Israel-Gaza conflict: markets & potential regional impact. Dubai GDP. CPI & WPI in Saudi Arabia. Inflation in Egypt & Qatar.

Weekly Insights 20 Oct 2023: Regional macro data yet to show any impact of the conflict in Gaza; markets do

1. Israel-Gaza Conflict & Potential Regional Impact

- Growth momentum has already slowed significantly this year; this conflict has the potential to further slow growth and raise already record-high public debt

- Any disruption in transport and logistics will have an impact on global supply chains, energy & food prices => increase in global inflation, slower growth

- Downward impact on tourism if conflict spreads (e.g., Egypt & Jordan)

- Investor confidence will be affected, resulting in capital outflows & lower FDI inflows

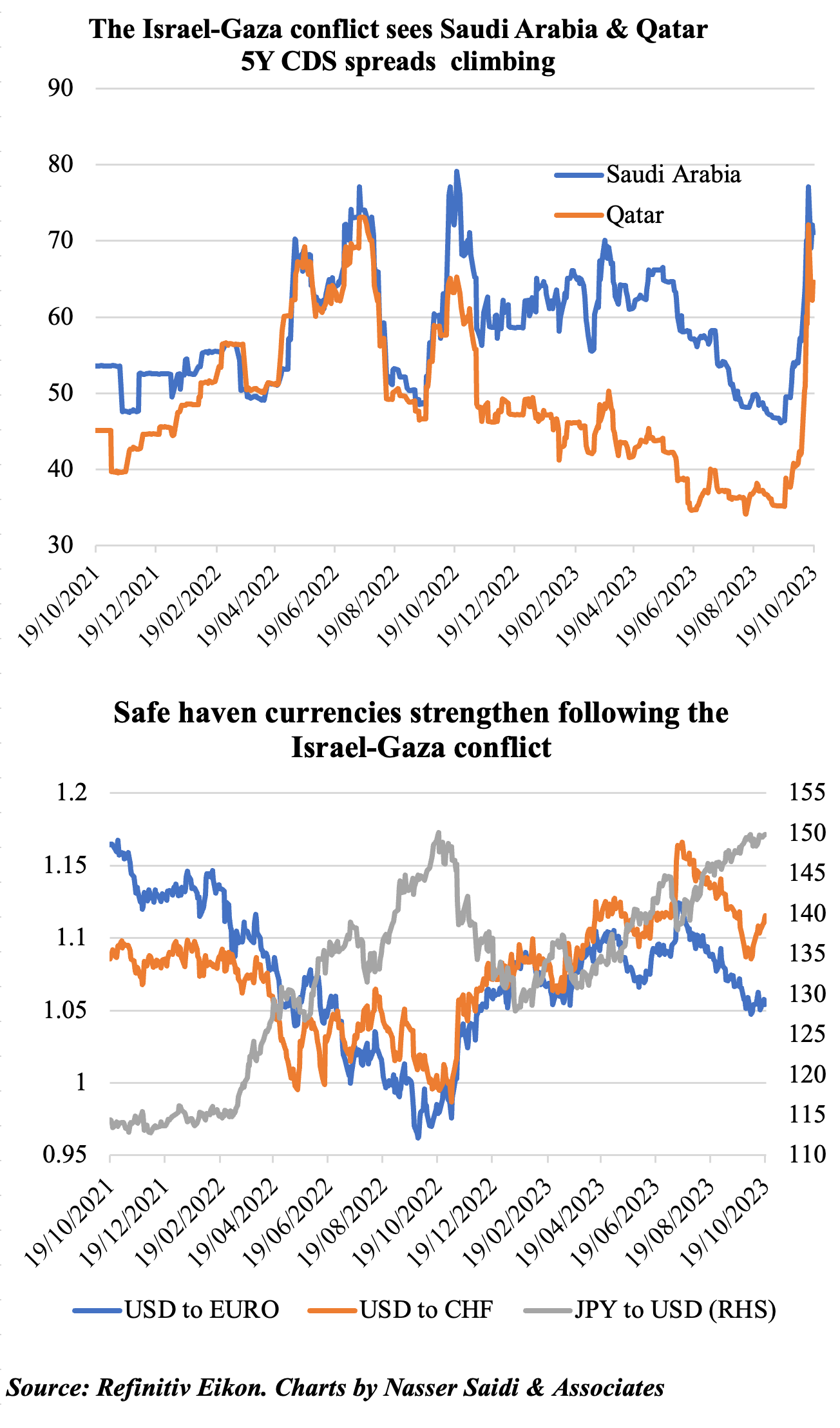

- Geopolitical tensions could see the dollar benefit given its safe-haven status: difficult for nations facing currency depreciation; supports nations pegged to the USD

- At the end of 2022, the MENA region hosted about 2.4mn refugees in addition to about 12.6mn internally displaced persons & more (UNHCR). Any further addition to this would put severe strain on the hosting nations’ budget & finances and socio-economic-political stability.

- Sectors that could be negatively affected: markets, tourism, hospitality, real estate

2. Israel-Gaza Conflict & Impact on Global Markets

- Global uncertainty will tick up. Much will depend on how long the conflict lasts, whether it will spillover and draw in other parties and whether it will disrupt transport and logistics including for energy.

- Heightened geo-political risk resulted in immediate market moves.

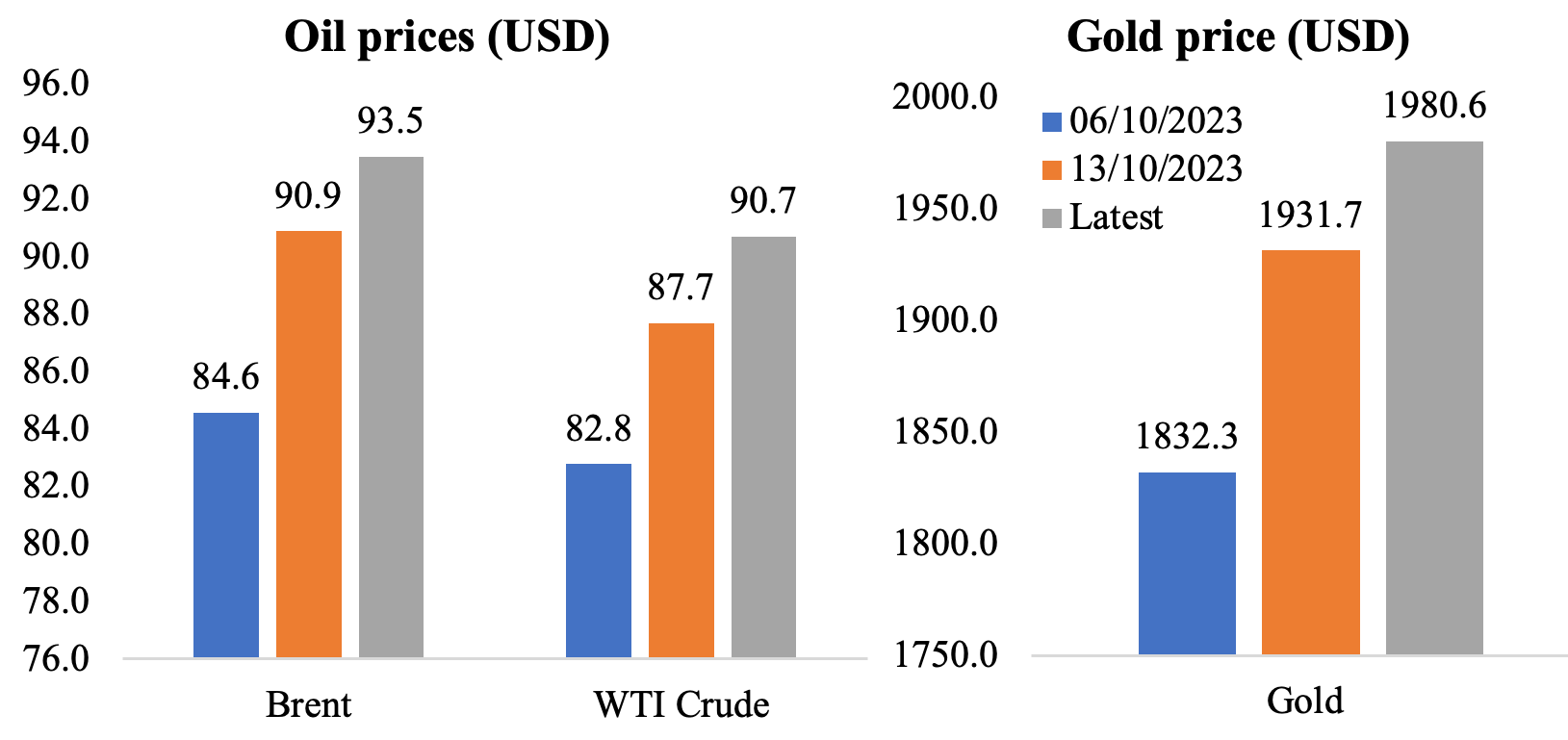

- Most direct change was seen in oil prices, with both Brent and WTI rising to above USD 90 (Brent touched USD 93 on Wednesday). A further escalation / broadening of the conflict would see upward pressure on oil. If conflict leads to disruption on any major oil transit chokepoint, it could impact supplies in an already tight market.

- Safe haven assets – gold and currencies like the Swiss franc and Japanese yen – have gained since early-Oct. USD strengthened, but this could change if inflation ticks up & US growth slows substantially.

- Bonds issued by Lebanon, Jordan and Egypt have been hit hard. Credit-default swaps on Saudi Arabia and Qatar climbed significantly.

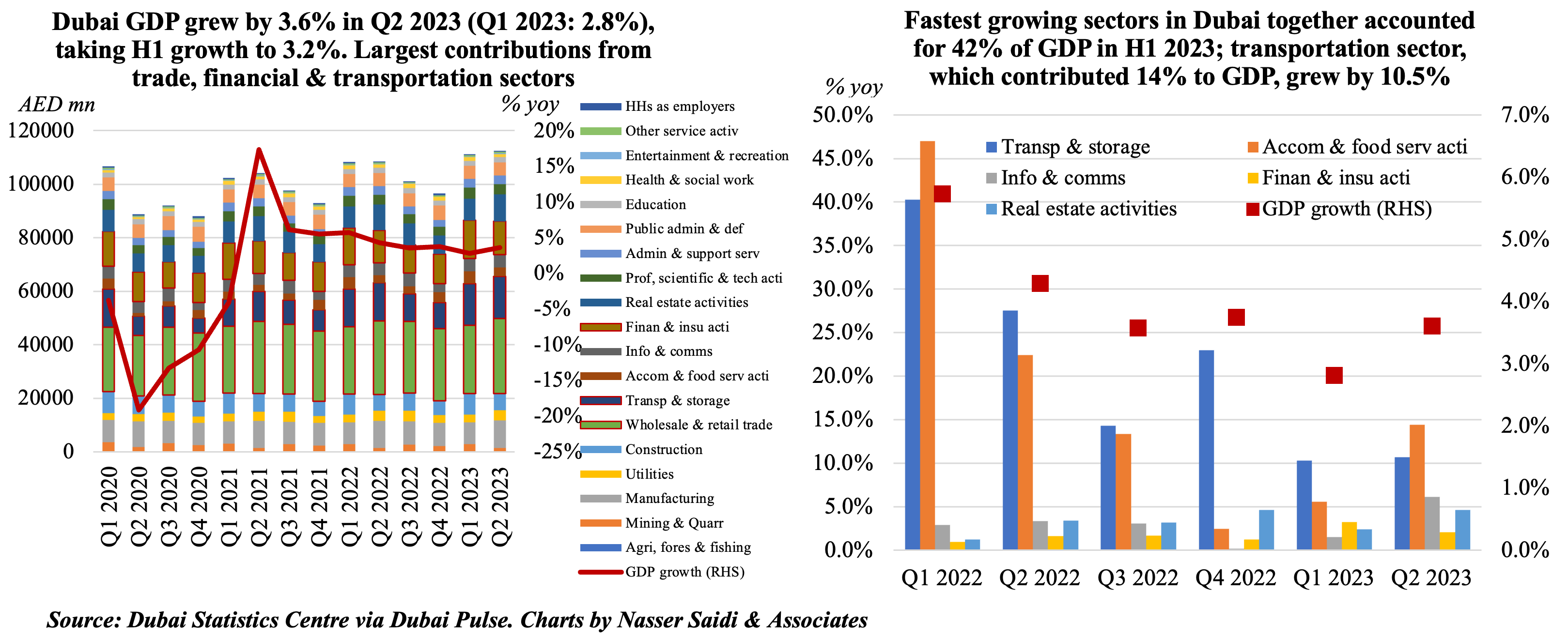

3. Dubai’s real GDP grew by 3.2% yoy in H1 2023, supported by a 3.6% yoy gain in Q2; services-related sectors major gainers

- Real GDP in Dubai grew by 3.6% yoy in Q2 following Q1’s 2.8% growth rate. Growth in the first half of this year is up by 3.2% yoy to AED 223.8bn, with the oil sector’s contribution at less than 2% of the total. The uptick is also evident from the rise in PMI readings: 1 point rise to 55.5 in H1 2023 from a year ago.

- The fastest growing sectors in Q2 were mostly services-related sectors: accommodation and food services (14.4%), transportation & storage (10.7%) followed by information & communication (6.1%), real estate activities (4.6%) and entertainment & recreation (2.6%). Hospitality-related indicators are supported by the uptick in tourism sector activity during H1 2023 while real estate sector activity has been booming thanks to the long-term residency reform alongside reforms to attract businesses and a high-skilled workforce.

- Sectors that contributes most to growth are wholesale & retail trade (24%), transportation & storage (14%), financial sector activity, real estate and manufacturing. Together these 5 sectors account for more than two-thirds of GDP. Trade growth slowed, in line with global trend.

- Will UAE be affected by spillovers from the conflict in Gaza? It is too early to see the impact – but, one can expect some slowdown in real estate sector activity in addition to tourism / hospitality (some concerts in the coming weeks are being cancelled; but major events on the calendar like COP28 are unlikely to be cancelled unless the situation deteriorates drastically).

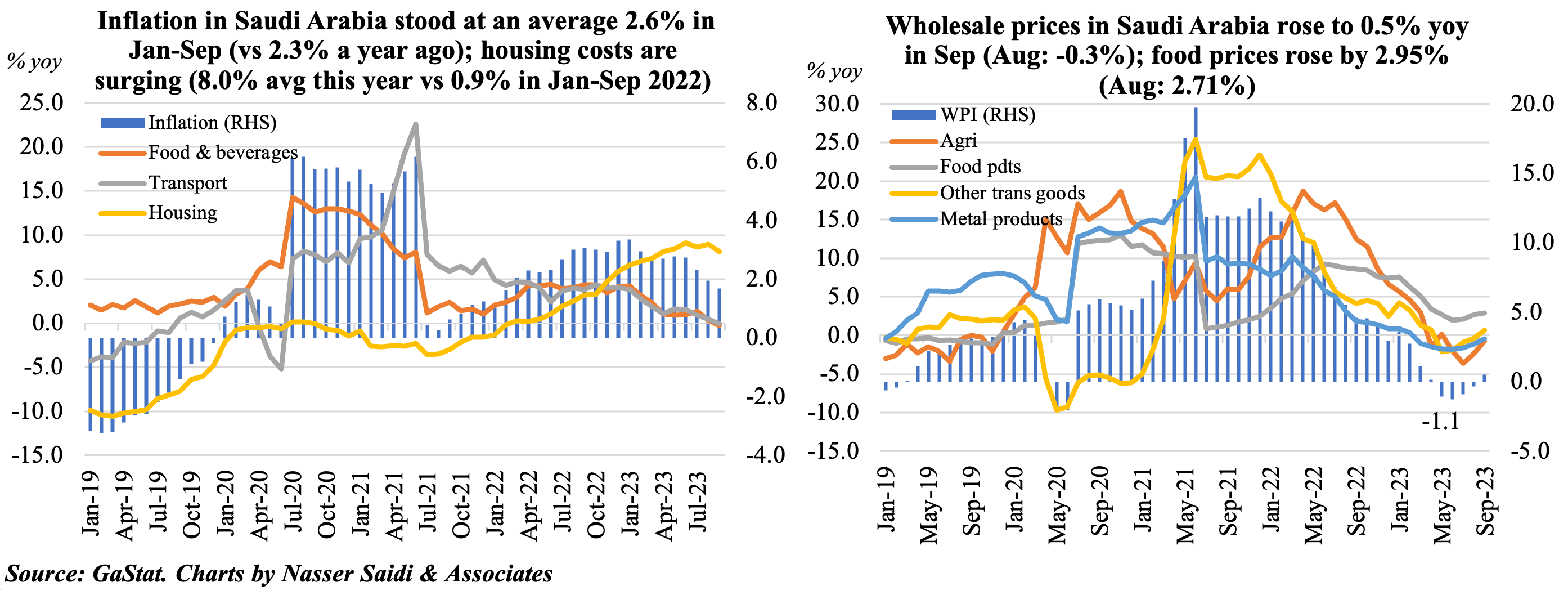

4. In Sep, inflation in Saudi Arabia eased to the lowest since Feb 2022 while wholesale prices rebounded

- Consumer price inflation in Saudi Arabia eased to 1.7% yoy in Sep (Aug: 2.0%), as housing costs slowed (8.1% from Aug’s 9% gain), alongside declines in both food and transport prices (-0.2% and -0.1% respectively).

- In the period Jan-Sep 2023, consumer inflation averaged 2.6%, compared to 2.3% in the same period a year ago. Housing & utilities costs have climbed by an average 8% this year (from 0.9%) and restaurants & hotels costs are up by 4.8% (from 4.5%) with easing food prices (1.6% versus 3.6%) and transport costs (1.6% from 4.1%).

- Wholesale prices in Saudi Arabia rebounded in Sep, rising by 0.5% (the first positive reading since Apr 2023) as readings rose across all main categories. WPI eased to 0.5% in the Jan-Sep 2023 period, from the 9.1% surge a year ago. Food prices were up to 2.95% in Sep (Aug: 2.71%) and other transportable goods moved to a 0.66% gain (from Aug’s -0.39%) while other categories declines’ softened: metal products (-0.4% from -1.1%); ores and minerals saw prices edge down to 0.58% from Aug’s 0.59% dip; agriculture eased to -0.72% (from -2.31% in Aug).

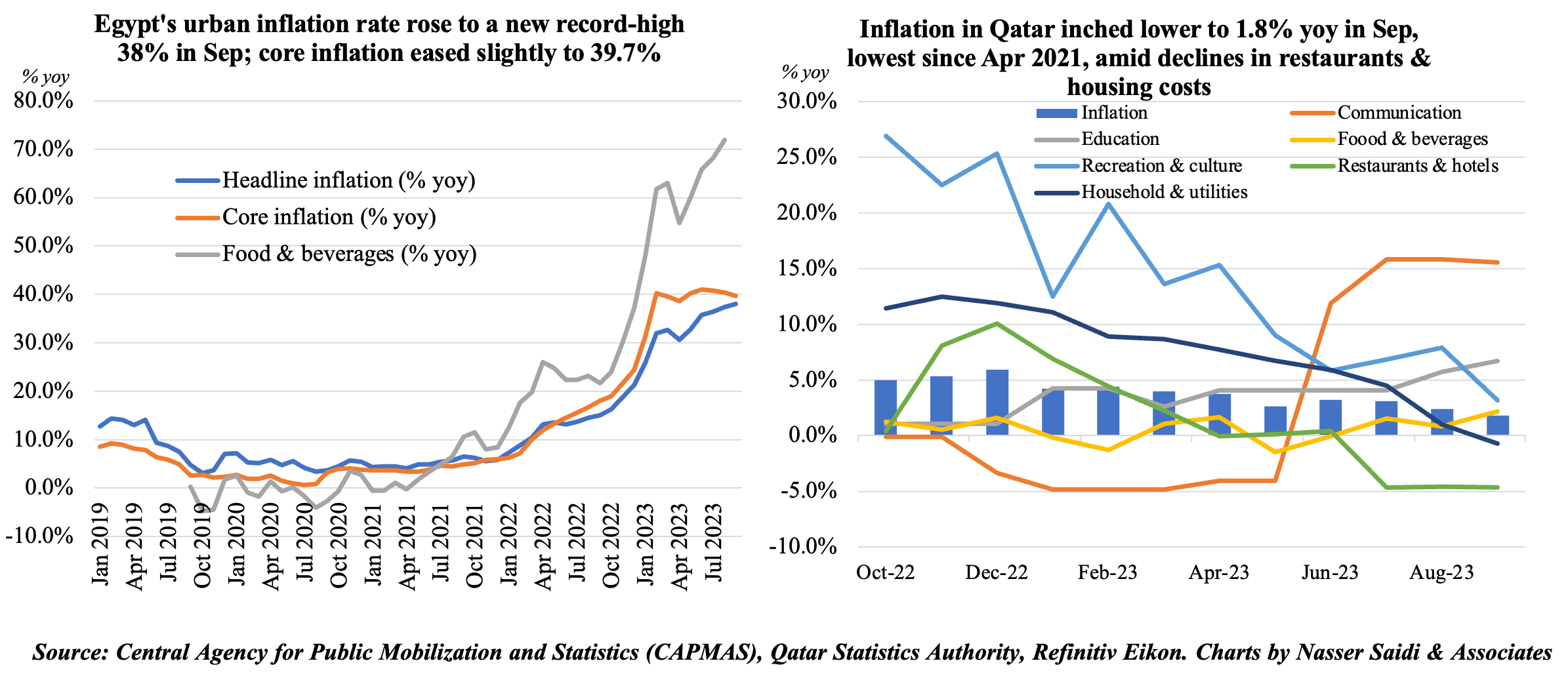

5. Inflation climbs to a new record-high in Egypt while in Qatar it eased to the lowest since Apr 2021

- Egypt’s inflation jumped to 38% in Sep (Aug: 37.42%), the 4th consecutive month of a new record high, as food inflation jumped by a whopping 76.3%. Non-food inflation slowed for the first time since Oct 2021 (though still at a high 20.6%) while core inflation eased slightly to 39.7% (Aug: 40%). Real interest rates remain negative.

- The price reduction on staple foods & exemption from customs duties announced this month might provide a slight respite: it will offer only a temporary relief and is unlikely to be a sustainable measure.

- The root causes of inflation remain unaddressed: a depreciating Egyptian Pound & its pass-through to consumers + a severe foreign currency crisis. The country’s external debt has been rising: about USD 14.6bn is due in debt service payment come H1 2024.

- Markets expect further devaluation: but with elections scheduled for Dec this year, any devaluation reform measure, will likely happen only after the elections.

- In Qatar, inflation slipped to 1.8% yoy in Sep – the lowest since Apr 2021. While food prices rose to a 1-year high of 2.2% and education costs jumped (6.7% from Aug’s 5.7% gain). However, restaurants & hotels costs declined (-4.7%) as did household & utilities (-0.7% from 1%) amid easing of costs in communication (15.6% from 15.9%) and recreation (3.2% from 7.9%) among others.

Powered by: