Markets

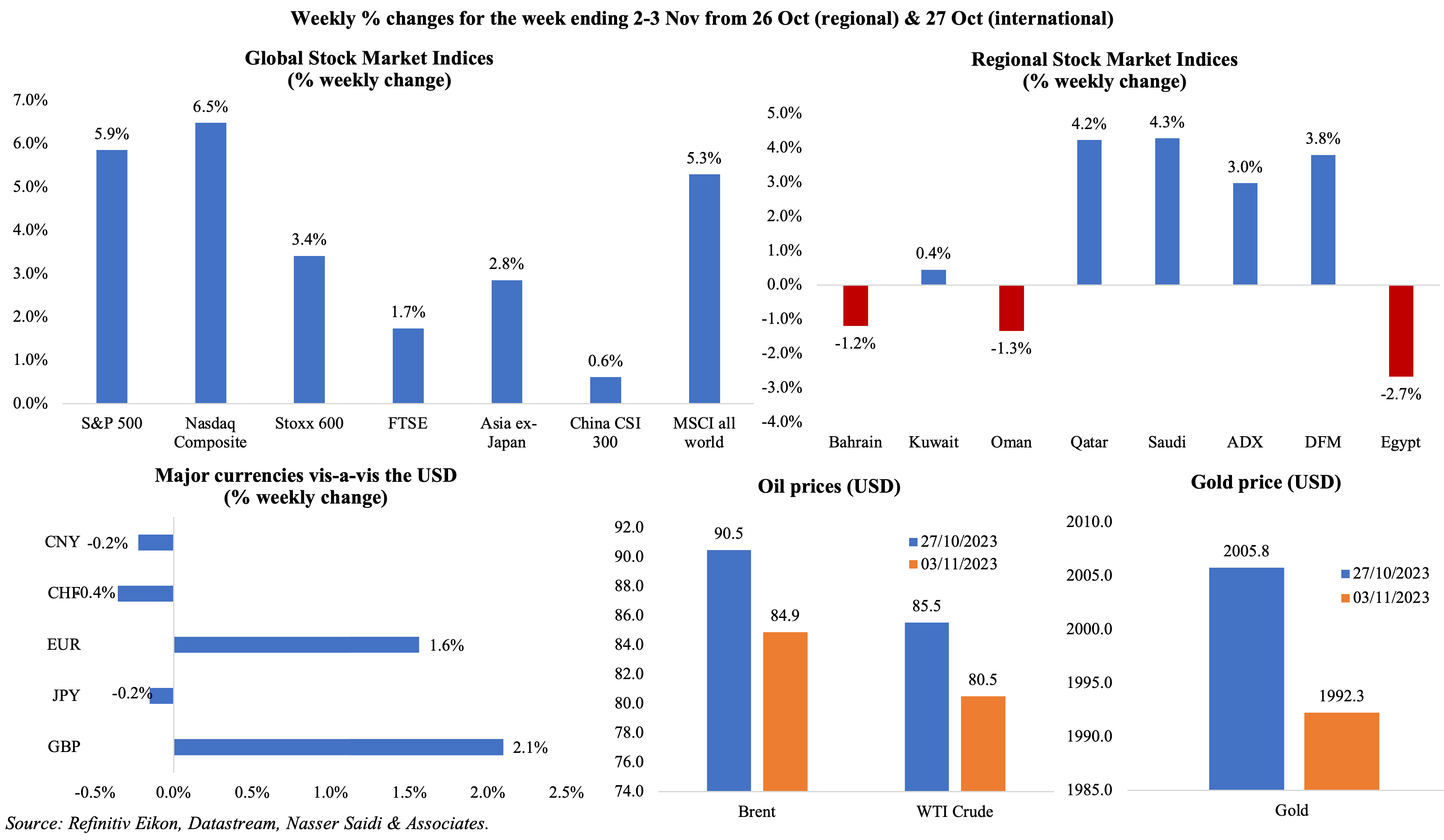

Equity markets rallied last week, with the S&P 500 and MSCI all world index posting the best weekly gain this year. Equity markets in the region were mostly up after the Fed left rates unchanged. The GBP and EUR gained most during the week when USD fell to a 6-week low; the yen tumbled and came under pressure after the BoJ announced a change to the yield control policy. As geopolitical risk premiums eased amid limited impact on demand or a supply disruption (from the Israel-Gaza conflict), oil prices fell by 6% compared to a week ago; gold price also ended lower last week.

Global Developments

US/Americas:

- US Fed left policy rates unchanged for the second time in a row, after hiking eleven times since Mar 2022.

- Non-farm payrolls grew by 150k in Oct, declining sharply from Sep’s 297k gain. While average hourly earnings grew by 4.1% in Oct (Sep: 4.3%), unemployment rate moved to 3.9% (Sep: 3.8%), the highest level since Jan 2022. Labour force participation rate slipped to 62.7% (from 62.8%).

- Non-farm productivity increased at a 4.7% annualised rate in Q3 (Q2: 3.6%), the fastest pace since Q3 2020. Unit labour costs fell by 0.8% in Q3 (Q2: 3.2%).

- Private sector added 113k jobs in Oct (Sep: 89k), with education and health services leading the uptick. ADP disclosed that pay grew by 5.7% yoy, the smallest gain since Oct 2021.

- JOLTS job openings ticked up to 9.553mn in Sep (Aug: 9.497mn) and layoffs dropped to a 9-month low. There were 1.50 job openings for every unemployed person in Sep (Aug: 1.49), and way above the pre-pandemic ratio of 1.2.

- The Employment Cost Index, the broadest measure of labour costs, rose 1.1% qoq in Q3 (Q2: 1%). Gains in annual compensation is slowing but remains above pre-pandemic pace.

- Initial jobless claims increased by 5k to a 7-week high of 217k in the week ended Oct 27th and the 4-week average moved up by 2k to 210k. Continuing jobless claims increased by 35k to 1.818mn, the highest since early Apr, in the week ended Oct 20th.

- Factory orders gained by 2.8% mom in Sep (Aug: 1%), thanks to orders for computers and electronic parts (1%) and machinery orders (0.7%) while civilian aircraft orders rebounded (92.5%). Orders for non-defence capital goods excluding aircraft, ticked up by 0.5%.

- Dallas Fed manufacturing business index worsened in Oct, falling to 19.2 from Sep’s -18.1 reading, as new orders plunged alongside positive output growth while shipments dipped.

- S&P Case Shiller home price indices accelerated by 2.2% yoy in Aug (Jul: 0.2%).

- Chicago PMI edged down to 44 in Oct (Sep: 44.1), with production sub-index dropping below-50 after 2 months of expansion amid increases in new orders and employment.

- ISM manufacturing PMI slipped to 46.7 in Oct (Sep: 49), staying below 50 for the 12th month in a row, partly dragged down by the auto-workers strike. New orders slumped (45.5 from 49.2) and employment fell (to 46.8 from 51.2) as prices paid rose to 45.1 (from 43.8).

- ISM services PMI also slowed to 51.8 in Oct (Sep: 53.4), despite an uptick in new orders (55.5 from 51.8) while employment declined (50.2 from 53.4). New export orders contracted to 48.8 (Sep: 63.7), as did inventories (49.5 from 54.2).

Europe:

- Eurozone GDP grew by 0.1% yoy in Q3 (Q2: 0.5%); in qoq terms, GDP fell by 0.1% (Q2: 0.2%). German GDP fell by 0.1% qoq and 0.3% yoy in Q3 (Q2: -0.3% qoq and -0.7% yoy), France’s GDP grew by just 0.1% qoq and Italy remained unchanged. In Germany, household consumption fell in Q3 while capital investment made a positive contribution to growth.

- Inflation in the eurozone fell to 2.9% yoy in Oct (Sep: 4.3%), the lowest since Jul 2021, as energy costs dropped (-11.1%), food and beverages costs eased (7.5% from 8.8%) and services inflation remained stable (4.6%). Core inflation eased to 4.2% in Oct (Sep: 4.5%), the lowest since Jul 2022.

- The harmonised index of consumer prices in Germany slipped to 3.0% yoy in Oct (Sep: 4.5%), the lowest rate since mid-2021, largely due to the drop in energy prices. Core inflation fell to 4.3% (Sep: 4.6%).

- Manufacturing PMI in the eurozone and Germany inched up by 0.1 point (from the preliminary estimates) to 43.1 and 40.8 in Oct. Despite the gain, PMI remains contractionary with new orders continuing to drop and firms’ expectations still pessimistic.

- Germany’s exports and imports declined by 2.4% mom and 1.7% respectively in Sep (Aug: 0.1% and -0.3% respectively). Exports to China plunged by 7.6% while those to the US and other EU nations were down by 4% and 2.1% respectively. Trade balance narrowed to EUR 16.5bn in Sep (Aug: EUR 17.7bn).

- Unemployment rate in Germany climbed to 5.8% in Oct (Sep: 5.7%), the highest level since Jun 2021. In the euro are unemployment rate inched up to 6.5% in Sep (Aug: 6.4%), with the number of unemployed persons rising by 69k to 11.017mn.

- Economic sentiment indicator in the euro area edged down to 93.3 in Oct (Sep: 93.4), the lowest reading since Nov 2020. Business climate in Oct inched up to -0.33 in Oct (Sep: -0.35) while consumer confidence remained unchanged at 17.9.

- The Bank of England left interest rates unchanged at 5.25% but ruled out rate cuts soon, with the governor stating that inflation is “still too high”. Three members of the committee voted to raise rates by 25bps to 5.5%.

Asia Pacific:

- China manufacturing PMI unexpectedly fell to 49.5 in Oct (Sep: 50.2) as new export and imports orders shrank for an eight consecutive month; manufacturing PMI has now contracted for 6 of the 10 months this year. Non-manufacturing PMI eased to 50.6 (Sep: 51.7) as services and construction activity slowed and composite PMI, at 50.7 (Sep: 52), was the weakest since Dec 2022.

- Caixin manufacturing PMI shrank to 49.5 in Oct (Sep: 50.6), with new exports down below-50 for 4 consecutive months on weak foreign demand. Caixin services PMI improved to 50.4 in Oct (Sep: 50.2), staying above the 50-mark for the tenth month in a row, as foreign sales grew and employment stabilised.

- The Bank of Japan left interest rates unchanged and announced that it will increase flexibility on yield curve control. The BOJ said the target level of the 10-year JGB yield will be held at 0% but will take the upper bound of 1% “as a reference”.

- Japan’s unemployment rate slipped to 2.6% in Sep (Aug: 2.7%), with the number of unemployed persons declining by 50k to 1.82mn. The job availability ratio was unchanged at 1.29 i.e. there were 129 job openings for every 100 job seekers.

- Industrial production in Japan rebounded by 0.2% mom in Sep (Aug: -0.7%), thanks to an increase in motor vehicles production (6% vs Aug’s -3.9%). In yoy terms, IP fell by 4.6% (from Aug’s 4.4% drop).

- Retail trade in Japan grew by 8% yoy in Sep (Aug: 7%), the 19th consecutive month of gains. Growth was highest for fuel and food & beverages (7.5) and automobiles (7%).

- India’s manufacturing PMI fell to an 8-month low of 55.5 in Oct (Sep: 57.5), on slowing consumer goods demand and new orders fell to a 12-month low while job creation was the slowest since Apr.

- Retail sales in Singapore grew by 0.6% yoy in Sep (Aug: 4.2%), the slowest reading since Jan (when it fell by 1.2%). Sales slowed at supermarkets (1.1% from Aug’s 1.5%) and declined at department stores (-5.6% vs. Aug’s 0.8% gain). In mom terms, sales fell by 1.6% (Aug: 1.9%).

Bottom line: Manufacturing PMI in Asia slumped, alongside the continued weak readings recorded in Europe and the US. New orders and output slowed amid rising cost pressures, while the contraction in China raises worries for global growth. Markets have been focused on what seems to be a halt in the rate-hiking cycle (given pauses from the Fed, Bank of England, and Norway last week) though central bank officials have stressed that more may need to be done to tackle inflation. But, it is too early to write off the concerns related to the geopolitical situation in the Middle East: it adds a layer of uncertainty.

Regional Developments

- GCC central banks held interest rates unchanged, mirroring the Fed’s move.

- Non-oil sector PMI in Egypt fell further to 47.9 in Oct (Sep: 48.7), with new orders declining further (to 47.1 from 47.6); however, output inched up to 46.4 (from 45.7) and future output expectations rose to a 10-month high of 56.4.

- The Central Bank of Egypt left interest rates unchanged at the latest meeting: the lending and deposit rates were left at 20.25% and 19.25% respectively. The apex bank stated that the rates “remain a function of forecasted inflation rather than prevailing inflation rate” while also suggesting that economic activity has been slowing (given past rate hikes).

- The Ministry of Finance plans to borrow EGP 388.75bn from the local market in Nov via 24 issuances of T-bills and bonds – part of a larger plan to borrow EGP 1.2635trn in Q2 of the fiscal year 2023-24 to repay previous debts and finance the budget deficit. Separately, last week, Egypt sold almost USD 500mn in 5-year Samurai bonds with an average yield of 1.5% – this follows the issuance of panda bonds in mid-Oct.

- Egypt’s external debt declined to USD 164.7bn in Jun 2023, compared to USD 165.361bn in the previous quarter. For the 2022-23 fiscal year, external debt grew by USD 9bn or 5.8% yoy. Ratio of external debt to GDP stood at 40.3% in Jun.

- Fitch downgraded Egypt’s credit rating to “-B” with a stable outlook from “B”, the second downgrade this year, citing risks to “external financing, macroeconomic stability and the trajectory of already-high government debt”. The finance minister, in his response to the downgrade, disclosed that the nation has secured sources of external financing until the end of the current fiscal year, estimated at USD 4bn.

- Egypt disclosed that logistics and transportation firms will be offered to private sector management “in the near future”.

- Trade deficit in Egypt narrowed by 26.4% yoy to USD 27.4bn in Jan-Sep 2023, as imports fell by 1% to USD 53.6bn while exports slipped by 3% to USD 26.2bn.

- Egypt’s net international reserves rose to USD 35.102bn in Oct from USD 34.97bn in Sep. Net foreign assets deficit widened by EGP 27.5bn to negative EGP 828.7bn in Sep, owing to an increase in central bank liabilities. It had narrowed by EGP 11.1bn and EGP 24.9bn in Aug and Jul 2023 respectively.

- Egypt raised petrol prices by up to 14.3% while diesel price was kept unchanged. This is the second price hike in 8 months.

- Tourist arrivals into Egypt grew by 20% yoy to 11mn tourists in Jan-Sep 2023, with hotel accommodation prices up by 20-30% during the period, according to the CEO of the General Egyptian Authority for Tourism Promotion.

- Oil exports from Kuwait fell by 30% to 490k metric tonnes (104k barrels per day) in Oct (Sep: a record-high 720k tonnes).

- Oman’s annual household food consumption touched OMR 2.7bn (USD 7.02bn) in 2022, with the food sector accounting for 4.5% or OMR 1.2bn of GDP.

- Qatar PMI clocked in at 50.8 in Oct (Sep: 53.7), the lowest since Jan, and dipping lower than the long-run average of 52.3. While output, new orders and employment grew, the pace of expansion eased. Output prices grew at the fastest rate in 6 months while input prices fell for the first time this year. Employment grew, thanks to hiring by construction firms and manufacturers.

- Qatar signed a 27-year deal with Sinopec to supply 3mn tons of LNG annually – this is the 3rd long-term LNG supply deal between Qatar and China. QatarEnergy will transfer a 5% stake to Sinopec in a joint venture company that owns the equivalent of 6mn tons per annum of LNG production capacity in the North Field South project.

- MENA equity capital markets raised USD 7.5bn in equity and equity-related issuances during Jan-Sep 2023, down by 50% yoy, while the number of issuances fell by 14%, according to Refinitiv Deals Intelligence data. IPOs accounted for 91% of activity, while follow-on issuance accounted for 9%. M&A transactions totalled USD 59.5bn in Jan-Sep, down by 16% yoy, and the lowest 9-month total since 2020.

- Saudi Arabia will continue with its voluntary output cut of 1 million barrels per day (bpd) until end-Dec; Russia also announced a continuation of its the additional voluntary supply cut of 300k bpd.

Saudi Arabia Focus

- Saudi Arabia’s real GDP fell by 4.5% in Q3 2023, according to preliminary data, dragged down by the sharp plunge in the oil sector (-17.3% yoy from Q2’s 3.8% drop). Non-oil sector grew by 3.6% in Q3, though thepace has been slowing in recent quarters (it has averaged 4.8% this year vs an average of 5.3% in Jan-Sep 2022).

- Non-oil sector PMI in Saudi Arabia rose to 58.4 in Oct (Sep: 57.2), thanks to a jump in new orders (to a 4-month high of 66.1) while employment rose to a 9-year high of 54.5 in Oct. Input price inflation touched a 1-year high (partly due to wage increases) though firms were reluctant to pass on price hikes to consumers – output prices posted the strongest drop since May 2020 on competitive pressures.

- Saudi Arabia posted a 23.8% yoy drop in oil revenues in Jan-Sep 2023, resulting in a decline in overall revenues (-10.1% to SAR 854.3bn till Sep) while non-oil revenues were up by 21.5%. Bulk of non-oil revenues came from tax on goods & services (up 18% to SAR 199.5bn in till Sep). In Q3 alone, oil and overall revenues fell by 36% and 14% respectively.

- Saudi Arabia plans to sign more free trade agreements with an “ambitious” list of countries, revealed the Minister of Economy and Planning during a Bloomberg interview. He also stated that the GCC is negotiating an FTA with the UK and looking to resume talks for a deal with the EU.

- Net foreign assets (NFA) at the Saudi Central Bank increased by USD 12.8bn to SAR 1.576trn in Sep; however, in year-on-year terms, NFA were down by 6.5%.

- The Saudi Ministry of Industry and Mineral Resources issued 174 industrial licenses in Sep (Aug: 136), bringing the total permits issued this year to 969. The volume of investments linked to the licenses amounted to SAR 5.3bn in Sep.

- Expat remittances declined by 12.57% yoy and 8% mom to SAR 9.91bn in Sep 2023. This brings the total remittances of expats in Saudi Arabia to SAR 31.3bn in Q3.

- Goldman Sachs research expects investments in Saudi Arabia’s key sectors to touch USD 1trn by 2030: of this, USD 245bn will be spent on upstream energy, while metals & mining and transport & logistics follow closely (at USD 170bn and USD 150bn respectively).

- Research and development in Saudi Arabia grew by 32.7% yoy to SAR 19.2bn in 2022, with government funding accounting for 58% of the total.

- Saudi climate tech start-ups attracted USD 68mn in venture capital investments since 2018 till H1 2023 from 21 deals, according to MAGNiTT. This compares to total VC funding for MENA and Turkey of USD 651mn from 225 deals over 5 years.

- Total number of employees in Saudi Arabia’s private sector rose to 10.7mn workers in Oct, according to the Saudi National Labour Observatory; 2.3mn were Saudi citizens.

- Saudi Arabia, as the sole remaining candidate, presented a bid to host the 2034 FIFA World Cup. Australia was the other contender but did not present a bid, thereby almost confirming the host nation for the tournament.

- Saudi Arabia has expressed interest in investing in India’s cricket league (Indian Premier League or IPL): Bloomberg reported that advisers from Saudi have discussed the possibility of moving the IPL into a holding company (valued at USD 30bn). It had previously proposed investing as much as USD 5bn into the IPL and expanding into other countries.

UAE Focus![]()

- The UAE Minister of Economy disclosed that UAE’s GDP grew by 3.7% in H1 this year, supported by the non-oil sector’s 5.9% growth.

- UAE PMI jumps to 57.7 in Oct (Sep: 56.7), the highest since Jun 2019, supported by new orders (which also posted the strongest growth since Jun 2019). Inflationary pressures are ticking up: input prices rose to a 15-month high, due to higher fuel and raw material prices as well as a “modest uptick in wages” to retain staff. Output prices were raised in Oct, for the first time in 1.5 years “albeit only fractionally as discounting efforts remained wide”.

- Dubai announced a 12% yoy increase in private school enrolment for the current 2023-24 academic year.This provides a good proxy for activity in the emirate. The number of students more than doubled since 2010-11 & schools have risen from 127 to 220 (in 2023-24).

- Jordan and the UAE signed MoUs worth USD 6bn last week: this includes both investment and development projects. The minister of state for foreign trade disclosed that UAE’s direct investments into Jordan was USD 4bn, accounting for 14% of Jordan’s total FDI inflow, making it the largest global investor (followed by UK & Kuwait at 8.2% & 7.2% respectively).

- Dubai Taxi Corporation, a unit of the Road and Transport Authority, aims to raise AED 1.1bn from an IPO this month, according to Bloomberg. A listing of Dubai Parking is likely afterwards, as per the article.

- Following the UAE-Turkey CEPA, bilateral trade between the two nations stood at USD 13.5bn in H1 2023 and crossed USD 14bn in Jan-Sep 2023 – on track to meet USD 15bn by end-2023 (+50% yoy). Turkey’s trade minister also disclosed that UAE investments in Turkey stood at USD 3.4bn across multiple sectors (including renewable energy, water, health and tourism among others) while Turkish firms had invested USD 350mn in the UAE.

- Dubai Integrated Economic Zones Authority launched a AED 500mn venture capital fund, Oraseya Capital, to support tech startups as part of the Dubai Economic Agenda.

- Dubai’s Program for Gaming 2033 aims to create 30k jobs in the gaming industry by 2033, alongside an increase in the sector’s contribution to GDP (by USD 1bn). The MENA region has an estimated 377mn gamers.

- UAE hospitality sector is making a strong recovery: hotel guests in Abu Dhabi and Dubai grew by 33% yoy and 21.7% to 2.9 and 11.1mn in Jan-Aug. Additionally, occupancy levels and average daily rates have crossed the 2019 benchmark (except for Abu Dhabi’s occupancy). Q4 is estimated to see further improvement given the tourist season and key events.

- The number of real estate transactions in Dubai grew by 33.8% to 116,116 in Jan-Sep while the value grew by more than 36.7% yoy to AED 429.67bn. Number of women investors rose by 38.2% yoy to 27,120 who made investments worth AED 62.38bn (53.8% yoy). Separately, ValuStrat reported that residential rents in the emirate surged by 27.2% yoy and 2.1% qoq in Q3 2023.

- Construction activity in the UAE hit a five-year high for new business enquiries in Q3 2023, according to the Royal Institution of Chartered Surveyors global construction monitor. The overall reading was a positive 45% while the private residential sector was the strongest (at a 56% positive sentiment).

Media Review

The big central banks need to use their time outs wisely

https://www.ft.com/content/2139751e-9d2c-48d2-a8ba-fe5f667b95d8

Markets think interest rates could stay high for a decade or more

https://www.economist.com/briefing/2023/11/02/markets-think-interest-rates-could-stay-high-for-a-decade-or-more

Private equity rushes to Gulf as fundraising dries up

https://www.reuters.com/business/finance/private-equity-rushes-gulf-fundraising-dries-up-2023-11-03/

Dr Al Jaber hails agreement on loss and damage fund (ahead of Cop28)

https://www.thenationalnews.com/climate/cop28/2023/11/04/dr-al-jaber-hails-agreement-to-operationalise-loss-and-damage-fund/

Powered by: