Markets

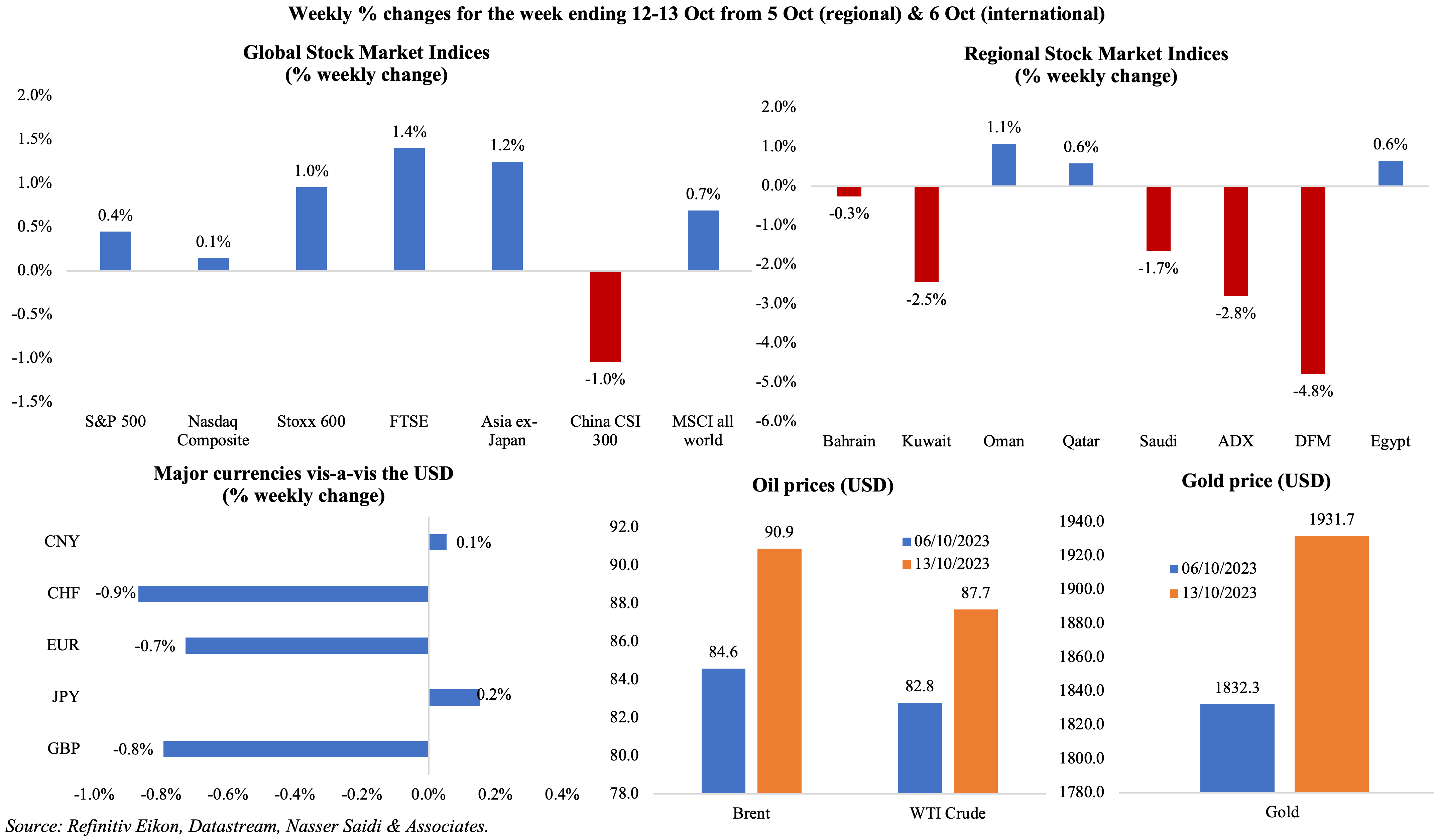

Major equity markets closed higher last week; disappointing data from China (e.g., weak exports, deflationary pressures) dragged down its equity market. Regional markets were dragged down given the escalation in the Israel-Gaza conflict and potential contagion effects: DFM and ADX closed with weekly losses of 4.8% and 2.8% respectively. As the conflict continues, gold and the USD have benefitted from its haven status; the dollar posted its biggest one-day increase since Mar 15th on Thursday. Oil prices were up by almost 6% last Friday, with the Brent closing just above USD 90 a barrel, as the conflict stoked fears of disruptions to oil exports; gold price remained above the USD 1900-mark.

Global Developments

US/Americas:

- US inflation rose to 3.7% yoy in Sep, the same pace as in Aug; in month-on-month terms, prices increased for fuel oil (8.5%), gasoline (2.1%) and energy (1.5%) alongside upticks in services-related prices (such as hospital services, up by 1.2%). Core inflation slipped to 4.1% yoy (Aug: 4.3%).

- Producer price in the US inched up to 2.2% in Sep (Aug: 2%), driven up by gasoline (+5.4%) and food prices. Excluding food and energy prices were up by 2.7% (Aug: 2.5%).

- NFIB business optimism index in the US slipped moderately to 90.8 in Sep (Aug: 91.3), staying below its 49-year average of 98 points for the 21st month in a row. The share of owners expecting better business conditions over the next 6 months fell 6 points to a net -43%.

- Michigan consumer sentiment index dropped to 63 in Oct (Sep: 68.1), with the gauges for current economic conditions and future expectations both falling to 5-month lows of 63 and 60.7 respectively. The 1- and 5-year consumer inflation expectation rose to 3.8% and 3% respectively in Oct (Sep: 3.2% and 2.8%).

- Initial jobless claims held steady at 209k in the week ended Oct 6th, staying below 210k mark for the 4th straight week, and the 4-week average slipped by 2.5k to 206.25k. Continuing jobless claims increased by 30k to 1.702mn in the week ended Sep 29th.

Europe:

- Industrial production in the euro area fell by 5.1% yoy in Aug (Jul: -2.2%), with durable consumer goods declining by 7.2%, capital goods by 7% and energy by 6.3% among others.

- Sentix investor confidence in the eurozone worsened in Oct, falling to -21.9 (Sep: -21.5); the situation assessment stood at -27 points, the lowest since Nov 2022.

- German industrial production fell by 2% yoy and 0.2% mom in Aug (Jul: -1.7% yoy and -0.6% mom). This was the 5th drop this year, with declines recorded across energy production (-6.6% mom), construction (-2.4%) and manufacturing of machinery (-2.3%) among others.

- UK GDP inched up by 0.2% mom in Aug, with services sector the main driver of growth (0.4%). Industrial and manufacturing production fell by 0.7% mom and 0.8% respectively while construction dropped by 0.4%.

- UK like-for-like retail sales grew by 2.8% yoy in Sep (Aug: 4.3%), as activity was affected by high cost of living.

Asia Pacific:

- Inflation in China was flat in Sep (Aug: 0.1% yoy), as food prices fell by 3.2% (Aug: -1.7%) while non-food inflation inched up (to 0.7% from Aug’s 0.5%). Core inflation remained unchanged at 0.8% in Sep.

- Producer price index in China fell by 2.5% yoy in Sep (Aug: -3.0%), the 12th month of deflationary reading. In mom terms, prices edged up 0.4% in Sep, the 2nd month of increase.

- Exports from China fell by 6.2% yoy in Sep (Aug: -8.8%), with exports to ASEAN nations contracting. Imports into China fell by 6.3% (Aug: -7.3%), indicating a slight recovery in domestic demand; South Korean exports to China fell at their slowest pace in 11 months in Sep. Trade surplus hence widened to USD 77.71bn in Sep (Aug: 68.36bn).

- Money supply in China grew by 10.3% yoy in Sep (Aug: 10.6%) and outstanding yuan loans grew by 10.9% (Aug: 11.1%). New loans surged to CNY 2.31trn in Sep (Aug: CNY 1.36bn).

- Current account surplus in Japan narrowed slightly to JPY 2.279trn in Aug from Jul’s JPY 2.771trn reading. It tripled from a year ago.

- Machinery orders in Japan plunged by 7.7% yoy in Aug (Jul: -13%). Core machinery orders fell by 0.5% mom (Jul: -1.1%), as the non-manufacturing sector posted a 3.8% drop.

- Japan’s producer price index inched up to 2% in Sep (Aug: 3.3%) – this was the lowest reading since Mar 2021.

- Inflation in India eased to 5.02% yoy in Sep (Aug: 6.83%), falling within the central bank’s target range, as food inflation slowed (6.56% from Aug’s 9.94%). In month-on-month terms, prices fell by 1.13%, the sharpest decline since Dec 2013.

- India’s trade deficit narrowed to USD 19.37bn in Sep (Aug: USD 24.2bn) as imports fell sharply (-15% yoy to USD 58.8bn) alongside a 2.6% drop in exports (to USD 34.5bn).

- Industrial output in India grew to a 14-month high of 10.3% yoy in Aug (Jul: 5.7%), supported by manufacturing output which climbed by 9.3% (Jul: 5%). Cumulative output was up by 6.1% during the period Apr-Aug 2023.

- Advance estimates showed that GDP in Singapore grew by 1% qoq and 0.7% yoy in Q3 (Q2: 0.1% qoq & 0.5% yoy). According to the Ministry of Trade and Industry, manufacturing contracted 5% yoy while services and construction sectors grew by 1.9% and 6% respectively. Separately, the MAS kept its monetary policy unchanged for the 2nd time this year.

Bottom line: According to the IMF, global economic growth momentum slows (3% & 2.9% in 2023 & 2024 respectively from 6.2% in 2022) amid more-persistent-than-expected inflation. Even as the Russia-Ukraine war looks on track to become a new Verdun, a long war of attrition draining fiscal and military resources, fears of another long-drawn out conflict in the Middle East looms large. Regional tensions have the potential to render the IMF’s latest forecasts moot, worsen investor confidence and potentially slow growth, raise inflation (the IMF anticipates that a 10% rise in oil prices would raise global inflation by 0.4 percentage points) and widen already record-high public debt levels.

Regional Developments

- The IMF forecasts MENA growth to slow in 2023 (to 2.0% from 5.6% in 2022), due to lower oil production, monetary policy tightening and country-specific factors (e.g., Egypt, Lebanon). Inflation in MENA is projected to moderate in 2024 (15% from an estimated 17.5% in 2023), while in the GCC inflation rates have almost returned to pre-pandemic averages.

- Inflation in Egypt surged to a new record 38% yoy in Sep (Aug: 37.4%), with prices of food and beverages up by 73.6%. Core inflation slipped to 39.7% from the previous month’s 40.3% uptick. Separately, the government reached an agreement with private producers and retailers to reduce the price of staple food items (including fava beans, lentils, and dairy products) by 15-25% and also exempt them from customs duties for 6 months.

- Egypt’s trade deficit narrowed to USD 2.93bn in Jul, down by 23.2% yoy. Exports fell by 10.9% yoy to USD 3.1bn while imports plunged by 17.3% to USD 6.03bn.

- Tourism revenues in Egypt surged 26.8% yoy to USD 13.6bn in the fiscal year 2022-23, surpassing pre-Covid levels, thanks to a 35.6% jump in number of tourists to 13.9mn.

- Tax revenues in Egypt grew by 18.5% yoy to EGP 250bn in Q1 2023-2024. Primary surplus is estimated to touch 2.5% of GDP during the current fiscal year.

- Renewable energy projects under development by the private sector in Egypt are worth USD 4.4bn, reported Asharq Business, citing the minister of electricity and renewable energy.

- Moody’s downgraded 5 Egyptian banks by one notch to CAA1 from B3, following the downgrade of the nation’s sovereign rating.

- Kuwait exports inched lower to KWD 6.12bn in Q2 (Q1: KWD 6.6bn) while imports also slowed to KWD 2.87bn (Q1: KWD 2.97bn).

- Exploratory drilling operations in Lebanon’s offshore Block 9 resulted in no hydrocarbon finds, reported Reuters. Block 9 falls alongside the newly delineated maritime border between Lebanon and Israel.

- Oman’s public revenues fell by 15% yoy to OMR 7.923bn at end-Aug 2023, as net oil revenue declined by 10% to OMR 4.145bn. Spending also slipped, by 13% to OMR 7.149bn.

- Bank deposits in Oman grew by 6.6% yoy to OMR 27.9bn in Aug, while credit extended saw a 6.8% uptick to OMR 30.4bn. Non-financial corporations received the highest share of the total private sector credit (45.8%), followed by households at 44.6%.

- Oman’s OQ and partners have invested over USD 10bn across various projects in the Duqm economic zone, according to a senior official.

- Qatar reported a 78% yoy to 264k tourists in Aug 2023; it was down by 8.5% mom from Jul’s 288k reading (which was driven up by the Formula 1 race and international concerts). About 43% of Aug visitors were from the GCC.

- QatarEnergy and France’s TotalEnergies signed a 27-year LNG deal to provide France with up to 3.5mn metric tons of LNG per year, with deliveries expected to start in 2026.

- Saudi Arabia, UAE and Egypt accounted for 67% of total construction project value in H1 2023, according to JLL. Of a total USD 101bn worth projects awarded in MENA, Saudi Arabia’s stood at USD 44bn, followed by USD 23bn in the UAE. Residential was the main segment in UAE (75% of the total), with Dubai-based projects totalling over USD 9bn.

Saudi Arabia Focus

- Inflation in Saudi Arabia eased to 1.7% in Sep (Aug: 2%), the slowest since Feb 2022, as transport costs fell (-0.1% from Aug’s 0.5%) and housing and utilities costs eased (8.1% from 9% in Aug).

- Industrial production in Saudi Arabia shrank by 12.2% yoy in Aug (Jul: -9.5%), the steepest decline since Apr 2021. In mom terms, industrial output fell by 0.3, much slower than the 6.5% plunge in Jul. While ongoing oil production cuts has contributed most to the IP decline, manufacturing activity has been slowing as well, clocking in 4.6% growth in Aug (Jul: 8.7%), its average has declined to 11.3% in Jan-Aug 2023 (vs 22.9% in Jan-Aug 2022).

- Saudi Arabia’s GDP is expected to grow by 4% yoy in 2024, according to the IMF, following just 0.8% growth in 2023.

- Commercial registrations in Saudi Arabia increased by 16% yoy and 2.3% qoq to 1.3mn in Q3 2023: of this, 33.7% were owned by Saudi women. There was a 12% yoy increase in e-commerce businesses to 36,330 in Q3, with Riyadh accounting for 40% of the e-commerce registrations. Furthermore, firms registered in the electronic games development sector jumped by 56% to 2803.

- Finance companies in Saudi Arabia posted a 9% yoy increase in total assets to SAR 62.36bn in H1 2023. Credit portfolio of the finance and real estate refinance sector grew by 11% to SAR 80.71bn during the same period; retail sector accounted for 76% of total loans.

- Saudi PIF announced a new investment company Tasaru Mobility Investments to develop local supply chain capabilities for the automotive and mobility sector. The company’s first investment through a joint project will be to develop a logistics center in King Abdullah Economic City, serving the aftermarket parts industry.

- Saudi Arabia’s General Authority for Competition approved 41 M&A applications during Q3 2023. Thirty-nice applications out of the 89 submitted without objection, while two were authorized conditionally.

- Saudi Arabia’s electricity and gas supply sector grew by 21.5% yoy in Aug: the sector has shown high annual expansion since the start of 2023.

- Aramco signed a provisional agreement with Chinese firm Shandong Yulong Petrochemical for a 10% stake in the company; this deal will increase the former’s global downstream expansion.

- Container volumes in Saudi Arabia ports grew by 11.6% to 732,293 cargo-handling containers in Sep.

- Saudi Arabia’s Greenhouse Gas Crediting and Offsetting Mechanism is set to launch in early 2024: this will allow companies to purchase credits offsetting GHG emissions as part of its efforts to achieve net-zero emissions by 2060.

- Over 29k families benefited from Sakani’s housing options and financing solutions in Q3 2023; September saw the highest number of families receiving support (at 10,808) and about 6800+ families received possession of their first home.

- Riyadh will likely see an 85% rise in centimillionaire residents over the next 10 years – the third-highest global increase, according to Henley & Partners. The city currently houses 65 individuals whose estimated financial wealth is at least USD 100mn, and also 9 billionaires.

- ACWA Power announced a financial closure of USD 14bn in last 12 months, the largest-ever in the firm’s history, with NEOM’s USD 8.5bn green hydrogen facility a significant accomplishment.

UAE Focus![]()

- The UAE Cabinet approved a Federal budget of AED 192bn for 2024-2026. The 2024 federal general budget estimates spending at AED 64.06bn (+1.6% yoy), of which social development & benefits account for 42%, and revenues of AED 65.73bn (+3.3%).

- In the latest Regional Economic Outlook report, the IMF forecasts UAE growth to rise by 3.4% and 4% in 2023 and 2024.

- Dubai GDP grew by 3.2% yoy in H1 2023, with a strong 3.6% growth recorded in Q2, according to the Crown Prince of Dubai and Chairman of Dubai Executive Council. Growth was highest in transportation & storage (10.5% in H1), accommodation & food services (9.2%), information and communication (3.8%) and real estate sector (3.6%).

- Dubai PMI inched up to 56.1 in Sep (Aug: 55), with new orders climbing to the highest in since Jun 2019 while costs for businesses rose at the fastest pace in 14 months. Respondents commented on improving demand condition and greater sales efforts; business confidence grew to the highest since Mar 2020, driven by the construction and wholesale & retail sectors.

- Announced FDI projects in Dubai stood at 880 in H1 2023:greenfield (wholly-owned) projects accounted for 4% of total number of projects and 36.7% of investment. FDI inflows went largely into the financial services sector (53%), underscoring the attractiveness of Dubai’s financial / fintech space. By source nation, Canada invested the most (50%) in H1 and had a share of 5.5% of total projects. US had 136 projects (15.5% of total) and 10.1% of total investment.

- UAE and South Korea have completed talks for a bilateral trade deal: in H1 2023, bilateral non-oil trade stood at USD 3bn (similar to H1 2022). South Korea is also negotiating a FTA with the wider GCC-bloc. While the UAE-Georgia CEPA will come into force in Q1 2024, the UAE plans to secure 6 more trade and investment deals by end-2023, disclosed the minister of state for foreign trade. On being asked about the Israel-Gaza conflict and its impact on economic agreements, the minister stated that “we don’t mix the economy and trade with politics”.

- The Abu Dhabi Securities Exchange (ADX) witnessed a 364% surge in the value and volume of trading in exchange-traded funds since the beginning of this year: ETF trading on the ADX reached AED 4.5bn (USD 1.23bn) by Oct 11th, making it the most active and liquid ETF market in the MENA region.

- Abu Dhabi plans to set up a new Smart & Autonomous Vehicle Industries cluster: this is expected to contribute up to AED 120bn (USD 32.67bn) to the economy and create nearly 50,000 new jobs. This supports plans by both Abu Dhabi and Dubai to encourage greater use of sustainable modes of transport by 2030.

- UAE allocated USD 200mn to support low-income nations in poverty reduction and growth. This falls under the UAE’s participation in the IMF’s Poverty Reduction and Growth Trust Facility.

Media Review

IMF World Economic Outlook, Oct 2023

https://www.imf.org/en/Publications/WEO/Issues/2023/10/10/world-economic-outlook-october-2023

https://www.imf.org/en/Blogs/Articles/2023/10/10/resilient-global-economy-still-limping-along-with-growing-divergences

China saves billions of dollars from record sanctioned oil imports

https://www.reuters.com/markets/commodities/china-saves-billions-dollars-record-sanctioned-oil-imports-2023-10-11/

MENA carbon market likely to reach around 150m tons by 2030

https://www.arabnews.com/node/2389511/business-economy

In Riyadh, the Middle East rehearses for Cop28

https://www.agbi.com/opinion/frank-kane-in-riyadh-the-middle-east-rehearses-for-cop28/

Taiwan will not surrender its semiconductor supremacy

https://www.economist.com/business/2023/10/12/taiwan-will-not-surrender-its-semiconductor-supremacy

Powered by: