Markets

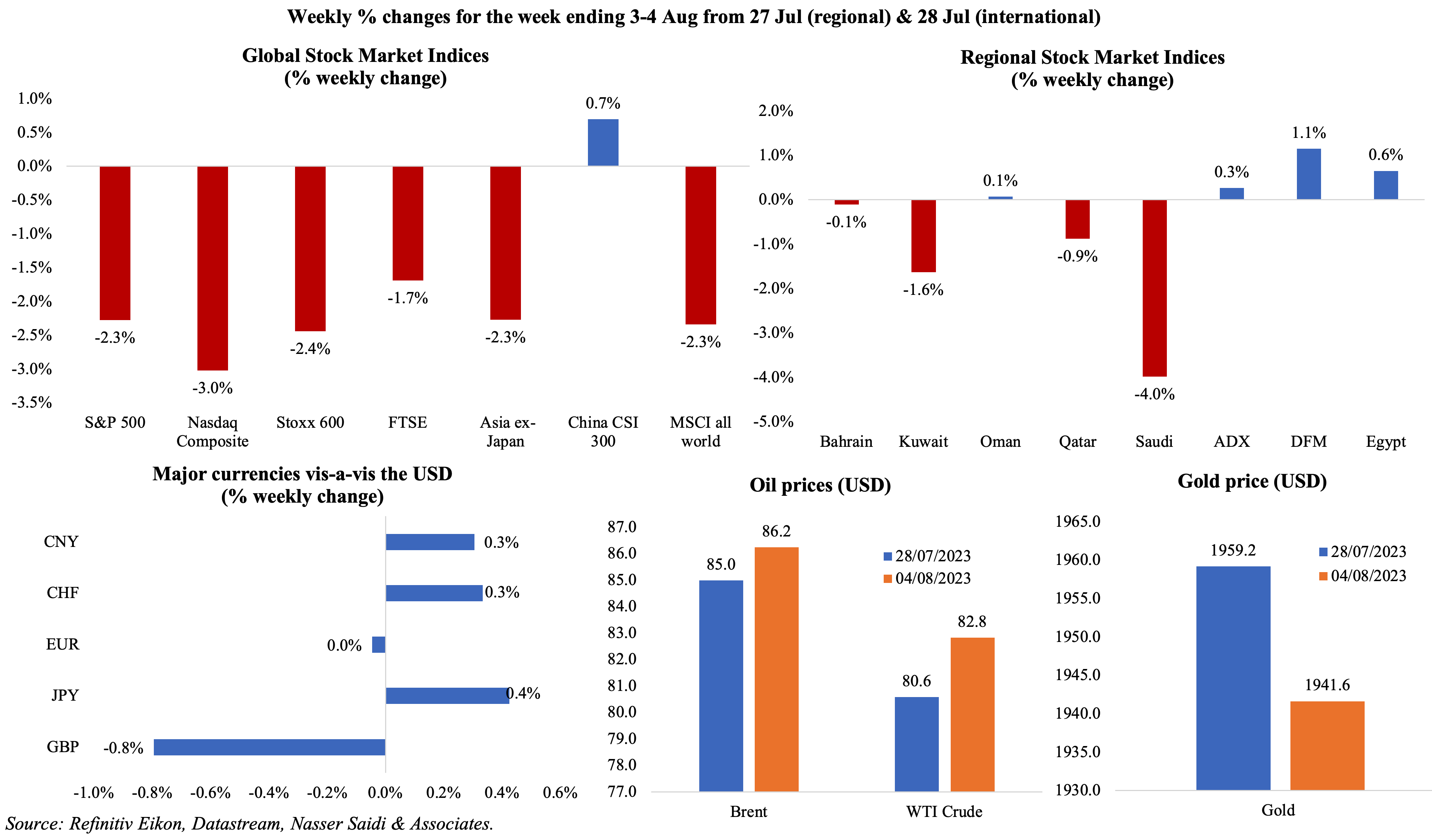

Global equities markets were in the doldrums last week, with China’s CSI 300 eking out a 0.7% gain. Regional markets were mostly down on profit taking, while the UAE exchanges posted a weekly gain on stronger oil prices and corporate earnings (Dubai had touched an 8-year high earlier in the week). The dollar fell against a basket of currencies after 2 weeks of gains while Sterling hit its weakest level vs the USD since late Jun after the BoE’s rate hike. Oil prices gained for a sixth consecutive week while gold price inched lower.

Global Developments

US/Americas:

- Non-farm payrolls increased by 187k in Jul (Jun: 185k): though employment in the leisure and hospitality sector rose by 17k, it remains below the Feb 2020 level by 352k. Average hourly earnings remained unchanged at 0.4% mom and 4.4% yoy while unemployment rate slipped to 3.5% from 3.6%. Labour force participation rate remained unchanged at 62.5%.

- Unit labour cost inflation slowed down in Q2, rising by just 1.6% (vs Q1’s 3.3% gain), partly due to a rebound in non-farm productivity which grew by 3.7% yoy in Q2 (Q1: -1.2%). Productivity has grown at a 1.4% rate since Q4 2019, much lower than the long-term historical average rate of 2.1% dating back to 1947.

- US private sector added 324k jobs in Jul (Jun: 455k), with the services sector adding 303k jobs while the manufacturing sector lost jobs (-36k) for the 5th month in a row.

- JOLTS job openings slipped by 34k to 9.582mn in Jun, the lowest level since Apr 2021, and there were 1.6 job openings for every unemployed person. Layoffs and discharges fell 19k to 1.527mn, hiring dropped 326k to 5.905mn (the lowest since Feb 2021) and resignations fell by the most since Apr 2020.

- Initial jobless claims increased by 6k to 227k in the week ended Jul 28th and the 4-week average fell by 4.5k to 228.25k. Continuing jobless claims inched up by 21k to 1.7mn in the week ended Jul 21st, the lowest level since late-Jan.

- Factory orders grew by 2.3% mom in Jun (May: 0.4%): transportation equipment surged by 12% (May: 4.2%), with civilian aircraft orders jumping 69.4%. Orders for non-defence capital goods excluding aircraft rose by 0.1%.

- Chicago PMI inched up to 42.8 in Jul (Jun: 41.5), staying below-50 for the 11th consecutive month. Dallas Fed manufacturing business index improved in Jul, rising to -20 (Jun: -23.2), even with new orders remaining in negative readings for over a year (Jul: -18.1).

- ISM manufacturing PMI rose to 46.4 in Jul (Jun: 46), staying below-50 for the ninth straight month: new orders index rose to 47.3 (Jun: 45.6) and employment index fell to 44.4 (lowest since Jul 2020, and from Jun’s 48.1) while prices paid inched up to 42.6 (Jun: 41.8). ISM services PMI slipped to 52.7 in Jul (Jun: 53.9), as employment fell (to 50.7 from 53.1) and new orders eased (55 from 55.5) alongside a hike in prices paid (56.8 from 54.1).

- S&P Global composite PMI output index in the US moved to a 5-month low of 52 in Jul (Jun: 53.2). Manufacturing PMI improved in Jul, albeit remaining below-50 (49 from 46.3): while total new orders increased further, export conditions worsened. Services PMI continued to drive growth (52.3 from Jun’s 54.4): new business from abroad rose even as domestic demand lost some momentum given higher interest rates.

Europe:

- Preliminary estimates showed GDP in the eurozone expanded by 0.3% qoq and 0.6% yoy in Q2 (Q1: flat qoq and 1% yoy). The growth was largely driven by GDP gains in France and Ireland, rising by 0.5% and 3.3% respectively; Italy unexpectedly shrank by 0.3%.

- Inflation in EU eased to 5.3% yoy in Jul (Jun: 5.5%), the lowest reading since Jan 2022; food, alcohol and tobacco prices were up by 10.8% (Jun: 11.6%) while services inflation rose to 5.6% (Jun: 5.4%). Core inflation remained unchanged at 5.5%.

- EU producer price index fell by 0.4% mom (the sixth month of decline) and 3.4% yoy in Jun (May: -1.6% yoy). The yoy decline was the steepest since Jun 2020, driven down by the decline in energy costs (-16.5% from May’s -13.5%).

- Retail sales in the eurozone declined by 0.3% mom and 1.4% yoy in Jun (May: -2.4% yoy and +0.6% mom). Sales fell in yoy terms for both food, drinks and tobacco (-0.3% from May’s 0.3%) and non-food products (-0.2% from May’s 0.6%).

- Composite PMI in the eurozone fell by 1.3 points to 48.6 in Jul, the lowest since Nov 2022, as demand conditions worsened (lower than the preliminary estimate of 48.9). Manufacturing PMI worsened to a 38-month low of 42.7 (Jun: 43.4), with a steep reduction in new orders from foreign markets (demand from external clients fell at the quickest pace Apr 2009) alongside a decline in input costs. Services PMI inched slightly lower to 50.9 (from the preliminary estimate of 51.1 and Jun’s 52).

- Germany’s composite PMI fell below-50 in Jul for the first time since Jan, to 48.5, higher than the preliminary estimate of 48.3 (Jun: 50.6). Manufacturing PMI plunged to 38.8 (from 40.6), with output, new orders and factory gate prices falling at faster rates; also reported the first drop in employment since Jan 2021. Services PMI inched lower to 52.3 (Jun: 54.1).

- German factory orders rebounded in Jun, rising by 3% yoy (May: -4.4%); in mom terms, orders grew by 7%, the third consecutive month of increase, and following May’s 6.2% gain. Orders for capital goods rose by 9.9% mom while intermediate and consumer goods grew by 2% and 7.7% respectively; domestic orders fell by 2% while foreign orders jumped by 13.5%.

- Exports from Germany inched up by 0.1% mom in Jun from a similar gain the month before; imports fell markedly by 3.4% reflecting weak demand (May: 1.4%). Trade surplus hence widened to EUR 18.7bn from EUR 14. 6bn.

- Retail sales in Germany unexpectedly fell by 0.8% mom in Jun, the first monthly drop since Mar and from May’s 1.9% gain. In yoy terms, sales were down by 1.6% (May: -2.1%), with food prices falling for 2 years.

- Unemployment rate in the euro area remained unchanged at 6.4% in Jun while in the EU it remained stable at a historic low of 5.9%. In Germany, unemployment rate eased to 5.6% in Jun (May: 5.7%), with the number of unemployed higher by 147k compared to a year ago.

- The Bank of England raised interest rate by 25bps to a 15-year high of 5.25%. The apex bank expects inflation to fall by end-2023, returning to its 2% target by Q2 2025. The BoE stated that though the labour market was “loosening”, it remained tighter than pre-pandemic.

- UK manufacturing PMI fell to a 38-month low of 45.3 in Jul(preliminary estimate 45) from Jun’s 46.5, with output and new orders falling at faster rates. Services PMI slipped to 51.5 from 53.7 and composite PMI as a result eased to a 6-month low of 50.8 (Jun: 52.8).

Asia Pacific:

- China’s NBS manufacturing PMI inched up to 49.3 in Jul, staying below-50 for the fourth consecutive month; also remaining in contractionary territory were new orders (49.5) and export sales (46.3). Non-manufacturing PMI slipped to 51.5 in Jul (Jun: 53.2), with new orders and foreign sales falling to 48.1 and 47.7 respectively amid weak employment (46.8).

- Caixin manufacturing PMI fell to 49.2 in Jul (Jun: 50.5), the lowest reading in 6 months, as new orders dropped, and employment fell for the 5th straight month. Caixin services PMI unexpectedly moved up to 54.1 in Jul (Jun: 53.9), supported by an acceleration in new orders growth and rising employment.

- China’s central bank stated that it would use policy tools – including reserve requirement ratio cuts, open market operations and medium-term lending facilities and other structural monetary policy tools – flexibly and in a coordinated manner, to ensure reasonably ample liquidity in the banking system. Earlier in the week, China’s State Council released a 20-point plan to increase consumption across the board, focusing on housing, culture and tourism, and green consumption (e.g. EVs). However, it largely lacked specific details on its proposals, nor did it outline any measures to raise income and/or employment levels.

- Manufacturing PMI in Japan inched up to 49.6 in Jul, from the preliminary estimate of 49.4 (Jun: 49.8) as both output and new orders scaled back while business sentiment remained at the joint-second highest level seen since the start of 2022. Composite PMI inched up to 52.2, as services PMI eased to 53.8 (vs preliminary estimate of 53.9 and Jun’s 54).

- Japan industrial production rebounded by 2% in Jun (May: -2.2%), fourth gain this year, and following the previous month’s 2.2% drop. This was supported by gains in motor vehicles (6.1%) and electronic parts production (6.8%). It declined by 0.4% yoy in Jun (May: 4.2%).

- Unemployment rate in Japan edged down to 2.5% in Jun (May: 2.6%), the lowest rate since Jan. Jobs to applicants’ ratio stood at 1.3 in Jun (May: 1.31), the lowest since Jul 2022.

- Retail sales in Japan grew for the 16th month in a row in Jun, up 5.9% yoy (May: 5.8%), driven by an uptick in automobile sector (19.3%) as well as pharmaceuticals and cosmetics (9.5%); large retailer sales were up by 4.1% (May: 3.4%). In mom terms, overall sales fell by 0.4% (May: +1.4%).

- Infrastructure output in India expanded by 8.2% yoy in Jun (May: 4.3%), recording the fastest pace in 5 months. A breakdown by sector indicates a broad-based growth, with the steel sector growing by 22%, coal by nearly 10% and cement sector by 9.4%.

- Singapore PMI inched up to 49.8 in Jul (Jun: 49.7), staying below-50 for 5 months in a row, with softer falls recorded in new orders, exports, output and employment.

- Retail sales in Singapore fell by 0.8% mom in Jun (May: -0.2%). In yoy terms, retail sales grew by 1.1% (May: 1.8%) while excluding motor vehicles it rose by 2.5%. The highest yoy increase was posted in food and alcohol (30.7%) while computer and telecommunications equipment sales were up by 9.4%.

Bottom line: Global manufacturing PMI was unchanged at 48.7 in Jul, staying below-50 for the 11th month running. Asia was showing signs of a weakening while the euro area posted a sharp decline (production had contracted to the greatest extent since the height of the global pandemic in spring 2020). Global inflation readings continued to ease (albeit with stubbornly high core inflation prints) though the recent jump in commodity prices (given recent drone strikes and oil production cuts) could add to inflationary pressures. Last week the BoE hiked rates and followed other major central banks’ rhetoric by leaving the door open for more hikes while underscoring data dependency; meanwhile, emerging markets have begun rate cuts, starting with Brazil and Chile. Container shipping firm Maersk has warned that a contraction in global trade would be longer and deeper than feared, as companies cut inventories in the face of recession risks. The recent fall in shipping costs is likely to continue – the Drewry’s composite World Container Index, at USD 1,761.33 this week (as of Aug 3rd) is now 83% below the peak of USD 10,377 touched in Sep 2021.

Regional Developments

- Saudi Arabia extended its 1mn barrel per day (bpd) cut into Sep, while also stating the possibility that it could be “extended, or extended and deepened” beyond that period. Production in Saudi will be around 9mn bpd in Sep. Shortly after this announcement, Russia announced it would reduce oil exports by 300k bpd in Sep. Later, the OPEC+ kept its current oil output policy unchanged: the group’s output cuts (excluding additional voluntary cuts) amount to 3.66mn bpd or 3.6% of global demand.

- Egypt’s PMI inched up to 49.2 in Jul (Jun:49.1), remaining below the 50-mark for the 32nd consecutive month. Output contracted across all 4 sectors covered by the survey, and at the slowest rate since Sep 2021. There was some relief in inflationary pressure: selling prices rose modestly and at the softest pace since Apr 2022. Though business confidence ticked up from Jun, it is still among the lowest-ever recorded.

- Egypt’s central bank hiked interest rates by 100 bps raising the deposit rate to 19.25% and the overnight lending rate to 20.25%. The apex bank expects inflation to peak in H2 2023, and stressed that interest rates depends on expected inflation not prevailing inflation rates. However, the central bank does not appear to be moving towards exchange rate flexibility, which is necessary for monetary and exchange rate stabilisation.

- The Arab Monetary Fund extended a new loan of USD 615.8mn to Egypt to support banking sector reforms including improving the efficiency of the payment system, enhancing economic inclusion, and strengthening the regulatory framework.

- Iran’s President officially invited UAE’s President to visit Tehran, reported Tasnim agency. Iran appointed an ambassador to the UAE in Apr 2023 for the first time since 2016.

- Bilateral trade between Iraq and Saudi Arabia increased to SAR 913mn (USD 243mn) in H1 2023, jumping from SAR 381mn in Mar.

- Kuwait approved the 2023-24 draft budget last week: based on an oil price of USD 70, the budget forecasts a deficit of KWD 6.8bn (USD 22.13bn) and spending at KWD 26.3bn.

- Lebanon PMI inched up further to 50.3 in Jul (Jun: 50.2), the strongest improvement since Jun 2013, driven by stronger domestic demand (a likely effect of summer tourism). A slight ray of hope with the rate of job creation accelerating to the fastest since Sep 2015. Firms remain mostly pessimistic, as the political and economic crisis continues unresolved.

- Lebanon’s interim central bank governor urged the caretaker government to implement a capital control law, a financial restructuring law and a 2023 state budget within six months. At the press conference, he promised to reject government financing requests that were “outside the legal framework”.

- Inflation in Oman eased to 0.7% yoy in Jun (May: 0.9%): food and beverage costs were up 2.18% while hospitality costs rose by 3.68% and furnishings prices increased by 2.93%.

- FDI into Oman surged by 23.3% yoy to OMR 21.2bn (USD 55.5bn) in Q1 2023. The oil and gas sector saw FDI of OMR 15.8bn (Q1 2022: 11.69bn) while FDI into the manufacturing sector posted a decline (to OMR 1.57bn from Q1 2022’s OMR 1.67bn).

- Oman Investment Authority assets grew by 12% yoy to nearly OMR 17.9bn (USD 46.5bn) in 2022, as per its annual report. Return on investment stood at 8.8%, and the OIA contributed OMR 5.6bn in dividends to the finance ministry (between 2016 till end-2022).

- Passenger traffic in Oman surged by 30.3% yoy to 1.98mn travellers in H1 2023 while air traffic jumped by 28.4% to 9,784 flights. Airport operations have recovered by 70% compared to 2019 levels.

- The CEO of India’s Petronet revealed that the company is “seriously engaged” with Qatar to extend its long-term deal to beyond 2028, hopefully at lower prices than those offered in recent deals with China and Bangladesh.

- Qatar’s producer price index plunged by 31.33% yoy and 3.24% mom in Jun, given the fall in hydrocarbon prices.

- Qatar central bank disclosed that the application process for BNPL firms will open in Sep, leading up to the licensing and regulation of such firms.

- Argentina’s government agreed to a USD 775mn loan from Qatar: this was used to make an IMF repayment. The loan will have the IMF’s variable interest rate applicable to SDRs, currently 4.033% per annum.

- Most investible sectors in India are open for 100% investment from the Gulf region via “automatic route” (i.e. without needing prior approval of the government), according to the minister of state for external affairs.

- Startups in the Middle East clinched 31 deals valued at a total of USD 95mn in Jul (+167% mom), with UAE leading the rounds (USD 64.7mn raised, largely due to One Moto’s USD 40mn lease financing round) followed by Saudi Arabia (USD 18mn from 5 deals), Egypt (USD 7mn) and Morocco (USD 2mn).

- Student population in the GCC is expected to increase to 14.2mn by 2027 from an estimated 13.1mn in 2022, according to a report from Alpen Capital. Students in private schools are expected to grow at a CAGR of 1.7% since 2022 to reach 3.1mn by 2027. Saudi Arabia allocated the highest expenditure to education at 17% of its total budget, or USD 50.4bn, in 2023, followed by Oman at 16.7% (USD 1.9bn) while it stood at 15.5% in the UAE.

- A free trade agreement between the UK and GCC could boost commerce by 16%, according to a UK government press release. GCC is the UK’s seventh-largest export market, with total trade valued at GBP 61.3bn.

- The meeting held in Jeddah for Ukraine crisis talks were hailed as “productive” by Ukrainian officials: the meeting was attended by more than 40 nations including India, China and European nations though Russia did not attend. Notable was China’s participation, as it had stayed away from earlier rounds of talks.

Saudi Arabia Focus

- Saudi non-oil sector PMI slipped to a 7-month low of 57.7 in Jul (Jun: 59.6),dragged down by an easing of new order growth while employment increased for the 16th month in a row (though at the slowest pace since Nov 2022). Fastest output expansion was reported by manufacturing and construction firms; businesses reported using price discounting to promote sales, and were optimistic about government-backed project spending supporting further business expansion.

- Saudi Arabia reported a 15% yoy decline in revenues to SAR 314.8bn in Q2 2023, largely due to the 28% plunge in oil revenues (to SAR 179.7bn) while non-oil revenues were up 13% (to SAR 135.1bn). Spending increased by 9% yoy to SAR 320.1bn in Q2 (with compensation of employees accounting for a 41% share), resulting in a wider deficit of SAR 5.3bn (Q1: SAR 2.9bn deficit).

- Money supply (M3) in Saudi Arabia grew by 9.1% in Jun while private sector loans grew by 9.6% (May: 10.3%). Saudi Arabia’s deposit growth lagged credit expansion in H1 2023, though the gap has been narrowing. Credit to SMEs showed a 10.12% mom uptick, with the increase from finance companies clocking in at 9.3%. SAIBOR surged to a record again, crossing 6%, raising concerns about the giga-project pipeline and cost of its funding.

- Talks are underway between China and Saudi Arabia’s stock exchanges to allow exchange-traded funds (ETFs) to list on each other’s bourses, reported Reuters. For China, an ‘ETF Connect’ tie-up with Saudi Arabia will be the first such beyond East Asia.

- Companies authorized by Saudi Arabia’s Capital Market Authority posted a 17% yoy increase in profits to a record high SAR 60.34bn (USD 16.08bn) in 2022, thanks to a 26% rise in revenue to a record SAR12bn+.

- PIF, in its 2022 annual report, disclosed that its assets under management grew by 12.8% yoy to SAR 2.23trn (USD 595bn) last year. The fund established 25 companies last year, created 181k jobs, made international investments worth SAR 512bn last year while local investments stood at SAR 1.71trn. It was also disclosed that the fund had injected SAR 25.5bn into NEOM till end-2022.

- Saudi PIF established a new sports investment company (SRJ Sports Investments Co) to acquire and develop new events intellectual property, commercializing notable competitions and organizing major global events in the country.

- Saudi Central Bank approved insurance fintech rules: aims to regulate the underlying business and its operations, assure client protection, and promote fair competition in solution provision while incorporating rules such as practitioners’ obligations and clients’ information accuracy among others.

- The Real Estate Price Index in Saudi Arabia inched up by 0.8% yoy in Q2 2023, as a result of increases in property prices of both residential (+1.1%) and commercial (+0.2%).

- Saudi Arabia reached a 63% self-sufficiency rate in the value-added agriculture sector, reported the Sustainable Agricultural Rural Development Program, also known as Reef. Fruits reached a self-sufficiency rate of 22%, producing 90,000 tons this year.

- Air traffic in Saudi Arabia grew by 26% yoy to over 403k flights in H1 2023 while air connectivity rose 15% to 7,153 destinations.

- Ship traffic in Saudi Arabia increased by 8.1% yoy to 14,266 vessels in 2022, with Jeddah Islamic Port having the largest share in ship traffic (3,907 vessels), according to data from the General Authority for Statistics.

- The Saudi Fund for Development signed an agreement with Belize to finance a new solar project worth USD 77mn. The loan will support building a 60-megawatt solar power plant, that will reduce emissions by 60,000 tons annually from the energy sector.

- Saudi Arabia plans to grant USD 1.2bn to Yemen in economic aid, reported Reuters: the donation would be used to pay government wages, fuel for power plants and food imports.

UAE Focus![]()

- UAE’s PMI slipped to 56 in Jul (Jun: 56.9): output eased (62.8 from 64.1), new export orders were stagnant, with firms reporting an easing of cost pressures. Though backed by strong customer demand, new orders declined by 3.6 points to 57.4, the largest drop in the series history. Slower sales growth stemmed from greater competition.

- UAE GDP grew by 3.8% yoy in Q1 2023, following an estimated 7.9% growth in 2022, with growth in the non-oil sector remaining resilient (up by 4.5% in Q1). Thefastest-growing sectors in Q1 2023 were transportation & storage (+11%), construction (9.2%) and accommodation & food services activities (7.8%).

- Bank deposits in the UAE posted an increase of 2.3% mom in May, driven by resident deposits (1.5%) and non-residents deposits (11.1%). Gross credit expanded by 1.6% mom to AED 1.897trn, thanks to a 1.7% and 0.7% rise in domestic and foreign credit respectively. Private sector loans grew by 3.3% yoy in May and 4.8% year-to-date. UAE central bank’s foreign assets surged further to a record AED 590bn in May.

- DIFC added 661 new firms and a record 3057 new jobs in H1 2023, bringing the total number of firms in the financial freezone to 4,949 and employees to 39,140 (+20% yoy). DIFC was home to 632 regulated firms at end-Jun 2023.

- Electricity accounts in Dubai grew by 5.5% yoy to over 1.4mn at end-Jun 2023, according to DEWA. DEWA’s total capacity increased to 14,917MW of electricity and 490 million imperial gallons of water per day.

- Dubai welcomed a record 8.55mn international visitors in H1 2023, up 20% yoy and surpassing the 8.36mn tourists recorded in H1 2019. Western Europe’s share of international visitors stood at 20%, while the GCC and MENA together accounted for 28% alongside South Asia at 17%.

- Dubai rents have increased by 19% yoy in Q2 2023, according to Property Finder’s Market Watch Q2 2023: one- and three-bedroom apartment rents were higher by 20.5% and 22.2% respectively, while villa rents were up by 25.5%.

- Abu Dhabi’s IHC reported a decline in profits to AED 6.12bn in Q2 (Q2 2022: AED 6.81bn) and announced a shift with greater focus on domestic acquisitions.

- ADNOC announced that it would bring forward its net zero carbon emissions target to 2045 (vs 2050 before). It also disclosed that emissions from its operations touched about 24mn metric tons of CO2 equivalent in 2022. Its upstream carbon intensity meanwhile was around 7 kilograms of CO2 equivalent per barrel of oil equivalent, among the lowest in the world. Separately, in a bid to grow its international gas business, ADNOC announced that it would acquire a 30% equity stake in the Absheron gas and condensate field.

- UAE’s e& is planning to increase its stake in Vodafone to 20%: it had taken a 9.8% stake in the firm in May 2022 (for USD 4.4bn), and as of Apr 2023 its stake was around 14.61%. Separately, e& agreed to pay EUR 2.2bn to acquire Czech PPF Group’s telecom assets in Bulgaria, Hungary, Serbia, and Slovakia: the transaction is expected to close by Q1 2024.

- The crypto arm of Nomura, Laser Digital, received an operating license from Dubai’s Virtual Asset Regulatory Authority. The firm is set to launch their Trading and Asset Management businesses in the coming months, offering institutional investors OTC trading services and a comprehensive range of digital asset investment products and solutions.

Media Review

Who Controls AI?

https://www.project-syndicate.org/onpoint/who-controls-ai

Chinese economists told not to be negative as rebound falters: FT

https://www.ft.com/content/b2e0ad77-3521-4da9-8120-1f0c1fdd98f8

Reform delays threaten to plunge Lebanon’s crisis-struck economy into darker depths (with Dr. Nasser Saidi’s comments)

https://www.thenationalnews.com/business/economy/2023/08/04/reform-delays-threaten-to-plunge-lebanons-crisis-struck-economy-into-darker-depths/

The rapid loss of Antarctic sea ice brings grim scenarios into view

https://www.economist.com/graphic-detail/2023/08/02/the-rapid-loss-of-antarctic-sea-ice-brings-grim-scenarios-into-view

Powered by: