Markets

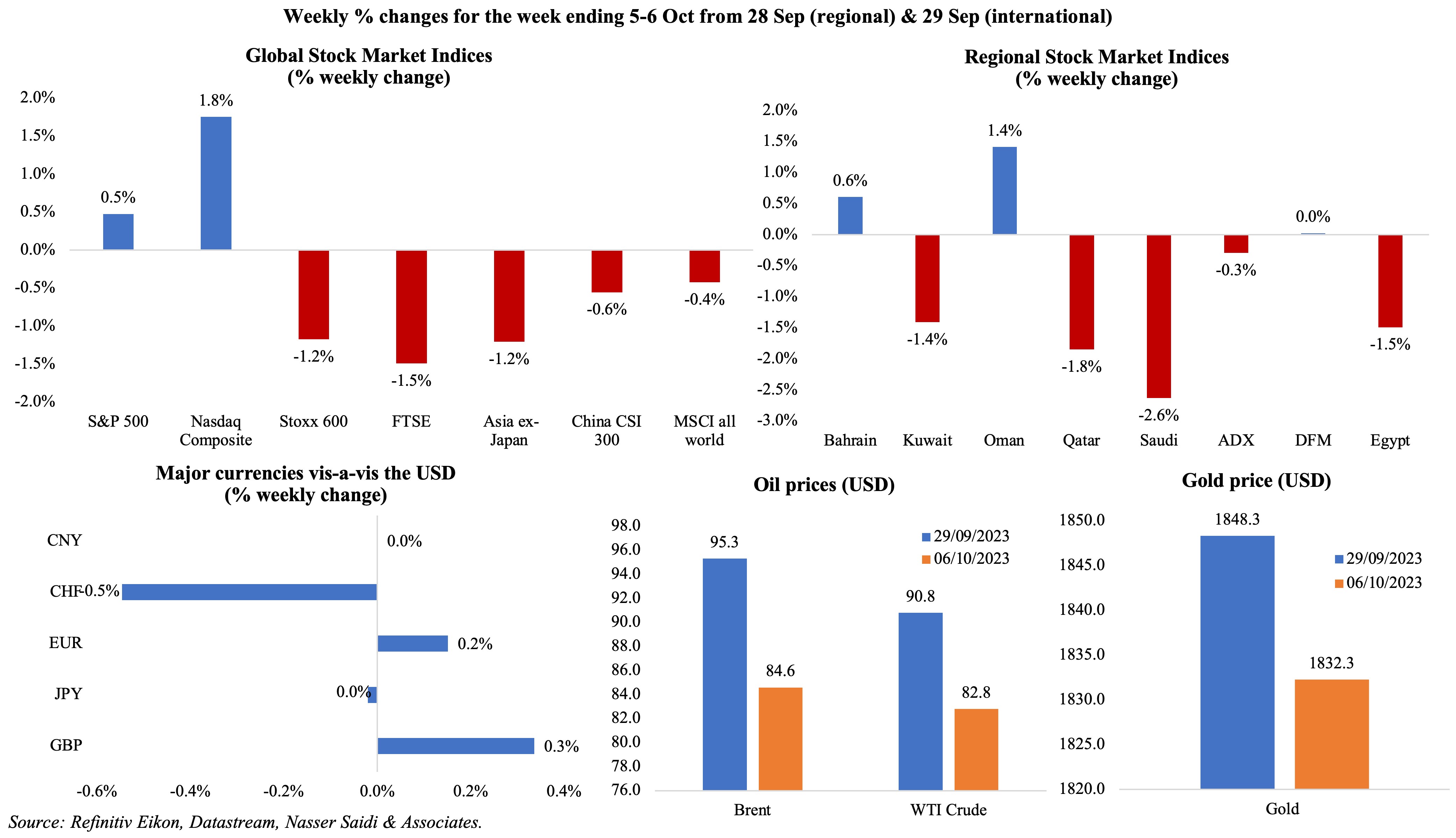

Major equity markets were down last week, while US markets benefitted from the strong payrolls data signalling a continued, strong US labour market. Regional markets were mostly down, as oil prices fell, with Bahrain and Oman posting slight gains. The euro gained vis-à-vis the greenback after 11 weeks of straight declines, while the yen rose to above JPY 150 on Tuesday (a nearly 1-year high) before tumbling (potentially due to government intervention). Oil prices posted the steepest weekly loss since Mar: Brent by 11% and WTI just over 8%. Gold price went through a 9-day losing streak before gaining some ground on Friday, but closed with a weekly loss (-0.9%).

Global Developments

US/Americas:

- Non-farm payrolls increased by 336k in Sep (Aug: 227k), with the leisure and hospitality sectors and government employers adding 96k and 73k jobs respectively. Average hourly earnings jumped by 0.2% mom and 4.2% yoy in the month while labour force participation rate was unchanged at 62.8%. Unemployment rate held steady at 3.8%. All signal a continuing strong US labour market.

- Private sector employers in the US added 89k jobs in Sep (Aug: 180k), with gains concentrated in the services sector (81k). JOLTS job openings climbed to 9.61mn in Aug (Jul: 8.92mn), posting the largest increase in over 2 years. There were 1.51 job openings for every unemployed person in Aug and unfilled positions rose by the most in two years.

- Initial jobless claims inched up by 2k to 207k in the week ended Sep 29th and the 4-week average slipped by 2,500 to 208.75k. Continuing jobless claims slipped by 1k to 1.664mn in the week ended Sep 22nd.

- Factory orders in the US rebounded by 1.2% mom in Aug (Jul: -2.1%); orders grew by 0.5% yoy. Civilian aircraft orders fell 15.9% mom while motor vehicle orders rose 0.3% and machinery orders gained 0.6%.

- S&P manufacturing PMI climbed to 49.8 in Sep (Aug: 47.9 and the initial estimate of 48.9), as output inched up while new orders declined for the fifth month in a row. Services and composite PMI slowed to 50.1 and 50.2 respectively (Aug: 50.5 & 50.2). Also reported were waning demand for consumer services (travel, tourism) and financial services activity.

- ISM manufacturing PMI in the US rose to 49 in Sep (Aug: 47.6), lifted by new orders (49.2 from 46.8) and employment (51.2 from 48.5) while prices paid fell further to 43.8 (Aug: 48.4).

- US ISM services PMI eased moderately to 53.6 in Sep (Aug: 54.5), as both new orders and employment slipped to 51.8 and 53.4 (from 57.5 and 54.7 respectively in Aug) while prices paid remained unchanged at 58.9.

- Goods and services trade deficit in the US fell to USD 58.3bn in Aug (Jul: USD 64.7bn), the lowest level since Sep 2020. Services surplus increased USD 1.0bn to USD 26.2bn, the highest since Mar 2018. Goods trade deficit inched up by 0.2bn to USD 84.5bn in Aug; exports were up by 1.8% to USD 171.5bn, with capital goods rising to a record high.

Europe:

- Preliminary manufacturing PMI in the eurozone inched lower to 43.4 in Sep(Aug: 43.5), with the new orders posting the steepest decline in 26-years. Services and Composite PMIs improved to 48.7 and 47.2 respectively, but demand for eurozone goods and services fell at the strongest rate since Nov 2020, signalling an impending recession. .

- Producer price index in the eurozone plunged by 11.5% yoy in Aug (Jul: -7.6%), the steepest decline on record as energy costs tumbled (-30.6% yoy). In month-on-month terms, prices rose by 0.6% reversing seven months of declines.

- Retail sales in the eurozone fell by 1.2% mom and 2.1% yoy in Aug. The monthly drop was partly due to the drop in internet shopping (-4.5%) and petrol sales (-3%).

- Exports from Germany declined by 1.2% mom in Aug (Jul: -1.9%) alongside a 0.4% drop in imports (Jul: -1.3%), resulting in a narrower trade surplus of EUR 16.6bn (Jul: EUR 17.7bn). Exports to other eurozone nations and US fell by 2.6% and 1.3% mom respectively.

- German factory orders dropped by 4.2% yoy in Aug (Jul: -10.1%). In mom terms, orders rebounded by 3.9% (Jul: -11.3%), with the biggest gain recorded by the manufacture of computer, electronic and optical products sector (37.9%).

- The preliminary manufacturing PMI in Germany edged higher to 39.6 in Sep (Aug: 39.1, but 0.2 point lower than the preliminary estimate), with the steepest decline in output since May 2020 as demand faltered; new orders remained below-50 for 18 months. Services and composite PMIs moved up to 50.3 and 46.4 (Aug: 47.3 and 44.6 respectively).

- Unemployment rate in the eurozone slipped to a record-low 6.4% in Aug (Jul: 6.5%). The lowest jobless rate was in Germany (3%), while the highest were in Spain (11.5%), Italy (7.3%) and France (7.3%).

- UK services PMI moved to 49.3 in Sep (lower than Aug’s 49.5 but much higher than the preliminary reading of 47.2), the lowest level since Jan, as new work declined, export sales fell for the first time since Nov 2022 and employment fell (at the fastest pace since Jan 2021). Meanwhile, manufacturing PMI inched up by 1.3 points to 44.3.

Asia Pacific:

- China’s foreign exchange reserves declined to USD 3.1151trn at end-Sep (Aug: USD 3.1601trn), while the value of gold reserves fell to USD 131.79bn (Aug: USD 135.22bn).

- Services PMI in Japan fell by 0.5 point to 53.8 in Sep, with demand coming mostly from the domestic market as growth in foreign demand stalled; it also reported the sharpest decline in employment since Jan 2022.

- Overall household spending in Japan fell for the sixth consecutive month in Aug, down by 2.5% yoy (Jul: -5%) to an average JPY 293,161 (USD 1,975) for households with 2-persons or more. Labour cash earnings jumped by 1.1% yoy in Aug, from a similar increase in Jul.

- Preliminary readings of Japan’s leading economic index and coincident index inched up by 1.3 and 0.1 points to 109.5 (highest reading since Nov) and 114.3 respectively in Aug.

- The Reserve Bank of India left policy rates unchanged for the fourth meeting in a row. Repo and reverse repo rates stand at 6.5% and 3.35% respectively. It was also signalled that bond sales would be used to keep liquidity tight and get inflation close to the 4% target.

- Singapore PMI moved up to 50.1 in Sep (Aug: 49.9), crossing the 50-mark for the first time in 7 months. The electronics sector activity remained contractionary at 49.8 (Aug: 49.5).

- Retail sales in Singapore increased by 1.7% mom and 4% yoy in Aug (Jul: 0.8% mom and 1.3% yoy). The food and beverages sales surged by 24.1% while department store and petrol station sales fell by 5.2% and 2.7% respectively.

Bottom line: Global PMI readings point towards weakening demand conditions amid higher goods prices: this is evident in the developed nations in Europe as well as in emerging markets like China (though India remained a strong performer). There have been signs of slowing activity in services sector – new business inflows into the sector fell globally in Sep, for the first time since Dec 2022 – in addition to fuel prices driving up overall input costs (in addition to wage costs). As the IMF-World Bank meeting get underway in Morocco, expect the rhetoric to be of weakening economic activity and easing inflationary pressure (though under pressure from oil prices), as well as high interest rates for longer, amid high levels of public debt and potential debt crises in emerging countries.

Regional Developments

- The World Bank expects growth in the MENA region to slow to 1.93% yoy in 2023, from 6.2% in 2022. Growth in the GCC has been revised lower to 1% in 2023 (from 3.2% in the Apr update): this compares to 2022’s 7.3% growth but a recovery is expected in 2024 (to 3.6%). Within the GCC, Saudi Arabia is expected to grow at just 0.03% in 2023 (2022: 8.7%).

- The OPEC+ panel left oil policy unchanged at the latest meeting. Both Saudi Arabia and Russia will continue with the voluntary cuts. The next meeting is on Nov 26th, the same day as the full meeting of the OPEC+ nations to decide policy.

- Real GDP in Bahrain grew by 2% in Q2 2023(Q1: 2%), with non-oil and oil sectors up by 2% and 2.2% respectively (Q1: 3.6% & -5.9% in the non-oil and oil sectors). In H1 2023, overall growth stood at 2% yoy (slower than H1 2022’s 6%). In terms of contribution to growth to real GDP in Q2 2023, financial sector topped the list (17.3%), followed by crude petroleum & natural gas (17.1%), government services (14.1%) and manufacturing (13.6%).

- Non-oil PMI in Egypt remained in contractionary territory for the 34th consecutive month in Sep: clocking in at 48.7, this was slightly lower than Aug’s 49.2 reading. The backlog index rose to 53.1 in Sep, the highest since Apr 2012, while the output and new orders sub-indices fell to 45.7 and 47.6 respectively (Aug: 48 and 48.3).

- Egypt’s current account posted a surplus of USD 557mn in Apr-Jun, in contrast to the deficit of USD 3.49bn recorded in Jan-Mar, as tourism revenues increased (to USD 3.34bn) and imports fell (to USD 16.18bn from USD 17.55bn in Jan-Mar). Remittances from abroad almost halved to USD 4.63bn in Apr-Jun from USD 8.29bn a year ago.

- Egypt plans to resume LNG exports from Oct, stated the petroleum minister to Reuters, on the side lines of an energy conference in the UAE. Egypt’s LNG terminals on the Mediterranean coast have the capacity to ship 12 million metric tonnes per annum (aim to reach this figure in 2025) but exports have been constrained by high domestic consumption.

- Moody’s downgraded Egypt’s credit rating to the substantial risk “Caa1” category from “B3”, given high inflation, rising borrowing costs, a pipeline of debt service payments and foreign currency shortages.

- Two banks in Egypt have suspended the use of EGP debit cards outside the country, citing the foreign currency shortage.

- Iraq will ban cash withdrawals and transactions in US dollars starting Jan 2024, according to a central bank official, seen as a broader push to de-dollarise the economy. From 2024, dollars deposited can be withdrawn only in local currency at the official rate of 1,320, substantially below the black market rate.

- GDP in Jordan grew by 2.6% yoy in Q2 2023, resulting in growth of 2.7% yoy in H1 2023. Agriculture, forestry & fishing sector posted the highest growth rate (8.2%) while others also remained strong – for example, restaurants & hotels (5.9%), transport & communications (5.2%) and mining & quarrying (4.3%).

- PMI in Lebanon inched up to 49.1 in Sep (Aug: 48.7), as the pace of decline in new orders and business activity slowed. Orders from foreign clients remained subdued, while new work was also lower given lower purchasing power, ongoing domestic weakness, and uncertainty.

- Lebanon issued a circular limiting fees and commissions that commercial banks can impose on “lollar” accounts (i.e. dollars deposited in Lebanese banks before the economic crisis in Oct 2019). This move, if implemented, should increase transparency on banks fees.

- Foreign assets of the central bank of Oman surged by 27.4% yoy to OMR 6.86bn by end-Jul while local liquidity grew by 4.9%. Private sector deposits grew by 6.5% (to OMR 18.17bn) alongside an 8.7% uptick in total loans and financing (to OMR 30.27bn). Separately, S&P Global Ratings upgraded Oman’s long-term credit rating from “BB” to “BB+”.

- Luxury hotels in Oman reported a 26.3% yoy surge in revenues to OMR 138.38mn (USD 359.4mn) in Jan-Aug 2023. Hotel guests were up by 26.7% to 1.28mn during the period while hotel occupancy grew by 10.4%.

- According to the Central Bank of Oman, employment opportunities in Oman grew by 16.2% yoy in 2022: opportunities were up by 3.6% and 23.3% for citizens and expats respectively.

- Qatar PMI remained robust at 53.7 in Sep (Aug: 53.9), thanks to the strong output and new orders readings, while employment grew at the fastest rate since Jun 2022.

- Trade surplus in Qatar widened by 8.7% mom to QAR 21.4bn in Aug: exports grew by 8% mom to QAR 31.4bn while imports increased by 6.6% to QAR 10.1bn. In yoy terms, exports and imports were down by 32.9% and 4.8% respectively. China was the top exports destination in Aug, accounting for 23.9% of overall exports, followed by South Korea (12.4% share) and India (10.5%).

- Balance of payments in Qatar recorded a surplus of QAR 7.9bn (USD 2.17bn) in Q2 2023, according to the central bank. Goods and services accounts posted surpluses of QAR 59.6bn and QAR 31.3bn respectively.

- GCC’s Financial and Economic Cooperation Committee adopted an implementation plan and timetable for completing the Gulf Customs Union requirements before end-2024.

- GCC tourism ministers will submit views on a unified GCC visa by end-Dec: GCC welcomed 39.8mn inbound visitors in 2022 (136.6% yoy) and spending jumped by 101.2% to USD 85.9bn.

- The COP28 President disclosed that more than 20 oil and gas companies had positively answered calls to align around net zero by 2050, and to zero out methane emissions and eliminate routine flaring by 2030, without elaborating further. Last week, a conference brought together major energy and heavy industry firms to discuss a decarbonisation commitment.

- Three ports in the MENA region – Oman, UAE and Morocco – are among the top 5 most efficient ports globally, as published in Unctad’s latest Review of Maritime Transport. Qatar and Saudi Arabia were ranked 8th and 17th respectively.

- Start-ups in the MENA region saw a total of USD 36mn being raised across 36 deals in Sep 2023. UAE and Saudi dominated the list: the former saw 14 deals worth over 27mn while Saudi secured USD 2.7mn from 7 deals. Year-to-date total investment stands at USD 1.8bn, inclusive of USD 687mn from debt financing.

- The 2023 Geography of Cryptocurrency Report for the MENA region by Chainalysis showed Saudi Arabia to be among only 6 nations globally where the volume of cryptocurrency deals grew (12% yoy) between Jul 2022-Jul 2023. Elsewhere in the region, declines were posted: UAE (-17%), Qatar (-26%), Oman (-49%), Jordan (-55%) and Lebanon (-96%). MENA, with an estimated USD 389.8bn on-chain value, accounted for only 7.2% of global transaction volume during the period.

Saudi Arabia Focus

- Saudi Arabia’s PMI rose to 57.2 in Sep (Aug: 56.6), thanks to upticks in output (62.8 from Aug’s 19-month low of 59.1) and new orders (up 4 points to 64.2) though export sales fell for the second month in a row. Competitive pressures saw selling charges drop for the second time in 3 months while employment levels increased (among the fastest pace recorded in the past 5 years).

- The Saudi energy minister revealed that trials of the first hydrogen train in the Middle East will begin this week, and “hopefully for the next few months”. He also disclosed, without providing details, that Saudi will be launching a “credible, transparent and adaptable domestic market mechanism” on Monday.

- A ministry of energy official revealed that Saudi Arabia will continue oil production cuts of 1mn barrels per day (bpd) in Nov and Dec implying that the production in Nov-Dec will be around 9mn bpd.

- Japan’s imports of Saudi crude oil increased slightly to about 27.93mn barrels (or 36% of the total) in Aug (Jul: 27.6mn barrels or 38% of the total oil imports). About 94.6% of Japan’s oil imports came from the GCC in Aug.

- Saudi Arabia issued licenses to 162 regional business centres by end-Q3 2023.

- Balance of payments for tourism in Saudi Arabia surged to SAR 40bn (USD 10.67bn) in H1 2023, up by 327% yoy; foreign visitors spent SAR 83.7bn in the country (+130% yoy) during this period.

- The Saudi Ports Authority improved its ranking in UNCTAD’s global liner shipping connectivity index, rising to 77.66 points in Q3 (Q2: 76.16).

- Saudi nationals working in the private sector increased 10.5% yoy to 2.2mn in Q2 2023, according to a report by the National Labour Observatory. Of the Saudi employees, there were 1.3mn males and 900k females, and the total Saudization rate stood at 22.3%.

- Saudi Arabia is putting in a bid to host the 2034 FIFA World Cup: this announcement comes given its ongoing plans to welcome football fans as it hosts the 2023 FIFA Club World Cup (in Dec) and 2027 AFC Asian Cup.

UAE Focus![]()

- UAE PMI increased to 56.7 in Sep (Aug: 55.0), with the new orders sub-index rising to the fastest since Jun 2019 (to 64.7 from Aug’s 57.6) and output up 0.9 points to 62.8. While new export orders were the most in over 4 years, employment slowed to a 7-month low, and confidence was the highest since Mar 2020.

- Real GDP in Abu Dhabi grew by 3.5% yoy in Q2(Q1: 3.9%), bringing the half year growth this year to 3.7% (H1 2022: 10.5%). Non-oil growth surged, touching AED 154.11bn in Q2 (12.3% yoy & 5.5% qoq): the highest quarterly non-oil GDP reading since 2014. The financial sector grew the most in Q2 (29.8% yoy – the fastest pace since 2014), followed by construction (19.1%) and transportation & storage (16.9%).

- Dubai attracted 511 greenfield projects in H1 2023, topping the global list and accounting for 6.58% of total greenfield FDI projects (H1 2022: 3.83%). Dubai’s greenfield FDI projects account for 65% of total announced FDI projects (880 projects, +70% yoy) during the period.

- ADIA’s investment of INR 49.67bn (USD 598mn) in India’s Reliance Retail Ventures, translates into a 0.59% stake in the firm, and comes ahead of the latter’s potential IPO.

- Abu Dhabi’s IHC increased its stake in India’s Adani Enterprises to more than 5%, a few days after it sold stakes in other Adani Group firms, stating that it believes in the firm’s ability to “incubate” and scale up airports, data centres and green hydrogen businesses.

- Luxury home sales in Dubai (those worth USD 10mn+) touched USD 1.6bn in Q3, up by 41.6% yoy, according to a report from Knight Frank. Total sales stood close to USD 5bn in Jan-Sep 2023. The number of luxury homes sold in Jan-Sep was 277 in Dubai, ahead of New York, Hong Kong and London, and the cash buyers dominated activity.

- Real estate services firm CBRE revealed that there was a 43.5% increase in tenancy contracts in Dubai to 325,727 till Jul 2023 compared to the same period in 2019. Additional costs have deterred renters from moving properties: there was a 12.6% drop in the total number of new contracts registered, in contrast to a 29% growth in renewed lease signups.

- UAE inaugurated its first large-scale utility wind power project: developed by Masdar, the four wind farms (located in Fujairah and Abu Dhabi) have a total combined capacity of 103.5MW and will power 23,000 homes.

- ADNOC’s Ruwais refinery received the International Sustainability and Carbon Certification to supply sustainable aviation fuel (SAF). The firm will release its first batch of SAF later this month, which will be enough to fuel a 787-10 Dreamliner flight from Abu Dhabi to Paris. Separately, ADNOC awarded two engineering, procurement and construction contracts worth roughly USD 16.94bn for a gas project aimed at producing 1.5 billion standard cubic feet per day of gas before the end of the decade.

- Dubai Electricity and Water Authority (DEWA) signed a 30-year water purchase agreement with Saudi Arabia’s ACWA Power for developing the first phase of the seawater reverse osmosis plant at Hassyan. Once completed, water desalination capacity is expected to rise to 670mn imperial gallons per day (MIGD) by 2027 (from 490 MIGD currently) and is in line with DEWA’s initiative to raise capacity to 730 MIGD by 2030.

- A preliminary agreement between UAE’s Masdar and the Malaysian Investment Development Authority will see the joint establishment of 10GW of renewable energy capacity worth USD 8bn by 2025.

- The UAE was ranked fourth globally in terms of international tourist spending by the UN World Tourism Organisation, behind US, Spain and the UK, with visitors spending AED 224bn in 2022.

- Hotels in the UAE generated revenues worth AED 26bn (+24% yoy) in Jan-Jul 2023, after hosting 16mn guests (15%+ yoy). Hotel occupancy rate reached 75% from Jan-Jul, up 5% yoy.

- The Ministry of Human Resources and Emiratisation disclosed that over 6.5 million employees have subscribed to the Unemployment Insurance Scheme from Jan 1st (when registration started) to Oct 1st, 2023.

Media Review

The Gulf is on track to lead global climate tech: Dr. Nasser Saidi

https://www.agbi.com/opinion/the-gulf-is-on-track-to-lead-global-climate-tech/

World Bank’s MENA update, Oct 2023

https://openknowledge.worldbank.org/server/api/core/bitstreams/6188e5e6-1432-4f18-bfd9-2d6fc24eeb07/content

https://www.worldbank.org/en/news/press-release/2023/10/05/sharp-deceleration-expected-for-middle-east-and-north-africa-economies-in-2023

The Global Recovery Is Faltering

https://www.project-syndicate.org/commentary/world-economy-losing-momentum-by-eswar-prasad-2023-10

How Managing Inflation Expectations Can Help Economies Achieve a Softer Landing

https://www.imf.org/en/Blogs/Articles/2023/10/04/how-managing-inflation-expectations-can-help-economies-achieve-a-softer-landing

Russia surpasses UAE as India’s top naphtha supplier amid discounts

https://www.reuters.com/business/energy/russia-surpasses-uae-indias-top-naphtha-supplier-amid-discounts-2023-10-05/

Powered by: