Markets

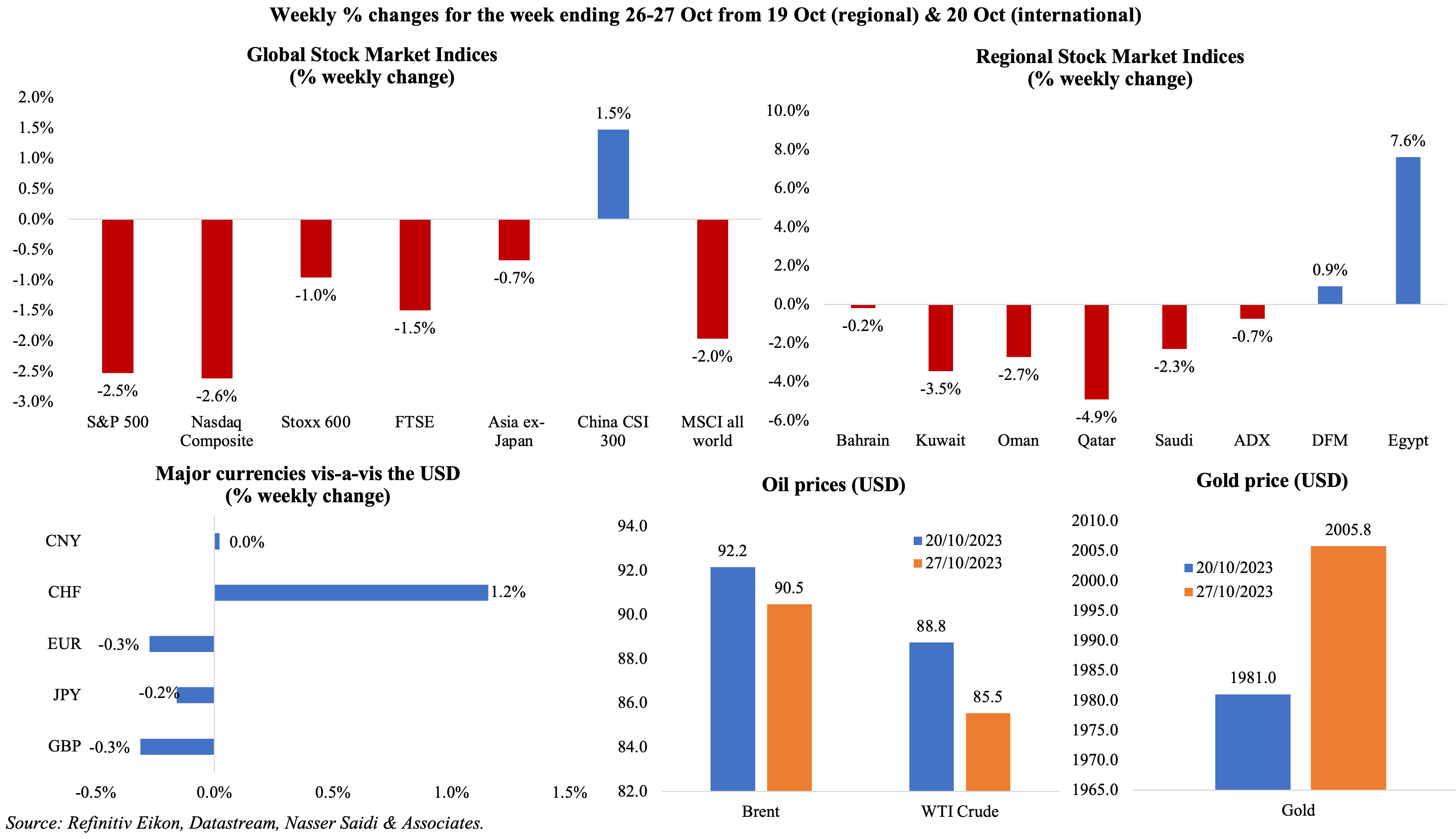

Major equity markets were down last week, jittery on fears of an escalation of the Middle East conflict: European shares fell to 7-month lows on Friday, while the MSCI Asia-Pacific index (excluding Japan) clocked in a new 11-month low on Thursday. The Cboe Volatility Index (VIX) is close to 7-month highs. Regional markets ended mostly in the red, except for Egypt, given the conflict and potential for higher interest rates in the US. The dollar index posted a weekly gain while the yen saw a new 1-year low of 150.77. Oil prices posted their first weekly drop in three weeks while gold price continued to rise for the third week in a row (and went past USD 2000 for the first time since mid-May).

Global Developments

US/Americas:

- US GDP grew at an annualised 4.9% in Q3 (Q2: 2.1%), largest gain since Q4 2021, thanks to consumer (+4.0%) and government spending (4.6%), exports, gross domestic investment (8.4%) and inventories. PCE increased by 2.9% in Q3 (Q2: 2.5%) and core PCE rose to 2.4%, the slowest since Q4 2020, and from Q2’s 3.7% pace.

- Personal income grew by 0.3% mom in Sep (Aug: 0.4%), with wages advancing by 0.4% (Aug: 0.5%). Personal spending was up by 0.7% (Aug: 0.4%), with spending on services up by 0.8% supported by international travel, healthcare, and airline transportation services. The saving rate dropped to 3.4% in Sep from 4.0% in Aug.

- Durable goods orders rebounded in Sep, up 4.7% mom (Aug: -0.1%): this was the largest monthly increase since Jul 2020, largely due to the uptick in transportation equipment. Non-defence capital goods orders excluding aircraft increased by 0.6% (Aug: 1.1%).

- Trade deficit in the US widened to USD 85.8bn in Sep (Aug: USD 84.5bn). Exports and imports were up by 2.9% and 2.4% respectively to USD 174bn and USD 259.8bn.

- Manufacturing PMI in the US moved up to a 6-month high of 50 in Oct (Sep: 49.8), thanks to production rising at the quickest pace since Apr though foreign demand remained subdued. Services PMI also increased, rising to 50.9 in Oct (Sep: 50.1): output grew at the fastest in 3 months, alongside gains in employment while new business fell for the 3rd month in a row.

- Richmond Fed manufacturing index moderated to 3 in Oct (Sep: 5), as shipments moved to 9 (from 7), new orders fell to -4 (from 3) and employment remained unchanged at 7. Kansas manufacturing activity index stayed in negative territory, though it improved to -8 in Oct (Sep: -13): production, shipments, and order backlog indices showed moderate declines. Chicago Fed National Activity Index improved to 0.02 in Sep (Aug: -0.22). The 3-month average moved to 0 from -0.14 in Aug, implying economic growth nearing historical trends.

- Michigan consumer sentiment index fell for the 3rd month in a row, to 63.8 in Oct (Sep: 67.9). The 1- and 5-year inflation expectation accelerated to 4.2% and 3% (up from 3.2% and 2.8% respectively in Sep).

- New home sales in the US grew by 12.3% mom to 759k units in Sep, the highest level since Feb 2022, supported by the 19-month high touched in new single-family homes. With mortgages averaging around 7.9%, the highest since Sep 2000, the prospects look weak for the months ahead. Pending home sales unexpectedly rebounded in Sep, up 1.1% mom (Aug: -7.1%); in yoy terms, it fell by 11% in Sep.

- Initial jobless claims rose by 10k to 210k in the week ended Oct 20th and the 4-week average moved up by 1.25k to 207.5k. Continuing jobless claims increased by 63k to 1.779mn, the highest since early May, in the week ended Oct 13th.

Europe:

- The ECB left policy rates unchanged at 4%, following 10 consecutive hikes since Jul 2022. ECB’s Lagarde mentioned that rate cuts are not being discussed for the moment “we have to be steady”.

- Eurozone’s manufacturing PMI declined slightly to 43 in Oct (Sep: 43.4), with new orders falling sharply and employment falling at the sharpest rate since Aug 2020. Services PMI also slipped, down by 0.9 point to 47.8, the largest decline since Feb 2021, as new businesses fell the most since Jan 2021 and hiring almost stalled.

- Consumer confidence in the eurozone slipped by 0.1 point to -17.9 in Oct (Sep: -17.8). For the EU, sentiment remained unchanged at -18.7.

- Manufacturing PMI in Germany edged up to 40.7 in Oct (Sep: 39.6), with the decline in new orders easing while employment declined at the fastest since Oct 2020. Services PMI slipped below-50, clocking in 48 from Sep’s 50.3 reading, with new business activity falling to the lowest level since Q2 2020. Composite PMI fell to 45.8 in Oct (Sep: 46.4), a contractionary reading for a fourth straight month.

- German Ifo business climate index improved to 86.9 in Oct (Sep: 85.8), with the services sector considerably more positive than others while in trade firms are “more pessimistic regarding the coming months”. Current situation assessment rose to 89.2 (Sep: 88.7) while expectations moved up to 84.7 (Sep: 83.1).

- UK manufacturing PMI improved to 45.2 in Oct (Sep: 44.3), the highest in 3 months, while firms reported the fastest decline in factory gate prices since Feb 2016. Services PMI edged down to a 9-month low of 49.2 (Sep: 49.3), with weak client demand cited in the real estate sector.

- GfK consumer confidence survey in Germany showed increased pessimism: the reading fell for the 3rd month in a row, to a 7-month low of -28.1 in Nov (Oct: -26.7).

- Unemployment rate in the UK stood at 4.2% in the 3 months to Aug (May-Jul: 4.3%) while the employment rate fell 0.3 percentage points to 75.7%. The economic inactivity rate grew by 0.1 ppt to 20.9% for the period. The latest data release did not include any details on working hours, the extent of self-employment or part-time work, and any sectoral breakdown.

Asia Pacific:

- Manufacturing PMI in Japan remained unchanged at 48.5 in Oct, with reduction in new orders and faster decline in export orders. Services PMI fell to 51.1 (Sep: 53.8), with easing input and output inflation alongside a decline in foreign demand for the 1st time in 14 months.

- The leading economic index in Japan slipped to 109.2 in Aug, from the preliminary reading of 109.5: it is still the highest reading since Nov 2022. Meanwhile, the coincident index was revised higher, by 0.3-point to 114.6.

- Inflation in Tokyo accelerated to 3.3% in Oct (Sep: 2.8%). Excluding fresh food, core inflation rose to 2.7% (Sep: 2.5%) while excluding food and energy, core-core inflation eased to 3.8% (Sep: 3.9%). Services prices rose 2.1% yoy in Oct (Sep: 1.9%).

- GDP in South Korea grew by 0.6% qoq in Q3, supported by a rebound in exports (3.5% from Q2’s 0.9% dip), construction investment (2.2% from -0.8% in Q2) and private consumption (0.3% from -0.1% in Q2). In yoy terms, growth was 1.4% (Q2: 0.9%).

- Inflation in Singapore climbed to 4.1% yoy in Sep (Aug: 4%), as private transport prices surged (8.5% from Aug’s 6.3%). Core inflation eased to an 18-month low of 3% due to lower inflation for food and retail (4.3% each in Sep) among others.

- Unemployment rate in Singapore inched up to 2% in Q3 (Q2: 1.9%). Total employment excluding migrant domestic workers rose for the eighth straight quarter by 24k in Q3, with financial and professional services reporting gains.

- Industrial production in Singapore rebounded in Sep, rising by 10.7% mom following Aug’s sharp 10.8% drop. IP fell by 2.1% yoy (Aug: -11.6%), as output rebounded for electronics (10.2% from Aug’s 18.9% drop) alongside a plunge in biomedical manufacturing (-18.9% from -2.3%) and chemicals (-12.9% from -5.6%).

Bottom line: Flash PMIs indicated rising recession risks in the Eurozone, stalled private sector activity in Japan and generally weak conditions in Europe; US PMI however pointed towards better growth conditions alongside weakening price pressures. The Fed, BoJ and Bank of England meet this week, and all are widely expected to follow the ECB’s footsteps and hold rates, though rumours are afloat that the BoJ could change its policy on the yield-curve control program.

Regional Developments

- Bahrain’s money supply grew by 3.8% yoy to BHD 15.8bn in Aug. Private deposits grew by 3.1% to BHD 13.9bn. Of the total loans and credit facilities (1.8% to BHD 11.6bn), 43.2% went to the business sector and another 50.9% to private individuals.

- Egypt is in discussions with UAE and Saudi Arabia to secure deposits worth USD 5bn. Currently the apex bank holds about USD 29.9bn in deposits from the Arab nations (including USD 15bn in medium- and long-term deposits). Net international reserves increased to USD 34.97bn at end-Sep 2023.

- Egypt’s government expects FDI of USD 35bn over the next five years; in 2023-24, the nation expects to attract around USD 12bn in FDI.

- Given the ongoing Israel-Gaza war, EGP has depreciated rapidly, hitting a new low of nearly 47 against the dollar in the black market (vs the official rate at EGP 30.9 per dollar). It largely stems from concerns of lower tourism revenues, impact on balance of payments, and foreign exchange shortages. Separately, the country needs to build up its dollar reserves ahead of a potential devaluation (probably after the elections later this year).

- Trade between Egypt and 11 East and South Asian nations grew to USD 34.5bn in 2022, with exports rising by 15.9% and imports by 3.9%. Exports to South Korea (mostly LNG) topped the list (USD 2bn in 2022), followed by India (mostly crude oil exports). China was the main source of imports (USD 14.4bn), followed by India (USD 4.1bn).

- Tourism arrivals into Egypt is estimated to touch 15mn at end-2023, according to JLL. Occupancy levels in Cairo rose to 68% in Aug (Aug 2022: 61%) while the average daily rate dropped by 3% yoy to USD 144 in Jan-Aug 2023.

- Egypt reached an agreement with Belgium’s Deme Group for the latter to invest USD 3bn to build a green hydrogen facility. Production will be allocated for export to Europe.

- Inflation in Oman inched up to 1.3% in Sep, following 0.2% and 0.6% in Jul and Aug, with food and beverages prices rising by 3.4% alongside declines in transport (-1.37%) and communications (-0.18%).

- Oman’s population grew by 6.1% yoy to 5.136mn at end-Q3, while expat numbers were up by 11.1% (to 2.23mn). The capital, Muscat, accounted for 28.7% of the total population.

- Qatari citizens working in the private sector surged by 150% qoq to 534 in Q2 while the 1315 citizens entered the public sector workforce.

- GCC and China will sign a free trade agreement “soon”, according to the GCC’s secretary general. Separately, the GCC unified tourist visa will be rolled out within the next 2 years, disclosed the UAE Minister of Economy; specific regulations and legislations will be developed during this time.

- Purchase of plane tickets to Middle East nations Egypt, Jordan and Lebanon have declined by 26%, 49% and 74% respectively since the Israel-Gaza conflict began, according to ForwardKeys.

- Dubai tops the MENA region in Kearney’s 2023 Global Cities Index and ranks 23rd globally (down one rank from last year) while Abu Dhabi rose 10 points to rank 66th globally. Riyadh and Doha also jumped 7 and 9 places to 61st and 50th respectively.

Saudi Arabia Focus

- Saudi Arabia’s non-oil GDP is expected to grow by around 6% this year, according to the finance minister, “and possibly to 2030 and beyond”. The minister also stated that the nation’s aim is to accelerate reforms, spend within “our fiscal space”, and were not worried about deficits.

- Saudi Arabia will stick to its Jan 2024 deadline for international firms to move their regional HQs to Riyadh, to be able to secure government contracts. The finance minister disclosed that a tax framework had been agreed with such firms, without elaborating further. The KAFD Development & Management Co (DMC) CEO took the names of Deloitte and JLL as firms that are moving their regional HQs among others.

- The Tourism Minister of Saudi Arabia revealed that the country may record almost 100mn tourist visits in 2023, contributing 6% of GDP. Additionally, the 2030 target has been revised to 150mn visitors (up from the previous 100mn target). The ministry also plans to invest over USD 800bn in the next decade to support the sector.

- Saudi Arabia’s overall exports fellby 23.4% yoy to SAR 102.4bn in Aug. The fall in exports stemmed from declines of both oil and non-oil exports, which plunged by 27.1% and 21.8% respectively. China remained the top trade partner in Aug, accounting for 13.4% of total exports and 19.3% of total imports.

- Exports of refined oil products grew by 16% mom to 1.3mn barrels per day (bpd) in Aug, according to data from the Joint Organizations Data Initiative. This was largely due to higher shipments of diesel (+45% to 587k bpd).

- NEOM announced a USD 10bn joint venture with Denmark’s DSV (the 3rd largest freight forwarder globally): it is expected to create 20k work opportunities, and “will provide end-to-end supply chain management, development and investments in transport and logistics assets and infrastructure as well as transport and delivery of goods and materials within NEOM”.

- Saudi PIF signed a JV with Italy’s Pirelli, for a total investment of USD 550mn, for the latter to build a tyre manufacturing facility in the country. PIF will hold a 75% stake in JV.

- Managers Gate Platform, a new digital platform for collaboration between the PIF and external fund managers, was launched at the FII: to support secure data sharing, improved communications, and digitization of operational & investment due diligence processes.

- Construction sector pipeline in Saudi Arabia is strong, with projects worth at SAR 8trn (USD 2.1trn) for the next 8 years, according to a senior PIF executive. Of this, SAR 3trn worth are at the PIF level and the rest at the country level.

UAE Focus![]()

- UAE banks’ gross assets surged by 10.7% yoy to AED 3.9trn (USD 1.062trn) in Aug. Deposit growth accelerated, up 8.2% year-to-date as of Aug (to AED 4bn), supported by private sector (18% ytd to AED 1.51bn). Gross credit grew by 3.9% ytd to more than AED 1.95trn, and credit to the public sector accelerated by 7.2%. Meanwhile, monetary base inched lower by 1.9% mom to AED 613.4bn in Aug.

- UAE banks’ investments grew by 19.5% yoy to a record high AED 585.4bn in Aug: bonds held until maturity accounted for the largest share of bank investments at 47%, followed by investments in debt bonds (42.1%). Separately, the total value of fund transfers between UAE banks grew by 35.6% yoy to AED 10.997bn in Jan-Aug.

- The UAE’s Services Export Strategy will be launched in partnership with the private sector, according to the Minister of State for Foreign Trade. Services exports is on track to touch AED 4trn by 2031, as per the minister; in 2022, the UAE was the world’s 12th largest service exporter (USD 154bn or 2.2% of global services exports).

- UAE’s non-oil trade with Belt and Road Initiative partner countries grew by more than 13% to USD 305bn in H1 2023, accounting for 90% of non-oil trade. About 88% of UAE’s imports originate from BRI nations and about 94% of non-oil exports are sent to these nations. The UAE invested USD 10bn in the China-UAE investment fund to support BRI projects in East Africa and signed 13 MoUs with China in 2018 to invest in various sectors in UAE.

- Bilateral non-oil trade with Georgia grew by 27.9% yoy to more than USD 225mn in H1 2023, following a total of USD 468mn in 2022 (+110% yoy). UAE, which signed the CEPA with Georgia in Oct, now accounts for over 63% of Georgia’s trade with Arab countries.

- Dubai issued a resolution to set up a Family Business and Family Ownership Disputes Settlement Committee in a bid to ensure the continuity and sustainability of such businesses.

- Total revenues of UAE’s hotel establishments grew by 24% yoy to AED 26bn during Jan-Jul 2023, with a 15% jump in number of guests (to 16mn). Total number of hotels jumped to 1,224 and hotel occupancy stood at 75% (+5% yoy).

- Dubai private schools’ enrolments grew by 12%+ yoy to 365k students in the 2023-24 academic year, according to the Knowledge and Human Development Authority (KHDA). The emirate currently has 220 private schools, teaching students from more than 180 different nationalities, offering 17 curricula.

- The Sharjah Chamber of Commerce and Industry welcomed 4,981 new member firms till Q3 this year, taking the total number to 45,373 active members. The members total export and re-export values jumped to AED 17bn till Q3 2023.

- DP World and Russia’s nuclear agency Rosatom have set up a JV to develop the “Northern Sea Route”, an additional trade route for maritime container transportation through the Arctic (made possible given the melting of the Arctic ice sheets).

Media Review

Arab world needs a regional development bank as it continues to tally the cost of war: Dr. Nasser Saidi

https://www.thenationalnews.com/business/comment/2023/10/26/arab-world-needs-a-regional-development-bank-as-it-continues-to-tally-the-cost-of-war/

As Israel-Hamas war rages, global finance chiefs in Saudi sound gloomy note

https://www.reuters.com/world/middle-east/israel-hamas-war-rages-finance-chiefs-meeting-saudi-pessimistic-2023-10-24/

A Better Biden-Xi Summit?

https://www.project-syndicate.org/commentary/us-china-must-not-squander-possible-biden-xi-meeting-at-apec-by-stephen-s-roach-2023-10

Plunging foreign direct investment piles pressure on China’s economy

https://www.ft.com/content/56294843-7eff-4b83-9fa2-c46fb4ac1278

Powered by: