Middle East PMIs. GDP in Saudi Arabia & UAE. Monetary stats in Saudi Arabia and UAE. Regional trade growth Q1 2023.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 4 Aug 2023: Expansionary PMIs & GDPs in the GCC, with signs of moderation & a resilient financial sector recovery

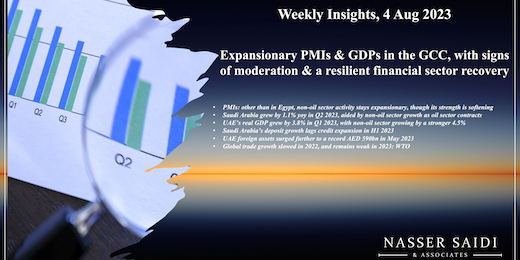

1. PMIs: other than in Egypt, non-oil sector activity stays expansionary, though its strength is softening

- Saudi non-oil sector PMI slipped to a 7-month low of 57.7 in Jul, dragged down by an easing of new order growth. Fastest output expansion was reported by manufacturing and construction firms; while price discounting to promote sales remains a fixture, businesses are optimistic about government-backed project spending supporting further business expansion.

- UAE PMI eased to 56 in Jul (Jun: 56.9): new orders (though backed by strong customer demand) fell by 3.6 points to 57.4, the largest drop in the history of the series; new export orders were stagnant; firms reported an easing of cost pressures.

- Lebanon PMI inched up further to 50.3 in Jul (Jun: 50.2), the strongest improvement since Jun 2013, driven by stronger domestic demand (a likely effect of summer tourism). A slight ray of hope with the rate of job creation accelerating to the fastest since Sep 2015. Firms remain mostly pessimistic, as the political and economic turmoil continues unresolved.

- Egypt was the only one in contractionary territory, though PMI inched up to 49.2 in Jul (Jun:49.1). Output contracted, across all 4 sectors covered by the survey, and at the slowest rate since Sep 2021. Some relief in inflationary pressure as well: selling prices rose modestly and at the softest pace since Apr 2022. Though business confidence ticked up from Jun, it is still among the lowest-ever recorded.

- Main features of last month’s PMIs in the Middle East: domestic demand is a cornerstone of PMI gains (construction has been posting a strong recovery, also evident in GDP numbers ahead); new export orders haven’t recovered as fast as overall new orders; input costs are on the decline, but firms are still pressing ahead with price discounting to boost sales.

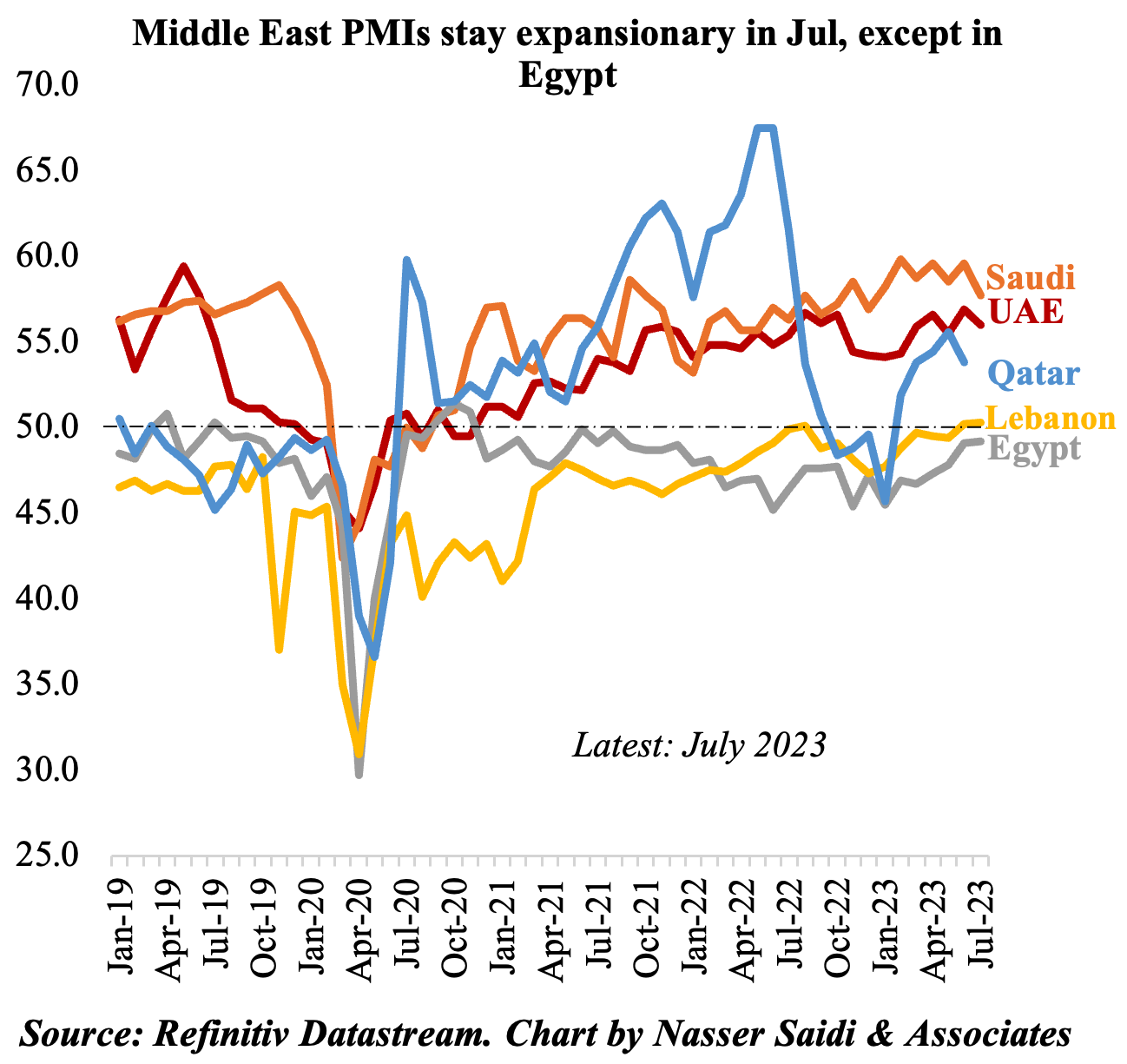

2. Saudi Arabia grew by 1.1% yoy in Q2 2023 (Q1: 3.8%), aided by non-oil sector growth (5.5%) as oil sector contracts (-4.2%)

- Preliminary estimates show a 1.1% yoy increase in Saudi Arabia’s real GDP growth in Q2 2023. Growth was substantially lower compared to the 3.8% uptick in Q1 2023 and 11.2% in Q2 2022.

- This was largely a result of the fall in oil sector growth (-4.2%) given the oil production cuts. The stricter voluntary cuts by 1 million barrels per day have been extended for a further month until Sep and will have a negative impact on Q3 GDP.

- However, the non-oil sector GDP stays resilient, rising by 5.5% in Q2 following a 5.4% uptick in Q1 2023. The strong project pipeline given mega and giga projects will support growth in the coming quarters (MEED Projects disclosed that Saudi accounts for more than 50% of the Gulf projects market as of mid-Jul, around USD 1582bn).

- Government activity, which grew by 2.7% in Q2 following Q1’s 3.8% gain, has also supported non-oil sector growth. Oil revenues declining by 17% to SAR 358.3bn in H1 will leave a mark on government coffers and subsequent spending.

- In qoq terms, GDP declined in Q2 by 0.1% following a 1.4% drop in Q1, with the oil sector hit most severely. The sector posted three consecutive quarterly declines: -0.3% qoq in Q4 2022, -4.7% in Q1 2023 and -1.4% in Q2 203.

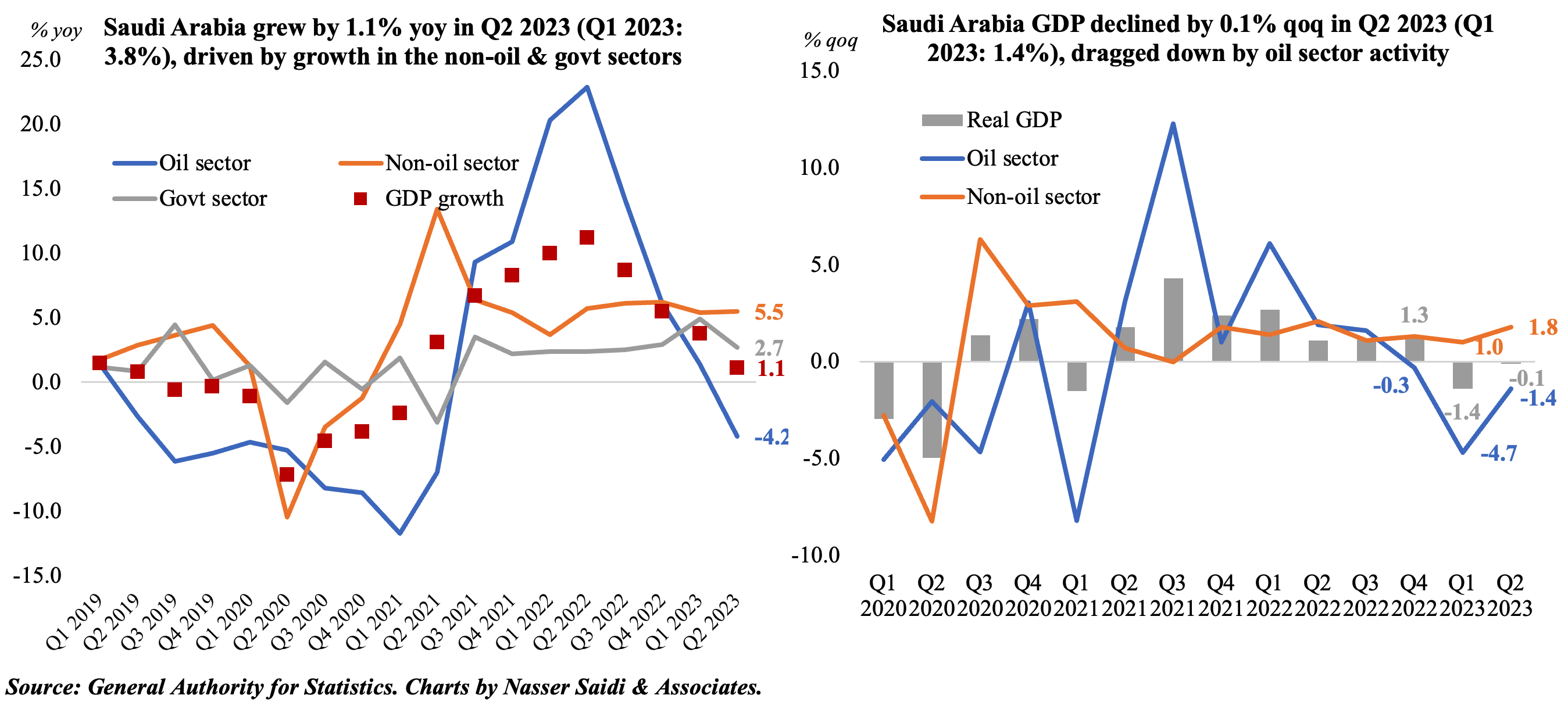

3. UAE’s real GDP grew by 3.8% in Q1 2023, with non-oil sector growing by a stronger 4.5%

- UAE’s economy grew by 3.8% yoy (to AED 418.3bn) in Q1 2023, following an estimated 7.9% growth in 2022 (Source: Quarterly Economic Review Q1 2023, UAE central bank).

- Growth in the non-oil sector remained resilient, up by 4.5% yoy in Q1 (from 7.2% in 2022) – which is also evident from the PMI readings this year, supported by increased domestic demand.

- The fastest-growing sectors in Q1 2023 were transportation & storage (+11%), construction (9.2%) and accommodation & food services activities (7.8%). This is similar to Abu Dhabi’s main sectors of growth in Q1 2023.

- Construction has seen the fastest jump: from 0.1% growth in Q1 2022 to 9.2% in Q1 2023 (again similar to Abu Dhabi’s uptick to 14.36% from 0.23% a year ago).

- Covid-affected sectors posted highest double-digit growth, indicating a broad-based recovery: transport (11%), accommodation & food services (7.8%) and wholesale & retail trade (5.4%) among others.

- Oil production cuts will result in lower growth rates in the oil sector. On the non-oil side, travel and tourism industry is likely to support non-oil sector growth (evidence from passenger traffic at Dubai airport during summer and given the global COP28 conference to be held later this year), as will construction and real estate (UAE reported a surge in project announcements as of mid-Jul, touching USD 593bn or just higher than 1/5th of GCC projects according to MEED Projects).

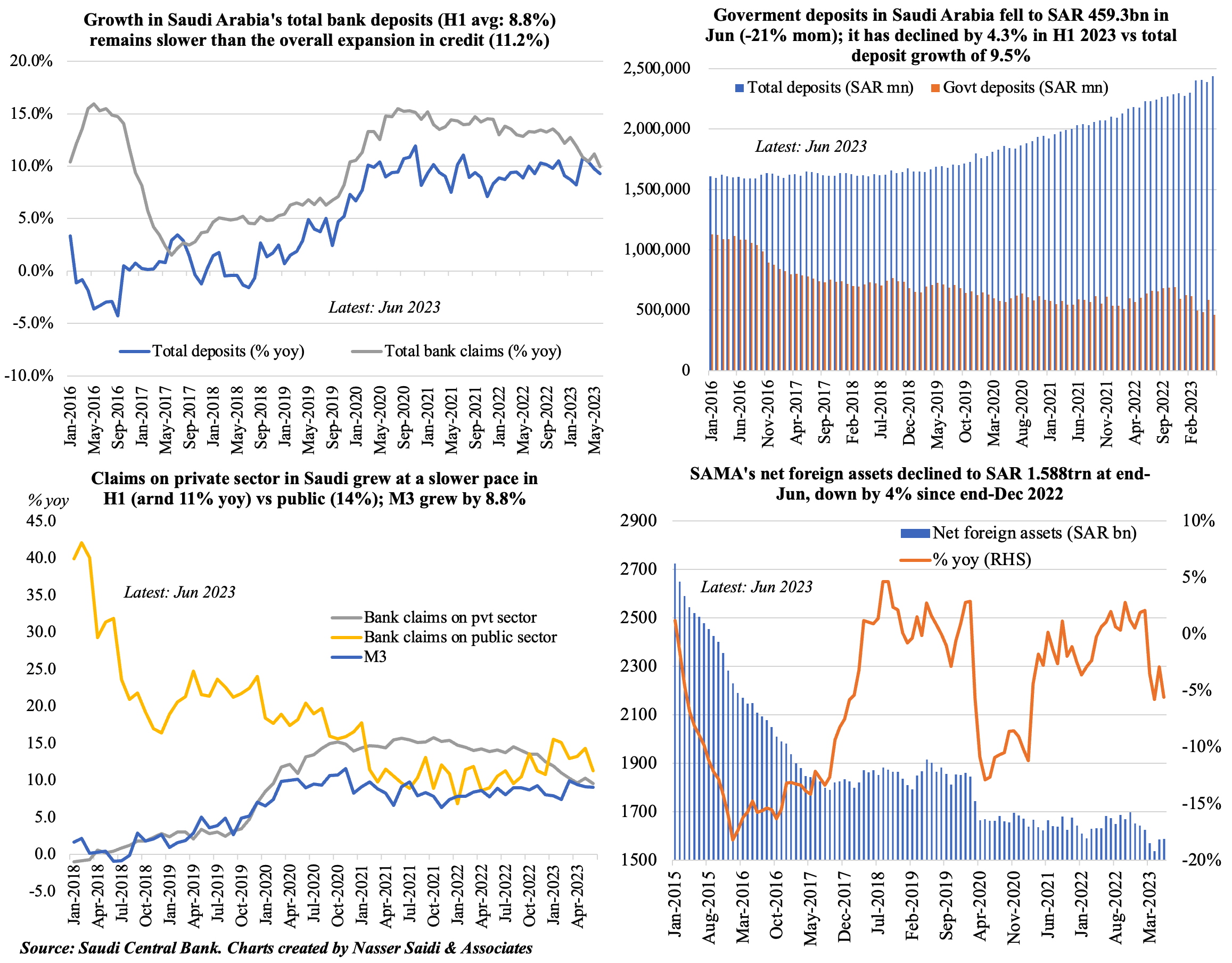

4. Saudi Arabia’s deposit growth lags credit expansion in H1 2023, though the gap has been narrowing; govt deposits are down by 23% from end-Dec; net foreign assets declined after May’s uptick; SAIBOR surged to a record again, crossing 6%, raising concerns about the giga-project pipeline & cost of its funding

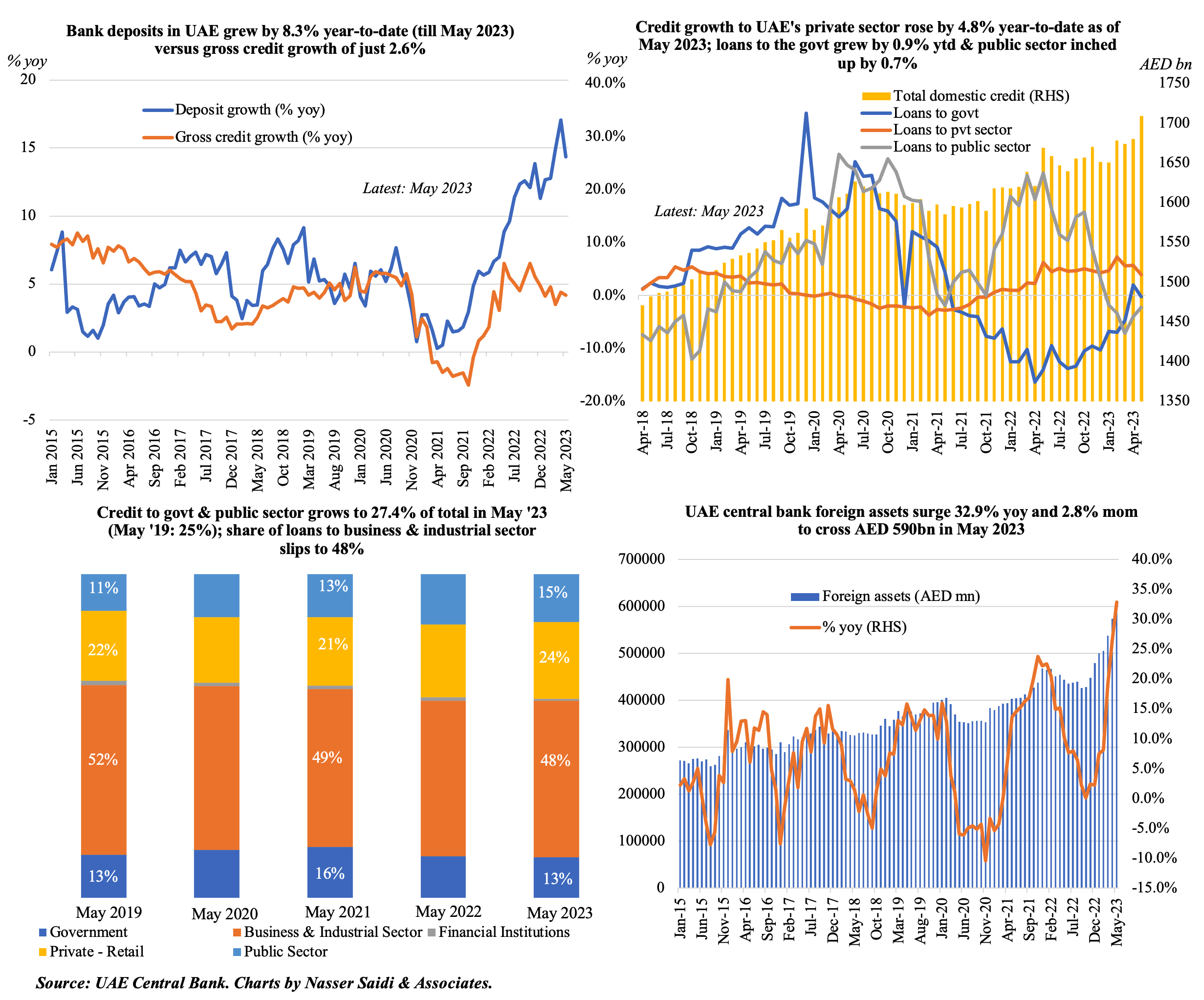

5. UAE banks lending to the private sector grew by 4.8% year-to-date (as of May 2023); deposit growth continues to exceed credit growth (with govt deposits up 4.7% ytd); foreign assets surged further to a record AED 590bn

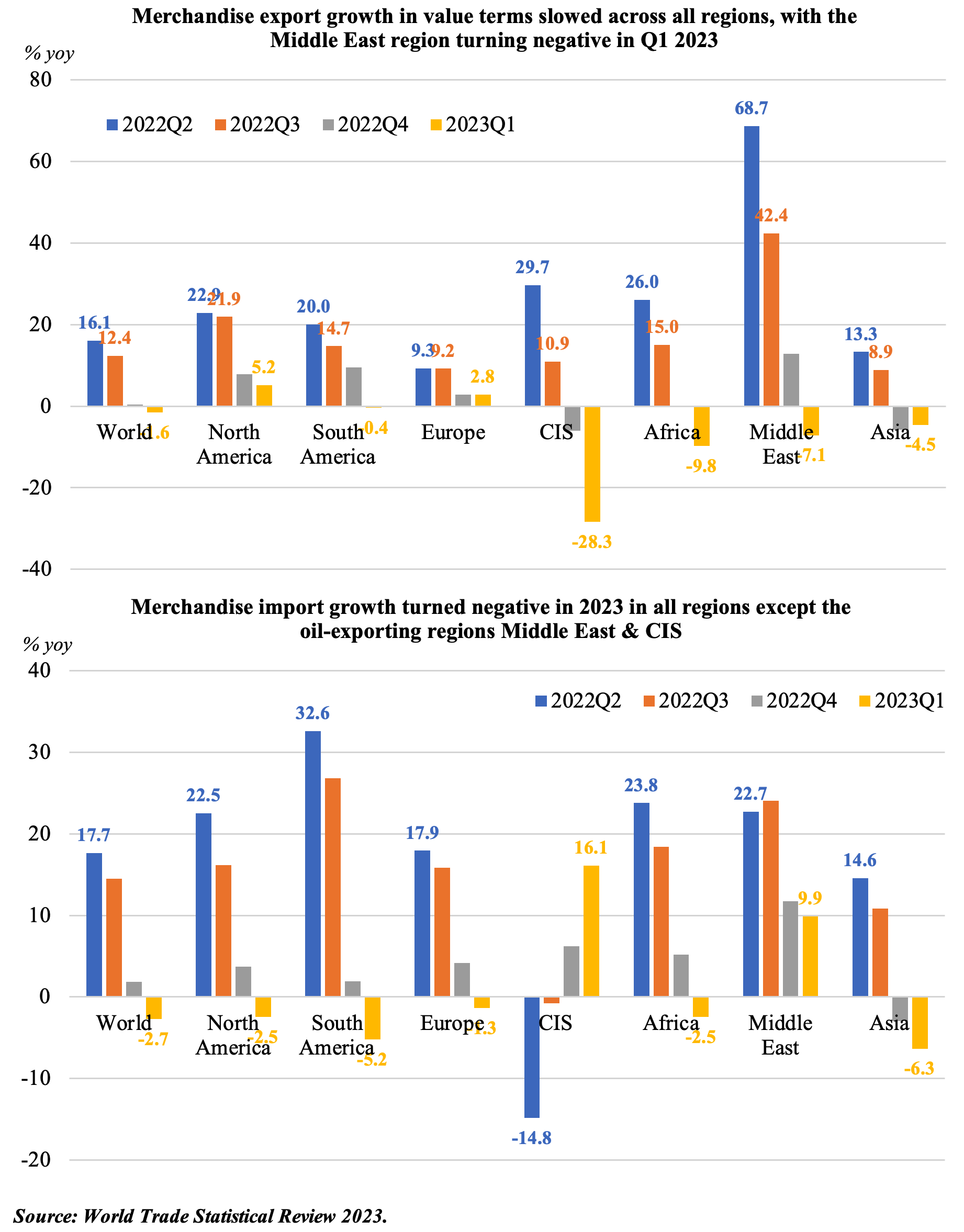

6. Global trade growth slowed in 2022 & remains weak in 2023: WTO

- The World Trade Organisation, in its latest World Trade Statistical Review report, affirms that while trade growth has slowed, it remains resilient and positive overall.

- High inflation rates (especially via energy prices) and subsequent pace of monetary policy tightening in major economies dampened consumption, also weighing on economic activity.

- Downside risks (WTO): geopolitical tensions, food and energy insecurity, increased risk of financial instability & high levels of external debt.

- Services trade continues to perform better than goods trade; however, weak tourism recovery within Asia puts travel exports at lower than pre-pandemic levels.

- Value of merchandise trade expanded last year, partly due to high global commodity prices, with the highest growth rates in the oil-rich Middle East region. Global exports of fuels & mining products grew on average by 19% per year between 2019 & 2022, touching USD 5,158bn last year.

- By quarter, merchandise trade growth fell to near-zero in Q4 2022: steeper declines were seen in oil-producing regions (and continues into Q1 2023). Imports were up 10% and 16% in the Middle East and the CIS regions respectively as high oil and natural gas prices boosted domestic revenues.

Powered by: