Markets

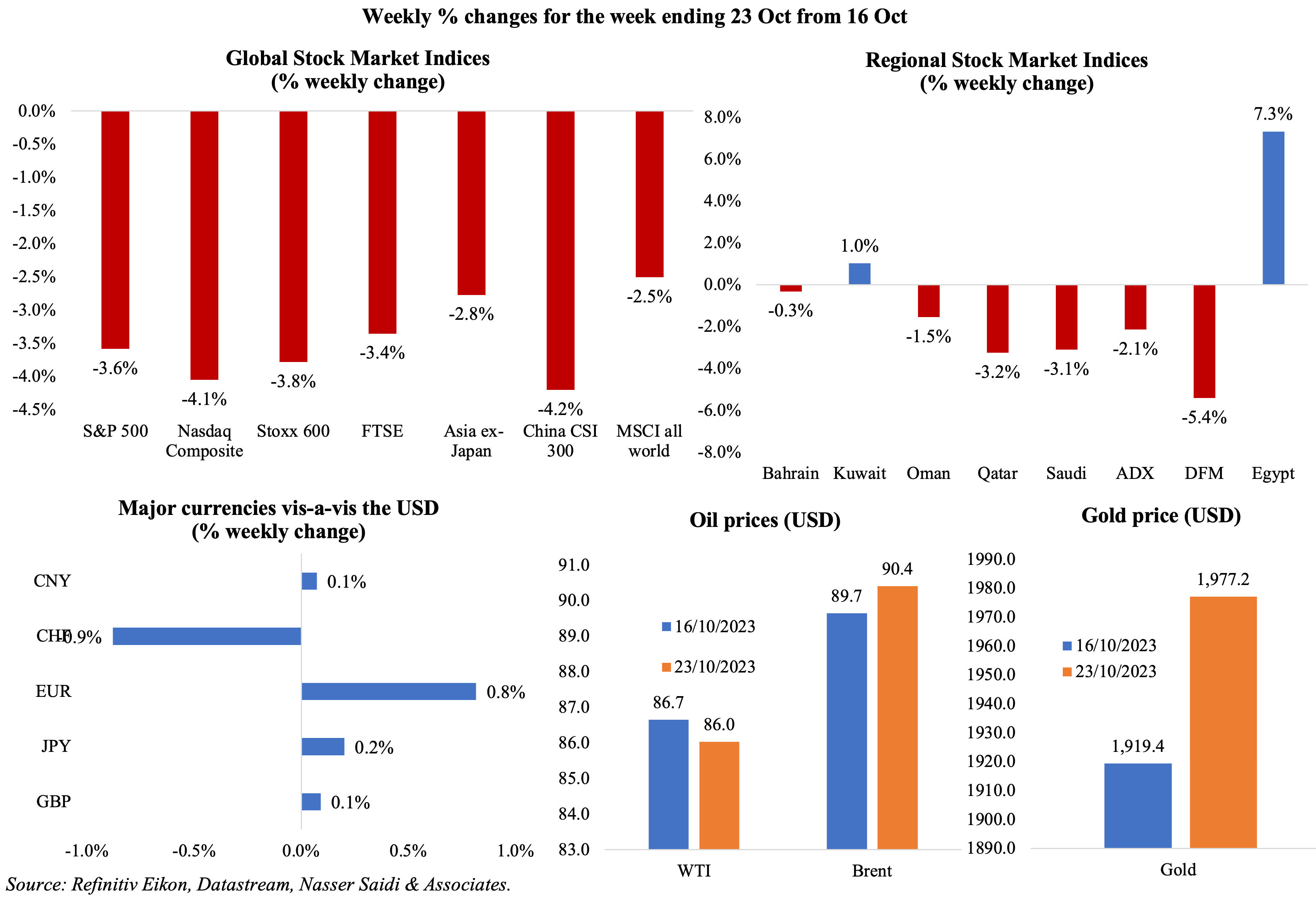

Equity markets weekly loss can be traced back to multiple factors including concerns about broadening of the conflict in the Middle East, potential higher inflation, additional rate hikes and the mixed earnings picture. The Cboe Volatility Index VIX closed on Friday at the highest level since March 24 (but is not as high as when Ukraine was invaded last year), but closed lower on Monday. The benchmark 10Y US Treasury yields crossed 5% for the first time since Jul 2007 before tumbling. MSCI Asia ex-Japan and MSCI global emerging market indexes touched their lowest level since Nov 2022. Regional markets were mostly down with DFM the worst affected (down by 5.4% compared to a week ago) while Egypt continues to soar as local investors rush to protect savings from high inflation and potential devaluation. The dollar touched the symbolic 150-mark versus the JPY, but later recovered (partly due to a softer dollar). Oil prices saw a drop yesterday on diplomatic efforts in Gaza; gold price advanced, closing near the USD 2,000-mark.

Global Developments

US/Americas:

- Fed Beige Book shows outlook for the economy as “stable or having slightly weaker growth”, alongside labour market tightness and prices rising at a modest pace.

- US industrial production inched up by 0.3% mom in Sep, after a flat Aug, as manufacturing rebounded (0.4% from Aug’s 0.1% drop) and mining grew by 0.4%. Capacity utilisation rose to 79.7% (Aug: 79.5%), a rate equal to its 1972–2022 average.

- US government posted a budget deficit of USD 1.695trn in the fiscal year 2023 (ending Sep), widening by 23% from the year before. Revenues fell by 9% yoy to USD 4.439trn while spending fell by 2% to USD 6.135trn. Interest costs on federal debt rose sharply, up 23% to a record-high USD 879bn and net interest payments grew 39% to another record USD 659bn.

- Retail sales in the US increased by 0.7% mom in Sep (Aug: 0.8%), thanks to purchases of motor vehicles (1% mom) and sales at food and drinking places (0.9%) while online sales jumped 1.1%. Excluding autos, sales were up by 0.6% (Aug: 0.9%).

- NY Empire State manufacturing index plunged to -4.6 in Oct (Sep: 1.9) as new orders fell slightly (-4.2 from 5.1) and shipments were down (1.4 from 12.4). Philadelphia Fed manufacturing survey improved to -9 in Oct (Sep: -13.5), thanks to improvements in new orders (4.4 from Sep’s -10.2), shipments (10.8 from -3.2) and employment (4 from -5.7).

- Building permits in the US fell by 4.4% mom to 1.475mn in Sep, with permits for single-family homes rose (1.8% to 965k) while multi-family housing permits dropped (-14% to 459k, lowest since Oct 2020). Housing starts grew by 7% mom to 1.358mn in Sep, supported by the jump in single-family housing starts (3.2% to 963k units).

- Existing home sales fell by 2% mom to 3.96mn in Sep, the lowest level since Oct 2010. The median existing house price rose by 2.8%yoy to USD 394,300, the highest ever for any Sep. The average rate on the 30-year fixed mortgage jumping to a nearly 23-year high (of 7.7% two weeks ago) will also negative affect home resales in the coming months.

- Initial jobless claims fell by 13k to 198k in the week ended Oct 13th, a 9-month low, and the 4-week average slipped by 1k to 205.75k. Continuing jobless claims increased by 29k to 1.734mn in the week ended Oct 6th.

Europe:

- The ZEW Economic Sentiment Index in Germany turned less pessimistic to -1.1 in Oct (Sep: -11.4), alongside a fall in current situation assessment (to -79.9 from -79.4). Economic Sentiment Index for the eurozone moved up to a positive range (+2.3, from Sep’s -8.9 reading) while the current situation reading fell 9.8 points to -52.4 points.

- Wholesale price index in Germany fell for the 6th month in a row in Sep, declining by 4.1% yoy (Aug: -2.7%): this was the largest decline since May 2020, partly due to the base effect. Separately, producer price index fell by 14.7% yoy and 0.2% mom in Sep (Aug: -12.6% yoy and 0.3% mom). This was the biggest yoy decline since 1949, again coming off a record high in Sep 2022, which resulted from the war in Ukraine and high energy prices.

- Inflation in the UK held steady at 6.7% yoy in Sep and core inflation eased to 6.1% (Aug: 6.2%). Food prices declined month-on-month, while the all-services CPI rose by 6.9% yoy (Aug: 6.8%). Producer price index for output fell by 0.1% yoy in Sep (Aug: -0.5%), falling for the 3rd month in a row. Retail price index eased to 8.9% yoy in Sep (Aug: 9.1%).

- UK average earnings including (excluding) bonus slowed marginally in the 3 months to Aug, rising by 8.1% (7.8%) compared to the previous month’s reading of 8.5% (7.9%) gain. Still close to record highs, higher pay has been supporting against the impact of higher rates.

- Retail sales in the UK fell by 0.9% mom in Sep (Aug: 0.4% mom), as sales at non-food stores fell by 1.9%. Sales fell by 1% yoy (Aug: -1.3%), the smallest decline since Apr 2022.

- GfK consumer confidence index in the UK plunged to -30 in Oct (Sep: -21), with the 9-point drop the largest since a survey done at the beginning of the pandemic in 2020 (and before that in Dec 1994).

Asia Pacific:

- China’s GDP grew by 1.3% qoq and 4.9% yoy in Q3 (Q2: 0.5% qoq and 6.3% yoy), implying that the stimulus is resulting in some recovery in economic activity.

- The People’s Bank of China left rates unchanged: one- and five-year loan prime rates stand at 3.45% and 4.2% respectively. This year, the 1- and 5-year LPRs were cut by 20 and 10bps respectively. Separately, the PBOC injected a net CNY 733 bn of cash with the reverse repurchase contracts on Friday; this follows the biggest medium-term liquidity injection since Dec 2020 of a net CNY 289bn via a 1-year policy loan.

- Industrial production in China grew by 4.5% yoy in Sep (Aug: 4.5%). Growth in retail sales accelerated by 5.5%, faster than Aug’s 4.6% gain. Fixed asset investment increased by 3.1% in Jan-Sep, slightly lower than the 3.2% growth registered in Jan-Aug.

- Foreign direct investment to China fell by 8.4% yoy in Jan-Sep (Jan-Aug: -5.1%). FDI in manufacturing rose by 2.4% and 37,814 new foreign-invested firms were set up.

- Inflation in Japan eased to 3% in Sep (Aug: 3.2%) while excluding food and energy, prices eased to 4.2% (Aug: 4.3%). Core inflation (i.e., excluding fresh food) rose by 2.8%, slower than Aug’s 3.1% uptick, and falling below the 3% mark for the first time since Aug 2022.

- Japan’s exports rebounded by 4.3% yoy in Sep, rising for the first time in 3 months, supported by growth in shipments of autos and auto parts. Imports plunged by 16.3%, enabling trade balance to move to a surplus JPY 62.4bn (from Aug’s JPY 937.8bn deficit). Exports to China fell for the 10th month in a row (-6.2% yoy, on lower shipments of semiconductors) while exports to the US rose by 13% (led by hybrid vehicles).

- Industrial production in Japan dropped by 0.7% mom (Jul: flat), with production lower for motor vehicles (-3.9% from Jul’s 0.6%) and transport equipment (-1.8% from 7%) among others. IP fell by 4.4% yoy in Aug (Jul: -2.3%), the most since Apr 2020.

- The Bank of Korea left rates unchanged at 3.5% for the sixth consecutive meeting, though a warning was sounded on risks to inflation from higher oil prices. Inflation is forecast to average 3.5% this year.

- Wholesale price index in India fell by 0.26% yoy in Sep (Aug: -0.52%), but stand at a 6-month high, as price decline moderated for fuel and power (-3.35% from Aug’s -6.03%) and manufactured products (-1.34% from -2.37%).

Bottom line: As the Israel-Gaza war continues into a third week, there is much uncertainty as to how it will evolve and how it will be resolved. With investor sentiment already negative, oil price developments will be a key indicator to watch. With this backdrop of uncertainty, Powell’s speech last week pegged inflation as “still too high” though he was non-committal as to the direction of policy. US GDP estimates for Q3 (out this week) should provide an insight on whether rising rates have curbed growth. This week sees the ECB meet on policy – expect a pause.

Regional Developments

- The Cairo Peace Summit condemned the Israel-Gaza conflict but fell short of reaching an agreement calling for an end to the violence. While Arab leaders call for an end to the attacks, Western nations called for humanitarian relief efforts; senior US and Israeli officials were absent at the summit. Since then, there have been signs of a possible escalation, with statements and warnings coming from various parties, amid fears of escalation and spillover to other countries and parties.The GCC had pledged USD 100mn in emergency aid for the Gaza strip early last week.

- Bahrain attracted USD 295mn in direct investments into the ICT sector during Jan-Sep 2023, disclosed a senior official at the EDB during a conference. Having gone into 10 local and international projects, the investments are expected to create over 1,600 jobs in 3 years.

- S&P downgraded Egypt’s long-term sovereign rating by one notch to “B-” while keeping outlook at “stable”, citing funding pressures and delays to the implementation of monetary and structural reforms, including privatisation.

- Egypt sold yuan-denominated “panda bonds” valued at CNY 3.5bn (USD 479mn) last week. The sale of panda bonds benefits from the low interest rate of 3.5% annually for 3 years and in being more competitive than its USD equivalents.

- Egypt’s Suez Canal Economic Zone and the China Energy Engineering Corporation signed a USD 6.75bn deal to build a green ammonia and green hydrogen project in the former’s Sokhna industrial zone. Additionally, Hong Kong’s United Energy Group signed an MoU for a potassium chloride production complex in the zone with an expected investment of up to USD 8bn. Egypt is offering tax rebates of 33-55% for green hydrogen production.

- Effective 15th Jan, 2024, Egypt’s Suez Canal Authority will raise transit fees for ships passing through by 5-15%.

- Kuwait’s inflation moderated slightly to 3.73% yoy in Sep (Aug: 3.75%). While food inflation held steady at 5.7%, other categories showed a slight easing such as housing & utilities (3.1% vs 3.2%), transport (2.7% vs 3.1%) and recreation (3.1% vs 3.3%).

- Nominal GDP in Oman fell by 2.4% yoy to OMR 20.4bn in Q2 2023, largely due to the decline in oil prices (to USD 81.4 from USD 90.4 a year ago). Non-oil sector’s value added inched up by 0.3% yoy to OMR 13.8bn, with services sector leading the uptick (7.8%).

- Oman’s banking sector recorded a 5.1% yoy increase in total deposits to OMR 22.4bn as of end-Aug, with private sector accounting for 68.1% of total deposits. Credit disbursed grew by 5.4%, with credit to the private sector up by 5.5% to OMR 20.3bn.

- Saudi Arabia and Oman signed an agreement to improve nuclear and radiation safety and protection, and to use the technologies for peaceful purposes.

- Inflation in Qatar slipped to 1.8% yoy in Sep– the lowest since Apr 2021. While food prices rose to a 1-year high of 2.2%, education costs jumped (6.7% from Aug’s 5.7%). Restaurants & hotels costs declined (-4.7%) as did household & utilities (-0.7% from 1%) amid easing of costs in communication (15.6% from 15.9%) and recreation (3.2% from 7.9%) among others.

- Qatar agreed to another 27-year gas deal, agreeing to supply Shell in the Netherlands (following a similar deal with France’s TotalEnergies). QatarEnergy and Shell agreed to two sale and purchase agreements for 3.5mn tonnes of LNG a year, to start delivery from 2026.

- GCC project awards surged 86% yoy to USD 41.8bn in Q3 2023. The largest markets by project value were Saudi Arabia (USD 21.2bn from USD 9.3bn a year ago) and UAE (101.7% yoy to USD 15.5bn), and together with Qatar account for 93% of overall projects.

- The MENA banking sector posted a 30% yoy jump in net profits in H1 2023, according to EY, and net assets rose by 12.2%.

- India and the GCC are likely to initiate free trade negotiations in early-Nov, according to India’s commerce ministry officials, after a chief negotiator was appointed on the GCC side.

- Malaysia’s PM proposed a free trade agreement between ASEAN and the GCC at a summit of the two blocs.

- A survey of 200 companies across 9 MENA nations show that businesses in the region “lag behind” their global counterparts in net zero targets, with only 12% committed to net-zero targets and only 6% having a “roadmap”. The WEF -Bain & Co report also noted “encouraging signs of progress” in a few entities, citing UAE’s Majid Al Futtaim, Adnoc and Etihad alongside Kuwait’s Agility and Saudi’s ACWA Power and Sabic among others. The report can be downloaded via the link: https://www.weforum.org/publications/closing-the-climate-action-gap-accelerating-decarbonization-and-the-energy-transition-in-mena

Saudi Arabia Focus

- Saudi Arabia’s Energy Minister, at the 3rd Belt and Road Initiative Summit, disclosed that the country plans to establish 60 logistics zones by 2030 while also emphasising that there are various areas of alignment between the BRI and Vision 2030.

- Data from JODI revealed that crude oil production in Saudi Arabia fell by 19.3% yoy to 8.9mn barrels per day in Aug (Jul: 9.01mn bpd) – this is the lowest output level since Jun 2021. Crude oil exports fell to 5.6mn bpd, the lowest since Apr 2021 and from Jul’s 6.01mn bpd.

- Saudi PIF plans to list its first dollar denominated USD 3.5bn Sukuk on the London Stock Exchange’s International Securities Market. The issuance was oversubscribed more than 7 times, with the order book crossing USD 25bn.

- Saudi Arabia and Singapore signed 7 MoUs to facilitate investment opportunities and strengthen economic ties. Bilateral trade between the two nations surged by about 50% yoy to SAR 45.2bn (USD 12.05bn) in 2022. Cooperation will be explored across sectors including infrastructure, transport & logistics, financial services, energy, digital economy and tourism. SAMA signed an agreement with the Monetary Authority of Singapore to share information on fintech and innovation.

- The office of the Philippines President disclosed that over USD 4.26bn worth investment deals had been signed between a Philippines business delegation and Saudi business leaders. This covers construction export and human resources services among others.

- Saudi real estate price index rose by 0.7% yoy in Q3, largely due to the increase in residential property values (+1.1%). Meanwhile, prices of buildings and villas declined annually by 0.9% and 3.8% respectively in Q3. Separately, the rental index increased by 22% yoy in Sep, with over 294k residential and commercial rental transactions registered.

- KadiPay became the 6th BNPL player to obtain a permit from SAMA, thereby increasing the number of licensed and authorized financing companies to 56. SAMA’s annual fintech report mentioned 230 such firms by 2025 as a milestone, with an influx of SAR 2.6bn in venture capital investments.

- ACWA Power signed seven cooperation agreements with various Chinese firms, during the third Belt and Road Forum held in Beijing, across multiple sectors, including solar energy, green hydrogen, and water desalination.

- Saudi Arabia’s FII conference is underway, with around 300 Chinese “decision makers” in attendance, according to the organisers. Only 15-20 out of 6,000 participants cancelled attendance on safety aspects due to the Israel-Gaza conflict.

UAE Focus![]()

- S&P revised the outlook for Ras Al Khaimah to “positive” on upcoming projects including the USD 3.9bn Wynn Al Marjan Island, while affirming the emirate’s A-/A-2 sovereign credit ratings.

- Speaking about the UAE’s commitment to clean energy investment, the Chairman of the Abu Dhabi Department of Economic Development revealed that UAE had invested more than USD 40bn (AED 147bn+) in clean and renewable energy sources over the past 15 years, and plan to invest an additional USD 160bn over the next three decades in the road to net zero.

- Kazakhstan plans to boost its trade exchange with the UAE to USD 1bn from USD 632mn last year, disclosed a senior government official.

- UAE launched an initiative to reskill and retool its workforce to adapt to AI challenges, with the Minister of State for AI also stating that “if someone is a year or two from retirement and has no interest in retooling, they have the option of retiring early”. Separately, UAE’s G42 partnered with OpenAI to push AI adoption in the UAE and other countries in the region.

- Mubadala Capital raised its stake in Brazilian ethanol producer Atvos, after acquiring a 6.85% stake from the holding company that controls Atvos. Mubadala already had a direct stake of 31.5% in the company.

- The UAE’s pension scheme allowed the nation to climb two places to be ranked 23rd among 47 nations tracked in the Mercer CFA Institute Global Pension Index for 2023.

Media Review

What is Israel’s endgame in Gaza invasion?

https://www.reuters.com/world/middle-east/israels-endgame-no-sign-post-war-plan-gaza-2023-10-18/

https://www.economist.com/middle-east-and-africa/2023/10/22/israels-window-of-legitimacy-in-gaza-is-shrinking

Ten years of China’s Belt and Road: what has USD 1trn achieved?

https://www.ft.com/content/83501dd5-fe6d-4169-9d83-28a8cf46e681

Harm From ‘De-Risking’ Strategies Would Reverberate Beyond China

https://www.imf.org/en/Blogs/Articles/2023/10/17/harm-from-de-risking-strategies-would-reverberate-beyond-china

Powered by: