Markets

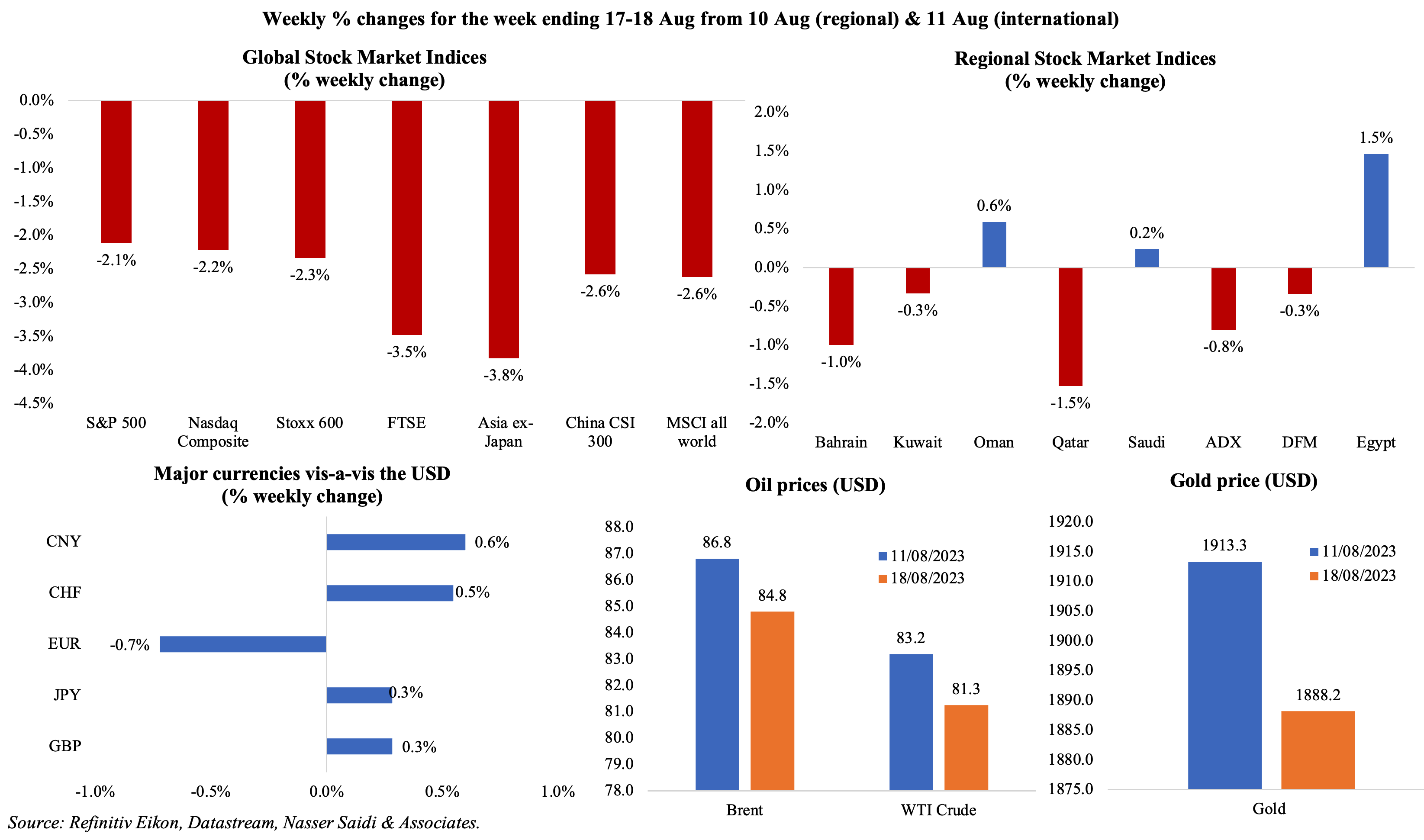

Global equities markets ended in the red, as investors waited for signals from the Jackson Hole meeting this week on Fed policies. Last week saw US Treasury yields breaking into new multi-year highs, while FTSE fell to the lowest level in 5 months (on Friday) and the Chinese stimulus measures brought little joy to the markets. Regional markets were mixed as the US rate outlook remained uncertain. The dollar continued its strong show, gaining for the fifth week in a row – its longest streak in 15 months; the yen and the yuan fell to 9-month lows versus the dollar last week, while the euro touched a 6-week low. Oil price posted a weekly drop after 7-weeks of gains and the gold price dropped.

Global Developments

US/Americas:

- FOMC minutes showed participants view inflation as “unacceptably high”, and “see significant upside risks to inflation, which could require further tightening of monetary policy”. Furthermore, it expects “additional softening in labour market conditions [to] take place over time”.

- US industrial production rebounded by 1% mom in Jul (Jun: -0.8%), supported by a surge in motor vehicle production (+5.2% from Jun’s 3.9% drop). Capacity utilisation increased to 79.3% from Jun’s 78.6%: it is still 0.4 percentage point below its 1972–2022 average.

- Retail sales in the US increased by 0.7% mom in Jul (Jun: 0.3%), rising for the fourth month in a row, partly affected by a boost from Amazon Prime Day promotion. Sales at non-store retailers, sporting goods, hobbies, books & musical instruments, and clothing stores were up by 1.9%, 1.5% and 1.0% respectively. Excluding autos, sales grew by 1% (Jun: 0.2%).

- Building permits in the US inched up by 0.1% mom to 1.442mn in Jul, with permits for housing projects with five units or more down by 0.2% to 464k units, lowest since Oct 2020.

- Housing starts increased by 3.9% to 1.452mn in Jul, thanks to the jump in single-family housing starts (6.7% to 983k). Though the housing market seems to have stabilised, the recent jump in mortgage rates could affect future readings. The 30-year fixed mortgage has risen to 6.96% in recent weeks, close to 7.08% seen in late-Oct/ early-Nov (highest since Apr 2002).

- Some contrasting views on business conditions: the NY Empire State manufacturing index plunged to -19 in Aug (Jul: 1.1), with declines recorded in new orders (-19.9 from Jul’s 3), shipments (-12.3 from 13.4) and employment (-1.4 from 4.7). Philadelphia manufacturing survey index jumped to 12 in Aug (Jul: -13.5), rebounding for the first time since Aug 2022. However, employment sub-index fell (to -6 from Jul’s -1) and the 6-month business conditions index fell to 3.9 (Jul: 29.1).

- Initial jobless claims declined by 11k to 239k in the week ended Aug 11th, reversing part of the gains from the week before, and the 4-week average rose by 2.75k to 234.25k. Continuing jobless claims rose by 32k to 1.716mn in the week ended Aug 4th, down from a high of 1.86mn in mid-Apr.

Europe:

- GDP in the euro area grew 0.6% yoy and 0.3% qoq in Q2, matching the preliminary estimates. Industrial production in the eurozone fell by 1.2% yoy in Jun (May: -2.5%), the fourth consecutive month of decline. In mom terms, IP inched up by 0.5%.

- Trade balance in the eurozone moved to a surplus EUR 23bn in Jun (May: deficit of EUR 0.3bn). Exports inched up by 0.3% yoy while imports plummeted by 17.7%. Imports from Russia fell sharply, resulting in a narrower trade deficit of EUR 8.7bn in H1 (H1 2022: EUR 92.1bn). Trade deficit with China fell to EUR 148.7bn in H1 from EUR 189.3bn in H1 2022.

- ZEW economic sentiment index in the euro area, showed less pessimism, moving to -5.5 in Aug (Jul: -12.2), the highest in four months. Furthermore, the indicator of the current economic situation rose by 2.4 points to -42 and inflation expectations were up by 2.4 points to -76.7.

- German ZEW economic sentiment indicator was less pessimistic, improving to -12.3 in Aug (Jul: -14.7), with most respondents not expecting any further rate hikes in the EU and the US. The current situation however worsened to -71.3, the worst reading since Oct 2022 and from -59.5 in Jul.

- Germany wholesale price index dropped by 0.2% mom and 2.8% yoy in Jul, with downward readings across multiple segments including petroleum products (-20.8%), metals & metal ores (-18.3%) and chemical products (-16.5%) among others.

- Inflation in the UK eased to 6.8% in Jul (Jun: 7.9%), the lowest since Feb 2022, as fuel costs fell (-24.9%) as did transport prices (-2.1%) while food costs eased (to 14.8% from Jun’s 17.3%). Core inflation remained unchanged at 6.9% while services sector inflation inched up to 7.4% (Jun: 7.2%). Producer price index in the UK fell: fuel and raw material input costs by 3.3% and cost of output by 0.8%. Retail price index eased to 9% in Jul (Jun: 10.7%).

- Retail sales in the UK fell sharply by 1.2% mom and 3.2% yoy in Jul (Jun: 0.6% mom and -1.6% yoy) as wet weather played spoilsport alongside high costs of living. However, the weather resulted in an uptick in online sales (+2.8%).

- Unemployment rate in the UK inched up to a 2-year high of 4.2% in the 3 months to Jun (prev: 4%). However, wage growth is accelerating – average earnings excluding bonus grew by 7.8% (prev: 7.5%); average earnings including bonus rose by one percentage point to 8.2% – affected by the NHS one-off bonus payments made in Jun 2023.

Asia Pacific:

- This morning (on Aug 21), the People’s Bank of China shifted into monetary easing as it lowered the 1-year loan prime rate to 3.45% from 3.55% while leaving the 5-year rate unchanged. This follows last week’s unexpected rate cuts: it lowered the rate on CNY 401bn (USD 55.25bn) worth of one-year medium-term lending facility (MLF) loans to some financial institutions by 15bps to 2.50%. The PBoC also injected CNY 204bn through 7-day reverse repos while cutting borrowing costs by 10bps to 1.80%.

- On Friday, the China Securities Regulatory Commission unveiled a few measures to support the stock exchange: this includes cutting trading costs, supporting share buybacks, boosting the development of equity funds, studying the possibility to extend trading hours, and encouraging long-term investment among others.

- China’s industrial production grew by 3.7% yoy in Jul, slowing from Jun’s 4.4% gain. Retail sales grew by 2.5%, the slowest since Dec 2022 and compares to Jun’s 3.1% pace. Fixed asset investment expanded by 3.4% in Jan-Jul (H1: 3.8%) while investment in the property sector fell by 8.5% (H1: -7.9%). Urban unemployment ticked up to 5.3% in Jul, from Jun’s 16-month low of 5.2%. Data on youth unemployment rate was suspended, citing need for further improvement and optimisation in labour force survey statistics.

- FDI into China fell by 4% yoy in Jan-Jul (H1: -2.7%), while FDI into high-tech manufacturing expanded by 25.3% yoy in Jan-Jul.

- Japan’s GDP grew by 1.5% qoq and 3.4% yoy in Q2 (Q1: 0.9% qoq and 2% yoy), at an annualised rate of 6%. While exports expanded by 3.2% qoq in Q2, imports fell by 4.3% (the highest on record) and private consumption fell by 0.5%. The weaker yen has supported inbound tourism which has returned to more than 2/3-rds of pre-pandemic levels.

- Inflation in Japan remained unchanged at 3.3% yoy in Jul; excluding food and energy, prices inched up to 4.3% (Jun: 4.2%). Excluding fresh food, inflation edged down to 3.1% (Jun: 3.3%), staying above the BoJ’s target for the 16th consecutive month.

- Industrial production in Japan was flat in Jun (May: -0.4% yoy), though rising by 2.4% mom. The month-on-month gain was the strongest since Feb 2023, and was driven by motor vehicles (6.1% vs May’s -8.9%) and electronic parts & devices (6.8% from -4.0%) among others. Separately, core machinery orders rebounded by 2.7% mom in Jun (May: -5.8%).

- Exports from Japan declined by 0.3% yoy in Jul (Jun: 1.5%), for the first time in 2.5 years, largely due to a dip in demand for light oil and chip-making equipment. Exports to China fell by 13.4% yoy in Jul (Jun: -10.9%). Imports fell sharply by 13.5% (Jun: -12.9%), leading to a deficit of JPY 78.7bn (Jun: surplus of JPY 43.1bn).

- Consumer price inflation in India accelerated to 7.44% in Jul (Jun: 4.87%), the highest since Apr 2022 as food inflation surged (11.51%, the highest since Jan 2020). Irregular monsoons have led to a jump in food prices; the government imposed a 40% export duty on onions (till end-Dec) to improve domestic supplies and curb the price rise. But, Wholesale Price Inflation in India fell by 1.36% in Jul (Jun: -4.12%): this is the fourth month of deflation.

- Trade deficit in India widened to USD 20.67bn in Jul: exports stood at USD 32.25bn while imports were USD 52.92bn. Exports from Russia doubled to USD 20.45bn in Apr-Jul from USD 10.42bn a year ago. Services and merchandise exports fell about 6% yoy to USD 244.15bn in the period Apr-Jul, while imports fell 11% to USD 272.41bn.

Bottom line: China weakness (including its worsening property crisis) and concerns over interest rates staying higher for longer are the main discussion points across the globe, also leading to increased demand for “safer” assets. Chinese authorities’ measures to support recovery so far are not seen as sufficient to stimulate household consumption, hence sentiment is still downbeat. This week’s preliminary PMI readings are unlikely to be optimistic: in the backdrop of strong labour markets and rising input prices, need to see if the services sector still supports economic growth (especially given the Aug tourism season) amid a manufacturing slump. This would be a good indicator to judge the direction of ECB & BoE moves next month: pause or another hike?

Regional Developments

- Total assets of Bahrain’s Future Generations Reserve Fund amounted to USD 680.1mn in H1 2023, after ending last year at USD 614.3mn, as per the fund’s annual report.

- Bahrain’s central bank foreign currency assets rose for the 3rd month in a row in Jun, up by almost USD 800mn to USD 5.17bn, the highest level since Q4 2015, according to HSBC. This was supported partly by the strong current account balance, with 8 consecutive surpluses recorded since Q2 2021.

- Bahrain is planning its largest solar project, set to generate 72 megawatts, and contribute to the target of achieving 250 MW from renewable sources by 2025. It will include rooftop installations, ground-mounted arrays, and solar panels integrated into car parks.

- Egypt will keep its electricity prices unchanged for consumers till Jan 2024, according to a cabinet statement, continuing with its subsidy policy.

- UAE-based agribusiness Al Dahra and Abu Dhabi Exports Office signed a USD 500mn 5-year deal to supply Egypt with wheat “at competitive prices”. The deal is currently awaiting Parliamentary approval, expected by Nov. Egypt currently has strategic wheat reserves sufficient for 4.7 months and vegetable oil reserves for 3.9 months.

- Egypt launched sugar trading on its commodities exchange: “to regulate the markets of strategic and basic commodities”, it invited companies last week to register to trade sugar on the bourse, which already offers yellow corn and wheat. The nation’s strategic reserves of sugar are expected to cover consumption until the spring of 2024. It is not clear how local sugar trading will interact with international sugar trading.

- Inflation in Kuwait eased to 3.75% in Jul (Jun: 3.83%), thanks to a decline in food inflation to a 3-year low of 5.8% (Jun: 6.3%) and transport prices (3.1% from 3.6%).

- Kuwait approved a ministerial proposal to pay monthly social allowance and children allowance to Kuwaiti owners of micro-enterprises. The government aims to encourage young nationals to open micro-enterprises, thereby reducing the number of jobseekers.

- In a push for transparency, Lebanon’s central bank disclosed that its liquid foreign assets stand at USD 8.57bn. It also revealed that the apex bank’s obligations included USD 106mn in deposits and USD 660mn in FX loans from Gulf Arab states.

- The anti-ML/CFT Special Investigation Commission (currently headed by the acting central bank governor) in Lebanon froze the bank accounts of the former central bank governor and associates, also lifting banking secrecy on the accounts.

- Lebanon’s PM highlighted the failure to take action so far and called for a special session of the parliament to pass long-pending financial reform plans. The more the delay in passing legislation, “the consequences will be very detrimental on the economy”. Last week, a session to discuss the law on capital control and the creation of a sovereign wealth fund was postponed after the lack of a quorum.

- Oman LNG signed a 4-year contract with the German company Secure Energy for Europe to supply 0.4 million tons of LNG per annum and will begin supply from 2026.

- The total number of new jobs in government and private sector entities in Oman touched 18,716 by end-Jun, on track to meet the labour ministry’s goal to provide at least 35,000 job opportunities in 2023.

- Credit disbursed by Oman’s banks grew by 5.1% to OMR 20.2bn at end-Jun while deposits increased by 3.1% to OMR 22.2bn. Government deposits grew by 7.7% to OMR 5.4bn while private sector deposits grew by 2.1% (to OMR 14.8bn, or 66.4% of total deposits). Separately, assets of the Islamic banking sector surged by 12.6% yoy to OMR 7bn as of end-Jun.

- Oman’s exports to China grew by 26.7% yoy to USD 36.24bn in 2022, with overall trade volume rising by 25.8% to USD 40.45bn. Chinese investments in Oman reached USD 9.5bn in 2022, with new direct investments surging to USD 21.74mn, disclosed the Ambassador of China to Oman.

- Inflation in Qatar inched up to 3.11% yoy in Jul (Jun: 2.5%), driven up by communication (15.85%), culture & recreation (6.84%) as well as housing & utilities (4.49%). Food inflation rebounded in Jul, rising to 1.54% from the 0.1% drop in Jun.

- Qatar central bank disclosed that volume of online payment transactions reached 4.24mn in Jul, with the total value touching QAR 2.75bn. Also, the volume of operations via its 69,040 PoS devices amounted to 27.2mn and its value stood at QAR 6.48bn.

- Hungary’s foreign minister revealed that the country will begin to receive LNG shipments from Qatar starting in 2027, after having “reached a political agreement”. Talks between the two nations’ energy companies will “determine the quantity, pace and shipment route of the supplied gas”.

- Syria raised prices of gasoline and other petroleum products, as the government slashes subsidies; on the other hand, the government announced a 100% hike in public sector salaries and pensions to help with the high costs of living.

- GCC nations sold US Treasury bonds in Jun: Saudi holdings sold USD 3.2bn, causing its US treasuries holdings to drop to USD 108bn; UAE’s holdings fell to USD 65.2bn (May: USD 69bn) while Kuwait’s fell to USD 40.6bn (May: USD 41.4bn).

- Brazil’s exports to the Arab world grew by 8% yoy to USD 10.61bn in Jan-Jul 2023, according to the Arab Brazilian Chamber of Commerce. Brazil’s exports to Saudi totalled USD 1.873bn during the period, while that to the UAE stood at USD 1.646bn.

- The Global Wealth Report placed Saudi household wealth at USD 2.3trn at end-2022 while the UAE’s stood at USD 1.2trn. At the end of 2022, financial assets made up 56.7% of gross assets in Saudi Arabia and 56.5% in the UAE. Inequality is quite high, with the share of the top 1% in the wealth at 37.6% in Saudi Arabia and 44.6% in the UAE.

Saudi Arabia Focus

- Saudi Arabia’s Crown Prince met Iran’s Foreign Minister last week – the highest level of talks since reconciliation talks began – and the latter revealed that the “discussions were frank, beneficial and productive”. Earlier, the Saudi foreign minister welcomed Iran’s endorsement of Riyadh’s bid for the Expo 2030.

- Consumer price inflation in Saudi Arabia eased to 2.3% yoy in Jul(Jun: 2.7%), driven by higher housing costs (8.64%). Overall housing rents surged (10.3% yoy) alongside apartments rents (21.1%), given higher demand for expatriate accommodation. Inflation inched up to 2.8% in Jan-Jul 2023, versus 2.1% in the same period a year ago. Housing & utilities costs have climbed by 7.9% (from 0.34%) and restaurants & hotels costs are up by 5.4% (from 3.7%) with easing food prices (2.0% versus 3.5%) and transport costs (1.9% from 4.1%).

- Wholesale prices in Saudi Arabia fell in Jul, declining for the third month in a row,with declines seen in 3 of the five categories. WPI plunged to 0.6% in the Jan-Jul 2023 period, from the double-digit 10.25% surge a year ago.

- Saudi Arabia issued 71 new mining licenses in Jul, compared to 32 the month before. The total number of mining licenses valid in the sector reached 2,348 until end-Jul, topped by 1,453 for quarrying building material. Separately, Saudi plans to open bidding for 8 mining complexes in the Riyadh region and the Eastern Province.

- Saudi oil production declined to 9.956mn barrels per day (bpd) in Jun (May: 9.959mn bpd), according to figures from the Joint Organizations Data Initiative (JODI)and Saudi exports fell to a 21-month low of 6.8mn bpd (May: 6.93mn bpd).

- PIF’s US equities holdings increased to USD 38.93bn at end-Q2, up 9.6%, after it expanded stakes in Lucid, Air Products and Alibaba. Excluding Lucid Group, PIF holdings grew by 10.7% qoq and 25.9% yoy.

- Saudi Arabia signed 12 housing agreements with Chinese companies, disclosed the Saudi housing ministry, worth more than SAR 5bn (USD 1.33bn).

- Saudi central bank governor revealed that Saudi Arabia is the largest Islamic finance market, with total assets exceeding SAR 3.1trn (USD 830bn).

- Saudi Arabia launched a SAR 750mn (USD 200mn) fund for early investment in local and international high-tech companies, as part of a strategy announced for the King Abdullah University of Science and Technology.

- Employees who earn SAR 10,000 or more (USD 2,600) in the Saudi labour market touched approximately 965k during Q2 2023. This included about 708k employees in the private sector and 256k persons in the government sector.

- Saudi Arabia Railways reported a 84% yoy surge in passenger traffic to 4.4mn in H1 2023, partly due to the Hajj season. About 16,404 trips were recorded during this period, up 46%.

- Riyadh is home to infrastructure projects worth USD 1trn, it was reported ahead of the Cityscape Global Expo. A further USD 18bn worth of projects are currently at the bidding/evaluation stage with an additional USD 170bn to be awarded in the near future.

UAE Focus![]()

- India and UAE began settling trade in local currencies: refiner Indian Oil Corp paid ADNOC for the purchase of a million barrels of oil. This followed the sale of 25kg of gold from a UAE-based gold exporter to a buyer in India worth INR 128.4mn (USD 1.54mn).

- The UAE-Indonesia Comprehensive Economic Partnership Agreement (CEPA) will be implemented next month, according to the Ambassador of Indonesia to the UAE. The deal is expected to raise annual bilateral trade to USD 10bn within 5 years and raise the total value of trade in services to USD 630mn by 2030.

- Bilateral trade between UAE and Pakistan is expected to grow by up to 20% annually once the CEPA is signed in Q4 this year, disclosed Pakistan’s ambassador to the UAE.

- Non-oil bilateral trade between Brazil and the UAE touched USD 4.3bn in 2022, up 32% yoy. Brazil is currently the UAE’s largest trading partner in Latin America.

- Industrial licenses issued in Abu Dhabi grew by 16.6% yoy in the year to Jun; capital investments by manufacturers operating in Abu Dhabi grew by AED 12.42bn (USD 3.38bn) to AED 384.06bn.

- Adnoc signed a 5-year deal to supply LNG to Japan Petroleum Exploration Co (Japex), with the deal valued between USD 450-550mn.

- Abu Dhabi National Oil Co. and Tabreed (the National Central Cooling Co.) plan to use geothermal energy to decarbonise cooling of buildings in Masdar City.

- Abu Dhabi’s Taqa is not in discussions to invest in Adani Group’s power businesses, clarified both entities, after newspaper reports to the contrary.

- Dubai’s DP World reported a 9.7% yoy decline in profits to USD 651mn in H1 2023, despite a 13.9% uptick in revenue to over USD 9bn.

Media Review

To restore the Lebanon central bank’s credibility, independence is key by Dr. Nasser Saidi

https://www.thenationalnews.com/opinion/comment/2023/08/15/to-restore-the-lebanon-central-banks-credibility-independence-is-key/

Is Germany once again the sick man of Europe?

https://www.economist.com/leaders/2023/08/17/is-germany-once-again-the-sick-man-of-europe

The Populist Advantage by Dr. Raghuram Rajan

https://www.project-syndicate.org/commentary/populist-economic-policies-easier-sell-than-liberal-orthodoxy-by-raghuram-rajan-2023-08

IMF’s Reported Social Unrest Index: August 2023 Update

https://www.imf.org/en/Publications/WP/Issues/2023/08/18/Reported-Social-Unrest-Index-August-2023-Update-537696

Science, Technology and War Beyond the Bomb

https://www.nytimes.com/2023/08/15/opinion/war-tech-oppenheimer.html

Powered by: