Markets

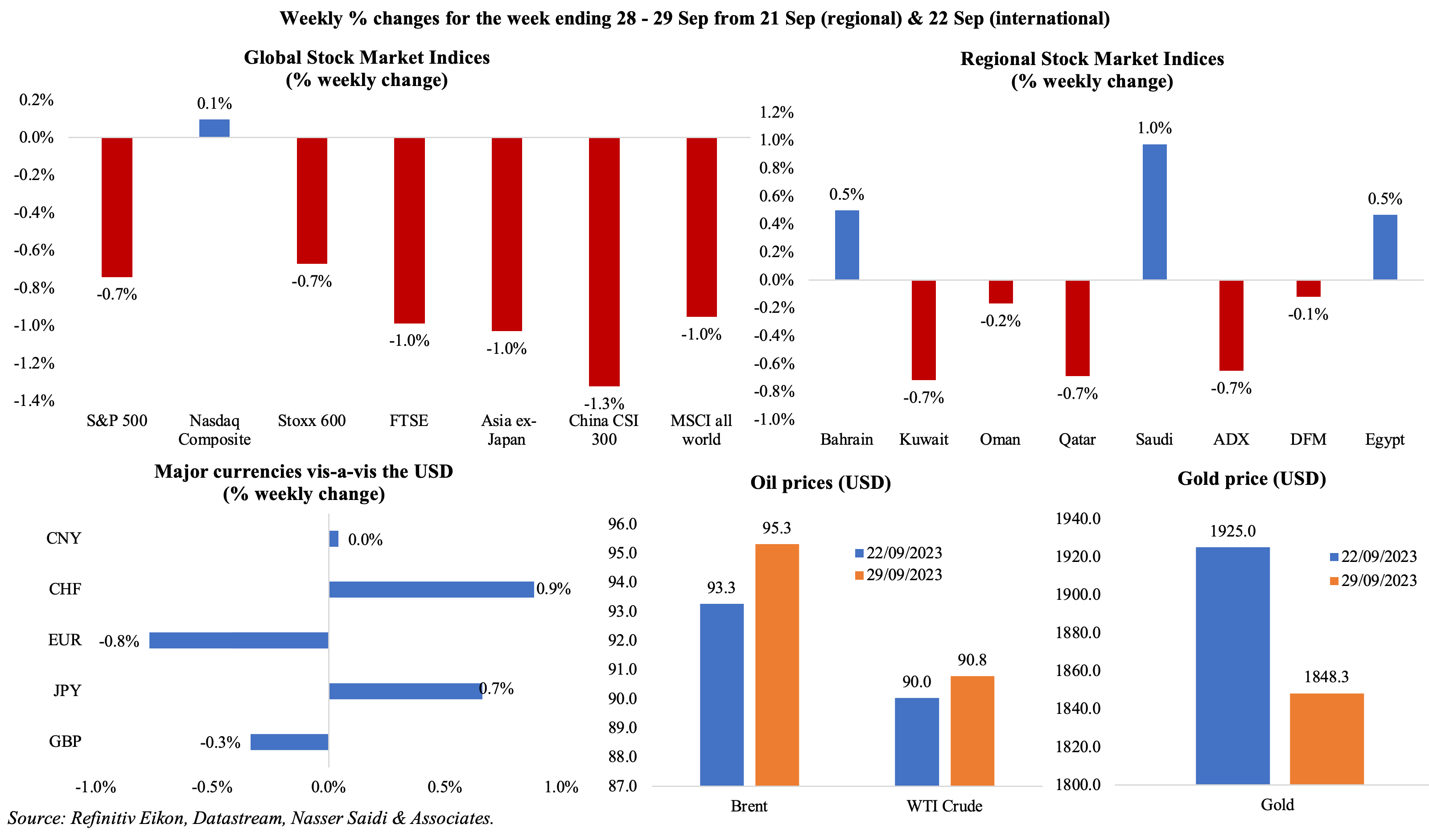

Major equity markets ended in the red for the last week of Sep: threats of a partial Federal shutdown in the US, the auto workers strike and indicators of a weakening economy affected sentiment in the US, while Europe’s drop in inflation only provided an early boost before its impact waned, with Europe teetering into recession. The MSCI equities index fell 4.3% in the month of Sep (the most in a year) and posted the first quarterly drop in a year (-6.6%). Regional markets were mostly down on expectations of higher interest rates for longer, given their dollar peg; Saudi Tadawul posted its biggest gain in nearly four months on Wednesday before receding the next day. The dollar gained for the 11th week in a row, also posting its biggest quarterly gain in a year; the yen is still trading close to the 150-mark (one that could result in authorities’ intervention). Oil prices touched a new 10-month high last week, while for the quarter it was up by around 30%. Gold prices declined compared to a week ago, and in monthly and quarterly terms.

View Reuters 2023 asset performance chart (year-to-date & quarter-to-date till end-Sep).

Global Developments

US/Americas:

- GDP growth in the US remained (from the second estimate) at an unchanged 2.1% annualised rate in Q2. Consumer spending was lowered to 0.8% from the previous estimate of 1.7% while this was offset by an increase in the estimate for business investment.

- Core PCE softened in Aug, rising by 0.1% (Jul: 0.2%), the slowest monthly pace since Nov 2020. In yoy terms, core PCE was 3.9% in Aug – the first time below 4% since Jun 2021.

- Personal spending rose by 0.4% in Aug (Jul: 0.9%), with the rise partly due to rising gasoline prices as well as increased expenditure on housing, utilities and transportation among others. Income also grew by 0.4% alongside a 0.5% jump in wages. Saving rate slipped to 3.9% in Aug (Jul: 4.1%), the lowest reading since Dec.

- Durable goods orders unexpectedly rebounded by 0.2% mom in Aug (Jul: -5.6%); transportation equipment orders fell by 0.2%, due to a 15.9% plunge in civilian aircraft. Non-defence capital goods orders excluding transportation bounced back by 0.9% (Jul: -0.4%).

- Richmond Fed manufacturing index rose to 5 in Sep (Aug: -7), the first positive reading since the spring of 2022, with all 3 components posting increases: shipments (7 from -5 in Aug), new orders (3 from -11) and employment (7 from -3).

- Dallas Fed manufacturing business index worsened to -18.1 in Sep (Aug: -17.2), the 17th straight month in contraction, despite a jump in production (20 points to 7.9, the highest in 2023).

- The Chicago Fed national activity index fell to -0.16 in Aug (Jul: 0.07), with declines posted in two of the four sub-categories compared to a month ago (production & income and consumption & housing).

- Michigan consumer sentiment index slipped to 68.1 in Sep (Aug: 71.6), with expectations over personal finance dragging down current economic conditions (to 71.4 from 75.7 in Aug). Inflation expectations for one- and five-year ahead was 3.2% and 2.8%, lower than Aug’s readings of 3.5% and 3% respectively.

- S&P Case Shiller house price index inched up 0.1% yoy in Jul (Jun: -1.2% yoy). Home price in Jul is about 45% higher than it was four years ago in pre-Covid Jul 2019.

- New home sales plunged by 8.7% mom to a seasonally adjusted 675k in Aug (Jul: 8%); the median new house price stood at USD 430,300 (-2.3% yoy) and there were 436k new homes on the market. However, the rise in mortgage rates is likely to depress sales further: the 30-year fixed mortgage rose to an average 7.19% 2 weeks ag, the highest since Jul 2001.

- Pending home sales in the US fell by 7.1% mom in Aug after 2 months of gains, as mortgage rates crossed the 7%-mark (vs a range of 4.99%-5.5% a year ago). The monthly drop is the largest since Sep 2022, while in yoy terms sales were down by 18.7%.

- Initial jobless claims inched up by 2k to 204k in the week ended Sep 22nd and the 4-week average slipped by 6.25k to 211k. Continuing jobless claims rose by 12k to a low 1.67mn in the week ended Sep 15th.

Europe:

- Inflation in the EU slipped to 4.3% in Sep (Aug: 5.2%), the slowest since Oct 2021; core inflation, at 4.5%, posted the biggest fall since Aug 2020 (Aug 5.3%).

- Eurozone economic sentiment index in Sep moved lower to 93.3 (Aug: 93.6), posting the lowest reading since Nov 2020. Business climate eased to -0.36 (Aug: -0.41) while consumer confidence slipped 1.8ppts down to -17.8.

- Inflation in Germany fell sharply to 4.3% in Sep (Aug: 6.4%), the lowest reading since the war in Ukraine began in Feb 2022. Core inflation fell to a 1-year low of 4.6%. Separately, German import prices recorded the largest yoy decline since Nov 1986 in Aug (-16.4%), partly due to base effects.

- Germany IFO business climate index fell to 85.7 in Sep (Aug: 85.8), declining for the fifth month in a row. Current assessment worsened to 88.7 (from 89 in Aug) while expectations inched up to 82.9 (Aug: 82.7).

- Retail sales in Germany unexpectedly fell by 1.2% mom in Aug from a flat reading the month before. This was the steepest fall since Dec 2022, with both food and non-food sales dropping (-1.2% and -0.7% respectively). In yoy terms, sales fell by 2.2%.

- The number of unemployed in Germany rose by 10k in seasonally adjusted terms to 2.642mn in Sep. Sep also saw fewer job openings: down by 112k from Sep 2022 to 761k.

- Consumer confidence in Germany dipped to -26.5 in Oct (Sep: -25.6), the lowest since Apr. Propensity to save saw a massive increase (8.0 from 0.5), the highest since Apr, while income expectations and propensity to buy were weak (-11.3 and -16.4 respectively).

- UK GDP grew by 0.2% qoq in Q2 (Q1: 0.3%), with household spending up by 0.5% in Q2 and disposable income up by 1.2%. Q2 GDP was 1.8% above pre-pandemic level in Q4 2019.

Asia Pacific:

- China NBS manufacturing PMI inched up to 50.2 in Sep (Aug: 49.7), the first 50+ reading since March, thanks to increases in output (52.7 from 51.9), new orders (50.2) and buying levels (50.7). Non- manufacturing PMI moved to 51.7 in Sep (Aug: 51), the 9th consecutive month of expansion, even though new orders and overseas orders remained below-50.

- Caixin manufacturing PMI fell to 50.6 in Sep (Aug: 51): output expanded while export orders fell and employment declined. An increase in input costs was transferred to consumers: output prices rose for the first time in 7 months and to the highest since Mar 2022.

- Core inflation in Tokyo eased for the third straight month in Sep: but at 2.5% (Aug: 2.8%), it remains higher than the BoJ’s 2% target for the 16th month in a row. Excluding fresh food and fuel, prices were up 3.8% yoy (Aug: 4%).

- Japan industrial production was flat in Aug (Jul: -1.8% mom), alongside a sharp decline in automobile production (-4% mom in Aug vs 0.4% gain in Jul), partly due to plant shutdowns. IP fell by 3.77% yoy in Aug, the most since Apr 2020, following Jul’s 2.3% drop.

- BoJ’s Tankan survey showed that big manufacturers’ business confidence index rose to 9 in Sep (Jun: 5) while for big non-manufacturers it rose to 27 (from 23). Inflation expectations remain quite high: firms expect consumer prices to rise 2.5% a year from now (Jun: +2.6%), an annual 2.2% in 3 years and an annual 2.1% in 5 years from now.

- Japan retail sales expanded for the 18th straight month in Aug, up by 7% yoy – this was the fastest pace since Feb 2023. Food, automobile, and fuel retailers gained the most: 9.4%, 9% and 7.9% respectively. In mom terms, sales inched up by 0.1% (Jul: 2.2%).

- Leading economic index rose to 108.2 in Jul from the preliminary estimate of 107.6, though remaining below Jun’s 108.8 reading (largely due to a contraction in manufacturing). Coincident index slipped to 114.2 in Jul, from the flash estimate of 114.5 and Jun’s 115.6.

- Current account deficit in India widened to USD 9.2bn in Q2 or 1.1% of GDP (Q1: USD 1.3bn or 0.2% of GDP). Foreign exchange reserves increased by USD 24.4bn, and net FDI decreased to USD 5.1bn.

- Inflation in Singapore eased to 4% in Aug (Jul: 4.1%), the lowest since Jan 2022; while food and household durables costs moved lower (to 4.8% and 5.1% respectively), transport and healthcare became more expensive (4.8% and 4.3%). Core inflation moved to 3.4% (Jul: 3.8%), the lowest since Apr 2022.

- Singapore’s industrial production fell by 10.5% mom and 12.1% yoy in Aug (Jul: -1.1% yoy). This was the 11th straight month of yoy decline, and the sharpest decline since Nov 2019, largely owing to the fall in electronics output (-20% yoy vs Jul’s 5.1%).

Bottom line: The US Federal government shutdown was avoided for the time being – the short-term funding bill enables the government to remain open through November 17. However, the increased political bickering and dysfunctional politics suggests that more is to come before year-end. Looking ahead this week, the US jobs report is expected to show signs of a hiring slowdown, and will offer insights to Fed’s next move (deceleration in jobs lower the chances of another rate hike). With oil prices inching closer to the USD 100-mark, the meeting of the OPEC+ panel (Joint Ministerial Monitoring Committee) this week will be watched closely: it is unlikely that the current policy will be changed. Meanwhile, signs of current oil demand can be gauged from China’s Golden Week holidays, which usually sees a surge in domestic and international travel.

Regional Developments

- Bahrain’s imports grew by 3% yoy to BHD 534mn (USD 1.416bn) in Aug, with China ranking first (BHD 78mn), Australia (BHD 48mn) and Brazil (BHD 47mn). Exports of national origin plunged by 22% yoy to BHD 324mn: Saudi, UAE and US were the main destinations. Re-exports increased by 8% to BHD 70mn.

- Domestic debt issued by Egypt’s government touched EGP 4.67trn (USD 151bn) in Aug, according to the ministry of finance. Treasury bills formed the bulk (EGP 2.449trn), followed by treasury bonds (EGP 2.25trn).

- Money supply (M2) in Egypt rose by 24.381% yoy to EGP 8.468trn (USD 274.49bn) in Aug, according to the central bank. Net foreign assets deficit narrowed by EGP 24.9bn to a negative EGP 801.3bn in Aug.

- At the AIIB annual meetings last week, Egypt’s PM stated that EGP trillions had been invested in building infrastructure to support growth while also disclosing that AIIB’s investment portfolio in Egypt amounts to USD 1.3bn. Separately, the finance minister reiterated plans to boost private sector’s role in increasing economic activity to 65% in the medium term.

- Egypt launched an international bidding round for oil and gas exploration in 23 open blocks last week.

- Iraq’s transport adviser to the PM revealed that the 30-km railway link between Iraq and Iran could be completed within 18 months: it would largely be for pilgrims’ transportation.

- The Central Bank of Kuwait announced that a questionnaire to calculate PMI had been developed, and initial results would be available for internal use from Oct (and will remain so in the pilot phase, 6 months).

- Crude oil exports from Kuwait to Japan fell by 51.2% yoy to 4.68mn barrels |(or 151k barrels per day) in Aug. The nation is Japan’s 3rd biggest oil provider (behind UAE and Saudi Arabia at 1.15mn bpd and 899k bpd respectively).

- Kuwait’s exports to the EU stood at EUR 3.5bn and imports were EUR 5.5bn last year. In the Jan-Jul 2023 period, exports to the EU from Kuwait jumped to EUR 3.16bn: mineral fuels, lubricants and related materials formed the bulk of exports to the EU.

- Inflation in Lebanon jumped to 230% yoy in Aug (and up 1% mom), staying above 100% for the 38th month in a row. Prices were driven up by food (274% yoy), housing & utilities (233%), healthcare (235%) and transport (231%). As cash dollarisation increases, LBP will depreciate further, thereby keeping inflation high.

- Oman’s GDP grew by 2.1% yoy in H1 2023, supported by non-oil sector activity (2.1%) alongside the oil sector (1.4%). The Minister of Economy also revealed that the size of public debt declined to about 37% of GDP.

- The Minister of Heritage and Tourism stated that tourism sector revenues in Oman touched OMR 1.9bn (USD 4.9bn) in 2022. Furthermore, he revealed that the sector’s contribution to GDP will rise to 2.75% in the next 2 years (from 2.4% at end-2022).

- Both Fitch and S&P upgraded Oman’s credit rating. Fitch raised the rating to BB+ on improved finances (i.e. decline in debt-to-GDP and rationalised spending patterns). S&P raised Oman’s credit rating to BB+ with a stable outlook, also stating that further upgrades were possible if the external debt could be reduced.

- Qatar reported a balance of payments surplus of SAR 7.9bn (USD 2.17bn) in Q2 2023, according to the central bank, thanks to surpluses in its goods (QAR 59.6bn) and services (QAR 31.3bn) accounts.

- Private sector exports from Qatar fell by 9% yoy to QAR 15.2bn (USD 4.17bn) in H1 2023 and 31.5% yoy to QAR 6.1bn in Q2, according to data from the Qatar Chamber.

- QatarEnergy’s deal with South Korea’s Hyundai, valued at QAR 14.2bn (USD 3.9bn), sees the construction of 17 LNG carriers in the second phase of the former’s fleet expansion program. In the first phase, 60 carriers were constructed in Korean and Chinese shipyards.

- The Gulf Cooperation Council disclosed that it had “initialized” a free trade agreement with Pakistan, with the GCC Secretary General and Pakistan’s trade ministers as signatories.

- At the Future Hospitality Summit, the UAE Minister of Economy stated that the single visa system across the GCC (similar to the Schengen visa) could be introduced “very soon”, allowing for greater mobility and boosting tourism. Bahrain’s Minister of Tourism revealed that talks have been underway. As of now only GCC citizens enjoy visa-free travel within the GCC with expat residents needing a visa for travel.

- The hotel supply index in the GCC surged in the past 4 years, according to a senior STR official: Doha at 54%, Dubai at 27% and Riyadh at 20%. Furthermore, Makkah is the city with the largest pipeline globally (25k keys), followed by London and Dubai as third (23,500 keys).

- India’s oil imports from Iraq grew by 17% yoy to 1.1mn barrels per day in Sep while imports from Saudi Arabia fellto 676k bpd (-10% mom), according to LSEG data.

Saudi Arabia Focus

- Saudi Arabia, in its preliminary budget statement, disclosed that it expects GDP to grow marginally by 0.03% this year (vs previous projection of 3.1%) and for budget to record a deficit of 2% of GDP (vs previous forecast of 0.4% surplus). For 2024, the government expects total revenues at SAR 1.172trn (USD 312.51bn) and total spending of SAR 1.251trn: this compares to an estimated SAR 1.18trn in revenues in 2023, and spending of SAR 1.262trn. Given deficits, the nation will prepare an annual borrowing plan and “access global debt markets to enhance the kingdom’s position in international markets”, according to the ministry of finance.

- Unemployment among Saudi citizens fell to 8.3% in Q2 (Q1: 8.5%; Q2 2022: 9.7%). Overall unemployment rate (including expats) declined to 4.9%. Female citizens unemployment rate slipped to 15.7% while for male citizens it stood at 4.6%.

- Saudi Arabia issued 136 industrial licenses in Aug (Jul: 102), with food product manufacturing sector receiving the most 29 permits; this brings the total this year to 795 licenses. The Ministry of Industry and Mineral Resources stated that the number of factories this year touched 11,110 and its total investments reached SAR 1.489trn (USD 400bn).

- Saudi Arabia’s Ministry of Investment plans to grant incentives and premium residency to executives based at regional headquarters. Thisincludes granting visas based on the firm’s requirements, allowing spouses under the family residency to work, and extending the age limit for dependents allowed to stay with regional headquarters employees to 25 years.

- Saudi cargo business SAL Saudi Logistics Services Co, owned by Saudia (70%) and Tarabot Air Cargo Services (30%), set a price range of SAR 98-106 per share. This will enable the firm to raise as much as SAR 2.54bn from its IPO.

- Bilateral trade between Saudi Arabia and Singapore stands at USD 12bn, disclosed the former’s minister of commerce. Saudi Arabia is a main trade partner for Singapore in the Middle East, with the total value of annual trade growing by 47% yoy in 2022.

- Endowment investment funds in Saudi Arabia increased by 13 to a total 24 this year, as per the General Authority of Awqaf. The funds’ net assets crossed SAR 500mn this year.

- According to the Saudi ambassador to the US, women-owned start-ups in Saudi Arabia account for 40% of the total and the participation of women in the workforce has doubled in the last 5 years.

- Saudi Aramco will acquire a minority stake in LNG firm MidOcean Energy for USD 500mn, thereby tapping into LNG opportunities globally.

- Electric vehicle firm Lucid opened its first international manufacturing plant in Jeddah. The facility has an initial capacity to produce 5,000 units a year and plans to scale this up to produce 155k units per annum.

- With an aim to link power grids, Greece and Saudi Arabia agreed to setup a company (Saudi Greek Interconnection) to study the commercial viability. Greece’s IPTO and Saudi’s National Grid will each hold a 50% stake in the firm.

UAE Focus![]()

- Dubai’s public debt will decline by AED 29bn (USD 7.9bn) by end of 2023, according to WAM, citing data from the Public Debt Management Office. This includes a “partial settlement” of a combined AED 20bn loan from Abu Dhabi and the central bank as well as bilateral and syndicated loans and the redemption of sukuk.

- The Crown Price of Dubai approved a set of new transformative projects as part of the third phase of Dubai 10X initiative: this includes projects in transportation, aviation, urban planning and healthcare.

- UAE and the Egypt central bank entered a bilateral swap deal in local currencies with a nominal amount of up to AED 5bn (USD 1.36bn).

- Abu Dhabi is investing AED 10bn (USD 2.7bn) to more than double the size of its manufacturing sector to AED 172bn, create 13,600 skilled jobs and raise non-oil exports to AED 178.8bn by 2031.

- The UAE-Thailand CEPA (currently in negotiations) is expected to contribute about USD 250mn to bilateral trade and at least USD 300mn to the latter’s GDP, according to the ambassador of Thailand to the UAE.

- UAE-based supermarket franchise Spinneys is planning an IPO in Q2 2024: the company has 65 outlets in the UAE and operates 7 stores in Oman.

- India permitted the export of 75,000 tonnes of non-Basmati white rice to the UAE via the National Cooperative Exports Limited (NCEL). The government has allowed non-basmati rice exports to Bhutan, Mauritius and Singapore through the NCEL.

- Abu Dhabi’s IHC is planning to sell its stake in 2 of Adani Group companies – Adani Green Energy & Adani Energy Solutions – as part of its “portfolio rebalancing strategy”.

- ADNOC and Taqa secured financing for a USD 2.2bn project to provide sustainable water supply to ADNOC’s onshore operations. The project will include a centralised seawater treatment facility along with a transportation and distribution network.

Media Review

Dr. Nasser Saidi’s Al Arabiya interview (in Arabic) on the US shutdown

Reuters: US-Saudi defence pact tied to Israel deal, Palestinian demands put aside

https://www.reuters.com/world/us-saudi-defence-pact-tied-israel-deal-palestinian-demands-put-aside-2023-09-29/

Saudi Arabia’s New Nationalism

https://www.project-syndicate.org/commentary/mbs-behind-saudi-nationalist-surge-by-bernard-haykel-2023-09

Forget the shutdown. America’s real fiscal worry is rising bond yields

https://www.economist.com/leaders/2023/09/28/forget-the-shutdown-americas-real-fiscal-worry-is-rising-bond-yields

IMF charts: US dollar share of global FX reserves stays at 58.9% in Q2 2023

https://data.imf.org/?sk=e6a5f467-c14b-4aa8-9f6d-5a09ec4e62a4

World Bank: Sustained Growth, Momentum Slowing in East Asia and Pacific

https://www.worldbank.org/en/news/press-release/2023/10/01/east-asia-and-pacific-sustained-growth-momentum-slowing

Powered by: