Markets

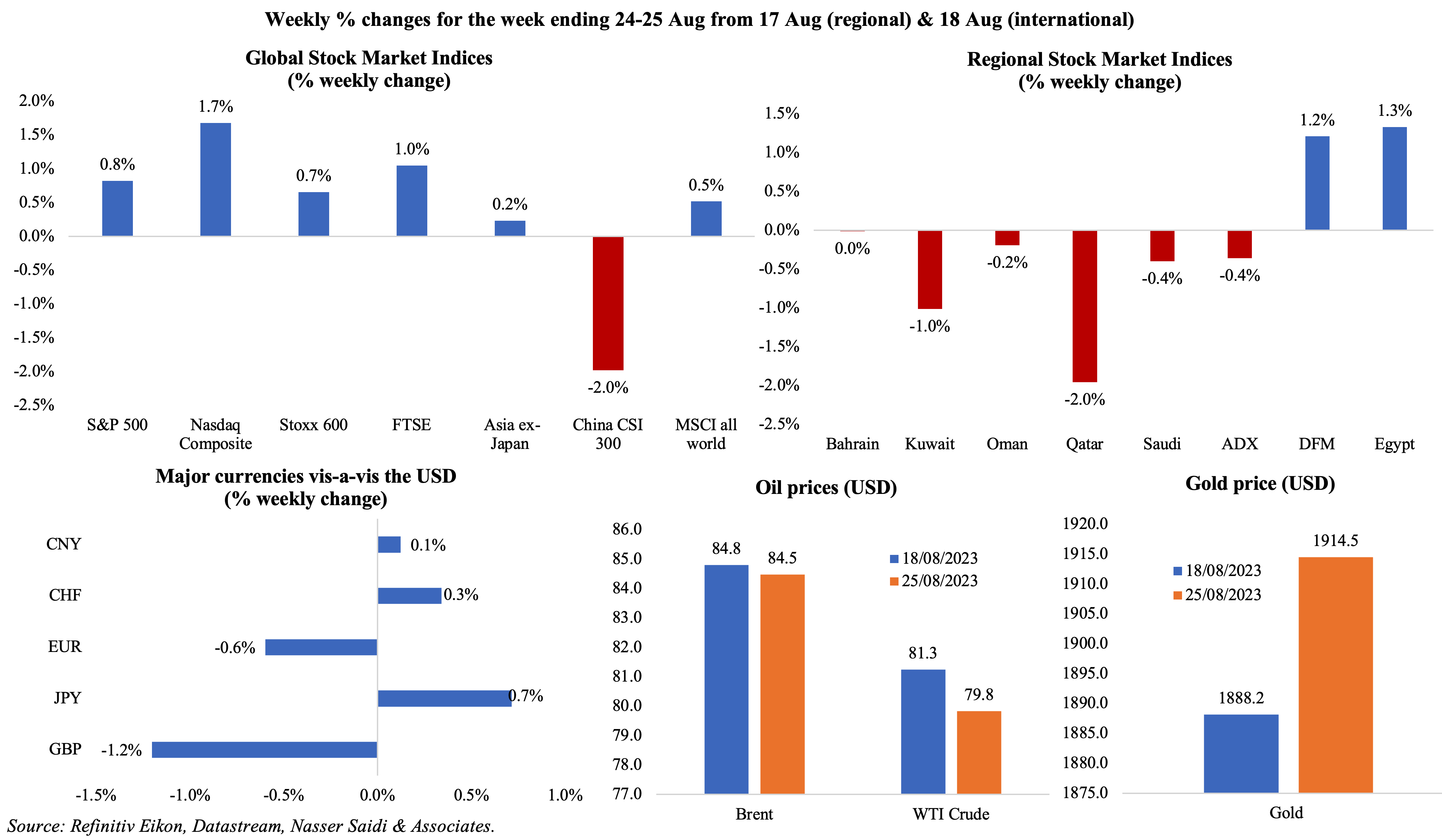

Global equity markets inched up across most markets though China CSI 300 extended losses, dropping 2% from a week before. Regional markets were mixed affected by uncertainty in the energy markets and oil prices, with the DFM and Egypt posting rises; the former had a 6-session winning streak last week though ending lower on Friday. The GBP touched a 10-week low after the flash PMI data raised recession fears, while the euro fell on expectations that the ECB could pause its tightening cycle at the meeting next month; the yen fell to its lowest level against the dollar since Nov. Oil prices fell for the second week in row while gold price rose by 1.4%.

Global Developments

US/Americas:

- Durable goods orders in the US fell by 5.2% mom in Jul (Jun: 4.4%), the largest decline since Apr 2020, as demand for aircraft declined. Non-defence capital goods orders excluding aircraft rebounded, up by 0.1% (Jun: -0.4%). Shipments of core capital goods slipped 0.2% in Jul after declining by 0.1% in Jun. car

- Existing home sales in the US fell by 2.2% mom to a 6-month low of 4.07mn in Jul, as mortgage rates increased (the 30-year fixed rate mortgage crossing 7%). New home sales grew by 4.4% to 714k in Jul, the highest level since Feb 2022; the median prices of new homes sold were down by 8.6% yoy to USD 436,700.

- Richmond Fed manufacturing index eased to -7 in Aug (Jul: -9), thanks to the new orders sub-index rising to -11 (Jul: -20) while employment index slipped to -3 (Jul: 5). Kansas Fed manufacturing activity rebounded in Aug, rising to 12 from Jul’s -20 reading, the first positive reading since Sep 2022.

- Chicago Fed national activity index improved to a 12-month high of 0.12 in Jul (Jun: -0.33), with the production related indicators rebounding to +0.18 (Jun: -0.36).

- Michigan consumer sentiment index slipped to 69.5 in Aug from the preliminary reading of 71.2, with expectations and current conditions sub-indices revised down to 65.5 and 75.7 respectively (from 67.3 and 77.4). The one and 5-year consumer inflation expectation inched up to 3.5% and 3% from the previous reading of 3.3 and 2.9% respectively.

- S&P Global manufacturing PMI in the US slipped to 47 in Aug (Jul: 49), as new orders and output declined at a faster pace. Services PMI also declined to 48.7 (from 51.5), posting the slowest expansion in 6 months. Composite PMI eased to 50.4 (Jul: 52), as new orders fell for the first time in 6 months, pace of job creation slowed to an over 3-year low and input cost inflation increased.

- Initial jobless claims fell by 10k to 230k in the week ended Aug 18th and the 4-week average rose by 2.25k to 236.75k. Continuing jobless claims fell by 9k to 1.702mn in the week ended Aug 11th, down from a high of 1.86mn in mid-Apr.

Europe:

- Services PMI in the eurozone fell into contractionary territory to 48.3 in Aug (Jul: 50.9), falling below-50 for the first time since Dec 2022, with Germany posting the steepest decline and employment growth the smallest since Feb 2021. Manufacturing PMI inched up by one point to 43.7 as output fell for the fifth month in a row. This caused the composite index to move down to 47 (Jul: 48.6).

- Current account surplus in the eurozone widened to EUR 36.8bn in Jun (Jun 2022: deficit EUR 4.4bn), the largest surplus since Sep 2021, driven by goods surplus (EUR 42.7bn). In H1 2023, the consolidated surplus was at EUR 59.5bn versus a deficit of EUR 42.1bn in H1 2022.

- Consumer confidence in the eurozone fell to -16 in Aug (Jul: -15.1) while the sentiment declined by 0.9 points to -17.

- Germany’s economy stagnated in Q2, after two consecutive quarterly declines, in line with a preliminary estimate. Household consumption posted zero growth alongside a 0.1% uptick in government spending while exports fell by 1.1%.

- German manufacturing PMI inched up to 39.1 in Aug (Jul: 38.8), staying below-50 for the 14th consecutive month, and dragged down by new orders. The composite PMI fell to 44.7 in Aug (Jul: 48.5), the lowest since May 2020, as services PMI plunged to below-50 for the first time in 8 months (47.3 in Aug from Jul’s 52.3).

- Producer price index in Germany fell by 1.1% mom and 6% yoy in Jul (Jun: -0.3% mom and 0.1% yoy). This is the first yoy fall since Nov 2020, and the sharpest decline since Oct 2009. Energy and electricity prices slumped by 19.3% yoy and 30%. Excluding energy, producer prices were up by 2% yoy.

- German Ifo showed declines in business climate (to 85.7 in Aug from 87.4), current assessment (89 from 91.4) and expectations (82.6 from 83.6). The current assessment reading was the lowest since Aug 2020.

- UK’s services sector PMI slipped to 48.7 in Aug (Jul: 51.5), the first contraction since Jan, as new orders fell the most since Nov 2022. Manufacturing PMI also edged lower to a 39-month low of 42.5 in Aug (Jul: 45.3) and the composite output index to slip to a 31-month low of 47.9 (Jul: 50.8).

- The GfK consumer sentiment indicator in the UK rose to -25 in Aug from a 3-month low of -30 in Jul, as easing inflation supported household spending.

Asia Pacific:

- China halved stamp duty on stock trading in a bid to boost the markets, after a key share index fell to 9-month lows. This was the first such cut since the 2008 financial crisis. Separately, the China Securities Regulatory Commission plans to slow the pace of initial public offerings in light of “recent market conditions”.

- Profits at China’s industrial firms fell for the seventh month by 6.7% yoy in Jul (Jun: 8.3%), after earnings shrank by 15.5% given weak demand. Earnings at state-owned enterprises and foreign firms plunged by 20.3% and 12.4% respectively.

- Inflation in Tokyo slowed to 2.9% yoy in Aug (Jul: 3.2%); excluding food and energy, inflation was unchanged at 4%while excluding just fresh food, inflation slipped to 2.8% (Jul: 3%). Services costs were up 2% in Aug (Jul: 1.9%), slower than goods prices up 4%.

- Japan’s preliminary manufacturing PMI inched up to 49.7 in Aug (Jul: 49.6), staying below-50 for the third month in a row; employment was unchanged following 28-months of job creation. Services PMI rose to 54.3, from Jul’s final reading of 53.8, thanks to an increase in new orders and export orders.

- India is expected to ban sugar exports come Sep, reported Reuters, as lack of rain is expected to affect yields: if so, this would be the first such move in 7 years. Separately, India’s government set a minimum price for exports of basmati rice, the latest restriction.

- Bank of Korea left interest rates unchanged at 3.5% last week, staying put for the fifth straight meeting. The apex bank lowered growth rate for next year to 2.2% (from 2.3%) while the forecast for this year was left unchanged at 1.4%.

- Inflation in Singapore eased to 4.1% in Jul (Jun: 4.5%), the lowest since Jan 2022, as food, housing and transport costs slowed to 5.3% (from 5.9%), 3.9% (from 4.3%) and 3.7% (from 4.6%) respectively. Core inflation eased to 3.8% (from 4.2%), the softest since May 2022.

- Singapore’s industrial production declined by 0.9% yoy in Jul (Jun: -6.6%), falling for the tenth month in a row. Some sectors rebounded including chemicals (2.3% from -8.9%) and electronics (5.1% vs -2.9%).

- Despite lip service and policies to support an energy transition, a new IMF report places total global spending on fuel subsidies at a record USD 7trn in 2022, equivalent to 7.1% of global GDP, up by USD 2trn over the past two years. Explicit subsidy costs (i.e. what governments pay directly to keep electricity or pump prices artificially low) more than doubled since 2020, to USD 1.3trn.

Bottom line: At the Jackson Hole meeting, Powell’s messaging touched on the need to contain inflation (via rate hikes) and staying the course, while also stating that economic uncertainty called for “agile” monetary policymaking implying that the Fed’s moves are likely to be very dependent on data releases. On the other hand, the flash PMI readings are in contractionary territory, reflecting the impact of months of monetary policy tightening and weak demand – among the developed markets contraction was the main message, with new orders falling at a fast pace. Many services PMIs fell below-50, joining the already down-in-the-dumps manufacturing PMI amid ongoing price pressures (including rising wage costs). Lastly, the weakness from China is an ongoing story – amid the property downturn and generally weak datapoints (IP, retail sales and such), the authorities one-off measures have not yet improved sentiment to the extent needed.

Regional Developments

- The BRICS extended an invite to Egypt, Iran, Saudi Arabia, and the UAE to join the group, along with Argentina and Ethiopia. This is the group’s first expansion in 13 years. Officially, the nations will join the group on Jan 1, 2024. See our article https://www.agbi.com/opinion/nasser-saidi-saudi-arabia-brics-change-world/

- Bahrain’s national origin exports fell by 23% yoy to BHD 323mn in Jul, with the top 10 nations accounting for 68% of the total exports value. Imports declined by 6% to BHD 441mn; re-exports rose by 3% to BHD 50mn, with UAE, Saudi Arabia and Malaysia the top partners.

- Bahrain and Oman signed an agreement to exchange credit information to support transparency and reduce financial risks, mirroring previous agreements with Saudi Arabia and Kuwait.

- Registered unemployment rate in Egypt declined by 0.1% qoq to 7% in Q2 2023. There were a total 2.17mn unemployed persons in Q2, roughly 7% of total labour force, of which 1.23mn were men. The 15-29 age group accounted for 61.8% of the unemployed.

- Egypt announced a new oil discovery in the Geisum and Tawila West Concession in the Gulf of Suez. In the current phase of exploration, total output from the field has reached about 23k barrels per day.

- E-trade exports from Egypt rose to 2.9% of total exports in 2021, from just 0.2% in 2011, according to the Central Agency for Public Mobilization and Statistics. Egypt ranked 109th globally and 13th in the region in 2020, as per UNCTAD’s eTrade Readiness Assessments.

- Iraq and Turkey have not yet reached an agreement about resuming Iraq’s northern oil exports after the flows were stopped on March 25th.

- Jordan reported a 50% increase in tourists to 3mn persons in Jan-Jul 2023 while tourism revenues surged by 59.4% to USD 3.45bn. Separately, Jordan citizens spent USD 905.5mn (46.6% yoy) in H1 2023 on travel and tourism activities outside the country.

- At the conclusion of the IMF’s Article IV consultation with Kuwait, it was disclosed that non-oil growth will be robust in 2023 (3.8% from 4% in 2022), alongside a fall in inflation and a large current account surplus. The IMF however warned that resolving the political gridlock between the government and Parliament is critical to accelerate reform momentum.

- Kuwait plans to transfer land with a total area of 842,000 square metres worth more than KWD 2.5bn (USD 8.12bn) to the pension fund for investment (Public Institution for Social Security Fund).

- Bank credit to Kuwait’s residents grew by 3.3% yoy in Jul, but slowed to 0.6% year-to-date (Jun: 0.8% ytd): lending to households grew by 3.6% yoy and compares to corporate credit growth at 1.5%. Residents’ deposits grew by 0.7% yoy while deposits from the government and public institutions fell by 10.8%.

- Lebanon’s acting central bank governor stated that the apex bank will not print money to lend to the state. Thegovernment’s draft budget for 2023 includes a deficit of 24% or LBP 46trn, and this would not be covered by the central bank.

- Exploratory drilling for oil and gas began in Lebanon’s offshore Block 9 last week. The energy minister stated that the results of the drilling would be available after 67 days. However, Lebanon should be careful not to ramp up spending in expectation of an oil windfall which is not likely before 6 to 8 years; a national oil fund independent of the finance ministry should be set up for the economy to reap the benefits of any potential future revenues.

- Inflation in Oman fell to a 28-month low of 0.41% yoy in Jul (Jun: 0.69%), thanks to declining transport costs (-1.7%) and easing food inflation (1.36% from Jun’s 2.18%).

- Oman’s Salalah Free Zone signed five new land lease agreements worth a total investment of OMR 727mn during H1 2023. Total cumulative agreements reached 127 pacts with a total volume of OMR 4.5bn.

- Qatar Investment Authority plans to invest USD 1bn in India’s Reliance Retail Ventures, for a 1% stake.

Saudi Arabia Focus

- Saudi Arabia’s foreign minister appreciated the BRICS invitation to join the group and disclosed that the nation would take “the appropriate decision” before the Jan 1st joining date proposed by the bloc.

- Saudi Arabia revealed a masterplan to develop 59 logistics centres (with a total area of more than 100mn sqm) by end of this decade: this is being rolled out as a part of its National Transport and Logistics Strategy; already, 21 centres are in development.

- Exports from Saudi Arabia grew by 39.7% yoy to SAR 88.8bn in Jun 2023, despite a 38.3% drop in oil exports (to SAR 71.9bn). Non-oil exports, including re-exports, grew by 45% to SAR 16.9bn; excluding re-exports, non-oil exports plunged by 46.1%. China, South Korea and India were the top trading partners with China accounting for 15.5% of total trade. UAE was among Saudi’s top 10 trading partners, with imports touching SAR 3.6bn in Jun, 7% of total imports into the country (behind just China and the US).

- Saudi Arabia tops the list of number of dollar millionaires in the MENA region, with 354k in 2022 (+8% yoy), according to a Credit Suisse report. Saudi ranked 23rd globally in a list dominated by US and mainland China (with 22.7mn and 6.2mn respectively).

- SMEs in Saudi Arabia touched 1.23mn in Q2, up by 2.6% qoq, according to data from Monsha’at. Separately, the minister of commerce disclosed that SMEs accounted for 80% of total jobs while the annual growth of e-commerce touched 33% between 2016-22.

- Saudi Arabia’s off-plan property sales surged by 52% yoy in H1 2023, according to Wafi, the off-plan sales and leasing committee in the Ministry of Municipal, Rural Affairs and Housing. The committee licensed 79 projects in H1 to provide 1,832 new real estate units in all regions countrywide.

- Saudi Arabia’s Digital Experience Maturity Index jumped to 80.68% in 2023 (prev: 77.26%), disclosed the Digital Government Authority.

UAE Focus![]()

- Reuters reported that India’s central bank was encouraging local banks to nudge their clients to settle trade in local currencies with the UAE, in either the AED or INR, to reduce USD-based transactions. India’s trade deficit with the UAE touched USD 21.62bn or 8.2% of total deficit in the fiscal year 2022-23.

- Private loans in the UAE grew by 4.2% yoy in Jun (May: 3.3%), with credit disbursed to the government and public sector rising by 2.5% and 3.7% respectively. UAE central bank’s foreign assets jumped to USD 161.33bn in Jun, and the monetary base grew by 0.1% mom to AED 622.2bn. The UAE central bank’s public budget grew by 32% yoy and 0.2% mom to AED 649.42bn at end-Jun 2023, with deposits standing at AED 135.3bn and cash & bank balances at AED 257.2bn.

- According to data from the Dubai Chamber of Commerce, its members’ top global export destination was Saudi Arabia in H1 2023. Exports to Saudi grew by 15% yoy to AED 35bn) while Kuwait came in 2nd (AED 12.8bn) and to Qatar it grew by 39.3% to AED 12.4bn.

- Six UAE banks financed green projects worth AED 190bn (USD 51.8bn) in 2022, according to the UAE Banks Federation.

- Moodys’ disclosed that UAE’s biggest banks, that together account for 77% of banking assets, posted a combined net profit of USD 7.4bn in H1 2023 (+68% yoy). This was largely due to the increase in interest rates and higher business volumes.

- Abu Dhabi Investment Authority-owned vehicle plans to double its investment (to USD 449mn) in an Australian real estate private credit vehicle called Qualitas, disclosed the latter.

- Dubai International Airport reported a 49% increase in passenger traffic to 41.6mn in H1 2023, surpassing pre-pandemic levels. The forecast for this year has been raised to 85mn passengers, from 83.6mn before: this is just 1.6% lower than annual traffic reported in 2019.

- DP World plans to invest around USD 510mn to build a new container terminal at the Kandla port in the Indian state of Gujarat. The firm already operates 5 container terminals in the country and the new terminal is estimated to be completed by early 2027.

Media Review

With Saudi on side, the Brics can change the world: op-ed by Dr. Nasser Saidi

https://www.agbi.com/opinion/nasser-saidi-saudi-arabia-brics-change-world/

Saudi Arabia’s economic diversification thrives amid global uncertainty: with Dr. Nasser Saidi’s comments

https://www.arabnews.com/node/2362111/business-economy

A Crisis of Confidence Is Gripping China’s Economy

https://www.nytimes.com/2023/08/25/business/china-economy-confidence.html

Why China’s economy won’t be fixed: The Economist

https://www.economist.com/leaders/2023/08/24/why-chinas-economy-wont-be-fixed

China LNG buyers expand trading after adding more US, Qatari contracts: Reuters

https://www.reuters.com/business/energy/china-lng-buyers-expand-trading-after-adding-more-us-qatari-contracts-2023-08-21/

Fossil Fuel Subsidies Surged to Record USD 7trn: IMF

https://www.imf.org/en/Blogs/Articles/2023/08/24/fossil-fuel-subsidies-surged-to-record-7-trillion

Powered by: