Inflation in Saudi Arabia, Qatar & Egypt. Oman fiscal stance. Middle East airlines recovery. Easing supply chain pressures & food prices. Uptick in geopolitical risk index.

Weekly Insights 17 Nov 2023: Easing inflation amid drop in supply chain pressures; will rising geopolitical risk change this picture?

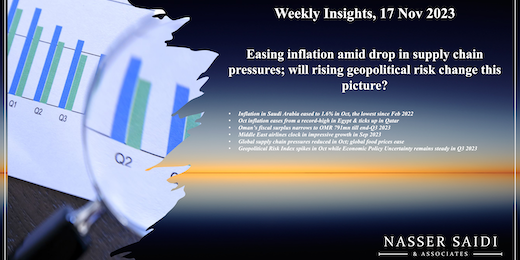

1. Inflation in Saudi Arabia eased to 1.6% in Oct, the lowest since Feb 2022 while wholesale prices rebounded

- Consumer price inflation in Saudi Arabia continued to ease for the fifth month in a row in Oct, falling to 1.6% yoy (Sep: 1.7%), as housing costs slowed (7.8% from Sep’s 8.1% gain) and food prices gained (0.8% from Sep’s 0.2% drop); both recreation & transport prices remained relatively unchanged. Housing prices will take time to stabilise: demand has been rising, but it will take time for the supply pipeline of 650k+ residential units to be absorbed.

- In the period Jan-Oct 2023, consumer inflation averaged 2.5%, compared to 2.3% in the same period a year ago. Housing & utilities costs have climbed by an average 8% this year (from 1.1%) and restaurants & hotels costs have eased (4.5% from 4.8%), as has food (1.5% versus 3.7%) and transport costs (1.4% from 4.1%).

- Subsidies and price caps on specific products have enabled Saudi Arabia to keep its inflation relatively low; the strong USD has helpedcontain imported goods inflationary pressures.

- Wholesale prices in Saudi Arabia rose by 0.98% yoy in Oct (Sep: 0.5%, the first positive reading since Apr 2023), largely driven by the jump in prices of “other transportable goods” which rose to 2.5% (Sep: 0.7%) while other costs continued to decline. WPI eased to 0.55% in the Jan-Oct 2023 period, from the 8.7% surge a year ago.

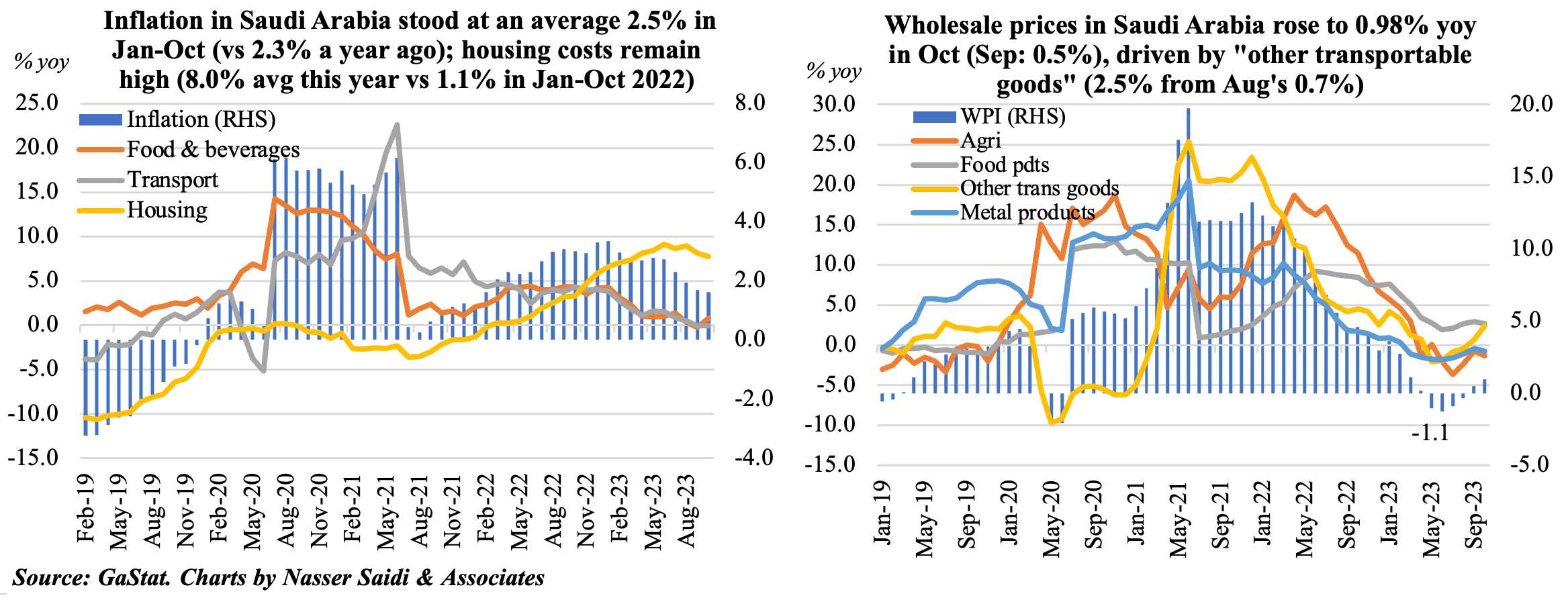

2. Oct inflation eases from a record-high in Egypt & ticks up in Qatar

- Egypt’s inflation eased to 35.8% in Oct (Sep: 38%): food inflation eased slightly, though it remained at a stubbornly high rate of 3%. Core inflation eased slightly to 38.1% (Sep: 39.7%).

- The price reduction on staple foods & exemption from customs duties in Oct provided a slight respite, but it will only betemporary measure. The reading next month will be impacted by the hike in fuel prices as well as the weakening pound.

- Curbing of imports leading to supply shortages, and dollar shortages leading to a rise in the dollar rate in the parallel market are ongoing issues. A potential devaluation / exchange rate liberalization are likely to happen only after the elections in Dec. However, the geopolitical situation in the region adds another layer of uncertainty.

- In Qatar, inflation accelerated to 2.5% yoy in Oct, from Sep’s 1.8% (which was the lowest since Apr 2021). Food prices inched up to a 13-month high of 3.9% (Sep: 2.2%) and recreation costs jumped (11.2% from Sep’s 3.2% rise). Costs declined for household & utilities (at a faster pace of -2.4% from -0.7%) and restaurants & hotels costs (at a slower -2.4% from -4.7%).

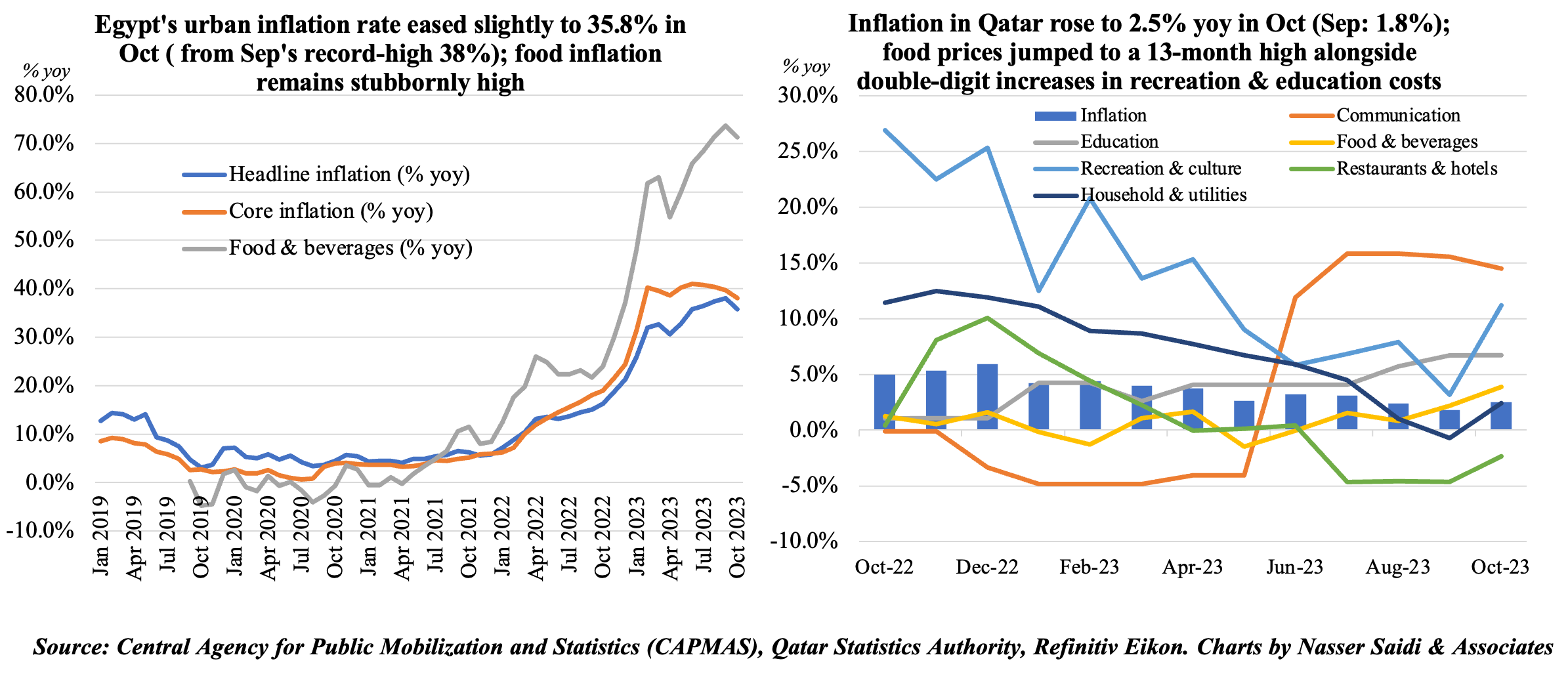

3. Oman’s fiscal surplus narrowed to OMR 791mn till end-Q3 2023

- Oman posted a budget surplus of OMR 791mn at end-Sep 2023: total revenue decreased by 16% yoy to OMR 8.9bn while spending fell by 14% (to OMR 8.1bn). This compares to a projected deficit of OMR 1.3bn as per the 2023 budget.

- While oil production fell by 0.2% yoy to 1.054mn barrels per day at end-Sep 2023, oil price fell by 14% to USD 81, leading to a 8% drop in net oil revenue to OMR 4.8bn as of Sep 2023.

- Net gas revenues tumbled by 42.3% to OMR 1.58bn (largely due to “the deduction of gas purchase and transport expenses from total revenue collected from Integrated Gas Company” according to the ministry). But together net oil and gas revenues accounted for close to 72.3% of total public revenue, making it more vulnerable to volatility in the oil & gas markets.

- Spending was lower in the period ending Sep 2023, given a 10% yoy decline in current expenditures while oil and electricity sector subsidies amounted to OMR 236mn and OMR 408mn respectively. At end-Sep, development expenditure touched OMR 671mn, close to 75% of total development spending allocated for 2023. A further OMR 300mn was transferred towards future debt obligations.

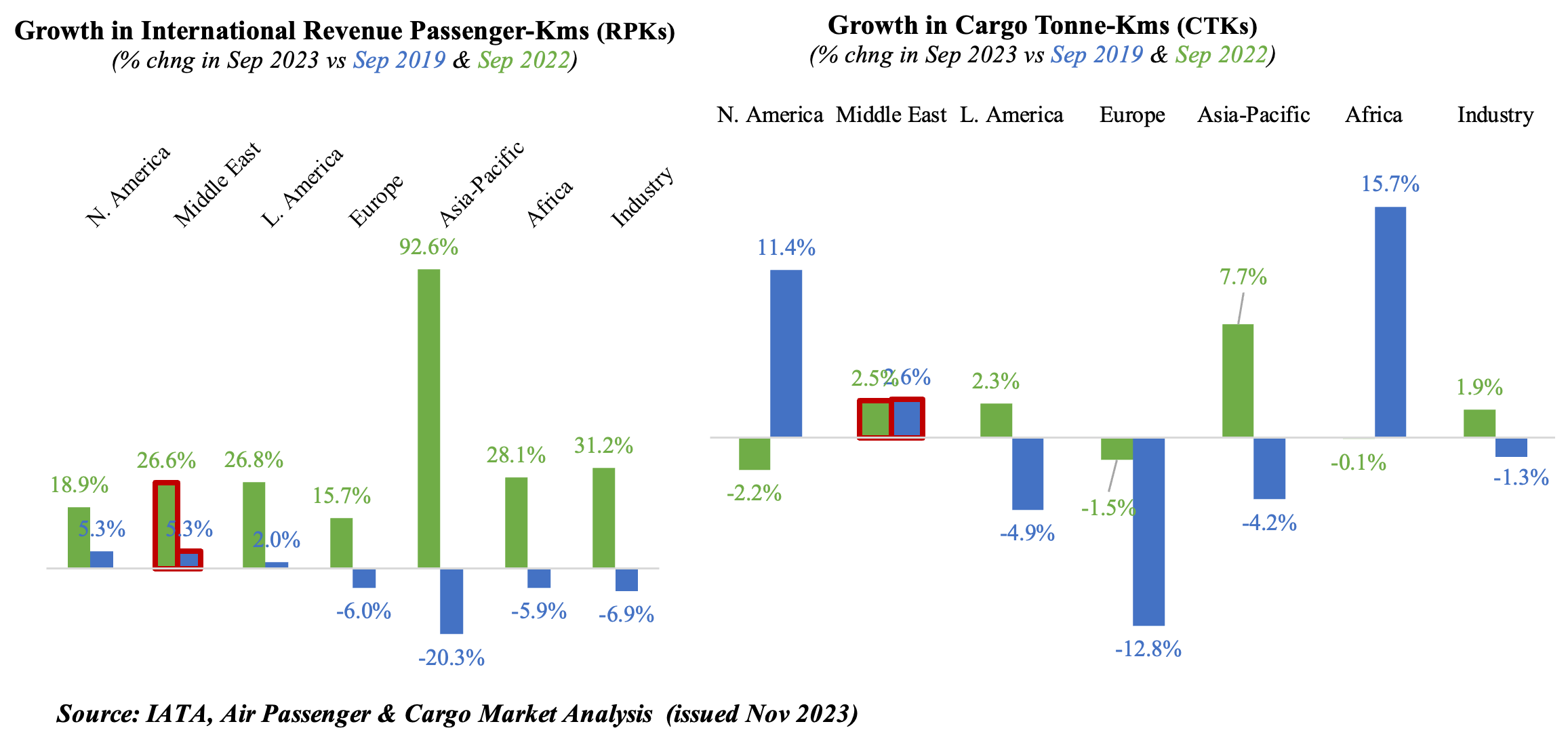

4. Middle East carriers clock in impressive growth in Sep 2023

- International revenue passenger kilometres (RPKs) in the Middle East grew by 26.6% yoy in Sep, also surpassing their pre-pandemic RPKs levels. In comparison, Asia Pacific carriers nearly doubled their international RPKs compared to the previous year.

- International traffic was higher across all major route areas: apart from the Middle East-Asia route area, routes that had fully recovered to pre-pandemic levels expanded their recovery in Sep; the Europe-Middle East route reached 2019 levels in Sep.

- Cargo activity moderated in Sep: Middle East registered a 2.5% yoy growth in international cargo tonne-kilometers (CTKs), thanks to growth in demand in the Middle East –Europe and Middle East – Asia markets. The Middle East–Asia trade lane experienced a 7.0% yoy rise, marking the fourth consecutive month of growth; Middle East- Europe segment expanded by 3.3% yoy (faster than Aug’s 0.5% gain).

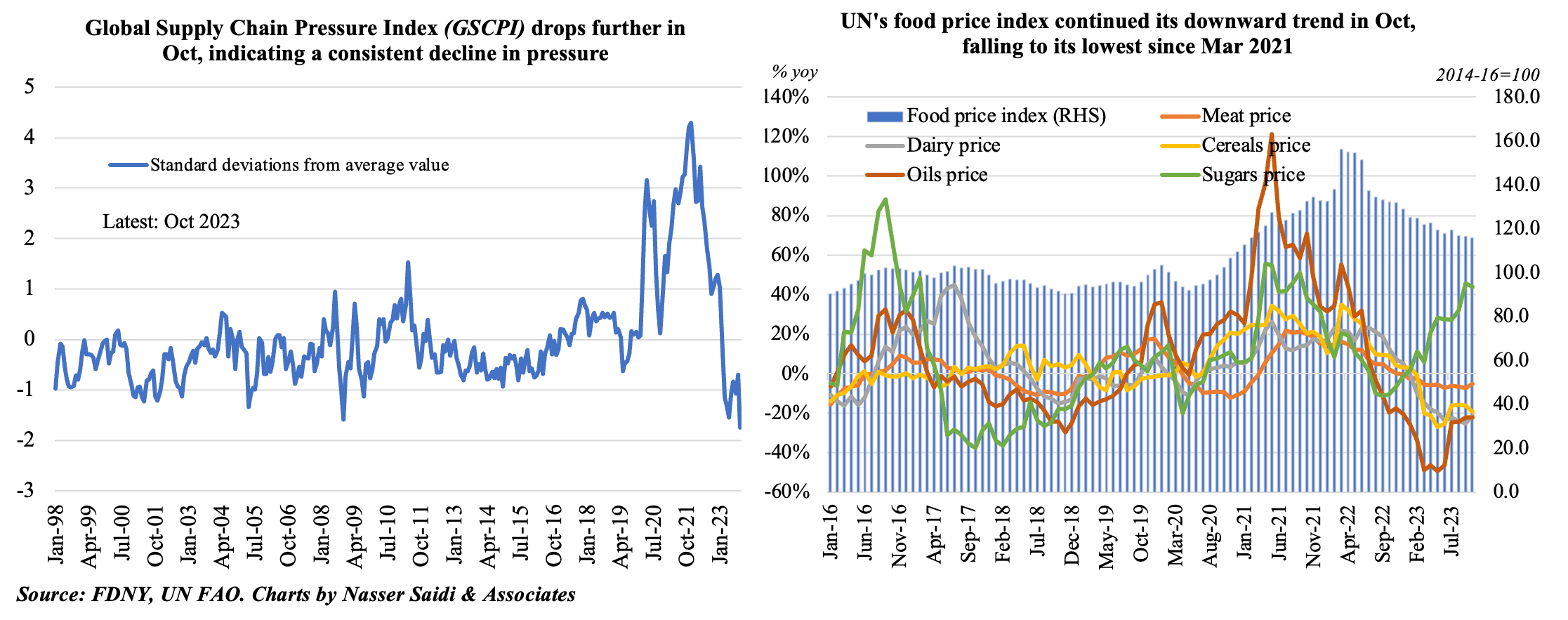

5. Global supply chain pressures reduced in Oct; global food prices ease

- Inflation has been easing across the globe, including in many developed nations: it can be traced to the decline in commodity prices (steel, oil, food prices) + easing of supply chain disruptions (which led to shortages & price hikes) + inflation in non-energy services.

- The former two have come off pandemic-highs while the last factor will take the longest time to moderate (as it takes into consideration the demand-supply equation – housing for example).

- UN’s food price index fell to 120.6 points in Oct, the lowest since Mar 2021, driven by declines in sugar, cereals, vegetable oils and meat. Sugar prices remain 46.6% higher than a year ago, though it has been easing given the pace of production.

- The Fed’s Global Supply Chain Pressures Index (GSCPI) readings slipped to a record low of -1.74 in Oct: it turned negative in Jan 2023 and has been declining since (i.e. standard deviations are below index’s historical average) – implies global supply chain conditions have returned to “normal”.

- Container rates have returned to pre-pandemic levels & container capacity is expected to increase next year, as newly built ships are delivered, leading to further decline in freight rates.

- Unless significant spillovers from Israel-Gaza war affects trade movements (incl. commodities), easing of inflation is most likely.

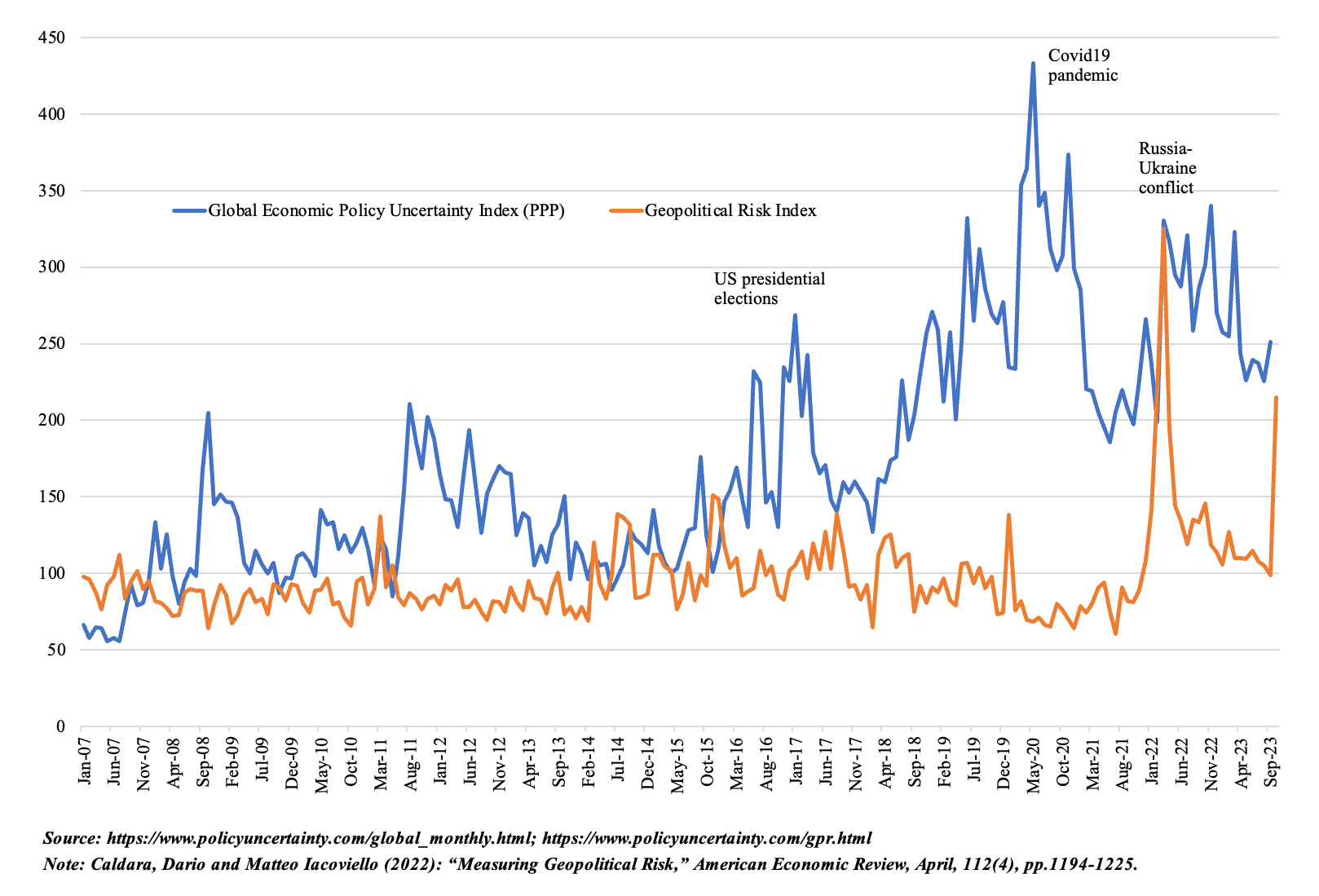

6. Geopolitical Risk Index spikes in Oct while Economic Policy Uncertainty remains steady in Q3 2023

- The Geopolitical Risk Index spiked in Oct 2023, given the Israel war on Gaza. According to the authors of the index, higher geopolitical risk foreshadows lower investment, stock prices, and employment. Higher geopolitical risk is also associated with higher probability of economic disasters and with larger downside risks to the global economy.

- In contrast, the Economic Policy Uncertainty Index stays relatively high in Q3 2023, most likely due to the risks of recession, continued increase in borrowing costs and relative uncertainty of the direction of monetary policy (given high levels of core inflation).

Powered by: