IMF growth update. Our MENA outlook. Kuwait fiscal surplus. Saudi oil exports plunge, FDI rise. UAE fiscal surplus & credit sentiment. Dubai inflation.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 28 Jul 2023: Macroeconomic Outlook & Risks for the MENA region

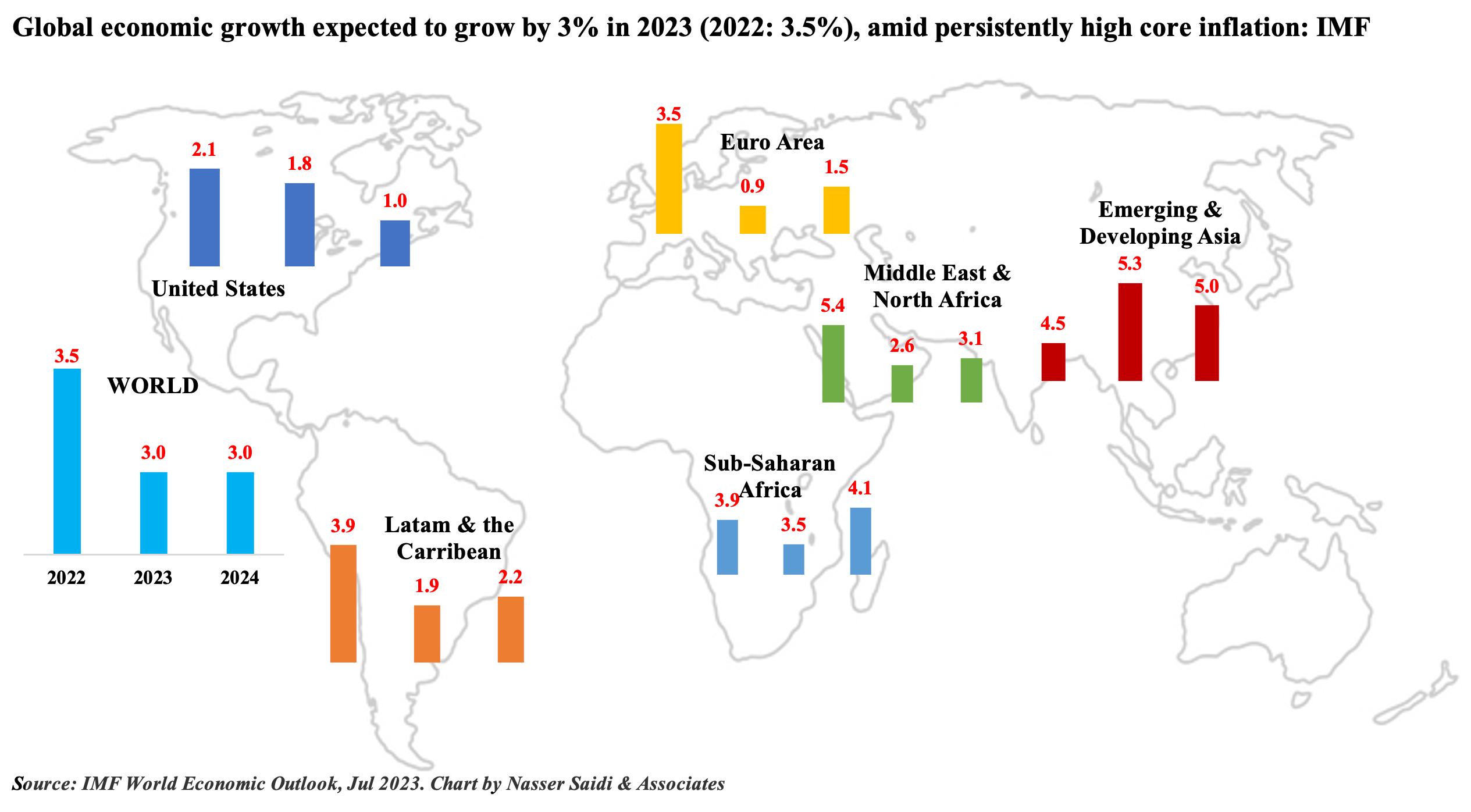

1.IMF projects global growth to slip to 3.0% this year (2022: 3.5%)

- Global economic growth is forecast to fall to 3.0% in 2023, following 3.5% growth in 2022, with growth supported by emerging markets. In general, manufacturing remains weak alongside stronger services sector activity. China’s post-Covid recovery has not sustained the initial boost (with potential spillovers into the rest of the world).

- Inflation has eased from 2022 peaks, while food prices remain high; given persistent core inflation (and above central bank targets), major central banks have continued with a tightening policy that has further constrained economic activity.

- Oil prices are projected to fall by about 21% in 2023, following the 39% surge last year, reflecting the slowdown in global economic activity. This is reflected in the growth forecasts for oil-exporter Saudi Arabia (1.9% this year from 2022’s 8.7% growth); given its stature as the largest economy in the region, growth in the wider MENA region is also estimated to decline to 2.6% in 2023. However, diversification is key: as long as non-oil sector activity in Saudi Arabia remains robust (forecast of ~ 6%), growth can be resilient.

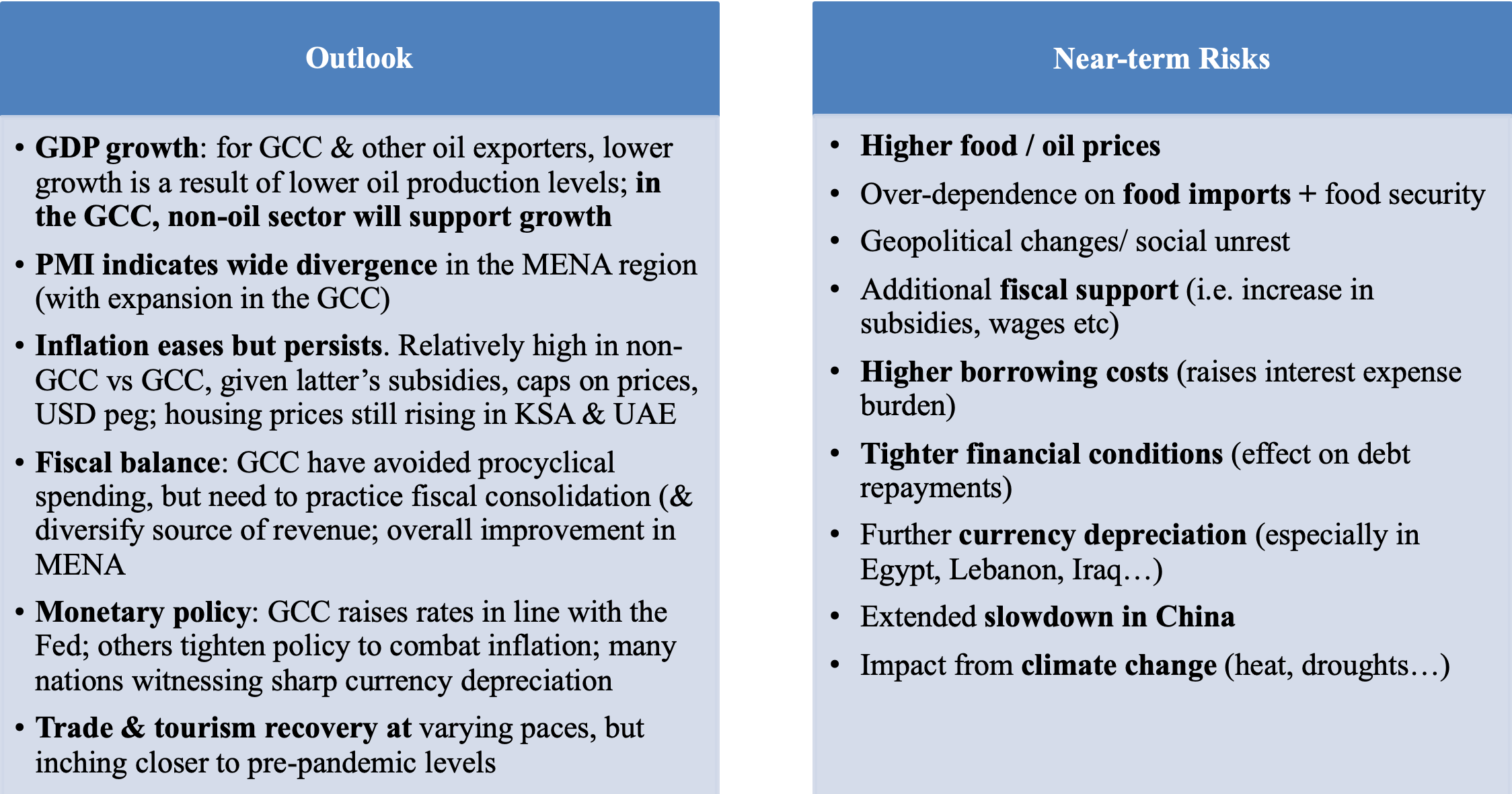

2. Growth in Middle East and North Africa is set to decline to 2.6% this year: IMF. What is our outlook for the region?

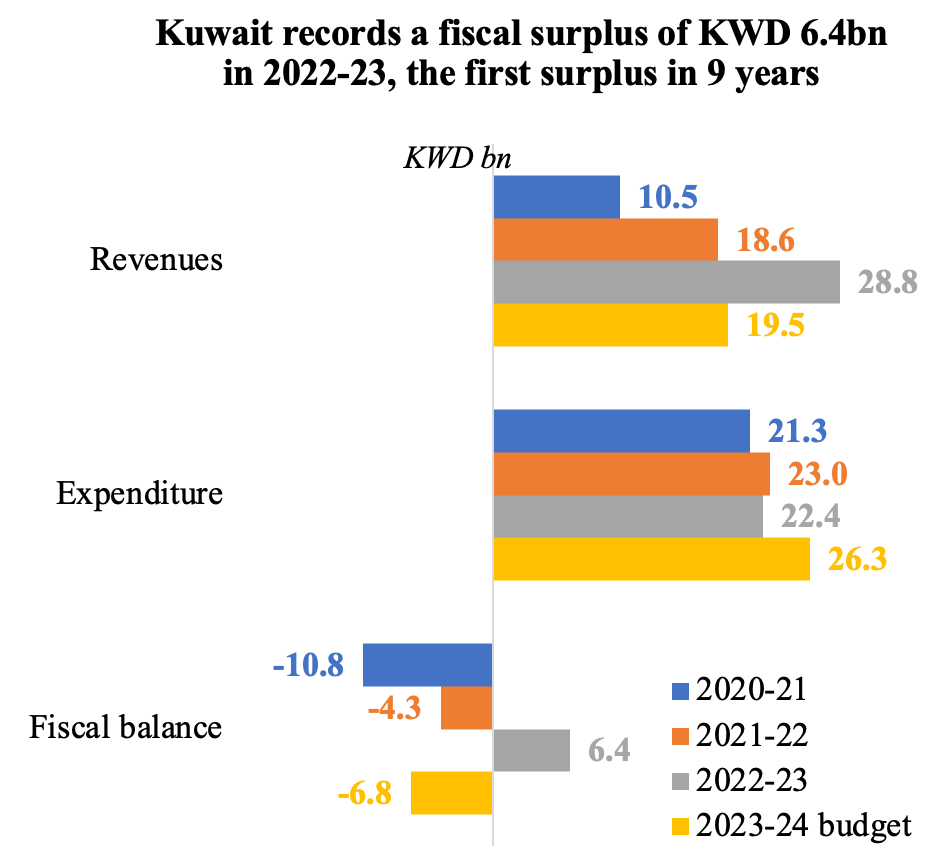

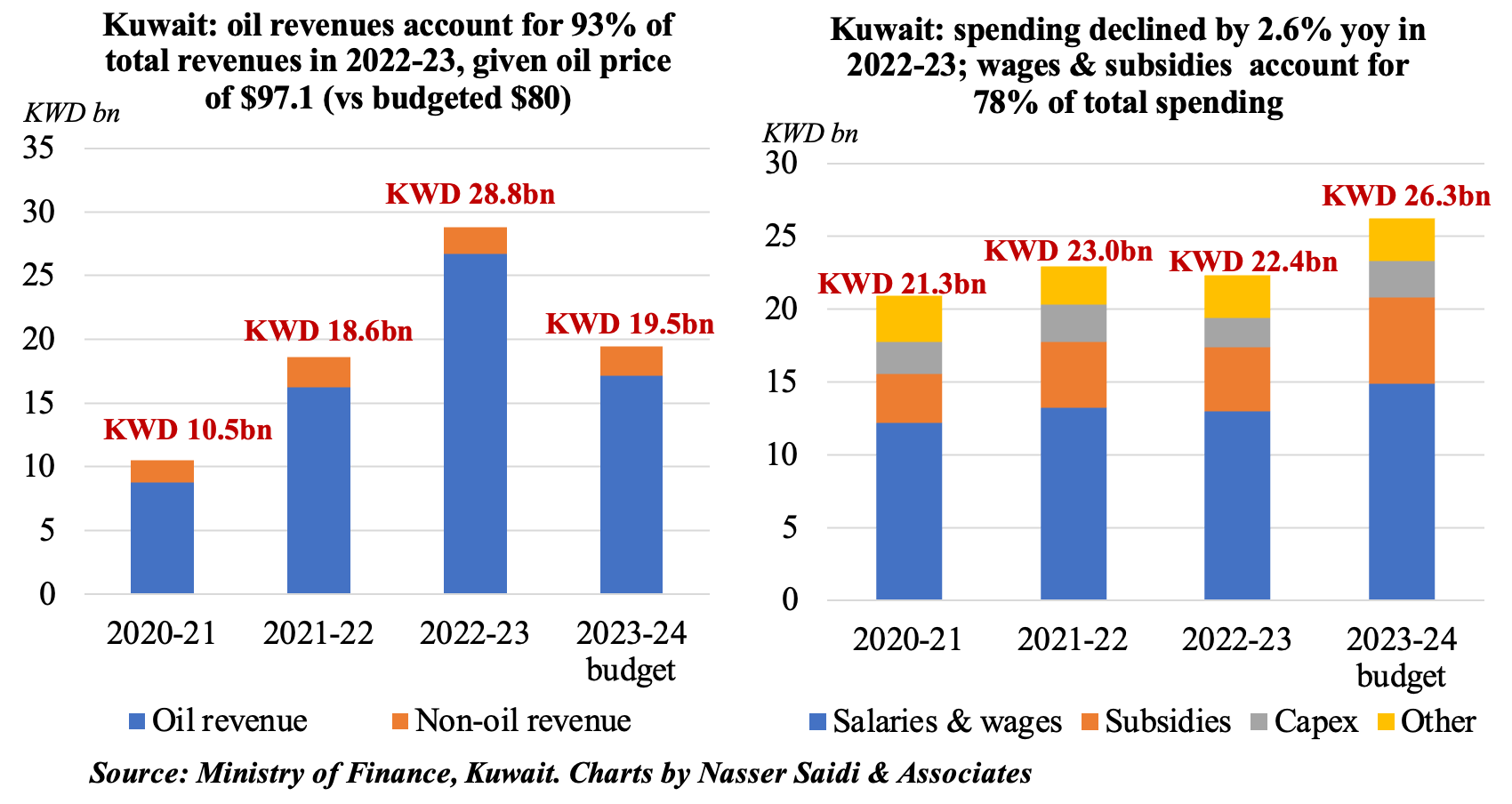

3. Kuwait posts its first fiscal surplus in 9 years: KWD 6.4bn in 2022-23

- Kuwait posted a fiscal surplus of KWD 6.4bn in 2022-23, driven by the surge in oil revenues (64.7%) alongside a 2.6% drop in spending.

- Revenues grew by 54.7% yoy to KWD 28.8bn (23.1% higher than the 2022-23 budget, which was based on an oil price of USD 80 vs actual USD 97.1. The 2023-24 budget forecasts a 19.5% drop in oil revenue (based on oil price at USD 70). Oil and non-oil revenues accounted for 87.1% and 12.9% of total revenues respectively.

- Expenditures fell by 2.6% yoy to KWD 22.4bn (5% lower than the 2022-23 budget), dragged down by capex spending (-20.3% yoy to KWD 2.1bn) while salaries and subsidies inched lower by 2% and 2.9% respectively.

- Unlike other GCC nations, Kuwait is constrained by its lack of non-oil revenue proceeds and delays in passing its new debt law (that would allow the nation to tap international markets) among others.

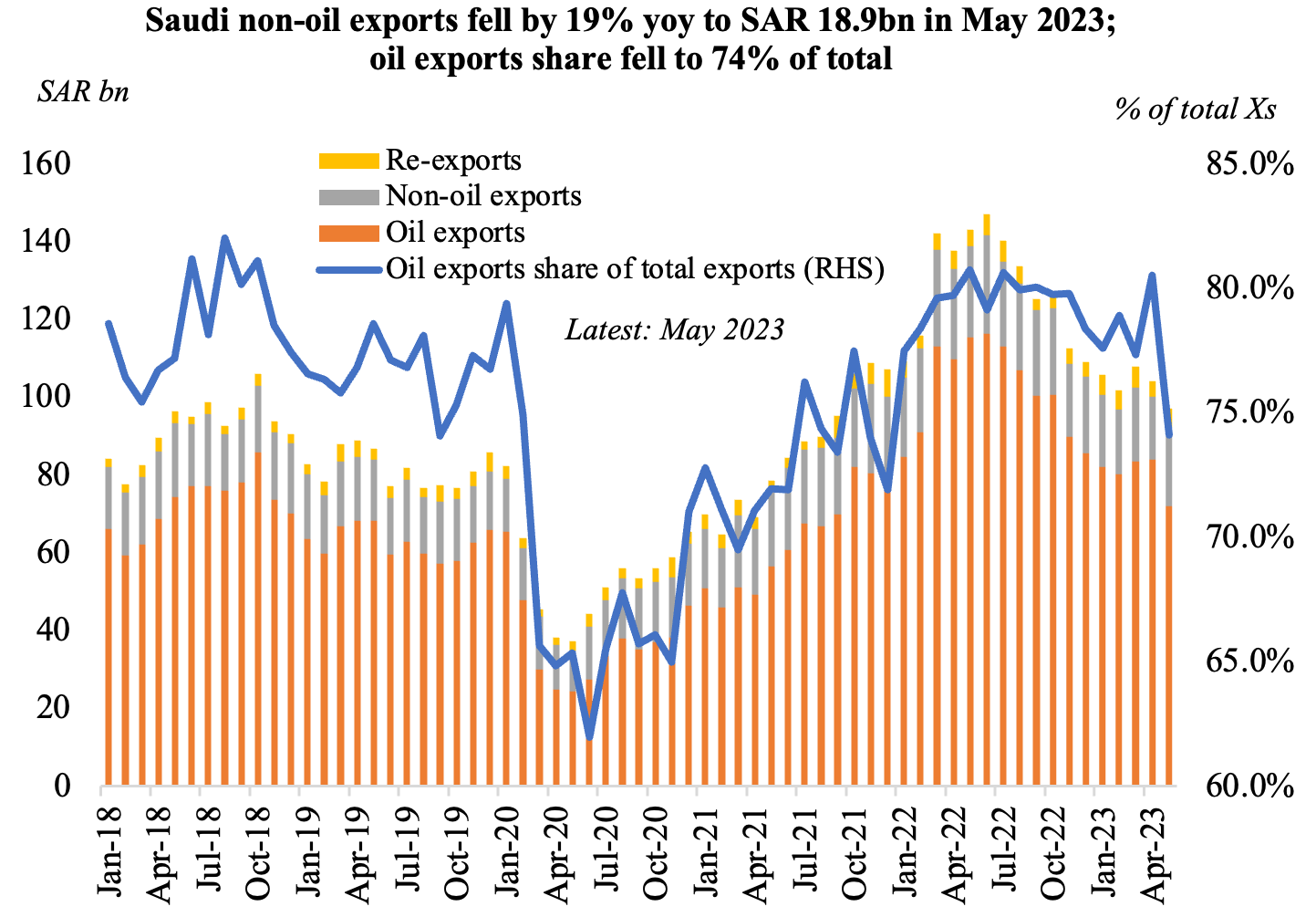

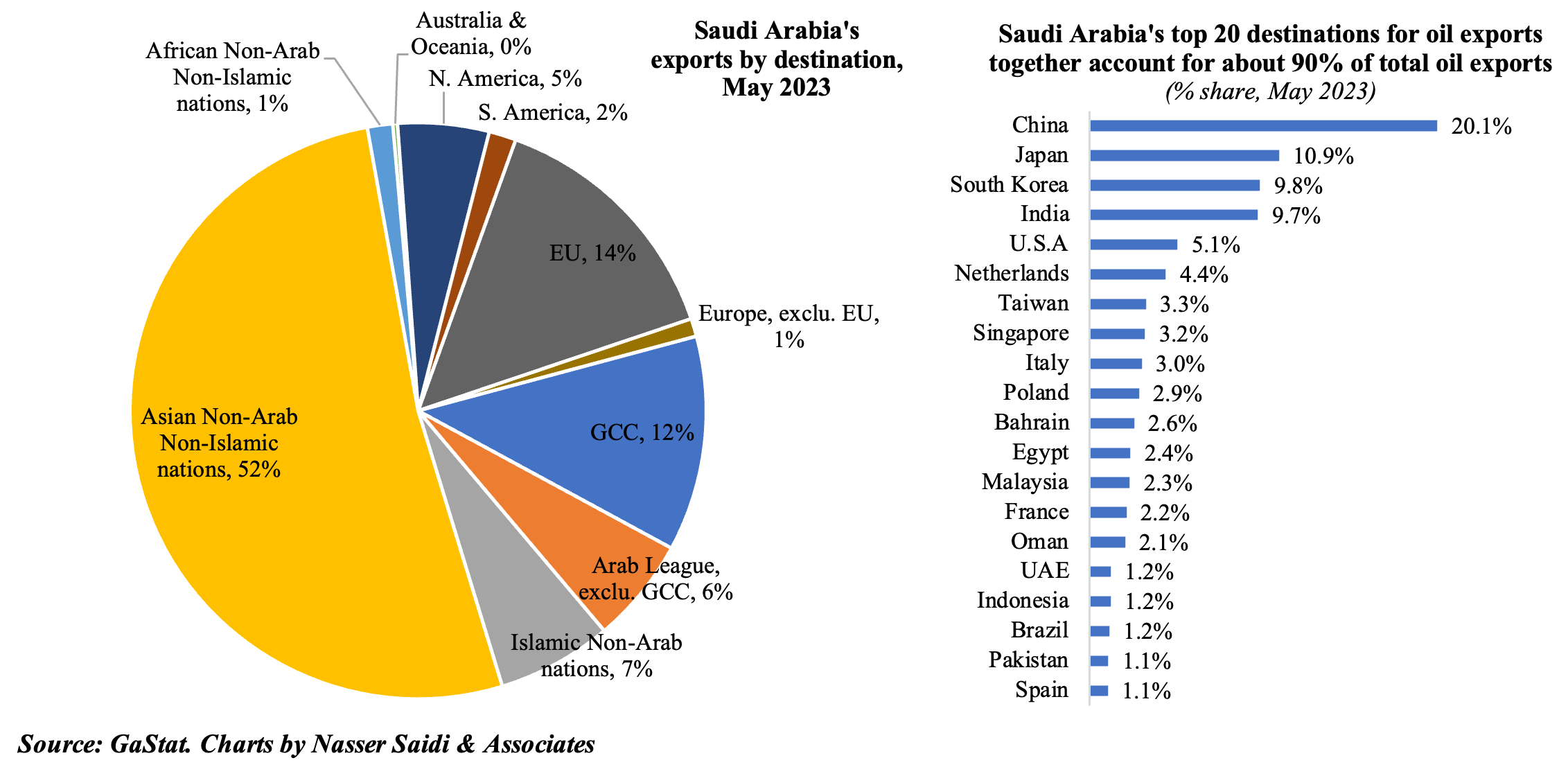

4. Saudi Arabia’s oil exports plunge in May, dragging down overall exports

- Saudi Arabia’s exports fell by 32% yoy and 6.7% mom to SAR 97.1bn in May – this is the lowest reading since Sep 2021. The fall in exports stemmed from oil exports, which plunged by 38% yoy and 14.1% mom, mainly on lower prices.

- The share of oil exports to overall exports fell to 74.1% in May, the lowest since end-2021.

- Oil exports to the top 5 destinations (China, Japan, South Korea, India and the US) accounted for 56% of the total oil exports and for the top 20 it was at ~90%.

- Largest non-oil exports (including re-exports) were chemicals & allied products and plastics (55% of outbound trade).

- Imports increased sharply: 16.9% yoy to SAR 67.7bn, led by machinery & mechanical appliances and vehicles (22% and 17% respectively of total imports).

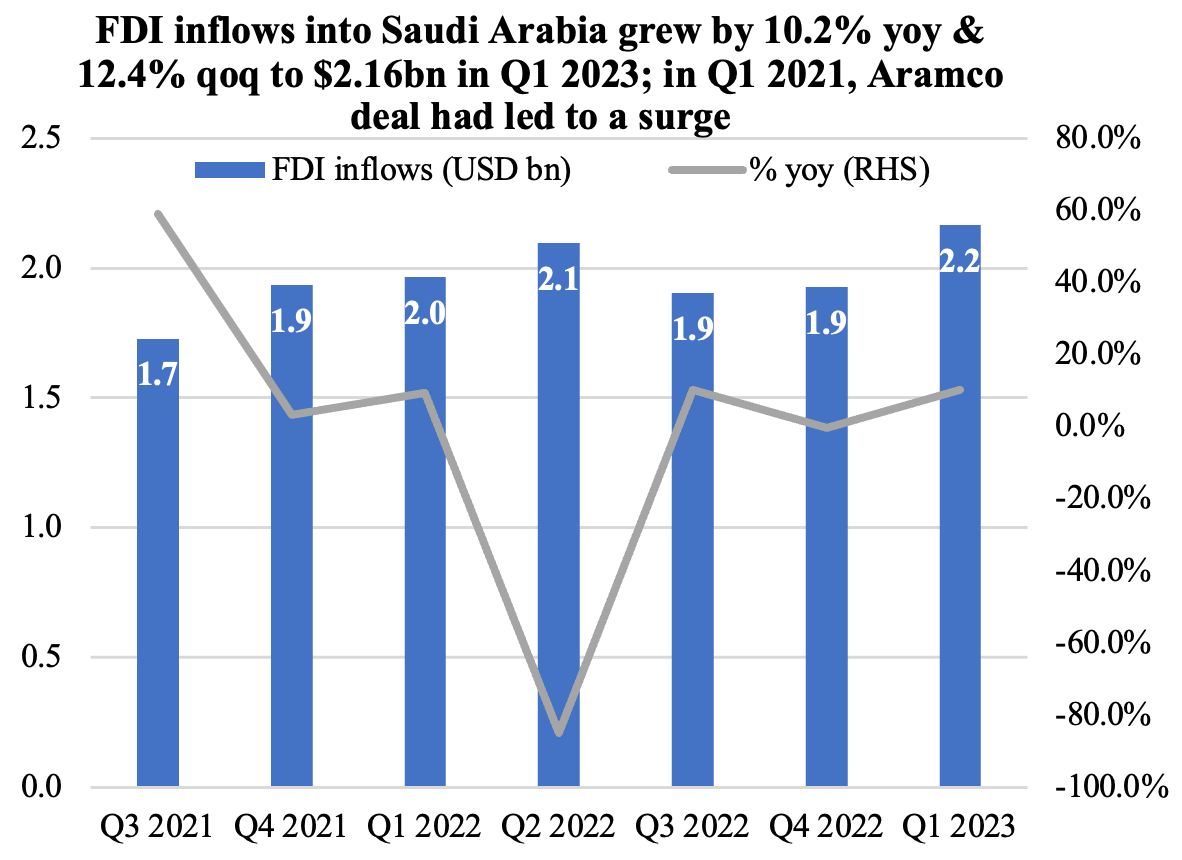

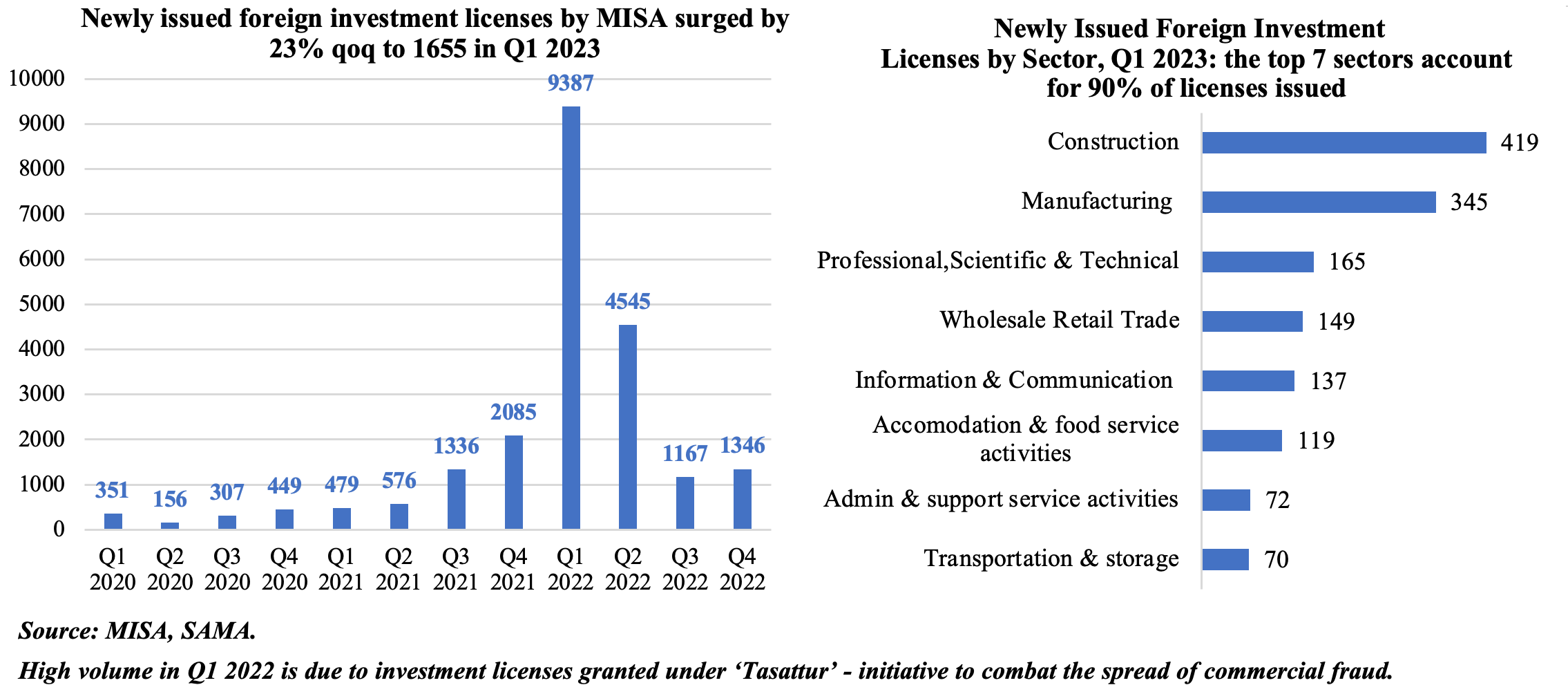

5. Saudi Arabia’s FDI rises in Q1 2023, as does foreign investment licenses

- FDI into Saudi Arabia increased by 10.2% yoy and 12,4% qoq to USD 2.1bn in Q1 2023. This is the highest reading since Q2 2021 when the Aramco deal had led to a massive surge (to USD 13.8bn).

- The increase in FDI can be attributed to the host of economic reforms rolled out in the recent years: an estimated 600 economic reforms since 2016, according to the finance ministry.

- MISA reported an increase in newly issued foreign investment licenses in Q1 2023: 23% qoq to 1346.

- Construction licenses accounted for 1/4th of licenses, not surprising given the mega/ gigaprojects in the pipeline. Manufacturing continues to attract investments as well, with 1/5th share of licenses, thereby confirming strength in manufacturing output (within IP).

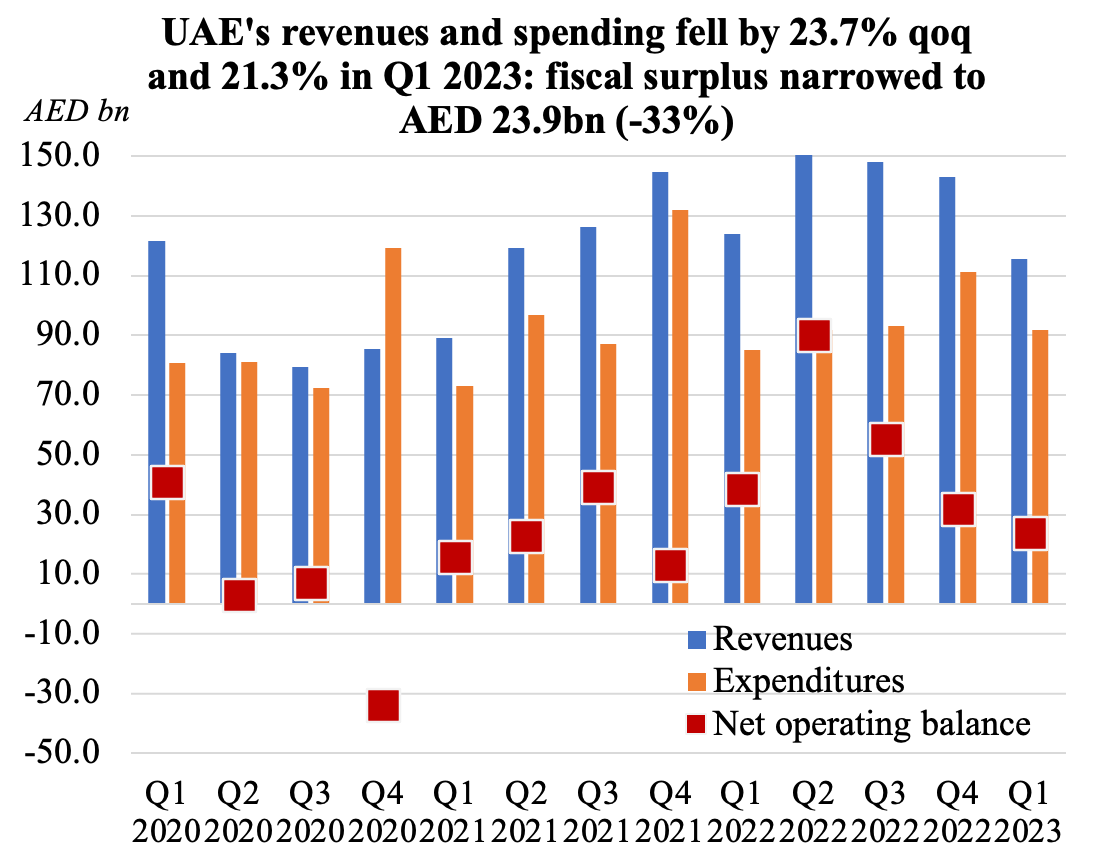

6. UAE’s net fiscal operating surplus narrows to AED 23bn+ in Q1 2023

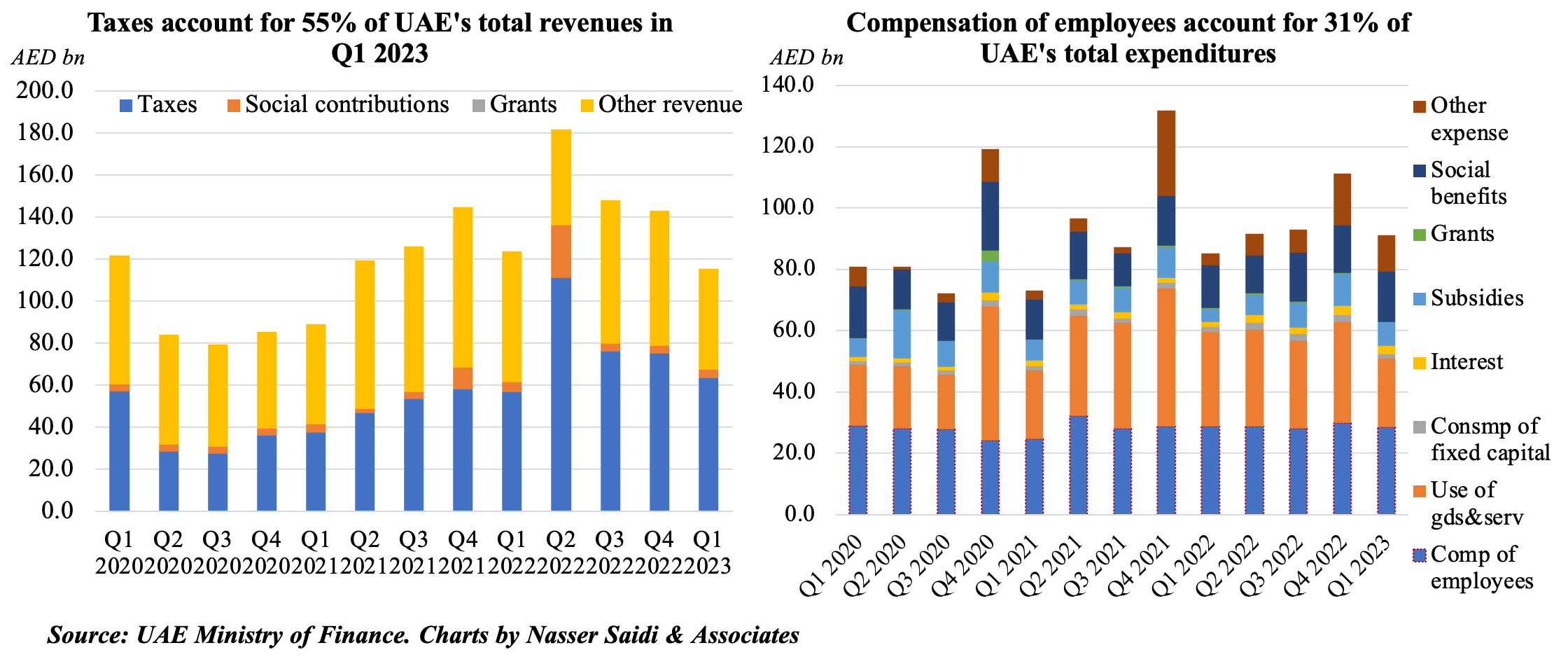

- UAE’s federal revenues declined by 6.6% yoy and 19.2% qoq to AED 115.6bn in Q1 2023. Taxes accounted for 55% of total revenues, underscoring the government’s efforts to diversify source of revenues (away from oil).

- Though tax revenues ticked up by 12.1% yoy to AED 63.5bn in Q1 2023, it had declined by 18.1% qoq.

- Spending fell by 21.3% qoq to AED 91.7bn in Q1 2023, resulting in a narrowing of net operating balance to AED 23.9bn.

- Compensation of employees (31.1% of overall expenditure) fell by 0.6% yoy and 4.8% qoq to AED 28.5bn while social benefits posted a 15.6% yoy increase to AED 16.3bn. Both subsidies and grants almost doubled in Q1 2023 in yoy terms.

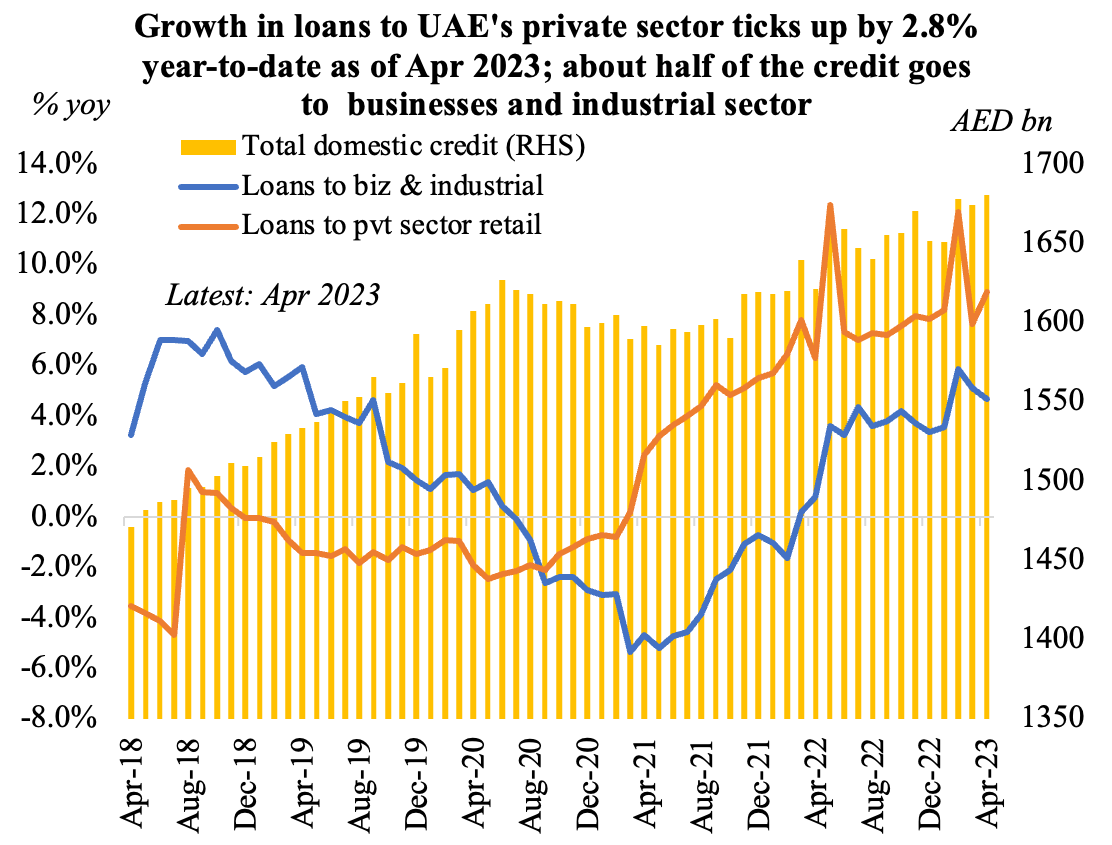

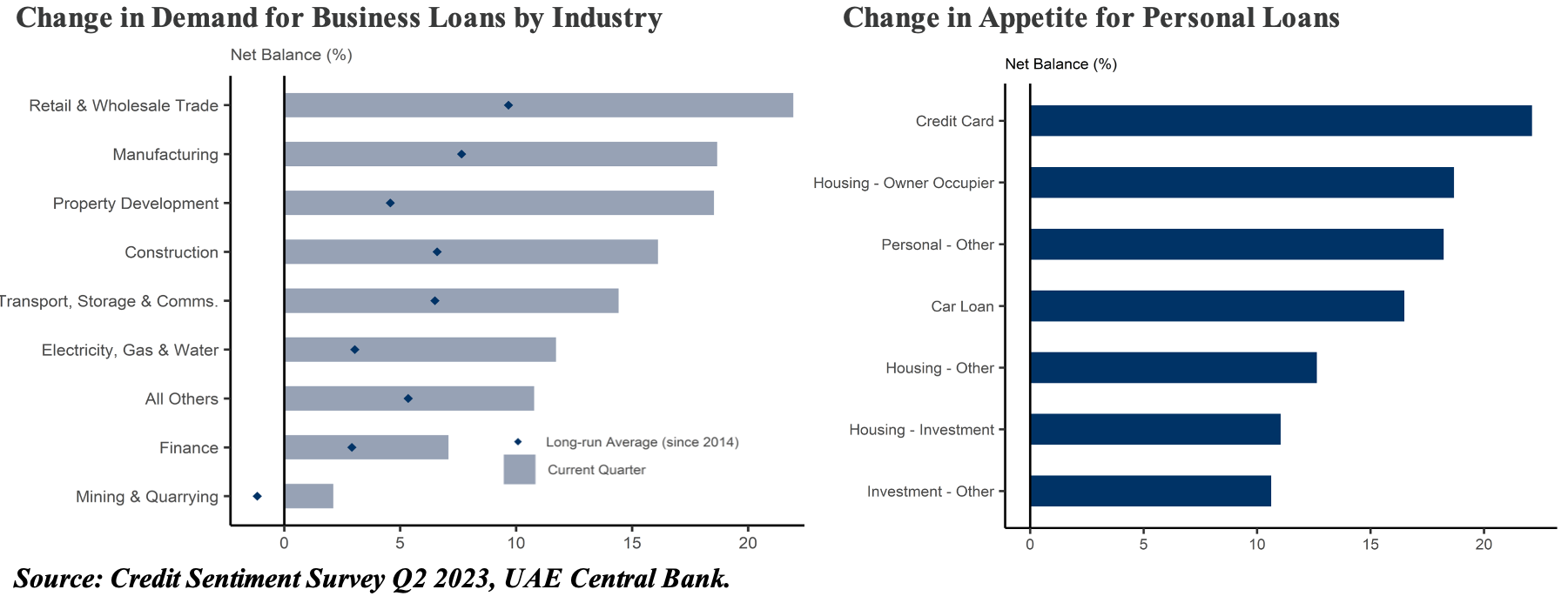

7. UAE’s Q2 2023 credit sentiment survey indicates robust lending despite rate hikes; healthy demand expectations for personal lending in next quarter

- Loans disbursed to UAE’s business & industrial sector accounts for ~50% of total domestic credit.

- UAE central bank’s credit sentiment survey shows a healthy credit appetite, despite of the steady increase in interest rates in line with the Fed (given the dollar peg). Demand is rising alongside banks’ willingness to lend (credit 2.8% ytd till Apr)

- Growth in demand for business loans was robust in Q2 2023 (though lower than Q1): net balance of +21.8 vs Q1’s +23.4. Demand was high among large firms, SMEs & GREs: expected to continue into Q3. Dubai recorded the strongest growth rate.

- By industry, demand was relatively strong in retail & wholesale trade, manufacturing, property development & construction. Positive economic outlook outweighed impact of interest rates.

- Personal loans demand jumped to +24.4 in Q2 2023, with highest reading since Jun 2014. Credit cards and housing were the most significant segments.

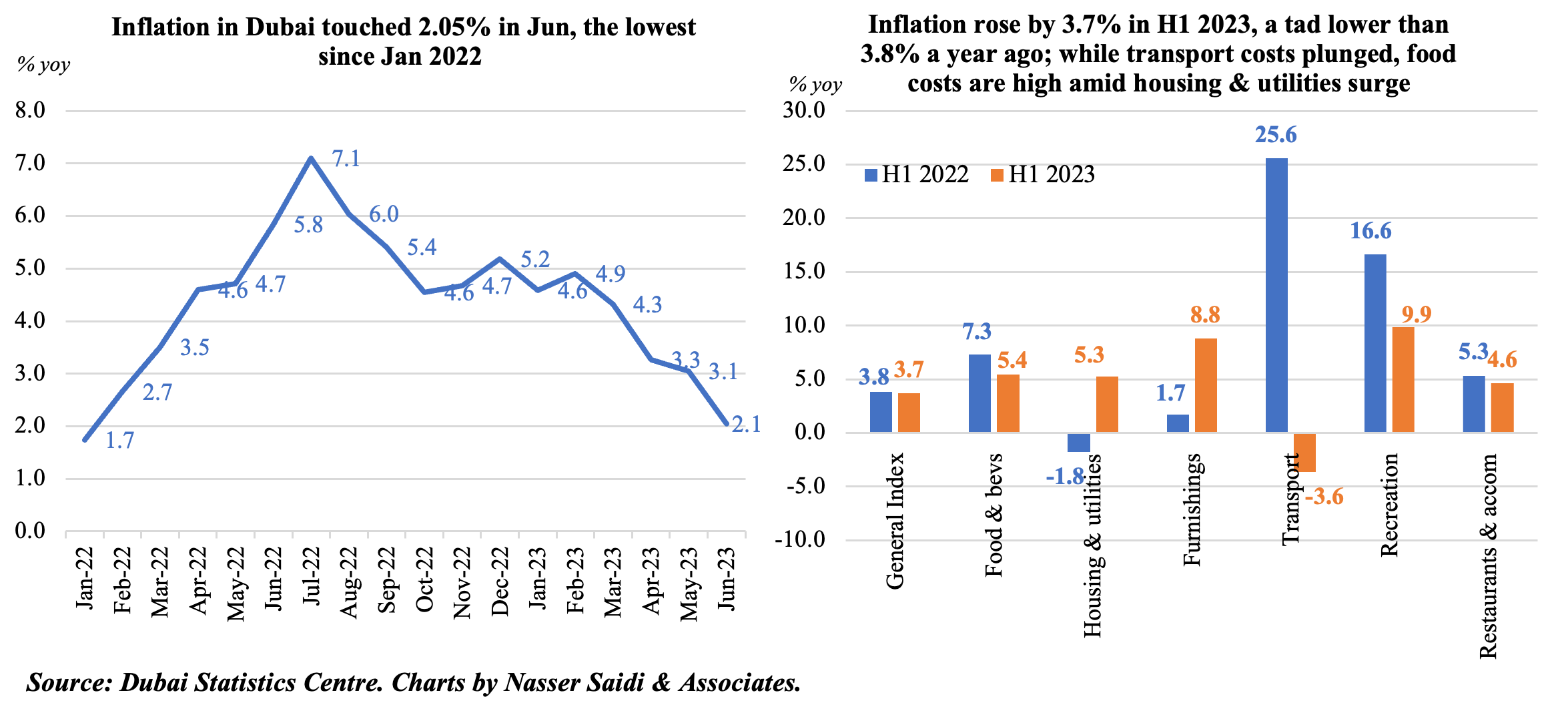

8. Inflation in Dubai eased to 2.1% in June 2023, the lowest since Jan 2022

- In June, inflation in Dubai eased to 2.1% yoy (May: 3.1%), the lowest reading since Jan 2022. June saw slower increases in food prices (3.9% from May’s 4.8%) and furnishings (7.7% from 8.2%) alongside sharper declines in transport prices (-13.9% from -7.1%) and recreation (-4.4% from -1.2%).

- Upticks were seen in housing & utilities (a record-high 5.94% from 5.74%) and restaurants & accommodation (4.87% from 4.56%). Housing & utilities have the largest relative weight in the CPI basket (40.68%). Real estate prices & rents have risen quite rapidly: according to CBRE, Dubai residential property prices surged by 16.9% in the year to June 30, the fastest in almost a decade while average rents rose at a faster pace of 22.8% (slowing from 24.2% at end-May, and moderating).

- Comparing the prices in H1 2023 vs 2022, the headline inflation has eased slightly (3.7% from 3.84%), supported by the plunge in transport costs (-3.62% vs 25.6%). The largest increases were seen in education (1.17% from 0.17%), furniture (8.81% from 1.69%) and clothing (5.4% from 3.49%).

Powered by: