boost during COP28, amid evidence of slowing inflation & lower oil exports

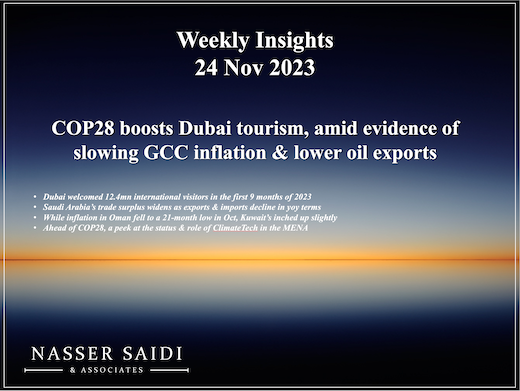

1. Dubai welcomed 12.4mn international visitors in the first 9 months of 2023 (+23% yoy and 2.6% higher vs Jan-Sep 2019)

- Regional composition of tourists remained broadly unchanged: South Asia accounting for close to one-fifth of visitors and GCC at 16%.

- Major changes among top source nations: (a) Chinese travelers have jumped to 7th largest in the list of visitors; (b) Saudi Arabia and Oman are the second and 5th largest source nations; (c) Russia has moved lower to 4th largest (from second in the period till Jul 2023).

- Occupancy rate crossed pre-Covid levels; revenue per available room remains high; room rates have fallen (-4% yoy to AED 473) & so has length of stay (3.7 from 4.0).

- Q4 is one of the busiest quarters: following events such as Gitex & Dubai Airshow, this weekend sees the Formula1 finale race in Abu Dhabi (potential spillovers); COP28 is expected to receive 70k+ participants – Wego (an online travel marketplace) reported a 29% rise in flight & hotel bookings in Nov (vs Nov 2022); the New Year celebrations will be another major attraction (hotels already abt 75% booked).

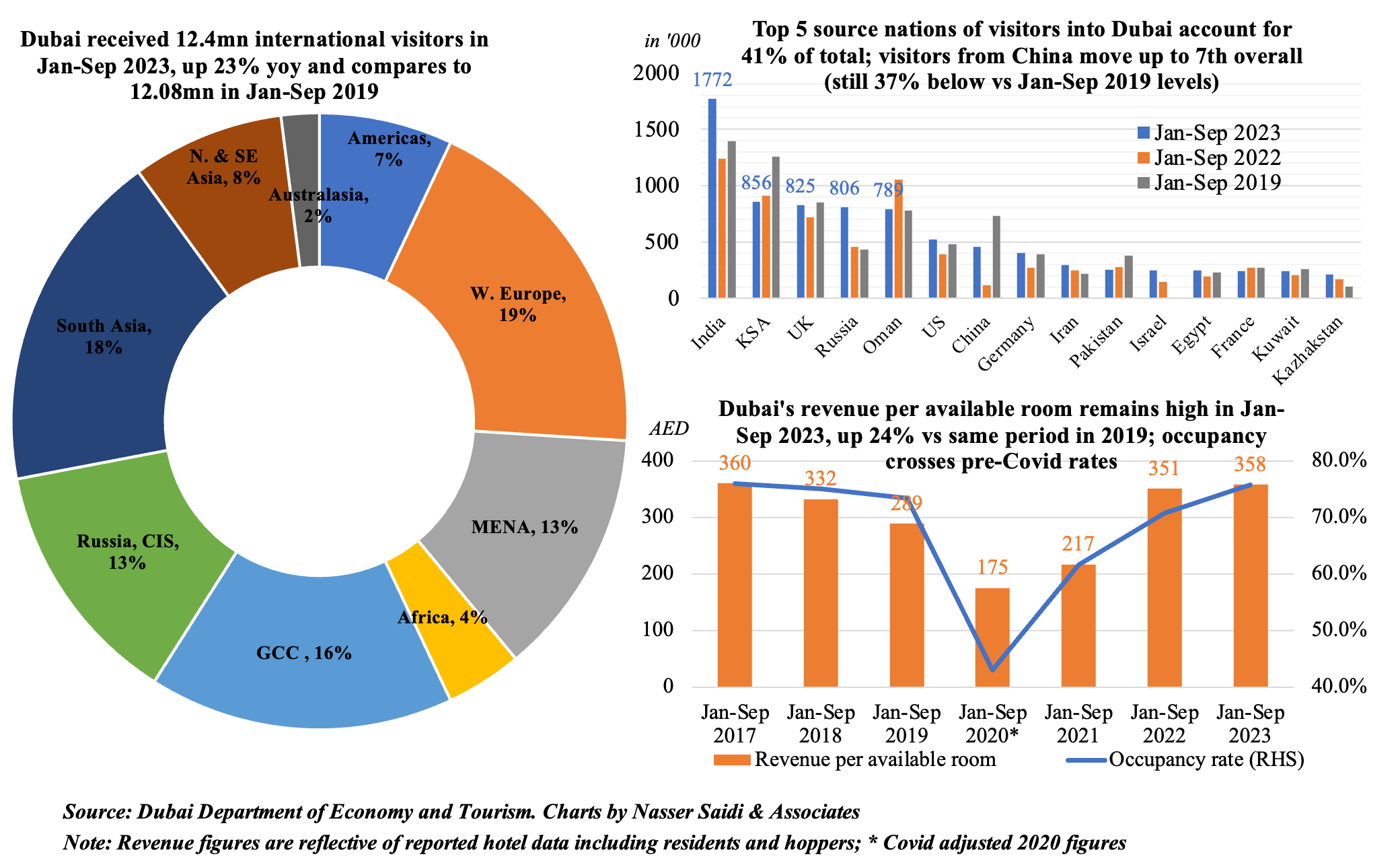

2. Saudi Arabia’s trade surplus widens as exports & imports decline in yoy terms

- Saudi Arabia’s overall exports fell by 17.1% yoy and 0.1% mom to SAR 103.8bn in Sep – due to the drop in oil exports (-17.1% yoy) and non-oil exports (-25.8% yoy and -13.5% mom).

- Though re-exports plunged 40% from Aug, it grew by 48.1% yoy.

- Share of oil exports to overall exports rose to 80.1% in Sep.

- Imports declined in Sep: it fell by 13.7% yoy and 2.2% mom to SAR 60.1bn, led by base metals and machinery & mechanical appliances (21.7% and 17.8% respectively of total imports).

- As a result, trade surplus widened to SAR 43.73bn in Sep, from Aug’s SAR 34.31bn.

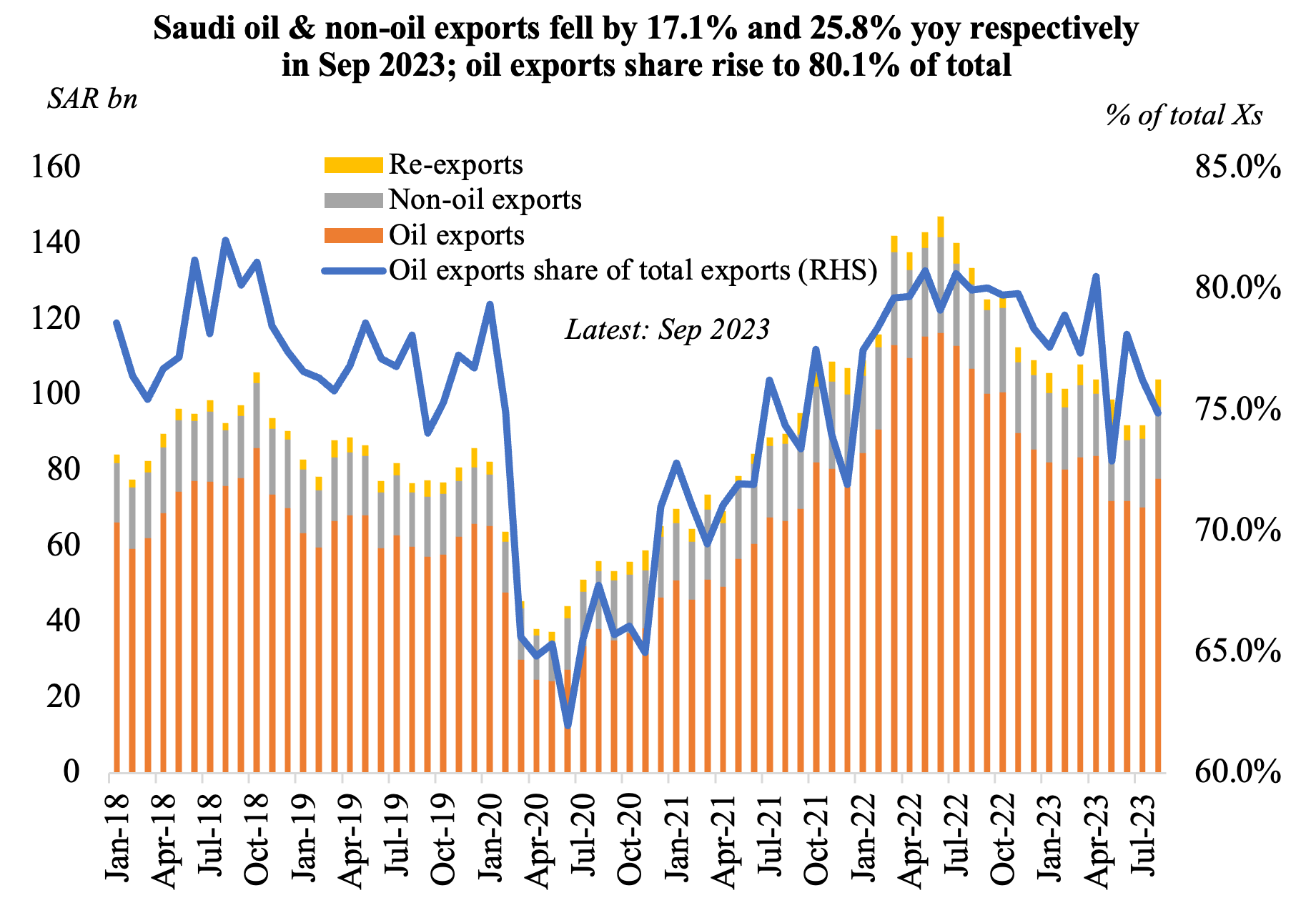

- China was the top trade partner in Sep: accounting for 18.3% of overall exports and 20.5% of total imports.

- Oil exports to the top 5 destinations (China, Japan, South Korea, India and the US) accounted for 58.5% of total oil exports in Sep and for the top 20 it was close to 90%.

- Largest non-oil exports (including re-exports) were chemicals & allied products and plastics (close to 60% of outbound trade).

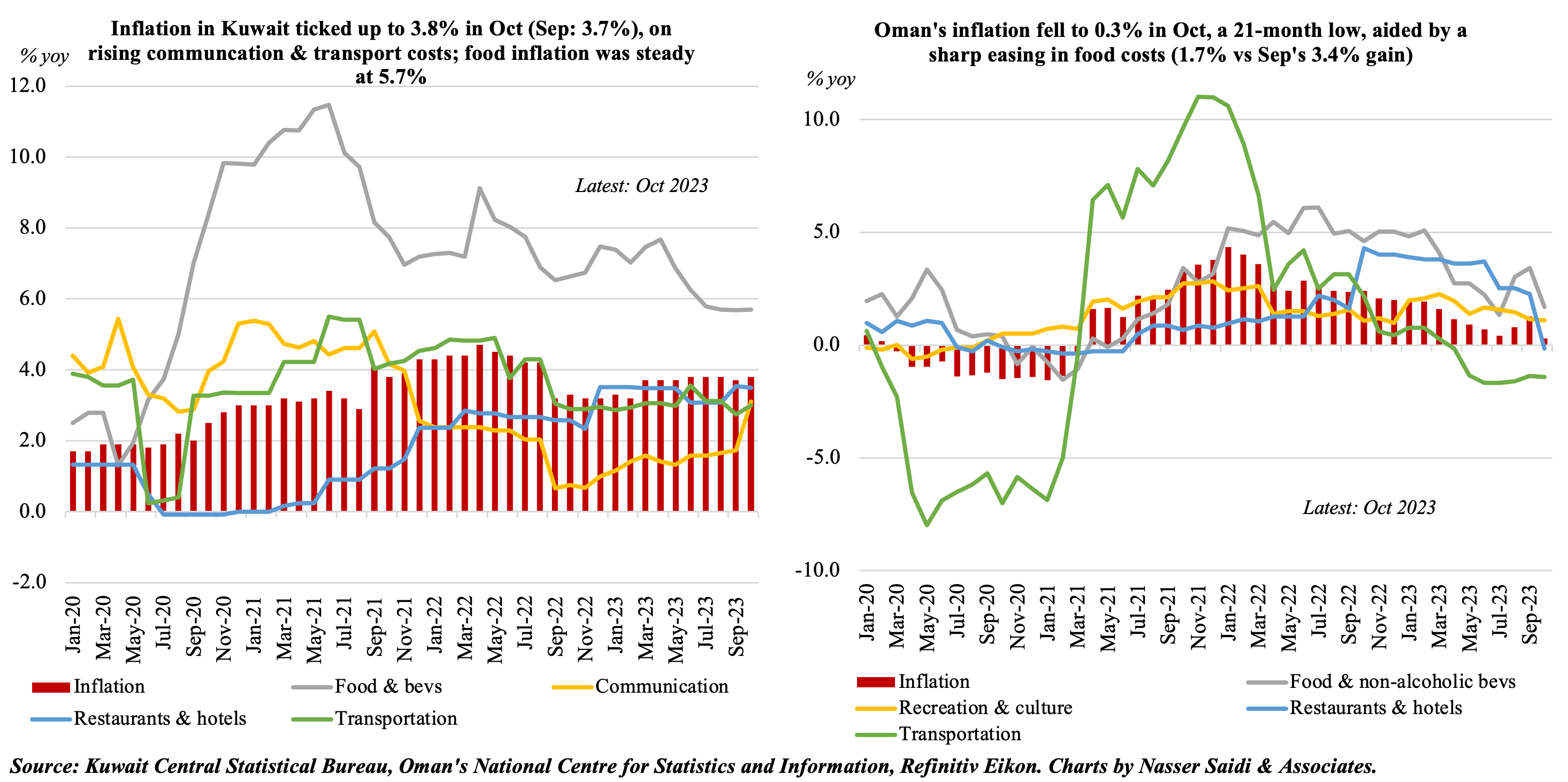

3. While inflation in Oman fell to a 21-month low in Oct, Kuwait’s inched up slightly

- Inflation in Kuwait inched up to 3.8% in Oct (Sep: 3.7%): this stemmed from an increase in communication costs (3.1% in Oct from Sep’s 1.7% gain) and transportation (3.0% from 2.7% in Sep).

- Core inflation, that excludes both food and housing, also edged up to 3.5% (Sep: 3.4%). Average inflation this year stands at 3.7%.

- Clothing inflation remained relatively high (7% in Oct), while food inflation held steady at 5.7% (though it was up by 0.9% from Sep). Other major categories that remained stable were restaurants & hotels (3.1%), housing & utilities (3.1%) and education (0.7%).

- Oman’s inflation eased to a 21-month low of 0.3% yoy in Oct, from Sep’s 1.3% rise.

- This reflected declines across multiple categories, including education (-2.3%), transport (-1.4%) and communication (-0.2%). Food costs moved lower to 1.7% (Sep: 3.4%) while clothing and housing posted no change in year-on-year terms.

- It is however important to note that Oman has a price cap on fuel products (due to expire this year) and other specific products (such as essential food items); strength of the USD (to which OMR is pegged has allowed imported inflation to be kept at bay).

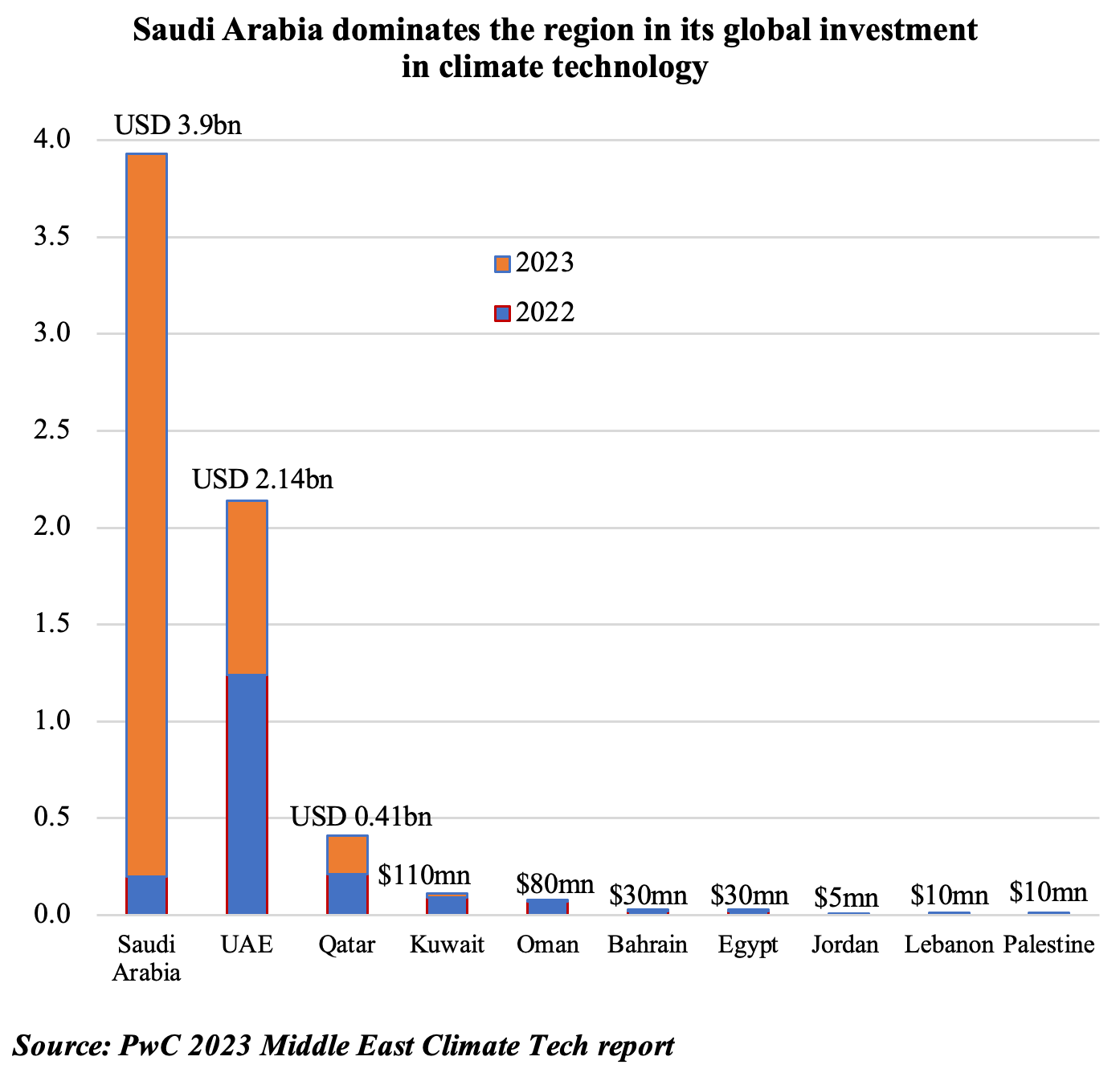

4. Ahead of COP28, a peek at the status & role of ClimateTech in the MENA

- ClimateTech will play an important role in helping communities and ecosystems become more resilient, especially in light of MENA region’s extreme weather events.

- GCC & MENA will continue to produce oil & gas to meet energy demand: support needed to make fossil fuels greener.

- A relatively minor portion of startup investments is allocated to climate technology solutions which target major contributors to emissions reductions.

- According to PWC’s “Climate Tech in the Middle East” report:

- Middle East climate tech-related transactions globally stood at USD 5bn in the 12 months to end-Sep 2023, almost triple estimated spending of USD 1.8bn in 2022. Bulk of the funding comes from Saudi Arabia (USD 3.7bn), followed by UAE (USD 900mn) and Qatar (USD 225mn);

- About 73.1% of Middle East investment in climate technology globally has gone into Mobility & Transport;

- Climate tech funding in the Middle East itself fell to USD 152mn this year from USD 1bn in 2022; number of start-ups & unique investors fell to a 5-year low;

- Since 2018, UAE-based companies received largest share of climate tech funding in the Middle East (USD 1.17bn of a total USD 1.85bn); focus on mobility & transport. Saudi Arabia and Egypt follow (USD 460mn & USD 210mn respectively), but with funding mostly going to clean energy (80% & 70% of the total respectively).

- To achieve climate goals, increased investments need to be directed towards technological solutions for hard-to-abate sectors like industrial and power, as these technologies will have a more significant impact on reducing emissions.

Powered by: