Markets

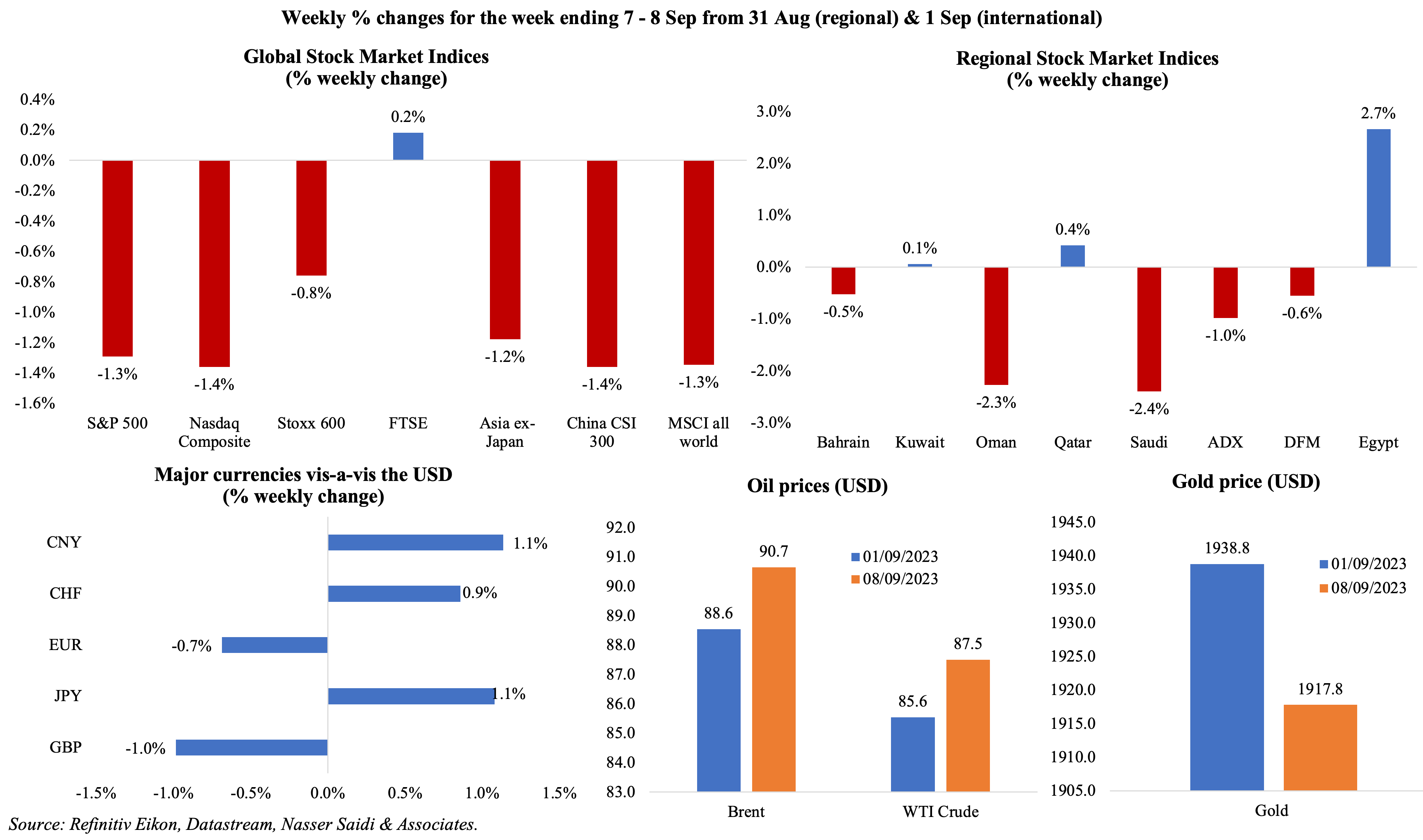

Global equity markets were mostly lower for the week: with strong economic data in the US, including in the labour markets, expectations are that interest rates will remain high for longer; this contrasts with the weak demand outlook in China where concerns are growing about dwindling growth and European indicators in contractionary territory. Regional markets were mostly down, with Saudi easing on IMF’s expectations of lower growth this year while Egypt posted the largest gains (+2.7% weekly). The dollar gained for the eighth week in a row (longest streak since 2014), Japanese yen stood at its lowest this year, yuan sank to a 16-year low which is likely to boost exports, and India’s rupee posted a record closing low last Thursday. Extension of cuts from Saudi Arabia and Russia saw oil prices jump to a 9-month high, with the Brent posting a 2.4% weekly gain.

Global Developments

US/Americas:

- US factory orders fell by 2.1% mom in Jul, partly reversing the previous month’s 2.3% gain. Durable-goods orders plunged by 5.2 % while non-durable goods orders rose 1.1%.

- Non-farm labour productivity in the US grew by 3.5% in Q2, lower than the preliminary estimate of 3.7%. In yoy terms, productivity rose by 1.3%, the first uptick since Q4 2021. Unit labour costs rose by 2.2%, much higher than Q1’s 1.6% gain.

- The Beige book showed “economic growth was modest” in Jul-Aug while retail spending continued to slow. Most districts reported slower overall price inflation, with the deceleration faster in manufacturing and consumer goods sectors.

- ISM services PMI unexpectedly increased to 54.5 in Aug (Jul: 52.7), the strongest in 6 months, supported by an increase in new orders (57.5 from 55) and employment (54.7 from 50.7) while prices paid edged up to 58.9 (from 56.8).

- S&P Global composite and services PMI readings were lower than the preliminary estimates, clocking in at a final 50.2 and 50.5 respectively (from 50.4 and 51). Services PMI dipped due to a contraction in new business and subdued domestic demand; new export orders however increased alongside responses that wage bills were driving up input prices.

- Goods and services trade deficit in the US widened to USD 65bn in Jul (Jun: USD 63.7bn). Deficit with China increased by USD 1.2bn to USD 24.0bn while balance with the UK moved to a surplus USD 0.5bn (Jun: USD 0.8bn deficit).

- Initial jobless claims fell for the fourth week in a row: it was down by 13k to 216k in the week ended Sep 1st, the lowest since Feb, and the 4-week average slipped by 8.25k to 229.25k. Continuing jobless claims also declined by 40k to 1.679mn in the week ended Aug 25th, remaining low compared to a high of 1.86mn touched in mid-Apr.

Europe:

- GDP growth in the eurozone was revised down slightly in Q2: it stood at 0.1% qoq and 0.5% yoy (from previous estimates of 0.3% qoq and 0.6% yoy; Q1: 0.1% qoq). Household consumption was stable and government expenditure rebounded (0.2% vs Q1’s 0.6% drop) while gross fixed capital formation rose by 0.3%.

- Eurozone’s composite PMI slipped to 46.7 in Aug (prelim: 47), the largest contraction since Nov 2020, as services PMI contracted for the first time this year (9 from the preliminary reading of 48.3, with declines led by France and Germany).

- Producer price index in the euro area declined by 0.5% mom and 7.6% yoy in Jul, declining for the seventh month in a row. The drop was largely driven by the decline in energy sector (-24.2%) and intermediate goods (-4%) as capital, durable and non-durable consumer goods increased by 4.7%, 5.1% and 7.6% respectively.

- Retail sales in the EU fell by 0.2% mom and 1% yoy in Jul, largely a result of lower auto fuel purchases (-1.2%mom). In yoy terms, retail sales have fallen for 10 consecutive months.

- European Sentix investor confidence fell to -21.5 in Sep (Aug: -18.9), as both components fell: expectations to -21 (Aug: -17.3) and current situation to -22.0 (Aug: -20.5); the latter was at the lowest since Nov 2022.

- Composite PMI in Germany inched lower to 44.6 in Aug (prelim: 44.7), the lowest since May 2020 driven by lower volumes of new export business. Services PMI was confirmed at 47.3 in Aug, the first below-50 reading in 8 months, as demand weakened alongside increase in both input and output prices.

- Germany’s exports fell by 0.9% mom (to EUR 130.4bn) in Jul while imports inched up by 1.4%. Trade surplus narrowed to EUR 15.9bn from EUR 18.8bn the month before. Trade within the EU was stable (+0.5%), and sales to nations outside the EU declined by 2.5%.

- German factory orders plunged by 11.7% mom and 10.5% yoy in Jul (Jun: 7.6% mom) – the first drop in industrial orders since Mar, and the steepest since Apr 2020. Orders for capital goods fell by 15.9% while new orders for other transport equipment plummeted by 54.5%.

- Industrial production in Germany declined by 0.8% mom in Jul (Jun: -1.4%), with declines across the board: capital goods (-2.9%), consumer goods (-1.0%), and intermediate goods (-0.7%).

- Both composite and services PMI in the UK were revised up vis-à-vis the preliminary estimate. Composite PMI rose to 48.6 (from 47.9), with total new work declining for the second consecutive month. Services PMI was up to 49.5 (from 48.7), though still the first sub-50 reading since Jan on weaker lower output and falling sales.

- UK like-for-like retail sales grew by 4.3% yoy in Aug (Jul: 1.8%): the fastest pace in four months, supported by strong sales in health, beauty and food & drink during the summer holidays. However, sales fell in volume terms.

Asia Pacific:

- Inflation in China rose to 0.1% yoy in Aug (Jul: -0.3%), with core inflation unchanged at 0.8%: non-food costs ticked up by 0.5%while food prices fell by 1.7%. Producer price index remained deflationary: -3% yoy in Aug (Jul: -4.4%), though this was the smallest drop in 5 months.

- China’s exports fell by 8.8% yoy in Aug, alongside a 7.3% drop in imports, moving the trade surplus to a narrower USD 68.36bn (Jul: USD 80.6bn). Exports to the US and EU fell by 17.4% yoy and 10.5% to USD 45bn and USD 41.3bn respectively. China’s imports from Russia, mostly oil and gas, grew 13.3% yoy to USD 11.52bn billion.

- China’s Caixin services PMI eased to 51.8 in Aug (Jul: 54.1), as new order growth slowed, and export sales fell (first time since Dec) while employment rose for the 7th straight month.

- GDP in Japan grew by an annualised 4.8% in Q2, down from the preliminary estimate of 6%; in qoq terms, GDP grew by 1.2% (Q1: 1.5%). This was a result of a 1% drop in capital expenditure (vs. a flat prelim reading) and a 0.6% qoq drop in private consumption (vs. initial estimate of 0.5% dip).

- Overall household spending in Japan fell by 5% yoy in Jul (Jun: -4.2%), down for the fifth month in a row and posting the biggest drop in 2.5 years. Labour cash earnings (nominal) grew by 1.3% yoy in Jul (Jun: 2.3%) while real wages fell for the 16th straight month (-2.5% from Jun’s 1.6% dip).

- Japan’s current account surplus widened to JPY 2.772trn in Jul (Jun: JPY 1.509trn), expanding more than threefold compared to a year ago, partly due to the goods trade surplus (JPY 68.2bn from a deficit of JPY 1.18trn a year ago). Furthermore, Japan’s travel surplus came to JPY 336.8bn, a record high for July since comparable data became available in 1996.

- The preliminary reading of Japan’s leading economic index stood at 107.6 in Jul (Jun: 108.8), the lowest reading since Oct 2020, while the coincident index moved lower to 114.5 (from 115.6).

- GDP in South Korea grew by 0.6% qoq and 0.9% yoy in Q2: this was the fastest quarterly growth since Q2 2022 and brings growth in H1 to 0.9%. Imports tumbled by 3.7%, compared to a 0.9% drop in exports: net exports raised GDP by 1.4 percentage points. Private and government spending fell 0.1% and 2.1% in Q2.

- Retail sales in Singapore grew by 0.6% mom and 1.1% yoy in Jul, rising for the 6th month in row in yoy terms, supported by tourist arrivals (rose to 1.4mn in Jul, the highest in 2023). Excluding motor vehicles, retail sales were up by 0.4% yoy (the 17th straight month of expansion).

Bottom line: In addition to China’s data dump (from monetary statistics to industrial production and retail sales), this week sees the release of US inflation and UK jobs data (especially wage growth numbers); if data is weak, a rate hike the week after is less likely. Looming ahead is also the ECB meeting – inflation has eased since the last meeting, but is still sticky; a pause is possible this time round given data pointing towards an economic slowdown (weak PMI readings & business confidence, fall in German IP etc).

Regional Developments

- At the G20 Summit, the India-Middle East-Europe Economic Corridor (IMEC) was launched by the EU, India, Saudi Arabia, the UAE, the US and other G20 partners. The project aims to link Middle East nations by rail, connect them to India by seaport, thereby facilitating the flow of energy supply and trade from the Gulf to Europe. Plans are also to lay along the route cable for power and data lines, as well as for pipeline for hydrogen.

- Egypt’s inflation jumped to a record-high of 39.7% in Aug (Jul: 38.2%), driven up by a large jump in food and beverage prices (71.9%) and clothing and footwear (23.6%). The situation was worsened by the shortage of foreign currency. Core inflation eased slightly to 40.4% (Jul: 40.7%).

- PMI in Egypt was unchanged at 49.2 in Aug, its joint-highest level in 2 years. While activity and new orders dropped modestly, employment and inventories moved to above-50. With input cost inflation at a 5-month high (given exchange rate pressures, raw material supply issues and rising wage pressures), many firms expect a recessionary period ahead. The 12-month ahead business sentiment is among the weakest since the series began in 2012.

- Trade between Egypt and the G20 nations increased by 10.1% yoy to USD 88.1bn in 2022, with the value of exports rising by 21.1% (to USD 25.6bn) alongside a 6.1% uptick in imports (to USD 62.5bn). Turkey topped the list of nations importing from Egypt (close were Italy and Saudi), while China was the top exporter (followed by Saudi Arabia and the US).

- Egypt’s finance minister disclosed that the nation plans to secure new external financing ranging between USD 1.5-2bn this year, including USD 1bn via the issuance of Samurai and Panda bonds.

- Egypt settled USD 52bn of its foreign liabilities during the two fiscal years 2022-2023 and 2021-2022, according to an official statement. Furthermore, the nation also paid USD 25.5bn in debts in the first half of the current fiscal year.

- Population in Egypt increased by 25mn persons in the last decade, revealed the country’s planning minister. She stated that in Egypt, “every 100 people responsible for production work to provide the needs of 60 other people”, thereby lowering average incomes, and savings and investment at the state level.

- Egypt set up a national council to attract investments into green hydrogen projects in the country, reported Asharq Business. The nation expects FDI into such projects to touch USD 81.6bn by 2035.

- The IMF’s first loan program review for Egypt is unlikely to happen in Sep as the team are waiting for the implementation of more “wide-ranging reforms”. The review is expected to happen later this year, and expectation is building for a potential devaluation before end-2023.

- Japan extended a USD 100mn loan to Jordan, to support its electricity sector reforms.

- Lebanon PMI slipped below-50 back again to contractionary territory 48.7 (Jul: 50.3), a 7-month low, with deteriorating output and new orders alongside rising input costs (given exchange rate movements). A faint ray of optimism was seen as the future output index touched its highest point since Mar 2020.

- Lebanon’s central bank plans to establish a new international currency exchange platform through Bloomberg, according to the acting central bank governor, phasing out the Sayrafa platform.

- Oman’s OQ Gas Network plans to float up to 49% of its shares, reckoned to be the largest IPO offering in almost 20 years. The listing will be on the Muscat Stock Exchange, potentially in Oct, and the IPO could raise between USD 700-800mn, reported Reuters.

- Oil exports from Oman touched 178.9mn barrels until Jul while oil production stood at 223.55mn barrels. Bulk of the exports went to China (163.2mn barrels), while Japan (5.9mn), India (2.7mn) and Korea (1.95mn) were the next largest recipients.

- The tourism industry in Oman grew by 47.3% yoy to OMR 1.9bn (USD 4.93bn) in 2022. Direct value added from the sector stood at OMR 1.1bn, contributing 2.4% to GDP. Domestic tourism accounted for 68% of earnings while international visitors reached 2.9mn (348% yoy).

- The Saudi Fund for Development signed a USD 150mn agreement to support SMEs in Oman, disclosed Saudi state TV Al-Ekhbariya.

- Qatar’s PMI slipped to 53.9 in Aug (Jul: 54), while reporting a boost in manufacturing and financial services new orders; employment grew steadily for the sixth straight month. Financial services continued to outperform, with new business rising at the fastest pace in the year, resulting in an uptick in hiring (the most since Oct 2021).

- Saudi crude oil exports to India surged by 69% mom to 820k barrels per day in Aug while oil exports from the UAE slipped by 6% to 273k bpd, according to Press trust of India, citing Vortexa data.

- Oman’s Minister of State for Foreign Affairs disclosed that the GCC nations will resume free trade agreement talks with Japan.

Saudi Arabia Focus

- Saudi Arabia’s real GDP grew by 1.2% in Q2 2023, slightly higher than the preliminary reading, with non-oil sector posting a 6.1% growth (compared to the oil sector’s 4.3% drop).

- Saudi Arabia extended the voluntary oil output cut of 1mn barrels per day (bpd) until the end of this year: this (along with Russia’s extension of 300k bpd cuts) sent oil prices higher than USD 90 last week and will lower growth for the full year. We expect strong domestic demand and strong pipeline of megaprojects to support non-oil activity. The latest IMF report projects overall growth of 1.9% for this year, given lower oil output & prices.

- Saudi Arabia PMI eased by 1.1 points to an 11-month low of 56.6 in Aug. Output dropped to 59.1 (lowest since Jan 2022), new orders slipped (to 60.2), and export salesslowed, while input cost inflation accelerated to the fastest in a year and selling prices rose marginally (given competitive pressures). Business confidence fell to the lowest since Jun 2020.

- The number of fintech firms in Saudi Arabia rose to over 200 as of Aug 2023, according to the central bank governor, from 89 in 2022 and just 51 in 2021. Fintech firms generated a total revenue of SAR 2.8bn (USD 746.4mn) in 2022, up from SAR 2bn in 2021. SAMA is targeting 525 fintech firms by 2030, with 18k new specialised jobs. Separately, a senior central bank official disclosed that the share of digital payments in Saudi Arabia stands at 62% currently and is on track to meeting the target of 70% by end-2025.

- Saudi PIF completed the sale of its 10.92% stake in the National Gas and Industrialization Co. for SAR 491mn (USD 131mn) to Jadwa Investment Co.

- Saudi Ministry of Industry and Mineral Resources issued 36,293 certificates of origin in Aug, up from 34,926 in Jul, as it continues to boost export competitiveness across sectors.

- Saudi Arabia’s General Authority for Competition approved a total of 13 merger and acquisition requests in Aug (Jul: 16), with acquisitions accounting for 84.6% of approvals. The authority has approved 120 deals this year (without conditions).

- SMEs in Saudi Arabia’s entertainment sector were provided SAR 70mn (USD 18.6mn) in support, by the General Entertainment Authority since the inception of the Financing Guarantee Program in Jul 2022. As of end-Jun, 16 SMEs had been backed by the initiative.

- The General Commission for Audiovisual Media in Saudi Arabia revealed that the sale of 51mn tickets since the opening of cinemas has generated revenues more than SAR 3bn. Overall across 20 Saudi cities, there are 7 movie operators, 69 movie theatres, more than 620 display screens and more than 64k seats.

- Saudi PIF backed oil & gas drilling company Ades Holding plans to raise up to SAR 4.6bn from its IPO. The firm will sell 338.7mn shares, including 101.6mn existing shares (held by PIF, Ades Investments and Zamil Group Investment) and 237.1mn newly issued shares.

- Saudi Arabia’s auto rental firm Lumi set the price of its IPO at SAR 66, thereby valuing the company at SAR 3.63bn (USD 967.8mn). The firm plans to sell 16.5mn shares or 30% of its issued share capital.

- Knight Frank’s Saudi giga projects report revealed that the combined value of commissioned infrastructure and real estate developments reached USD 250bn while including projects yet to be fully approved or given a construction date would take total to over USD 1.25trn. Around USD 70bn worth of NEOM projects have been commissioned, nearly half (45%) of which have been completed.

UAE Focus![]()

- UAE PMI slipped by a point to a 6-month low of 55 in Aug, with the output index slowing to 61.9 (Jul: 62.8) while new orders remained stable at 57.6 as domestic demand supported growth. In contrast to Saudi, business confidence in the UAE was strong with the index at its highest since Mar 2020.

- Trade between the UAE and G20 nations touched USD 341bn in 2022, up 21% yoy and 34% from 2019. According to the minister of state for foreign trade, G20 nations account for 43% of UAE’s non-oil exports, 39% of re-exports, and 67% of imports. In H1 this year, non-oil exports were up 10.6% yoy to USD 23.4bn.

- UAE revealed the setup of a federal gaming regulator, General Commercial Gaming Regulatory Authority, to establish “a robust regulatory body and framework for the UAE’s lottery and gaming industry”. According to WAM, the authority will “will coordinate regulatory activities, manage licensing nationally and facilitate unlocking the economic potential of commercial gaming responsibly”.

- About 30,146 new businesses registered with the Dubai Chamber of Commerce in H1 2023, up from around 21k a year ago. Indian businesses account for more than 1/5th of the total (22%), followed by the UAE (4,445 firms) and Pakistan (3,395).

- The Abu Dhabi Export Office signed a financing agreement with the National Bank of Egypt: this will support UAE export transactions to Egypt, with the establishment of a revolving loan facility worth USD 100mn.

- UAE announced end-of-service benefits scheme for private sector employees, including in free zones. This will be optional for companies, but will provide 3 investment options – risk-free investment, risk-based investment and sharia-compliant investment.

- UAE’s Global Investment Holding Co. agreed to buy a 30% stake in Egypt’s Eastern Co. (the nation’s main tobacco products maker) for USD 625mn. This will reduce the stake of Egypt’s state-owned Holding Company for Chemical Industries to 20.95%. The government had earlier sold a 4.5% stake on the stock exchange in 2019.

- ADNOC will develop the Habshan carbon capture project: once completed, the project will have the capacity to capture and permanently store 1.5mn metric tons of carbon dioxide per year, and triple ADNOC’s carbon capture capacity to 2.3mn metric tons per year.

- Masdar won the contract worth AED 5.5bn (USD 1.5bn) to construct the 6th phase of the 1,800 MW Mohammed bin Rashid Al Maktoum Solar Park. Masdar was awarded the contract as it offered a levelized cost of energy of USD 1.621 per kilowatt hour, the lowest of any of DEWA’s solar independent power producer model projects to date.

- Speaking at the African Climate Summit, UAE’s COP28 President-designate revealed that the UAE will give USD 4.5bn to Africa’s clean energy initiatives – to be distributed in collaboration with Africa50, an investment platform established by African governments and the Africa Development Bank.

- UAE’s Mubadala Investment Company officially opened its Beijing office, with the 10-person team focusing on direct and fund investments in the country.

Media Review

The Gulf’s boundless ambition to change the world: The Economist

https://www.economist.com/leaders/2023/09/07/the-gulfs-boundless-ambition-to-change-the-world

Factbox: Gulf firms’ investments in European telecoms

https://www.reuters.com/business/media-telecom/gulf-firms-investments-european-telecoms-2023-09-06/

The Global Economy’s Real Enemy is Geopolitics, Not Protectionism by Dani Rodrik

https://www.project-syndicate.org/commentary/global-economy-biggest-risk-is-geopolitics-not-protectionism-by-dani-rodrik-2023-09

Have we reached peak pessimism on China?

https://www.ft.com/content/7beb34d5-5437-43b7-a114-3836be0d2fc5

Harnessing GovTech to Tax Smarter and Spend Smarter: IMF

https://www.imf.org/en/Blogs/Articles/2023/09/07/harnessing-govtech-to-tax-smarter-and-spend-smarter

Powered by: