Saudi Arabia exports & US Treasuries holdings. Tourism & air traffic recovery in the Middle East surpasses global + future prospects.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 22 Sep 2023: Will higher fuel prices affect travel & tourism recovery as Saudi Arabia extends production cuts?

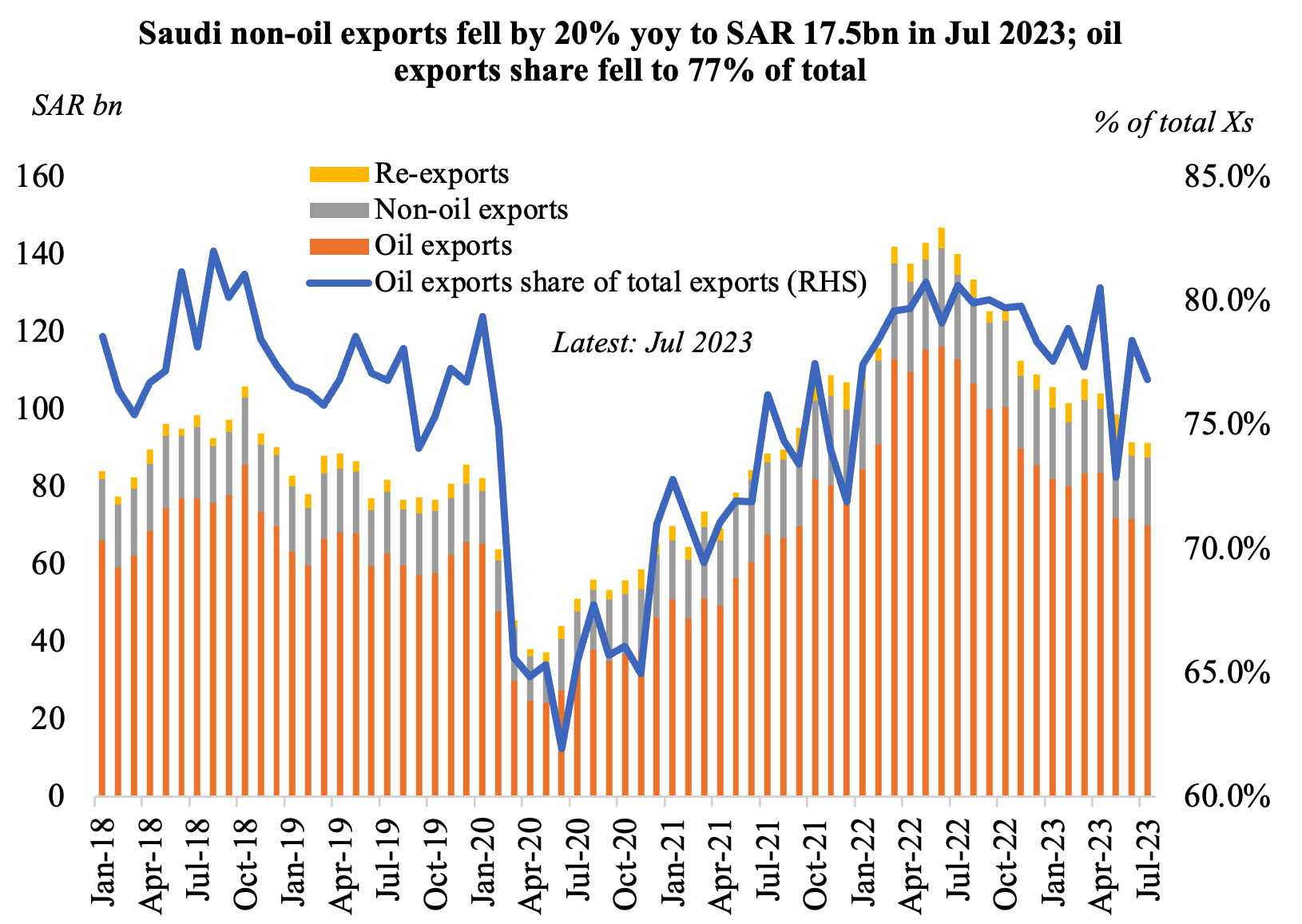

1. Saudi Arabia’s oil exports plunge in Jul, dragging down overall exports

- Saudi Arabia’s overall exports fell by 35% yoy and 0.4% mom to SAR 91.3bn in Jul – this is the lowest reading since Sep 2021. The fall in exports stemmed from oil exports, which plunged by 38% yoy and 2.4% mom. The share of oil exports to overall exports fell to 76.8%.

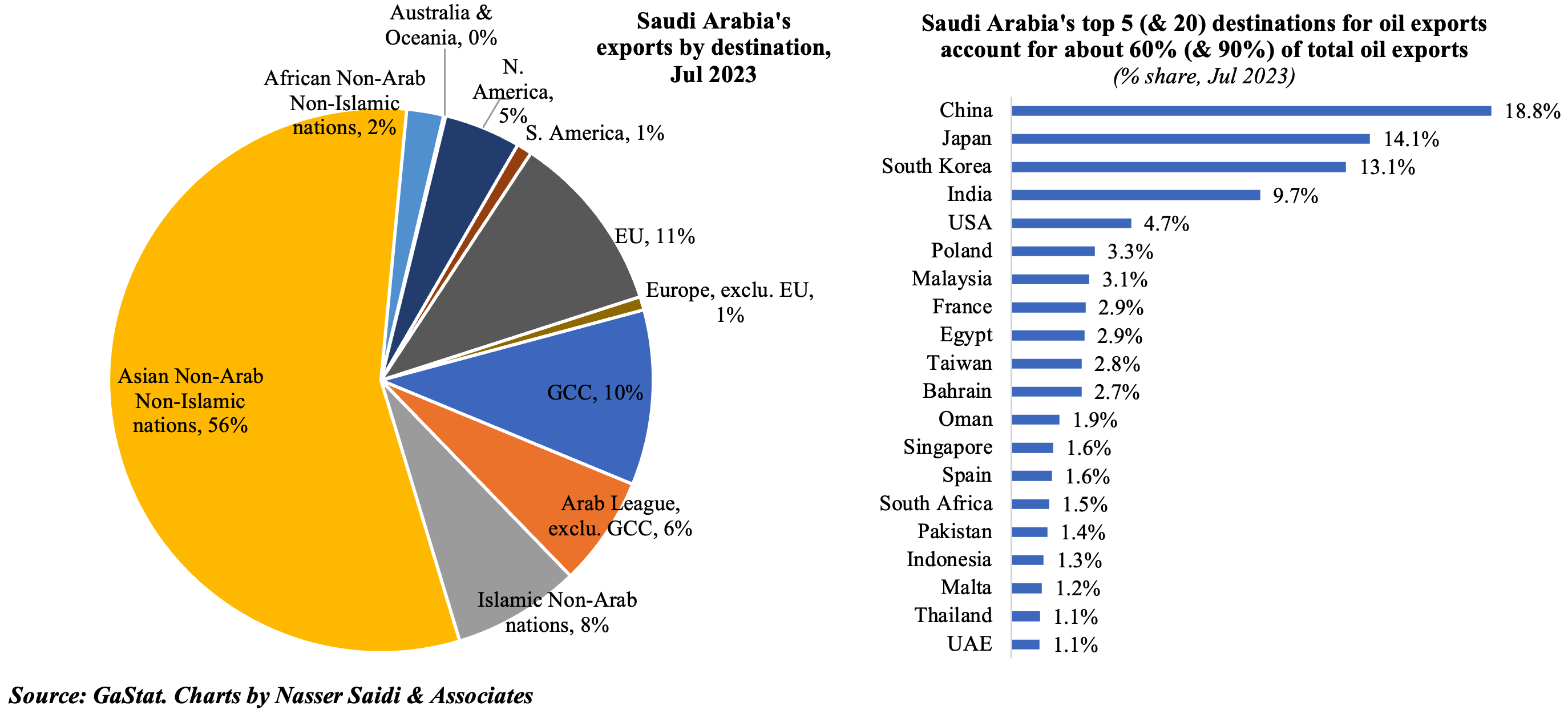

- Oil exports to the top 5 destinations (China, Japan, South Korea, India and the US) accounted for 60.4% of the total oil exports in Jul and for the top 20 it was just higher than 90%.

- Largest non-oil exports (including re-exports) were chemicals & allied products and plastics (close to 60% of outbound trade).

- Imports increased sharply: 19.7% yoy and 6.7% mom to SAR 68.9bn, led by machinery & mechanical appliances and vehicles (21.4% and 18.5% respectively of total imports).

- China was the top trade partner in Jul: accounting for 17.2% of total exports and 20.2% of total imports.

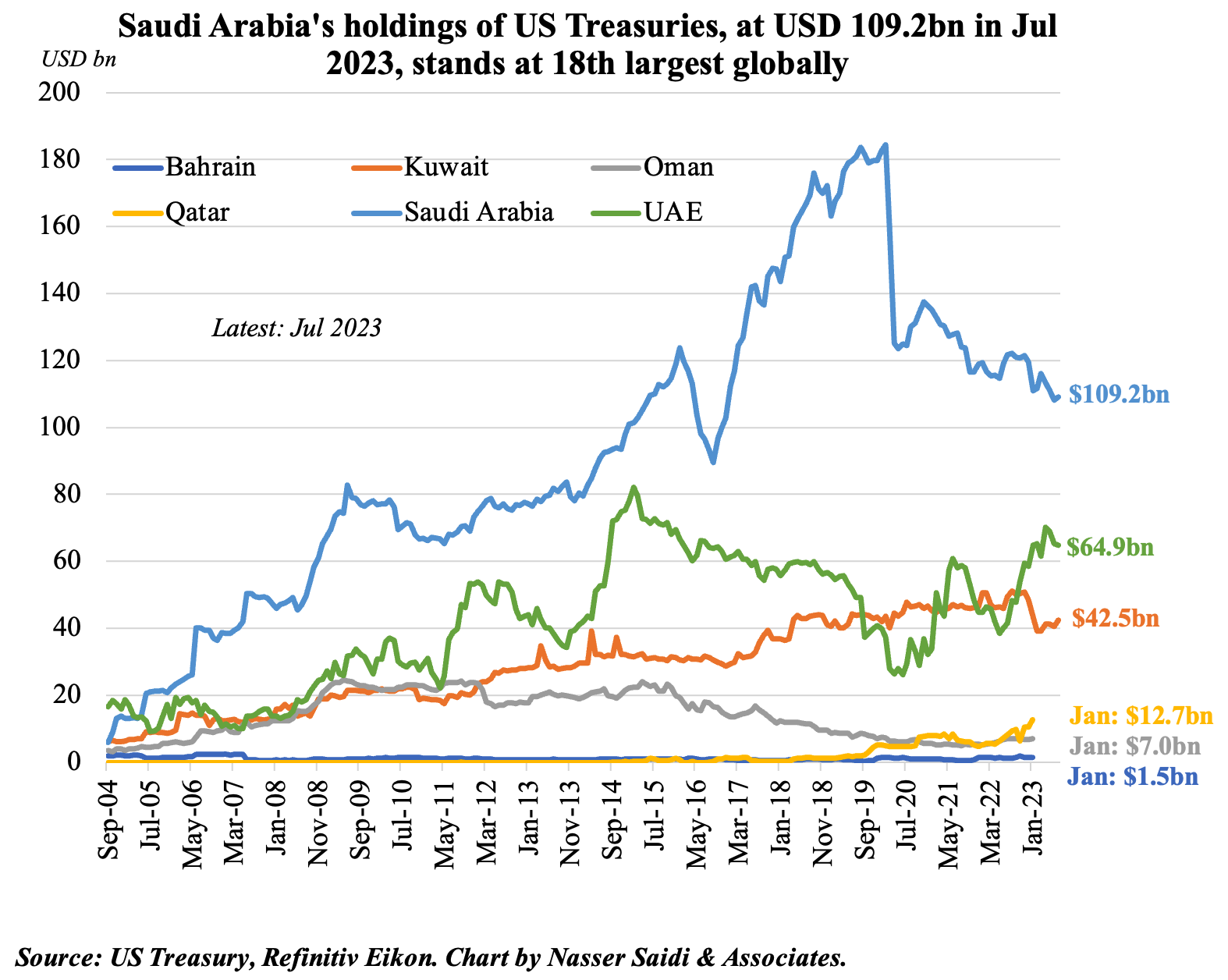

2. Saudi Arabia US Treasuries holdings stand at USD 109.2bn in Jul 2023, the 18th largest investor globally; UAE raises share to USD 64.9bn

- Saudi Arabia is currently the 18th largest investor in US Treasury bonds globally as of Jul 2023 (USD 109.2bn)

- This pales in comparison to the top of the list Japan (USD 1.112trn) and China (USD 821.8bn), but it is still highest among the GCC

- Both Kuwait and Saudi Arabia have decreased their holdings compared to end-2022 – by 12.4% and 8.8% respectively.

- In Jun, KSA had lowered its holdings to a 6-year low of USD 108.1bn. The PIF’s asset diversification strategy has meant that different asset classes are being considered (vs keeping most of the reserves in US Treasuries).

- UAE’s holdings clocked in at USD 64.9bn in Jul, up 10.8% from end-2022, but it lower than this year’s high of USD 70.2bn (in Apr).

- Global central banks’ aggressively raising rates to combat inflation & it staying higher for longer have contributed to selling of Treasuries; the potential for weaponization of the dollar has also added to such moves (China reduced its holdings by USD 45.3bn since end-2022.

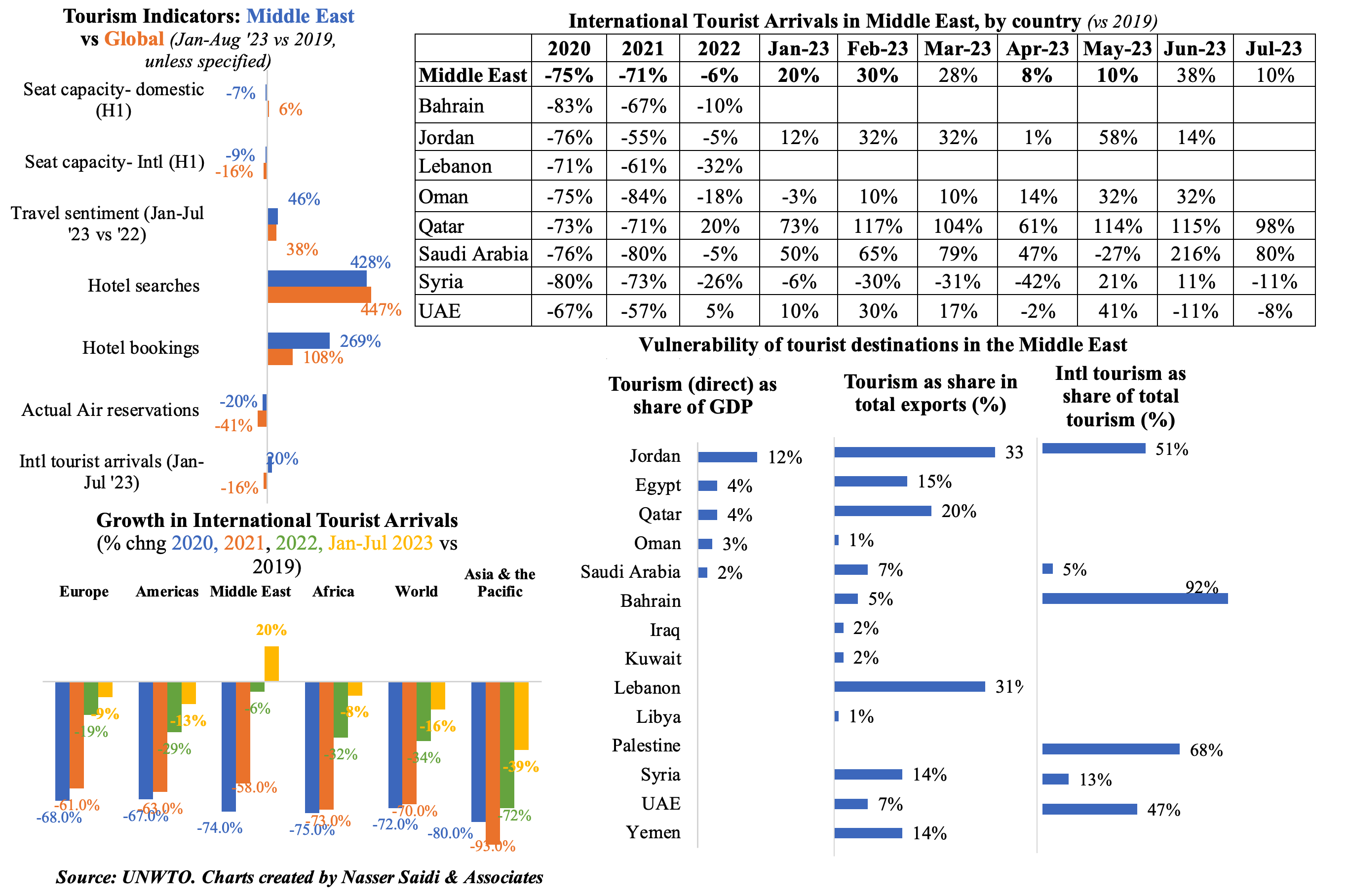

3. Global tourism recovered to 84% of its pre-pandemic levels by end-Jul; Middle East stands out as the best performing region in international tourist arrivals (+20% in Jan-Jul 2023 vs 2019), also outpacing global average in other indicators

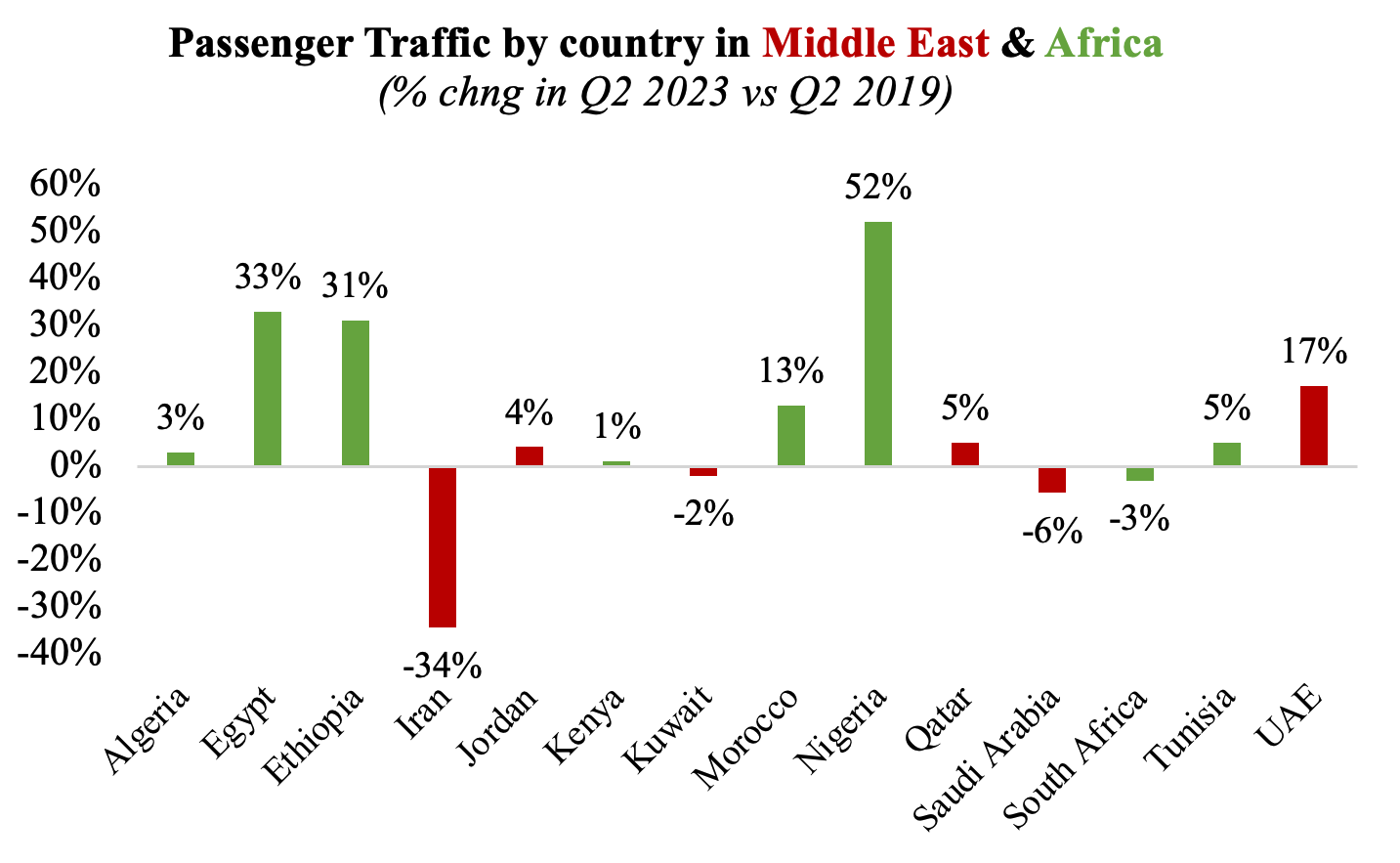

4. Middle East airlines post impressive Q2 ‘23 performance

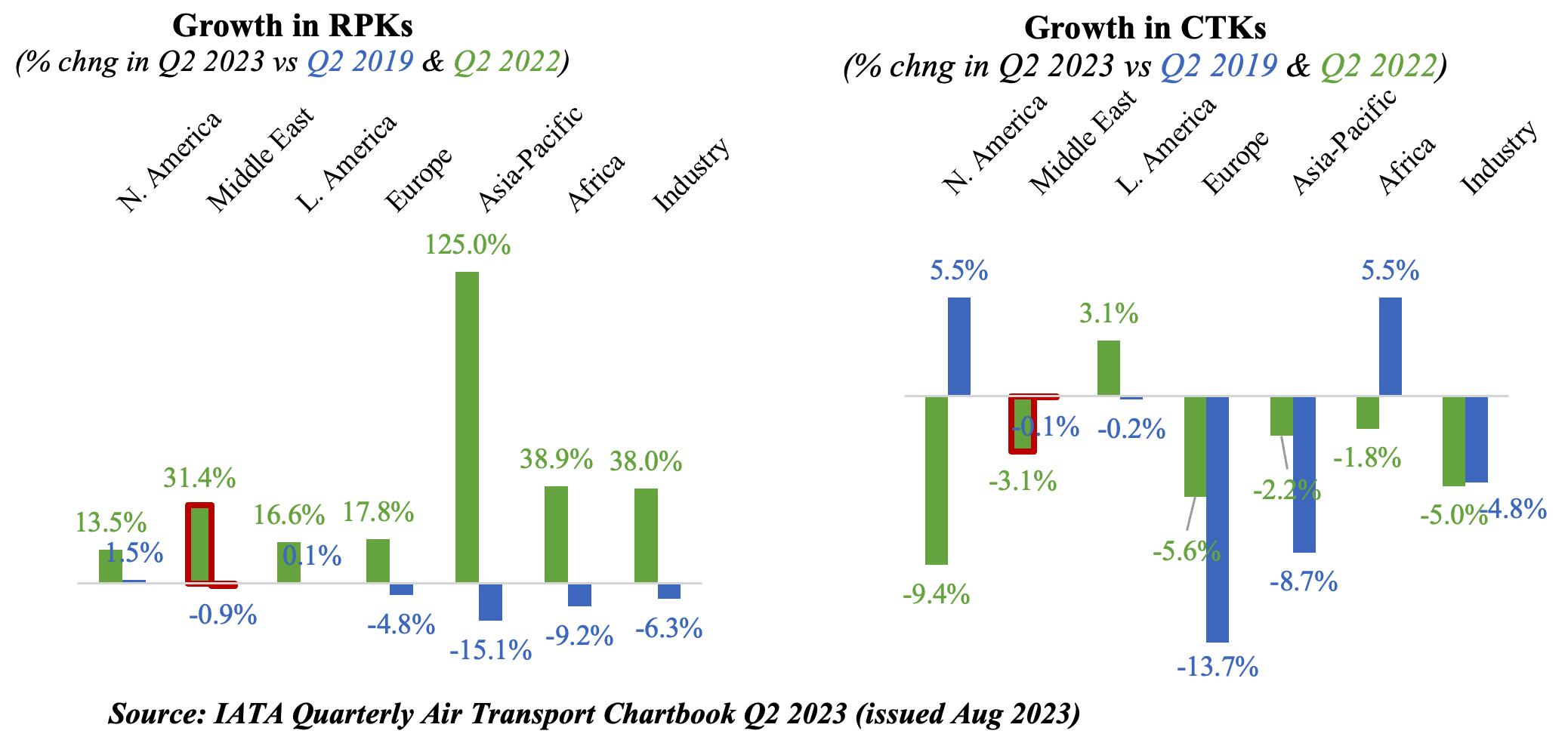

- Passenger traffic in the Middle East grew by 31.4% yoy in Q2 & revenue passenger kilometres (RPKs) were within 0.9% of Q2 2019 levels.

- Most countries in the Middle East region rebounded: Jordan, Qatar and UAE posted strong performances (vs Q2 2019), while Iran, Saudi Arabia and Kuwait were lower (partly affected by the timing of Ramadan). Kuwait and Saudi Arabia were within 2% and 5.6% of full recovery vs Q2 2019.

- Cargo activity declined, but it was slower than the drop seen in Q1 (Q2: -3.1%; Q1: -8.1%). The region’s cargo activity growth was flat compared to Q2 2019 and remained better than global activity.

5. Middle East air passenger traffic to return to 2019 levels this year; demand to be sustained amid some risks

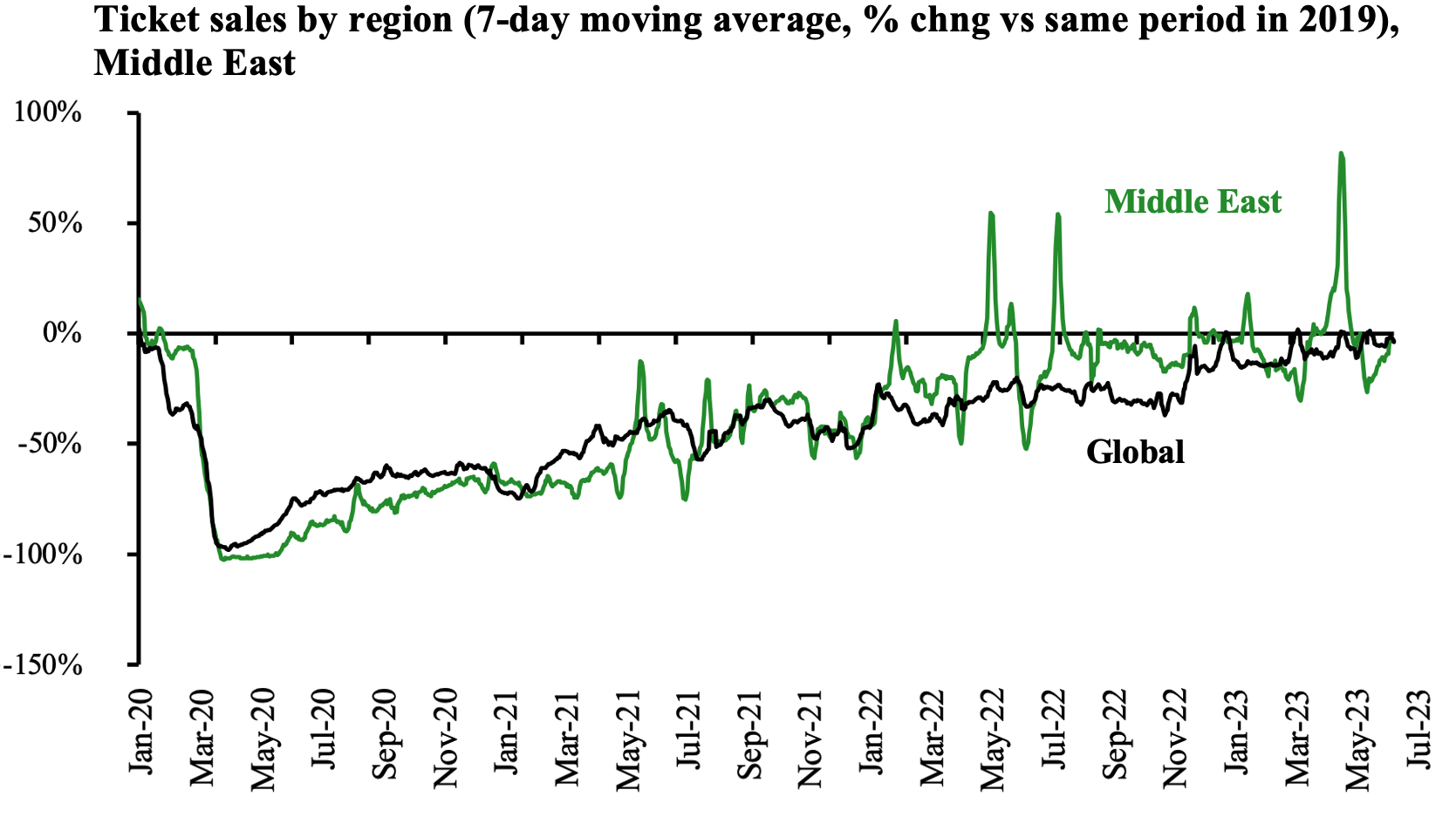

- Ticket sales in the Middle East have generally outperformed the global average, though there were some shifts due to the timing of Ramadan (early Q2). The upward trend is likely to continue, considering the sustained demand.

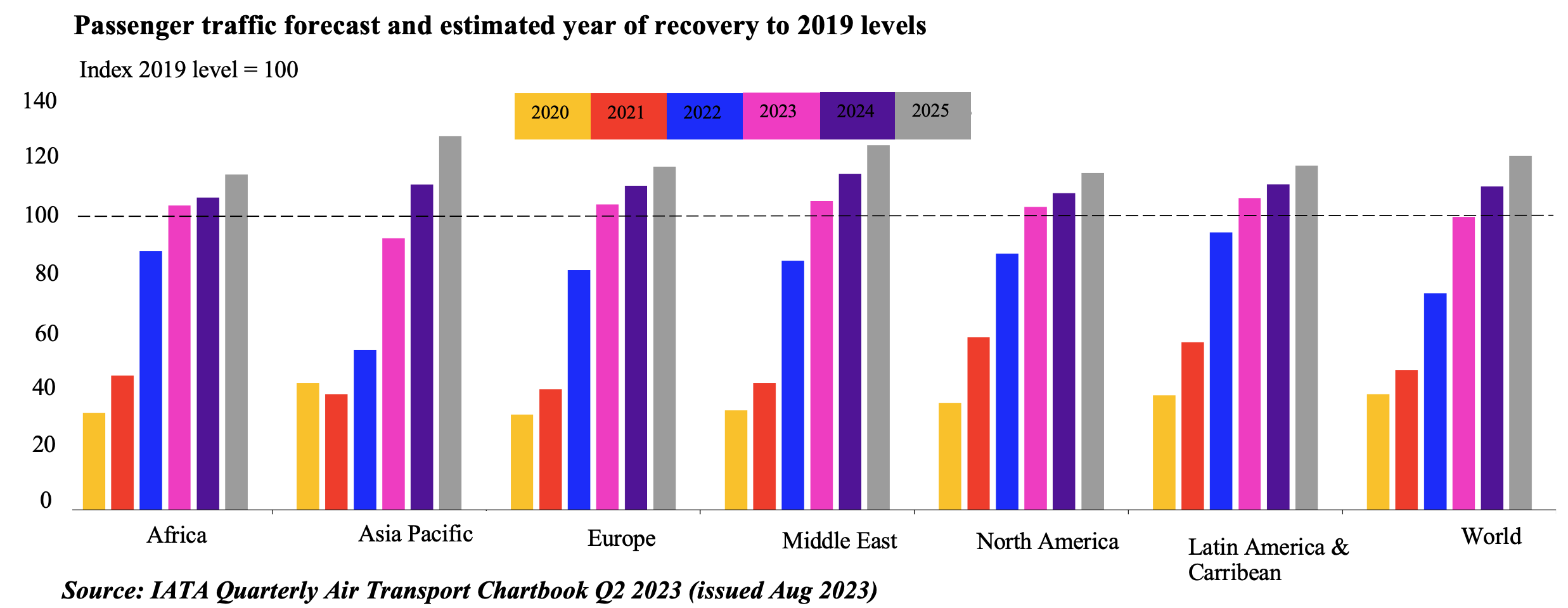

- This is also reflected in the passenger traffic forecast, wherein it is estimated that the Middle East will surpass its 2019 levels in 2023 (ahead of forecast for the world).

- IATA estimates global air passenger traffic to grow, rising to 2019 levels early next year, and double by 2040; also supported by increased connectivity.

- There however are risks to this outlook including higher energy prices (especially jet fuel, which currently stands at USD 130 a barrel), higher services inflation (that might deter international travel) and supply-side constraints in the airline industry.

Powered by: