Markets

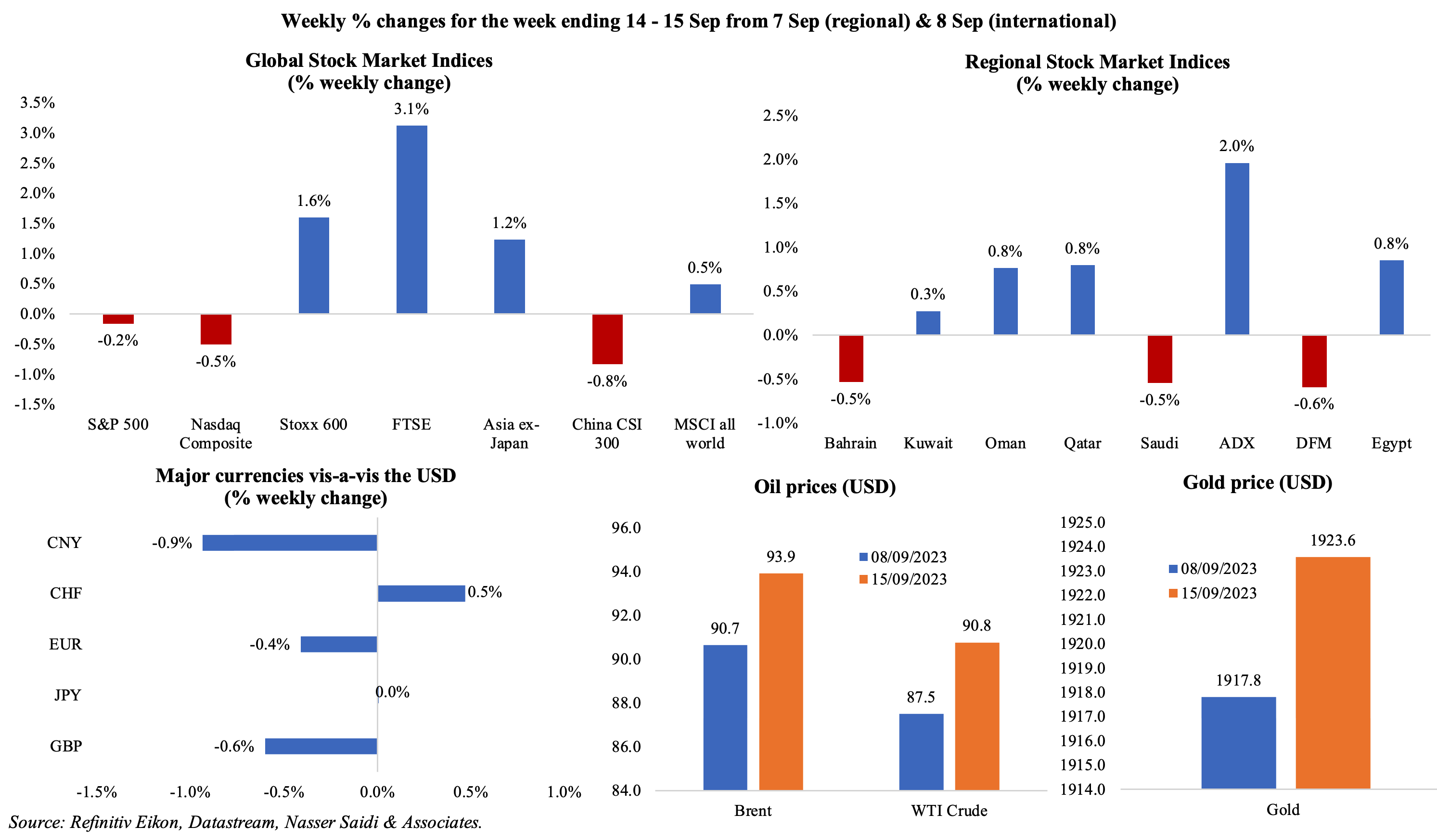

Global markets posted a mixed picture last week: while S&P 500 and Nasdaq composite retreated, FTSE 100 had its best day of 2023 on Thursday, gaining almost 2% and ending 3% higher compared to a week ago; European stocks cheered the ECB’s signalling an end of its policy tightening cycle. Regional markets saw the Abu Dhabi Securities Exchange emerging the best performer (+2% weekly gain). The dollar posted gains for the ninth week in a row, strengthening vis-à-vis the yen after the latter hit a 10-month high earlier in the week. Oil prices gained for the third straight week on supply remaining tight (it touched a 10-month high on Thursday) and gold prices moved up as well.

Global Developments

US/Americas:

- US inflation inched up by 3.7% yoy in Aug (Jul: 3.2%),largely due to higher energy prices; housing and other services continue to be the main drivers of inflation, with the former rising for the 40th month in a row. Core inflation eased for the fifth month to 4.3% yoy (Jul: 4.7%).

- Producer price index in the US rose by 0.7% mom and 1.6% yoy in Aug (Jul: 0.4% mom and 0.8% yoy), boosted by higher gasoline prices (10.5%). This was the largest month-on-month gain since Jun 2022. Excluding food and energy, prices eased to 2.2% (Jul: 2.4%), the lowest yoy level since Jan 2021.

- Industrial production in the US grew by 0.4% mom in Aug (Jul: 0.7%), with manufacturing edging up by just 0.1% mom. Production was dragged down by motor vehicle and parts output, which fell by 5% in Aug. Excluding motor vehicles, factory output grew by 0.6%, after being unchanged in Jul. Capacity utilisation inched up to 79.7% (Jul: 79.5%).

- Retail sales in the US ticked up by 0.6% mom in Aug (Jul: 0.5%), with gasoline receipts soaring 5.2% (Jul: 0.1%) and clothing sales up 0.9%. Excluding gasoline stations receipts, sales rose by a modest 0.2%. Sales were up 2.5% yoy, below the 3.7% yoy CPI inflation rate.

- US posted a budget surplus of USD 89bn in Aug (Jul: deficit of USD 221bn): receipts were down by 7% to USD 283bn while spending was down 63% to USD 194bn (because of the USD 319bn student loan forgiveness plan). Year-to-date deficit stands at USD 1.524trn, a 61% widening compared to the same period a year ago.

- NY empire state manufacturing index unexpectedly jumped to 1.9 in Sep (Aug: -19), thanks to increases in new orders (to 5.1 from -19.9) and shipments (12.4 from -12.3) while selling prices ticked up (to 19.6 from 12.6).

- Michigan consumer sentiment index slipped to 67.7 in Sep (Aug: 69.5), with the current economic conditions gauge sharply falling (to 69.8 from 75.7) while future expectations improved (to 66.3 from 65.5). The 1-year and 5-year inflation expectations eased to 3.1% (the lowest since Mar 2021) and 2.7% (a 1-year low) in Sep.

- Initial jobless claims inched up by 3k to 220k in the week ended Sep 8th and the 4-week average slipped by 5k to 224.5k, the lowest in 7 months. Continuing jobless claims rose by 4k to 1.688mn in the week ended Sep 1st.

Europe:

- The ECB raised rates for the tenth time in a row, by 25 bps to an all-time high to 4%, while hinting that borrowing costs had peaked.

- The European Commission forecasts GDP to grow by 0.8% in 2023 and 1.3% in 2024 versus previous forecasts of 1.1% and 1.6% respectively (made in May), citing weakness in domestic demand (especially consumption). The Commission projected a recession in Germany, with GDP shrinking by 0.4% in 2023 before inching up by 1.1% next year. Inflation was projected at 5.6% in 2023 and 2.9% in 2024, higher than ECB’s 2% target.

- The ZEW survey Economic Sentiment Index improved to -11.4 in Sep (Aug: -12.3) while the current economic situation reading worsened to -79.4 (Aug: -71.3), the lowest value in 3 years. In the eurozone, economic sentiment index fell to -8.9 in Sep from -5.5 a month ago; the situation indicator also decreased, falling 0.6 points to a new reading of -42.6.

- Industrial production in the eurozone fell by 1.1% mom and 2.2% yoy in Jul (Jun: 0.4% mom and -1.1% yoy). This month-on-month dip was due to the sharp declines in the output of capital goods (-2.7%) and durable consumer goods (-2.2%).

- German current account surplus narrowed to EUR 18.7bn in Jul Jun’s EUR 28.4bn.

- GDP in the UK shrank by 0.5% mom in Jul (Jun: 0.5%), with industrial production and manufacturing declining by 0.7% and 0.8% mom respectively (Jun: 1.8% and 2.4%) alongside services and construction sectors contracting by 0.5% each (first time since summer of 2022).

- Unemployment rate in the UK inched up to 4.3% in the 3 months to Jul (prev: 4.2%), the highest since Q3 2021. The number of people in work fell sharply (down by 207k, the biggest fall since Aug-Oct 2020) and vacancies dipped below 1 million for the first time in two years. Average earnings, excluding bonus, remained unchanged at 7.8% in the 3-months to Jul. Including bonus, earnings inched up by 8.5% (Apr-Jun: 8.4%), a new high (excluding months of pandemic-related distortions).

Asia Pacific:

- The People’s Bank of China cut banks’ reserve ratio requirements for a second time this year, by 25bps, hoping the increased flow of credit would restore economic activity and confidence. It left the 1-year Medium-term Lending Facility (MLF) rate unchanged at 2.5%.

- China’s money supply grew by 10.6% yoy in Aug (Jul: 10.7%). New loans jumped to CNY 1.36trn in Aug, nearly a 3-fold increase from Jul’s CNY 346bn, and up by 8.8% yoy. Outstanding yuan loans grew 11.1% in Aug, matching Jul’s growth.

- Industrial production in China grew by 4.5% yoy in Aug (Jul: 3.7%). Retail sales also grew at a faster pace of 4.6% yoy (Jul: 2.5%), the fastest pace since May. Fixed asset investment grew by 3.2% yoy in Jan-Aug (Jan-Jul: 3.4%).

- FDI into China fell by 5.1% yoy to Jan-Aug (Jan-Jul: -4%): during the period 33,154 new foreign-invested firms were set up (+33% yoy).

- Japan’s industrial production fell by 1.8% mom and 2.3% yoy in Jul (Jun: 2.4% mom and flat yoy). IP fell across major categories: production machinery (-4.8%), electronic parts and devices (-5.1%), and electrical machinery, information & communication equipment (-3.3%).

- Producer price index in Japan inched up by 0.3% mom and 3.2% yoy in Aug (Jul: 0.1% mom and 3.4% yoy). In yoy terms, pace of growth slowed for the eighth month, and this was the lowest reading since Mar 2021.

- Wholesale price inflation in India fell by 0.52% yoy in Aug (Jul: -1.36%), the fifth deflationary reading. Prices fell for fuel and power (-6.03%) and manufacturing (-2.37%) but falling at a slower pace.

- Industrial output in India grew by 5.7% yoy in Jul (Jun: 3.7%), with manufacturing up by 4.6% (Jun: 3.1%). Consumer durables’ production remained in contraction mode for the seventh time in eight months (-2.7%) while non-durables strengthened (+7.4% from Jun’s 1.2%). Cumulative industrial output rose by 4.8% from 4.5% in Jun.

- India’s trade deficit widened to a 10-month high of USD 24.2bn in Aug (Jul: USD 20.67bn) as imports surged (to an 8-month high of USD 58.64bn). In Apr-Aug, services and goods exports fell by 5% yoy to USD 306.33bn while imports declined by 10% to USD 343.8bn.

- Unemployment rate in Singapore stood at 9% in Q2, according to the Ministry of Manpower: resident unemployment was at 2.7% and citizen unemployment rate was at 2.8%.

Bottom line: Hot on the heels of the ECB’s meeting, where it signalled an end to the rate hiking cycle, comes another set of central bank meetings. This week sees the Fed and the BoE meetings – expectations are for the former to keep rates unchanged while the latter seems poised for a 15th hike in a row – while the BoJ governor’s comments about a potential end to its negative interest rate policy last week sent 10Y yields surging. Developed markets aside, this week also sees Egypt meet on rates, where inflation is rising to new records every month; Turkey also meets on policy where the only way for rates is up. Given China’s central bank moves last week, it seems unlikely that any changes will be made to either the benchmark one-year loan prime rate or 5Y LPR.

Regional Developments

- Bahrain and the US signed a strategic security and economic agreement, aimed at strengthening military and intelligence coordination. The two nations also plan to improve economic cooperation: the existing FTA of 2006 already tripled trade to USD 3bn a year.

- Egypt issued 7200 industrial licenses in a year, up 530% from a year ago, according to the minister of trade and industry. The aim is for the industrial sector to contribute 11-20% to GDP annually (contribution in 2021: 11.2%) and create around 200k job opportunities.

- The ministry of finance in Egypt is considering selling an additional 10-15% stake in Telecom Egypt in addition to the 10% offered last May.

- Egypt invested EGP 62.29bn in the low-income mortgage financing initiative by end-Aug, benefiting about 527,303 customers. The initiative offers long-term loans of up to 30 years with a subsidized interest rate for low- and middle-income households.

- Kuwait Oil Company’s first offshore exploratory and drilling operations for oil and gas are expected to end in 2026. Should the drilling be successful, new production could boost Kuwait’s oil and gas output.

- Lebanon’s central bank will restrict access to the new currency exchange platform, according to one of the vice-governors. The platform will likely be set up “within a month or few weeks”.

- Inflation in Oman eased to 0.82% yoy in Aug, a 28-month low and from Jul’s 0.41% reading. Food prices remained high at 2.9%, household furnishings rose by 2.63% while dining and lodging ticked up by 2.46%. Transport costs fell by 0.05% mom and 1.54% yoy.

- Oman Investment Authority signed a deal with the Industrial Innovation Academy, to dissect value chains, identify investment opportunities and empower SMEs, thereby empowering the national workforce.

- Industrial production in Qatar grew by 4.2% yoy in Jun and 3.75% in H1, largely owing to oil and gas sector activity (5.3% in Jun and 4.1% in H1 2023); sector has a relative weightage of 82.46% in overall IP. Manufacturing declined by 0.4% mom and 1.1% yoy in Jun.

- Qatar trade surplus widened to QAR 354.8bn in 2022 (2021: QAR 215.6bn). Exports surged by 50.2% to QAR 476.7bn while imports grew by 19.6% to QAR 121.9bn. Asia was the major trade partner, accounting for 66.2% of exports and 39.5% of imports.

- Online transactions in Qatar touched 5.46mn in Aug, according to the central bank, totalling QAR 3.19bn (USD 876mn). PoS transactions also increased during the month, rising to 27.7mn transactions with a value of QAR 6.74bn.

- Banks in the GCC are expected to report stronger profitability in 2023, according to S&P. As per the report, higher net interest margins and lower-cost business models will more than compensate for the increase in the cost of risk and deterioration in asset quality. Saudi banks will attain a return on assets (ROA) of 2.2% this year (higher than GCC average of 1.8%).

- A report from BCG, titled ‘Global Wealth Report 2023: Resetting the Course’, highlights that UAE and Saudi Arabia dominated the financial wealth in the region, accounting for nearly 13.2% and 14.5% of the total. Real assets in the UAE and Saudi Arabia are expected to grow by a CAGR of 6.9% and 5.8% to USD 2.6trn and USD 3.6trn in 2027.

Saudi Arabia Focus

- Consumer price inflation in Saudi Arabia eased to 2.0% yoy in Aug (Jul: 2.3%). Higher housing costs (8.95%) are the main driver of the 2% reading: rents for housing surged by 10.8% (rents have a weight of 20.97% in the CPI basket) and rents for an apartment jumped by 22.6%. Declines in transport and food costs have been offsetting the jump in rents.

- Wholesale prices in Saudi Arabia fell in Aug (-0.3% yoy), though the pace of decline was slowing (Jul: -0.9%): all broad categories other than food products posted declines. The sharpest plunge was registered in basic chemicals (-18%) while agriculture and fishery products were down by 2.3%. Food prices inched up to 2.7% in Aug (Jul: 2.1%).

- Industrial production in Saudi Arabia plunged in Jul 2023, down by 9.5% yoy, falling for the third consecutive month of decline (Jun: -1.6%). This brings growth this year to an average of 1.1%, a fraction of the 21.1% surge recorded in Jan-Jul 2022. In mom terms, industrial output fell sharply by 6.5% in Jul, reversing Jun’s 0.5% gain. Manufacturing has been resilient, but it grew by single digits in Jul (8.7%), the slowest pace since Oct 2021.

- Saudi Arabia plans to raise USD 11bn from a syndicated loan to finance its investment plans, reported Bloomberg.

- Saudi Arabia and India signed 8 agreements during the Crown Prince’s state visit to India, including an upgrade to a more comprehensive energy partnership (for renewables, petroleum & strategic reserves); furthermore, a joint task force will be created for USD 100bn in Saudi investment. The 2 nations also unveiled a Startup Bridge initiative to support the startup ecosystems in both nations.

- Saudi Central Bank granted a license to Intelligent Solutions to offer finance aggregation services – the second such license issued. The platform will connect financing firms with clients based on credit obligations and solvency to offer customized funding options.

- Saudi Arabia’s national funds (including the National Development Fund) provided financing to the tune of SAR 14.1bn (USD 3.7bn) in H1 2023. Disbursed support from the NDF was SAR 10.3bn while the Saudi Industrial Development Fund allocated SAR 1.6bn to 104 industrial entities.

- Saudi Arabia and South Korea inked multiple agreements amounting to USD 50mn, with investments toward smart farms and food products.

- Despite extension of the voluntary oil production cuts, Saudi Aramco notified North Asia refiners that it would be supplying full contractual volumes of crude in Oct, reported Reuters.

- Saudi Aramco agreed to purchase Chile’s Esmax Distribución SpA (Esmax) from Southern Cross Group. The firm Esmax distributes Petrobas fuel in Chile.

- Saudi developer Red Sea Global entered into a 25-year concession agreement with France’s EDF and UAE’s Masdar to service its ultra-luxury resort destination AMAALA. The new facility, that includes a battery energy storage solution, desalination plant and a wastewater treatment plant, will have the capacity to generate up to 410k MWh per annum, enough to power 10k households for an entire year.

- The Wall Street Journal reported that a Saudi entity would buy stakes in mining assets worth USD 15bn in Africa (Congo, Guinea and Namibia), with US firms having some rights to buy some of the production. This would support the nations’ energy transition moves.

- S&P confirmed Saudi Arabia’s credit rating at A/ A-1 with a stable outlook, based on its reform implementation over the recent years. The firm forecasts a growth rate of 0.2% for the country this year, while projecting a 3.4% growth for the period 2024-26.

UAE Focus![]()

- Dubai PMI eased to 55 in Aug (Jul: 55.7), the lowest reading since Feb. The above-50 reading was supported by “strong new order inflows and robust economic conditions” though the rate of sales growth was the softest since Mar. Employment rose, leading to the joint-fastest rise in employment since Nov 2015.

- Investments of UAE banks reached a record-high of AED 580bn at end-Jul, up 18.8% yoy. Banks’ investments largest share was in bonds held until maturity (1.3% to AED 266.8bn) while investments in stocks grew by 3.3% yoy to AED 12.5bn.

- Hypermarket chain and mall operator Lulu Group expects to launch IPO in H1 2024. According to the Chairman, while the shares will be listed in the Gulf, the exchange had not yet been decided.

- Assets under management in ADGM grew by a record 35% yoy in H1 2023. A total of 102 asset managers in the free zone manage 128 funds, and 46 firms have been granted in-principle approval during H1 2023.

- DMCC disclosed a 30% increase in Swiss firms’ registrations in two years: over 400 Swiss businesses are registered in the free zone.

- UAE and China’s Hainan province signed multiple agreements to boost trade and investments: bilateral non-oil trade had more than doubled to USD 900mn in 2022.

- Mubadala committed USD 1bn to an alternative investment manager Blue Owl Capital’s credit platform to provide financing for tech firms.

- The Ajman Chamber of Commerce and Industry registered over 3500 new memberships in H1 2023. Industrial membership grew by 6.9% to 773 in H1 2023.

Media Review

OPEC & its resilient oil demand forecast

https://www.reuters.com/business/energy/opec-sticks-oil-demand-growth-view-citing-resilient-economy-2023-09-12/

One Hundred Inflation Shocks: Seven Stylized Facts (IMF working paper)

https://www.imf.org/en/Publications/WP/Issues/2023/09/13/One-Hundred-Inflation-Shocks-Seven-Stylized-Facts-539159

Global Debt Is Returning to its Rising Trend: IMF

https://www.imf.org/en/Blogs/Articles/2023/09/13/global-debt-is-returning-to-its-rising-trend

How to Kill Chinese Dynamism by Yasheng Huang

https://www.project-syndicate.org/onpoint/china-innovation-growth-based-on-hong-kong-outsourcing-rule-of-law-market-institutions-by-yasheng-huang-2023-08

The global race to set the rules for AI

https://www.ft.com/content/59b9ef36-771f-4f91-89d1-ef89f4a2ec4e

Powered by: