CPI & WPI in Saudi Arabia. Egypt inflation & outlook. IP in Saudi & Qatar. UAE money & credit. Dubai tourism. Global tourism FDI. Trade prospects.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 15 Sep 2023: Middle East – Inflation, manufacturing, monetary stats & tourism

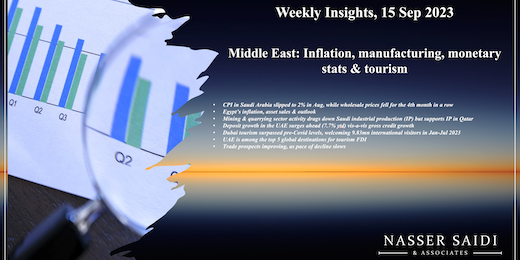

1.CPI in Saudi Arabia slipped to 2% in Aug, while wholesale prices fell for the 4th month in a row

- Consumer price inflation in Saudi Arabia dropped to 2.0% yoy in Aug (Jul: 2.3%). Higher housing costs (8.95%) are the main driver of the 2% reading: rents for housing surged by 10.8% (rents have a weight of 20.97% in the CPI basket) and rents for an apartment jumped by 22.6%. Declines in transport and food costs have been offsetting the jump in rents.

- The IMF estimates inflation to rise to 2.8% this year (2022: 2.5%), and ease to 2.3% in 2024: domestic subsidies/ price caps and the strength of the USD has helped contain domestic inflation.

- Wholesale prices in Saudi Arabia fell in Aug (-0.3% yoy), though the pace of decline was slowing (Jul: -0.9%): all broad categories other than food products posted declines. The sharpest plunge was registered in the prices of basic chemicals (-18%) while agriculture and fishery products were down by 2.3%. Food prices inched up: 2.7% in Aug from Jul’s 2.1% gain.

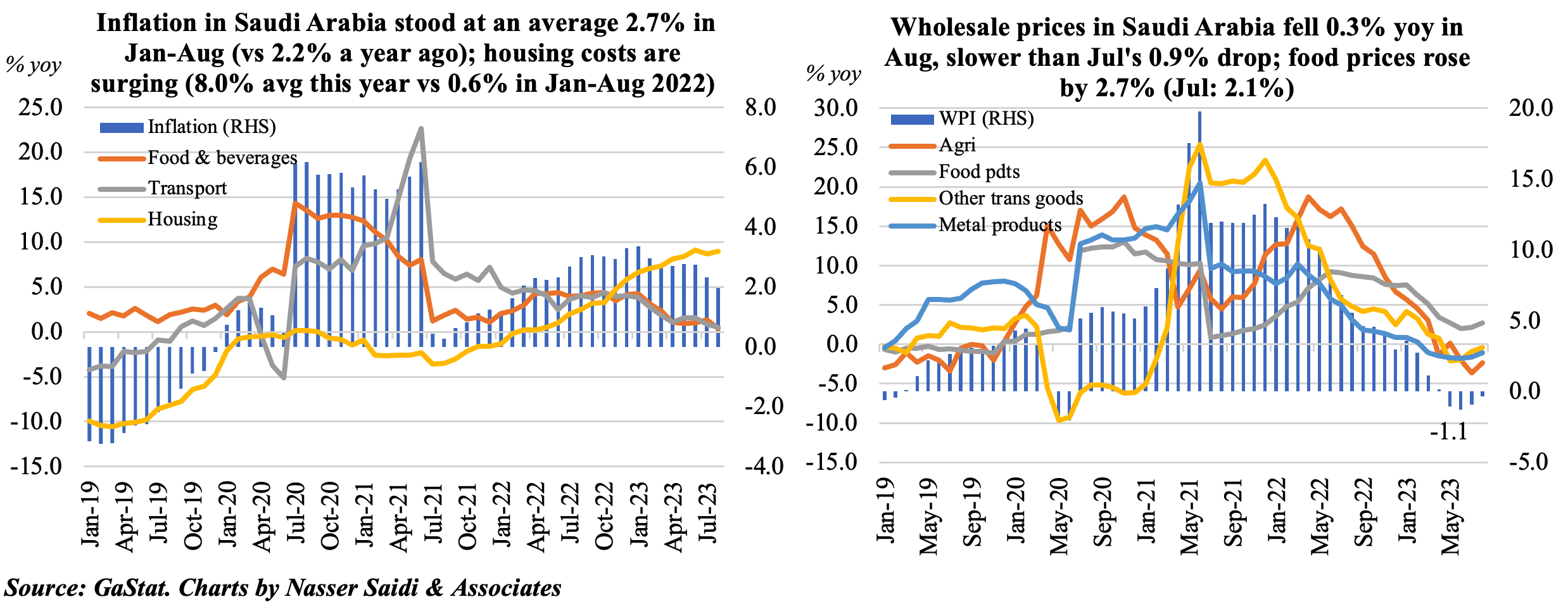

2. Egypt’s inflation, asset sales & outlook

- Egypt’s inflation jumped to a record-high of 39.7% in Aug (Jul: 38.2%), driven up by a large jump in food and beverage prices (71.9%) and clothing and footwear (23.6%). Core inflation eased slightly to 40.4% (Jul: 40.7%).

- The central bank is ambitiously targeting inflation rate of between 5-9% by Q4 of 2024 and 3-7% by end-2026, and just last month hiked rates by another 100bps to rein in inflation (total of 300bps this year, following 800bps in 2022). Real rates remain negative.

- Why are prices surging to new highs every month? Egyptian Pound depreciation pass-through to consumers + dollar shortage & import restrictions (driving up prices of imports).

- While global food prices showed a drop in Aug (despite rising rice prices), oil is at 10-month highs & the dollar has been strengthening – factors that would impact price behaviour in coming months.

- For now, EGP devaluation has not generated higher export proceeds or an uptick in remittances, as the market expects further devaluation; dollar scarcity adds on to pressure to devalue. IF the authorities proceed with further devaluation, be prepared for higher prices.

- Egypt plans to raise USD 5bn from IPOs of 6 projects (including power plants, water desalination plants & state-owned enterprises from Oct 2023-Jun 2024, disclosed a report from the Cabinet. The Sovereign Fund of Egypt sold stakes in 13 firms b/n Mar ‘22-Jul ‘23 for USD 5bn. Foreign currency from such sales will give some support in building up a foreign currency buffer – a condition needed prior to moving to a flexible exchange rate. But so far, privatisation has not picked up pace as expected, with valuation concerns deterring stake sales (in which case privatisation targets may not be met).

- Egypt is also experiencing a debt squeeze: the IMF, in its Fiscal Monitor report, estimated the country’s gross financing needs to be around 35% of GDP! This makes the nation even more susceptible to interest rate hikes.

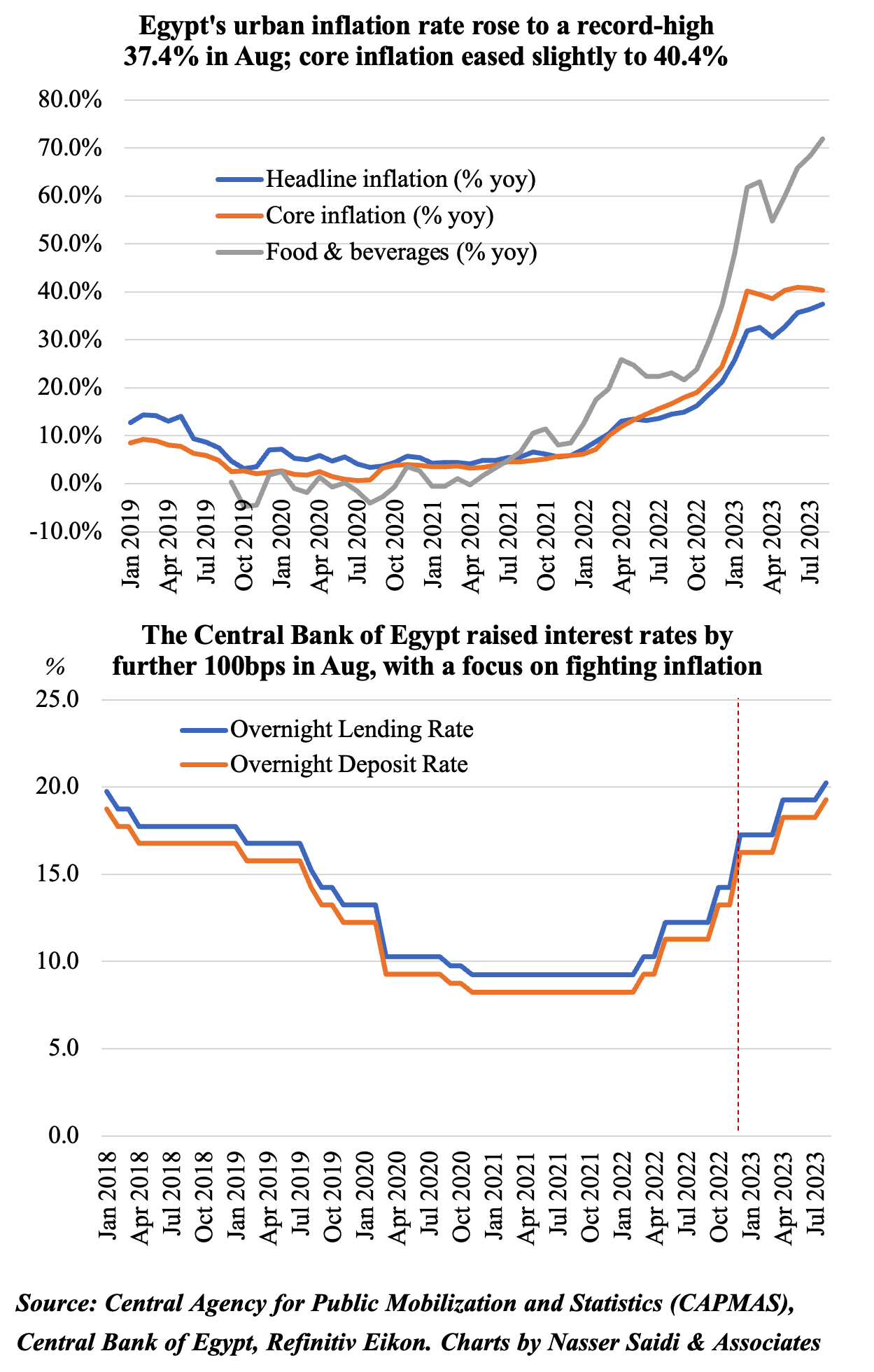

3. Mining & quarrying sector activity drags down Saudi industrial production (IP) but supports IP in Qatar

- Industrial production (IP) in Saudi Arabia plunged in Jul 2023, down by 9.5% yoy, falling for the third consecutive month of decline (Jun: -1.6%). This brings IP growth this year to an average of 1.1%, a fraction of the 21.1% surge recorded in the same period last year. In mom terms, industrial output fell sharply by 6.5% in Jul, reversing Jun’s 0.5% gain.

- Plunge in overall IP was largely due to the ongoing production cuts in the oil sector and poised for further slowdown given extended oil production cuts till end of this year. It fell by 16.1% yoy in Jul and 3.1% in Jan-Jul 2023, from a 21% gain in Jan-Jul 2022. By contrast, manufacturing has been resilient, but it grew by single digits in Jul (8.7%), the lowest pace since Oct 2021.

- In contrast, Qatar IP has been growing (+3.75% yoy in H1) largely owing to O&G sector activity (5.3% yoy in Jun and 4.1% in H1 2023); it also has a relative weightage of 82.46% in overall IP. Ongoing investments in mining & quarrying (including natural gas) projects will pay off in production capacity in the near-term. Manufacturing meanwhile declined by 0.4% mom and 1.1% yoy in Jun. Some improvement is likely in the next few months, given Aug PMI reading of a boost in manufacturing businesses’ new orders.

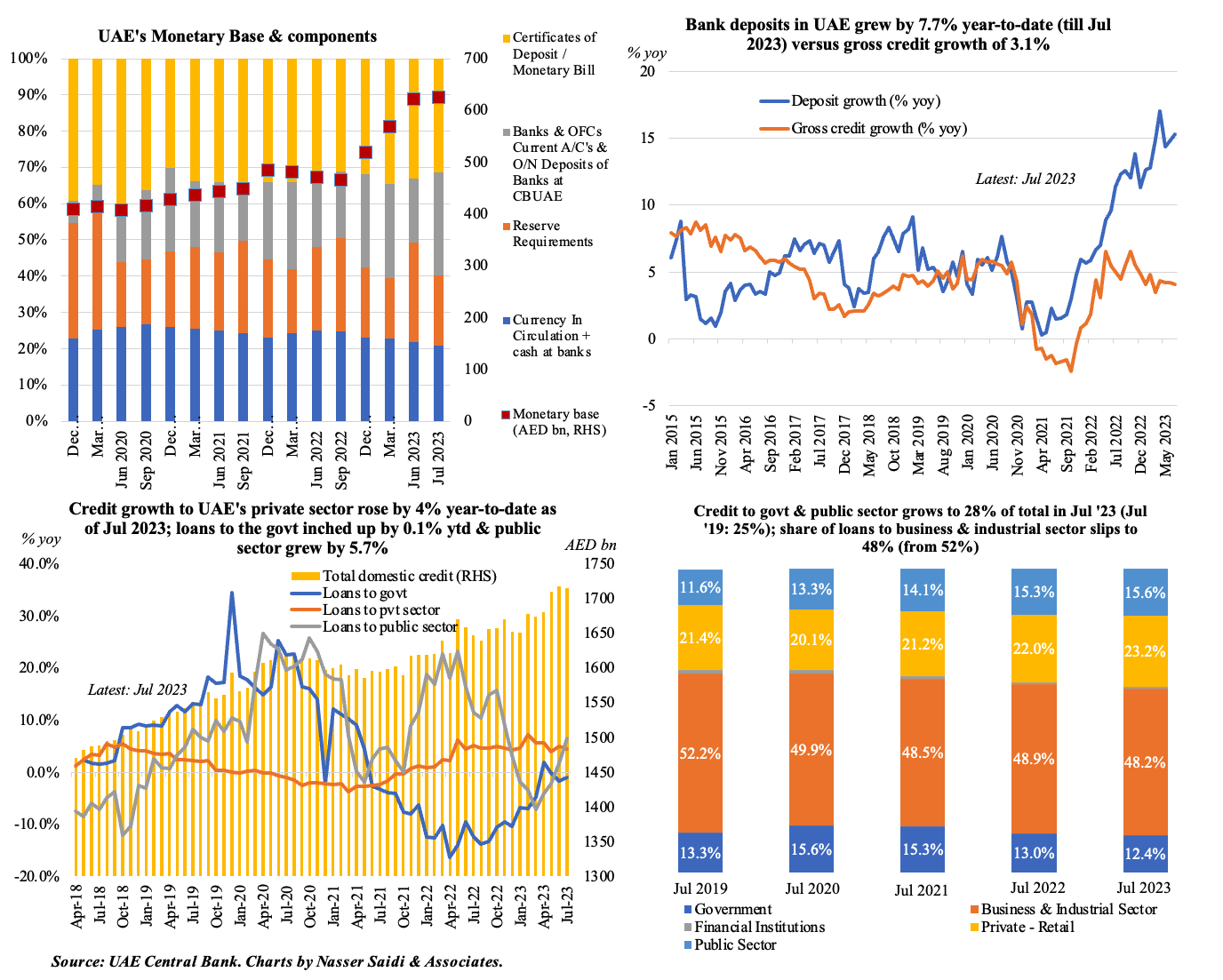

4. UAE’s monetary base rapidly expanded, up 20.5% ytd and 0.5% mom in Jul 2023. Deposit growth surges ahead (7.7% ytd) vis-a-vis gross credit growth; credit to the public jumps 5.7% ytd vs business & industrial credit (3.5%)

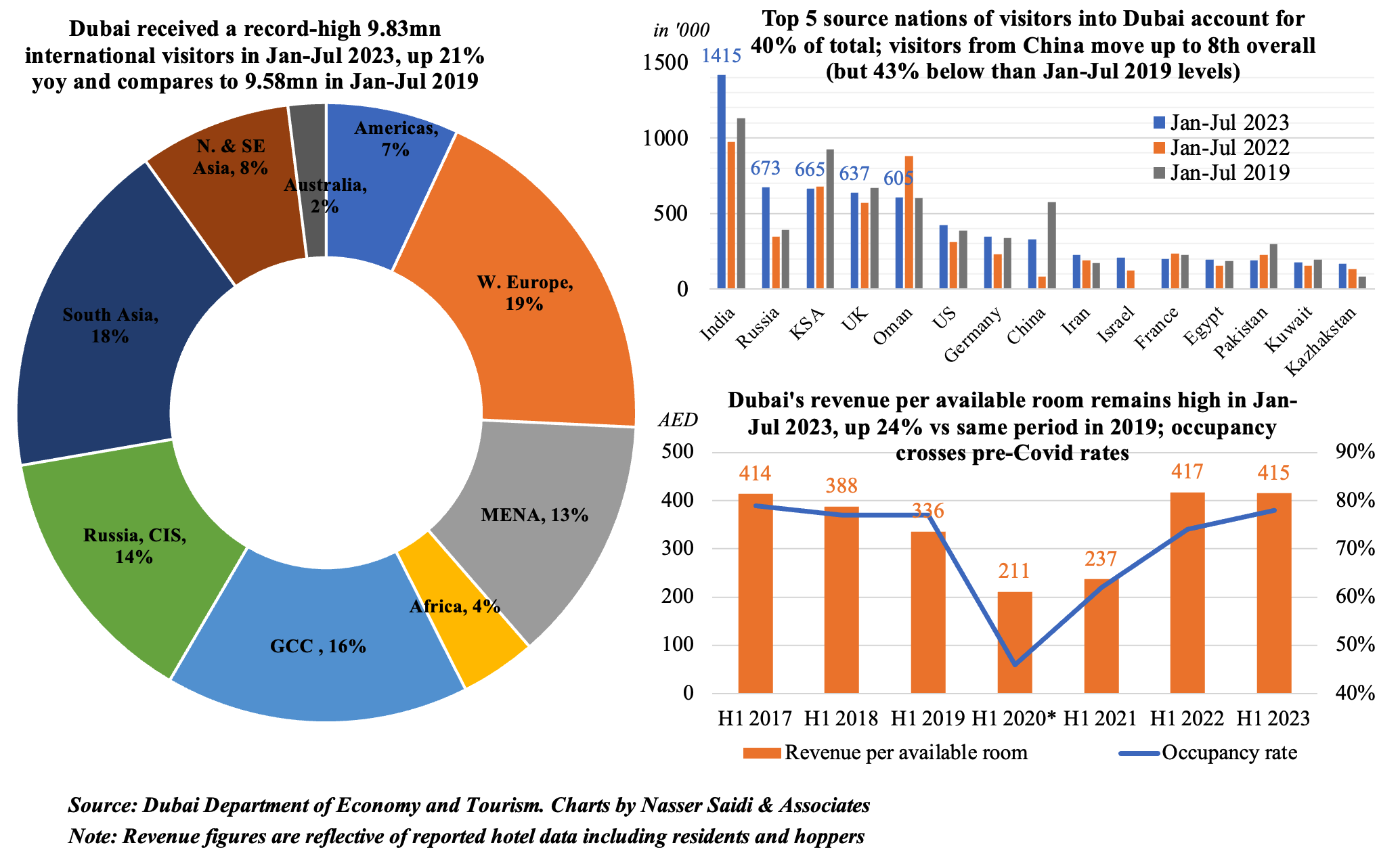

5. Dubai tourism surpassed pre-Covid levels, welcoming 9.83mn international visitors in Jan-Jul 2023 (up 21% yoy and 2.6% higher vs Jan-Jul 2019). Occupancy rates have also crossed pre-Covid days (76% this year vs 74% in 2019)

Regional composition of tourists has broadly remained similar, but top source nations are changing: Chinese travelers have jumped to 8th in the list of visitors; Saudi Arabia and Oman are the top 3rd and 5th source nations. Revenue per available room edged down slightly vs 2022, as has length of stay (3.8 from 4.1) & room rates (high at AED 508 from AED 538)

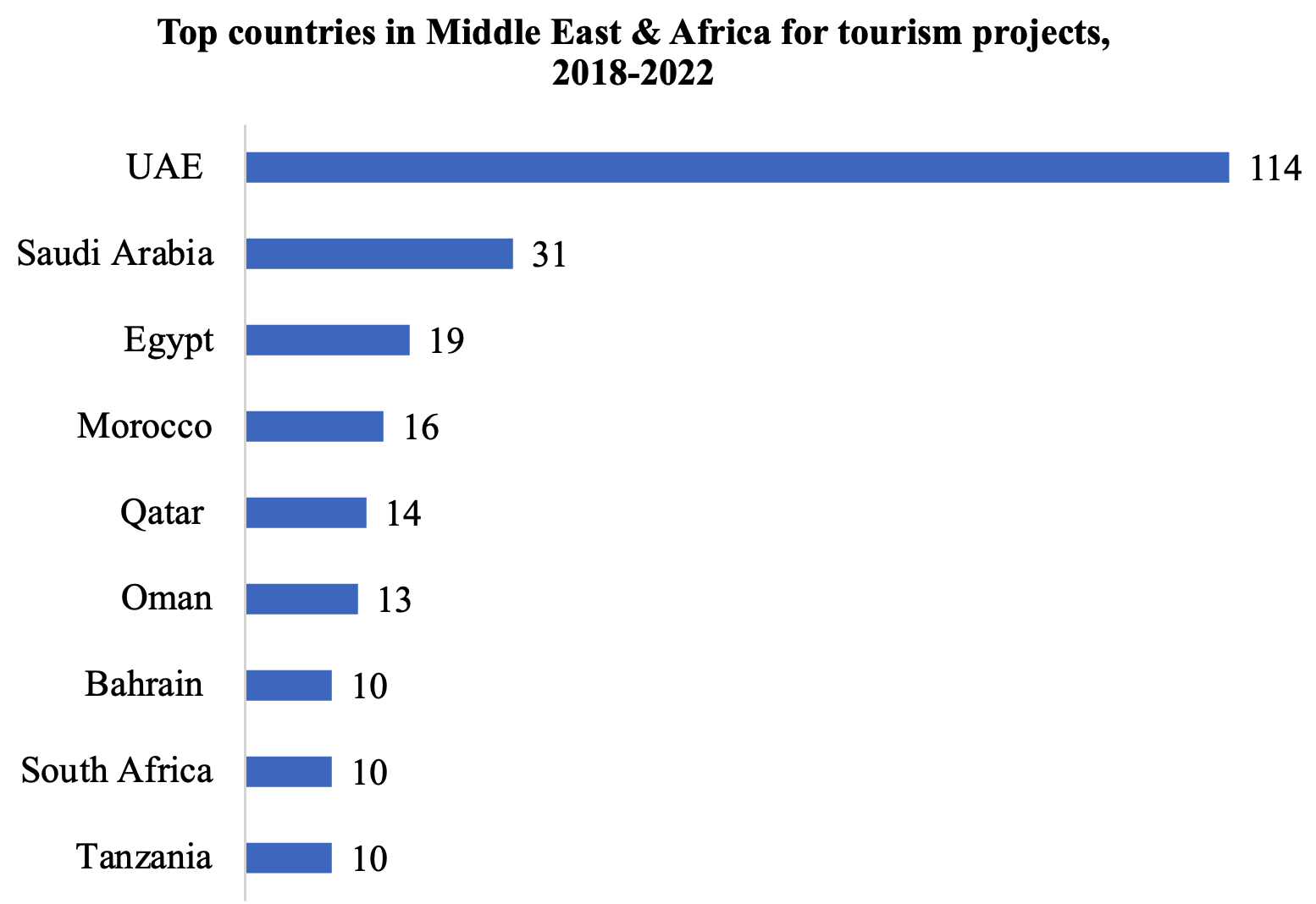

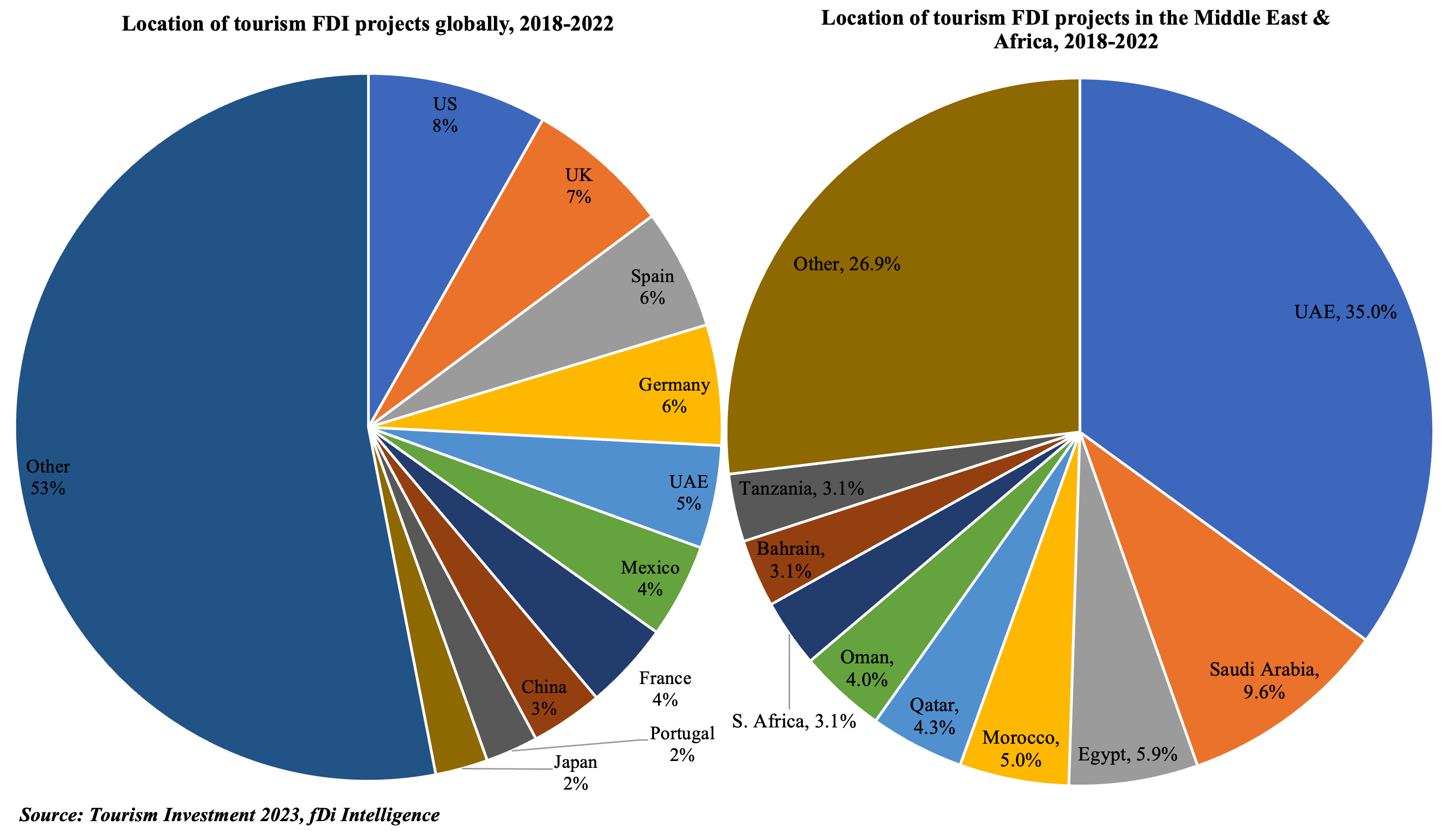

6. UAE is among the top 5 global destinations for tourism FDI

- The number of FDI projects in tourism globally increased by 21% yoy to 352 in 2022: a clear difference from lows seen in 2020-21, but the capital spending figures are yet to increase (USD 10.2bn vs USD 18.2bn in 2020 and USD 60.9bn in 2019). Job creation in tourism FDI also grew in 2022, up by 23% to 36,400 globally.

- UAE, with 114 tourism projects between 2018 and 2022, topped the list in the Middle East & Africa and was 5th globally. In the region, this accounted for more than 1/3-rd of total projects (total: 131 projects).

- UAE attracted USD 752mn+ in tourism-related investments last year from 33 announced projects while Saudi, in comparison, had 9 projects. Oman attracted more than USD 1.8bn in capital investment from tourism FDI during 2018-22.

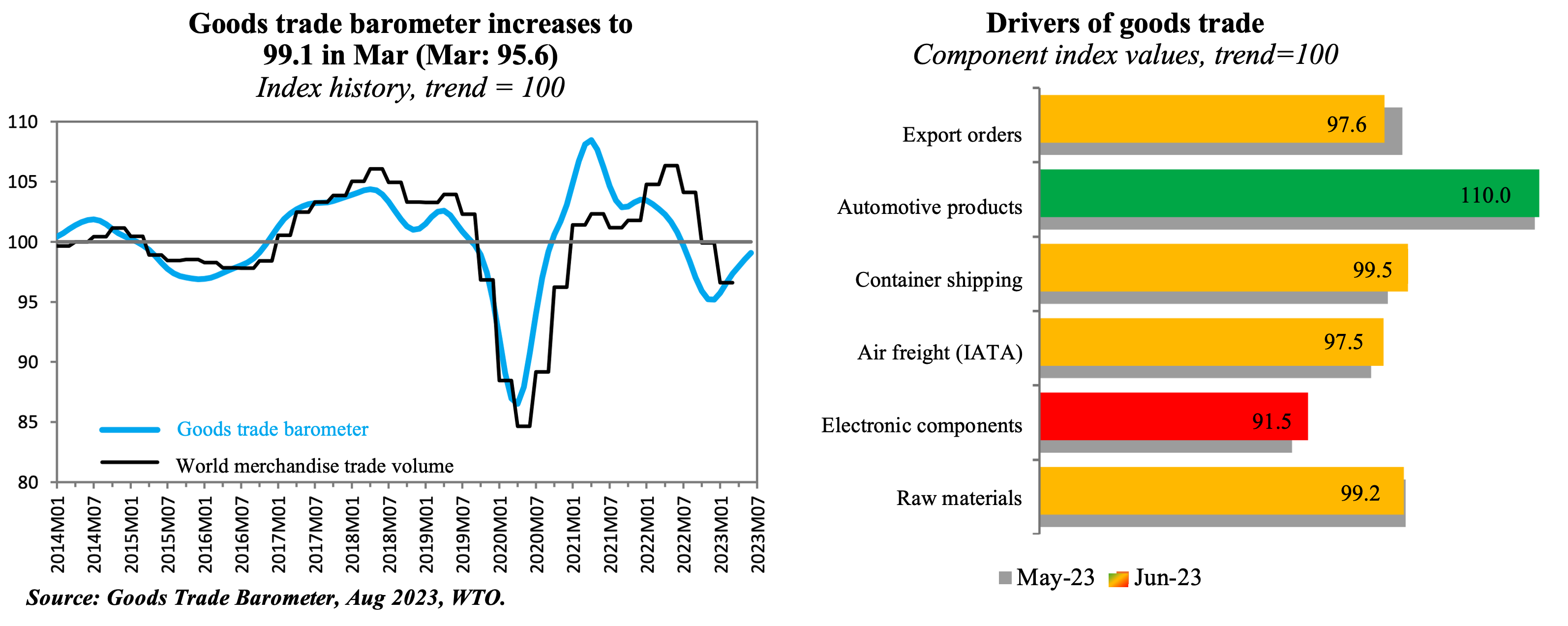

7. Trade prospects improving, as pace of decline slows

- WTO’s latest goods trade barometer suggests a moderate pickup in trade following two quarters of decline. The impact of high inflation and tighter monetary policy is visible in weak import demand globally. The WTO projects a 1.7% increase in merchandise trade volume in 2023, achievable if H2 sees an uptick in trade.

- Among various forward-looking indicators, automotive products have increased above trend, led by vehicle/ car exports from Japan & China. Electronics components have fallen significantly below trend while others remain on trend or slightly below.

- S&P Global’s Aug global manufacturing PMI showed that falling manufacturing exports led the trade deterioration, but also that the pace of contraction slowed. The downturn in trade was steepest in Europe, while among emerging markets India performed the best (export orders grew at the fastest pace in 9 years); China’s weak performance is concerning.

- Separately, air cargo performance has been improving; for container shipping, freight prices have declined & congestion levels have eased – both positive news for trade prospects.

Powered by: