IMF growth, inflation & government debt. UAE federal budget & spending. Dubai FDI. Saudi IP.

Weekly Insights 13 Oct 2023: Growth in the MENA region slows in 2023, with divergent recovery paces

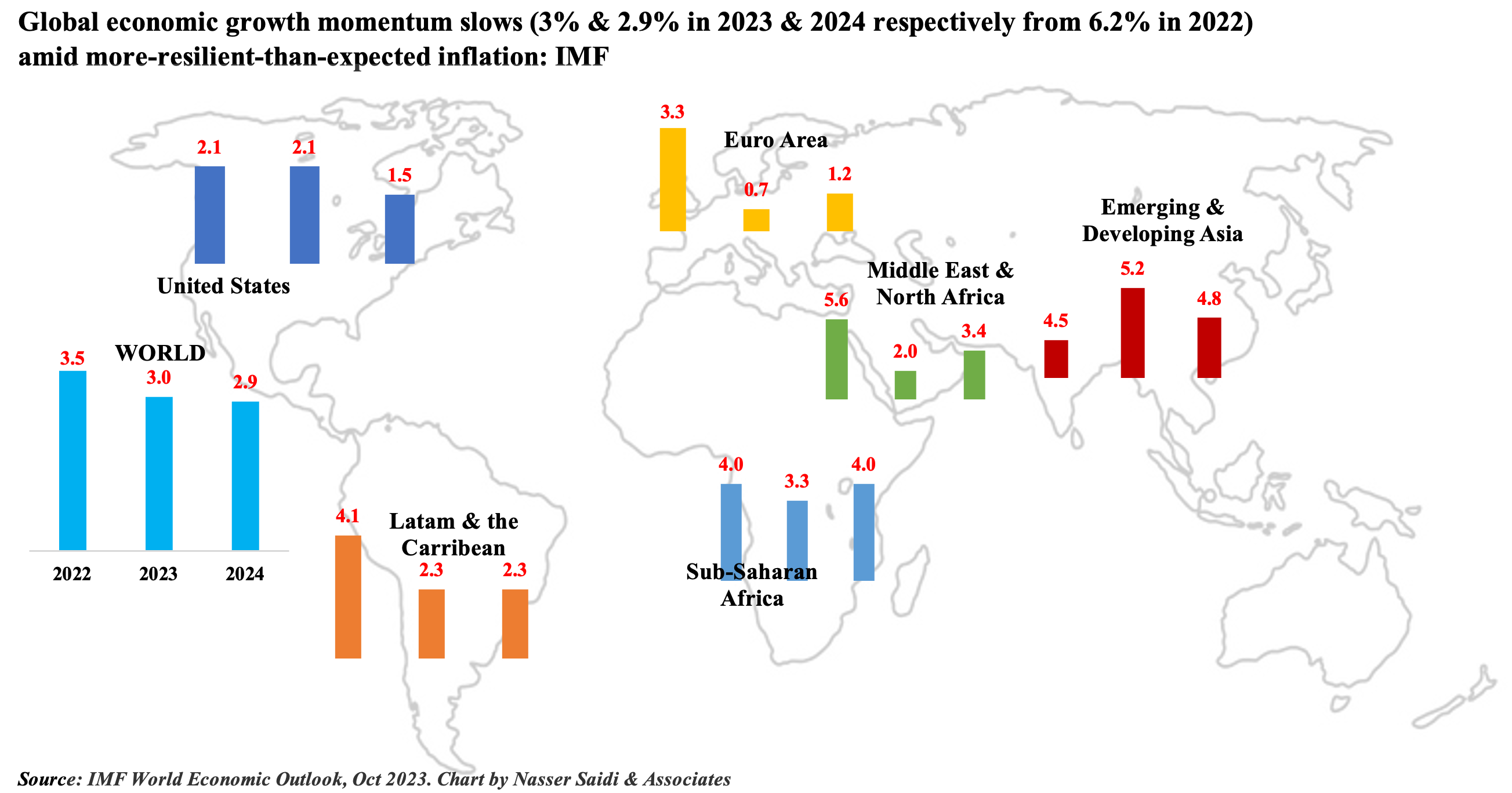

1. IMF projects global growth to slow: 3.0% in 2023 & 2.9% in 2024

- Global economic growth is forecast to fall to 3.0% and 2.9% in 2023 and 2024 respectively, following 3.5% growth in 2022, but more modest decline in emerging market economies (4.0% in 2023 and 2024 from 4.1% last year).

- Inflation is projected to ease (to 6.9% in 2023 and 5.8% in 2024 from 2022’s 8.7% jump), in part thanks to central banks’ monetary tightening policy (that has restrained economic activity; tighter credit conditions are also weighing on housing markets, investment, and activity) and in part to lower commodity prices. The WEO also notes that most nations aren’t likely to return inflation to target until 2025.

- Downside risks to forecasts include: slower growth in China; more volatile commodity prices; persistent inflation; monetary policy reassessment; debt distress increases; geo-economic fragmentation intensifies & social unrest resumes.

- The Russia-Ukraine war is likely to become a new Verdun, a long war of attrition draining fiscal and military resources. US trade and tech war on China is leading to: decoupling, lower productivity growth and a decline in and less efficient global FDI.

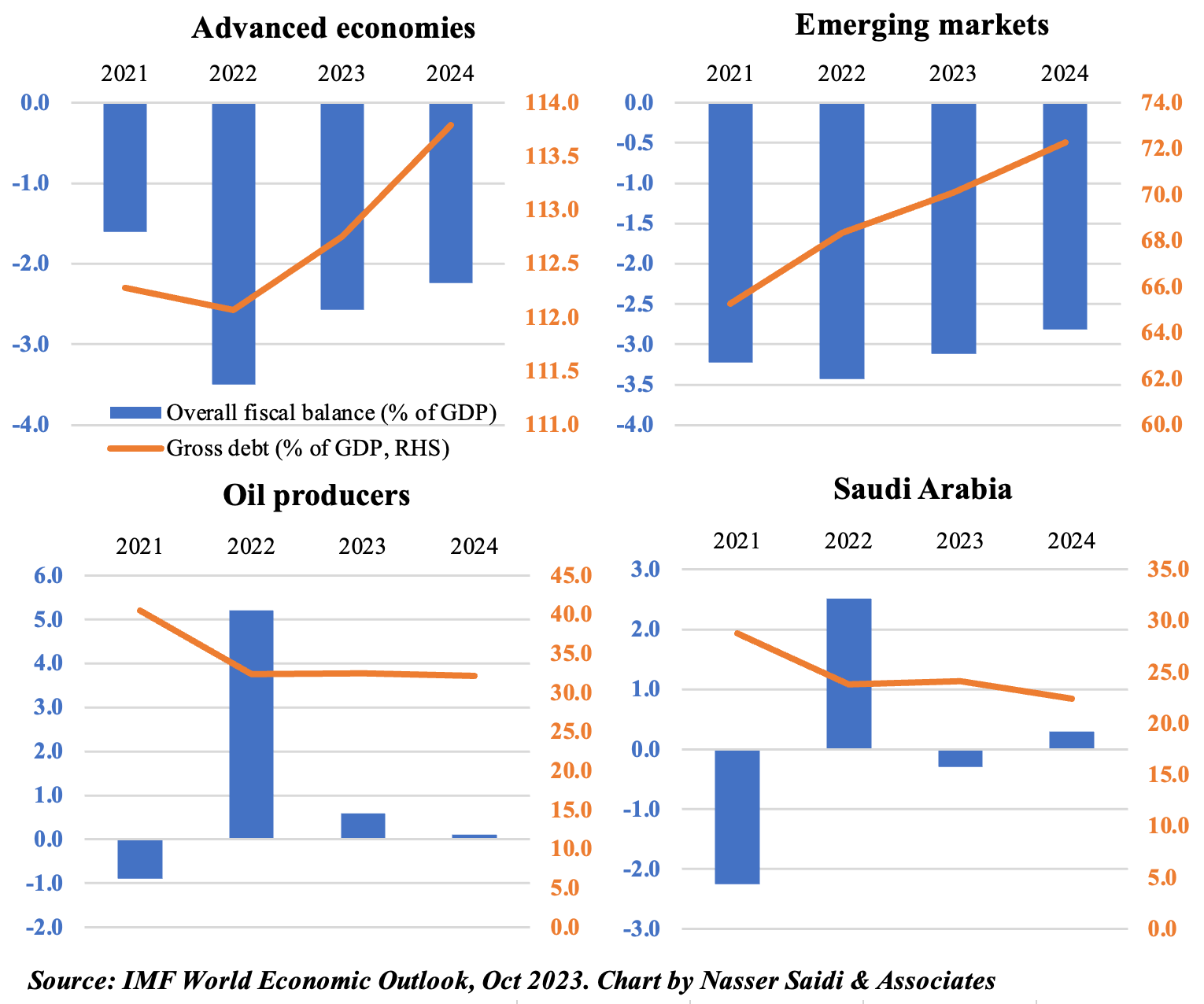

2. Can countries afford their Net Zero commitments with Debt/GDP ratios approaching 100% by 2030?

- IMF’s Fiscal Monitor report: debt to GDP ratios are forecast to increase by 1 percentage point (pp)a year during 2023-2028, growing faster than foreseen pre-pandemic.

- Partly due to the major economies incl. US and China. US government clocked in a USD 1.5trn deficit in the 11 months (Oct 2022-Aug 2023). US and China’s total non-financial public & private debt-to-GDP rates have converged at about 270% of GDP.

- Excluding these two nations, the debt-to-GDP ratio would instead decline by about 0.5pp annually.

- Projections indicate that global public debt ratio would be approaching 100% of GDP by the end of the decade.

- Implications from a green transition move are discussed: scaling up the current policy mix to deliver Net Zero => accumulation of public debt by 40–50 pps of GDP for a representative advanced economy and for a representative EME by 2050.

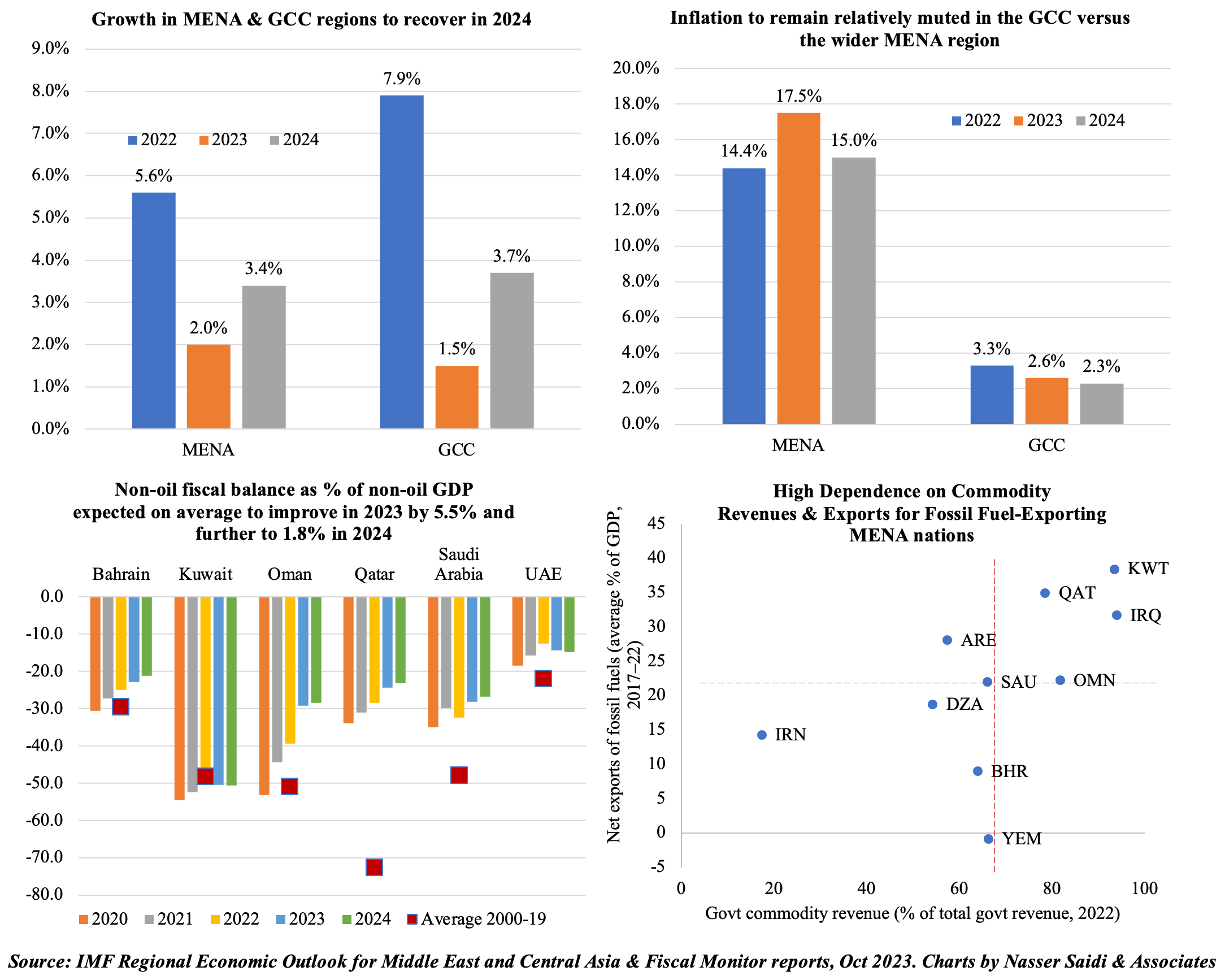

3. MENA growth to slow in 2023 (to 2.0% from 5.6% in 2022), while inflation is forecast to moderate in 2024

- Economic growth is expected to slow in the MENA region due to lower oil production, monetary policy tightening and country-specific factors (e.g. Egypt, Lebanon). Recovery in domestic demand and rebound in tourism activity provide support.

- GCC inflation rates have almost returned to pre-pandemic averages; currency depreciations have affected inflation in many nations (e.g. Egypt, Lebanon, Iran).

- In contrast to past years’ procyclical spending policies, many GCC nations have been practising fiscal consolidation => improving the non-oil fiscal balances (As % of non-oil GDP).

- Kuwait, Qatar, Iraq remain vulnerable due to their high dependence on oil-related fiscal and exports revenues.

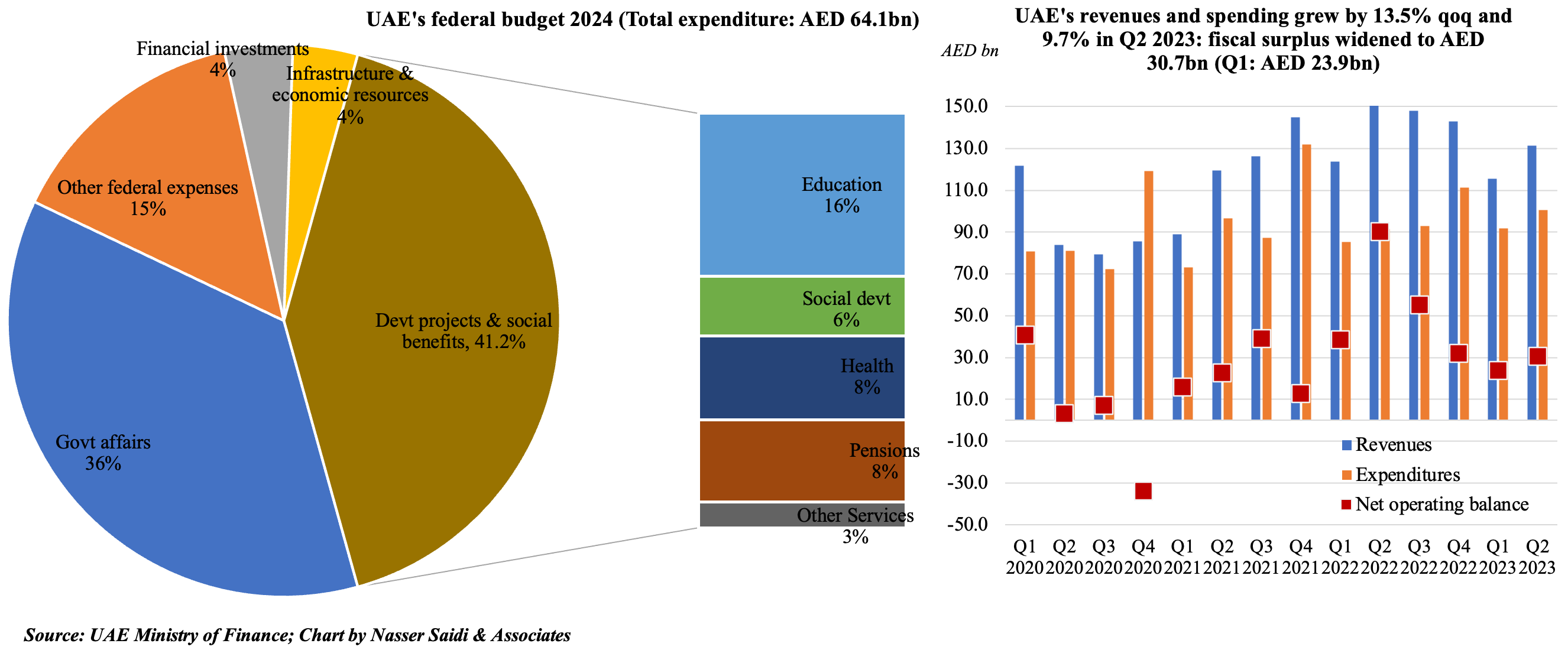

4. UAE Cabinet approved a Federal budget of AED 192bn for 2024-2026; Social development & benefits account for 42% of budget in 2024

- The UAE Cabinet approved a federal budget of AED 192bn for 2024-2026.

- The 2024 federal general budget estimates spending at AED 64.06bn (+1.6% yoy) and revenues of AED 65.73bn (+3.3%). Social development and benefits account for 42% of the federal budget in 2024.

- The breakdown shows government affairs and education sectors accounting for the largest share of spending (AED 25.2bn and AED 10.2bn respectively) while along with pensions, it accounts for close to 2/3-rds of total spending.

- In H1 2023, the consolidated federal fiscal balance recorded a surplus of AED 54.6bn: this was much lower than the AED 128.8bn surplus in H1 2022.

- Revenues slumped by 19% yoy to AED 246.9bn in H1 2023; though in qoq terms, revenues were up by 13.5% in Q2 2023 – largely due to the 31% qoq jump in tax revenues (to AED 83.2bn).

- Spending increased by 9% yoy to AED 192.3bn in H1 2023; in qoq terms, it rose by 9.7% to AED 100.6bn in Q2, as both subsidies and compensation of employees grew by 29.2% qoq (to AED 10.1bn) and 2.3% (to AED 29.2bn) respectively.

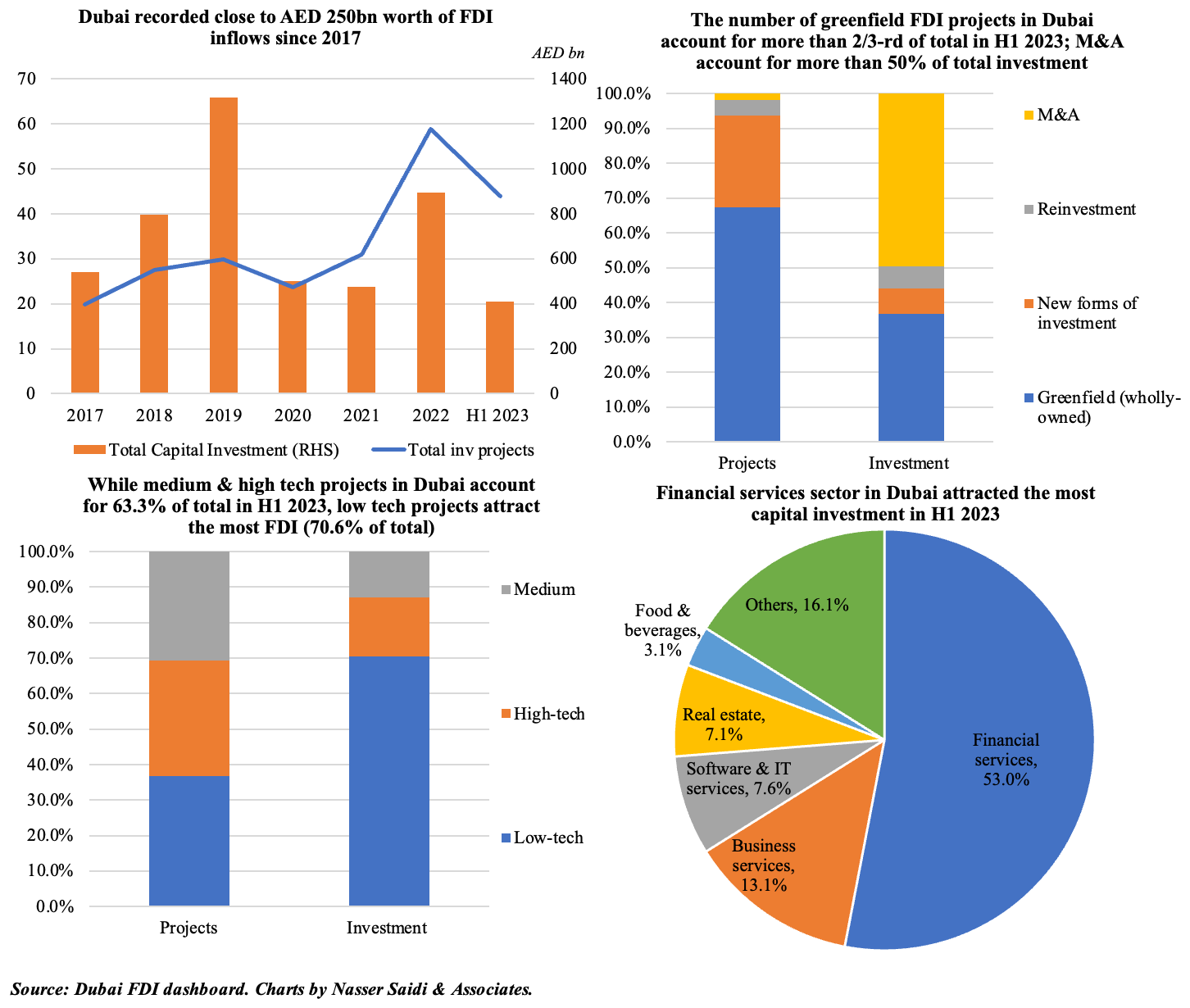

5. Dubai attracted 880 announced FDI projects in H1 2023 (+70% yoy)

- Dubai attracted some AED 250bn worth of FDI inflows since 2017, with AED 20.47bn reported in H1 2023.

- Announced FDI projects touched 880 in H1 2023, almost ¾-th of total projects for the full year 2022; much higher than in the past 5 years.

- Of the projects in H1 2023, greenfield (wholly-owned) projects accounted for 67.4% of total number of projects & 36.7% of investment. In terms of FDI, M&A projects accounted of the larger share (49.7%).

- Medium and high-tech projects share was 63.3% in H1 2023 though in terms of FDI, low tech projects took the larger share (70.6%).

- FDI inflows went largely into the financial services sector (53%), underscoring the attractiveness of Dubai’s financial / fintech space.

- By source country, Canada invested the most (50%) in H1 2023 and had a share of 5.5% of total projects. US had 136 projects (15.5% of total) and 10.1% of total investment.

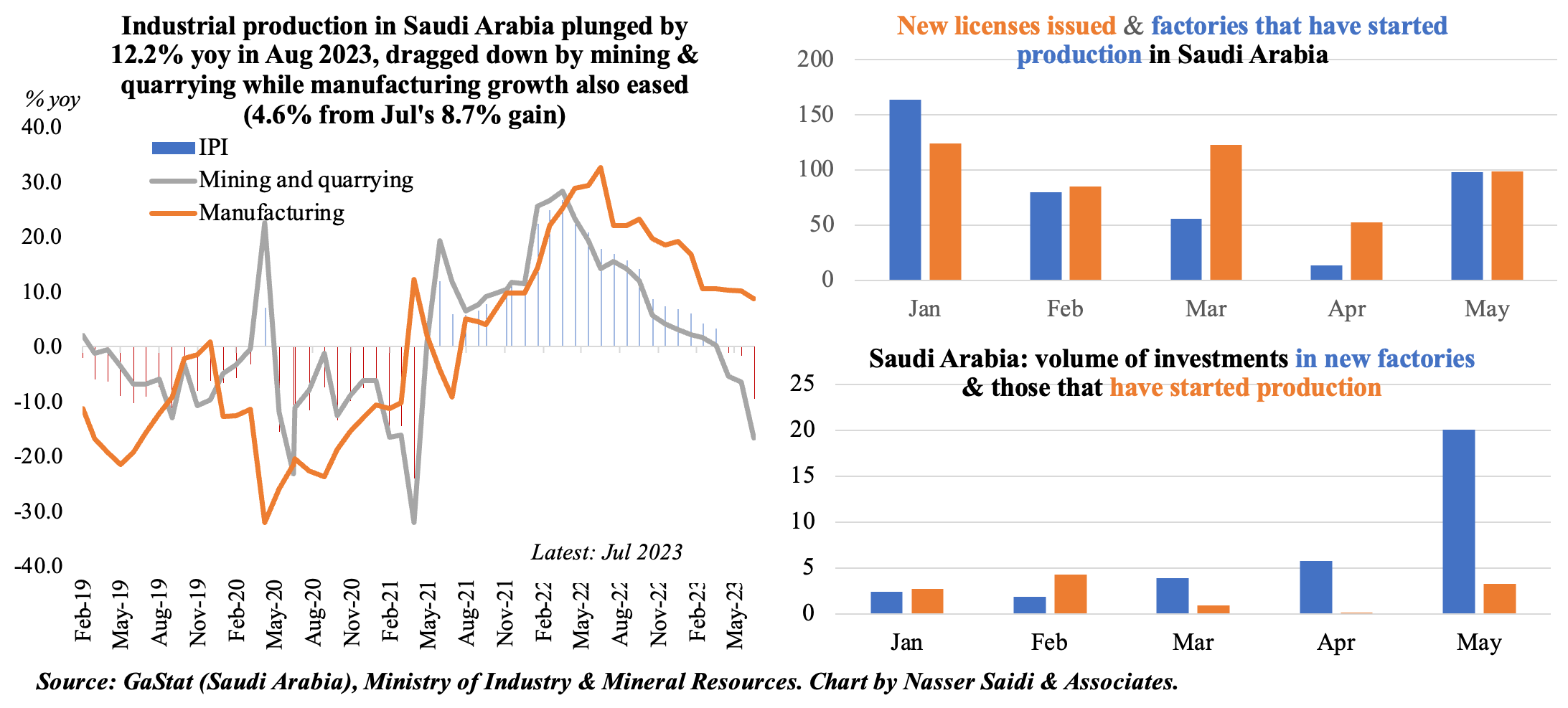

6. Mining & quarrying sector activity dragged down Saudi industrial production again; new industrial licenses should support activity

- Industrial production (IP) in Saudi Arabia shrank by 12.2% yoy in Aug (Jul: -9.5%), the steepest decline since Apr 2021. In mom terms, industrial output fell by 0.3, much slower than the 6.5% plunge in Jul. Overall IP has declined by an average 0.6% this year.

- Ongoing oil production cuts has contributed most to the decline in IP: production in the mining & quarrying sector fell by 19.3% yoy in Aug and 5.1% in Jan-Aug 2023, from a 20.5% gain in Jan-Aug 2022.

- Manufacturing activity has been slowing as well, clocking in 4.6% growth in Aug (Jul: 8.7%), its average has declined to 11.3% in Jan-Aug 2023 (vs 22.9% in Jan-Aug 2022).

- Some positive signs for non-oil sector activity in the future: at 57.2 in Sep, Saudi Arabia’s PMI returned above its long-run average of 56.9; new business intakes increased, and firms reported improving market conditions supporting client orders. The issuance of new industrial licenses also increased: as of July 2023, industrial establishments in the country reached a total of 11032 factories, with an investments value exceeding SAR 1.48trn.

Powered by: