Middle East PMIs. GDP in Saudi Arabia & Qatar. GCC inflation. Money & credit in Saudi Arabia & UAE.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 8 Sep 2023: GCC PMIs & GDPs paint a positive picture, despite a slower pace, with inflation softening

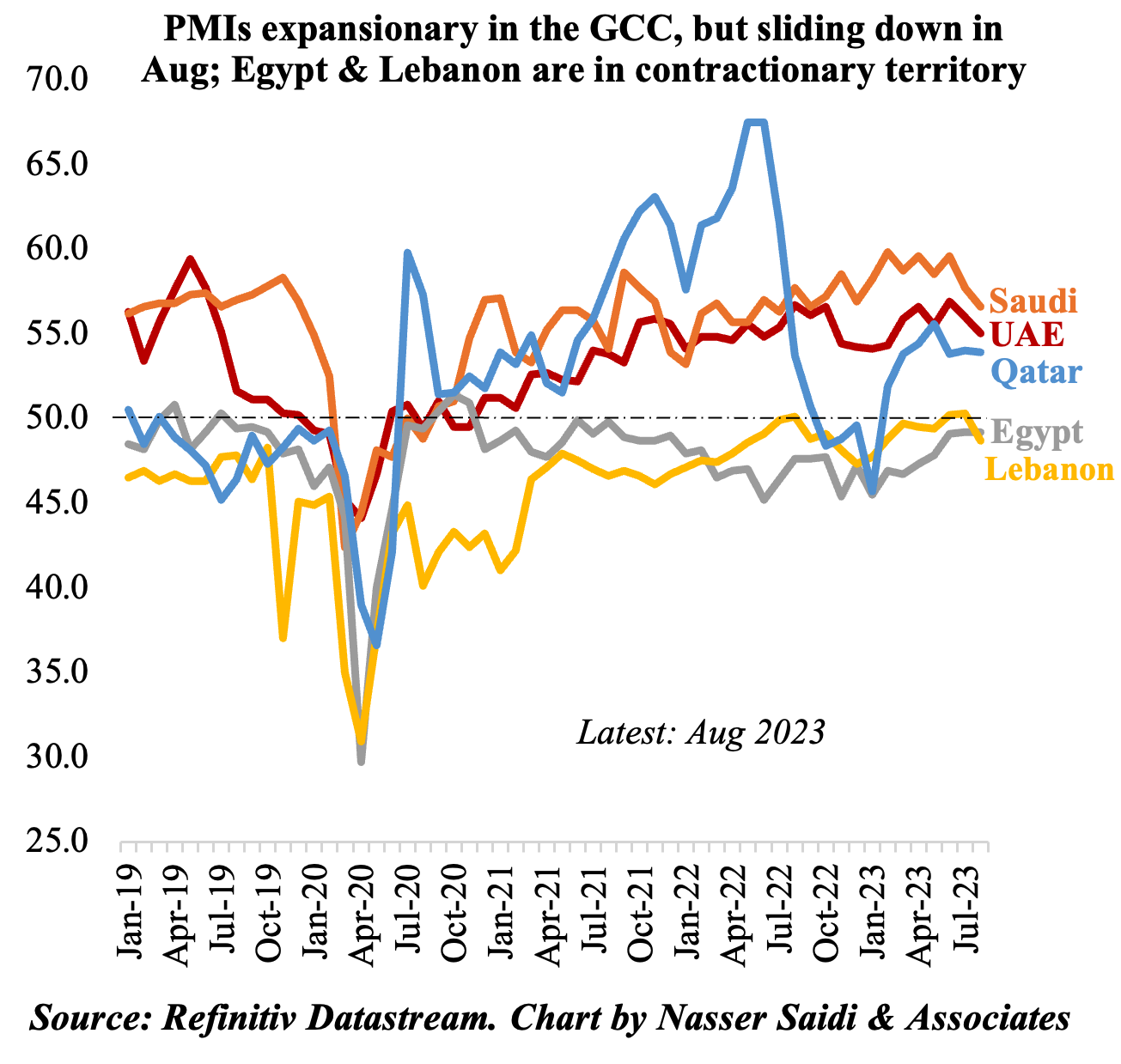

1.Middle East PMIs moderate in Aug: GCC stays expansionary, but Lebanon moved to below-50

- A contrasting tale in Saudi Arabia and the UAE:

- Non-oil sector PMI in Saudi Arabia fell to a 11-month low of 56.6 in Aug. In UAE, PMI eased to 55 in Aug, but new orders expanded, propped up by increased consumer spending.

- Export sales slowed in Saudi Arabia while UAE reported robust domestic sales and export orders.

- Input cost inflation in Saudi Arabia accelerated to the fastest in a year, and selling prices rose marginally (given competitive pressures). Meanwhile, UAE reduced output charges (lowest since Mar), though some firms reported hiking prices to account for higher costs & increased demand.

- Qatar’s PMI slipped to 53.9 in Aug (Jul: 54), while reporting a boost in manufacturing and financial services new orders; employment grew steadily for the sixth straight month.

- Lebanon PMI slipped below-50 back again to contractionary territory 48.7 (Jul: 50.3), with deteriorating output and new orders. Political and economic uncertainty continues, and input costs are rising given exchange rate movements. A faint ray of optimism: future output index touched its highest point since Mar 2020.

- Egypt PMI stayed unchanged at 49.2 in Aug, its joint-highest level in 2 years. While activity and new orders dropped modestly, employment and inventories moved to above-50. Many firms expect a recessionary period ahead:12-month ahead business sentiment is among the weakest since the series began in 2012.

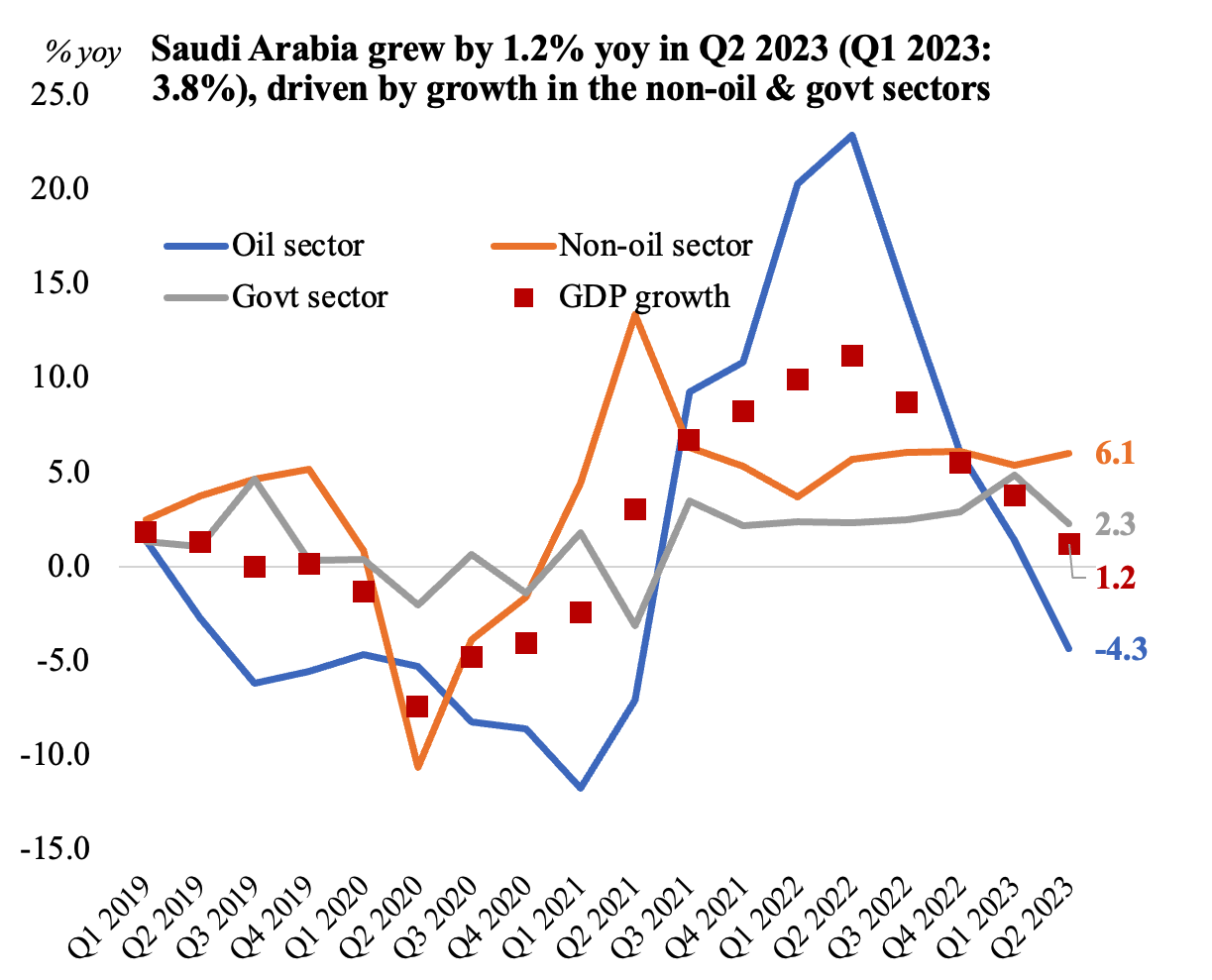

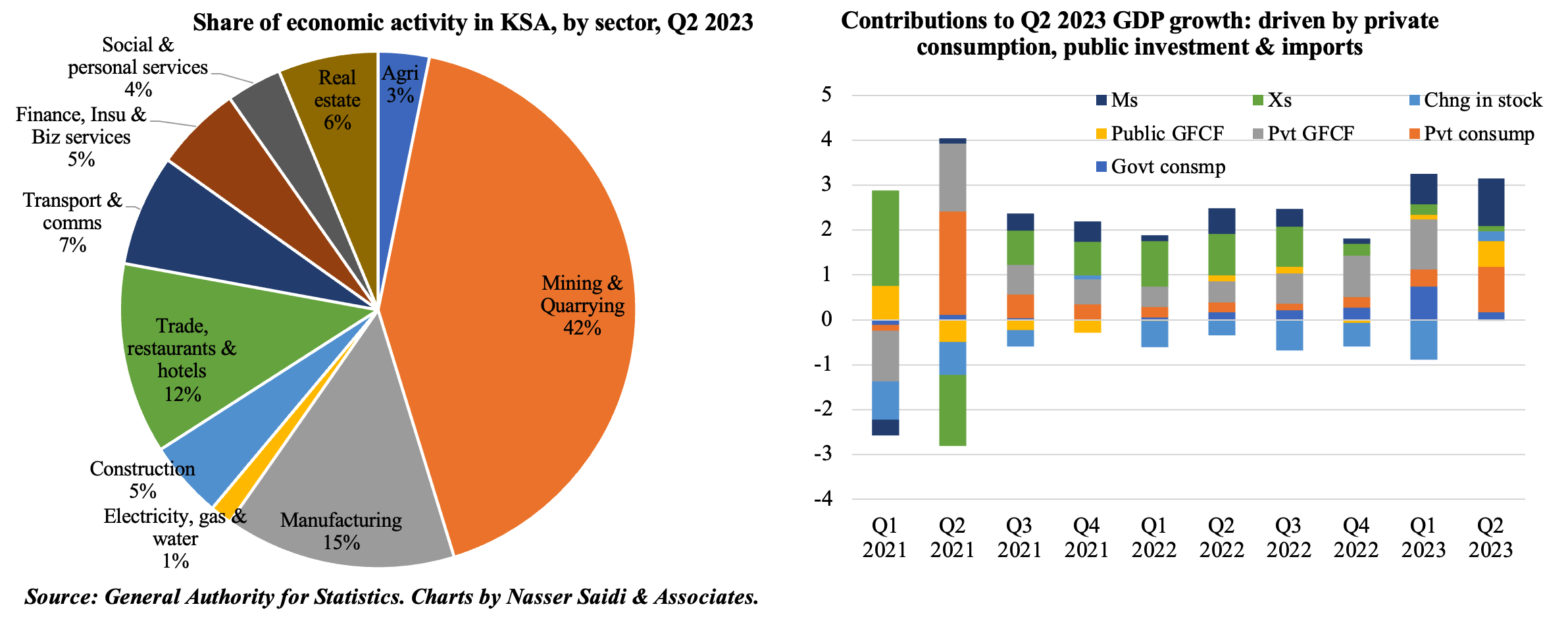

2. Saudi Arabia grew by 1.2% yoy in Q2 2023 (Q1: 3.8%), aided by non-oil sector growth (6.1%) as oil sector contracts (-4.3%)

- Saudi Arabia’s real GDP grew by 1.2% in Q2 2023, slightly higher than the preliminary reading, with non-oil sector posting a 6.1% growth (versus oil sector’s 4.3% drop). Latest IMF report, projects a growth of 1.9% for this year, given lower oil output & prices.

- With voluntary oil production cuts extended till rest of the year, expect lower growth in the oil sector & overall; strong domestic demand & pipeline of megaprojects will support non-oil activity (construction & real estate together accounted for 11% of total in Q2).

- In terms of contribution to growth by expenditure method, private consumption & public investment top the list in Q2. In contrast to recent quarters, private sector investment’s contribution has reduced, as has of exports.

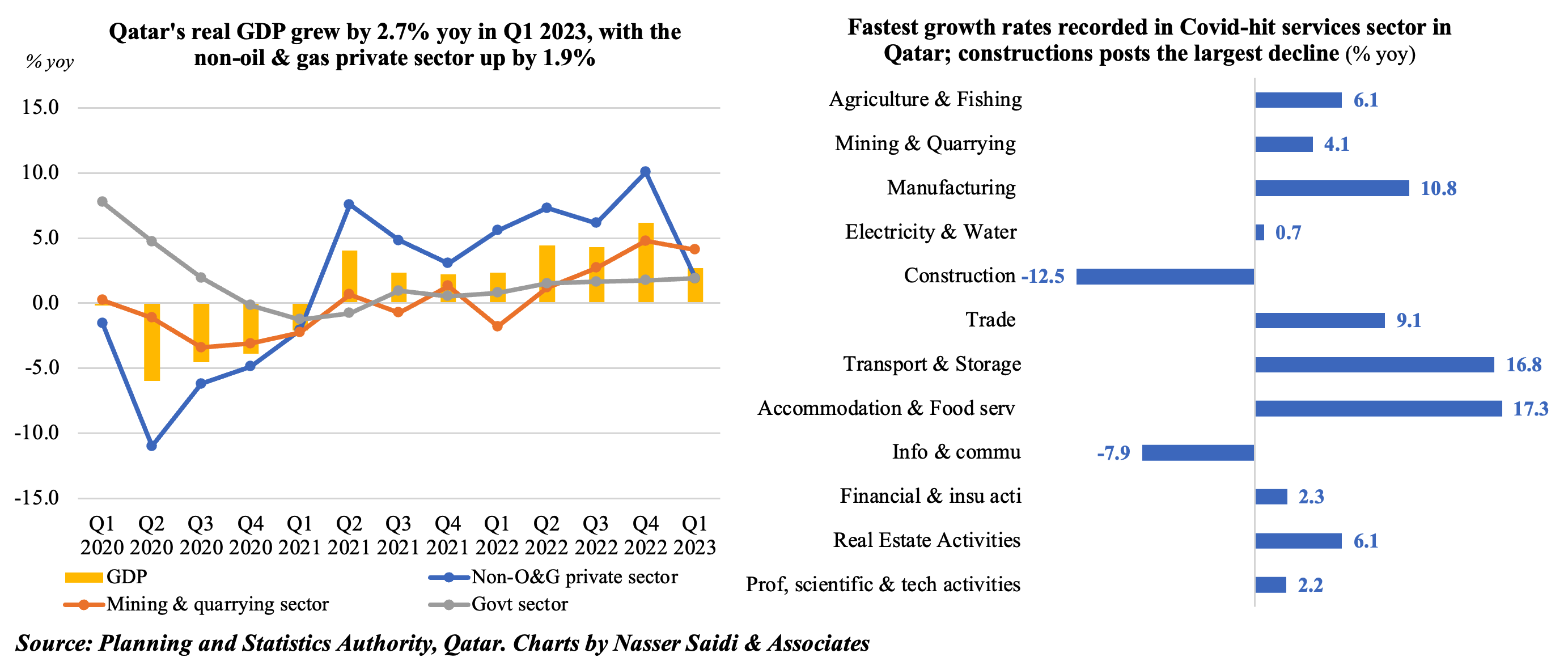

3. Qatar’s real GDP grew by 2.7% yoy in Q1 2023; but a 3.9% decline in qoq terms

- Real GDP in Qatar surged in Q1 2023, rising by 2.7% yoy to QAR 170.1bn. Non-mining and quarrying sector growth rose by a modest 1.9% in contrast to the gains in the mining & quarrying sector (4.1%). A breakdown of activity by sector shows that the biggest gains in Q4 were recorded in accommodation & food services (17.3% yoy), transport & storage (16.8%) and manufacturing (10.8%). For now, there seems to be sustained tourism and services sector growth post-World Cup.

- There was a 3.9% qoq decline in Q1 GDP, after the World Cup driven activity in Q4 2022, with non-hydrocarbon activity down by 6.3%; accommodation & food services activity fell sharply by 13.6% qoq while information & communication and trade fell by 20.6% and 16.1% respectively.

- Looking ahead, the government’s investments in LNG expansions/ projects and the long-term LNG contracts (with China, Bangladesh & others) are likely to support growth in the coming years; domestic demand will also aid activity.

- PMI readings so far this year underscores strength of the non-oil sector: average for H1 2023 (52.5) was slightly higher than the long-run trend since 2017 (52.3). This is particularly important as LNG prices have fallen by around 55% this year, implying lower government revenues and spending. Construction activity was down by 12.5% yoy in Q1 2023, indicating the lack of spending on infrastructure projects post-World Cup.

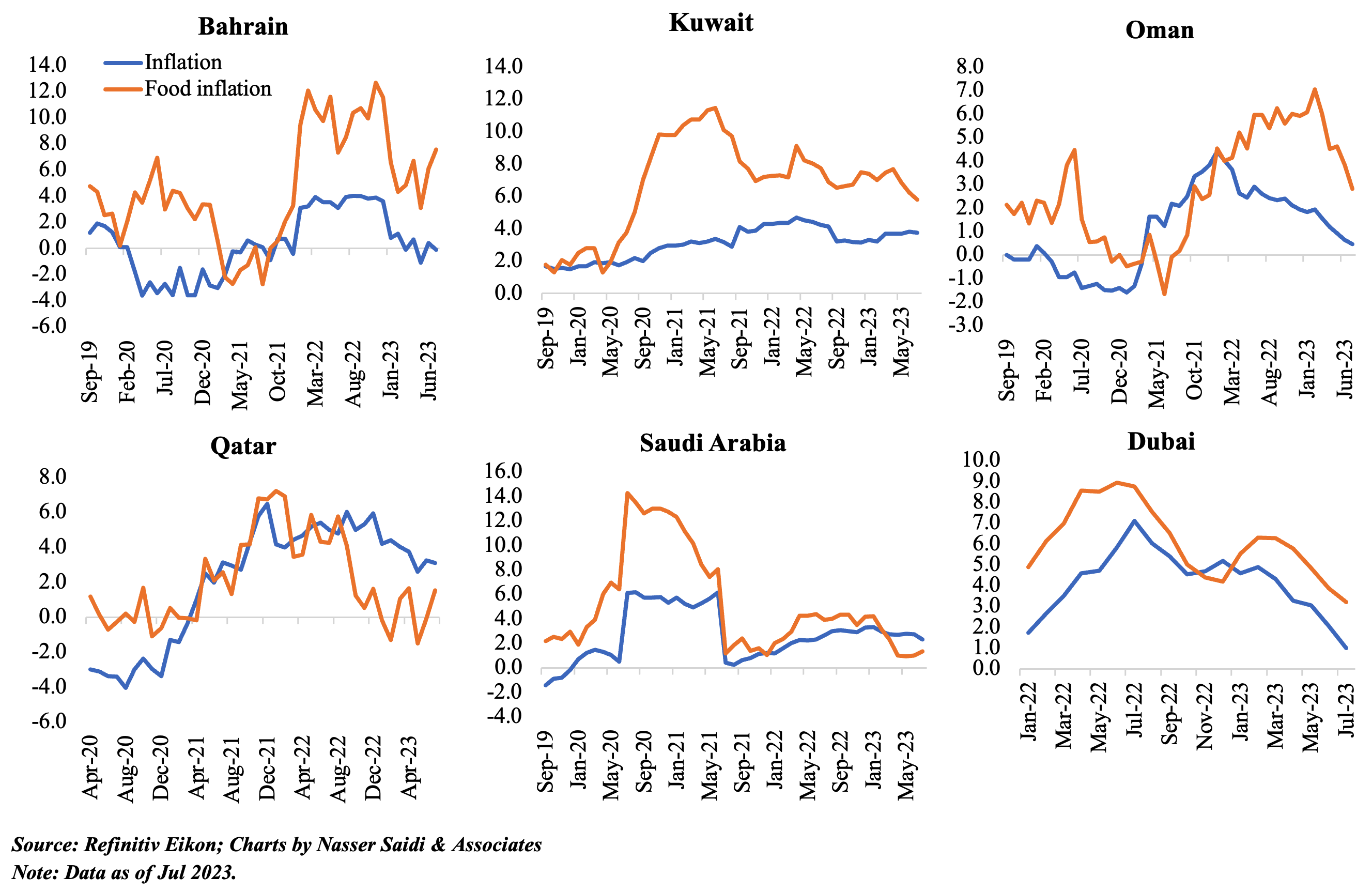

4. Inflation is softening in the GCC. In the UAE & Saudi Arabia, services & housing costs contribute most to overall inflation; with increased hiring & rising demand for housing, inflation could remain higher for longer (especially if supply does not increase in line with demand)

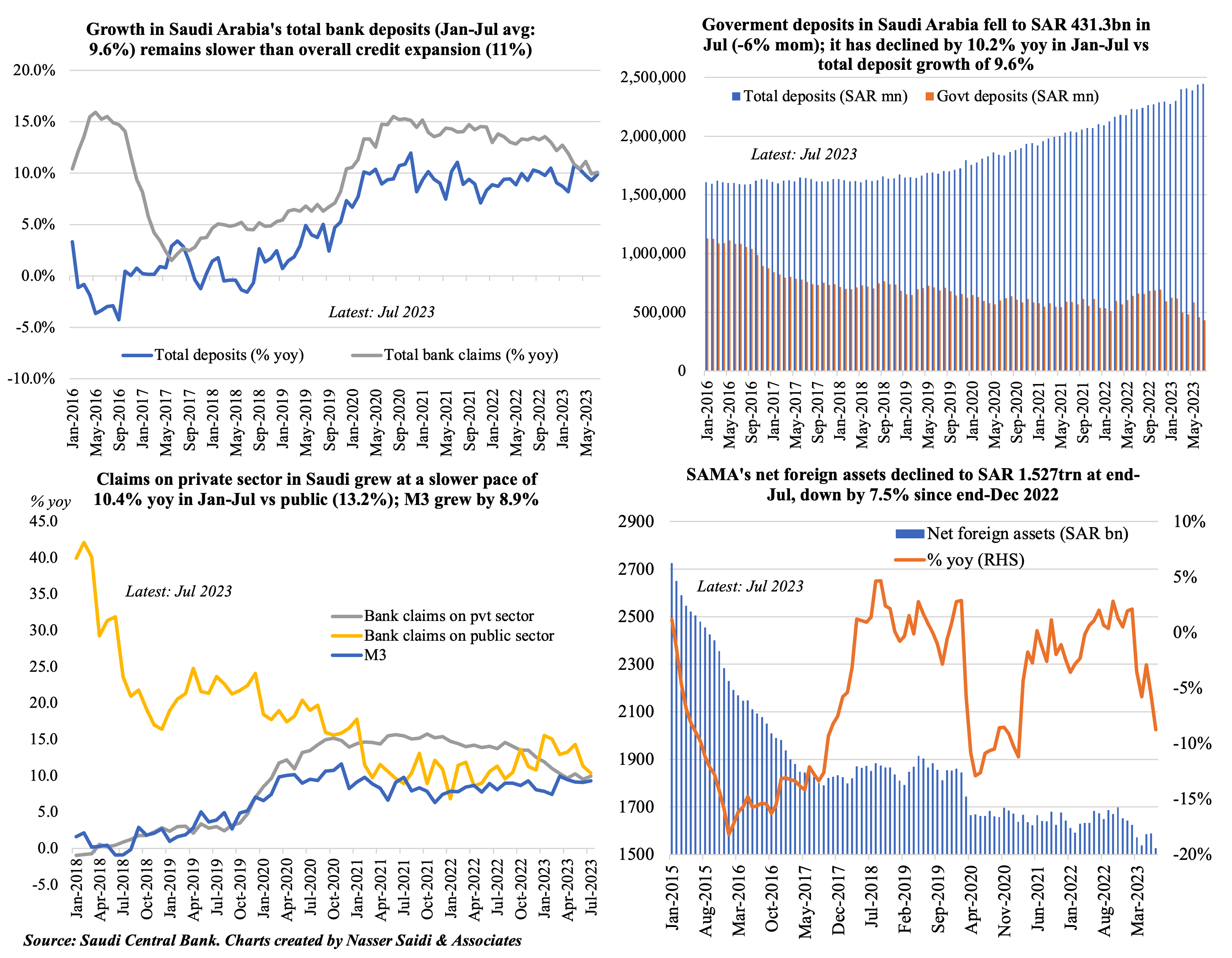

5. Saudi Arabia’s deposit-credit growth gap is narrowing; govt deposits declined by 10.2% yoy in Jan-Jul 2023 while net foreign assets shrank to USD 407bn in Jul – the sharpest drop since 2009

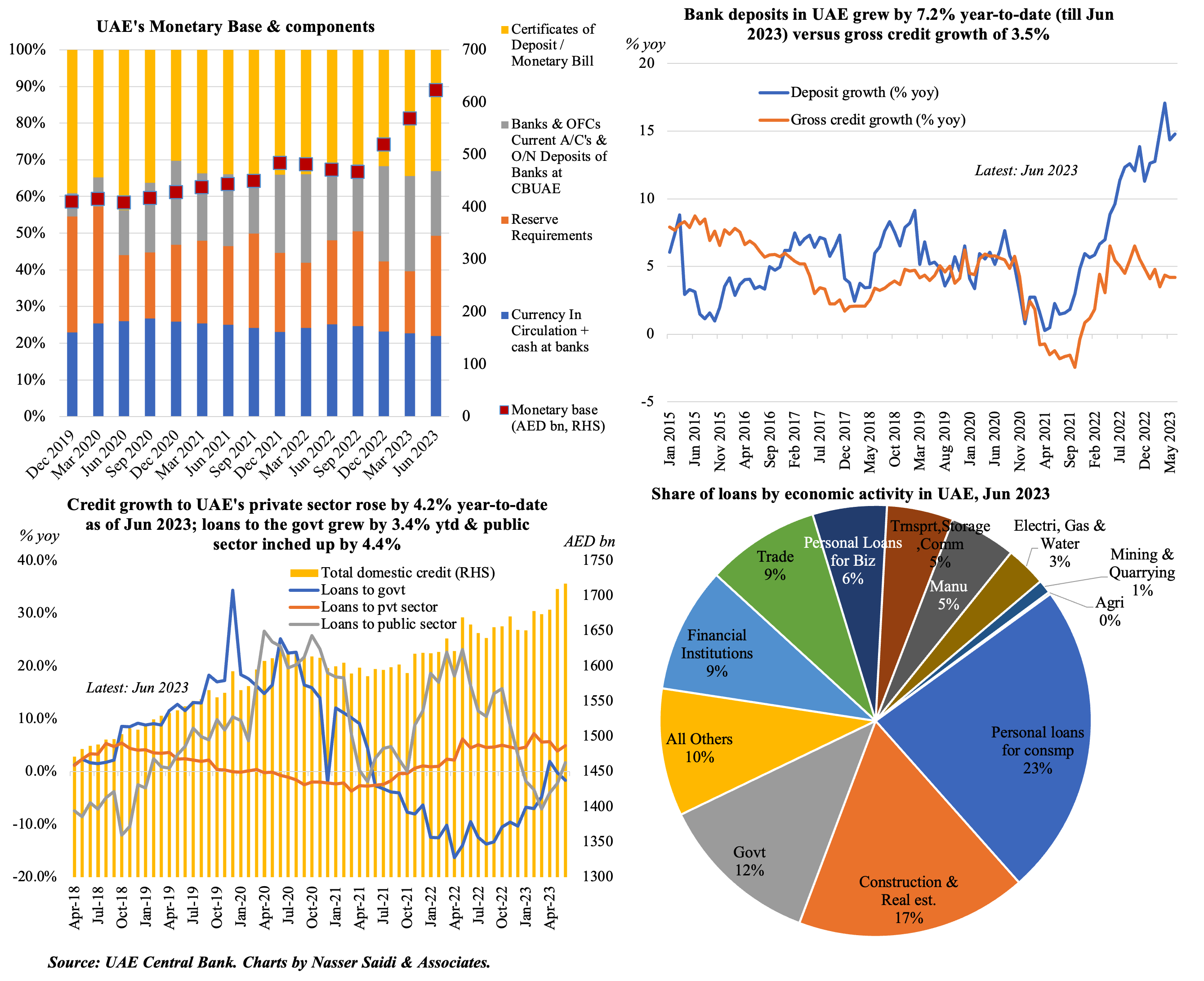

6. UAE’s monetary base has been rapidly expanded, up 20% ytd at end-Jun 2023. Deposit growth continues to outperform credit growth (with govt deposits up 7.3% ytd); more than 2/3rds of the credit goes to businesses & industrial sector

Powered by: