Markets

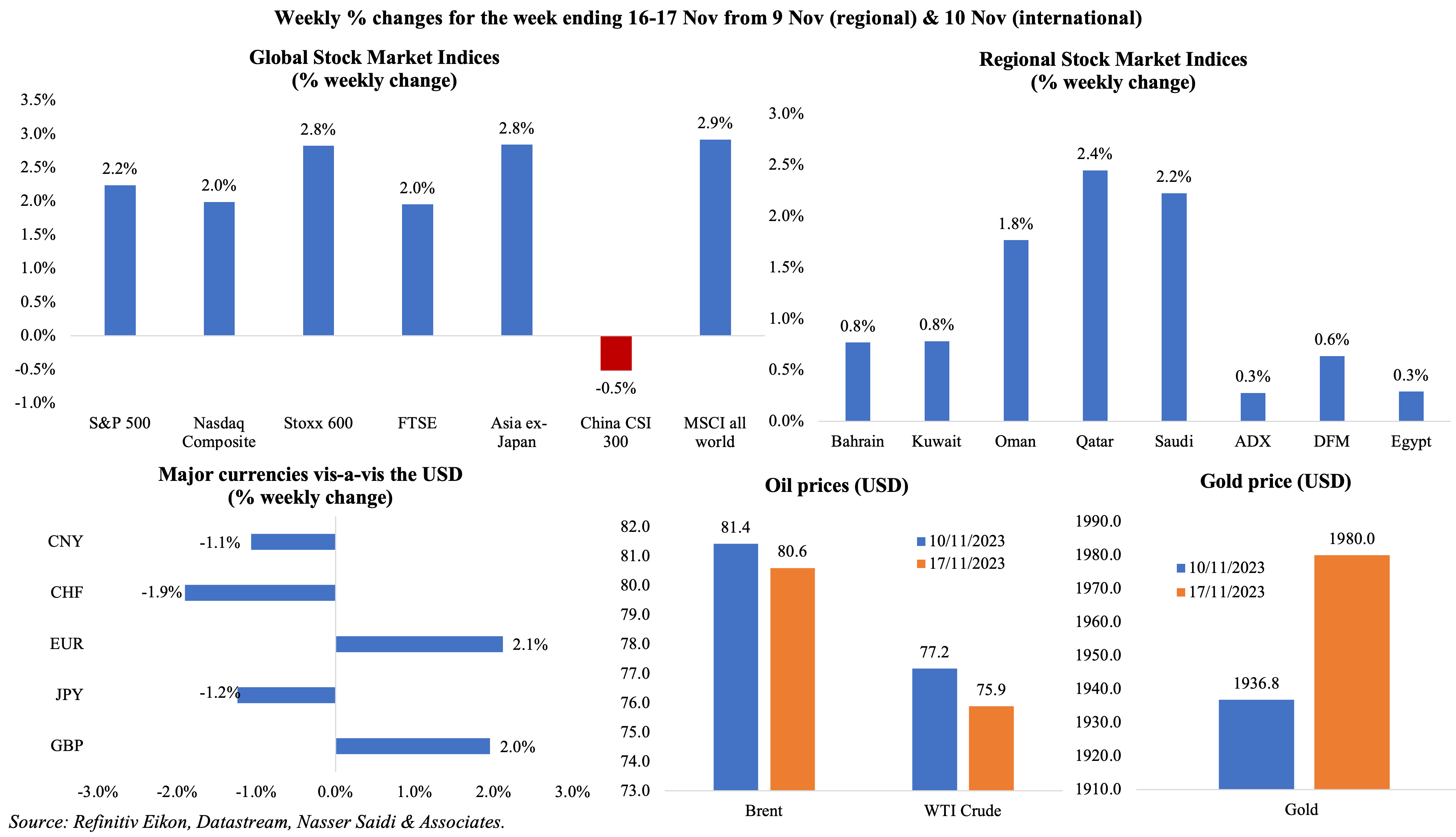

Equity markets were mostly up last week (except for China) on expectations that interest rates have peaked; regional markets also gained though Abu Dhabi’s index slipped given losses in investment firms. Given the expectations for rates, the dollar index fell, posting the second steepest weekly decline this year; the euro and the British pound were supported by the fall in inflation. Though oil prices rebounded on Friday from a 4-month low, rising by 4% on the day, they still closed lower compared to a week ago (the fourth week in a row). Gold price inched closer to the USD 2000-mark.

Global Developments

US/Americas:

- Inflation in the US eased to 3.2% yoy in Oct (Sep: 3.7%), posting the first decline in 4 months. Energy costs fell by 4.5% (Sep: -0.5%) while housing costs cooled (6.7% from 7.2%). Core inflation cooled slightly to 4% (Sep: 4.1%), the smallest since Sep 2021.

- Producer price index in the US slipped to 1.3% yoy in Oct (Sep: 2.2%). In mom terms, PPI declined by 0.5%, the most since Apr 2020; wholesale goods prices fell by 1.4% and gasoline prices fell by 15.3%. Core PPI eased to 2.4% (Sep: 2.7%).

- US retail sales fell by 0.1% mom in Oct (Sep: 0.9%), down for the first time in 7 months. While sales at motor vehicle dealers fell by 1%, it grew at food and beverages stores (0.6%) as well as restaurants and bars (0.3%) and online trade (0.2%). In yoy terms, retail sales slowed to 2.5% (Sep: 4.1%).

- US industrial production declined by 0.6% mom in Oct (Sep: 0.1%), with manufacturing falling by 0.7%. Output of motor vehicles was down by 10% (affected by the workers’ strikes) and consumer durables fell by 5.8%. Capacity utilisation slipped to 78.9% (Sep: 79.5%).

- US budget deficit shrank by 24% to USD 67bn in Oct (Sep: USD 171bn), the smallest deficit since 2017, thanks to revenues rising by 27% to a record USD 403bn.

- NY empire State manufacturing index rebounded to 9.1 in Nov (Oct: -4.6), the highest reading since Apr 2023. New orders remained unchanged at -4.9 while shipments rose to 10.

- Kansas Fed manufacturing activity moved up to -3 in Nov (Oct: -8): though both durable and non-durable goods manufacturing indices rose, the former was still in negative territory.

- Building permits grew by 1.1% mom to 1.487mn in Oct, thanks to permits for future single-family homebuilding rising by 0.5% to 968k – the highest level since May 2022. Housing starts unexpectedly increased by 1.9% mom to 1.372mn in Oct, with single-family housing starts up 0.2% to 970k. The 30-year fixed mortgage rate averaged 7.44% last week (lower than the 7.79% clocked in towards late-Oct – the highest since Nov 2000), affecting sales.

- Initial jobless claims grew by 13k to 231k in the week ended Nov 10th, the highest since Aug, and the 4-week average moved up by 7.75k to 220.25k. Continuing jobless claims increased by 32k to 1.865mn in the week ended Nov 3rd (the highest since Nov 2021).

Europe:

- GDP in the Eurozone contracted by 0.1% qoq in Q3, as per the latest estimate; in yoy terms, growth inched up by 0.1%. Quarterly growth was registered in France (0.1%), Spain (0.3%) and Spain (0.5%) while it declined in Germany (-0.1%) and Italy posted no growth.

- The ZEW economic sentiment index in eurozone jumped up to 13.8 in Nov (Oct: 2.3) though the current situation indicator dropped by 9.4 points to -61.8. Economic sentiment index in Germany increased to 9.8 in Nov (Oct: -1.1), the highest reading since Mar, while the current situation rose marginally by 0.1 point to -79.8.

- Industrial production in the euro area declined by 1.1% mom and 6.9% yoy in Sep, with the production of consumer goods and non-durable consumer goods down by 2.1% mom each.

- Current account surplus in Germany widened to EUR 28.1bn in Sep (Aug: EUR 22.8bn). Year-to-date, current account surplus widened to EUR 198.5bn from EUR 114.2bn a year ago.

- Wholesale price index in Germany fell in Oct (to -4.2% from Sep’s -4.1%), recording the steepest fall in since May 2019, partly due to base effects and drop in mineral oil costs (-1.9%).

- Inflation in UK eased to a 2-year low of 4.6% in Oct (Sep: 6.7%): housing and household services costs fell to the lowest since records began in Jan 1950 (1.9%) while food and non-alcoholic beverages fell to its lowest since Jun 2022 (10.1%). Core inflation inched down to 5.7% (Sep: 6.1%). PPI output prices fell by 0.6% yoy in Oct (Sep: 0.2%). Retail price index also eased, with prices rising by 6.1% in Oct (Sep: 8.9%).

- Retail sales in the UK unexpectedly fell by 0.3% mom and 2.7% yoy in Oct (Sep: -1.1% mom and -1% yoy). Excluding fuel, retail sales fell by 2.4% yoy (Sep: -1.5%). Volumes fell to the lowest level since early 2021 and are no higher compared to five years ago.

- UK unemployment rate remained unchanged at 4.2% in the 3 months to Sep. The number of job vacancies dropped to an over two-year low of 957k. Average earnings including (excluding) bonus eased to 7.9% (7.7%) from 8.2% (7.9%). Regular pay growth is still among the highest since 2001.

Asia Pacific:

- China’s money supply grew by 10.3% yoy in Oct while outstanding yuan loans grew by 10.9%. New loans rose by CNY 738.4bn in Oct (Sep: CNY 2.31trn), adding up to CNY 20.49trn in Jan-Oct.

- Fixed asset investment in China inched up by 2.9% in Jan-Oct (Jan-Sep: 3.1%). Industrial production grew by 4.6% in Oct (Sep: 4.5%), the strongest pace since Apr. Retail sales growth accelerated, up by 7.6% (Sep: 5.5%), supported by auto and restaurant sales growth. FDI into China worsened, falling by 9.4% yoy in Jan-Oct (Jan-Sep: -8.4%).

- Japan’s GDP shrank 2.1% on an annualised rate in Q3 (Q2: +4.8%). In qoq terms, GDP contracted by 0.5% (Q2: +1.2%). Private consumption fell flat in qoq terms.

- Exports from Japan grew by 1.6% yoy in Oct (Sep: 4.3%), as shipments to China fell by 4% yoy (the 11th straight month of decline); imports fell by 12.5% yoy (Sep: -16.6%), moving the trade balance to a deficit JPY 662.5bn in Oct (Sep: JPY 72.1bn surplus).

- Industrial production in Japan fell by 4.4% yoy in Sep (Aug: -4.6%). In mom terms, IP grew by 0.5% (Aug: -0.7%), as motor vehicles production jumped 6% (Aug: -3.9%).

- Japan’s core machinery orders rebounded in Sep, rising 1.4% mom (Aug: -0.5%), thanks to a 5.7% jump in the non-manufacturing sector, while manufacturing posted a 1.8% drop. In yoy terms, machinery orders declined by 2.2% in Sep, accelerating from Aug’s 7.7% drop.

- Retail inflation in India eased to 4.87% in Oct (Sep: 5.02%), with food costs relatively unchanged (6.61% from 6.62% in Sep). Core inflation inched lower to 4.2%.

Bottom line: The falling inflation readings across the developed nations will provide impetus to the view that market interest rates have peaked and provide some comfort to retailers ahead of the holidays: Thanksgiving and Black Friday sales should provide the first glimpse of whether demand is back. Markets already seem to be in a celebratory mood, on expectations that interest rates have peaked (and that rate cuts may be on offer next year). This week sees the release of preliminary PMI readings – likely to be in line with recent readings in Europe, which have been in contraction territory.

Regional Developments

- Egypt’s inflation eased to 35.8% in Oct (Sep: 38%): food inflation eased slightly, though it remained at a stubbornly high rate of 71.3%. Core inflation eased slightly to 38.1% (Sep: 39.7%).

- Budget deficit in Egypt widened to 3.2% of GDP in Jul-Aug, from just 1.4% in the same period last year, according to data from the Ministry of Finance. Expenditures jumped 92% yoy to EGP 590.7bn, as wages and compensation surged by 74% to EGP 79.99bn and interest on government debt rocketed to EGP 391.77bn (+161%).

- Qatar is expected to invest around USD 1.5bn into Egypt’s industrial sector in 2024, disclosed an official from Egypt’s Ministry of Trade and Industry.

- Egypt will resume its LNG exports in Dec or Jan, as domestic demand declines during winter, disclosed an executive from Italy’s ENI. Exports were also reduced by lower imports from Israel given the war in Gaza.

- The Central Bank of Egypt doubled the maximum limits for transactions on financial inclusion accounts, prepaid cards, and mobile payment services. The daily and monthly maximum mobile wallet transfers for individuals was doubled to EGP 60k and EGP 200k respectively.

- Egypt and India are exploring the possibility of using local currencies for bilateral trade settlements, also in a bid to strengthen economic ties. Also discussed was “the possibility of heading to Indian financial markets”, similar to recent issuance of Panda and Samurai bonds.

- Egypt’s trade with African nations grew by 1.2% yoy to USD 5.82bn in Jan-Aug 2023 and Egypt’s exports are projected to reach USD 5.5bn by end- 2023 (+10% yoy).

- Oman’s economy is forecast to grow by 1.3% yoy in 2023, slower than the 4.3% growth in 2022, according to the IMF Mission statement. The country is expected to rebound in 2024, supported by favourable oil prices and sustained reform momentum. More: https://www.imf.org/en/News/Articles/2023/11/15/pr23393-2023-article-iv-mission-to-the-sultanate-of-oman

- Investment in Oman’s special economic zones and industrial cities exceeded OMR 16.6bn by June 2023. Existing industrial cities received OMR 7.3bn, while Salalah Free Zone received OMR 4.5bn, and the Duqm SEZ received over OMR 3.8bn.

- The Oman Investment Authority disclosed that it had completed 6 major national projects with a value of over OMR 4bn. This includes the Duqm Refinery and Petrochemical Industries project, with a refinery with a capacity of 230,000 barrels per day (bpd) and storage and export facilities at Duqm Port.

- In Qatar, inflation accelerated to 2.5% yoy in Oct, from Sep’s 1.8% (which was the lowest since Apr 2021). Food prices inched up to a 13-month high of 3.9% (Sep: 2.2%) and recreation costs jumped (11.2% from Sep’s 3.2% rise). Costs declined for household & utilities (at a faster pace of -2.4% from -0.7%) and restaurants & hotels costs (slower -2.4% from -4.7%).

- Qatar-Canada bilateral trade clocked in at QAR 720mn in 2022, from QAR 620mn the previous year, according to the first Vice-Chairman of Qatar Chamber.

- Bilateral trade between Qatar and South Africa increased to QAR 845mn in Jan-Sep 2023. Meanwhile, total trade touched QAR 1.664bn in 2022, up by 32.5%.

- Target date for the GCC railway project to be functional has been agreed to be Dec 2030 at the meeting of GCC Ministers of Transport and Communications.

- Bilateral trade between Turkey and the GCC nations grew 11-fold to USD 22.7bn in 2022, from around USD 2.1bn in 2002. Turkey’s exports to the region jumped to USD 9.5bn (from USD 1.2bn) while imports surged to USD 13.3bn (from under USD 1bn).

- The Middle East and Africa region will need 296k new personnel in the aviation sector over the next 2 decades. This accounts for 13% of the global requirement of 2.277mn new personnel, according to Boeing’s Commercial Market Outlook. Commercial plane deliveries to the Middle East carriers are projected to be 3,025 between 2023 and 2024.

- A Strategy& report highlighted the potential for sustainability-focused construction technologies in the MENA region. With a planned USD 2trn investment in new “built environments”, such a move to sustainable construction could slash lifecycle emissions by 50-60% and create about 4.3mn jobs annually.

Saudi Arabia Focus

- Consumer price inflation in Saudi Arabia continued to ease for the fifth month in a row in Oct, falling to 1.6% yoy (Sep: 1.7%), as housing costs slowed (7.8% from Sep’s 8.1% gain) and food prices gained (0.8% from Sep’s 0.2% drop).

- Wholesale prices in Saudi Arabia rose by 0.98% yoy in Oct(Sep: 0.5%, the first positive reading since Apr 2023), largely driven by the jump in prices of “other transportable goods” which rose to 2.5% (Sep: 0.7%) while other costs continued to decline. WPI eased to 0.55% in the Jan-Oct 2023 period, from the 8.7% surge a year ago.

- Saudi private sector continued to expand steadily in Q3, supported by corporate stability, indicated the MEPX composite index released by the Ministry of Economy and Planning. The index showed that financial measures “remained soft”, while there was a rebalancing in the performance of consumer-related factors (PoS transactions & cash withdrawals).

- Tadawul introduced single stock options to attract global investors: this is expected to add depth and liquidity to the market and possibly reduce market volatility. In the first 2 weeks of this month, international investors added SAR 12.7bn to Tadawul. This follows from Oct, when foreign investors sold shares worth SAR 26bn, fearing uncertainties from the war on Gaza.

- Preliminary data for Oct showed Saudi Arabia’s net foreign assets declining to SAR 1.524trn (USD 406.35bn) from Sep’s SAR 1.579trn. In yoy terms, net foreign assets fell 8.7%.

- Saudi Arabia’s General Authority for Competition approved 19 business ventures in Oct (Sep: 12), with acquisitions accounting for 79% of the total, followed by mergers (21%). In Q3, the authority approved 41 mergers, acquisitions, and joint ventures.

- Crude oil production in Saudi Arabia grew by 0.67% mom to 8.98mn barrels per day (bpd) in Sep and crude exports grew by 3.04% mom to 5.75mn bpd, according to data from the Joint Organizations Data Initiative.

- Saudi Aramco discovered two new natural gas fields: gas flowed at a rate of 30mn standard cubic feet per day (scfd), and 1,600 barrels of condensate daily at the Al-Hiran gas field and at the Al Mahakik field, it flowed at a rate of 0.85mn scfd. Separately, Aramco disclosed that it had produced the first tight gas at South Ghawar – the facilities have a capacity to process 300mn scfd of raw gas and 38,000 barrels per day of condensate.

- Saudia Technic, the aircraft maintenance subsidiary of state-owned Saudia Group, is planning an IPO by 2028 or 2029.

- Cultural visits in Saudi Arabia jumped to 22mn in 2022, up from 12.2mn recorded in 2021. Domestic visits dominated, rising by 52% yoy to 18mn trips, while culturally specific international tourist trips surged to 4mn (2021: 480k).

- Nigeria and Saudi Arabia have signed multiple investment and cooperation deals including investments in the former’s oil refineries and a pledge to “a substantial deposit of foreign exchange to boost Nigeria’s forex liquidity” among others.

- The Saudi Fund for Development committed to funding of USD 90mn towards infrastructure development in two Caribbean states. The USD 50mn allocated to Saint Vincent and the Grenadines will be used for expansion, construction and rehabilitation of facilities affected by natural disasters. Another USD 40mn will be assigned to the Needsmust Power Plant expansion project in Saint Kitts and Nevis to improve energy quality and access.

- The number of Saudi citizens who have been in private sector jobs for over the past 20 years touched 123,000, according to the National Labour Observatory.

- Saudi Arabia’s outstanding debt capital markets expanded by 18.4% yoy to USD 358.8bn in Q3 2023, with 62% consisting of sukuk (and rest in bonds), according to Fitch Ratings.

UAE Focus![]()

- Dubai International airport welcomed 22.9mn passengers in Q3, the highest quarterly reading since 2019, and is on track to receive 86.8mn passengers this year (slightly revised upwards from Aug’s estimate of 85mn). Total passenger traffic grew by 39.3% yoy to 64.5mn in Jan-Sep 2023, and is 1% higher than Jan-Sep 2019. The CEO of Dubai Airports disclosed that construction was underway to increase the capacity of the airport to up to 120mn passengers by 2026, from the 100mn currently.

- UAE’s defence and security acquisitions authority inked around 28 deals worth a cumulative AED 16.78bn during the 3 days of the Dubai Airshow 2023. The event also saw Emirates sign a deal to purchase 15 additional Airbus A350-900 aircraft for USD 6bn, expanding its total A350 order book to 65 units.

- Nasdaq Dubai listed a USD 1.5bn 10-year green sukuk by DP World, with proceeds earmarked for eligible green projects. This brings Nasdaq Dubai’s current value of listed bonds to USD 120.95bn, with ESG bonds at USD 25.45bn and green issuances at USD 17.55bn.

- UAE business licenses linked to creative activities grew to 932k by H1 2023, according to the minister of economy.

- Adnoc aims to be “net-zero operations” in terms of greenhouse gas emissions by 2045, five years earlier than previously planned. Since Jan 2022, Adnoc has derived all its on-grid electricity from nuclear and solar energy.

- Over 84,000 Emiratis currently work in the private sector, with more than 54k joining in the last two years, according to the UAE’s Ministry of Human Resources and Emiratisation.

- S&P expects Dubai’s real estate sector to witness a price drop of 5-10% in the next 12-18 months, given concerns of dampened buyer interest and lower demand alongside oversupply, in addition to increasing competition.

- Dubai road toll operator Salik expects revenue-generating trips to grow by up to 10% in 2023. In Q3, the firm’s profits rose by 5.3% to AED 255mn (USD 69.43mn) and revenues were up by 14.2% to AED 509mn.

- The Abu Dhabi Pension Fund amended its retirement law enabling equal access to citizens working in both public and private sectors and raising the maximum pensionable amount to 100% of the deductible salary (once individuals complete the maximum years of service) among others.

Media Review

Dubai displays strength at air show as rivals tease deals

https://www.reuters.com/business/aerospace-defense/dubai-displays-strength-air-show-rivals-tease-deals-2023-11-17/

Gaza war a threat to fragile world economy, analysts warn (including Dr. Nasser Saidi’s comments)

https://www.arabnews.com/node/2411216/business-economy

China shows faith in Egypt with deeper investment

https://www.agbi.com/analysis/egypt-china-investment-belt-road/

Climate Change is Disrupting Global Trade

https://www.imf.org/en/Blogs/Articles/2023/11/15/climate-change-is-disrupting-global-trade

The Sam Altman drama points to a deeper split in the tech world

https://www.economist.com/business/2023/11/19/the-sam-altman-drama-points-to-a-deeper-split-in-the-tech-world

Powered by: