Middle East tourism recovery & impact of Israel-Gaza war. Saudi external trade. Oman fiscal surplus. UAE monetary stats.

Weekly Insights 27 Oct 2023: Will tourism remain a saving grace with lower GCC oil exports feeding into fiscal & monetary indicators?

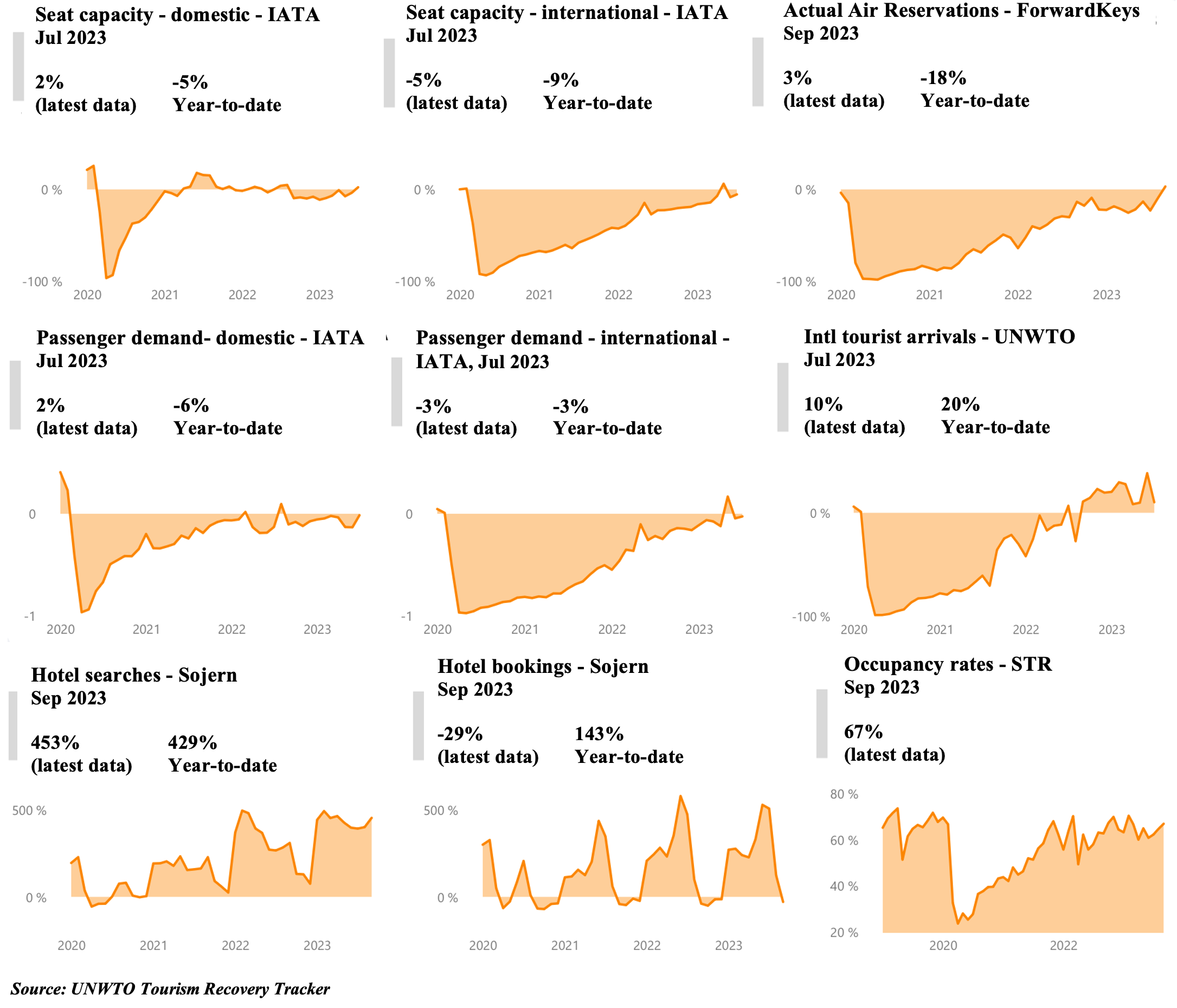

1. Middle East tourism recovery has been fast-paced, reaching pre-pandemic levels in some indicators. What will be the impact of the Israel-Gaza war?

- Tourism into the Middle East could see a decline from the Israel-Gaza conflict, given early signs of flight cancellations and travel warnings / restrictions.

- ForwardKeys data indicate that ticket purchases plunged to visit Egypt (-26% yoy), Jordan (-49%) & Lebanon (-74%) since early-Oct.

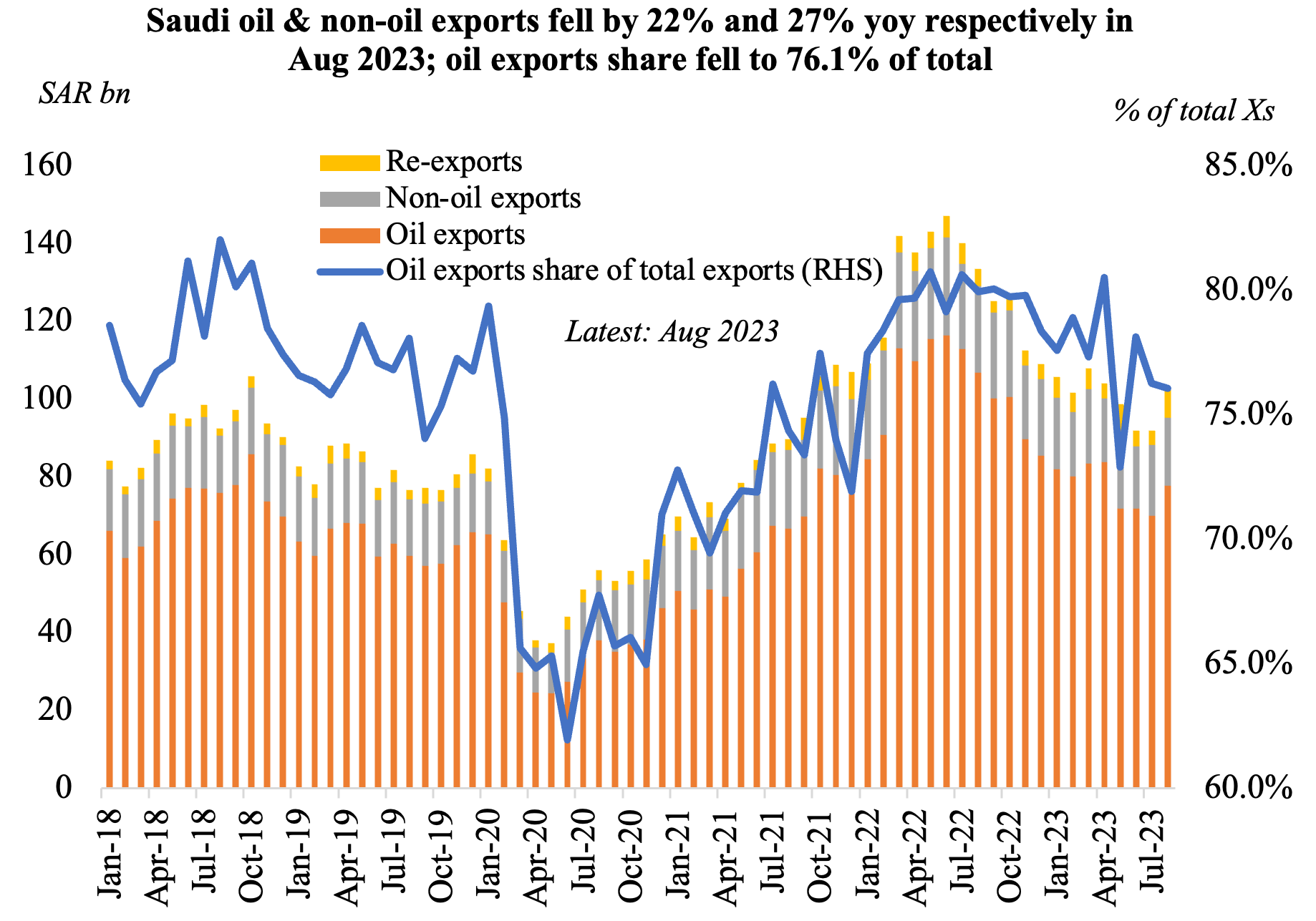

2. Saudi Arabia’s oil & non-oil exports fall in Aug, slashing overall exports

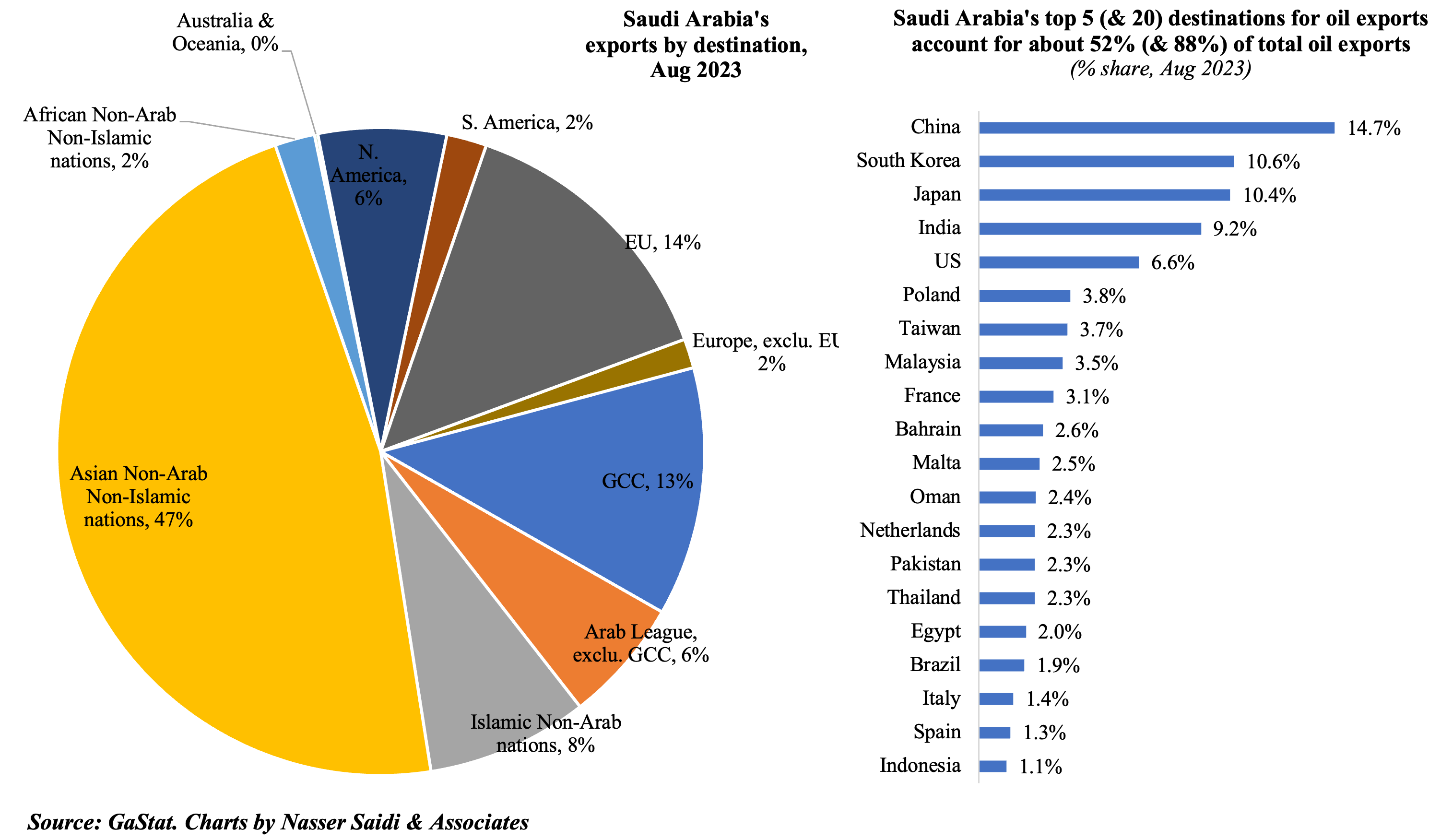

- Saudi Arabia’s overall exports fell by 23.4% yoy to SAR 102.4bn in Aug. The fall in exports stemmed from declines of both oil and non-oil exports, which plunged by 27.1% and 21.8% respectively. The share of oil exports to overall exports eased to 76.1%.

- Oil exports to the top 5 destinations (China, South Korea, Japan, India and the US) accounted for 51.5% of the total oil exports in Aug and for the top 20 it was 87.7%.

- Largest non-oil exports (including re-exports) were plastics and chemicals & allied products (together close to over 50% of non-oil exports).

- Imports increased sharply: 6% yoy and 12.1% mom to SAR 61.5bn, led by machinery & mechanical appliances and transport equipment & parts (23.5% and 16.8% respectively of total imports).

- China remained the top trade partner in Aug: accounting for 13.4% of total exports and 19.3% of total imports.

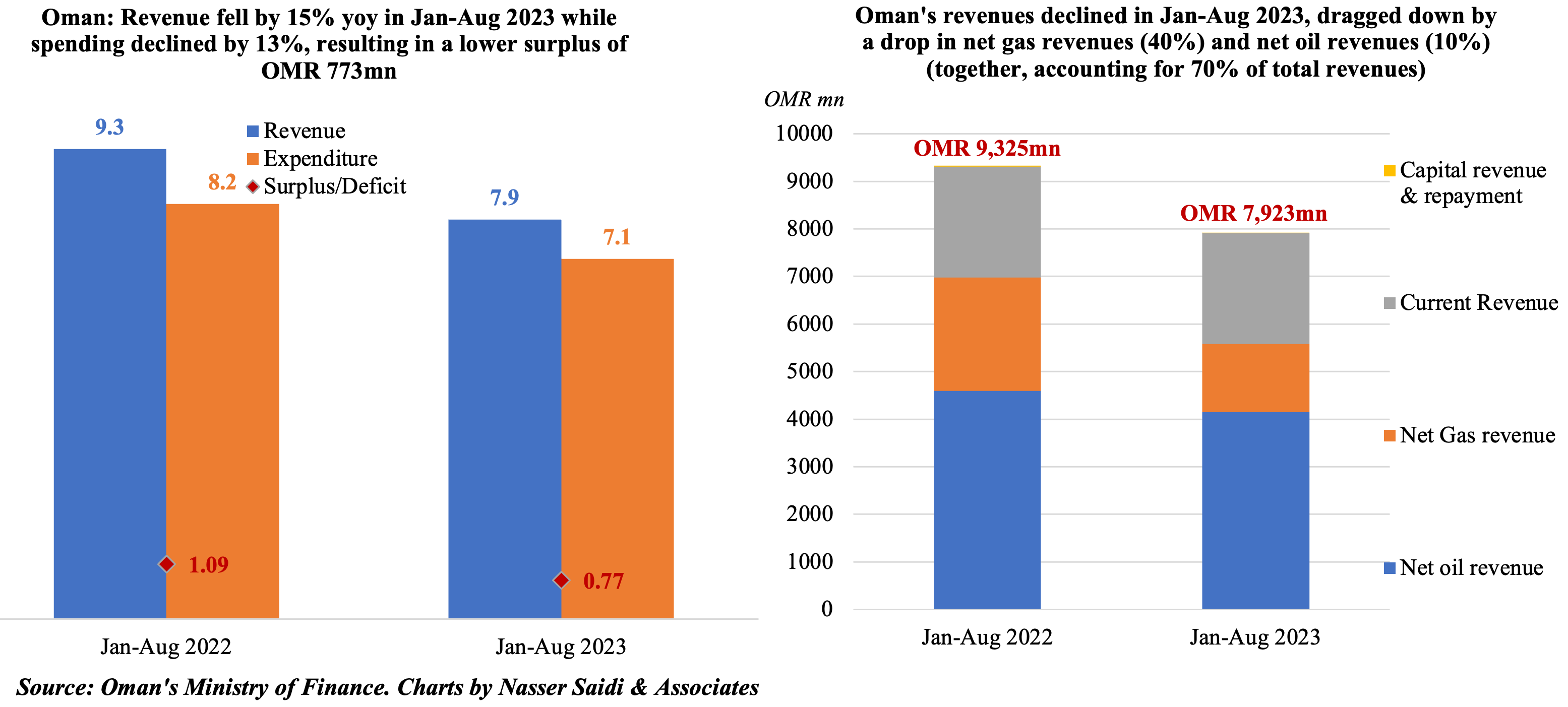

3. Oman’s fiscal surplus touches OMR 773mn in Jan-Aug 2023

- Oman posted a budget surplus of OMR 773mn at end-Aug 2023: total revenue decreased by 15% yoy to OMR 7.9bn while spending fell by 13%. This compares to a projected deficit of OMR 1.3bn as per the 2023 budget.

- While oil production increased by 0.9% yoy to 1.056mn barrels per day at end-Aug 2023, oil price fell by 10% to USD 82, leading to a 10% drop in net oil revenue to OMR 4.2bn as of Aug 2023.

- Net gas revenues tumbled by 40% to OMR 1.43bn (largely due to “the deduction of gas purchase and transport expenses from total revenue collected from Integrated Gas Company” according to the ministry). But together net oil and gas revenues accounted for close to 70% of total public revenue, making it more vulnerable to volatility in the oil & gas markets.

- Spending was lower in the period ending Aug 2023, given a 13% yoy decline in both current expenditures while oil and transport sector subsidies amounted to OMR 244mn and OMR 206mn respectively. At end-Jun, development expenditure touched OMR 572mn, close to two-third of total development spending allocated for 2023. A further OMR 266mn was transferred to future debt obligations budget-item.

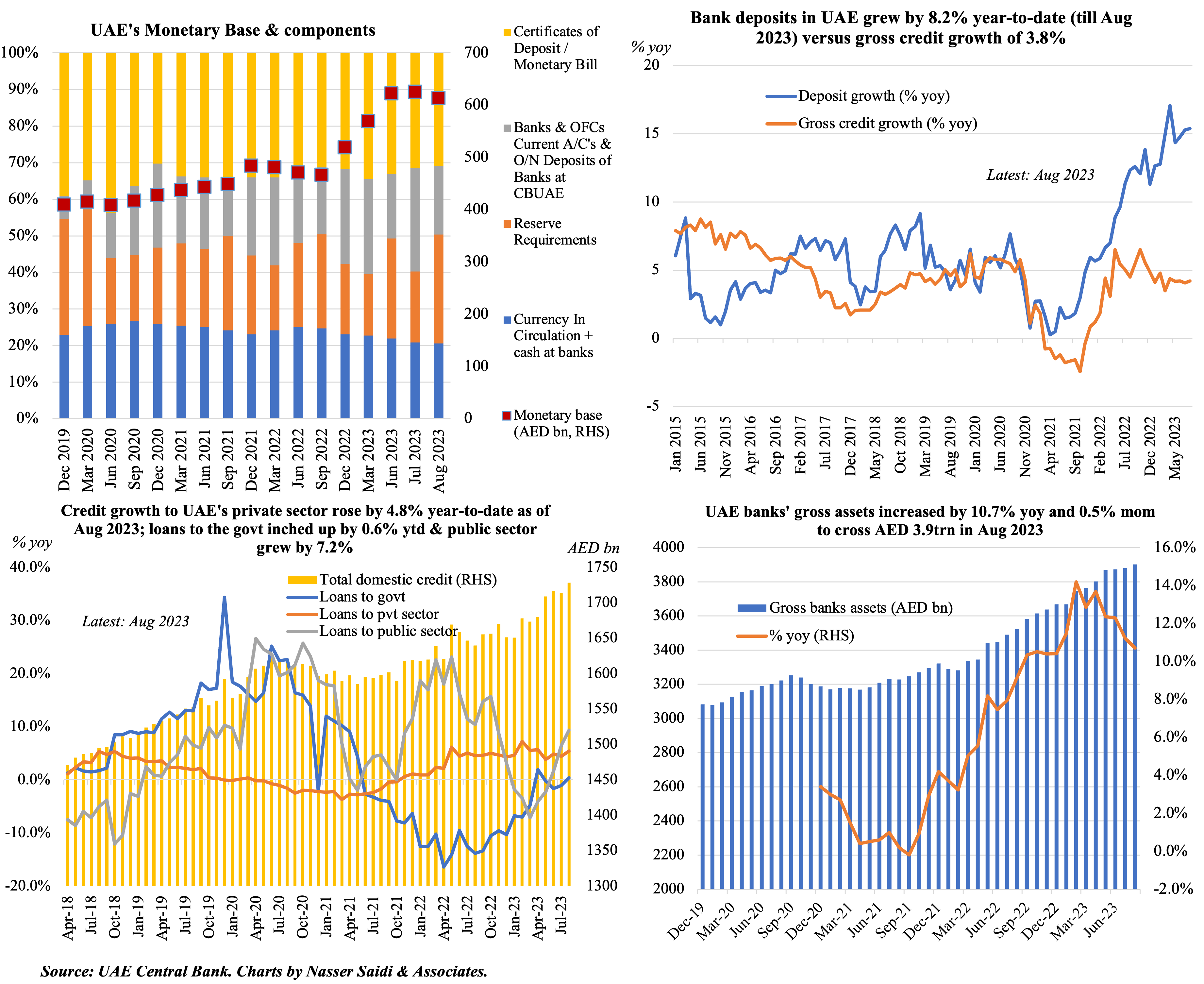

4. UAE’s deposit growth accelerated (8.2% ytd as of Aug) versus gross credit growth (3.8%); GRE deposits fell by 2.2% ytd; credit to public sector grew 7.2% ytd vs business & industrial credit (3.8%); monetary base inched lower (-1.9% mom)

Powered by: