Markets

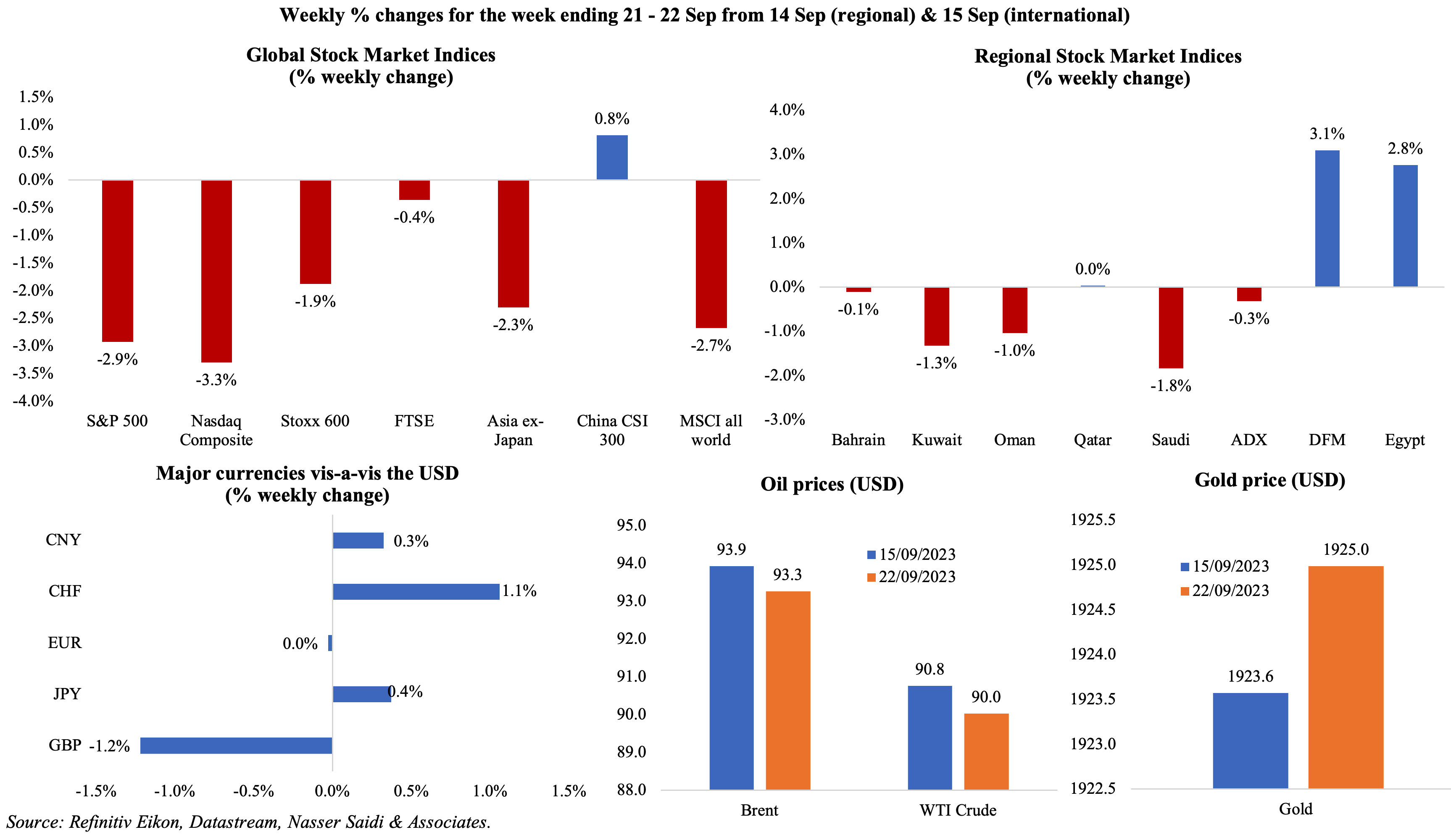

Major global equities markets posted weekly declines, as investors turned risk-averse with possibility that interest rates will stay higher for longer: US indices & MSCI global index posted the biggest declines since early March. Regional markets were mostly down except for DFM (which hit an 8-year high on Thursday, thanks to gains in banking & real estate) and Egypt (which touched new record highs, supported by foreign investors). The GBP touched the lowest level in 6 months (vs the USD) following the BoE decision to hold rates while the yen is close to the 150-mark, a level near where government intervention is considered likely. Oil prices has risen above USD 90 to 10-month highs as supply concerns grew, but profit taking led to a marginal weekly decline (breaking the 3 weeks of gains). Gold price meanwhile edged higher.

Global Developments

US/Americas:

- US Fed kept interest rates steady at the latest meeting, a unanimous decision, but warned of further hikes and that policy is likely to stay higher and remain so for longer than expected. The Fed’s new dot plot indicates one more hike in 2023 and only 50bps worth of cuts in 2024.

- Housing starts plunged by 11.3% mom to 1.283mn, the lowest since Jun 2020; single-family starts fell by 4.3% to 941k units. Building permits in the US grew by 6.9% mom to 1.543mn in Aug (the highest since Oct 2022), boosted by multi-family housing permits. The recent surge in mortgage rates is concerning: the 30-year fixed mortgage is around 7.18%, the highest since Mar 2002.

- Existing home sales unexpectedly fell by 0.7% mom to 4.04mn in Aug. Sales were affected by tight supply as inventory of pre-owned homes fell by 14.1% yoy to 1.1mn (lowest Aug reading ever). The median existing house price increased 3.9% yoy to USD 407,100.

- Philadelphia Fed manufacturing index fell to -13.5 in Sep (Aug: 12), the 14th negative reading in 16 months, as new orders and shipments moved to negative readings (of -10.2 and-3.2 respectively, from Aug’s 16 and 5.7).

- S&P manufacturing PMI climbed to 48.9 in Sep (Aug: 47.9), as contractions in output and new orders softened. Services and composite PMI slowed to 8 and 7-month lows of 50.2 and 50.1 respectively (Aug: 50.5 & 50.2). New orders fell, but at a faster pace for services (compared to manufacturing). Input prices are rising given wage costs and fuel expenses.

- Initial jobless claims fell by 20k to an 8-month low of 201k in the week ended Sep 15th, and the 4-week average slipped by 7.75k to 217k. Continuing jobless claims declined by 21k to 1.662mn in the week ended Sep 8th, the lowest level since Jan.

Europe:

- Inflation in the eurozone was slightly revised down in Aug: overall inflation eased to 5.2% in Aug (flash estimate: 5.3%). Services added 2.41-ppts to the final yoy inflation while core inflation was in line with initial estimates at 5.3%.

- Preliminary manufacturing PMI in the eurozone inched lower to 43.4 in Sep (Aug: 43.4), as new orders contracted, and employment fell for a 4th month. Services and Composite PMIs improved by 0.5 points to 48.4 and 47.1 respectively.

- Consumer confidence fell further in the EU and euro area to -18.7 and -17.8 in Sep (Aug: -17.1 and -16 respectively), much further below the long-term average.

- German producer price index dived 12.5% yoy in Aug (Jul: -6%): this was the biggest yoy decline since 1949. This was partly due to comparison to the highest-ever jump recorded in Aug 2022 (given the war in Ukraine).

- The preliminary manufacturing PMI in Germany edged higher to 39.8 in Sep (Aug: 39.1), with output falling to a 40-month low of 39.2 as demand faltered; new orders fell but at a weaker rate. Services and composite PMIs moved up to 49.8 and 46.2 (Aug: 47.3 and 44.6 respectively).

- The Bank of England left rates unchanged at 5.25%, after 14 consecutive hikes since Dec 2021. Five MPC members voted for current levels to be “maintained” while 4 chose to hike.

- UK inflation slowed to 6.7% yoy in Aug (Jul: 6.8%), with food inflation declining to 13.6% (Jul: 14.8%) and services sector inflation easing to 6.8% (Jul: 7.4%). Core inflation moved much lower to 6.2% from Jul’s 6.9%. PPI input and output prices weakened as it fell to -2.3% and -0.4% respectively (Jul: -3.2% and -0.7%). Retail price index edged up slightly to 9.1% in Aug (Jul: 9%).

- Retail sales in the UK fell by 1.4% yoy in Aug (Jul: -3.1%). Excluding fuel, sales were down by 1.4% (Jul: -3.3%). In mom terms, sales rebounded by 0.4% (Jul: -1.1%). Compared to pre-Covid times, shoppers spent 17.3% more (impact of inflation) while value was down by 1.5%.

- GfK consumer confidence in the UK improved to -21 in Sep (Aug: -25), the highest reading since Jan 2022, largely buoyed by strong wage growth and easing inflation. Despite improvements in general economic picture, personal finances and potential for major purchases, the sentiment remains much below the long-term average of -10.

- UK services PMI slipped to 47.2 in Sep (Aug: 49.5), the sharpest contraction since Jan 2021, as new work and output fell amid a decline in employment (first time this year). Meanwhile, manufacturing PMI inched up by 1.2 points to 44.2.

Asia Pacific:

- The People’s Bank of China held key lending rates steady, as expected: the one- and five-year loan prime rate were held at 3.45% and 4.2% respectively.

- The Bank of Japan left policy rates unchanged, maintaining ultra-low interest rates and maintained its yield curve control programme.

- Inflation in Japan eased to 3.2% yoy in Aug (Jul: 3.3%), though exceeding the BoJ’s 2% target for the 17th straight month. Excluding fresh food (i.e. the “core” index), prices were unchanged at 3.1%; excluding food and energy (i.e. “core-core”), prices stood at 4.3% (matching Jul’s reading).

- Japan’s exports fell by 0.8% yoy in Aug and imports tumbled by 17.8%, taking the overall trade deficit wider to JPY 930.5bn (the second consecutive month of deficits). Exports to Asia fell by 8.8% while that to China plunged by 11%.

- The preliminary readings of both manufacturing and services PMI in Japan fell by 1 point to 48.6 and 53.3 respectively in Sep. Manufacturing was dragged down by output and new orders shrinking the most in 7 months while services saw foreign demand falling for the first time in 13 months.

Bottom line: Even as the Fed and Bank of England held interest rates steady, following the ECB’s hints of an upcoming pause, the rising oil prices may throw a spanner into the works (calls for USD 100 oil are rising). Many emerging market nations’ central banks meanwhile are holding rates (instead of lowering cuts) to deal with the sliding currencies (e.g. Indonesia & Philippines last week). Preliminary manufacturing PMIs from advanced nations have also not provided much optimism for growth: weakened demand and price pressures were the main highlights.

Regional Developments

- Bahrain clocked in a budget deficit of BHD 381mn (USD 1.01bn) in H1 2023. Revenues touched BHD 1.44bn, lower due to a dip in oil prices while spending stood at BHD 1.82bn (2% lower than estimated). A joint meeting between government and legislative authorities also reviewed a proposal to raise the public debt ceiling by BHD 1bn to cover financing needs.

- The central bank of Egypt left interest rates unchanged, citing that underlying price pressures were easing. It is possible that the rates are not being hiked ahead of a potential devaluation move.

- Egypt and IMF agreed to merge the first and second reviews of its economic reform program after the initial review was delayed on questions related to progress of reform implementation (including a proposed devaluation).

- Egypt plans to list shares in the Administrative Capital for Urban Development – the firm building the new capital – by Q2 2024. About five or 10% of the firm is likely to be listed, according to the chairman of the company. The company is currently owned by the military (51%) and the government’s New Urban Communities Authority (49%).

- Oil and gas production in Egypt will be boosted by plans to drill new wells in the Zohr gas field through 2024 and 2025, as per the minister of petroleum & mineral resources. In the fiscal year 2022-2023, average daily production of natural gas from the Zohr field was about 2.4bn cubic feet, and about 3,700 barrels per day of condensates.

- The supply minister in Egypt disclosed that the nation is in talks with UAE-based Abu Dhabi Commercial Bank(ADCB) for the potential financing of its wheat purchases.

- Inflation in Kuwait inched up to 3.82% in Aug (Jul: 3.75%): while food inflation eased to a 3-year low of 5.7%, costs were higher for health (2.6% from Jul’s 2.3%) and recreation &culture (3.3% from 3.1%) among others. Money supply growth eased in Aug, rising by 3.65% yoy compared to Jul’s 3.93% gain.

- Kuwait’s trade surplus with Japan narrowed by 44.1% yoy to JPY 66.7bn (USD 451mn) in Aug, largely due to weaker exports (-34.2% yoy to JPY 87.8bn).

- GDP in Oman shrank by 9.5% yoy to OMR 10.1bn (USD 26.24bn) in Q2 2023, as oil sector activity dipped by 18.3% alongside a 3.6% drop in non-oil activity.

- Oman’s OQ Gas Networks set the IPO price range to between OMR 0.131 and 0.140 (USD 0.34-0.36) to institutional investors and OMR 0.126 per share for retail. The firm plans to float about 2.12bn shares, equivalent to up to 49% of share capital.

- Jewellery exports from Oman more than doubled in 2022: it grew by 104% yoy to OMR 46.42mn (USD 120.57mn), largely as re-exports grew more than 4-fold to OMR 33.367mn.

- Inflation in Qatar eased to 2.38% yoy in Aug (Jul: 3.11%), the lowest reading since Jun 2021. Restaurants & hotels prices fell by 4.6% in Aug while housing & utilities costs eased (1% from Jul’s 4.5%) as did food & beverages (0.8% from 1.5%).

- Reuters reported that Qatar held bilateral meetings separately with Iran and the US last week to reach an “understanding” on the nuclear issue, with more such talks likely this week.

- Saudi Arabia is currently the 18th largest investor in US Treasury bondsglobally as of Jul 2023: at USD 109.2bn, this is the first monthly increase in 4 months (0.1% mom). Both Kuwait and Saudi Arabia have decreased their holdings compared to end-2022 – by 12.4% and 8.8% respectively. UAE’s holdings clocked in at USD 64.9bn in Jul, up 10.8% from end-2022, but it lower than this year’s high of USD 70.2bn (in Apr).

- The Gulf Electricity Interconnection expansion project secured a USD 570mn loan from the Kuwait Fund for Arab Economic Development. Kuwait will receive an additional supporting capacity of 2,500 MW supporting the nation’s electricity grid.

- A report by the Global Energy Monitor reported an increase in MENA region’s renewable energy capacity to 361 GWby mid-2023 (292 GW or 400% yoy growth since mid-2022). About 47% (171 GW) are in pre-construction, while 46% of prospective projects have just been announced. More: https://globalenergymonitor.org/report/mena-grows-renewables-by-half-but-clings-to-risky-hydrogen-and-gas/

- Kenya extended an oil supply deal till end-Dec 2024: this deal was entered into in Mar with Saudi Aramco, Abu Dhabi National Oil Co. and Emirates National Oil Co. in a bid to drive down the cost of transporting oil and the premium it pays to suppliers.

- The 2023 IMD World Talent Ranking places UAE top in the region (22nd among 64 nations), followed by Bahrain (up 8 places to 27th), Kuwait (28th), Qatar (+4 to 30th), and Saudi Arabia (36th). The list, compiled using hard data and survey responses, was topped by Switzerland, Luxembourg and Iceland. More: https://www.imd.org/centers/wcc/world-competitiveness-center/rankings/world-talent-ranking/

Saudi Arabia Focus

- Saudi Arabia’s GDP exceeded USD 1trn mark, reaching the national goal ahead of the 2025 target date, and grew by 8.7% in 2022 (the highest among G20 nations), according to the Saudi Press Agency, citing a report by the Federation of Saudi Chambers.

- Various reports on Saudi Arabia and normalisation with Israel: in an interview with Fox News, the Saudi Crown Prince mentioned that “every day we get closer” to open diplomatic relations between the two nations, while also stating that “For us, the Palestinian issue is very important” and that it needs to be solved. This sentiment was also earlier echoed by the Saudi foreign minister who mentioned “the two-state solution”. Separately the Israeli foreign minister was optimistic – “a likelihood” that details of a deal could be finalised in Q1 2024.

- Saudi Arabia’s overall exports fellby 35% yoy and 0.4% mom to SAR 91.3bn in Jul: this is the lowest reading since Sep 2021. The fall in exports stemmed from oil exports, which plunged by 38% yoy and 2.4% mom. The share of oil exports to overall exports fell to 76.8%. China was the top trade partner, accounting for 17.2% of exports and 20.2% of imports.

- Data from JODI showed that Saudi Arabia’s crude oil exports fell to 6.01mn barrels per day (bpd) in Jul, down by 11.6% mom and their lowest since Jun 2021. Output fell by 943k bpd to 9.01mn bpd in Jul and inventories were down to 146.73mn (down by 2.96mn bpd). Oil demand of nations included in JODI increased by 3.24mn bpd (in yoy terms), remaining at a 5-year seasonal high in Jul.

- Saudi oil and gas driller ADES Holding priced its IPO at the top-end of SAR 13.50 a share, implying a valuation of SAR 15.242bn (USD 4.06bn). The firm drew nearly USD 76.5bn in orders from institutional investors.

- A report from the National Labour Observatory revealed that average wages in Saudi Arabia’s private sector grew by 45% over the past five years – rising to SAR 9,600 in 2023 from 2018’s SAR 6,600. The report also disclosed that those earning more than SAR 20k rose to 202,700 this year (up 139% from 2018’s 84,700).

- The Economic Cities and Special Zones Authority granted Lucid Motors a permit to operate a manufacturing unit in King Abdullah Economic City. Separately, the Wall Street Journal reported that Tesla was in talks with Saudi Arabia to set up a manufacturing facility in the country; this was later denied by Musk.

- The Red Sea International Airport in Saudi Arabia became operational last week. Flights from King Khalid International Airport in Riyadh are scheduled to arrive every Thursday and Saturday, connecting the two destinations in less than two hours.

UAE Focus![]()

- Non-oil sector growth in the UAE touched 4.5% in H1 2023, and this will drive overall growth to more than 6% in 2023, according to the minister of economy.

- UAE reported a 31.8% increase in federal revenues in 2022, enabling the nation to clock in an overall fiscal surplus. Spending grew by 6.1% yoy to AED 427bn in 2022, according to the finance minister, and growth in acquisitions of non-financial assets doubled.

- UAE’s minister of state for foreign trade disclosed that CEPAs with Pakistan, South Korea and Thailand will be finalised in the next 3 weeks, followed closely by agreements with Costa Rica, Chile & Vietnam (within 3 months).

- The UAE and Serbia have initiated discussions on free trade. UAE is currently the third-largest market for Serbian exports in the Middle East and bilateral non-oil trade touched USD 57.6mn in H1 2023, exceeding the total for the full year 2020.

- The UAE Ministry of Finance successfully closed its offering of USD 1.5bn worth of 10-year USD-denominated bonds, with the order book exceeding USD 7.4bn. Middle Eastern investors took the largest share (45% of the total), followed by American (21%), Asian (11%), Europe and UK investors with 14% and 9% respectively. The 10-year bond, to be listed on the London Stock Exchange and Nasdaq Dubai, has a yield of 4.917%, with a spread of 60bps over US Treasuries.

- The Minister of Economy disclosed UAE’s plans to boost the contribution of food and agriculture by USD 10bn in the next 5 years and create 20,000 jobs alongside measures to boost food security. He also disclosed 7 pillars to achieve this goal – including fostering domestic innovation to create agricultural disruptors, a UAE-first culture across food value chain and enabling players to diversify and gain access to new markets among others.

- An official from the Industrial Development Bureau disclosed that a year after launching Abu Dhabi Industrial Strategy, the number of new industrial licences had increased by 16.6%, and total capital investments by manufacturers operating in the emirate rose by AED 12.42bn to AED 384.06bn by end-Jun.

- ADC Acquisition Corporation, set up as a special purpose acquisition company by state investment fund ADQ, agreed to acquire and merge with ADQ’s United Printing & Publishing. The transaction gives UPP an enterprise value of AED 623mn (USD 169.63mn) and post-merger, UPP will become a publicly listed company on the Abu Dhabi Securities Exchange.

- Airline flydubai posted a jump in number of passengers carried to over 4mn between Jun to mid-Sep 2023, up 30% yoy. The company operated over 32k flights to over 52 nations.

- Hotel room rates in Abu Dhabi jumped by 24% yoy to nearly AED 500 (USD 136) in Jan-Aug this year, according to STR. Room rates year-to-date are 17% higher compared to 2019 levels, and revenue per available room stands at around USD 100 during the period.

- Knight Frank, in a recent report, disclosed that UAE’s hotel room inventory is expected to surge with the addition of 9200 new hotel rooms in Dubai alone this year. This will take the total number of rooms in Dubai to 154k by end-2023, up 6.4% yoy.

Media Review

Mohammed bin Salman says Saudi Arabia is getting ‘closer’ to Israel normalization

https://www.reuters.com/world/middle-east/saudi-crown-prince-says-getting-closer-israel-normalization-fox-interview-2023-09-20/

US sees big gains if Mideast mega-deal sealed – but at what price?

https://www.reuters.com/world/middle-east/us-sees-big-gains-if-mideast-mega-deal-sealed-what-price-2023-09-19/

How eight mega-projects are transforming Saudi Arabia’s Riyadh into a global destination

https://www.arabnews.com/node/2375896/business-economy

https://www.arabnews.com/node/2377271/business-economy

The Electric Vehicle Revolution Comes for German Industry

https://www.project-syndicate.org/commentary/german-carmakers-should-form-joint-ventures-with-chinese-competitors-by-dalia-marin-2023-09

Countries Can Tap Tax Potential to Finance Development Goals

https://www.imf.org/en/Blogs/Articles/2023/09/19/countries-can-tap-tax-potential-to-finance-development-goals

Powered by: