Markets

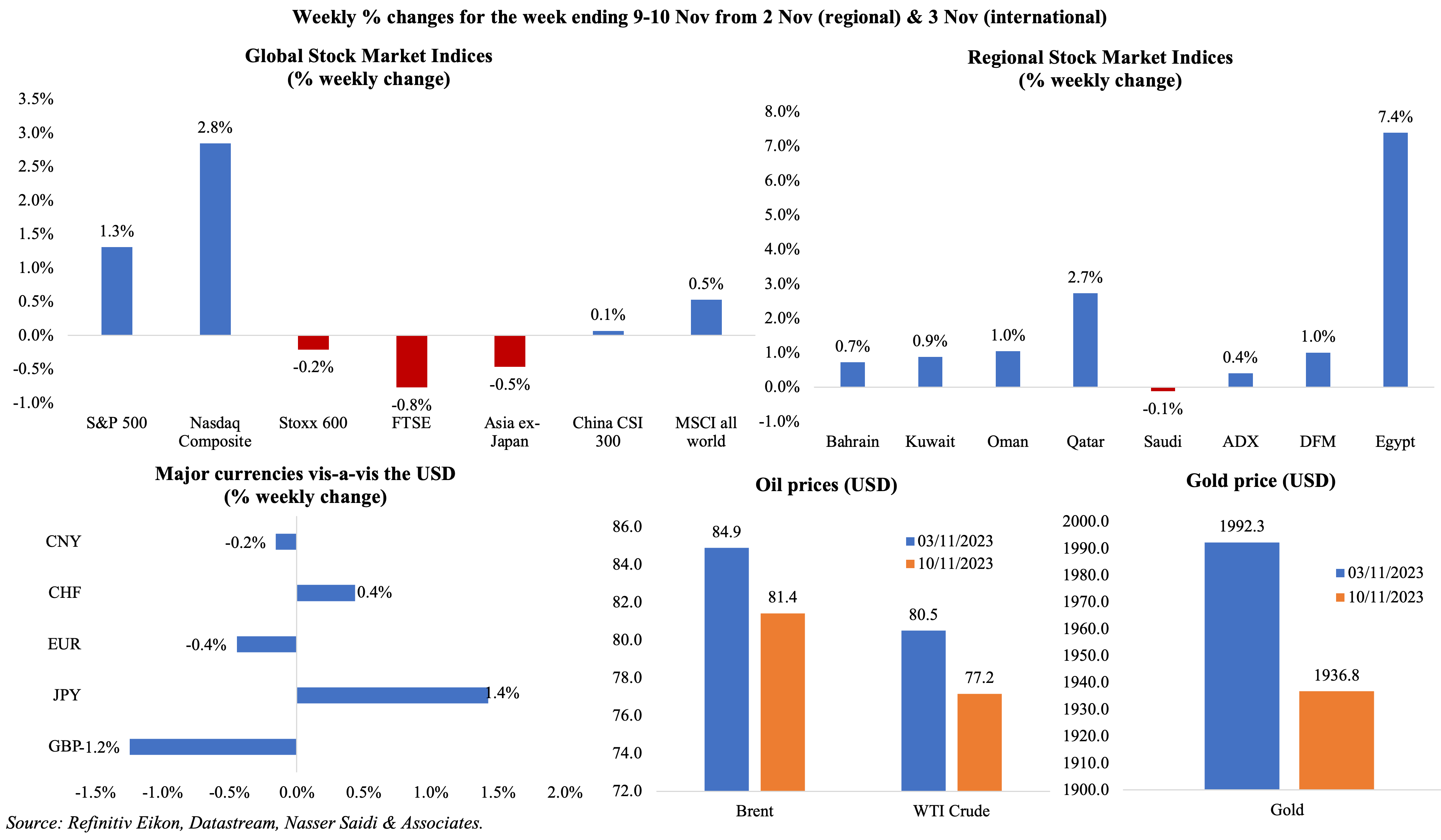

Equity markets rebounded on Fri after Powell’s hawkish remarks on Thursday. MSCI’s global equities performance edged up while the Stoxx600 and FTSE closed lower. Regional markets were mostly higher on strong corporate earnings. The Swiss franc’s haven status has held strong since Oct 7th; the GBP closed 1.2% lower from the week before. Despite oil prices rising by 1%+ on Friday, Brent and WTI prices were down by 4% compared to the previous week. Gold price fell by more than 2%, posting a second week of decline.

Global Developments

US/Americas:

- More hawkish comments from Fed Chair Powell: he stated that there was a “long way to go” to get to price stability, and that “if it becomes appropriate to tighten policy further, we will not hesitate to do so”.

- Trade deficit in the US widened to USD 61.5bn in Sep (Aug: USD 58.7bn) as exports grew by 2.2% to near an all-time high (USD 261.1bn) while imports rose by 2.7% (to USD 322.7bn, the highest since Feb). Trade deficit with China increased to USD 28.4bn (Aug: USD 22.7bn) as imports from China reached USD 40.3bn – the highest since Oct 2022.

- The preliminary reading of the Michigan consumer sentiment index slipped to a 6-month low of 60.4 in Nov (Oct: 63.8), as the current economic conditions gauge fell to 65.7 (from 70.6). The 1- and 5-year inflation expectations inched up to 4.4% and 3.2%– the highest readings since Apr 2023 and Mar 2011 respectively.

- Initial jobless claims fell by 3k to 217k in the week ended Nov 3rd and the 4-week average moved up by 1.5k to 212.25k (the highest level since Apr). Continuing jobless claims increased by 22k to 1.834mn in the week ended Oct 27th.

Europe:

- Eurozone services and composite PMIs remained unchanged in depressed territory (from the preliminary reading) at 47.8 and 46.5 respectively in Oct. Services PMI posted the deepest contraction since Jan 2021, with new export orders dropping by the fastest pace in 2.5 years. Composite PMI was the lowest since Nov 2020, with employment stagnating after a 32-month expansion.

- Producer prices in the euro area declined by 12.4% yoy in Sep (Aug: -11.5%), the steepest fall on record, as energy prices tumbled (-31.3%) as did intermediate goods prices (-4.8%).

- Sentix investor confidence in the eurozone improved slightly to -18.6 in Nov (Oct: -21.9), as economic expectations increased by 6.8 points (to -10 points) while the current situation assessment was weak (-26.8 points).

- Retail sales in the euro area fell by 0.3% mom and 2.9% yoy in Sep (Aug: -0.7% mom and -1.8% yoy). Sales of non-food products plunged the most since Jun 2022 (-1.9% mom) while fuel sales fell by 0.9% mom (declining for the 4th straight month).

- German factory orders fell by 4.3% yoy in Sep (Aug: -6.3%). In mom terms, it unexpectedly gained by 0.2% mom (Aug: 1.9%), supported by increase in orders for machinery and equipment (8.5%) and basic metals (8.7%). Foreign orders grew by 4.2% mom, thanks to orders from the euro area (+6.2%) while domestic orders fell by 5.9%.

- Industrial production in Germany fell by 1.4% mom and 3.7% yoy in Sep (Aug: -1.9% yoy and -0.1% mom). IP fell across the board: capital goods (-0.2% mom), intermediate goods (-1.9%) and consumer goods (-4.9%). In Q3, IP declined by 2.1% qoq.

- Services PMI in Germany inched up to 48.2 in Oct (preliminary: 48), as new businesses fell and sales in both domestic and international markets declined amid an easing of prices. Composite PMI fell to 45.9 (Sep: 46.4), staying below-50 for the 4th month in a row with all sub-indices posting declines and output prices the weakest since Feb 2021.

- GDP in the UK remained flat in qoq terms in Q3, while increasing by 0.6% yoy following a similar gain the quarter prior. The UK economy stood 1.8% higher than its level in late 2019. Total business investment tumbled by 4.2% qoq in Q3 (Q2: 4.1%).

- Like-for-like retail sales in the UK grew by 2.6% yoy in Oct (Sep: 2.8%), with officials stating that households are delaying spending to grab bargains during Black Friday sales.

Asia Pacific:

- Domestic demand in China point to weakness as CPI dropped 0.2% yoy and 0.1% mom in Oct (both turning negative together for the first time since Nov 2020). Producer price index declined 2.6% in Oct (Sep: -2.5%), in deflation for the 13th consecutive month.

- China’s exports fell by 6.4% yoy in Oct (Sep: -6.2%) while imports unexpectedly grew by 3% (Sep: -6.2%), causing trade surplus to narrow to USD 56.53bn in Oct (Sep: USD 77.71bn). China also recorded its first-ever quarterly deficit in FDI as direct investment liabilities stood at a deficit of USD 11.8bn in Q3 (partly as companies repatriated earnings).

- Foreign exchange reserves in China declined to USD 3.1trn in Oct (Sep: USD 3.115trn). The value of its gold reserves increased to USD 142.17bn end-Oct (end-Sep: USD 131.79bn).

- Leading economic index in Japan slipped to 108.7 in Sep (Aug: 109.2), with consumer confidence weakening to a six-month low and a contraction in factory activity. Coincident index inched up by 0.1 point to 114.7, the highest since Jun.

- Overall household spending in Japan fell by 2.8% yoy in Sep (Aug: -2.5%), the 7th consecutive month of decline. Labour cash earnings grew by 1.2% yoy in Sep (Aug: 0.8%) while inflation adjusted real wages fell by 2.4% yoy(slipping for an 18th month).

- Japan’s current account surplus rose to JPY 2.7236trn in Sep (Aug: JPY 2.279trn), its largest in 18 months, as trade balance moved into a surplus and due to gains from overseas investments. In H1 fiscal year 2023, current account surplus tripled to a record JPY 12.71trn, thanks to primary income at a record-high JPY 18.38trn and fall in energy import costs.

- Industrial output in India grew by 5.8% yoy in Sep (Aug: 10.3%), as consumer goods production slowed: durables and non-durables were up by only 1% and 2.7% respectively. Manufacturing was up by 4.5%, following Aug’s 9.3% gain.

Bottom line: In light of Powell’s comments last week, this week’s US inflation release will be closely watched. For now, Fed funds futures traders are pricing in a 22% chance of an additional hike by Jan. UK data on inflation, producer price index, employment and retail sales are out this week: will these readings align with the BoE Chief Economist’s statement that there could be rate cuts by mid-2024? EU production and consumer sentiment led by Germany remain weak suggesting the onset of recession in Q4, which will weigh on ECB decisions. Meanwhile, retail sales data from China will help gauge consumer demand – though last week’s deflation figures imply weakness, the unexpected increase in imports (which grew for the first time since Feb) indicates some recovery in spending.

Regional Developments

- Bahrain’s national origin exports fell by 24% yoy to BHD 943mn in Q3 2023 while imports dropped by 5% to BHD 1.4bn. Imports originated from China (BHD 208mn), UAE (BHD 131mn) and Australia (BHD 128mn), with top 10 nations contributing to more than two-thirds (69%) of total value of imports. Saudi, UAE and US were top destinations for exports.

- Inflation in Egypt eased to 35.8% yoy in Oct (Sep: 38%), with food and beverage prices up by 1.5% mom and 71.3% yoy. Core inflation slowed to a 9-month low of 38.1% (Sep: 39.7%). Partly benefiting from the mid-Oct decision to reduce staple foods’ prices and import duty exemptions, it will only be a temporary dip, especially given the recent hike in petrol prices.

- Egypt’s tourism minister expects the nation to meet its 2023 tourist arrival target of 15mn, stating that only less than 10% of total bookings have fallen through since the war began. He disclosed that Egypt was offering an extra USD 500 of incentives per flight landing in Sharm el-Sheikh to boost tourism.

- Foreign trade in Egypt touched USD 110.41bn in the fiscal year 2022-23, with UAE the top trading partner (with a volume of USD 8.54bn) followed by the US (USD 7.61bn) and China (USD 7.5bn). The top 14 trading partners accounted for 61.1% of total trade.

- Egypt’s international reserves grew by USD 131mn to USD 35.108bn in Oct, according to the central bank. The value of gold reserves rose by USD 454mn to USD 8.098bn.

- The Suez Canal Economic Zone signed a USD 15.6bn deal with Chinese entities to boost green hydrogen manufacturing. The agreement will result in creation of about 9k jobs from 11 projects.

- Kuwait is set to introduce a new corporate tax initiative, known as the “Business Profits Tax Law”: would impose a 15% tax on the profits of a wide range of operating structures but excluding individuals, micro and small enterprises. Currently only foreign firms are subject to tax on profits and capital gains income. But effective Jan 1st, 2025, Kuwaiti MNCs (and government entities operating overseas) with revenues more than EUR 750mn will be subject to the proposed tax. This will enable Kuwait join OECD-G20 Inclusive Framework on base erosion and profit shifting (BEPS) which other GCC nations are already members of.

- Oman’s public revenues fell by 16% yoy to OMR 8.886bn at end-Q3 2023, given the 10% drop in net oil revenue (to OMR 4.838bn, as average oil price fell to USD 81 per barrel from USD 94 a year ago). Spending also declined, down by 14% to OMR 8.095bn resulting in a narrowing of surplus – to OMR 791mn from OMR 1.123bn a year ago.

- About 1.4mn guests stayed at 3-5 stars hotels in Oman during Jan-Sep 2023 (+27.3% yoy), raising OMR 154mn in revenues (+26.4%). A breakdown of guests’ origins indicate that domestic travel is very strong, with Omanis accounting for close to 40% of total guests in Jan-Sep (+6.9% yoy), followed by Europeans (+43.4% yoy to 295k persons). The Ministry of Heritage and Tourism aims for 11mn tourists by 2040.

- International reserves and foreign currency liquidity of Qatar Central Bank increased by 11.73% yoy to QAR 243.53bn in Oct. Gold reserves rose to QAR 23.173bn (+QAR 6.111bn).

- Bilateral trade between Indonesia and Qatar stood at USD 975.3mn in H1 2023 and compares to USD 1.3bn for the full year 2022.

- The number of IPOs in the MENA region stood at 6 (-14% yoy) in Q3 2023, raising USD 523mn in funds (-66%), according to EY’s MENA IPO Eye. This brings the total this year to 29 IPOs raising USD 5.8bn. Saudi Arabia’s Tadawul and Nomu were the most active exchanges for listing this year, and none of the non-GCC exchanges listed any IPOs this year.

- The GCC’s interior ministers approved the unified GCC tourist visa, which will enable and streamline travel across GCC. This is expected to become operational between 2024-25.

- Start-ups in the MENA region raised USD 156mn in Oct (Sep: USD 63mn): this is however a sharp 76% yoy fall, according to Wamda. The number of deals rose to 51 in Oct (Sep: 36), with investments flowing into UAE (USD 90mn from 24 deals), Saudi Arabia (USD 51mn from 9 deals) and Egypt (USD 13mn from 9 deals). MENA’s total funding touched USD 1.9bn in Jan-Oct, down by 36.6% yoy.

- ForwardKeys data indicate that air travel to the Middle East has declined 26% since the start of the Israel-Gaza war: travel to the region went from 13% above pre-pandemic levels when the conflict started to 13% below now. Impact on Jordan has been the highest – number of tickets fell from 7% below pre-pandemic level before Oct 7th to 61% below now. Lebanon, Egypt and Turkey went to 73%, 25% and 17% below from 28% below, 10% above and 10% below respectively.

Saudi Arabia Focus

- Saudi Arabia issued a new methodology for calculating FDI: endorsed by the IMF, the new methodology shows FDI into Saudi Arabia grew by 22% yoy to SAR 122bn (USD 33bn) in 2022. FDI stock was calculated to be SAR 775bn in 2022, a downward revision from around SAR 1trn under the old methodology.

- Industrial productionin Saudi Arabia fell by 11.2% yoy in Sep (Aug: -12.2%), the fifth month in a row of declines, largely due to the plunge in mining & quarrying activity (-18.7% from Aug’s drop of 19.3%). In mom terms, IP rebounded in Sep, up by 0.8% (Aug: -0.3%). Manufacturing activity has been slowing, with its average dropping to 10.8% in Jan-Sep 2023 (vs 22.9% in Jan-Sep 2023). Separately, industrial permits issued rose to 174 in Sep (Aug: 136), bringing the total this year to 969. The volume of investments linked to the Sep licenses amounted to SAR 5.3bn (USD 1.41bn).

- The Saudi Ministry of Industry and Mineral Resources revealed that 38,988 certificates of origin had been issued in Oct (Sep: 34,745).

- The Royal Commission for Riyadh City launched a new Special Economic Zones center, which will be financially and administratively independent, to boost business competitiveness. The centre will oversee the development of special economic zones within Riyadh City.

- The Saudi Fund for Development will sign agreements over SAR 2bn (USD 533mn) with African nations, disclosed Saudi Arabia’s finance minister. He also stated that the PIF will be making some “game changing” investments in the continent. Separately, the Saudi EXIM Bank signed deals worth USD 185mn with African banks and financial institutions on the sidelines of the Saudi-Arab-African Economic Conference.

- A report from the Saudi Communications, Space and Technology Commission expects the Saudi space industry to reach an average annual value of USD 2.2bn from 2023 to 2030, after recording USD 400mn in revenue last year.

- Saudi Arabia Railways disclosed a record 2.28mn passengers in Q3, up 45% yoy, from 10,915 trips (+12% yoy). The number of freight train trips rose by 17% to 1422, contributing to the removal of more than 0.5mn trucks from the roads.

- Saudi Arabia has expanded its e-visa service for international investors to include all countries globally (from close to 60 nations trialled during the first phase). The e-visa can be used for multiple entries and has a validity period of up to one year.

- Saudi PIF plans to invest SAR 20bn directly in the southern region of Aseer near Yemen’s border on growing optimism that the war in Yemen is subsiding. Funds will be invested in two main projects – Soudah and Al-Wadi – as well the expansion of Abha airport.

UAE Focus![]()

- Dubai PMI jumped to 57.4 in Oct (Sep: 56.1), the highest reading since Aug 2022, on a surge in new orders. While sales growth was particularly marked among wholesale & retail firms and travel & tourism service providers, the only indicator that was lagging was employment which stood at a 13-month low. Input prices increased to the fastest in 15 months while output prices were reduced (to maintain a competitive edge).

- UAE plans to to establish comprehensive economic partnership agreements with 27 countries and economic blocs representing up to 95% of global trade, disclosed the UAE minister of state for foreign trade. These partnerships are expected to raise non-oil trade to AED 4trn by 2031. Negotiations are currently underway with 13 nations and economic blocs.

- Dubai approved the general budget for the 2024-26 fiscal cycle, with total expenditures of AED 246.6bn. The Department of Finance expects to achieve an operating surplus of up to 3.3% of Dubai’s GDP, during the 2024-2026 period. Spending for the fiscal year 2024 has been estimated at AED 79.1bn, with salaries and wages constituting 26% of the total.

- UAE’s ADNOC Drilling and Alpha Dhabi establish an investment partnership – to invest up to USD 1.5bn to acquire technology-enabled companies in energy and oilfield services.

- Emirates Airlines reported a profit of AED 9.4bn (+134% yoy) in H1 2023, thanks to a 19% surge in revenues (to AED 59.5bn). The airline reported that an average 81.5% of seats were filled in H1, versus a share of 78.5% last year.

- Economic licenses issued by the Department of Economic Development in Ajman grew by 11% yoy to 1,428 in Q3, with professional licenses accounting for the largest share (51%).

- Abu Dhabi Islamic Bank raised USD 500mn through a green sukuk: the sukuk was oversubscribed 5.2 times and will be listed and traded on the London Stock Exchange’s International Securities Market and the Sustainable Bond Market. Middle East and Africa was allocated the bulk share (78%), followed by Europe (13%) and 9% to Asia and the US.

- The Abu Dhabi Department of Economic Development and Jiangsu Provincial Overseas Cooperation and Investment Company signed an agreement to advance the development of industrial zones and attract more Chinese industrial investments. The focus is on manufacturers that specialise in solar, hydrogen, electric vehicles, healthcare, 3D printing and petroleum equipment making.

Media Review

There will be no peace in the Middle East without politics: FT

https://www.ft.com/content/f6ef59c3-b1a5-4772-9266-b9fc2c4e3abf

Investors pull record sums from Saudi in Middle East fund flight

https://www.reuters.com/markets/investors-pull-record-sums-saudi-middle-east-fund-flight-2023-11-12/

The Chinese yuan is losing value, yet gaining ground

https://www.economist.com/finance-and-economics/2023/11/09/the-chinese-yuan-is-losing-value-yet-gaining-ground

Powered by: